Emotional Players, Emotional Markets - Market Monday (08/10)

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

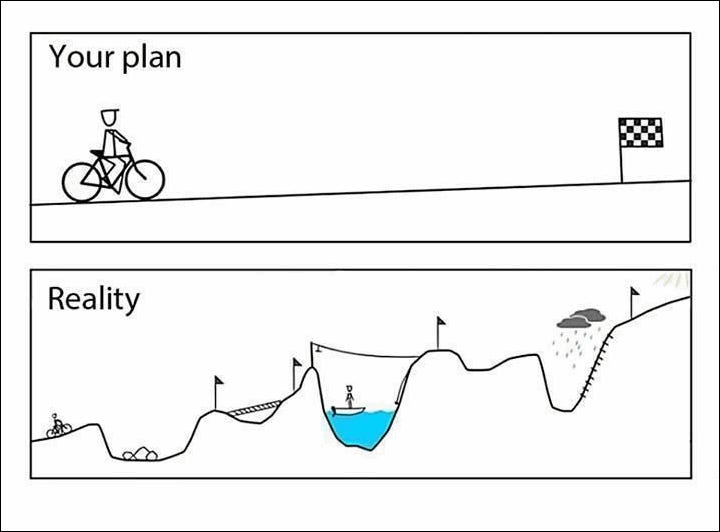

Here’s something to think about:

Markets are the place where the expressions of many individual’s beliefs manifest into a singular output: Price.

We are all emotional beings, and while we are told to remove emotion from investing, in reality, emotionality is a key component of what enables markets to function.

Markets are subjective and emotional, as the people that compose markets are all subjective and emotional.

If you currently believe that we’re embarking on the early stages of a bull market, you therefore must prepare for the roller-coaster of emotions that it brings. Not everyone is good at this, and most people think they are better than they think they are.

Crypto prices will 3x.

You will be overjoyed! Genius! Steak time! Buy a friend a present!

Then they will 1/3.

You will feel like you got punched in the stomach. You’ll question your spending. Ramen for dinner.

No one can fully detach from the emotional highs and lows of a market.

Anyone who holds a position in an asset is making a bet that they will get a hit of dopamine in the future from the price appreciation of their asset.

It’s better for you (and everyone around you) if you learn to integrate this reality rather than fight it.

Accept your emotions, and understand that they are apart of the game.

And remember the rule of thumb that can keep you safe: never position yourself in a way that could get you kicked out of the game.

If you lose a bet, make sure you can still play.

Vitalik Discusses ETH Supply on the State of the Nation

Speaking of emotional markets, you may have noticed a pretty spicy few days on Crypto-Twitter from members of the Bitcoiner camp who were voicing concerns that the Ethereum community had no good, quick, easy way to audit and verify the supply of ETH on Ethereum.

From the perspective of Bitcoiners, this is foundational to the structure of a blockchain.

I personally found it interesting that this wave of attacks from the Bitcoiner camp to the Etherean camp came after a two-week 20% price appreciation of ETH vs BTC, and the clear signal that the DeFi boom has been the main reason for the recent price appreciation in all crypto assets, Bitcoin included.

In some ways, the ETH/BTC ratio is a reflection of ETH/BTC community vitality, and I think it’s fair to claim that the collective emotions of twitter-Bitcoiner culminated into a dunking-on-Ethereum contest using a game they’ve invented.

Not to dodge the question about being able to audit the ETH supply on Ethereum.

It is important to be able to fully audit everything about a blockchain (a blockchain is itself one big audit). Ethereum and Bitcoin account for things differently, so using a Bitcoin frame-of-reference doesn’t work when discussing how Ethereum accounts for supply.

To help understand these differences, we’re bringing Vitalik Buterin onto the State of the Nation in order to unpack why Bitcoiners think it’s hilarious that Ethereans can’t audit ETH supply, and what Bitcoiners are willfully ignoring in order to present these criticisms.

-David

P.S. Subscribe to the Bankless YouTube to catch Vitalik on the State of the Nation

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

🎙️NEW EPISODE

Listen to episode 25 | iTunes | Spotify | YouTube | RSS Feed

MARKET MONDAY:

Scan this section and dig into anything interesting

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers 📊

- ETH mellows out by 0.76% to $395 from $392 last Monday

- BTC inches up 4.2% to $11,901 from $11,420 last Monday

- Total value locked extends 12.8% to $4.75B from $4.21B last Monday

- DAI stability fee stays at 0.00% with savings rate steady at 0.00%

Market opportunities 🤑

- Margin ETH perpetual on dYdX & get 10% off trading fees (last day for 55% off!)

- Borrow Dai from Maker at 0% interest with any collateral

- Trade w/ Loopring for near-zero gas fees (BANKLESS code for 6 bps on trades) 🔥

- Lend Dai on Aave for 4.9% (highest in DeFi)

- Unlock more affordable perks with the Crypto.com card

- Manage your Aave portfolio with DeFi Saver’s new dashboard!

- Buy yDai for a fixed rate, fixed term yield (⚠️warning: new!)

- Track your MTA rewards in real-time with mStable’s Earn feature

Yield Farming 🌾

- Weekly Crop Rotation: Anticipate the upcoming CRV distribution — sUSD pool offers 10.98% APY + 18% in SNX + CRV! (pre-launch rewards have ended though)

- Curve releases tool to calculate CRV earnings (it’s coming…)

- yEarn released yLINK & yaLINK vaults

- $ALEX is launching Uniswap liquidity incentives for his personal token

What’s new 📰

- Uniswap announced $11M Series A (and they added 68K users last month!)

- Etherscan got a facelift

- Aave showcases Credit Delegation with Deversifi (unsecured lending is trending)

- Genesis did $2B in loans & $5B in trading in Q2 2020 (crypto banks are massive)

- Opyn was hacked for $371K USDC (who insures the insurers??)

- yDai — fixed rate, fixed term borrowing & lending of Dai

- Set Protocol shares their v2 upgrade details (yeehaw yield farmers)

- Coinbase Pro now supports Band Protocol’s $BAND

- Nice dashboard on perpetual funding rates in DeFi

- This new Minecraft-like crypto game called ETHVerse

What’s hot 🔥

- Bankless Nation reaches 10,000 subscribers (You guys rock)

- Uniswap generated as much in fees as Bitcoin today 🤯

- Axie Infinity hints at a native governance token

- Grayscale files form to become SEC reporting entity (huge for institutions)

- Goldman Sachs may create its own crypto dollar (they also hired new crypto exec)

- Almost all DeFi projects have 30% of token supply held by top 5 holders (yikes)

- Ren Protocol has bridged over 10,000 BTC to Ethereum (Ethereum is a gravity well)

- Crypto dollars are now over $13B

- DeFi website traffic is surging

- mUSD supply hits $70M in 10 weeks

- Lawmakers ask IRS not to tax staking income (bullish for Eth2)

- There’s now an accelerator program specifically for DeFi

Money reads 📚

- RSA’s Read of the Week: 9 core value props of crypto networks - Jake Brukhman

- Synthetix surges despite demand lagging - Matteo Leibowitz

- Will DeFi governance look similar to traditional finance? - Token Daily

- Diving into the Bitcoin Perpetual Swap market - CoinMetrics

Governing DeFi (new!)

- Vote on Kyber Network’s new fee allocation. KNC holders can vote on their preferred allocation for protocol fees between voting rewards, liquidity rebates, and burns. Those who vote will be eligible to receive ETH rewards (currently ~444 ETH). Voting starts later today!

- yEarn is revisiting the issuance schedule. YIP 36 proposes to allocate system rewards towards operation expenditures instead of streaming it to governance. While this doesn’t explicitly change anything about the issuance schedule, the proposal highlights that the YFI community is working with Delphi Digital and Gauntlet to develop an economic model & inflation schedule for YFI. Keep an eye out!

WHAT I’M DOING

Check out a few cool things I’m capturing right now in crypto

Taking a day off. I’m not looking at prices today. I’m not on twitter. I’m resetting my mind, spending time with friends & family, and taking a break from the screens. If you’re on the Bankless journey I encourage you to do the same from time to time. Take time off. Reset. Quiet your mind.

Don’t lose sight of why we’re on the journey! It’s for our freedom. It’s for our loved ones. It’s for our relationships. It’s for our future. It’s for a better life.

Bankless is a means to an end.

Big thanks to Lucas and David who helped get Market Monday out today.

WHAT YOU’RE DOING

What’s the coolest thing you did in crypto last week?

- @iamDCinvestor redeemed his Bankless Badge (check out our guide here)

- @pierre_rochard went hard on contributing to Ethereum development

- @AxieAur earned SLP by playing Axie Infinity (and he sold them for ETH)

- @ljxie joined 2 token permissioned telegram chats (Bankless has one on Discord!)

See the rest here!

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

Our weekly assignment will drop TOMORROW with Tactic Tuesday.

DeFi Dad is going to show you how to swap tokens with ZERO fees on Uniswap.

Yeah, that’s right - no gas fees. During a time when gas prices are through the roof, this can be extremely valuable for anyone who’s actively swapping tokens.

On that note, this past tutorial should serve as a nice compliment to tomorrow’s assignment:

How to get gas price alerts with Hal:

Extra Credit Learning

- (Beginner) 📺How mStable works

- (Beginner) How Bancor V2 works

- (Intermediate) 📺 How to Zap into DeFi investments with Zapper

- (Intermediate) Learn about Balancer liquidity mining

- (Intermediate) Akropolis Yield Farming

Some recent tweets…

Don’t let the FUD get to you. ETH’s supply is verifiable. And it’s money!

Actions

- Execute any good market opportunities you saw

- Complete weekly assignment: Dropping tomorrow!

- Listen to YFI: Farming the Farmers | Andre Cronje

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.