DEX Title Fight: Uniswap vs. Sushiswap

Dear Bankless Nation,

I want to preface this article by saying this:

I believe Sushiswap is growing the pie for Uniswap and vice-versa. Big picture: it’s true these protocol compete, but it’s even more true that they benefit one another.

They both win more as a result of the existence of the other.

That said…it’s also useful to view them through the lens of competition. Through that lens, the Uniswap vs. Sushiswap DEX heavyweight title match is starting to heat up.

While Sushiswap was originally thought of as just another fork from #DeFiSummer2020, the protocol survived. They kept building. They innovated on their model. They developed an avid community and established culture.

Now, they’re approaching Uniswap in size.

I don’t think many of us would have seen this coming back in September.

So we had Lucas take some time and dive into the differences and see how they stack up against each other.

Let’s get ready to rumble.

The DEX title fight is here.

- RSA

WRITER WEDNESDAY

Bankless Writer: Lucas Campbell, Editor & Analyst for Bankless

DEX Title Fight: Sushiswap vs. Uniswap

There’s no doubt that there’s been a growing amount of tension between Uniswap and Sushiswap in recent weeks.

Even though Sushiswap was originally considered as a generic, tokenized fork of Uniswap amid the food farming mania, Sushiswap has not only survived, but thrived and innovated on the AMM model beyond all expectations. Sushi is now genuinely competing with its predecessor on multiple levels.

While they started as identical products, the past few months have diverged these two AMMs into two completely different products. Sushiswap has been constantly releasing new features—like Bentobox—while Uniswap core developers have been heads down building V3 behind closed doors. What’s in store for Uniswap V3 is tough to gauge, but it’s safe to say that competition between these two protocols is heating up.

The goal of this piece will dive into prominent on-chain metrics to compare how these two AMM protocols stack up against each other as they continue to battle it out for protocol dominance.

Let’s get into it.

Uniswap vs. Sushiswap

Round 1: Trading Volume

🏆 Winner: Uniswap

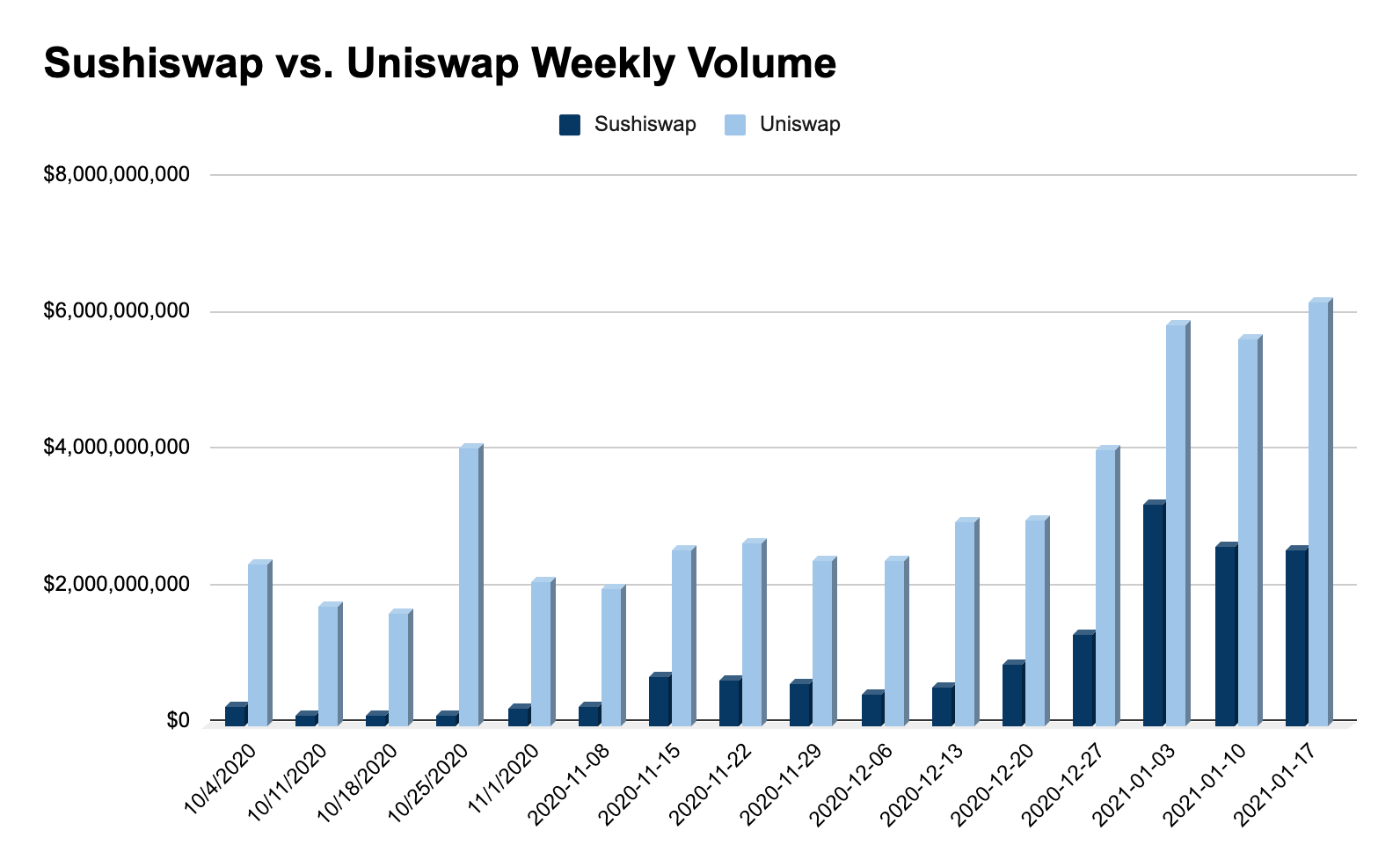

Naturally, one of the most fundamental metrics when measuring the success of any decentralized exchange is volume. After all, the core purpose of decentralized exchange is to facilitate token swaps among participants. And while Uniswap continues to dominate the DEX sector as a whole in terms of volume, Sushiswap is processing numbers that are tough to ignore anymore.

Over the past three weeks, Uniswap has averaged just shy of $6B in weekly volume while Sushiswap processed $2.8B—a substantial amount for a protocol who’s only been around for a few months.

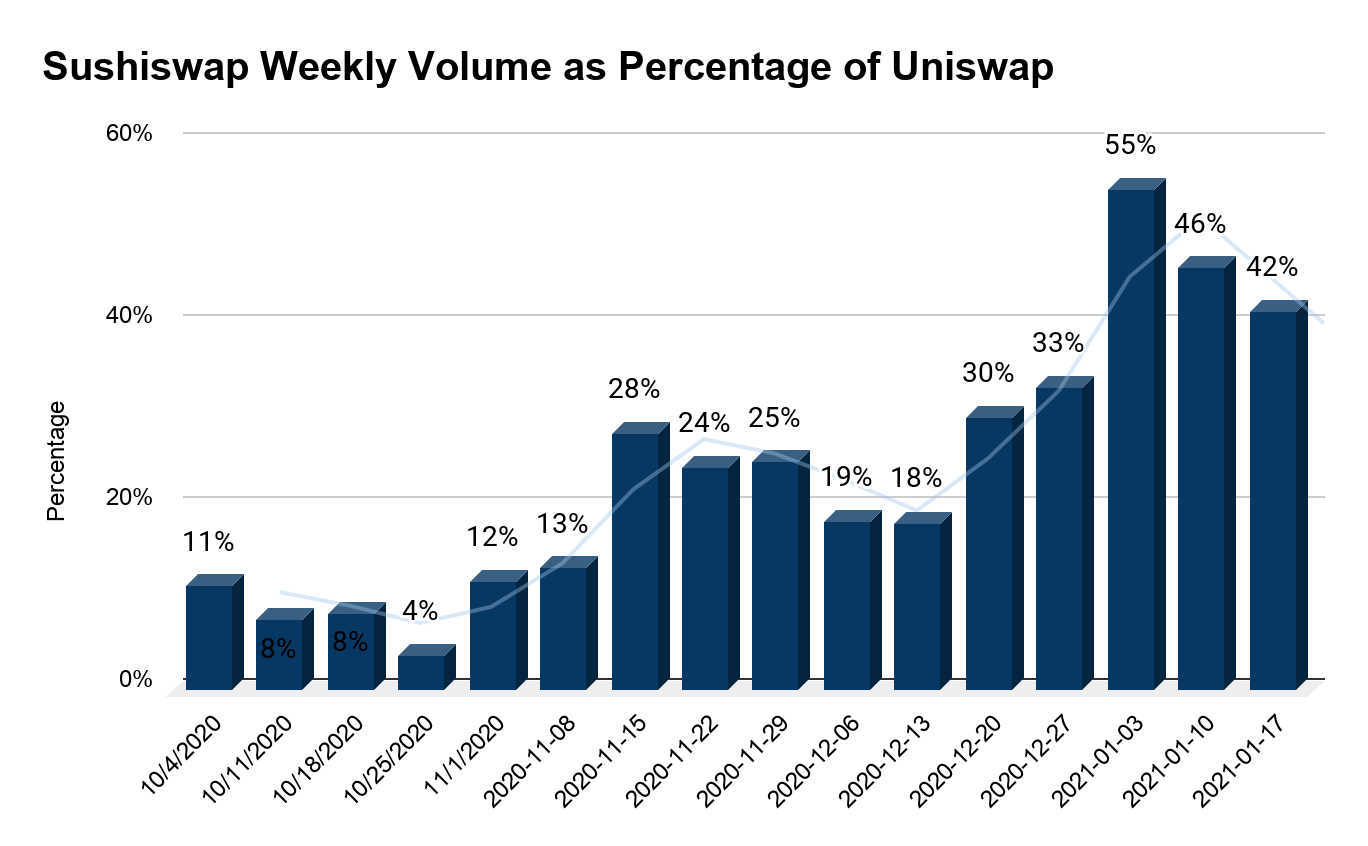

Despite still being materially lower than its competitor on a dollar by dollar basis (about a billion of them), Sushiswap is gaining ground, quickly. The data speaks for itself.

Just a month ago, in December, Sushiswap was processing an average of 25% of Uniswap’s weekly volume. Now, the protocol is averaging 48%. It’s nearly impossible to deny the trend: it’s up and to the right. If Sushiswap continues to eat away at Uniswap’s volumes at its average pace of ~2% per week, it would easily flippen Uniswap by years end. That’s no gimme though.

Round 2: Total Liquidity

🏆 Winner: Uniswap

The other key fundamental metric when it comes to measuring the success of a DEX is the total value locked, or the total amount of liquidity available within the protocol.

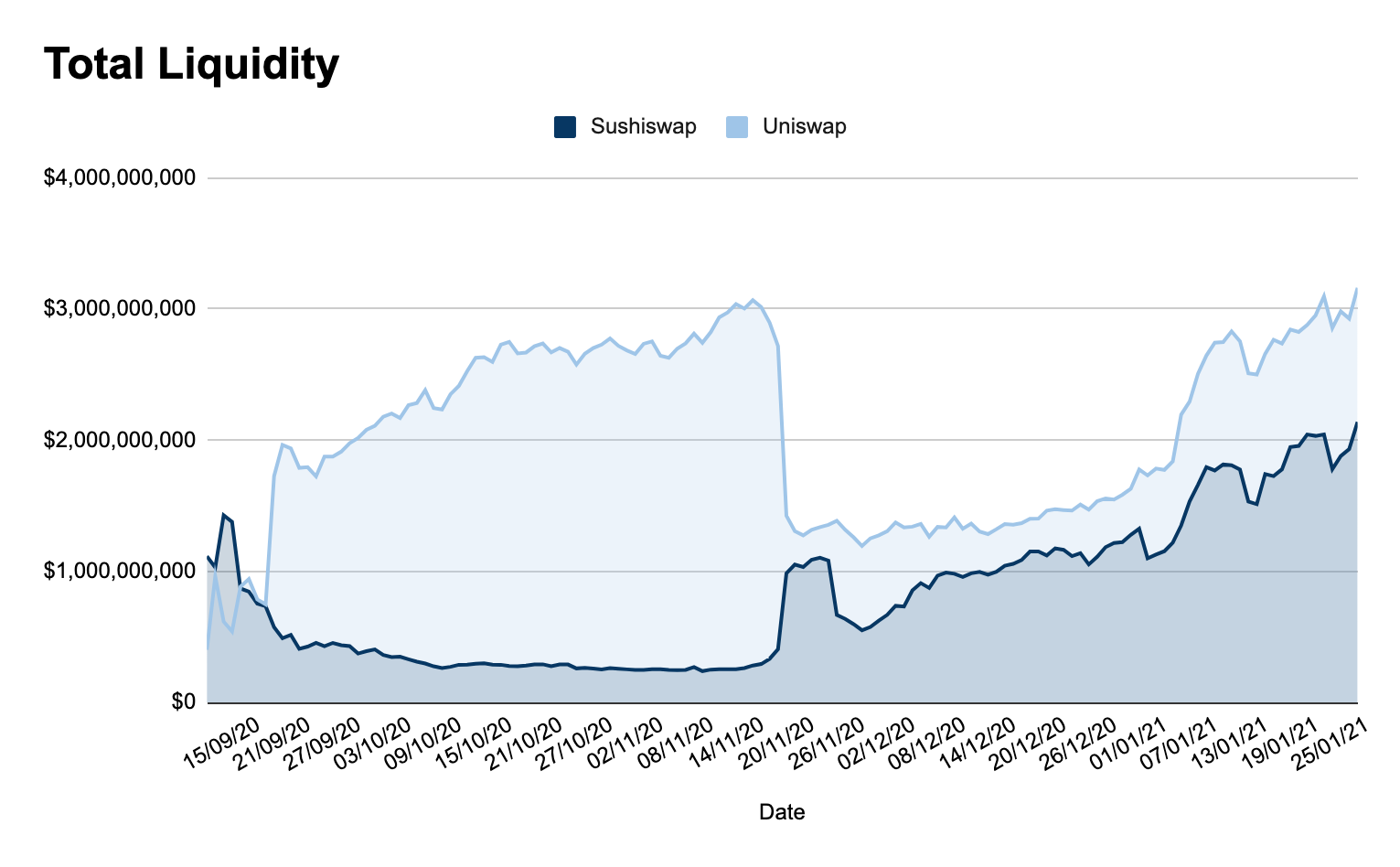

Sushiswap gained its recognition through its novel vampire attack, something that hurt the protocol’s reputation in its early days as it directly attacked DeFi’s darling. And the attack worked, at least for a little bit, as Sushiswap flippened Uniswap in total liquidity during this initial mania phase.

People just couldn’t resist the tokenized incentives. If anything, Sushiswap’s ‘fork + add a token’ strategy showed the power of tokenized incentives, and that moats can easily be destroyed if incentives are implemented properly.

But Uniswap fought back. Within weeks of the Sushiswap launch and encompassing vampire attack, Uniswap finally capitulated and launched its own token. But that wasn’t all.

Uniswap took it a step further by kickstarting a new movement by retroactively distributing 15% of the token supply to its previous users. (RSA—in our convo yesterday 0xMaki said Uniswap may have pushed out this airdrop to stay competitive). In other words, anyone that used Uniswap before earned a few thousands dollars in return. Actually, most recipients made more from using Uniswap once than the U.S. government was able to give to its constituents in 6 months amid the global pandemic.

UNIversal Basic Income was born. And like Compound’s yield farming craze, Uniswap’s retroactive distribution stuck with the DeFi industry and is now becoming standard for new and old protocols launching tokens.

⚔️ Sidequest: which DeFi project will do an airdrop next? Here’s our top 9 guesses.

As a result of Uniswap’s token launch, the tables turned instantly. After Sushiswap had soaked up a significant amount of liquidity in August, LPs flocked back to Uniswap in order to get their hands on newly minted UNI tokens from the initial liquidity mining allocation.

Months later and things have mellowed out. Both protocols are now boasting multi-billion dollars in liquidity.

But there’s one key difference. After ending the initial liquidity incentives in November, all of Uniswap’s $3B in liquidity is now completely unsubsidized by the protocol. Meanwhile, Sushiswap continues to heavily reward its LPs with further SUSHI rewards.

The caveat here is that while Uniswap’s liquidity isn’t directly incentivized by UNI tokens, plenty of projects are leveraging Uniswap as their primary trading venue, and are incentivizing their own community to provide liquidity to their respective Uniswap pools.

Regardless, the higher liquidity paired with the lack of native UNI incentives is a strong indicator of a product market fit. Uniswap continues to act as the premier trading platform for traders and token projects across the board. However, Sushiswap crossing its $2B milestone in total liquidity is nothing to brush off. There’s significant depth while key DeFi projects, notably the Yearn ecosystem, are electing to use Sushiswap as its primary liquidity venue instead.

Round 3: Revenue

🏆 Winner: Uniswap

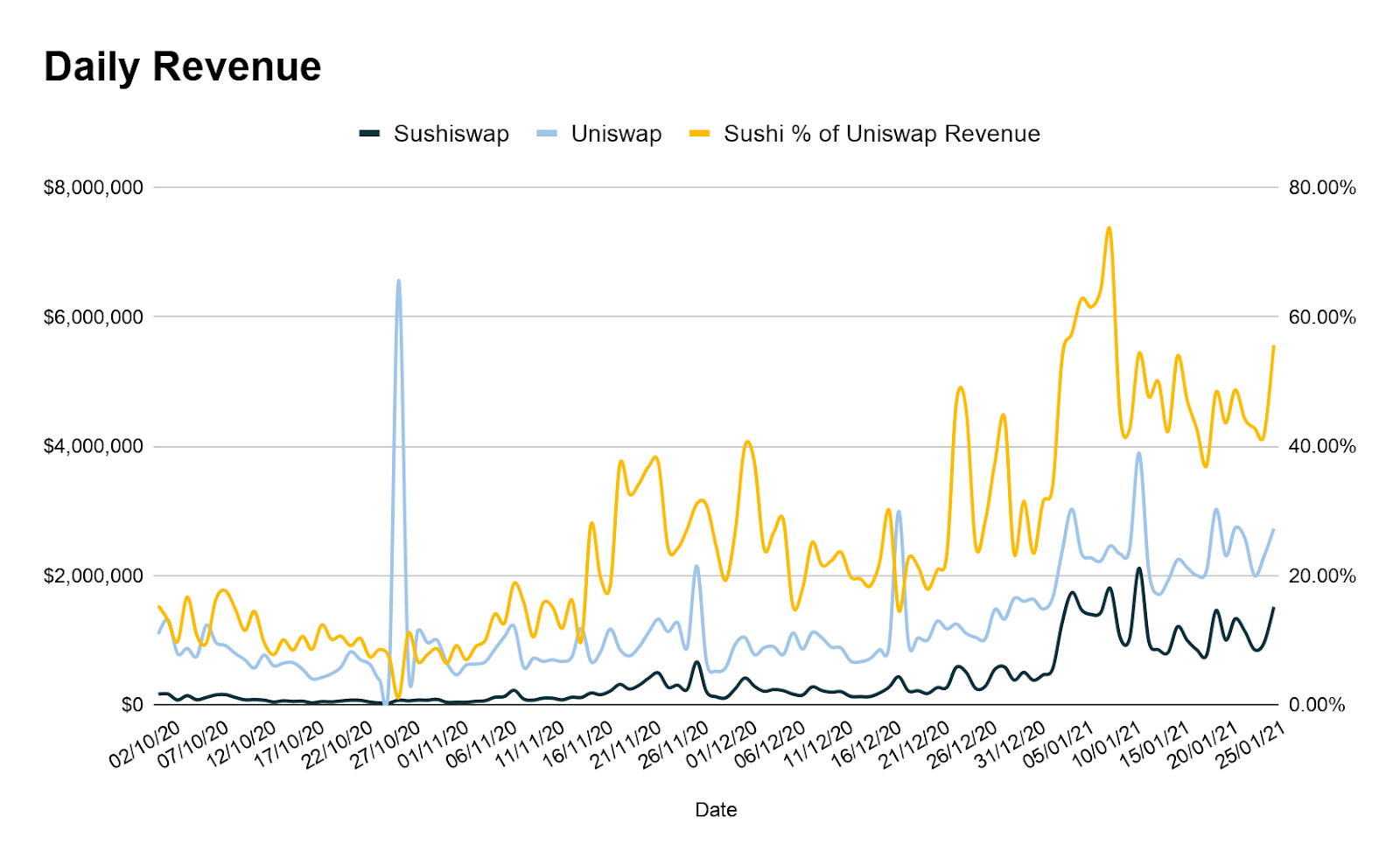

With both protocols competing closely in terms of volume and liquidity, revenue becomes another key metric to look at. Revenue comes from cash flows generated to LPs from trading fees. Notably, both protocols feature a 0.3% trading fee on any and all token swaps.

But even in the entire DeFi sector, Uniswap is king. The protocol is a cash flow generating machine. In January 2021, Uniswap averaged over $2.3M in fees to LPs per day—substantially higher than anything else in the sector. The next closest competitor? Yup, you guessed it. It’s Sushiswap. The AMM represents just half of Uniswap’s daily revenue, yet still averaging seven figure earnings to liquidity providers with ~$1.2M in daily fees.

Similar to volume, Sushiswap is gaining ground. Earlier this month, the protocol spiked to generate ~64% of Uniswap’s daily revenue while averaging ~46% of Uniswap’s daily revenue in the past 7 days. Even though this is still significantly lower than Uniswap, the trend is tough to ignore: Sushiswap is chipping away at its competitor.

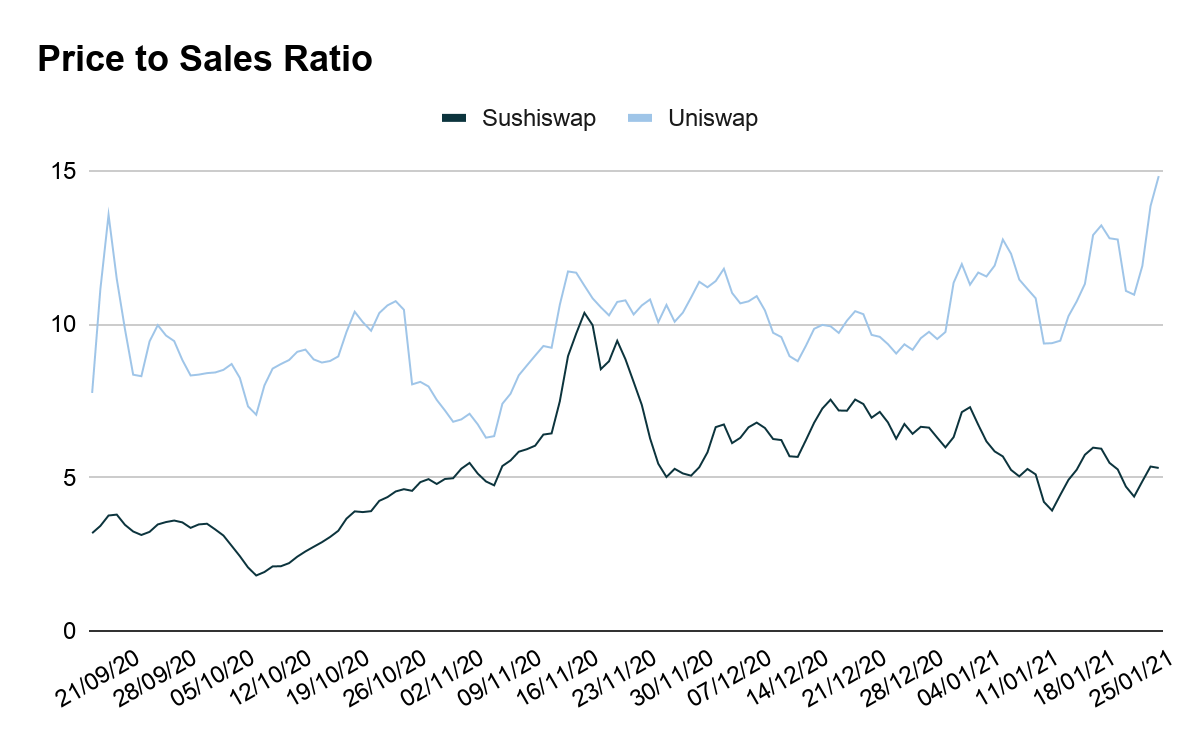

Round 4: Price to Sales (P/S)

🏆 Winner: Sushiswap

The price to sales ratio (P/S) is becoming a common valuation metric for DeFi protocols. We’ve touched on this topic plenty of times before, but for those that are new, the P/S ratio compares a token’s market cap to the protocol’s revenue, meaning its an indicator of how the market is valuing the protocol relative to the amount of fees it generates.

This means that tokens with a lower P/S ratio may be more fair valued than a similar protocol with a higher P/S OR that the market has lower growth expectations for the token (and vice versa).

According to Token Terminal, Sushiswap has been holding steady with a P/S ratio of ~5 while Uniswap recently touched ~15 on the back of a significant price run up over the past few weeks.

With the above in mind, the market is currently overvaluing Uniswap relative to Sushiswap strictly in terms of the cash flows it generates today. But this doesn’t mean Uniswap is overvalued. Or that Sushiswap is undervalued. As mentioned, there’s plenty of nuances behind this valuation metric and it’s really up to the reader on how they want to interpret this data.

The one thing I would like to mention about these two assets is their token economic design. UNI tokens are currently a non-productive governance token, meaning they don’t represent any economic rights over the cash cow that is Uniswap. On the other hand, SUSHI holders do have a claim to the protocol’s cash flows, making it a productive asset. (RSA—one reason for this difference may be regulatory concerns, again see our conversation with 0xMaki from Sushi)

With that in mind, Uniswap V2 introduced an optional protocol charge that would shift the 0.3% trading fee to LPs down to 0.25% to LPs and remaining 0.05% to be directed by a decentralized governance process. Sushiswap adopted this exact model but rather than being ambiguous about the intentions of the protocol charge (and having it off by default), it gave SUSHI holders a direct claim to the protocol’s cash flows by staking.

Today, the cash flows to SUSHI stakers returns ~8% APY from the $5.3M in staking fees generated over the past 30 days.

According to the 30D revenue, if Uniswap were to implement this same model, the protocol would be generating twice as much to UNI stakers at $11M in revenue this month, coming out to $132M in annualized revenue to our hypothetical UNI stakers, resulting in a dividend yield of 3.1%.

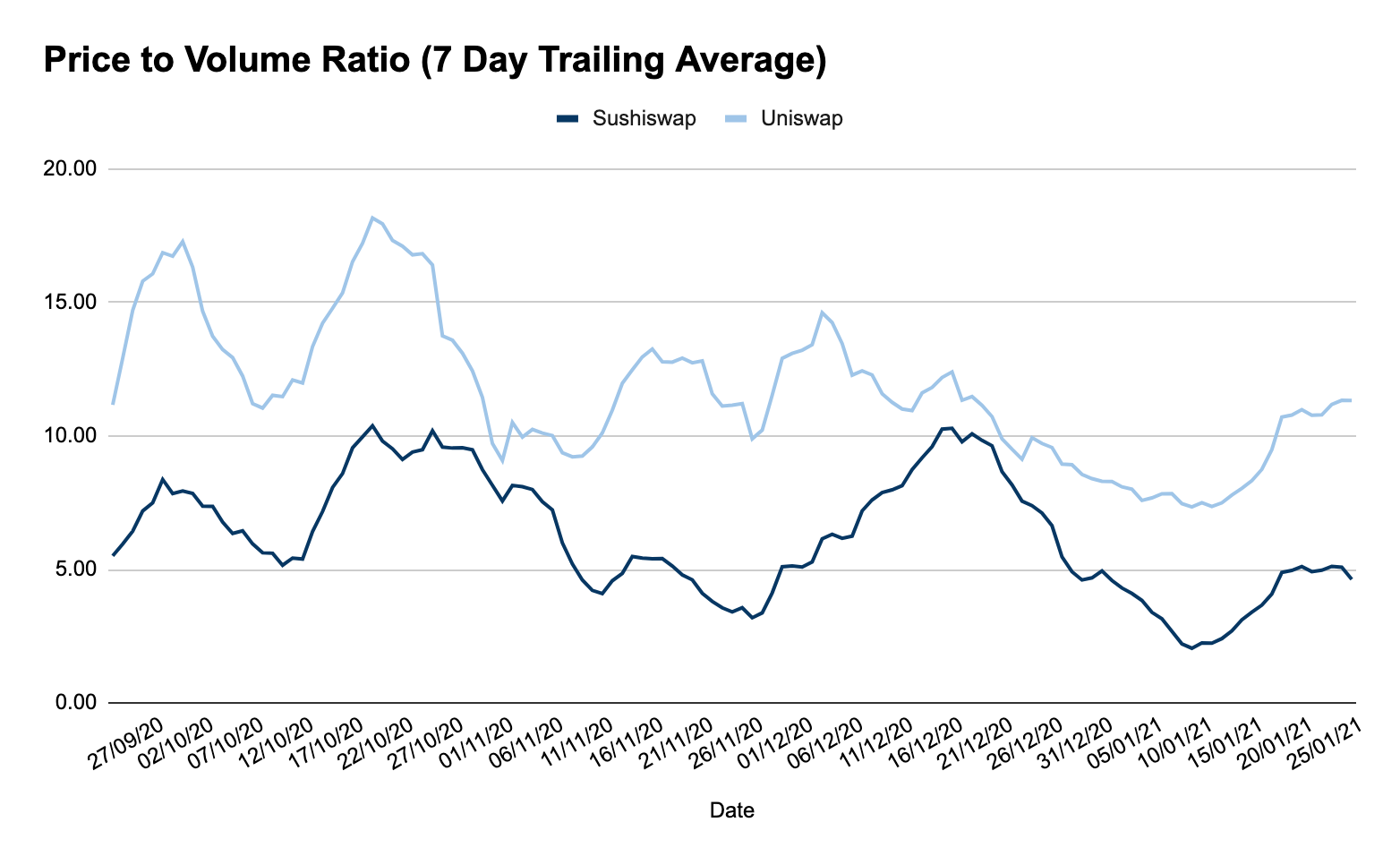

Round 5: Price to Volume Ratio (P/V)

🏆 Winner: Sushiswap

The Price to Volume Ratio (P/V) is a newer, DEX-specific valuation metric that holds similar properties as the P/S ratio (that I’m making up right now but let’s ride with it).

Rather than valuing these liquidity protocols based on the amount of fees they generate, which can become nuanced when looking at protocols with different take rates, the P/V ratio cuts through it all and identifies how the market is valuing the protocol based on the amount of volume the exchange facilitates.

To put this in simple terms, the market is currently valuing Sushiswap at ~$4 for every $1 in volume that it facilitates on a daily basis. For Uniswap, this ratio is higher at ~$11 for every $1 in volume it processes.

Under this measurement, you’re technically getting a better bang for your buck today on SUSHI than UNI. But as mentioned, valuation metrics can become nuanced as everyone has different perspectives.

Similar to the P/S ratio, the market could be valuing Uniswap at an increased P/V ratio as they have higher growth expectations for the protocol relative to Sushiswap. In the same vein, given how Sushiswap is still a newer protocol, growth expectations for the protocol could be lower from the market as it hasn’t clearly defined its moat—whereas Uniswap has.

Regardless for how you want to cut it, Sushiswap is currently punching above its weight class today in terms of the actual volume it generates compared to Uniswap when measuring it on the basis of P/V.

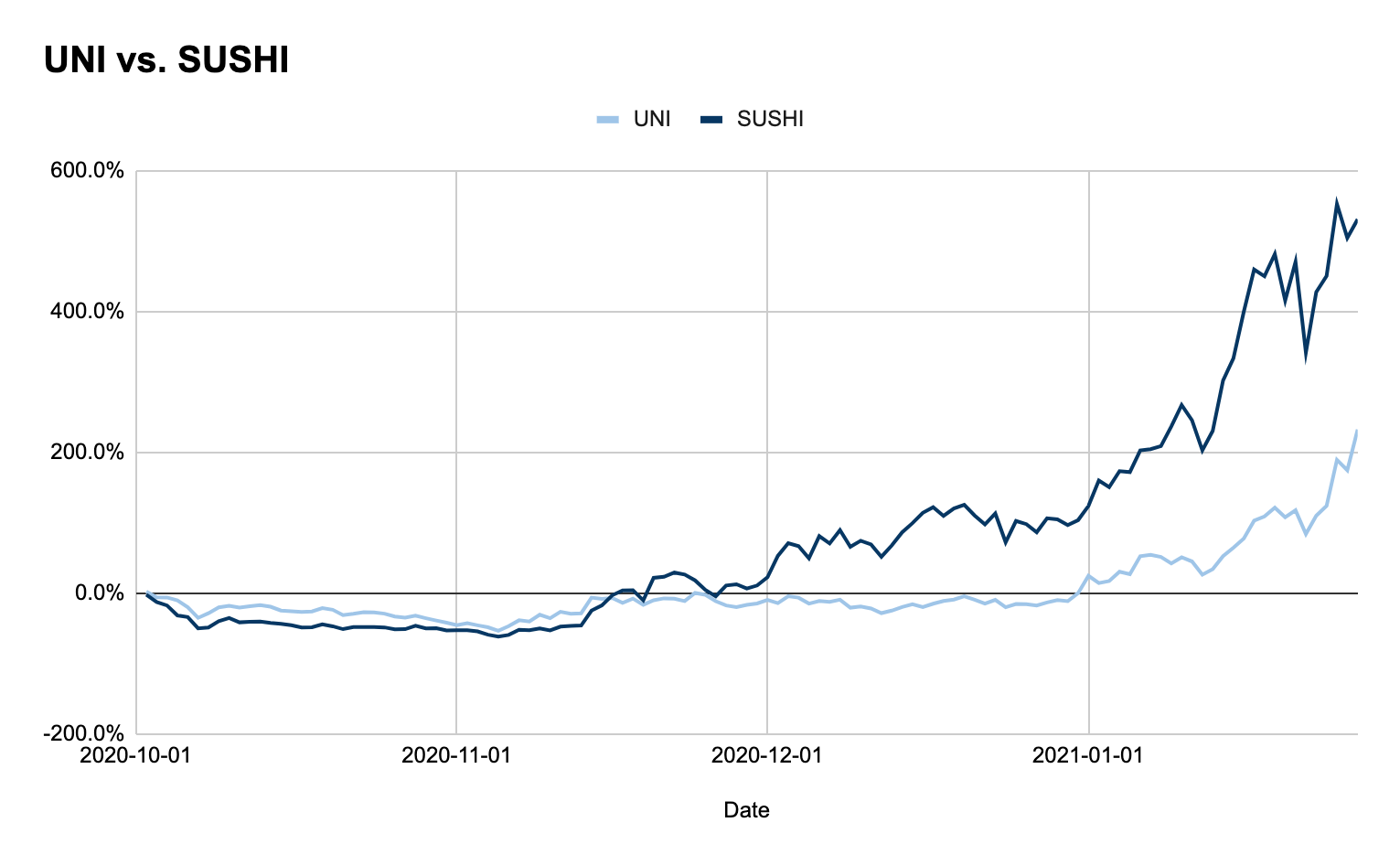

Price Performance

🏆 Winner: Sushiswap

Alright, let’s get to the main event. At the end of the day, fundamental and valuation metrics only get you so far.

The market is the ultimate referee. So how have these tokens performed against each other? Both protocols have seen a massive run up in recent weeks, so whether you’re a SUSHI or UNI holder, you’re probably pretty happy right now. But it hasn’t been all sunshine and flowers.

Uniswap and Sushiswap (and the entire DeFi market for that matter) had a rough time in late Q3 and early Q4. During this time, amid the DeFi bear market, UNI held its ground better relative to its fork as UNI’s lowest trough in Q4 was a -53% drawdown whereas SUSHI holders felt more of the pain at -61%.

Good thing both projects have bounced back considerably since then. Looking at it today, Uniswap has soared to 232% since the beginning of Q4 2020 whereas Sushiswap exploded back into the scene (after everyone thought it was dead) with a 530% gain.

It’s important to recognize that Uniswap is a higher market cap asset, meaning it’s naturally going to take more dollar inflow to move the needle. For reference, Sushi’s circulating market cap at the bottom was only $48M whereas Uniswap’s was still north of $500M.

Therefore, the intuitive expectation would be if a bull run were to happen and Sushiswap remained relevant, that Sushi would naturally outperform Uniswap. It simply takes less dollars to move it.

Tallying up the scores

While Uniswap still remains dominant, the growth of Sushiswap in recent months and its competitiveness in the market is a strong indicator of an increasing product market fit.

The end results of today’s battle? A tie: 3-3

Uniswap won out on fundamental metrics like volume, liquidity, and revenue due to its dominance as the premier liquidity and trading venue in DeFi. On the other hand, Sushiswap won out on valuation metrics like P/S, P/V, and price performance due to the more attractive economic design and the smaller market capitalization.

If anything’s for sure, the coming year for these two protocols will be exciting. The competition doesn’t look like it’ll slow down anytime soon either.

Both Sushiswap and Uniswap are slated for major releases—notably V3 for Uniswap and whatever upgrades that entails (RSA—come on Bankless podcast Hayden and tell us something pls) and the ambitious roadmap Sushiswap laid out earlier this year.

Only time will declare the winner.

Action steps

- Research how these two protocols stack up against each other

- Use the metrics in this piece to value how other protocols stack up to each other

- Learn about these protocols. What is Sushiswap? What is Uniswap?