It's DeFi Season

Dear Bankless Nation,

Welcome to 2021. Things are a bit different now.

XRP is a security. EOS has settled with the SEC. No one really thinks Bitcoin Cash is the real Bitcoin. Tron stopped working a few months ago. And who even talks about DAGs anymore?

It’s safe to say that the asset landscape has changed significantly since the last bull market cycle.

Speculation on Layer 1 assets is basically non-existent. Polkadot’s DOT is one of the only significant exceptions these days, and in the Bankless 2021 Predictions, I predicted that no new major L1 blockchain will ship.

What this means

In bull markets, hundreds of thousands of new market participants arrive with cash-in-hand. And all they’ll want to do is speculate.

They’re starting to feel the FOMO too. Bitcoin just ran from $5,000 to $40,000 while ETH nears its previous ATHs. Both assets are the de facto crypto monies in the current ecosystem and they’re comparatively the most de-risked crypto investments.

Bull markets are fueled by greed. They are fueled by people pulling out their calculator app, and asking “If I had put all my money into BTC in March of 2020, how much money would I have right now?”.

The answer of course is “8x the money!”, regardless of how overly-reductive this calculation is (most people probably would have sold along the way, most people wouldn’t have caught the bottom etc.).

These new entrants want that same 8x treatment BTC just got, but they’re seeing that $40,000 BTC price tag and thinking BTC doing another 10x or so is too unlikely.

And so these new players arrive, pockets full of cash, and they look further down the list of assets by market cap, looking to speculate on which token will score them a 10x!

The Crypto Bull Market Cycle

First BTC pumps. Then ETH follows. All of this new money then flows down to alts. Finally, we have a -40% drawdown. Rinse and repeat.

This is the way. This general rule of thumb is how people think these markets move forward. Gains in BTC rotate into gains in ETH, which rotates into Alts.

Alts, being the lowest market cap assets, are the easiest to pump. This is the point in the cycle where you see reflexive parabolic 100x gains. At this point, too many people have made too much money too quickly, and the whole ecosystem retraces by 30-40%.

The leverage and greed get washed out, and we wait for BTC to start increasing in price, indicating that it’s okay to take on more risk once again.

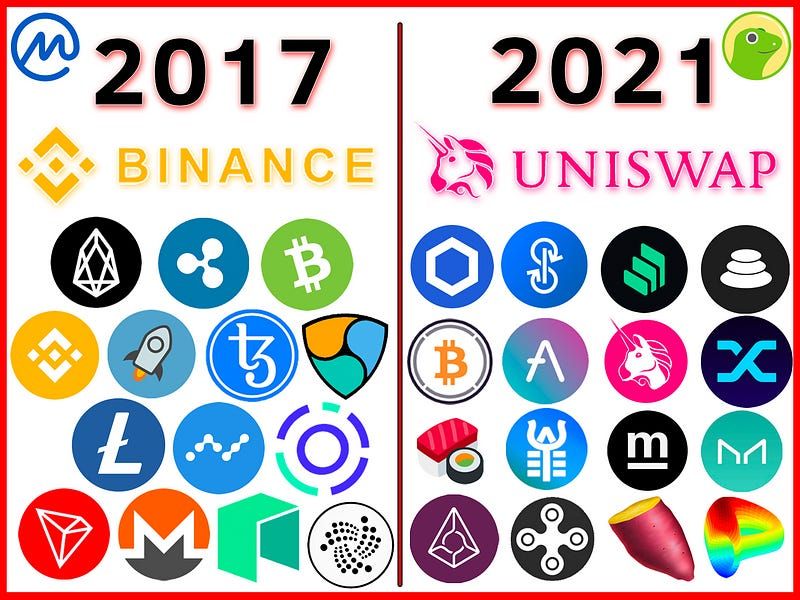

Binance Vs Uniswap

Binance was the darling exchange of 2017. It was one of the world’s fastest companies to achieve unicorn status by rapidly answering to retail demand and listing every single asset possible. Binance rose to fame by serving the speculation itch, and basically hosting #altszn. It became the Schelling point for token listing and liquidity moving forward.

One of the key drivers behind its traction was being freely accessible (Binance was KYC free until 2019) with unrestricted deposits and withdrawals.

It perfectly positioned itself to capture the needs of 2017. Because in 2017, there' was a significant amount of Layer 1 speculation. People wanted to buy into “the next Bitcoin” or any Ethereum Killer they could get their hands on.

Bitcoin was amid a civil war while Ethereum was only a few years old—no one was convinced they would succeed in the future.

As a result, the 2017 cycle held a lot of L1 token speculation. And in turn, it needed a centralized exchange to act as the cross-chain infrastructure.

You can’t trade BTC for ETH without an intermediary; these blockchains can’t communicate with each other, so you must have an intermediary provide that service for you. Binance was that intermediary.

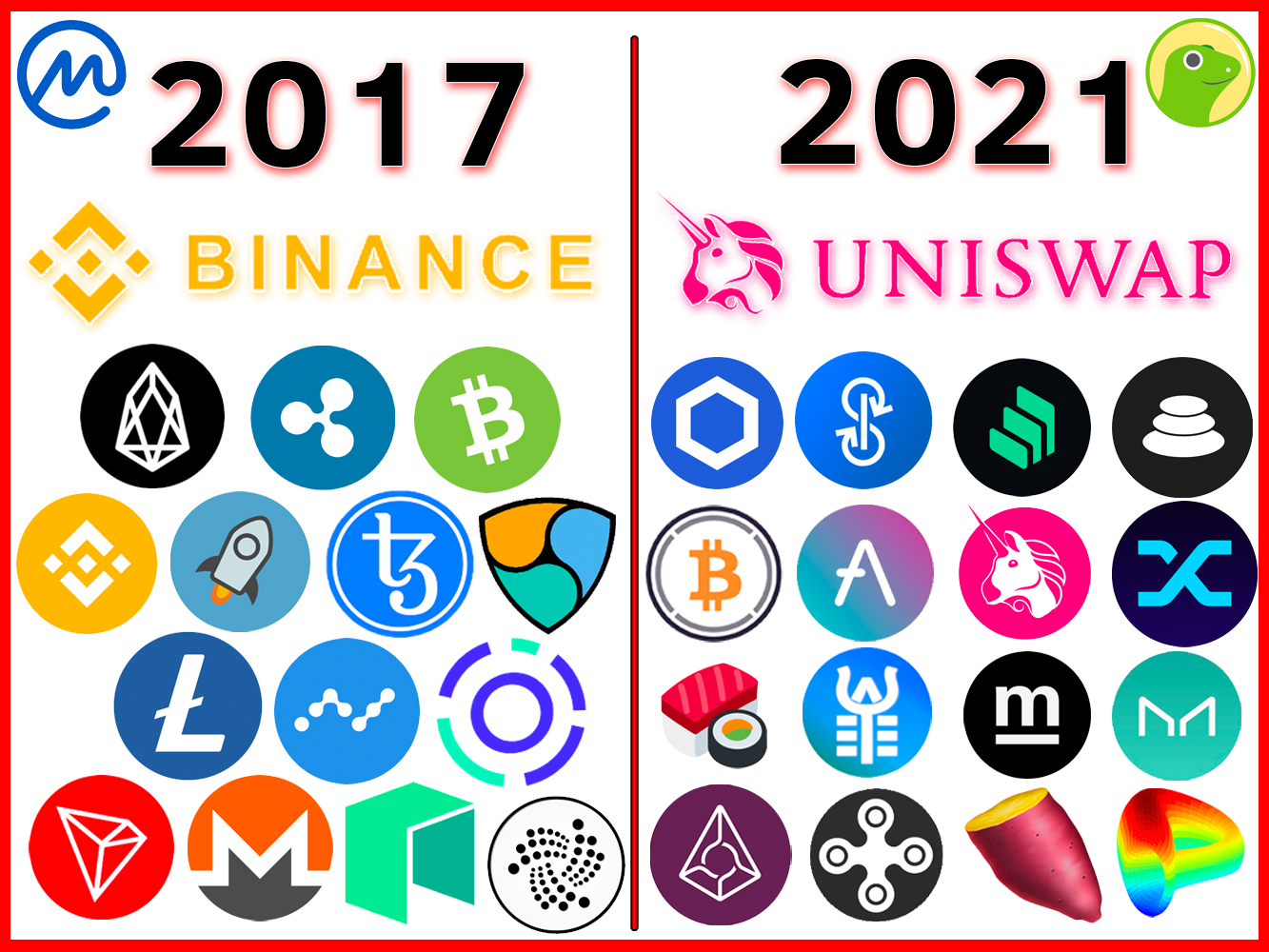

Uniswap

Uniswap is like Binance on steroids.

Not only is Uniswap KYC free, like the Binance of 2017, but it also doesn’t need email & password signup. If you have an Ethereum wallet, you have a Uniswap account.

Uniswap doesn’t require deposits and 20-minute confirmation times. If your money is on Ethereum, it’s ready for Uniswap. If your transaction is settled on-chain, your money is available to you at that very moment. No added friction required.

Better yet, rather than centralizing asset listing decisions to a team, and requiring token teams to pay enormouslisting fees, Uniswap pushes asset listing to the margins.

Want your asset on Uniswap? Go ahead, here’s the link. All you need is the token contract address and some ETH to go with it.

Part of Binance’s rise to success was the BNB token, which allowed Binance to receive funding and ‘go public’ extremely early in its lifespan. The ICO investors to Binance have been rewarded handsomely, as the token was sold in an ICO for $0.10 and it’s now worth ~$45 (this is why people speculate on low-cap tokens 😉).

In a similar manner, Uniswap distributed its UNIversal Basic Income to over 200,000 of its users. UNI traded at $1,200 at the time of distribution and is $3,600 now as Uniswap has become the Schelling point for asset trading on Ethereum. And as we know, Uniswap has already topped Coinbase in weekly trading volume.

Cryptocurrency and blockchain technology is revolutionary. Trading assets on centralized exchanges is not revolutionary.

The era of L1 speculation is coming to a close. Bitcoin and Ethereum have pretty much won. Now, the era of application layer speculation is upon us. And the winners are largelyundecided.

Even Uniswap, DeFi’s darling, has a viable alternative in Sushiswap. The competitor has 2x’d in price in the last 14 days and showing significant volumes, illustrating how much speculative potential there is in DeFi protocols.

Altcoins are Out. DeFi Tokens are In.

Ryan hates the term ‘Altcoin’.

His take is that the ‘Altcoin’ classification is an outgrowth of Bitcoin maximalist thought which refuses to acknowledge the categorical differences between many of the different assets under this catch-all umbrella.

I agree with this opinion, of course. This is the correct and informed way to view this industry. I hope that 2021 brings further comprehension and understanding about these categories, as they relate to crypto assets.

But…

The new players coming into crypto with cash-in-hand do not understand these distinctions. They aren’t informed like the readers of Bankless. They’re not crypto natives, they’re crypto noobs.

It’s unavoidable, but this industry is about to be flooded with novice investors who are wandering around in the dark trying to find their way. These nuances are beyond most of them. For these reasons, we’re still going to experience ‘Alt Season’; the term used to describe the time in which people chase 10x gains in low-market cap tokens.

But this time, it’s not going to be speculation on the future L1’s of the crypto industry.

BTC and ETH have already won that game. That area of crypto has already been discovered and settled-upon. If Ethereum truly has won the L1 wars, then the next frontier is Ethereum’s app layer.

This means DeFi tokens. And these assets are an extremely undervalued component of the overall crypto market cap.

History doesn’t repeat, but it does rhyme.

Human psychology has stayed the same, but the assets have changed.

Alt Season is out. DeFi Season is in.