Uniswap and the Overton Window of Capital

Dear Bankless Nation,

Universal Basic Income (UBI) has rocketed to mainstream conversation and popularity in the U.S.

What was recently spearheaded by Andrew Yang and his ‘not left, not right, but forward' movement, UBI has been branded as an apolitical, neutral mechanism for fostering the U.S. economy and supporting all sectors of the country.

As a result of the UBI campaign, as well as the following gut-punch of COVID, Universal Basic Income is now widely known—and is starting to gain support across both sides of the political aisle.

Meanwhile, the U.S. government has only sent a one-time check of $1,200 to all U.S. citizens, and talks of further aid in the ‘Universal’ category haven’t progressed. Restaurants and bars are still closed, jobs are still being lost, and in the midst of the most polarized time in U.S. history, COVID continues to rage.

It’s in this backdrop that Uniswap, Ethereum’s largest application, just printed billions of dollars of “equity” to anyone that’s ever used the application—all 185,000 of them. Anyone who’s used Uniswap before September 1st can now claim 400 UNI.

At a UNI price of $3, that means Uniswap’s drop matched the U.S. Federal Government’s COVID relief checks—$1,200 per ETH address.

$1,200 in UNIversal basic income

It’s as if Uber had given out shares of its company into the hands of anyone that’s ever ridden with Uber.

But Uniswap had no intention of providing any sort of Basic Income; that was not the goal. The goal was to distribute ownership of Uniswap to the right people—it’s early users.

The rationale? Uniswap’s users are far more likely to be good stewards of their favorite product vs. some rando without any skin-in-the-game.

Chris Burniske’s piece A Blank Slate of State puts forth a thesis for what DeFi and crypto is able to do. Chris believes that, through crypto-economic incentives and mechanisms, we’re able to integrate labor and capital together, rather than have them be so incredibly polarized. Chris wants to see labor compensated with more than just money, but rather with equity too.

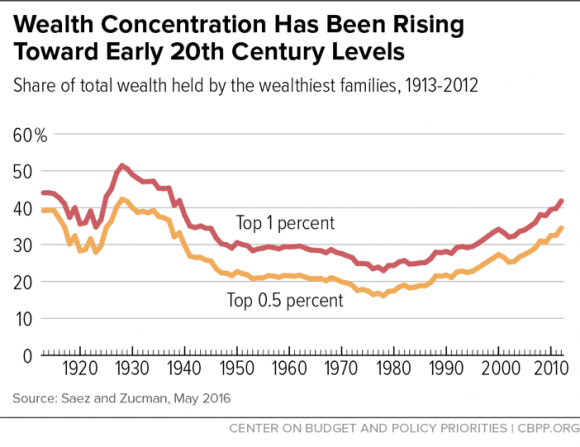

As the wealth inequality in the world has reached new highs, the global population is becoming increasingly thirsty for new forms of wealth to emerge. As jobs disappear, there either must become new ways of creating and distributing wealth or instead, there will be growing class conflict and an increasingly higher likelihood for the bottom half of society to ‘sweep the board’.

Good thing Uniswap changed the game for capital and wealth distribution.

By providing liquidity to Uniswap, you’re contributing ‘labor’ to the protocol (although it’s still an activity that requires capital). Liquidity is the input that’s required to produce the product (a decentralized exchange) that’s sold to consumers (traders). Therefore, Uniswap’s distribution model gave both Laborers AND Consumers equity in the protocol while laborers received an outsized share of the distribution.

While this model still has to work its way into the mainstream (starting with Uber drivers earning Uber shares in compensation, in addition to their salary), we are watching the Overton Window shift towards the integration of Labor and Capital.

And per usual, DeFi is spearheading this effort.

- David