Best DeFi Yields on USD | Q3 2021

Dear Bankless Nation,

Yields have cooled down a since DeFi summer.

But you have to admit, we were pretty spoiled with double-digit returns.

It’s still easy to beat Wells Fargo’s 0.01% savings accounts. Even the safest ways to earn in DeFi generate 3-7% APY on USD.

While returns have dropped, the good thing is that Layer 2 Summer is heating up. Polygon made the initial move, partnering with DeFi protocols to incentivize liquidity in its ecosystem while also throwing in some of its own tokens, MATIC, into the mix.

And the Layer 2 yields resemble the glory days of DeFi summer. The difference is that we’re not paying hundreds of dollars in gas fees for every transaction!

Is this just a hint of what’s to come in Layer 2 Summer?

Polygon is first…Arbitrum and Optimism next?

Either way, what are the best ways to earn dollars on your dollars right now?

Ben highlights the our favorite opportunities today.

- RSA

P.S. While we’re talking yields—Kyber just launched its liquidity mining program for its new Dynamic Market Maker (DMM). Learn more—APY’s lookin 🔥

What are the Best Yields on USD?

We’ve been spoiled over the past year. The explosive rise in crypto prices, DeFi activity, and the proliferation of liquidity mining led to a plethora of three, four, or even five-digit plus APR/APY opportunities for yield-hungry DeFi users.

But that’s not the world we live in today. The yield landscape has drastically changed as markets are on the ropes, on-chain activity has dropped to levels not seen post-DeFi summer, and the insatiable appetite for risk is gone.

What was once a bountiful harvest now resembles a famine. 💀

Okay…that’s a little dramatic. While yields have compressed considerably, there are still plenty of opportunities to earn a high return. This remains true for stablecoins.

Let’s explore some fruitful farming opportunities on both Ethereum and Polygon where you can put your stablecoins to work, along with secondary opportunities to redeploy the harvested rewards from these strategies to compound your returns.

But first…let’s ask the question: where are these yield coming from?

Where do stablecoin yields come from?

While they may someday function as a highly efficient medium of exchange, the primary value proposition of stablecoins today stems from their utility within DeFi.

There are numerous protocols where users can put their stablecoins to work while being paid to do so via liquidity mining incentives. While the yields are typically lowest on stablecoins when compared to opportunities with other assets, the key differentiator is that stablecoin holders can employ strategies that don’t expose them to price risk.

Although many “pool 2” farms have higher quoted yields, entering them comes with the heightened risk of losing your underlying capital. This could be in the form of the assets you are exposed to declining in price, or impermanent loss if you are providing liquidity on an AMM. This can be especially problematic if you are using leverage to farm via a money market like Compound or Aave, as it means you risk a situation where you cannot pay back your debt.

Stablecoin based strategies are not nearly exposed to those risks to the same degree because, well, their value is largely stable. This lack of price movement means the risk of impermanent loss is significantly reduced, as AMM LPs are essentially “short volatility,” while users can also participate in other types of opportunities without needing direct exposure to an asset that could lose its value.

⚠️ Holding stablecoins is NOT without risk. There is always the chance that a stablecoin loses its peg, and centralized stablecoins of course come with considerable counter party risk. Be sure to vet your stablecoins like you vet your farms!

The Drivers Of Yield

Before aping into any yield opportunity, it’s important to understand how yields are calculated and what drives them.

The yield of an incentivized DeFi pool is determined by four different supply & demand factors:

1. Supply of liquidity in the pool

All else equal, as the supply of liquidity in a pool increases, returns will decrease, as fees and rewards will be dispersed across a larger amount of capital (and vice versa).

2. Demand to use the pool

As the demand to use a pool increases, returns will increase, as more revenue, whether it be in the form of trading fees or lending interest, will be generated for liquidity providers.

3. Supply of the rewards token distributed to a pool

While this is usually a fixed amount determined and subject to change by the issuing party, when the supply of tokens distributed to a pool increases, returns will increase, as LPs will earn a greater number of tokens.

4. Value (demand) of the reward token

As the value of the reward token increases, returns increase, as LPs earnings will be denominated in an appreciating asset.

Let’s see what this might look like in practice.

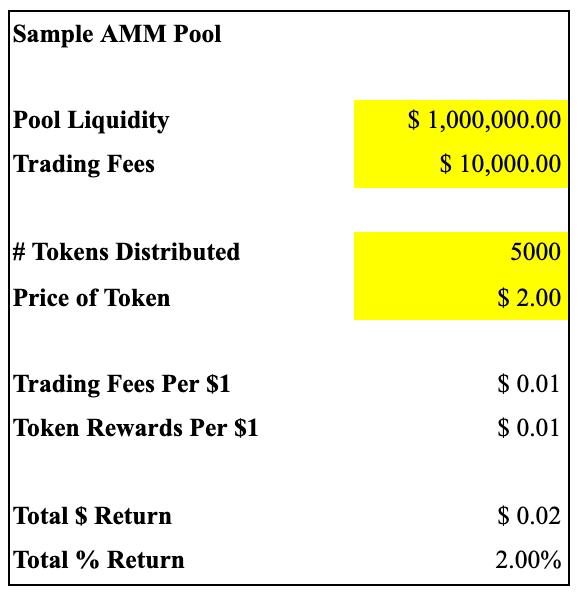

🤓 These figures are all completely made up. This model does not account for compounding fees or rewards. If you’d like to play around with it for yourself, click here!**

Sample AMM Pool

As we can see, there is $1 million of liquidity in the pool, with $10,000 in being generated in daily trading fees, and based on current prices, an additional $10,000 worth of token rewards being issued. This means that for every $1 of liquidity, LPs will earn $0.02, or 2% in combined fees and trading rewards. (This does not take into account the compounding of fees).

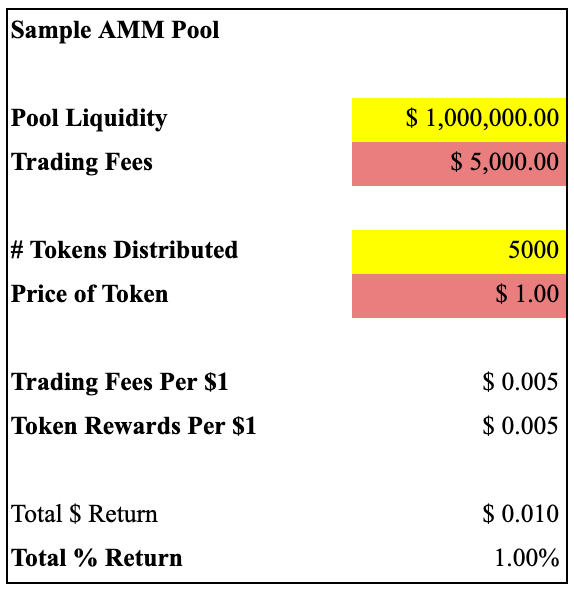

Now, we can have a look at how changes to some of these parameters impact the yield of the pool.

Sample AMM Pool

In this new scenario, while the liquidity of the pool remained the same, trading fees decreased 50% to $5000. Furthermore, although the distribution rate did not change, the price of the token being rewarded declined 50% as well to $1. As a result, a strategy that was once earning a liquidity provider 2% is now only yielding them 1%.

This example demonstrates why yields have come down across the board. As activity across DeFi has declined, DEX volumes are down nearly 50% over the past month, so too have fees.

In addition, the drop in token prices has meant that earnings from liquidity mining rewards have also been devalued.

Ok, with that understanding…let’s get into the opportunities! 🥳

The Best USD Yields (on Ethereum)

Now that we understand the tradeoffs of stablecoin farming, as well as how yields work, we can dive into some of the different opportunities on both Ethereum and Polygon. While there are certainly some higher reward opportunities elsewhere, these try to strike a balance between risk, risk, and complexity.

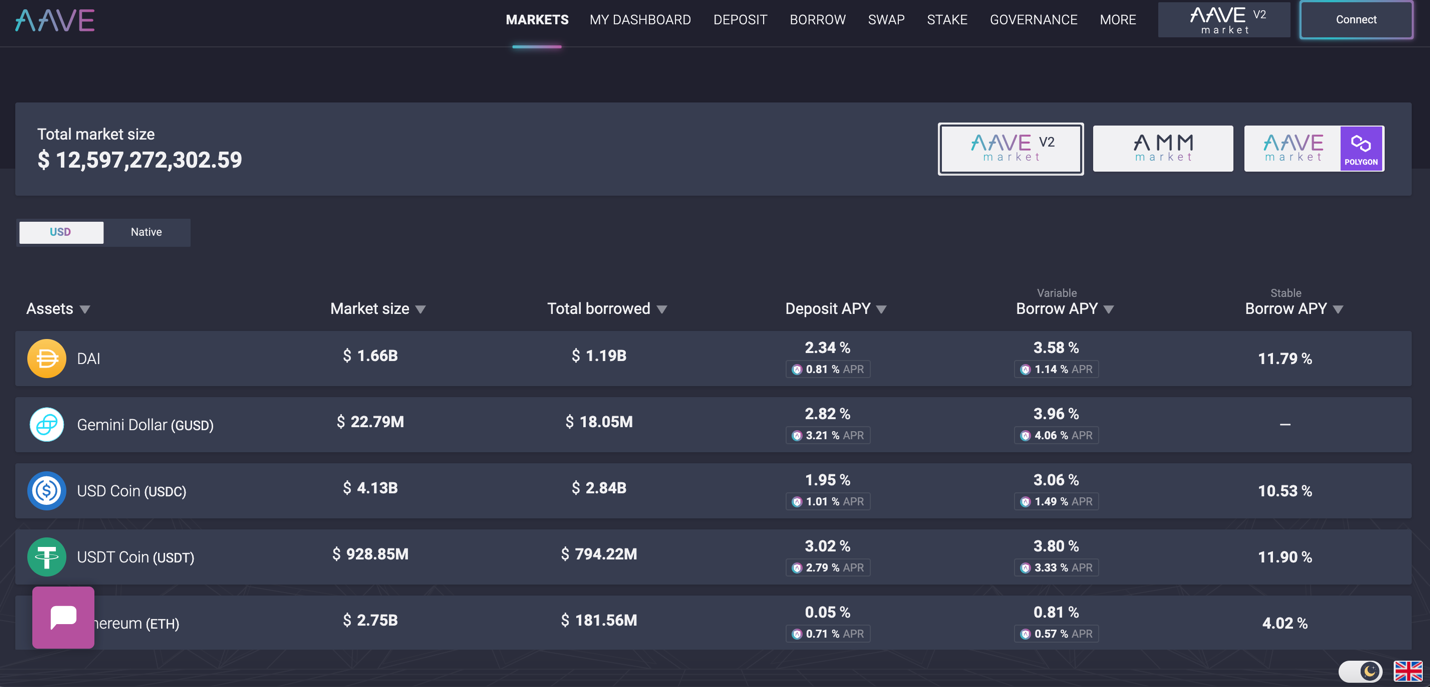

Opportunity #1 – Aave: 3-7%

I get it: Even in DeFi, leaving your money in the bank is boring. However, that doesn’t mean a good yield should go to waste as Aave is incentivizing liquidity for their Ethereum L1 market

To go along with lending interest, users can earn stkAAVE rewards (AAVE tokens earning a staked in the protocols safety module), if they deposit and/or borrow USDC, DAI, USDT, and GUSD. The program is active until mid-July, and the combined yield ranges between 3-7% depending on the assets, while rates are the highest for GUSD and USDT.

It’s even possible, albeit not all the time and for all assets, to be “paid” to borrow, if their rewards APR would offset, or even exceed the borrowing APY. This could be especially useful if you plan to leverage your ETH, stablecoins, or other collateral to pursue more farming opportunities (Be sure to monitor your health factor!)

🤑 Secondary Yield Opportunities:

- While there are no other price risk free strategies that I could find for stkAAVE, it’s earning a roughly 5% APR within Aave’s safety module!

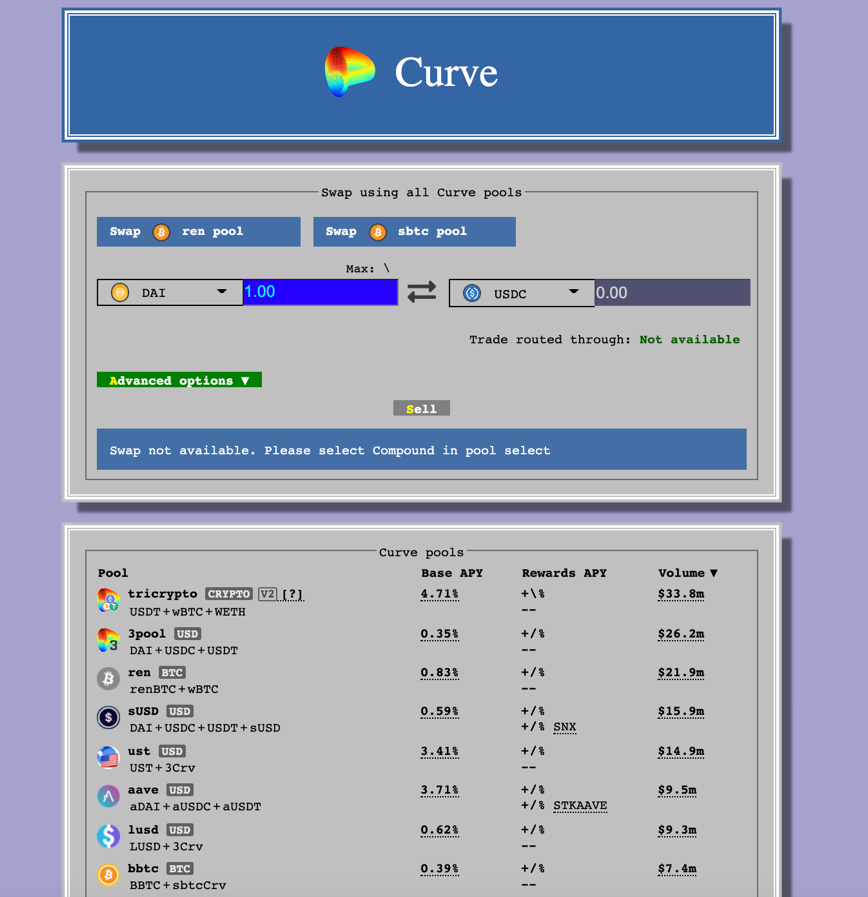

Opportunity #2 - Curve: 10-12%

With over $9.2 billion in value locked, Curve is one of the premier venues for earning a yield on stablecoins. Some have even posited that the AMM for trading between like-assets (and now volatile ones) provides the “risk free rate” for yield farmers due to the reduced odds of incurring impermanent loss, as well as the multiple streams of income liquidity providers can earn in the form of trading fees, CRV rewards, and, depending on the pool, lending interest or even other token rewards.

Curve is currently offering 24 different pools for stablecoin LPs, yielding combined fee and reward APYs that vary from 2% on the “3Pool,” which holds deposits of DAI, USDT, or USDC, to 12% on the “frax” pool, where users can trade between the 3Pool and FRAX, an algorithmic stablecoin.

Remember: Where there is a higher reward, there is commensurate risk to match it. It may be that the yields on the FRAX pool are so high because liquidity providers are taking on more risk by being exposed to a stablecoin that is less battle tested than those in the 3Pool.

It should also be noted that these APY estimates are taken from the low end of the range displayed on Curve’s interface, because they do not include returns from boosted CRV rewards (more on that below).

🤑 Secondary Yield Opportunities:

- Curve Finance - 17% APY: Lock CRV rewards for veCRV (vote-escrowed CRV), which can be staked to earn Curve trading fees. Note: veCRV is non-transferrable.

- Yearn Finance - 33% APY: Deposit CRV rewards into Yearn Finance’s yvBoost vault to receive yvCRV, a tokenized version of veCRV, along with Curve trading fees

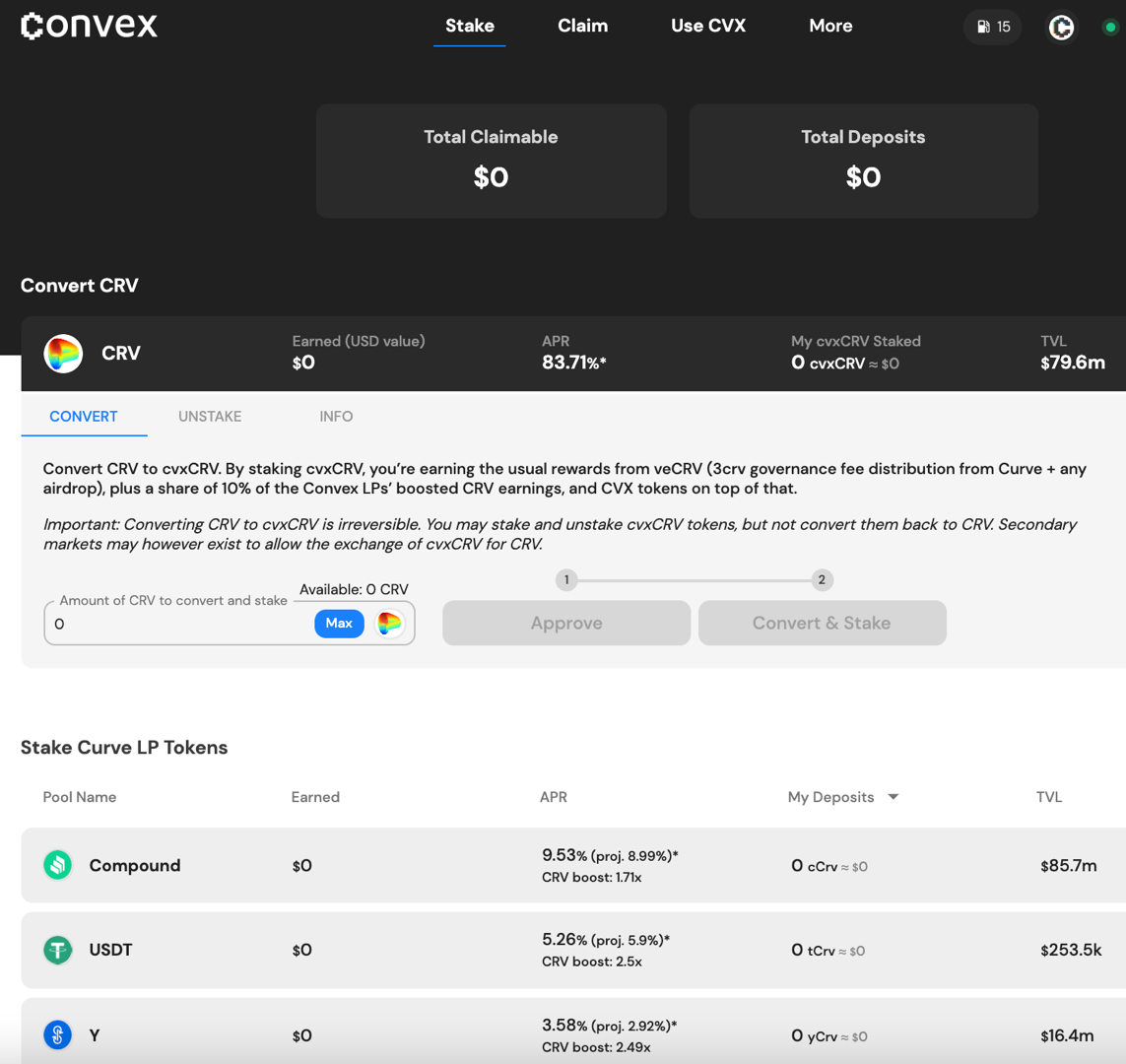

- Convex Finance - 83% APR: Deposit CRV rewards into Convex Finance’s CRV vault to receive cvxCRV, Curve trading fees, CRV rewards, and CVX tokens

Opportunity #3 - Yearn & Convex: 20-24%

Remember how the Curve yields above are from the low end of the range? Yearn and Convex Finance are two protocols that help users reach the higher end of these estimates by offering access to boosted CRV rewards.

One of the many wrinkles of Curve yield farming is that liquidity providers who hold veCRV are eligible to receive “boosted” CRV rewards. These boosts, which vary by pool and LP based on liquidity and CRV held, act as a multiplier on the CRV rewards earned by a liquidity provider. For example, a 2x boost means that an LP will earn twice the amount of CRV rewards as someone without the boost.

Where Yearn and Convex come in is that they enable Curve liquidity providers to attain boosted rewards without having to hold veCRV themselves. These protocols accumulate and lock CRV themselves, thereby offering access to boosted rewards for users who deposit into their Curve LP vaults.

📚 To read more about veCRV, boosting, Yearn, and Convex, click here

These vaults can greatly increase returns: For instance, the Convex crvFRAX vault, which benefits from the boost, earns depositors 29% APY, while the non-boosted return for the same strategy is just 12% APY.

While both protocols offer similar services, the yields vary between Yearn and Convex due to each individual vault having a different boost factor, and each platform employing a differing fee structure. Convex charges only a 16% performance fee, while Yearn charges a 2% management fee and 20% performance fee

Another key differentiator between the two is that Yearn automatically reinvests rewards back into the vault's respective strategy, while Convex pays out rewards to LPs in the form of CRV and CVX tokens that require manual harvesting.

Currently, the highest yielding vaults between the two are all on Convex, with the EURS, USDN, and DUSD vaults yielding 24%, 20%, and 20% APY respectively, but it’s worth keeping in mind the gas costs from manual harvesting when making a decision.

Remember: This increased return comes with increased smart contract risk over directly using Curve.

🤑 Secondary Yield Opportunities

- Convex Finance - 52% APR: Stake CVX to earn cvxCRV rewards

- Convex Finance (continuation of above) - 83% APR: Stake cvxCRV to earn to earn CRV, 3CRV (Curve trading fees)

The Best USD Yields (on Polygon)

Now let’s cross the bridge from the Ethereum mainchain to look at the rich assortment of opportunities on Polygon! Remember—higher return = higher risk.

📚 To figure out how to cross the bridge to Polygon check out our How to Use Polygon guide.

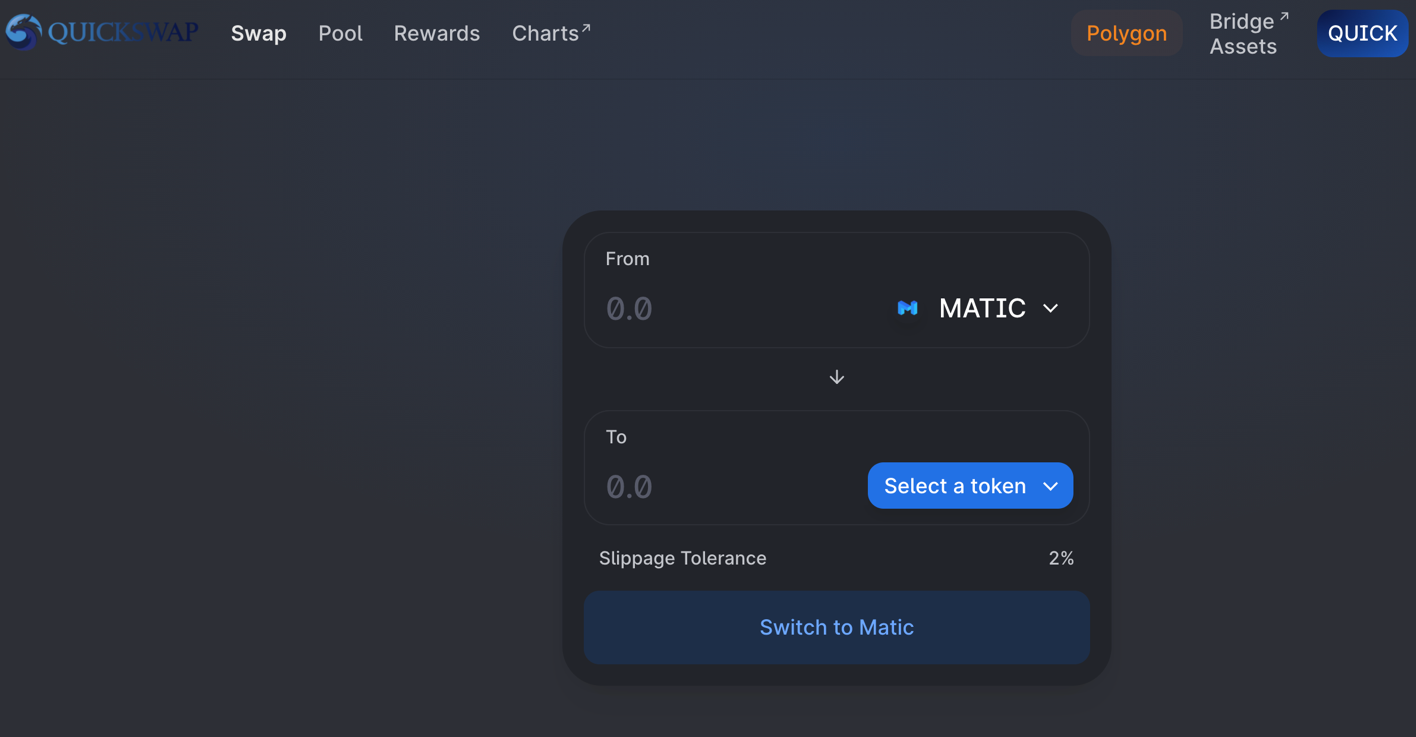

Opportunity #1 - QuickSwap & SushiSwap: 10-15%

QuickSwap and SushiSwap are the two largest decentralized exchanges on Polygon, with over $1.5 billion in combined liquidity and facilitating north of $200-250 million in daily volume.

In an interesting quirk of Polygon DeFi, both protocols, which are Uniswap V2 forks, have liquid and incentivized stablecoin-stablecoin pairs. This may come as a surprise to experienced DeFi users, as that model of AMM is not used for stablecoin swaps on Ethereum L1 due to the high slippage on those trades when compared to Curve or Uniswap V3.

While the strategy is the same for both DEXs, returns differ based on the trading volumes of each, and composition of rewards.

For QuickSwap, users who provide liquidity to the DAI/USDT, USDC/USDT, USDC/DAI, and MAI/USDC pairs will earn trading fees and QUICK rewards.

With SushiSwap, LPs of the DAI/USDC and USDC/USDT pairs are instead incentivized with SUSHI and MATIC rewards to go along with the fees.

Although yields among the two DEXs fluctuate, the most lucrative pairs as of now are all on QuickSwap, with MAI/USDC, DAI/USDC, and DAI/USDT yielding 15%, 10%, and 10%, respectively.

🤑 Secondary Yield Opportunities:

- QuickSwap - APY N/A: Stake QUICK tokens on QuickSwap to earn 0.04% of protocol trading fees in the form of dQUICK tokens.

- Aave - 5% APY: Deposit MATIC into Aave to earn lending interest and more MATIC rewards.

- Pickle Finance - 43% APY - Deposit MAI/USDC QLP into ‘jars’ and then ‘farms’ to have rewards compounded, along with PICKLE and MATIC rewards.

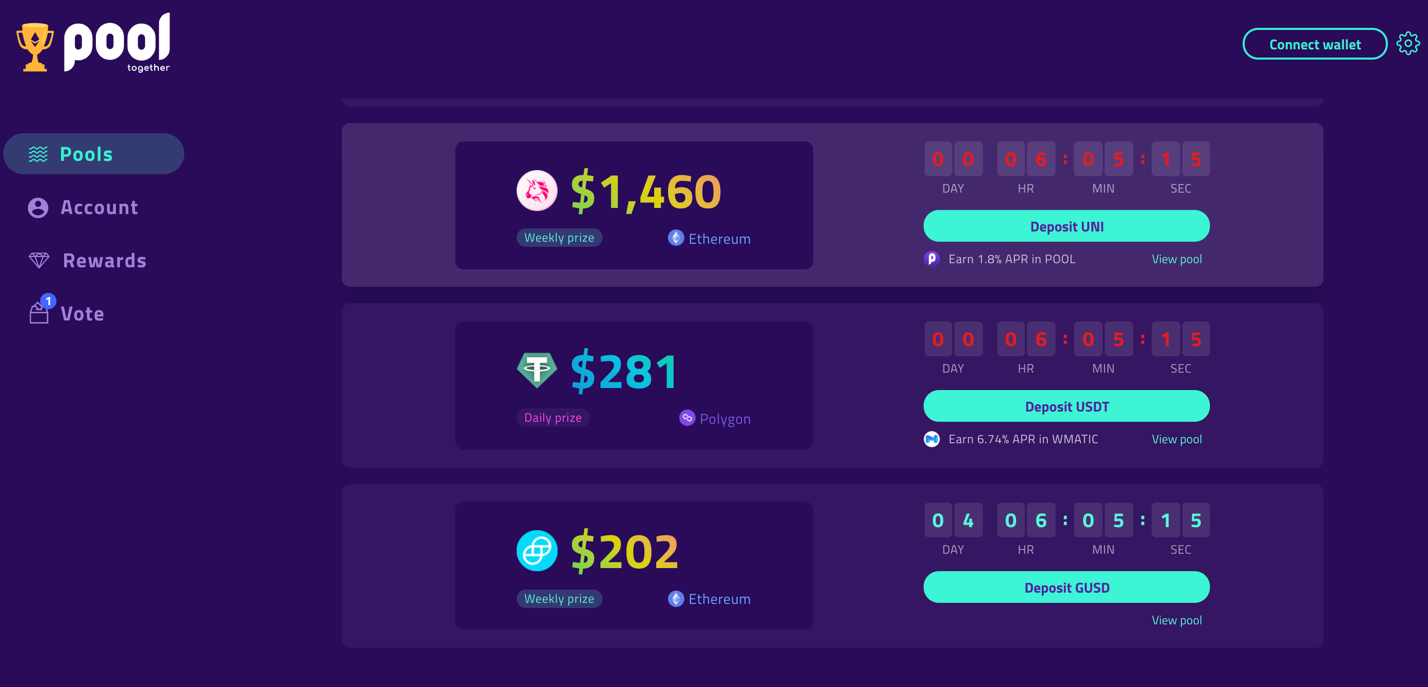

Opportunity #2 - PoolTogether: 7-10%

PoolTogether is another popular project from Ethereum L1 that has set up shop on Polygon by offering an incentivized USDT prize pool. While participants in the no-loss lottery have a shot at taking home the grand prize, all depositors “win” by earning MATIC rewards, currently issued at a clip that has ranged between 7-10% APR.

This may be an opportunity that’s been overlooked by Polygon farmers, as the USDT pool currently only holds $8.4 million in deposits (for reference, this is over 82x smaller than the $505 million Curve pool on Polygon). Furthermore, this yield comes with only one additional layer of smart contract risk beyond directly depositing into Aave.

🤑 Secondary Yield Opportunities:

- Aave - 5% APY: Deposit MATIC into Aave to earn lending interest and more MATIC rewards

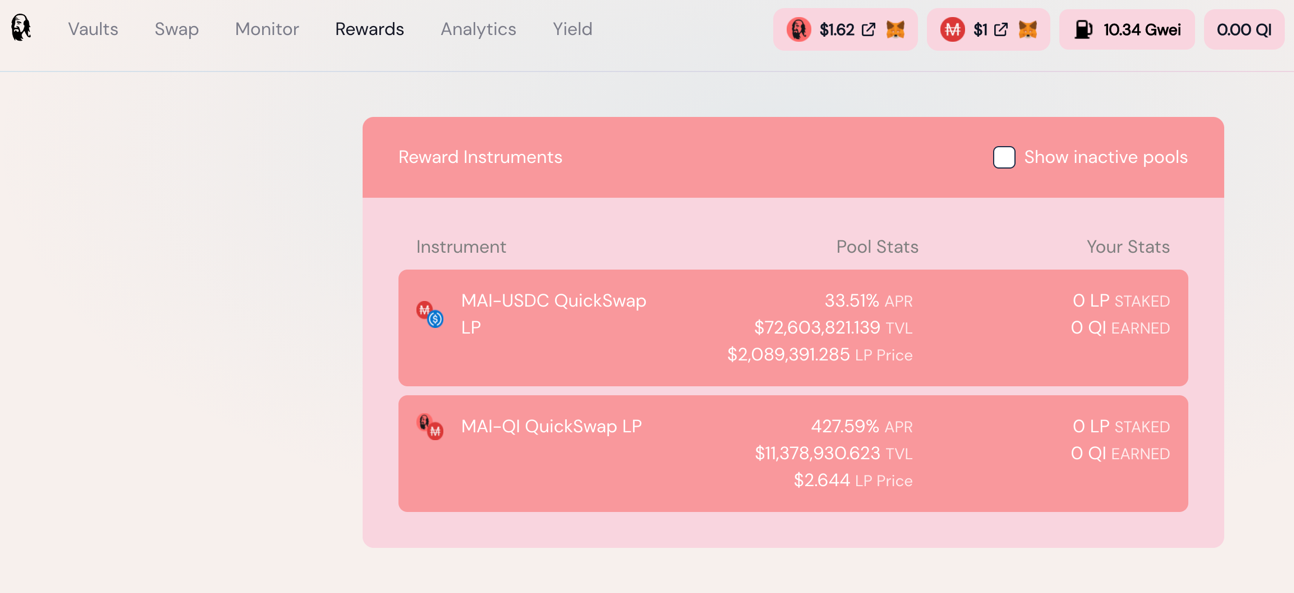

Opportunity #3 - Qi DAO: 25-30%

Qi DAO is a Polygon native stablecoin protocol. The system functions similar to Liquity in that users can deposit an asset, MATIC, which can be then used as collateral to mint a stablecoin, MAI (this name has been recently changed from miMATIC) while paying zero interest.

The project has grown to be one the largest DeFi applications in all of Polygon, with over 11.5 million MATIC locked within the protocols vaults, while MAI has a circulating supply exceeding $59 million.

The project is incentivizing liquidity for the MAI/USDC pair on QuickSwap in the form of QI rewards. Liquidity providers can stake their QLP tokens under the rewards tab on Qi DAOs interface to earn a rate that fluctuates between 25-30% APY.

It should be noted that users will have to pay a 0.5% deposit fee when they stake their LP tokens. Because of this, it’s important to remember that until the deposit fee is recouped, you’ll be farming at a loss.

🤑 Secondary Yield Opportunities:

- Qi DAO - Stake QI to earn a portion of repayment fees (coming soon)

Conclusion

Although they are lower than we’ve grown accustomed to, there’s still plenty of different opportunities to earn a high yield on stablecoins.

Better yet, most of these are being incentivized with tokens that can be put to use within a different strategy to further increase returns.

While farmers are in the midst of a brutal winter, it’s clear not every crop has withered. There’s still plenty of yields around for those who spend the time doing the research.

Happy farming!

Action steps

Earn the best yields on your dollars

Level up on our past resources on yield farming