Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Suddenly everything’s different. We’ve entered a new era.

And what’s worked in the past isn’t certain to work in the future.

The big banks are saying U.S. GDP will end the year at -1.5% with unemployment at 5.25%. That’s bad, but not terrible.

You think they’re right?

Conventional wisdom says stocks are a buying opportunity now.

You believe them?

How about these:

- It’s just an economic blip

- It’s just a temporary closure

- It’s just an emergency stimulus

It’s just a flu?

What if their models are wrong.

We need more than conventional wisdom.

We need unconventional wisdom for unconventional times.

Here’s a few things to expect next.

This is your bankless COVID-19 Prep Plan.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

4 things to expect next…

People are in a habit of making predictions at the beginning of the year. That’s hard. Who knows what a year will hold?

It’s probably more useful to make predictions as we’re exiting one era and entering another. This is a new era—the corona era. Historians will have a better name for it someday. But whatever they call it then, this new era will shape our lives now in even more profound ways in the decades to come.

Here are 4 things I expect to happen next.

1. Things will get uglier.

Things will get uglier for a time.

We haven’t contained the virus. The U.S. and many other western countries reacted late. Hospitals will be overrun and deaths will number in the millions—all this despite our social distancing efforts.

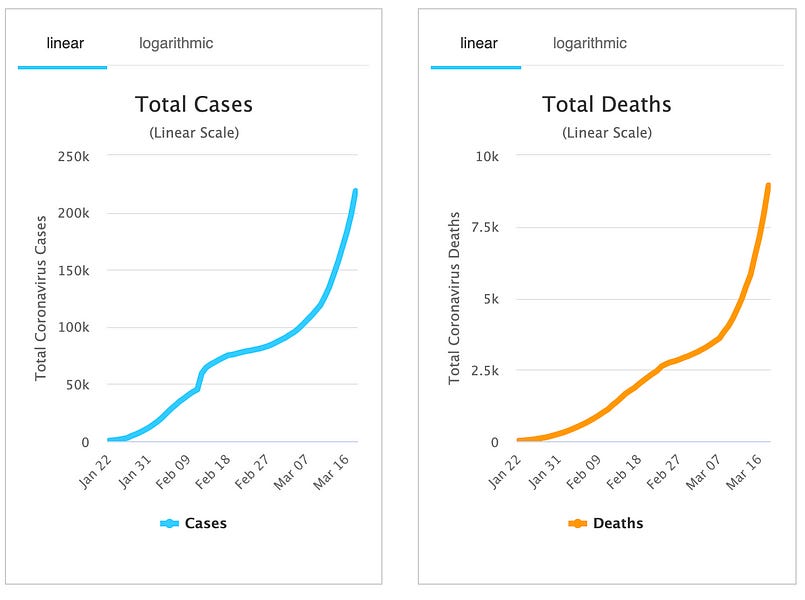

(Above) Total cases and total deaths from Coronavirus as of March 19th—exponential growth

Governments and companies now face an ugly tradeoff. Social isolation is the only way to contain the virus right now. Yet the more social isolation the higher the toll on the economy.

The markets started seeing it in late February—the S&P dropped almost 30% since then. That’s bad—but we’ve seen worse. In the Great Recession we dropped 50%. It took 6 years to get back to highs. Our great grandparents saw much worse than that—stocks dropped 90% during the Great Depression and didn’t fully recover until 1954—over 25 years later!

What’ll this one be before it’s over? A 4.3% drop in GDP and 10% unemployment like 2008? Or a 30% drop in GDP and over 20% unemployment like 1929? Something less? Something inbetween?

It’s hard to tell. But you should assume things will get uglier. Faced with bad options and in an attempt to avert a Depression governments will bring wheel out their secret weapon—the money cannon.

2. Central banks will print a lot of money.

Fiat currency supply has increased 10x over the last 20 years. The Fed printed more than $3 trillion to get us out of the Great Recession alone. They literally called it into existence by adding a few digits to their centralized banking ledger.

(Above) Global fiat base money supply increases since 1970 sourced by Crypto Voices

In crypto money of course the money printing is set by algorithm and maintained by social consensus. If someone changes the algorithm to print more and you don’t like it, you don’t have to accept their fork. Social consensus means opt-in.

Fiat has no such constraint. Fiat can issue 5% one year and 80% the next. Central banks can print money to bail out Wall Street, or Corporate Executives, or a Favorite Industry, or a Persuasive Politician, or, occasionally—the people. You want to fork? Sorry. They put you in jail for that.

Is there any greater power than the power to create money?

And governments around the world will use this power like they’ve never used it before. Not all of the issuance will be a bad. Maybe some is even necessary.

Regardless.

Tens of trillions will be printed. The QE and fiscal stimulus and industry bailouts and exotic buybacks during the Great Recession will look quaint in comparison.

And yet…

3. People will want dollars.

A liquidity crisis. That’s the first phase of an economic downturn of this type. And dollars are the most liquid asset that exists. It’s the money with the highest moneyness. The money you panic into. The global reserve currency. The king.

Everyone wants to own the king during a liquidity crisis. So they sell their other assets and buy dollars. This influx of demand increases the price of dollars relative to other currencies and relative to other assets.

(Above) U.S Dollar Index measures the value of dollars relative to other currencies—USD is up!

But it’s not just liquidity they’re after.

Part of the reason there's a rush to dollars is because so much global debt is denominated in dollars. If you have debt in dollars, and you’re suddenly facing an uncertain world, you want to be sure that you have dollar reserves in order to pay off your debt.

We saw a similar effect with DAI on a smaller scale over the past couple of weeks. DAI price shot up as high as $1.08. Why? Because Maker Debt holders needed DAI to pay off their DAI-denominated debt. USDC doesn't help if your debt is denominated in DAI, just like Australian Dollars don’t help it your debt is denominated in U.S. Dollars.

Oil? Mostly denominated in US dollars—every country on earth has future oil debt. That’s why currencies like Australian Dollars are getting crushed by USD right now.

(Above) Australian dollars losing over 15% relative to U.S. dollars over the past several weeks

Even though the Fed is bound to print tens of trillions in the next couple years people still want dollars. Not just for legacy reasons either. Japan, China, Europe—their money printers burn hotter and spit out cash even faster than USA.

In the land of the blind USD is the one-eyed man so he gets to be king.

At least for now.

4. Crypto will rise.

Crypto has shown recent correlation with stocks during this liquidity crisis phase. When stocks went down, so did crypto. The correlation between the two asset types has never been higher.

(Above) Correlation between S&P vs BTC/ETH is higher than ever. It’s above .6 now. That’s 2x higher than anything before. We're in a flight to liquidity like 2008. Will this last? Not in the next phase, not w/ the money printers firing up.

But we won’t always be in the liquidity crisis phase.

Markets operate on cycles. De-leveraging is an important phase of that cycle. Once it wanes people will pause to look at their infinite-issuance dollars and their 0% interest savings accounts and wonder if these are the best places to store value through the rest of the 2020s.

They’ll see what we’ve seen.

A money system that’s bankless. Not centralized, but permissionless, available to any citizen of the internet.

They’ll see monetary assets like Bitcoin and Ether that aren’t subject to the whims of central bankers and an open financial system that’s replacing banks with code.

They’ll see crypto monies with issuance at 1%.

They’ll see opportunities to earn double-digit interest on stablecoins.

They’ll see 1,000 reasons to log into a crypto bank or use an Ethereum address.

We’re seeing hints of this last one already. $150m new USDC stablecoins were issued in the past week alone. People are exiting ETH and BTC but instead of transferring dollars back to their WellsFargo accounts they’re keeping them in crypto. For them, the crypto money system—crypto banks, Ethereum addresses, crypto wallets, DeFi—are proving more useful for dollars than their legacy counterparts.

(Above) Stablecoin growth over time—massive recent growth (h/t Nic Carter)

That’s how it will happen.

The utility of the crypto money system will continue to grow.

The separation of money and state will become more attractive.

The central bankers will drop the ball in big ways.

And crypto will rise.

Final Thought

Don’t panic, position. Prepare for the new normal. Then get ready for things to get uglier, central banks to print, people chase dollars, and finally…for crypto to rise.

No, we’re not certain of these things. We’re betting on them.

The 2020s belong to crypto.

This has been your bankless COVID-19 prep plan.

Action steps

Things to watch:

Coronavirus cases and deaths to slow down

News of central banks printing money

Value of the dollar & T-bills relative to everything else

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

New to the Bankless program? Start here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.