Dear Crypto Natives,

There’s decades when nothing happens and weeks where decades happen.

Last week:

- Monday was “Black Monday” the worst day in stocks since 2008

- Tuesday was Italy’s first full lockdown day and we exceeded 100k Covid19 cases

- Wednesday the WHO declares coronavirus a pandemic

- Thursday “Black Thursday” & worst day in crypto & Fed adding $1.5T to repo

- Friday the U.S. declares a national state of emergency

- Saturday see first corona fiscal stimulus passed in U.S. House

- Sunday the Fed set rates to 0% and printed $700b out of thin air like it’s 2008

Today Europeans and North Americans woke up to a world of closed schools, closed stores, and closed borders. Those who can work from home, those outside maintain 6 feet of social distance, those in health care prepare for the onslaught.

By end of trading day the stock market had another Black Monday, worse than the last.

Welcome to the new normal. Things moving faster now.

First step? Accept it.

We’re likely headed for a recession. We’re in the early phases of a market deleveraging. We’ve moved from risk-on to risk-off. Don’t waste time in denial.

Next step? Play ahead.

This happened fast, but it was also predicted by crypto people. So let’s keep playing a few steps ahead. What’s likely to happen in the coming months?

- Stocks will continue to fall and eventually bottom

- Flight to safety will continue—out of risk-on assets and into cash & treasuries

- Central banks deploy massive interventions—printing trillions in the process

Crypto may continue to fall as the flight to safety continues. People need cash to weather the storm. Position yourself for this in the short to medium term.

But then something may happen, perhaps gradually, perhaps suddenly.

The money printing will have a cost.

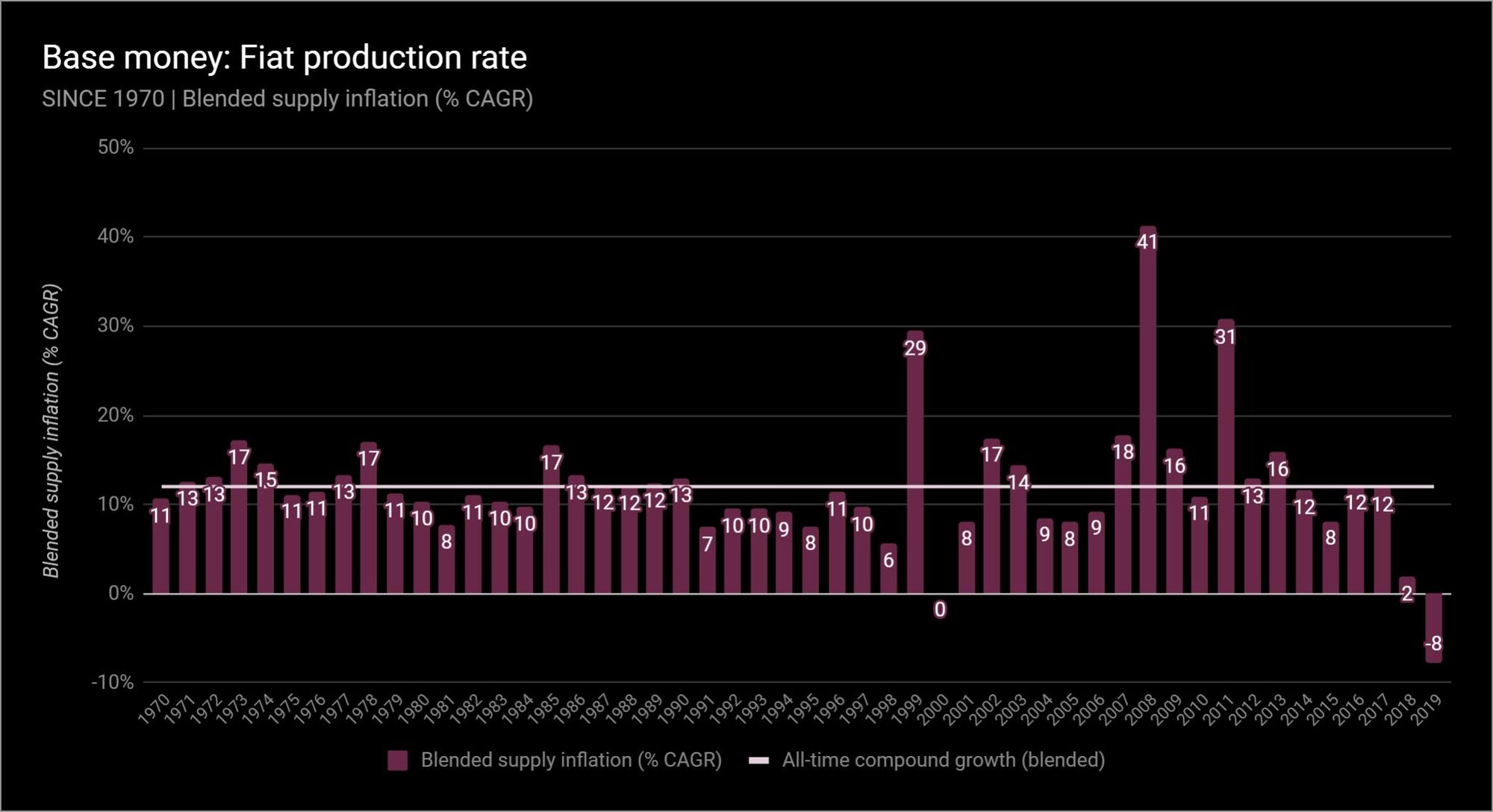

In 2008 alone governments increased their base money by 41% . From then to now the central bankers have 3x’ed the amount of base fiat money—yen, USD, Euros, yuan.

What do you think they’ll do in this crisis? If we assume this is anything like 2008, we should expect 20-30% issuance per year over the next several years. With the popularity of modern monetary theory maybe double that.

Printing worked for bankers in the 2010s. Crypto was small. Bitcoin’s annual issuance that decade was even worse than fiat. And Ethereum wasn’t alive for half of it.

(Above) Issuance of fiat—41% in 2008 alone—graphic from Crypto Voices Feb 2020

But the world of the 2020s is different.

The issuance of Bitcoin is now 3.5% dropping to 1.7% in a couple months.

The issuance of Ethereum is now 4.5% dropping to 1% in a couple years.

The addressable size of these money networks is anyone with an internet connection—that’s over 4 billion people—bigger than any single nation state.

Each of them will make a decision, would they rather hold a money controlled by and biased toward the bankers of a nation state and issuing 20% per year in new supply?

Or would they rather hold a programmable internet money issued by a credibly neutral algorithm and issuing 1% per year in new supply?

Would they rather use banker money or bankless money?

This time the money printing might cost fiat its moneyness.

Maybe we should welcome the bankers to the new new normal.

It’ll be here before they know it.

- RSA