Axie Infinity Economics 101

Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

Axie Infinity’s website is now among the top 500 most-visited in the world.

Additionally, the game’s builders also just raised a $152M Series B, launched the AXS staking system, and unveiled their latest progress on Battles V2 and Ronin DEX.

In other words, Axie Infinity’s drawing in big headlines lately and thus lots of new attention too. Naturally, then, many novices come ‘round and get curious as to how the leading play-to-earn NFT game actually works.

Send those novices this way! That’s because today we have a guest post from Axie wiz and Chapman Crypto executive board member Dominic Stephens, whose guide below gives us the inside scoop on all the key basics of the Axie Infinity economy! 🕹️

-WMP

🙏 Sponsor: Zerion—Your Gateway to the Metaverse✨

Inside the Axie Infinity economy

Over the past six months, Axie Infinity’s native token, AXS, rose from around $3 all the way up to ~$156. That incredible climb has put Axie’s market cap at nearly $30B billion across all assets, now placing the franchise among the most valuable gaming companies in the world.

Numbers like these can boggle the mind, but the real question many are asking is why. Why is Axie so valuable? How is it able to attract so many players? Where is all this economic activity coming from?

As someone deeply involved in the Axie community, I’ll do my best to answer these questions and leave all readers with a good understanding of the economics powering the Axie Infinity ecosystem.

Smooth Love Potion

A foundational element of the Axie Infinity economy is the game’s Smooth Love Potion (SLP) token.

- First and foremost, SLP motivates players to play the game. That’s because whenever a player wins an Axie match, they are rewarded with SLP.

- The amount of SLP that players earn depends on their ranking, so players with the highest skill and the best Axies are able to earn the most on a day-to-day basis.

- Top level Axie players are able to earn up to around 600 SLP a day. This translates to around $50 a day at the time of writing. Of course this is on the higher end of the spectrum, but an average player can expect to earn between 200-400 SLP a day.

Axies

After learning that you can earn up to $50 a day playing a game, you might be incentivized to give playing a try. Yet in order to play Axie Infinity, you’ll need a team of three Axies.

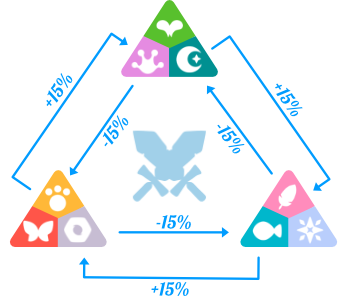

Axies are akin to NFT versions of Pokemon, in that they are the creatures you use to do battle with other players. There are also nine different types: Aquatic, Beast, Bird, Bug, Dawn, Dusk, Mech, Plant, and Reptile.

Accordingly, each Axie type can have a variety of abilities. Because of the variety in how powerful an Axie might be, they typically can cost anywhere from 0.05 ETH to 0.3 ETH. A top team usually costs somewhere around 0.5 ETH.

Axie breeding

Beyond collecting and battling, Axie’s offer another utility: breeding.

Like Pokemon, Axies can be bred with one another to produce children of their own. This means that there is theoretically an infinite amount of Axies that can be produced.

As such, the most lucrative aspect of Axie Infinity right now is the NFT game’s breeding market.

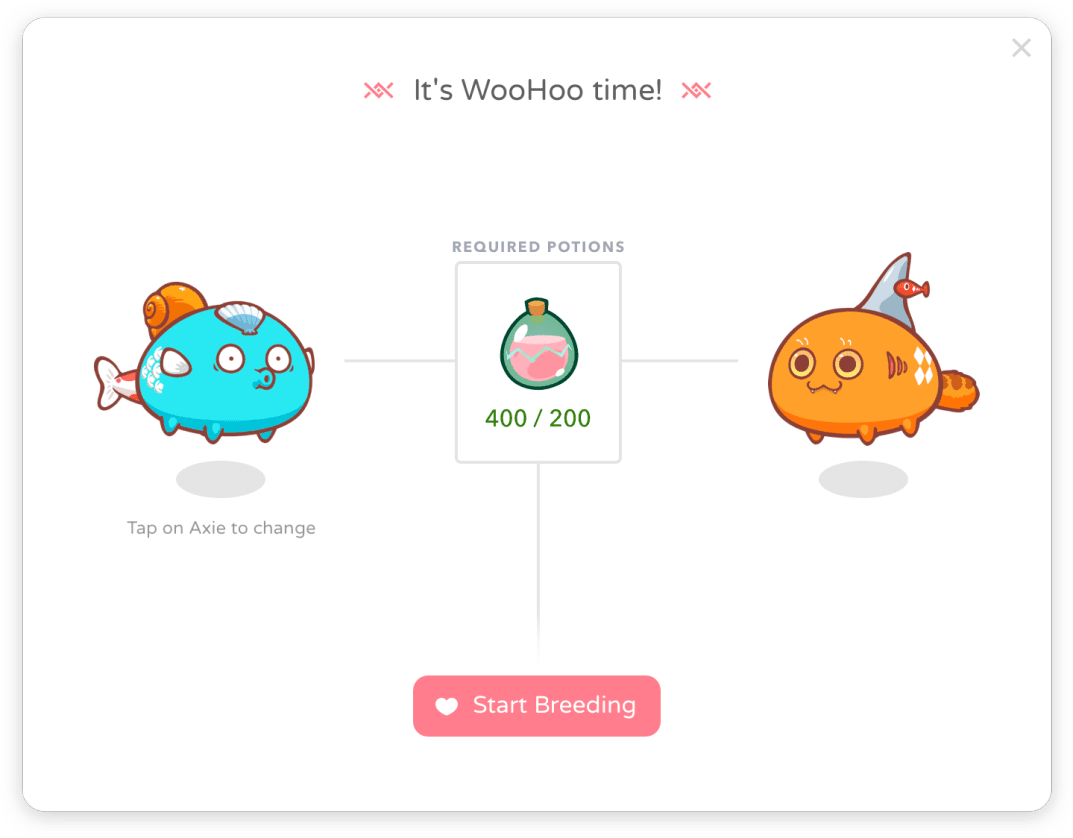

In order to breed Axies with one another, you must use a combination of both AXS and SLP.

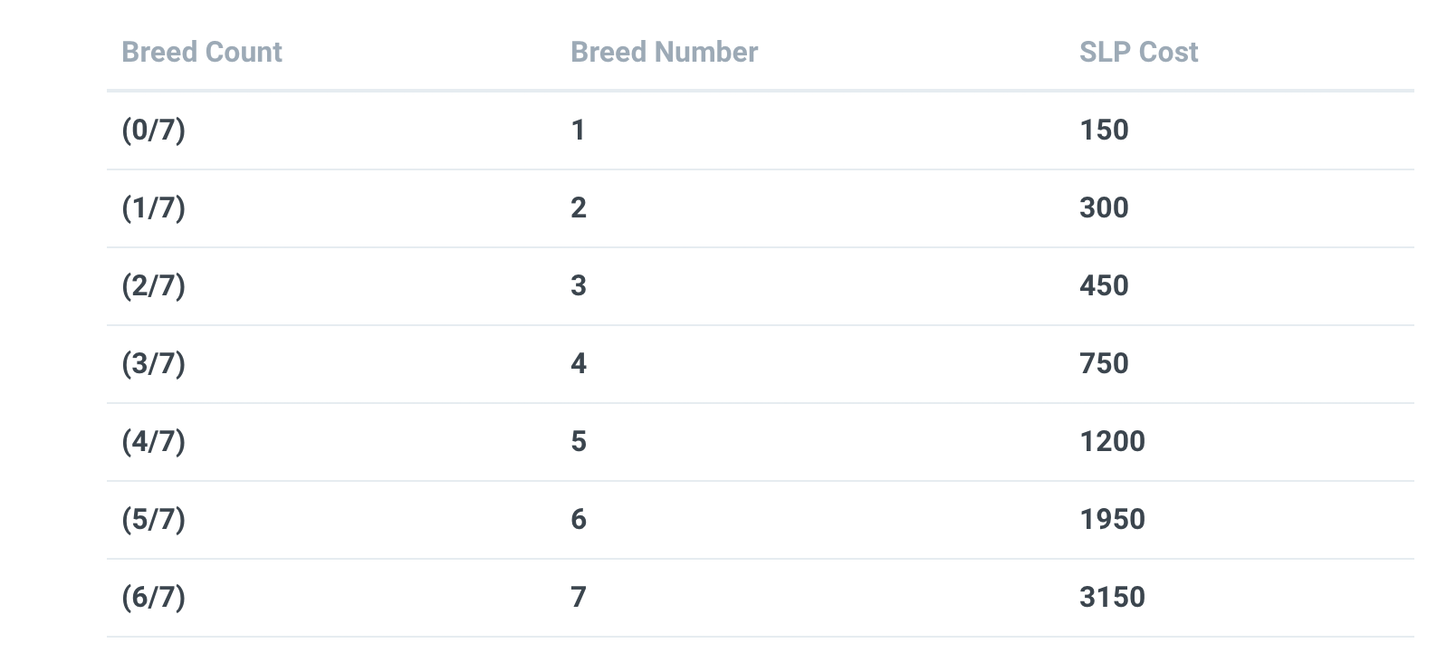

A player can breed an Axie up to a maximum of 7 times. More SLP is required per breed, making each egg less and less profitable. Keep in mind that a flat rate of 1 AXS token is used for every egg.

After 5 days of an egg being created, an egg is hatched. The resulting child is a random combination of the genes of each parent Axie, with different odds based on if the traits of the parent were dominant or recessive.

As you can see, this part can start getting really complicated really fast, which is why breeders are incentivized to pick a market based on supply and demand. The margins from a farm, however, have massive potential to be very profitable.

Mid- to high-tier breeders can expect to earn regular ETH income between 0.2 and 1 ETH every 5 days. Keep in mind that breeding can scale infinitely and it is very possible to earn more than a few ether in the span of a week.

If you’re still skeptical of the viability of an Axie business, consider the fact the Axie Marketplace is doing ~5,800 ETH (~$20 million USD) in volume a day. This makes it the second-most liquid and active NFT marketplace in the world, behind only to Open Sea in daily volume.

Scholarships

The major requirement behind setting up a good breeding farm, besides an initial purchase of high quality parents, is the SLP needed to breed your parents together. Recall from earlier in the article that SLP can be generated from playing the game, in addition to being bought off the open market.

However, it is also possible to generate passive yield of SLP by loaning your unused Axies out to other players. This practice is referred to as running an Axie scholarship.

- Scholarships are possible because of the fact that an Axie game account is separate from an Axie wallet.

- This means that you can give a player access to playing your Axies without giving them the ability to sell them or even access the tokens they earn. The burden falls on the manager to pay their scholars fairly.

- Typically the SLP split between the scholar and the Axie lender is anywhere between 75/25 to 50/50. For most people, the amount of time required to earn $10-$30 dollars a day might not be worth it, but for people in countries with underdeveloped economies the opportunity provided by a scholarship can be life-changing.

Zooming out

SLP is the backbone of Axie Infinity’s pricing structures. This means that as SLP becomes more expensive, more people are incentivized to buy Axies. The more people buy Axies, the more expensive SLP becomes as the ticket to entry becomes higher. It is an extremely reflexive system.

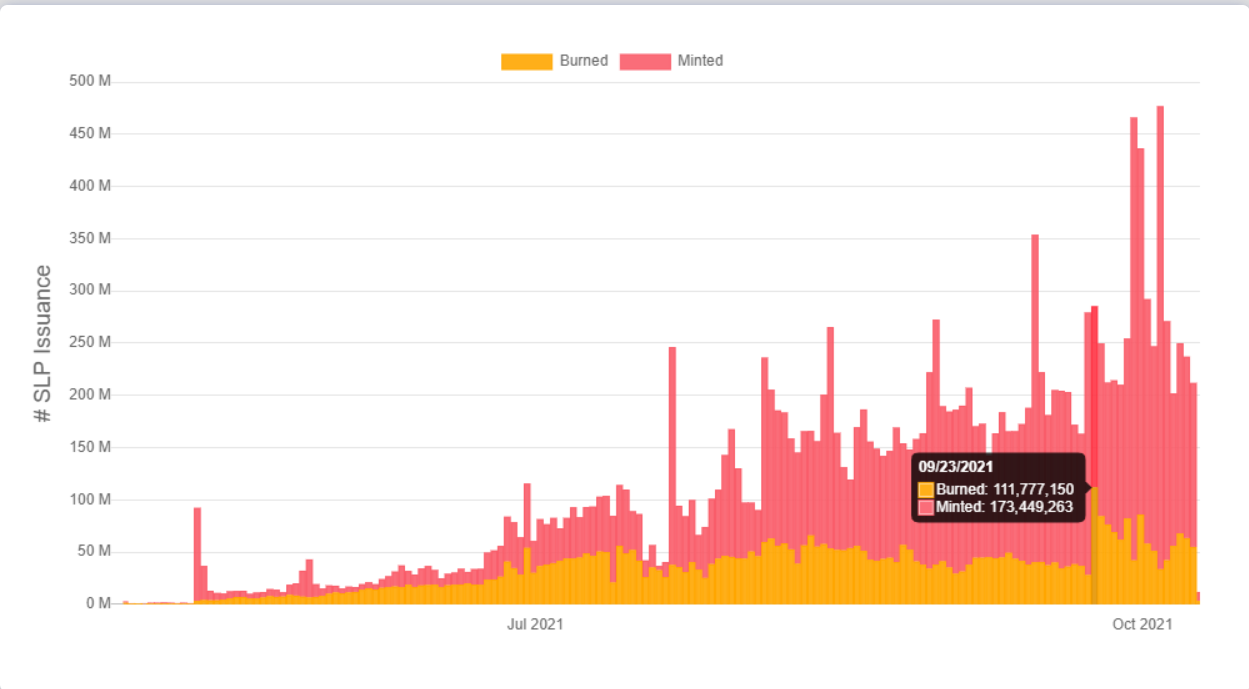

Below is a graph showing the amount of SLP being minted and burned. There is currently more SLP being minted than there is being burned by breeding. As a result of this, the price of SLP has been on a steady down trend over the past two months. However, last month Sky Mavis (the team behind Axie) increased the amount of SLP needed to breed by almost double.

This SLP change was a temporary fix, and it shows the power the builders have over the economy — to the point that, if they so wished, they could skyrocket the price of SLP merely by adjusting the burn rate.

However, such a maneuver would be unsustainable for long term growth, and Sky Mavis is currently seeking alternative solutions such that SLP can be used in more ways than just breeding going forward.

That said, many feel that they missed the boat on Axie, but if you truly understand the ecosystem you know that things are only just getting started. I am personally bullish on crypto gaming as a whole, as I believe it will be the sector that will onboard the most amount of crypto users over the next few years. Axie Infinity’s giving us an early glimpse at that future, I think! 🎮

Author Bio

Dominic Stephens is an executive board member at Chapman Crypto and an Axie Breeder/Scholarship manager. He enjoys trading NFTs.

Action steps

- 📺 Watch “Crypto Gaming Panel | Loot Squad, Yield Guild, Illuvium” by Bankless

- 📺 Watch “The Rise of Axie Infinity | Jeff “Jiho” Zirlin” by Bankless

- 📰 Read “How to make money playing Axie Infinity” by Bankless

- 📰 Read “How to collect NFTs on Layer 2” by Bankless

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

ZERION

With Zerion, you can invest in DeFi from one place—now fully revamped for your NFT collection!

So you spent months building up your collection, but you’re still viewing your NFTs on a website that looks like it’s stuck in 2015? Have some fun with Zerion – send NFTs between wallets, convert them to iPhone widgets and flex them on your Apple Watch - all alongside your entire crypto portfolio.

👉 Look out for Zerion’s L2 Support & Cross-Chain Composability.

👉 Connect Your Wallet & Show Off Your NFT Collection.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.