Are Productive DeFi Tokens Better?

Dear Bankless Nation,

Does it matter if a token has rights to cash flows?

We’ve argued before that onchain cash flows are the holy grail for crypto capital assets. DeFi tokens with governance will vote in cash flow rights. It’s likely that most (if not all) successful DeFi tokens will become cash flowing assets at some point.

All DeFi token owners want the same thing: number go up. And you'd think cash flow rights would help with that, wouldn’t you?

Well…we have some great examples to draw from in DeFi today. We can compare similar protocols like Uniswap and Sushiswap—both in the same market, but one has a cash-flow token (SUSHI) and the other has a non-productive governance token (UNI). Aave (AAVE) and Compound (COMP) are another example of this.

Do productive assets win?

The answer isn’t as straightforward as you might think.

Lucas digs in.

- RSA

P.S. If the recent Chrome update is messing with your Ledger + Metamask combo,you should try Ledger Live—lets you stake, borrow, lend, and more with security in mind :)

Are Productive DeFi Tokens Better?

Today, DeFi tokens largely fall under one of two categories: productive or non-productive.

Non-productive DeFi tokens are the classic, “‘valueless’ governance tokens” that we’ve all come to know and love. Tokens like UNI and COMP are the perfect examples; despite having generated hundreds of millions of dollars in revenue since their respective geneses, the tokens simply represent the right to participate in governance. There’s no cash flow rights.

On the other hand, we’ve also seen productive DeFi tokens like SUSHI and AAVE emerge. These are the holy grail of crypto capital assets as they represent both governance and on-chain cash flow rights. Unlike their counterparts, they allow holders to stake their position in return for passive income in the form of protocol fees (and in some cases inflation).

For Aave, holders can stake into the Safety Module where their capital will act as a collateral of last resort. In return, they earn rewards from an ecosystem reserve plus protocol fees. Similarly, SUSHI holders have the option to stake their tokens and receive xSUSHI which earns ~16.6% of all fees generated on Sushiswap.

Intuitively, we’d think that productive assets have the advantage—they’re always going to be the better choice for investors. But that may not be the case, and ultimately the most important thing in investing is market performance.

Like in traditional finance, what matters most is probably not whether the token has cash flow rights. Rather, it’s the growth in the underlying fundamentals like volumes, revenue, users, etc. that drive valuations.

This article explores whether productive token designs show any advantages over non-productive, using some quantitative (and qualitative) evidence to support it. As such, we’ll use two sets of like-protocols where one features a productive asset and the other a non-productive.

These are (1) Uniswap and Sushiswap and (2) Compound and Aave.

An Apples-to-Apples Comparison

Uniswap and Sushiswap

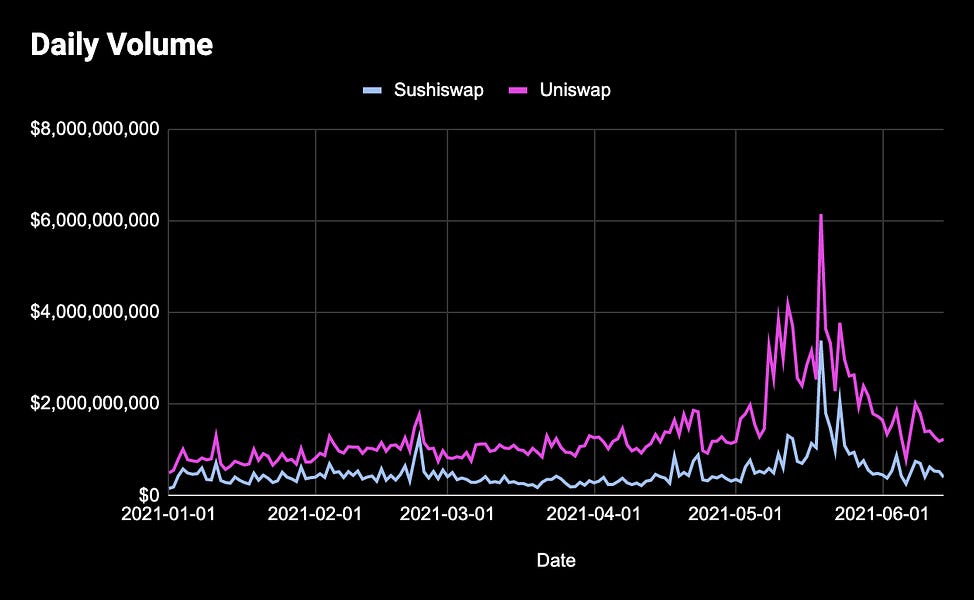

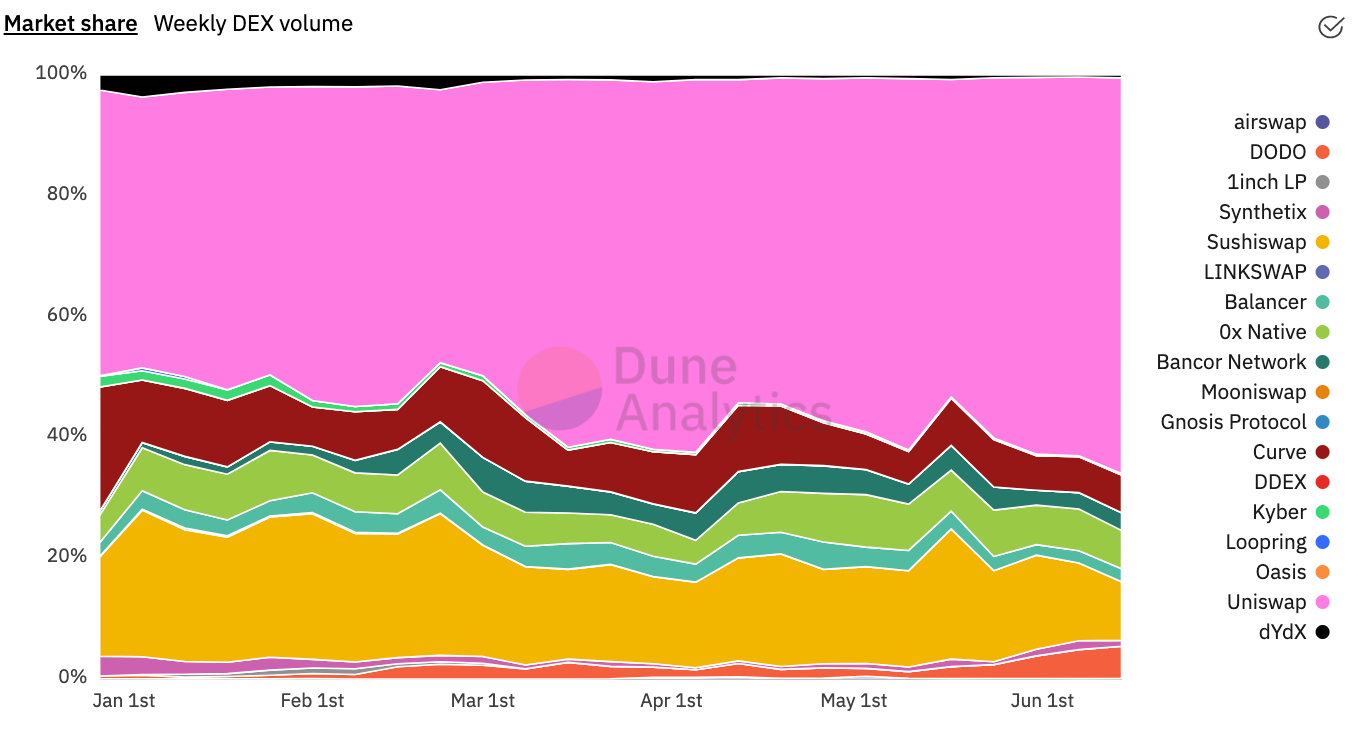

Naturally, the key metric to understand with any DEX token like SUSHI and UNI is trading volume. This is a fundamental indicator for the adoption and success of a decentralized exchange. Higher volume translates to more fee-generating revenue for the protocol, which drives the value of these DeFi tokens.

And the growth in volume has been in favor of Uniswap. According to Token Terminal, daily volumes at the beginning of 2021 averaged $733M per day. With the launch of V3 last month, Uniswap’s average volumes have grown to north of $1.4B per day—doubling YTD. Comparatively, Sushiswap averaged just shy of $400M in daily trading volume at the beginning of the year and grew to $560M as of late, a modest 42% increase in the past 6 months.

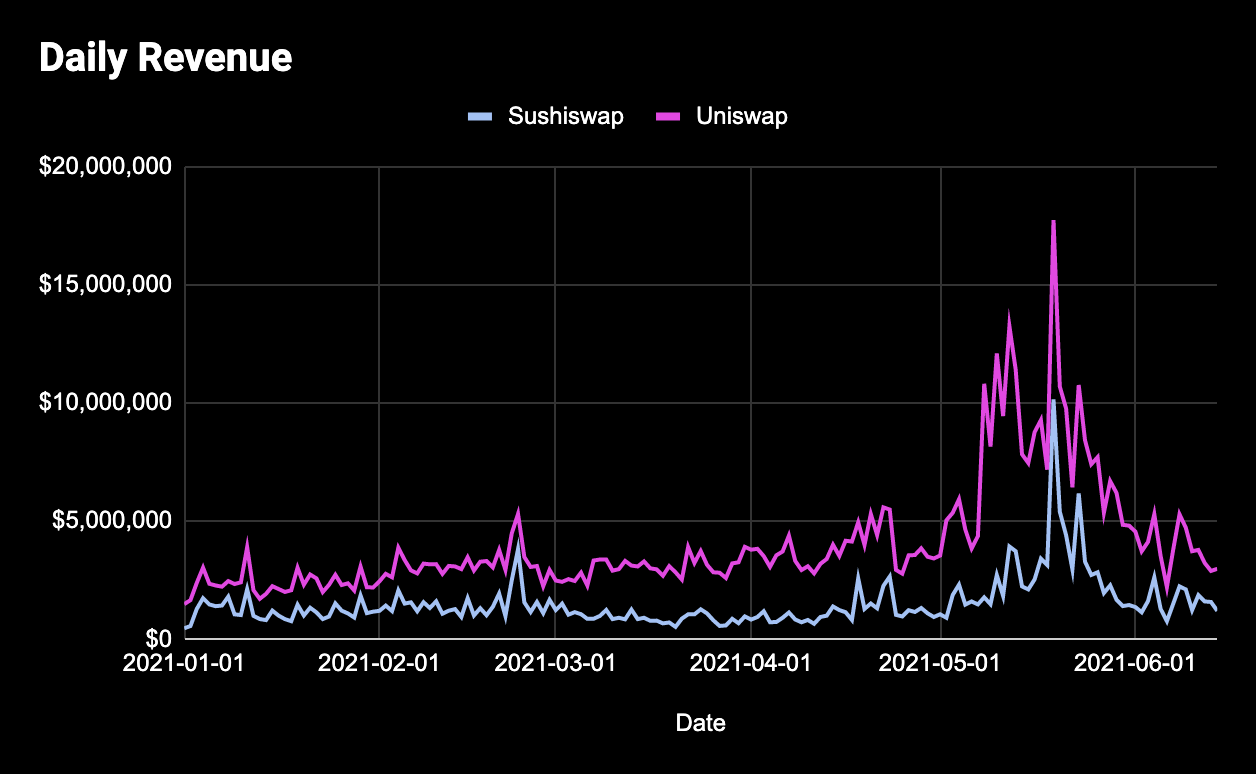

Volumes are directly tied to fees, so there’s no surprise that the daily revenue graph looks identical to above. But there’s a key difference in what these revenues mean for each protocol. As mentioned, SUSHI holders can stake their tokens and receive xSUSHI, which effectively represents the right to 16% of all revenue generated on the protocol. UNI on the other hand represents none, and all revenue generated is directed to liquidity providers.

As expected based on volume growth, Uniswap is leading in YTD growth with a 72% increase, reaching $3.3M in daily revenues to LPs. Comparatively, Sushiswap’s revenue has only grown by 42% this year to $1.6M in daily fees – directing ~$250K of that per day to xSUSHI holders.

🧠 Bonus Napkin Math: If we took Uniswap and UNI and modeled it under the same parameters as xSUSHI, “xUNI holders” would be on track to earn over $220M in fees this year! Applying the same 27% stake rate as Sushiswap, this would mean UNI stakers would be earning a nearly identical 7.55% APY. 🤔

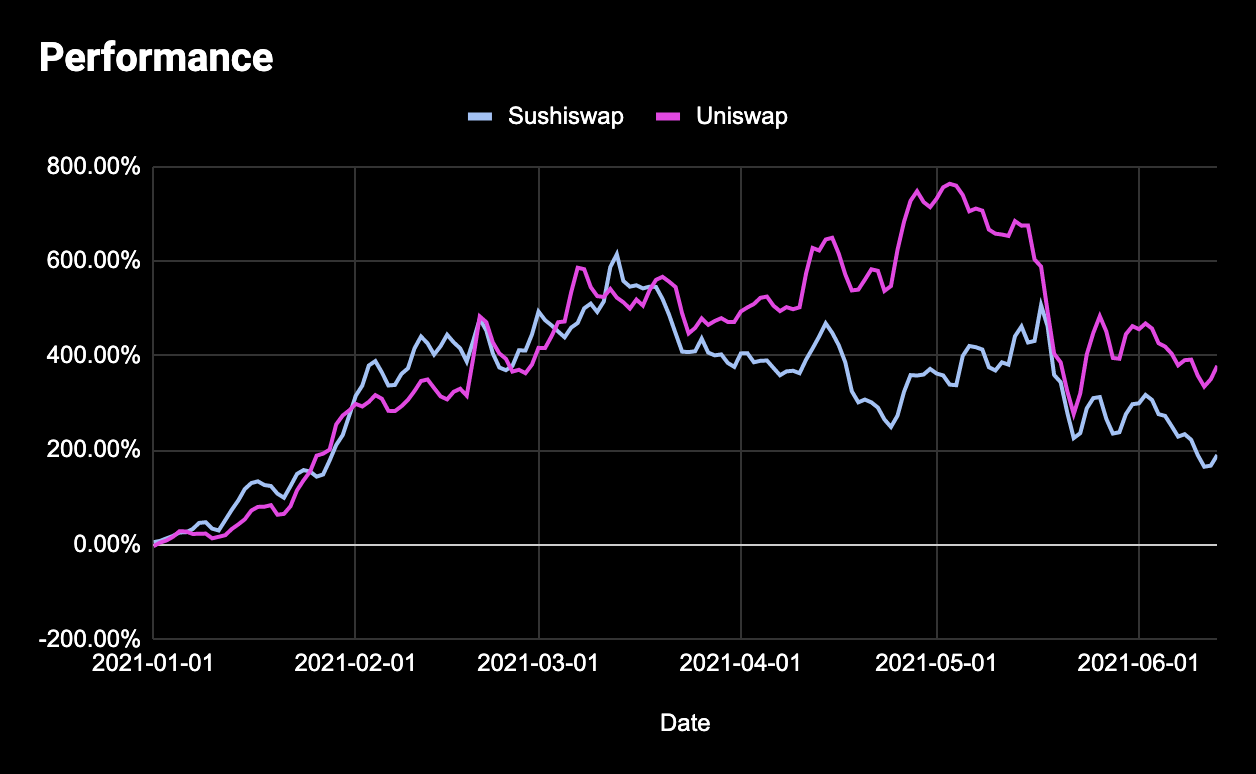

At the end of the day, there’s only one metric that matters for investors: price performance. Every investor wants to get on the fastest horse. And the market is the ultimate referee for this. Despite UNI representing no cash flow rights over the protocol, and even a relatively static governance ecosystem, it’s still outperforming SUSHI.

This makes sense after some digging. UNI is outgrowing SUSHI in key areas that drive the valuation for DEXs (volumes and revenue). However, there’s also one important qualitative aspect that we should highlight which may have directly impacted performance this year: token supply schedules.

Sushiswap experienced a large unlock of SUSHI tokens in late March for vested LPs while it continues to distribute liquidity mining rewards on a weekly basis. Alternatively, Uniswap has significantly fewer tokens hitting the market as there are no liquidity mining programs, and all vested tokens accrue to strong hands (core team, investors, and the community treasury). This is likely a key driver on why SUSHI started to trend down in March and April.

With that said, both protocols have had notable years. SUSHI has risen by over 189% in USD-denominated price, while UNI has grown 378% this year alone.

🥇 Winner: Valueless governance token

Compound and Aave

Compound and Aave pose a similar dichotomy to Uniswap and Sushiswap. Compound represents the U.S. based, V.C. backed, slower-moving lending protocol. Aave is the opposite—the team and its community have taken the “move fast” route with continuous asset listings, while empowering the AAVE token with cash flow rights via the introduction of Aavenomics.

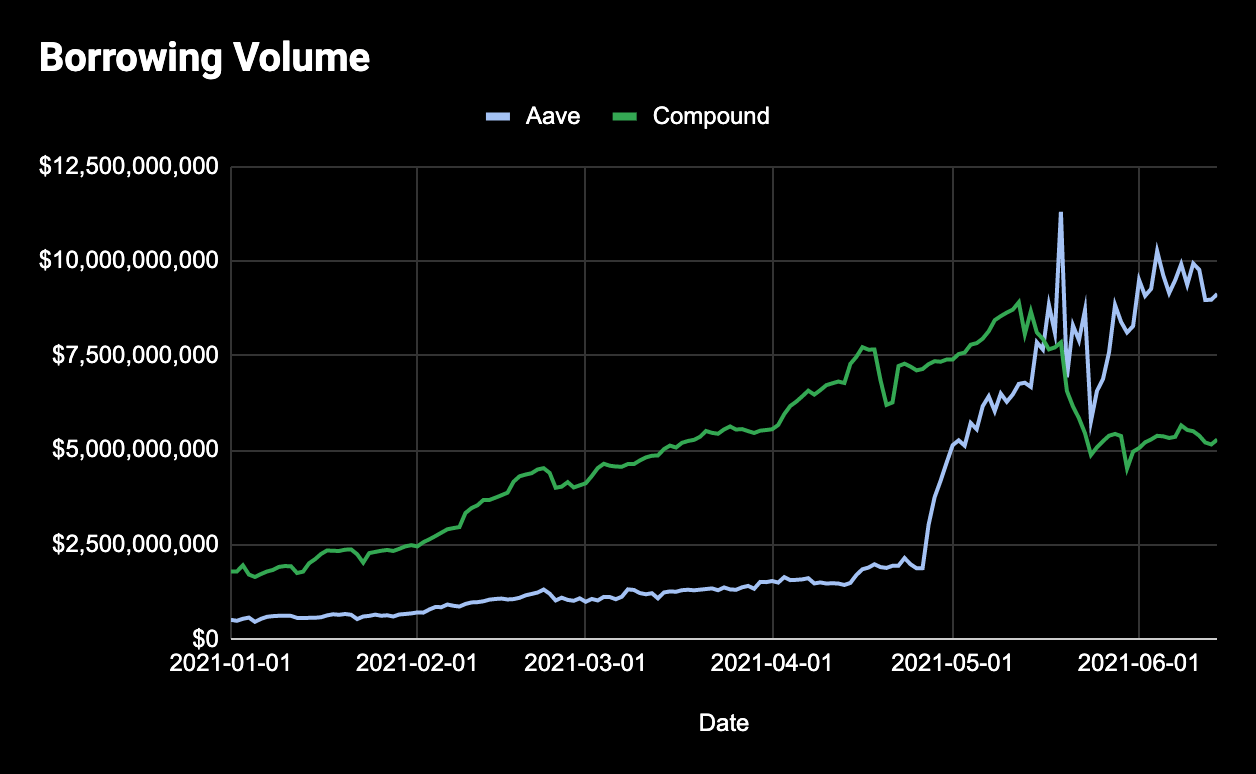

But how do these compare? Similar to DEXs and trading volume, one of the key things to look at with lending protocols is the growth in borrowing volume.

More borrowing volume translates into better interest rates for liquidity providers, which attracts more capital, which increases the protocol’s borrowing capacity. Despite having a long-time lead, Compound recently lost its position after Aave launched a long-awaited liquidity mining program in May 2021.

The introduction of Aave’s liquidity mining program led to a massive surge in borrowing demand on the protocol. To give you an idea, Aave started 2021 with only $500M in outstanding debt, which compared to Compound at time, was significantly smaller as Compound was facilitating over $1.7B in loans.

Fast forward to today and Aave has skyrocketed to to 1,700% YTD growth in borrowing volume as it’s now processing over $10B in loans. With that said, Compound’s debt has also substantially increased by over 200% YTD to $5.3B.

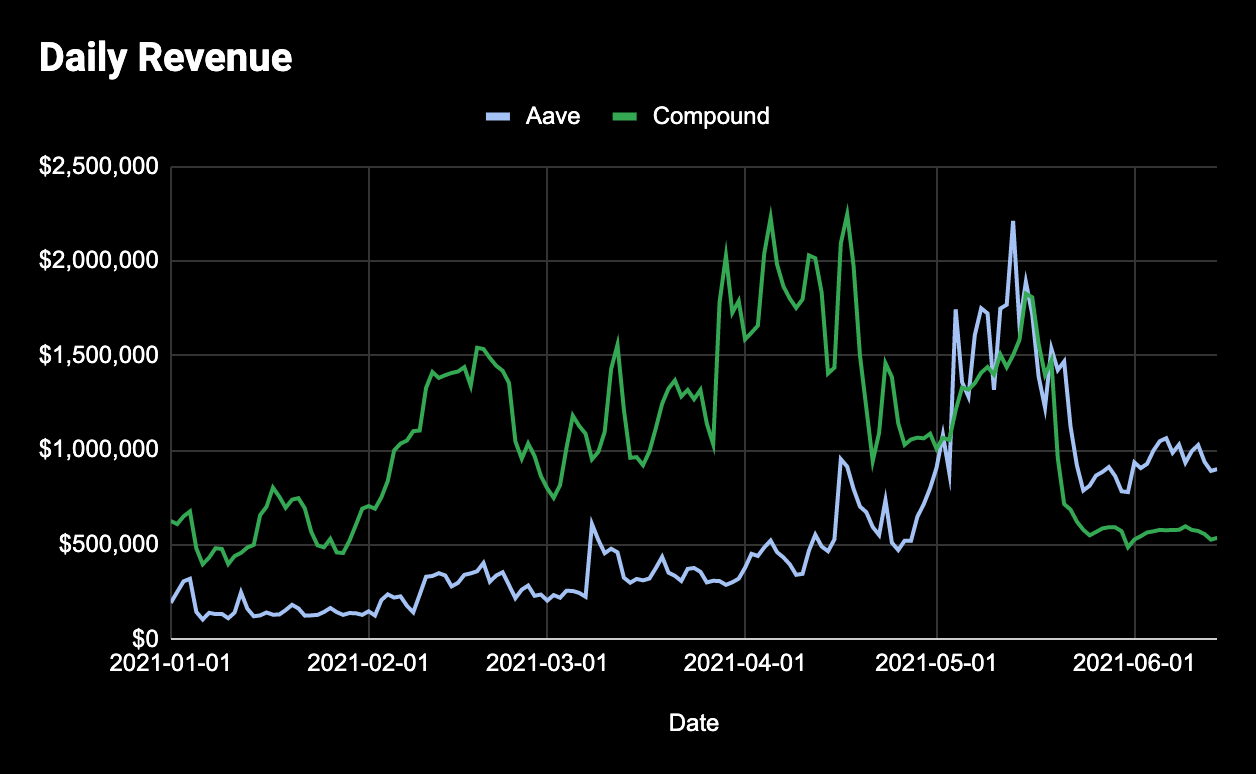

Naturally, as a result of the surge in borrowing volume, Aave has also taken the lead in daily revenue generated, which bodes well for AAVE holders.

Right now, Aave is earning just shy of $1M per day in revenue with a majority of that going to lenders. Meanwhile, Compound has taken a recent dip, likely as borrowers migrate to Aave for its liquidity mining program, as the interest rate protocol generates $550K per day for LPs.

It’s interesting to note that revenue for Aave has grown by over 360% this year, while Compound’s growth is flat at 2% YTD following the recent drawdown.

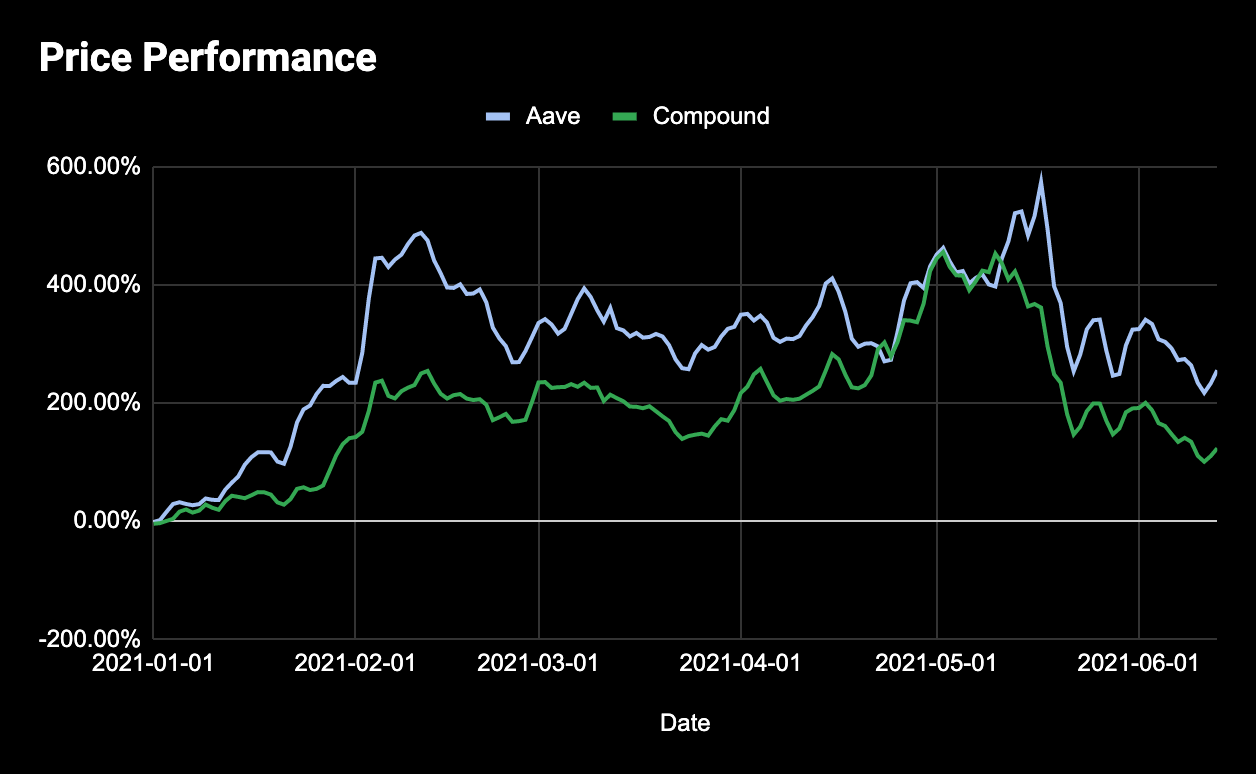

I’ll repeat this again: the most important thing at the end of the day for investors is performance. Investors want number to go up.

And with Aave’s explosive growth this year, it should come as no surprise that the protocol is outperforming its friend Compound. Both assets have done well this year, with COMP increasing over 123%. However, AAVE is winning at a 255% YTD increase.

🥇 Winner: Productive DeFi Token

Conclusion

Uniswap, despite being a non-productive asset, outperformed its productive counterpart. However Aave, being a productive asset, has outpaced its non-productive competitor. So what does this mean? Whether or not the asset is productive probably doesn’t matter. What matters most is the underlying product and its growth.

If the fundamentals are there and they’re growing, the market will react to them, regardless of whether or not the token has a value accrual mechanism.

No offense to UNI holders (I’m one of them), but the token may as well be classified as a paperweight. There’s no cash flow rights and there’s barely any governance happening in the first place (I’ll concede that there’s been more governance activity recently).

But guess what? Uniswap continues to be the dominant force in the DEX landscape. No other protocols are getting close to the amount of volume and fees it generates as indicated by its >60% market dominance and triple digit YTD growth.

This holds true for Aave as well—it has more borrowing volume and revenue than its counterpart and due to good timing on a liquidity mining program, has significantly outpaced Compound in growth this year. And I’d be willing to bet this would hold true if AAVE was an unproductive, valueless governance token. The productive characteristic of AAVE is just the cherry on top.

My thesis here is that whether or not a token is productive or non-productive, it actually doesn’t matter. Product market fit and product growth does. So yes, while having a value accrual mechanism that holders can rely on and point to is a nice addition, ultimately it’s not a guarantee that number will go up, or that it will outperform a similar protocol with a non-productive native token.

We see this holds true in traditional finance as well. Amazon and other high tech growth stocks have never paid out a dividend. And I’ve never met anyone that actually participates in shareholder governance.

But how many things have you ordered from Amazon this month?

Action steps

Debate whether or not productive assets matter in DeFi

Check out Token Terminal for more analytics

Level up with other Bankless resources on token valuations