Dear Bankless Nation,

When designing DeFi protocols, projects mostly had one design option: Build on mainnet, then port to the scalability layer. We’d always have to ask “When Layer 2?”

The problem here was twofold:

- Significant technological hurdles to bridge to L2

- Minimal trading volume in L2

But with the launch of Layer 2 solutions, spearheaded by Arbitrum, dYdX, and Optimism, more people are moving from the city to the suburbs.

Ten days ago the amount of value locked in L2 hit $3.5B.

The barriers to entry for L2 have lowered significantly. Now DeFi and other crypto protocols face a better alternative: Build on L2, then port to mainnet.

Lyra is one such project taking this route. They’ve deployed natively on Optimism.

My prediction: a year from now daily active users on L2 will far eclipse mainnet.

And it’s because of design choices like these.

- RSA

A Guide to Trading Options on Lyra

Lyra is an AMM built on Optimism that allows you to do two things for the first time in DeFi:

- Buy and sell options that are accurately priced

- Provide liquidity without constant volatility

Options are an integral part of the financial system, allowing traders to manage risk, obtain leverage, and construct any payoff structure. It is hard to quantify the market size of options in traditional financial markets—some estimate ten trillion, others up to hundreds of trillions of dollars. What we know for sure is that this market is truly massive and that the utility options provide make them a cornerstone of the financial system.

However, despite the recent growth and adoption of DeFi, options have had difficulty finding traction on-chain. There are a few reasons for this.

- Options are difficult to price with the gas and scalability constraints of layer 1

- Options are extremely risky and current protocols leave LPs unprotected.

These problems have led to low liquidity and uncompetitive pricing. Lyra solves these problems, combining the best of traditional options market making (proven pricing and risk management) with crypto’s two biggest strengths right now, scalability and composability.

By building natively on Optimism, Lyra has implemented the first market-based, skew adjusted pricing model which provides competitive pricing. Lyra also quantifies the risks incurred by liquidity providers and actively hedges them, encouraging more liquidity to enter the protocol.

What are options?

Options are some of the most versatile financial products. An option involves a buyer and seller, where the buyer pays a ‘premium’ for the rights granted by that option. There are two main types of options; call options, which allow the option holder to buy an asset at a specific price in the future, and put options that allow the holder to sell at a specific price in the future.

Traders may buy options to speculate on whether a token will increase or decrease and take a leveraged position at a lower premium than actually purchasing the underlying asset.

Options can be used in designing strategies surrounding speculation, hedging, or earning income which we’ll talk about more later in this post.

📚 Want to learn more about options? Check out these Bankless resources:

How the Lyra mechanism works

Lyra uses market demand and supply to update the implied volatility surface for each expiry. This surface is then fed into the Black Scholes pricing model to determine prices for all listed options, yielding performant pricing for traders and steady returns for LPs.

Lyra’s AMM actively hedges the delta risk incurred by LPs by composing with DeFi spot markets to trade in and out of the underlying asset. Vega (volatility) risk is quantified and is at the heart of its fee structure, allowing it to incentivize risk-reducing trades.

These innovations increase the alpha and improve the Sharpe ratio of the AMM. In a virtuous cycle, increased alpha leads to more liquidity, driving more volume and yielding more fees for the protocol.

🧠 Read up on the whitepaper for more details.

How to trade on Lyra

Walkthrough video guide:

Step 1: Add Optimistic Ethereum to your wallet

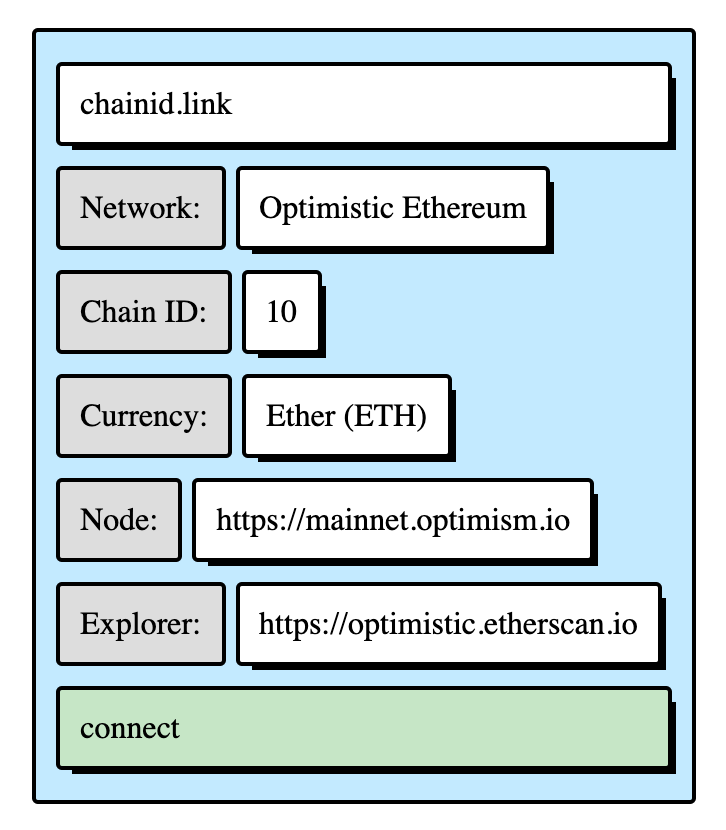

Lyra is the first project built natively for Optimistic Ethereum (OE). If you have never used OE before you will need to add the Optimistic Ethereum network to your wallet.

Pro tip: You can use chainid.link to add the network to your wallet with a single click!

Step 2: Bridge ETH from Mainnet to Optimism

After you have added the Optimistic Ethereum network, you will need to bridge funds from the Ethereum mainnet to Layer 2. The easiest way to do this is via the Optimism Gateway. This process is similar to bridging funds to other chains (i.e. Polygon).

You can watch a walkthrough of the Optimism gateway by Bankless here.

Step 3: Connect your wallet to Lyra

Head to https://app.lyra.finance/ and connect your desired wallet to the dApp.

Step 4: Select an expiry

Options don’t last forever. They have an expiration date. After this date, the holder can no longer buy or sell the asset at the strike price and the option is worthless.

You can select your desired expiry using the dropdown on the trade page. The list of strikes will update to reflect the available options for your selected expiry.

Step 5: Select “buy” or “sell”

Lyra’s AMM allows traders to buy and sell options. Traders who buy options are called holders and traders who sell options are called writers of options.

You can easily toggle between buying and selling on the trade page.

Step 6: Select “call” or “put”

A call option gives the holder the right to buy a token and a put option gives the holder the right to sell a token. Traders who are bullish can buy a call or sell a put, whereas if they're bearish, they can buy a put or sell a call.

You can toggle between calls and puts on the trade page.

Step 7: Select a strike price

On Lyra, one option covers one unit of the underlying token. This is different from traditional stock options which often cover 100 shares of the underlying stock. The scalability of the Lyra mechanism means that there is no lower limit of options order size, making the system accessible to all traders in the community.

Enter the number of options you wish to purchase or sell and approve the transaction in Metamask.

Step 8: Acquire sUSD & Synths through the in-app swap

Lyra’s mechanism uses Synthetix as a spot market to trade in and out of the underlying asset and therefore requires synths to buy or sell options.

You’ll need sUSD, a synthetic stablecoin, to open long positions and short puts, and you’ll need sETH as collateral for short calls. To seamlessly acquire synths, you’ll be prompted to swap to the minimum amount of the synth you need to open a position without having to leave the dApp.

This native swapping is powered by an integration with 1inch.

Step 9: View your positions on the ‘Portfolio’ page

The Portfolio page shows you your current positions as well as the unrealized profit and loss for those positions. You can close any open positions by pressing the “Close” button. This will give you more information about the closing trade, including incurred fees. When your positions expire, you can settle them in the “Expired Positions” tab.

Potential option strategies with Lyra

Now that you understand how to use Lyra, we can start looking at some potential strategies that could help you along the way.

Options are versatile tools that allow traders to construct creative and complex payoff structures to benefit in bull, bear, or even crab markets. At a base level options are great for three things: getting leverage to take speculative directional positions, hedging your portfolio, and generating passive income.

Directional speculation

Options give traders access to make leveraged trades to speculate whether an asset will move up or down. You may ask ‘Why wouldn’t I just buy the underlying token and hodl?’... Well, options allow you to access a significant amount of leverage. Options have a payoff structure that can provide theoretically infinite returns if the asset moves in the desired direction.

You can read about the different types of options in the Lyra docs here.

Portfolio hedging

Options trading strategies can be complex and multi-legged, but they can be simple enough for options trading beginners to enhance account performance. Puts give you the right to lock in a minimum return on your token until expiry.

This allows you to limit the potential downside of your positions in the volatile crypto environment. If your portfolio is exposed to price fluctuations of ETH, purchasing put options as insurance for an investment portfolio can be an effective beginner strategy.

Income generation

Trading options does not need to be a high-risk activity.

Options can be used to earn consistent income to complement more speculative elements in a portfolio depending on the trader's investment style. Potential strategies for earning income with options could include selling puts to the AMM and collecting fees, selling calls on assets that you already own known as covered calls along with more complex strategies like vertical spreads and iron condors.

It’s time for options in DeFi

The scalability of Layer 2 Ethereum has unlocked many exciting new opportunities that were not possible on Layer 1.

Building natively on Optimism has allowed Lyra to achieve something never seen before in DeFi; a fully functioning decentralized options market. Over 2200 unique addresses have traded over 3500 options on Lyra.

Are you going to join them?

Action steps

- 📈 Trade call and put options on L2 with Lyra Finance

- 🎓 Learn trading terminology

- 🎙️ Catch up on developments in the Optimism ecosystem

Author Bio

Cody Adam is a core contributor and the head of community and growth at Lyra Finance, a decentralized options AMM built natively for Layer 2 Ethereum.