DeFi Options Strategies for Traders

Dear Bankless Nation,

Options are a key tool for seasoned investors—they offer a diverse range of exposure to different assets in different ways.

Whether it’s hedging against volatility, speculating with leveraged exposure, or earning a passive income by selling contracts, there’s a way for you to leverage options to your advantage that’ll fit any investment thesis.

Opyn is a DeFi protocol tackling options. We’ve written about them before, but they recently released V2, which introduced a more capital-efficient protocol along with new features, providing more opportunities available for all the traders reading this.

Today, we’ll explore what’s new with Opyn. We’ll also explore some of the more advanced options strategies you can execute with this upgrade.

Let’s level up on options strategies!

- RSA

WRITER WEDNESDAY

Guest Writer: Wade Prospere, Head of Marketing and Community for Opyn.

Advanced Option Strategies with Opyn

What are Options?

Options are derivatives contracts that give the buyer the right, but not the obligation, to either buy or sell a fixed amount of an underlying asset at a fixed price on or before a certain date—commonly referred to as the expiry date.

In DeFi, underlying assets could include virtually any ERC-20 assets including: WETH, WBTC, UNI, YFI, SNX, among others.

In traditional finance, investors use options for a variety of reasons. This could include income generation, speculation, and hedging a position in your portfolio. At the end of the day, options serve as a reliable tool for investors to take more advanced, expressive positions in the market to better optimize the risk in their portfolio.

For the purpose of this article, we’ll focus on intermediate and advanced options strategies that leverage the capital efficiency of options positions such as spreads. Spreads allow long options to collateralize short options, enabling users to post the max loss of a structure as collateral.

A Brief Primer on Opyn V2

Built upon the Gamma Protocol, Opyn v2 is a DeFi options trading protocol that allows users to buy, sell, and create options on ERC20s. DeFi users and products rely on Opyn’s smart contracts and interface to hedge themselves against DeFi risks or take speculative positions on different cryptocurrencies.

There are seven things that make Opyn different from other DeFi options protocols:

- Allows for more capital efficient options trading strategies such as spreads

- Allows for flash mints (possible to mint options without collateral as long as they are burned before the end of the transaction)

- Has competitive pricing, as bid / asks are set by market supply and demand

- Allows users to sell options prior to expiry

- Options can auto-exercise for in the money options

- Permits anyone to create new options if the product has been whitelisted

- Allows operators to act / trade on a user’s behalf

The key characteristics of Gamma Protocol that allow for capital efficiency improvements across DeFi options trading are: margin improvements, European, cash-settled options, and flash mints.

Margin Improvements

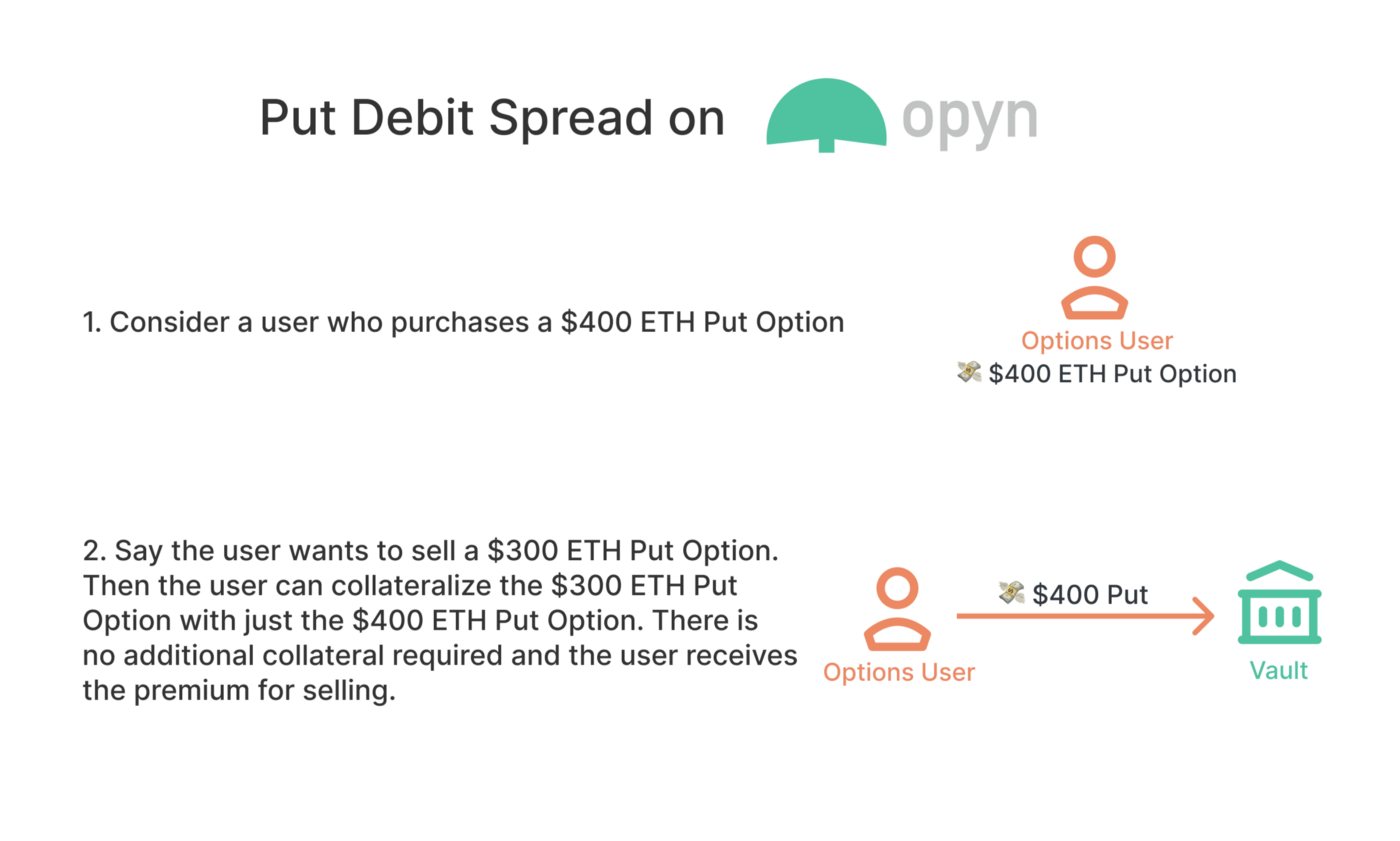

Gamma Protocol lays the foundation for more capital efficient options, starting with spreads. Specific to Opyn, spreads allow long oTokens to collateralize short oTokens, enabling users to post the max loss of a structure as collateral.

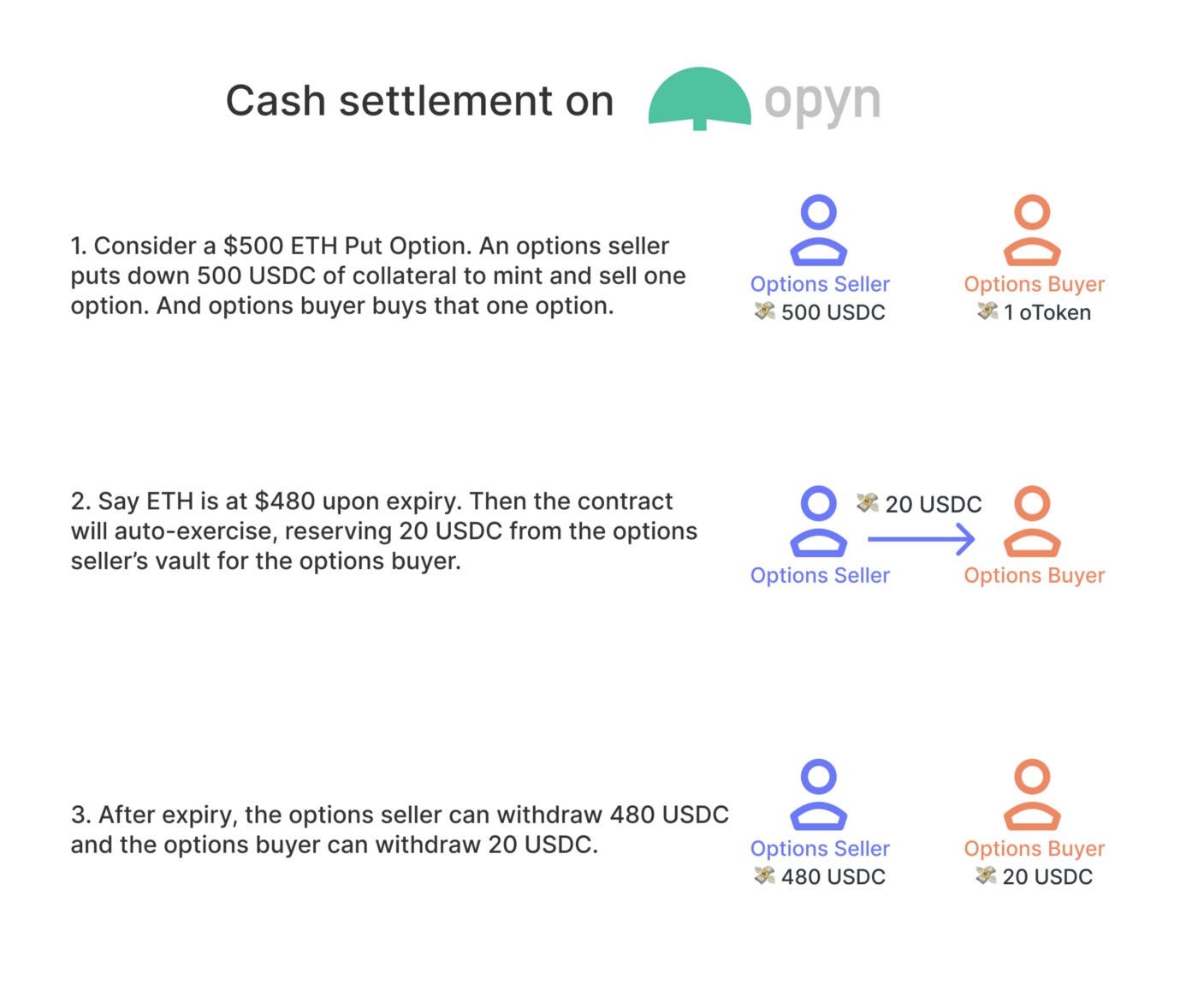

European, Cash-settled Options

Cash-settled, European options enable margin improvements by allowing for safe constructions of spreads.

European options mean that option holders can exercise options only upon expiry. Cash settlement means that option holders don’t have to provide the underlying asset in order to exercise. Rather, the options are settled in the collateral asset, and option holders receive a cash payout on exercise (difference in value between strike and underlying asset price in terms of the strike asset) is transferred.

Now that you have an understanding of how Opyn V2 works, we can learn how to use these improvements to our advantage, and take on more advanced option positions.

Intermediate Options Strategies

The characteristics outlined above enables Opyn v2 to make options trading in DeFi more capital efficient. This is one of the first step towards competing with traditional markets by significantly reducing a trader's collateral requirement.

Spreads allow long oTokens to collateralize short oTokens, enabling users to post the max loss of a structure as collateral. Generally speaking, spreads are a common way to reduce risk & margin requirements, and below are four of the most common option spreads:

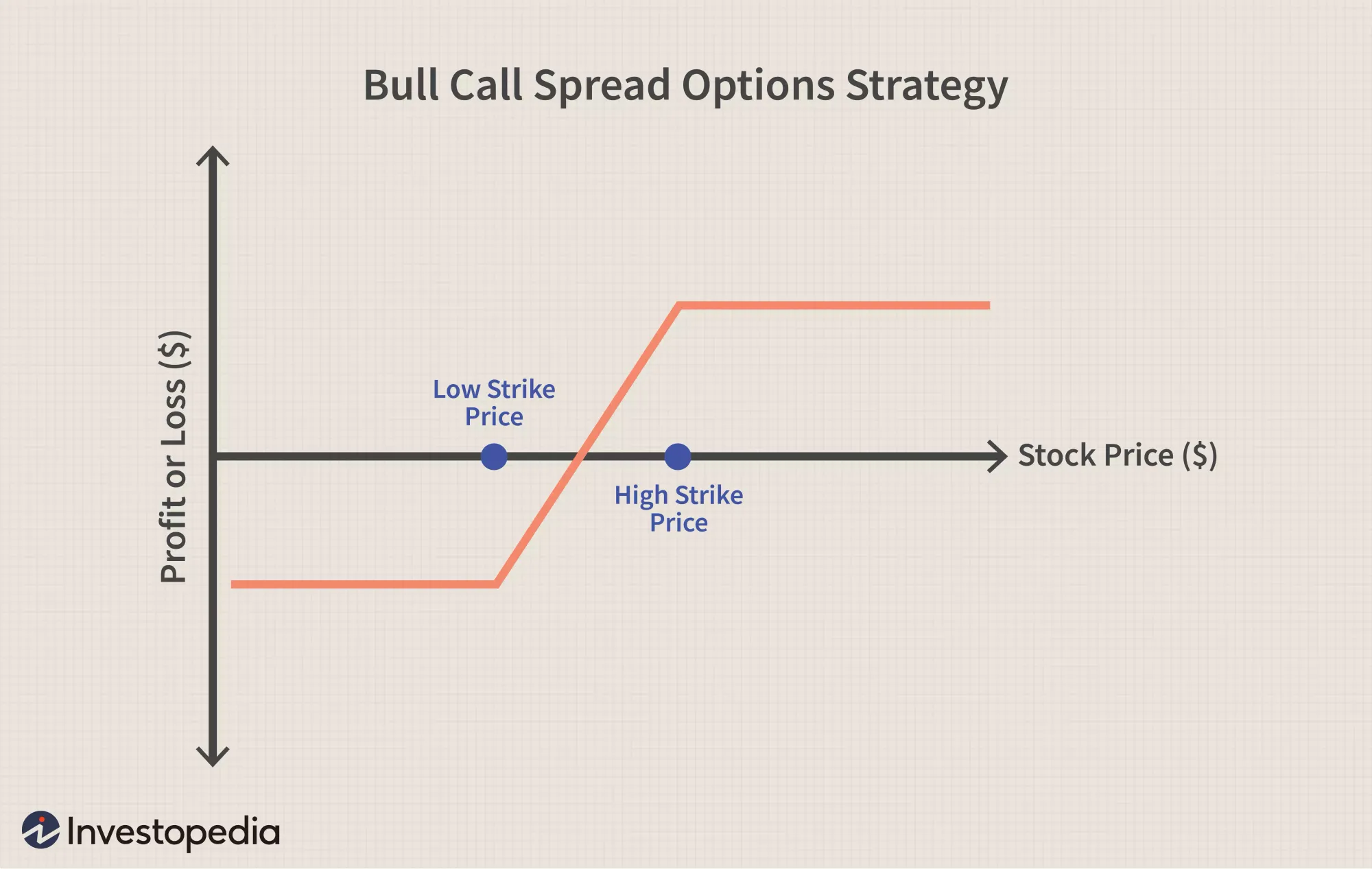

Strategy #1: Call Debit Spread

A Call Debit Spread, also known as a bull call spread, is an option strategy that involves simultaneously buying calls at a specific strike price and selling the same amount of options with a higher strike price, requiring a net outflow of cash. Both options have the same expiration date and underlying asset.

The result is a net debit to the trading account. The call debit spread reduces the cost of the call option, but it caps the gains in the asset’s price, creating a limited range where the trade can earn a profit.

Trading Scenario: Traders often use a bull call spread if they believe an asset will moderately rise in value. This happens most often during times of high volatility.

Max Gain / Max Loss: Potential profit for a call debit spread is limited to the difference between the strike prices minus the net cost of the spread. Maximum profit is realized if the stock price is at or above the strike price of the short call at expiration.

The maximum loss is equal to the cost of the spread. A loss of this amount is realized if the position is held to expiration and both calls expire worthless.

Position Details: The call debit spread involves two call options, resulting in a net debit to the trading account:

Buying a call option (long call) for a strike price above the current market with a specific expiration date.

Simultaneously, selling a call option (short call) at a higher strike price that has the exact same expiration date as the first call option

📒 How to trade a call debit spread on Opyn v2

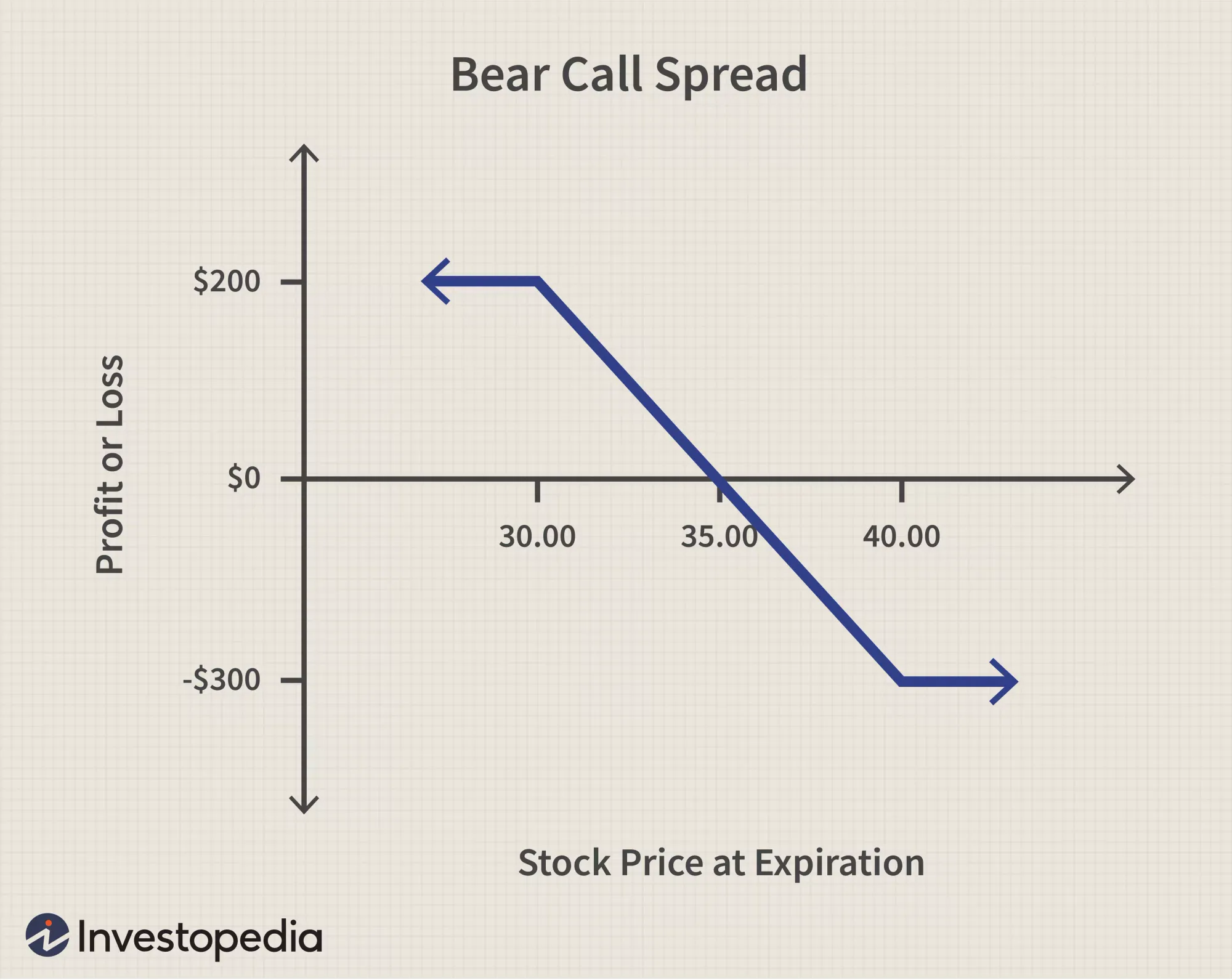

Strategy #2: Call Credit Spread

A call credit spread, also known as a bear call spread, is a type of options strategy achieved by purchasing call options with a specific strike price, while also selling the same number of calls with the same expiration date, but at a lower strike price. With this strategy, the investor should be expecting a decline in the price of the underlying asset.

One of the main advantages with this strategy is that you’re reducing the net risk of the trade by buying a call option with a higher strike price and selling the call option with a lower strike. Generally, this strategy can carry less risk than shorting the stock since the max loss is capped.

Trading Scenario: Traders often use a bear call spread when they expect a decline in the price of the underlying asset.

Max Gain / Max Loss: The maximum profit is equal to the credit received when initiating the trade. The maximum loss is equal to the difference between the strike prices minus the net credit received. A call credit spread is considered a limited-risk and limited-reward strategy. Limits of profits and losses are determined by the strike prices of the particular call options.

Position Details: The call credit spread involves two call options, resulting in a net credit to the trading account:

Buying a call option (long call) with a higher strike price with a specific expiration date, paying a premium

Simultaneously, selling the same number of calls (short call) with the same expiration date, but at a lower strike price.

📒 How to trade a call credit spread on Opyn v2

Strategy #3: Put Debit Spread

A put debit spread, also known as a bear put spread, is a type of options strategy achieved by purchasing put options while also selling the same number of put options on the same asset with the same expiration date at a lower strike price. While this seems similar to buying a standard put option, this strategy forfeits potential profit in return for a lower cost than a normal put option. With that, the risk with this strategy is limited to the net premium paid for the position and there’s minimal risk of the position incurring significant losses.

The result of this trade is a net debit to the trading account. The sum of all options sold (lower strike price) is lower than the sum of all options purchased (higher strike price), therefore the trader must put up money to begin the trade.

Trading Scenario: Traders often use a bear put spread when they expect a moderate decline in the price of an asset. This strategy nets a profit when the price of the underlying security declines.

Max Gain / Max Loss: The maximum profit to be gained using a put debit spread is equal to the difference between the two strike prices, minus the net cost of the options. The maximum loss is equal to the cost of the spread.

Position Details: The put debit spread involves two put options, resulting in a net debit to the trading account:

Buying a put option (long put) with a higher strike price with a specific expiration date, paying a premium

Simultaneously, selling the same number of puts (short put) with the same expiration date, but at a lower strike price, earning a premium

📒 How to trade a put debit spread on Opyn v2

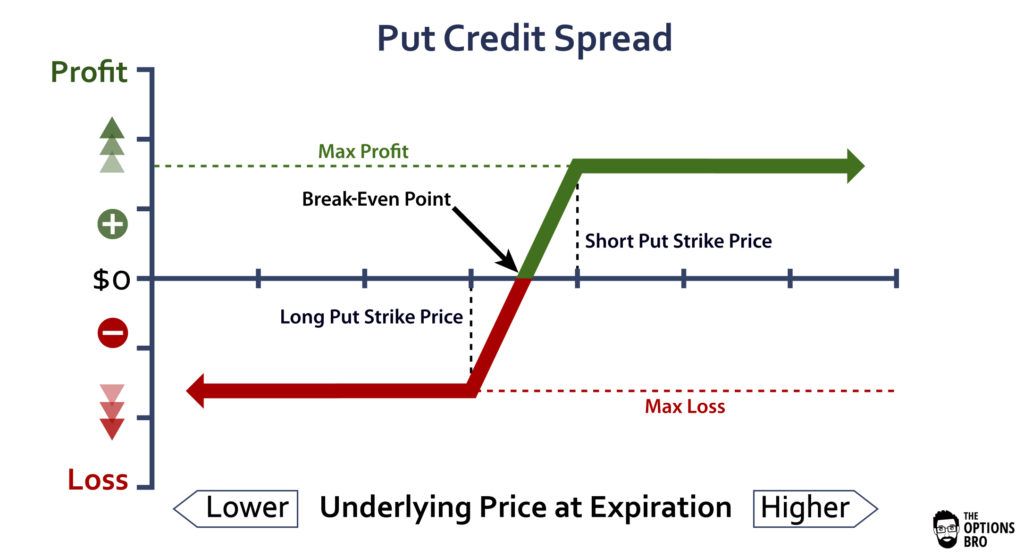

Strategy #4: Put Credit Spread

A put credit spread, also known as bull put spread, is a type of options strategy achieved by selling put options with a higher strike price, while also purchasing the same number of puts with the same expiration date, but at a lower strike price. The trader receives a net credit from the difference between the two premiums from the options.

- Trading Scenario: Traders often use a bull put spread when they expect a moderate rise in the price of the underlying asset.

Max Gain / Max Loss: The maximum profit, which is the net credit, only occurs if the asset’s price closes above the higher strike price at expiry. The maximum loss is equal to the difference between the strike prices and the net credit received. Limits of profits and losses are determined by the strike prices of the particular call options.

Position Details: The put credit spread involves two put options, resulting in a net credit to the trading account:

Buying a put option (long put) with a lower strike price with a specific expiration date, paying a premium

Simultaneously, selling the same number of puts (short put) with the same expiration date, but at a higher strike price, earning a premium

📒 How to trade a put credit spread on Opyn v2

‘Opyning’ the Door for New Possibilities

Options are a crucial tool in traditional finance that allows investors to express their positions with more color. As options protocols become more capital efficient, offer more contracts, etc., it opens up the door for more strategies for crypto investors, ultimately allowing DeFi markets to mature and become more efficient.

But let’s get this straight: this is not a fully comprehensive guide on every option strategy. In fact, it’s only the tip of the iceberg. Traditionally speaking, there’s virtually endless strategies that investors can execute with options. Covered calls and puts, married puts, straddles, iron condors, butterfly spreads…yeah you get the idea.

There’s a lot that you can do with options.

We’re only scratching the surface of what’s possible—so make sure to keep a finger on the pulse with the world of DeFi options.

You never know, there could be a profitable opportunity at any moment!

Glossary

- Option: Options are financial instruments that are derivatives based on the value of underlying assets such as ETH or BTC. An options contract offers the buyer the opportunity to buy (calls) or sell (puts) the underlying asset.

- Call Option: A call option is a financial contract that gives the option buyer the right, but not the obligation, to buy an asset at a specified price for a specific amount of time.

- Put Option: A put option is a financial contract that gives the option buyer the right, but not the obligation, to sell an asset at a specified price for a specific amount of time.

- Option Buyer: The person who buys an option by paying a premium. This person has the right, but not the obligation, to exercise the option. Also known as an options "holder," or someone who is "long" an option.

- Option Seller: The person who sells an option in return for a premium. The option seller is obligated to perform when the buyer exercises their right under the option contract. The options seller is also someone who is “short” an option.

- Underlying: The underlying asset on which an option's value is based. It is the primary component of how an option gets its value. Options are classed as derivatives because they derive their value from the performance or price action of an underlying asset.

- Premium: The money paid upfront by the option buyers to the option sellers in return. It is the cost of the option.

- Bid: The price a buyer is willing to pay for the option. If you’re selling an option, this is the premium you’d receive for the contract.

- Ask: The price a seller is willing to accept for the option. If you want to buy an option, this is the premium you’d pay.

- Strike Price: A strike price is the set price at which an options contract can be bought or sold when it is exercised. For call options, the strike price is the price an asset can be bought; for put options, the strike price is the price at which the asset can be sold.

- Expiration date: The date when the options contract becomes void. For European options, it’s the due date for options buyers to exercise the options contract. For American options, it's the date by which options buyers must exercise the options contract.

- Exercise: To exercise means to put into effect the right to buy or sell the underlying asset at the strike price. If the holder of a put option exercises, they will sell the underlying asset. If the holder of a call option exercises, they will buy the underlying asset.

- At The Money (ATM): A call or put option is at-the-money when its strike price is the same as the current underlying asset price.

- In The Money (ITM): Refers to an option that possesses intrinsic value. A call contract is in the money when its strike price is less than the current underlying asset price. A put contract is in the money when its strike price is greater than the current underlying asset price.

- Out of The Money (OTM): An option that only contains extrinsic value. A call option is out of the money when its strike price is greater than the current underlying asset price. A put option is out of the-money when its strike price is less than the current underlying asset price

Action steps

Try executing any of the above options strategies with Opyn v2

Read up on our previous resources on options:

Author Bio

Wade Prospere is the Head of Marketing and Community for Opyn. Prior to joining Opyn, he worked as a Financial Analyst for BofA Merrill Lynch and as a Consultant and Growth Advisor for startups throughout Latin America.