A Beginner's Guide to ETH Validators

Dear Bankless Nation,

The Merge drastically lowered the barriers to entry for the average person to get involved in securing Ethereum.

You don’t need to spend thousands (or millions) of dollars on hardware and energy costs, all you need is a laptop and some ETH.

While liquid staking protocols offer a more accessible solution for those that don’t meet the 32 ETH threshold, running your own validator helps preserve the decentralization & censorship-resistance of the network.

Today, you have three main options:

- Plug & play solutions (dAppNode & Avado)

- Solo staking (DIY hardware)

- Rocket Pool Operators

All these have different trade-offs.

Interested in getting started and earning some rewards?

Here’s how anyone can become an ETH validator.

- Bankless team

If you’re a supporter of Ethereum, one of the most important things you can do right now is to run an Ethereum validator.

This Bankless tactic will show you how to secure Ethereum and earn ETH by operating your own Ethereum Proof-of-Stake (PoS) validator system.

- Goal: Operate an Eth PoS validator

- Skill: Intermediate to advanced

- Effort: 2 hours of research to start

- ROI: 4.79% APR in ETH rewards for DIY validating

How to DIY stake on Ethereum

We want YOU to become an ETH validator

“Centralized providers provide a service that may degrade the overall decentralization of the network and cause your deposits to be less valuable over time. I strongly encourage every participant to stake in the most decentralized way they can, even if it means learning new skills to achieve this.” — Superphiz, April 2022

Last week, Ethereum completed its shift from Proof-of-Work (PoW) mining to PoS staking.

This means Ethereum’s consensus process has been virtualized and moved into the hands of ETH holders. Instead of having to run major physical mining operations to win PoW blocks, now the Ethereum network is simply secured by people who stake ETH holdings within Etherum itself and swear against their collateral to support and not cheat the network.

Upon this shift, the great promise is that Ethereum can become even further decentralized by welcoming more people into this consensus process via staking, since running large physical mining operations for PoW is really only feasible for those who have access to, and the know-how to command, considerable physical resources.

Accordingly, this guide will show you how to participate in ETH staking as a regular Ethereum user, starting with plug-and-play node solutions out of the gate.

But first, let’s begin with a quick word on the importance of client diversity!

Why client diversity matters

Client software determine the behavior of how a node runs.

When the majority of nodes run on the same client, attacks can destabilize a blockchain network. That, in a nutshell, explains why running a diversity of clients is important.

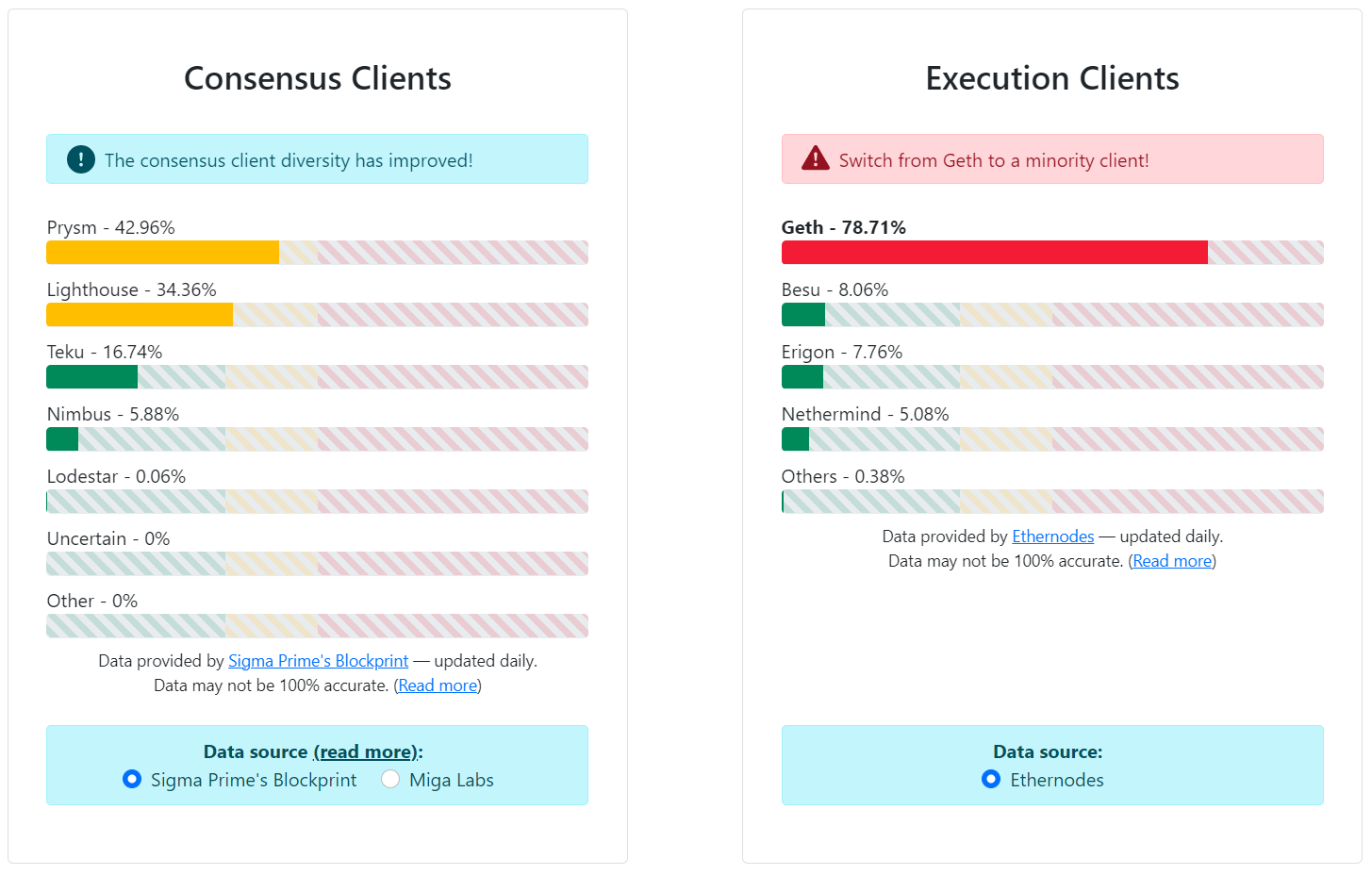

Post-Merge, Ethereum validators must simultaneously run two kinds of clients: an execution client, which handles the Ethereum Virtual Machine (EVM), and a consensus client, which facilitates PoS consensus.

As you can see from the image above, Ethereum validators have a variety of execution and consensus client combos to choose from, and it’s important that no single client or client combo becomes too popular as clientdiversity.org has explained:

“Many know client diversity is important for a more resilient network, but they don't understand why or just how essential it is. It's not only important — it's critical. If a single client is used by 2/3rds (66%) of validators there's a very real risk this can result in disrupting the chain and monetary loss for node operators.

It takes 2/3rds of validators to reach finality. If a client with 66%+ of marketshare has a bug and forks to its own chain, it'll be capable of finalizing. Once the fork finalizes, the validators cannot return to the real chain without being slashed. If 66% of the chain gets slashed simultaneously, the penalty is the whole 32 ETH.

So why is >50% marketshare still dangerous? If a minority client forks, the 50%+ majority client can obtain a 66%+ majority. With no client having a marketshare over 33%, these scenarios are avoided. That's why <33% marketshare is the goal for all clients.

Execution clients are not immune. The risks mentioned above apply to both consensus clients and execution clients equally.”

The takeaway?

When setting up your Ethereum validator, it is strongly recommended to use minority clients like Teku and Besu to make Ethereum as resilient as possible, as doing so will maximize Ethereum’s decentralization.

Now, let’s dive into which validator options are friendliest for at-home stakers.

1. Plug & Play Hardware

In Nov. 2020, Bankless published a Running an ETH Validator for the Barely Motivated guide.

Guess what? The advice in that post rings true today: Dappnode and AVADO are still top plug-and-play Eth validator solutions.

Let’s do a quick refresher here accordingly!

Dappnode

- Difficulty: Beginner

- Cost: 💰💰💰

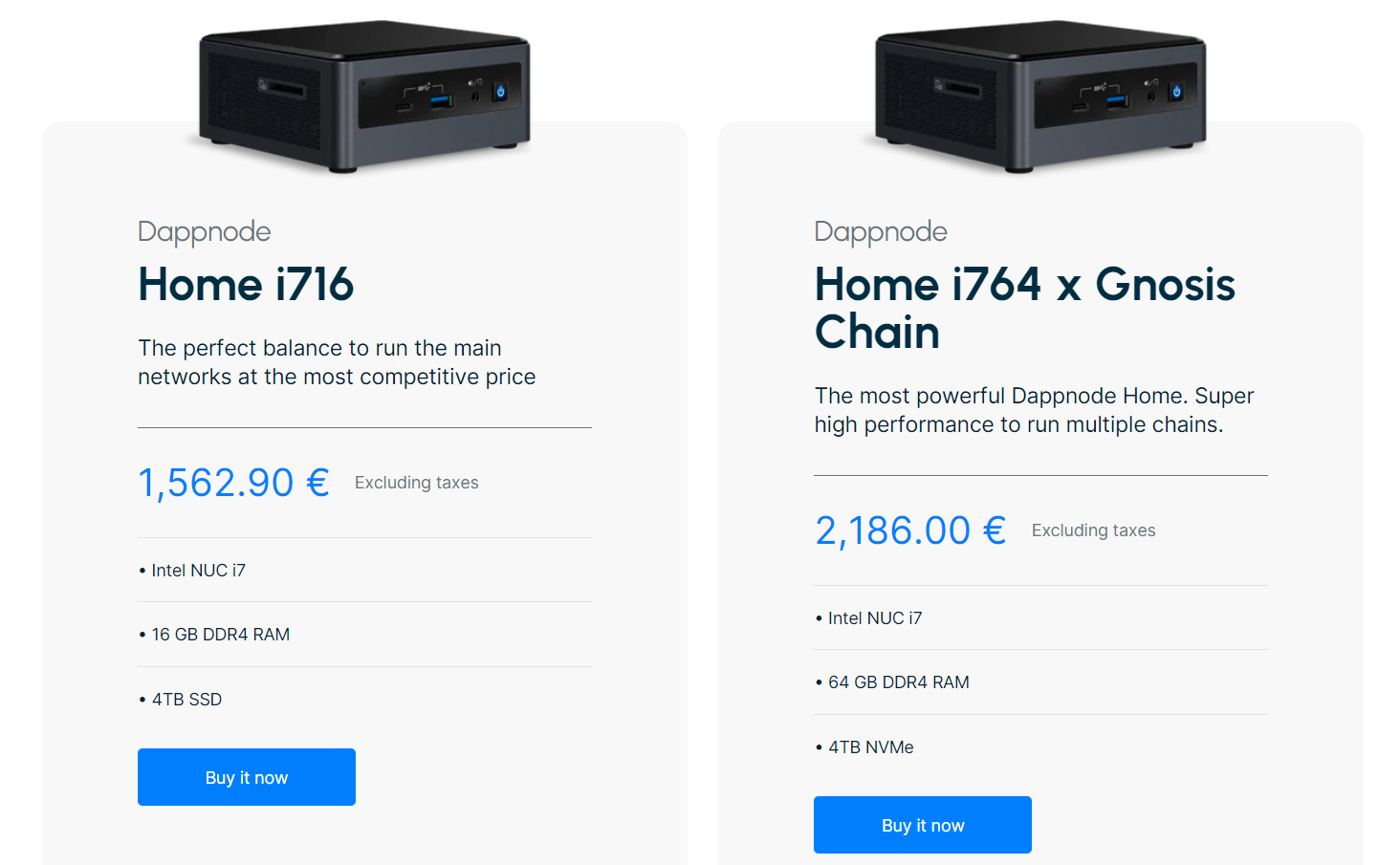

Dappnode provides hardware + software tools that make it easy for regular people to run their own blockchain nodes. As such, Dappnode’s devices have become extremely popular grassroots solutions for running Ethereum validator nodes.

What’s great about the Dappnode devices is they make ETH staking very easy for non-technical users. You plug your hardware in, and then the system simply walks you through all the steps needed to go from 0 to 100 in launching your own validator.

- What you will need: 32 ETH for depositing + a generated keystore to safely store your validator private key

- Starter tutorial: Installing a client from scratch with DappNode

- Clients natively supported: Teku, Lighthouse, Prysm (support for Lodestar and Nimbus coming soon)

- Pricing: The base Dappnode Home i716 unit starts at €1,562.90 each

AVADO

- Difficulty: Beginner

- Cost: 💰💰💰

After starting out as a fork of Dappnode in 2018, AVADO has since advanced in its own right and gone all-in on streamlining the “run your own node” process for Ethereum PoS and other blockchains.

Plug an AVADO device in, follow through the starter prompts, and in a matter of just a handful of clicks you can be readily staking ETH from home!

- What you will need: 32 ETH for depositing

- Starter tutorial: Setting up a Teku validator | Setting up a Prysm validator

- Clients natively supported: Teku, Prysm

- Pricing: The base AVADO i7 unit starts at $1,600 each

2. Solo staking with DIY hardware

- Difficulty: Intermediate/Advanced

- Cost: 💰

Are you interested in becoming a validator on Ethereum, but you’d prefer to repurpose hardware you have laying around, like a recently replaced computer, instead of using a plug-and-play node?

This route is certainly more challenging. But you’re in luck because there are a ton of great resources available that can help you navigate the “staking from home on your own” process straightforwardly!

Before jumping in, know the basic requirements though.

According to an April 2022 Reddit post by Superphiz, DIY solo stakers will need:

- Above average technical skills

- At least 32 ETH

- Hardware capable of operating 24/7

- An internet connection of at least 10Mbps

That said, besides meeting these basic demands you have lots of freedom to customize your solo staking setup however you’d like.

Whether you want to use a $100 Raspberry Pi 4 or a $1,000 Intel NUC for your rig, the choice is up to you.

For some inspiration here, check out some of the awesome DIY solo staking setups we’ve seen around the Ethereum community lately:

If you start to explore the option of DIY solo staking more seriously, there are a handful of community resources you should check out.

These resources include:

- Ethereum Launchpad — a one-stop information hub with all the info and resources you need to become an Ethereum validator

- EthStaker — a community and compendium of resources geared toward all things Ethereum staking

- CoinCashew’s Ethereum validator guide — a wiki-like hub covering how to start, maintain, and generally simplify your Ethereum staking operations

- Somer Esat’s Ethereum staking guides — a series of primers explaining how to set up different Ethereum staking client combos

3. Rocket Pool minipool operator

- Difficulty: Beginner

- Cost: 💰💰

Rocket Pool is a decentralized Ethereum staking protocol.

Notably, with a 0.01 ETH staking minimum, Rocket Pool lets anyone stake essentially any amount of ETH by trading whatever sum of ETH they want for rETH, the tokenized staking derivative of the project that provides passive income via staking rewards over time.

The protocol takes the ETH deposited from the aforementioned rETH staking process and bunches them into lots of 16 ETH.

These are Rocket Pool node operators, who run what are called minipools.

“The minipool handles 16 of your ETH, 16 ETH from the rETH staking pool, and merges them together so that it can send 32 ETH to the Beacon Chain deposit contract to create a new validator,” as Rocket Pool has explained.

As such, this minipool system has big advantages. It lets you stake with as little as 17.6 ETH (16 ETH + 1.6 ETH worth of Rocket Pool’s $RPL token for insurance), and it lets you earn $RPL rewards on top of your ETH validator rewards, boosting your yields.

The minipool system is also powerful because its combination with the rETH staking pool process makes it so anyone can stake with as little as 0.01 ETH, improving Ethereum’s decentralization.

Moreover, if you have the means to solo stake at home, then you have everything you need to operate a minipool.

“Rocket Pool minipool operators are doing all of the same things that solo stakers are doing,” as Superphiz has noted. “But they can do this with less ether and potentially higher rewards.”

Accordingly, if running a minipool sounds like the way you’d want to go, be sure to check out these great resources to get started:

Join the cause!

Running your own Ethereum validator is the most impactful thing you can do in the Ethereum community.

It helps secure the Ethereum network itself, ensuring the blockchain’s constant operations for users around the globe. Additionally, if you use minority clients in the process, you can make Ethereum that much more resilient.

And for your services and efforts, you can make nearly 5% APR denominated in ETH staking rewards as things currently stand.

We’re rebels with a cause… and on-chain paychecks!

Action steps

- 💥 Become an Ethereum PoS validator via plug-and-play nodes, DIY hardware, or Rocket Pool minipools

- 👀 Also check out our previous How to win the Ethereum PoW fork tactic if you missed it!