How to Win the Ethereum PoW Fork

Dear Bankless Nation,

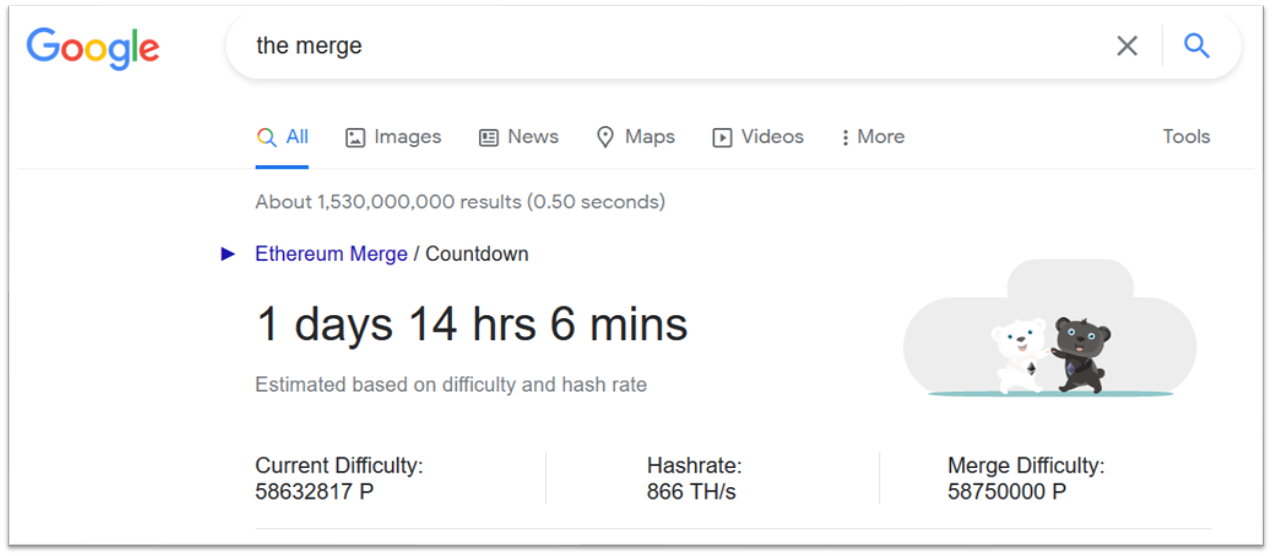

When that countdown hits zero, most of the Ethereum ecosystem will move on to the new Proof-of-Stake chain, except for a handful of disgruntled Ethereum miners who will be sitting on million dollars worth of mining rigs.

Rather than allowing their business to go to zero, these miners have announced their plans to fork the Merge and maintain a proof-of-work version of Ethereum (ETHPOW).

If that happens, you may own a copy of every single existing digital token on the ghost town replica version of the old Ethereum chain.

Some of these tokens might have value, most of them won’t.

If you’re thinking of dumping them for a quick profit, proceed with extreme caution!

There are many technical challenges that you’ll need to watch out for.

Today, William provides us with a handy checklist as to what to look out for.

Here’s how to win the Ethereum PoW fork, if there is one.

- Bankless team

During the Merge when the rest of the Ethereum community migrates to Proof-of-Stake (PoS), a group of miners plan to fork off and maintain a Proof-of-Work (PoW) alternative.

This fork, known as EthPoW, isn’t poised to have a serious future right now, but it should grant ETH holders new ETHPOW tokens on a 1:1 basis.

Interacting with ETHPOW can be extremely risky, so this Bankless tactic will give you a checklist you can use to navigate the fork safely.

- Goal: Sell your EthPOW for ETH if possible

- Skill: Intermediate

- Effort: 1 hour

- ROI: Potentially growing your ETH stack

ETHPOW Safety Checklist 🔀

✅ Understand the basics of the Merge

The tl;dr of the Merge is as follows:

- Ethereum is migrating from PoW to PoS consensus.

- PoW uses energy (in the form of computation) for security. PoS uses capital (in the form of crypto tokens) for security. The former is obviously very energy-intensive, while the latter is extremely energy efficient.

- The result is that Ethereum’s energy use will drop by ~99% upon shifting to PoS.

- This Merge to PoS has overwhelming community support, meaning a near total majority of Ethereum community members and projects are migrating to the updated Ethereum chain and won’t support any PoW forks.

✅ Understand the basics of the EthPoW fork

The tl;dr of EthPoW:

- Since July 2022, a group of miners such as Chandler Guo have accelerated plans to fork off a PoW version of Ethereum either during the Merge or shortly thereafter.

- Since essentially all Ethereum activity is moving to the PoS chain, this EthPoW fork doesn’t have a serious value proposition — it’s a money grab posing as a permissionless blockchain for the participating miners to maintain some semblance of dominance in a post-Merge world.

- When it launches, EthPoW will “airdrop” ETHPOW tokens to ETH holders on a 1:1 basis. Trying to sell these tokens can expose you to replay attacks, in which an attacker “replays” your EthPoW transaction on the real Ethereum chain and steals your funds accordingly. More on this attack vector directly below ⬇️

✅ Check the ChainID

The tl;dr of the EthPoW ChainID situation is as follows:

- ChainID was initially introduced in EIP-155 to mitigate replay attacks between the Ethereum and Ethereum Classic Chains; the former’s ChainID stayed at 1, while Ethereum Classic moved to 61.

- At the time of this post’s writing, EthPoW’s developers still have not updated their fork’s ChainID from 1 in their codebase — this means EthPoW is on the verge of launching with the same ChainID as Ethereum.

- If EthPoW proceeds with this dangerous dynamic, it will create ideal conditions for blackhats to conduct replay attacks.

🚨 DO NOT INTERACT WITH THE ETHPOW FORK UNDER ANY CIRCUMSTANCES IF THE NETWORK LAUNCHES WITH THE CHAINID OF 1. YOU COULD LOSE ALL OF YOUR ETH. 🚨

- In other words, the first major item on this checklist is checking whether EthPoW’s initial ChainID is 1 or the planned alternative of 10001. If the creators go with the former and not the latter, do not attempt to interact with the fork at any point.

- Additionally, some DeFi projects like Maker’s Dai stablecoin are hard-coded to use a ChainID of 1, meaning interacting with their EthPoW versions will open you up to replay attacks no matter what. Check projects’ recent comms on a case-by-case basis to see where they stand here.

✅ Determine if ETHPOW’s worth the trouble

- Let’s say EthPoW hypothetically launches with a ChainID of 10001, mitigating most replay attack concerns — even with that out of the way, will the value of ETHPOW warrant going through the time and effort to claim the tokens?

- That’s the big question for now! At the time of this post’s writing, ETHPOW IOUs were valued at $29.30 per token.

- Also, the difference between the spot price of ETH right now ($1,726) and the current price of ETH Sept. 30th futures ($1,710) suggests an implied ETHPOW price of ~$16 pre-launch.

- Claiming tokens that are worth $16-$30 each won’t be financially worthwhile for many ETH holders, though there is the possibility that price discovery pushes the ETHPOW price higher than this range upon its arrival on exchanges. On the flip side, ETHPOW may see its price quickly crater as many people sell the token en masse.

✅ Prep your ETH stack

- If EthPoW actually starts with a ChainID of 10001 and ETHPOW tokens start out with some decent price action, it may be worth your time to sell your ETHPOW for real ETH, USD, etc.

- To potentially prepare for selling ETHPOW, you’ll have the best assurances by holding your ETH in a non-custodial wallet that you totally control before the EthPoW fork. If you have ETH in an exchange wallet, that exchange may keep your ETHPOW airdrop for itself.

- Additionally, make sure pre-fork that you’re holding your ETH on Ethereum and not on an L2, e.g. Arbitrum. Only ETH on Ethereum will be credited with ETHPOW tokens on EthPow.

- Also unwrap your Wrapped ETH (WETH) to ETH pre-fork so you don’t have to bother with trying to unwrap your WETH on the EthPoW side of things once/if it goes live.

- Also withdraw your ETH from DeFi liquidity pools because you won’t be credited with ETHPOW for any ETH you have sitting in liquidity pools at the time of the fork.

- Consider borrowing ETH using a DeFi lending protocol to maximize your ETH holdings pre-fork; however, note that some lending protocols like Aave have already paused ETH borrowing amid a surge in borrowing activity.

✅ Pick your exchange

- Some exchanges, like BitMEX, have already announced plans to support ETHPOW trading.

- That said, it may take some exchanges days, weeks, or months to support ETHPOW deposits and/or account credits — make sure you land on an exchange that has clearly detailed its support plans so you know exactly what you can do and when you can do it.

Worried? Do Nothing

Right now, there are a lot of “ifs” that go into considering whether or not you should try to sell ETHPOW.

The critical thing to remember is that not playing is a viable strategy here.

If you can’t make it through the checklist outlined above with confidence, “winning the EthPoW fork” may simply mean abstaining and observing the chaos from the sidelines.

The biggest question outstanding is whether or not this unremarkable fork rolls out with a ChainID of 1 or 10001. If 1, then DO NOT INTERACT WITH THE FORK because the risks of replay attacks against your real ETH far outweigh what you could gain from selling.

The best case scenario?

EthPoW starts with the 10001 ChainID and you’re able to deposit ETHPOW to a supporting exchange and then cash out a decent sum to USD, or buy more ETH, or whatever’s right for you.

However, at this point it seems unlikely the EthPoW launch will go smoothly.

Action steps

- ☑️ Run through the ETHPOW safety checklist described above before making a decision on how to approach EthPoW

- 🕵 Also check out our previous How to use DeFi privately tactic if you missed it!