Guide to Sustainable Yield Farming

Dear Bankless Nation,

When we think of yield farming, we think of locking our tokens in a liquidity pool and earning yield in the form of token emissions.

But we know this model isn’t sustainable for tokens. It produces an inflationary effect on the token supply, introduces market volatility, and invites liquidity mercenaries who sell sell sell.

Today, we talk about you: the Retail investor.

How do you generate the highest yield in all market conditions?

You’ll have to get more creative these days in order to achieve double-digit APYs.

Ben goes deep, providing three possible trading strategies to maximize yield without relying on token emissions.

- The Basis Trade

- Delta-Neutral Staking

- Options Vaults

The best part?

These strategies are sustainable, meaning they work in bull and bear conditions.

Let’s check this out. 🚀

- RSA

One defining characteristic of the 2020-2021 crypto bull-run was the ability to earn incredibly high yields in DeFi. The safest of stablecoin farms would earn upwards of 40-50%, while many pool-2 farms would net farmers three or even four-digit APRs. These yields felt almost too good to be true – A user could just click a few buttons, sit back, and outperform every major TradFi hedge fund in the world.

This is due in large part to the composition of these yields, as many were fueled in large part by native token emissions from liquidity mining programs. Liquidity mining works well in bull markets when exuberant buy pressure could offset sell pressure from farmers harvesting their inflation-based rewards.

While lucrative at the time, those high yields have proven to not be sustainable over extended periods of time, drastically compressing as market conditions have weakened.

The gig is now up. Without buy pressure from a rising market, inflation-based yields - in conjunction with the prices of the tokens composing said yields - are destined to go down only.

However, for savvy farmers, there are ways to generate yield using alternative strategies that are not entirely based on token emissions. Although these strategies are more complex and can require far more active management than set it and forget it traditional farming strategies (TradFarm, if you will) they enable farmers to generate yield in a more sustainable way using strategies that can work regardless of market conditions.

Furthermore, these strategies are often ideally suited for a bear market unlike common TradFarm strategies, like LPing on an AMM. They often do not require a user to take on inventory risk, i.e. price exposure to the assets they are farming with.

Let’s go walk through some of these strategies and see what opportunities are out there.

✋ Note: Trading Perpetuals and derivatives in the US is heavily regulated. For example, there is a ban on many perpetuals products in the US. Your best bet here would be to look for regulated exchanges that offer perpetuals, like crypto.com

1. Basis Trade

Strategy Overview

One yield generation strategy not based on token emissions is the “basis trade.” Commonly employed by market makers and hedge funds, the strategy centers around capturing funding payments from perpetual futures (perps) contracts.

As experienced crypto traders likely know, perpetuals, or “perps” are a type of derivatives contract that constantly rolls over, meaning unlike traditional futures there is no expiration date. With perps, traders pay a “funding rate,” which are hourly interest payments paid to incentivize traders to keep the price of the derivative in-line with that of the underlying spot asset. When the price of the perp exceeds that of spot, i.e. the funding rate is positive, longs are paying shorts, and vice versa for when the price of the perp is less than that of spot.

An important factor to note when employing a basis-trade strategy is that a market participant is aiming to collect the yield from funding payments without taking on price exposure to the asset itself. To hedge out this price risk, a market participant can go “delta-neutral.” When one is delta-neutral, it means they have no exposure to price movements because they have an equal and offsetting long and short position of a given asset. Applying this to the basis trade, a farmer can go delta-neutral by going long or short the perp, depending on if the funding rate is positive or negative, and taking the opposite side of the trade by going long or short an equal amount of the spot of the asset.

📈 To read more about the historical performance of basis trade strategies and funding rates, click here.

The funding rate strategy is an effective and more sustainable alternative to traditional, emission-based yield farming strategies because it’s based entirely on the price action of the market, not the total supply of tokens.

While returns will not be as high when the market is quiet or conditions are choppy, the strategy can be highly lucrative during extreme bull or bear conditions, as yield from funding payments are based on the demand for leverage in the market, meaning they are necessarily not dependent on a given token increasing in price.

How to Set-Up The Strategy

While it may seem intimidating at first, setting up a basis-trade is relatively straightforward. However, it should be noted that this strategy requires a position to be far more actively managed and monitored than a typical farm.

- Deposit collateral into a perpetuals exchange.

- Open a perp position in which you collect funding (long if funding is negative, short if funding is positive).

- Open an opposite long or short spot position to hedge.

🤔 Learn more about setting up perpetual positions with BanklessDAO’s guide on Perpetual Protocol.

Strategy Specific Risks

- Liquidation Risk – A user must make sure they keep a requisite amount of margin to avoid liquidation

- Interest Rate Risk – Funding rates can be volatile, and must consistently be monitored to make sure they do not move against you (i.e. you are initially long a perp with a negative funding rate, which suddenly turns positive)

Current Opportunities

(Note - These yields are highly volatile and vary by asset)

- dYdX (StarkEx): 10-30% vAPR

- Perpetual Protocol (Optimism): 15-30% vAPR

- Mango Markets (Solana): 5-20% vAPR

- Drift Protocol (Solana): 20-60% vAPR

2. Delta-Neutral Staking

Strategy Overview

A second yield generation strategy not entirely based on token emissions is that of “delta-neutral staking.” This strategy is similar to the basis trade, as delta-neutral staking centers around isolating the yield from a given single-sided staking pool without taking on price exposure to the underlying asset being staked.

Like the basis trade, to go delta-neutral, a user will purchase and stake the spot of the asset, and then use either a perpetuals exchange or a money market, to short an equal amount of the same asset.

However, where this strategy can differ from the basis trade is that it sometimes may not be able to be performed entirely on-chain. Depending on the opportunity, delta-neutral staking can be a “CeDeFi” strategy, as a user can sometimes use a centralized exchange, such as FTX in-order to hedge if the staked asset cannot be shorted on-chain.

Let’s use LooksRare, the NFT marketplace, and the LOOKS token as an example to see how this works, and why this strategy can be somewhat more sustainable than traditional yield farming.

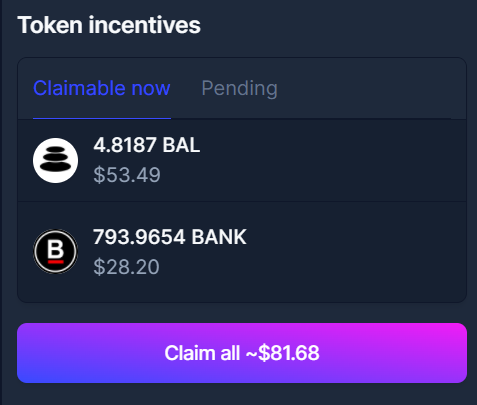

As we know, LOOKS holders that stake their tokens earn a yield that is composed of trading fees from the platform paid out in ETH, along with LOOKS emissions. Together, this combines for a current vAPR (variable APR) of 253%. That is a considerable yield – However, to capture it, one must buy the LOOKS token.

A savvy farmer can hedge out the price risk of holding LOOKS by shorting the asset’s perp on FTX. While they will incur a cost for doing so, as funding rates are deeply negative at roughly -127% annualized, this still means that were a staker to go delta-neutral, they would be earning net 126% vAPR while NOT having exposure to the LOOKS token, which is down more than 75% over the past two weeks.

Although this yield is partially fueled by token emissions, it demonstrates that this strategy can allow users to capture the inflation and/or platform fees from any such similar staking pool without needing to have exposure to the price fluctuations of the underlying token.

How to Set Up The Strategy

- Purchase the spot asset on a DEX and stake it.

- Short the perp of the asset on a DEX or CEX, or spot on a money market.

Strategy Specific Risks

- Liquidation Risk – A user will be at risk of liquidation when they open their short spot or perp position to hedge.

- Interest Rate Risk – Staking yields and funding rates can be volatile. It’s possible that a user can earn a net-negative yield if the staking yield compresses and/or funding rates rise.

Current Opportunities

- LOOKS (LooksRare on Ethereum & FTX): 126% vAPR

- CRV (Convex on Ethereum, Aave on Polygon): 39% vAPR

- RAY (Mango Markets and Tulip Protocol on Solana): 31% vAPR

3. Options Vaults

Strategy Overview

A third sustainable yield generation strategy not entirely based on token emissions involves utilizing options vaults.

While there has been debate as to whether this strategy qualifies as earning yield, options vaults enable users to earn income in a way that is not dependent on token emissions.

This is done through the automated selling of out-of-the-money (OTM) options to market makers, typically via strategies such as covered calls or cash-secured puts. In doing so, these vaults collect premium, which they pay back to their users by compounding it back into the vault.

These vaults can provide a valuable service to users because they abstract away a considerable amount of the complexity that comes with dealing with options. For instance, options vaults will handle the risk management of a position by algorithmically selecting the strike price, the price at which an option can be exercised, on behalf of a user.

Although convenient for users, this strike price selection is the greatest source of risk for option vault depositors. For example, in the case of covered calls, if the option sold by the vault was exercised, meaning that the selected strike price is greater than or equal to the price of the underlying asset at the time of expiry, users would underperform purely holding said asset as they would be selling their upside.

How to Set Up The Strategy

- Deposit assets into the options vault.

- That’s it!

Strategy Specific Risks

- Strike-Price Risk - As discussed above, depositors run the risk of selling the upside that would come from holding their asset if the strike price selected by the vault is exercised, i.e. if the out of the money options go in the money.

- Illiquidity Risk - User deposits in options vaults are locked for a period of time, typically ranging from one week to one month depending on the platform and asset.

Current Opportunities

- Ribbon Finance (ETH, AVAX, wBTC, SOL on Ethereum, Avalanche, and Solana) - 15-30% APY

- Dopex (ETH, AVAX, wBTC on Ethereum and Avalanche) – 7-12% APY

- Katana (ETH, wBTC, SOL, USDC on Solana) - 20-45% APY

- Friktion (ETH, wBTC, SOL, USDC on Solana ) - 20-45% APY

Conclusion

Although traditional yield farming (TradFarm) strategies fueled by token emissions proved to be highly lucrative during a bull market, they are poorly suited for when the market turns bearish.

However, there are alternative yield generation strategies available for users that are not entirely based on token emissions. Although they come with a new set of risks, and often require more active management, they enable a farmer to earn a more sustainable source of yield regardless of market conditions.

High yields in DeFi are alive and well - You just have to know how to find them.

Action steps

- 🔎 Explore some perpetual and options protocols

- 📑 Read Ben’s previous piece on WTF are veTokens