A Guide to Fixed Income on Element

Dear Bankless Nation,

Fixed income is a $100+ trillion market in traditional finance.

These are assets that payout fixed dividends over some specific period of time (known as a maturity date). Once the maturity date is reached, investors are repaid the principal amount they invested. Generally speaking, fixed income provides investors with a predictable, reliable yield on their capital.

Government bonds are the most popular examples of these products, but other assets like mortgage-backed securities fall into this category as well.

If you can imagine, fixed income (also referred to as “fixed yield” in this article) is a massive market and serves as one of the backbones of our existing financial system.

But in DeFi these markets don’t exist…yet.

There’s a handful of early players that have emerged, but none of taken off to the same degree as other lending protocols like Aave and Compound.

Element Finance is one of these protocols looking to tackle fixed income. They only launched last month but have already seen a fair amount of success, offering a unique way for DeFi users to earn a reliable income on their crypto dollars.

Fixed yield is coming to DeFi.

Here’s how to use it.

- Lucas

A Guide to Fixed Income on Element

DeFi is now home to high fixed rates. Element Finance is a new, open-source protocol for fixed and variable yield markets. The protocol shipped to Ethereum mainnet on June 30th. Since then, the core team has been busy onboarding new assets including USDC, DAI, LUSD, and ETH along with plenty more to come.

To give you an idea of the yields available, here are the average fixed rates available over the last week:

- USDC: 6.83%

- DAI: 4.5%

- crvSTETH: 7.3%

- crvTriCrypto: 20.28%

- crvLUSD: 11.36%, 12.43%

These are substantially higher than what is offered on major lending protocols like Aave and Compound while staying competitive with yield aggregators such as Yearn. The difference? Yields from DeFi are highly variable, whereas Element offers fixed rates. Once you jump in, you’ve secured that rate until maturity!

Fixed-rate DeFi is earning on autopilot. If you can buy an asset and hold it, you can earn a fixed yield on it.

The process is as follows:

- Buying a crypto asset at a discount with principal tokens

- Holding it until maturity

- Redeeming the principal token for the crypto asset (1:1)

- Realizing your fixed APR 🎉

While this might seem a bit confusing on the surface for those new to fixed income, this guide will teach you how to start earning high fixed rates for yourself in just a few minutes.

🧠 Insight: Element has gained over 1,200 unique addresses since the Ethereum Mainnet launch!

Fixed Yield for Everyone

Let's rewind to 2017, when holding crypto was not for the faint of heart. Before stablecoins, most people could only afford to expose a fraction of their money to crypto's volatility.

Even if they believed in crypto, it was too risky for most to go bankless. Crypto's appeal was largely limited to a narrow band of people who were early adopters and willing to take on high risks. But as stablecoins matured in the market and grew in liquidity, holding more crypto became a viable option for people.

Today, DeFi's yield markets feel like crypto in 2017. It's a game that rewards the same narrow band of risk-tolerant traders with yields that rapidly rise and fall without warning.

That’s where fixed yield comes in, or more traditionally known as fixed income. Fixed yield is earned in fixed amounts on a fixed schedule. You know exactly how much you'll earn before you invest. When you lock in your rate, it won't change no matter what else is going on in the markets.

This type of fixed earning allows consumers and institutions alike to plan their spending and steadily grow their savings over long periods. To give you an idea, the fixed income market is worth well over $100 trillion.

And for a long time, DeFi had nothing to offer this market.

That’s starting to change.

🧠 Insight: Element has reached over $56M in TVL. Check out the stats page for real-time updates.

How Element Works

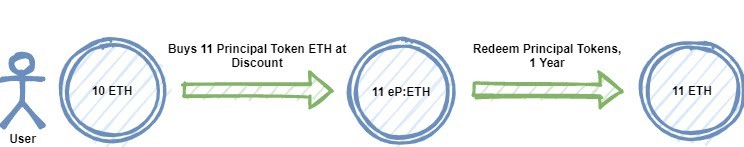

To get access to fixed rates on Element, you simply purchase Principal Tokens. The fixed rate is earned because Principal Tokens are redeemable 1:1 for their base asset deposit amount at the end of the maturity term.

As such, the fixed rate comes from users exiting their Principal Token (fixed rate) position before their term has matured. The willing buyer of that position will purchase the principal token at a discount due to the opportunity cost of waiting out the remainder of the term's duration.

Users who purchase principal tokens determine their fixed rate based on the discounted rate of the asset at the purchase time. Buyers of principal tokens that have yet to reach maturity will be trading at a discount to its underlying represented asset. The further away from maturity the principal token is, the higher the discount.

For example, if David uses 10 ETH to purchase discounted ETH at a 10% APR for a one-year term, he will get 11 Principal Tokens. Once the fixed term ends, he can take his 11 Principal Tokens and redeem them for 11 ETH.

Without effort, he has secured an additional 1 ETH.

Sound interesting?

Good. Here’s how to get in on it.

How to Start Earning Fixed Yield with Element

The first step to getting fixed rates with Element is to get your crypto asset of choice ready in your wallet.

Available assets to date on Element:

- DAI

- USDC

- ETH/stETH

- WBTC

- USDT

- LUSD

Step by Step Guide

Now let’s walk through the next steps together on the Element app.

- First, head over to save.element.fi and connect your wallet to the app. The Save UI contains only the essential components to buy, sell, and redeem fixed-rate positions.

- Select your preferred asset from the dropdown menu.

- Input your desired amount and select your term and APR. You can see how much yield you will earn at maturity based on the term's APR.

💭 Reminder: Before purchasing your principal tokens to get your fixed APR, you will need to grant approval to Balancer to spend your USDC in order to perform this transaction. This is because Element uses Balancer Pools for trading!

- Click 'Buy' and confirm your transaction to purchase your principal token.

- You have now successfully secured your first fixed-rate position on Element. To view your position details, click 'View Balances' and you'll see your newly purchased fixed rate position!

- And that's it! Now all you have to do is wait until the term has reached its maturity date and you will be able to redeem your purchased principal tokens for your base asset 1:1 to get your fixed APR.

🧠 Insight: On the 'View Balances' page, you can add the term redemption date to your Google Calendar to remind you to redeem your fixed APR when it matures.

DeFi's Fixed Rate Protocol Is Here

Element has been live for just over a month, and the growth has been incredible. Some of the highlights:

- $56M total value locked

- $46M in total liquidity

- $13M in trading volume

There’s more to what Element has to offer

This post was aimed at highlighting the simplicity of getting access to high fixed rate yields on your favorite crypto assets, but Element has much more to offer.

If you're interested in exploring how Element unlocks further paths of revenue, leverage, and capital efficiency, check out the Advanced UI, where you can get the full DeFi experience with both fixed and variable rates. This is reserved for the hardcore crypto natives on the frontier looking to maximize yield—it ain’t easy!

On the Horizon

Element is continuously onboarding new assets to the protocol, improving the platform, and adding integrations with other DeFi protocols.

In terms of the next big milestone, Element is currently focused on delivering its new governance primitives to the space, recently introducing its vision for governance.

Bonus: Tracking Element Finance

Element has been working on integrations to put the necessary infrastructure in place for the best user experience. This includes:

- Zapper functionality for viewing Element positions

- Dune Analytics dashboard for live data on the Element Protocol

- Loan Scan for viewing and comparing offered rates within the DeFi ecosystem!

Action Steps

- 👀 Explore what the Element platform has to offer

- 🤔 Curious to know more about where the fixed rates come from? Click here