5 Under the Radar Projects on Arbitrum

Dear Bankless Nation,

Arbitrum season is heating up.

This is on the back of Arbitrum Nitro, a hotly anticipated network upgrade increasing throughput and lowering gas costs for users, which finally shipped last week.

While it’s only been less than a week since launch, Nitro is already paying dividends.

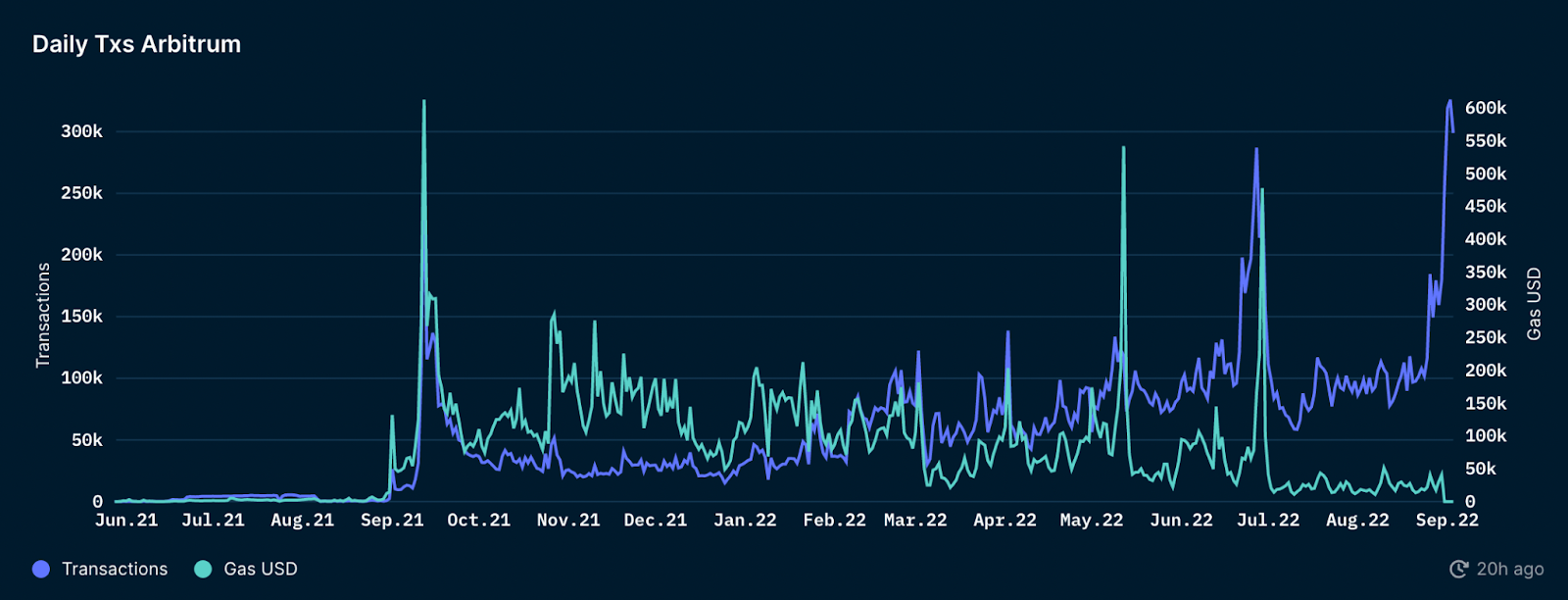

Albeit in a very small sample size, the total number of transactions on Arbitrum has increased +79.2% in the five days post-upgrade relative to the five days prior, while the total gas consumed by the rollup has fallen -47.8% during this period.

In other words — Arbitrum, and therefore Ethereum, is scaling.

This growth in transaction capacity, along with the upcoming resumption of Arbitrum Odyssey (and potential token launch) is likely to fuel further growth in the rollup’s DeFi ecosystem which has already managed to attract nearly $1B in value locked, the 7th most of any L1 or L2, without any network-wide incentives.

We covered many of the larger protocols that have bootstrapped organic usage last week in our piece on “How To Gain Exposure to Arbitrum,” but there are a plethora of other exciting (and smaller!) Arbitrum based projects that have turned the L2 into a hub of innovation.

Here are the one’s I have my eye on.

1. Vesta Finance

Vesta is a lending protocol. Forked from Liquity, Vesta allows users to collateralize a variety of decentralized assets, including popular Arbitrum-based tokens such as GMX and DPX, to mint a stablecoin at 0% interest.

The protocol currently has over $22.6M in deposits, while VST has a circulating supply of $7.4M!

The project is governed by the VSTA token, which has a MC of $5.8M and FDV of $77.9M.

2. Umami Finance

Umami is “The Yearn of Arbitrum,” and developing vaults that will source non-emissions based yield from Arbitrum-based DeFi protocols such as from GMX’s GLP. While Umami recently deprecated their V1 vault which gave depositors delta-neutral exposure to GLP, the DAO is still planning to ship V2 later in Q4 2022.

Umami helped popularize the trend of paying token holders a cut of product and treasury farming revenue in ETH, with UMAMI lockers currently able to earn a yield of 9%.

The token currently trades at a MC of $13.4M and an FDV of $21.2M.

3. Premia

Premia is an options protocol.

Premia utilizes an AMM, where users can buy puts or calls while liquidity providers can earn premium from underwriting these options. Premia is unique in that unlike prominent options protocols such as Dopex and Lyra, it uses American Options, or options that can be exercised anytime before their expiration date.

The protocol has attracted $7.0M in TVL and is governed by the PREMIA token, which currently trades at a MC of $14.2M and FDV of $134.2M.

4. Y2K Finance

Y2K is a protocol for pricing risk in pegged-assets.

The project is developing a suite of products where users can speculate on whether or not an asset will de-peg, or hedge their exposure to one doing so. Y2K is also developing a lending market for pegged assets as well as an RFQ orderbook where users can easily trade between different vault tokens on the platform.

Although a specific date has yet to be confirmed, Y2K is likely to launch sometime within the next few weeks. There is currently no Y2K token, though tokenholders will eventually be able to earn a cut of protocol revenues and vote on emissions to different vaults.

5. Rage Trade

Rage Trade is a perpetuals exchange.

The exchange is aiming to build the most liquid ETH perp through 80-20 vaults, or vaults that seek to boost returns for LP’s by routing 80% of deposits into external protocols to earn yield while utilizing the remaining 20% as liquidity for traders. Rage Trade is also planning to integrate with Layer 0 to allow 80/20 vaults to source yield from any L1 or L2.

Rage Trade’s 80/20 Tri-Crypto Vault is currently live on testnet, with the protocol is planning to launch their mainnet vaults on September 7.

The Arbitrum Space Odyssey

As we can see, there are numerous exciting, innovative projects building on Arbitrum across a variety of sectors, and (as premium subscribers will see in this week’s Trending Project) many others that we did not touch on.

With Nitro in the books and Odyssey around the corner, the L2 is poised to grow significantly in the coming months while serving as a prime example that Ethereum can and is scaling through L2s.

Get ready and start your engines.

The race to scale Ethereum is here.