How to Gain Exposure to Arbitrum

Dear Bankless nation,

It’s Arbitrum Nitro launch day!

Nitro is Arbitrum’s largest network upgrade yet, promising lower fees and higher transaction throughput.

For all the details, tap into the livestream today on the Bankless podcast.

Tl;dr - This is mega bullish.

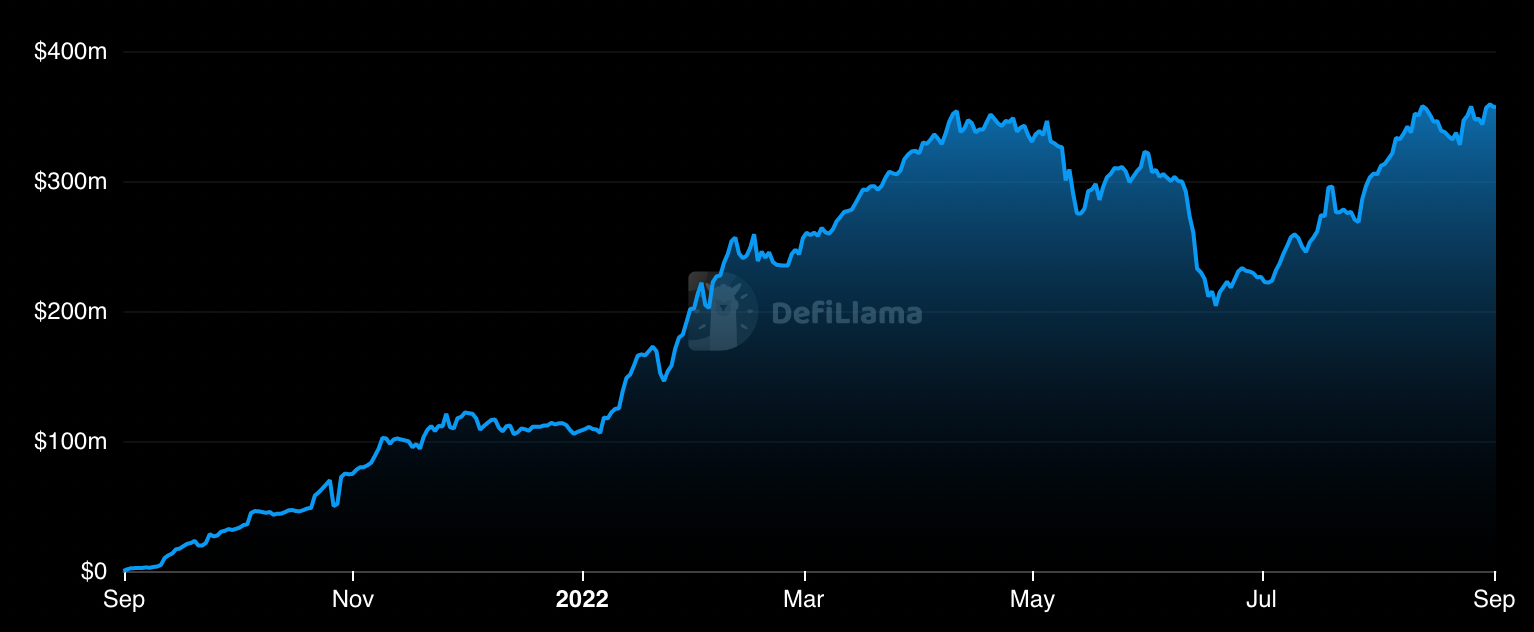

Arbitrum reigns supreme as Ethereum’s largest layer 2 ecosystem to date.

Further, its rate of growth shows no signs of slowing down. Liquidity is abundant, infrastructure is getting built out and daily active users are on the rise.

The Arbitrum universe is expansive, and opportunities abound for resident Arbinauts 👨🚀 who know where to look.

Ben gives us some expert tips to point us in the right directions today.

Strap in.

- Bankless team

Arbitrum season is coming.

After the successful completion of Nitro, a highly anticipated network upgrade that increased transaction throughput and lowered fees, Arbitrum is poised to experience further growth in liquidity, users, and activity.

There are several catalysts on the horizon that are poised to benefit from this increased transaction capacity and help fuel this trend. The first is Arbitrum Odyssey, an event designed to encourage the usage of applications on the L2. Odyssey should bring both users and attention back onto the network.

A second catalyst is the eventual launch of the Arbitrum token.

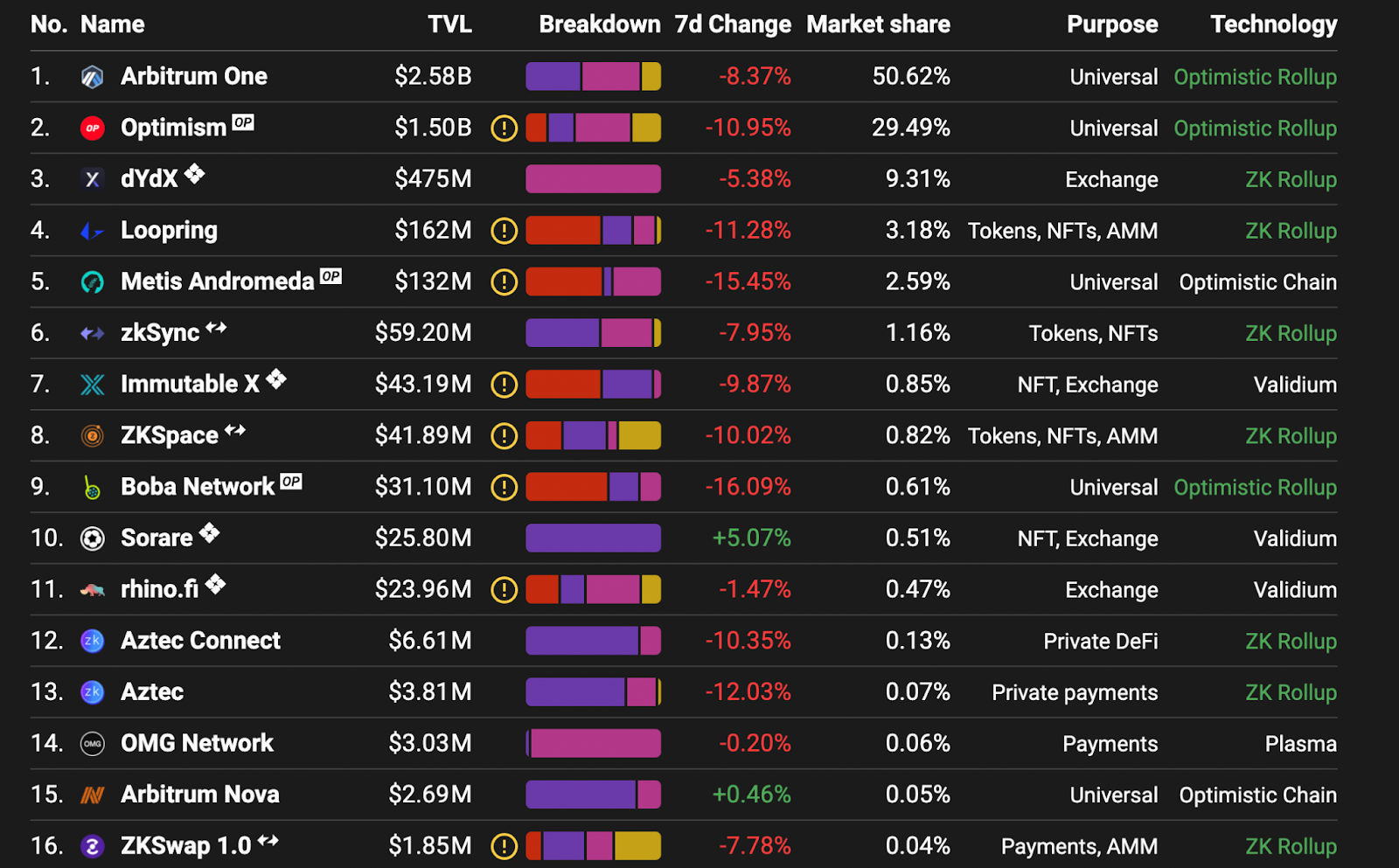

To date, the Arbitrum ecosystem has been bootstrapped organically. Despite having no network-wide incentives, Arbitrum is still the largest L2 by TVL at more than $2.58B. A token is poised to push that figure even higher, as it is likely to be used to incentivize liquidity and encourage the migration of even more popular, L1-based applications.

While these catalysts have caused the rollup to be the talk of the metaverse, adoption of the network is still in its early innings - Per Nansen, just 0.45% of Ethereum addresses have used Arbitrum.

So how does one get exposure to this ecosystem?

Here’s how.

1. Pure Plays: Arbitrum Native Projects

The most direct way to gain exposure to the Arbitrum ecosystem is by investing in projects that are native to the rollup.

These early adopters are poised to be prime beneficiaries of inflows into Arbitrum, as it is likely to fuel growth in TVL, revenues, users, and other core KPI’s.

There are numerous Arbitrum-based projects across a variety of sectors that investors can choose from to tailor-fit their portfolio composition and risk-profile.

Let’s touch on a few them below:

GMX (GMX)

GMX is a decentralized perpetuals exchange that uses a liquidity pool model, where traders can open positions by borrowing from a basket of assets known as GLP. GLP acts as the counterparty for traders on the platform, taking on their p&l risk while accruing fees, distributed in ETH, from the opening and closing of positions, swaps routed through GLP via DEX aggregators, and liquidations.

GMX is the largest protocol on Arbitrum by TVL at $282.7M, a 29.6% share of all value locked on the network, and has generated $10.36M in protocol revenue over the past six-months. This revenue is entirely paid in ETH to GMX stakers, with the token currently yielding 6.58%. GMX is emerging as a core Arbitrum primitive with projects such as Umami Finance, Dopex, Vesta, and others integrating or building on-top of the platform. GMX currently trades at a MC of $376M and FDV of $623M.

Dopex (DPX)

Dopex is an options protocol. Dopex offers a suite of different products including Single-Sided Option Vaults (SSOVs), where users can easily run covered call and cash secured put strategies, interest rate vaults, which allow users to speculate on the yields for different curve pools, and its newest product, straddles. Straddles is the first implementation of Atlantic Options (AOs), a unique new primitive in which options purchasers can, for a fee, borrow the collateral locked in an options contract.

Dopex currently has $29.15M in TVL across these offerings, while the DPX token can be locked to earn emissions as well as protocol fees paid out in ETH. There are several projects building on Dopex including Jones DAO, which creates options vaults that utilize Dopex’s infrastructure and Plutus, an L2 metagovernance protocol. DPX has a MC of $85M and FDV of $209M.

Mycelium (MYC)

Mycelium, formerly known as Tracer DAO, is building a suite of derivatives products on Arbitrum. This includes perpetual pools, a novel derivative that is most-similar to a leveraged ETF where users can hedge or take on outsized exposure to a given asset. Mycelium recently launched Perpetual Swaps, a fork of GMX where users can provide liquidity to traders via the MLP pool.

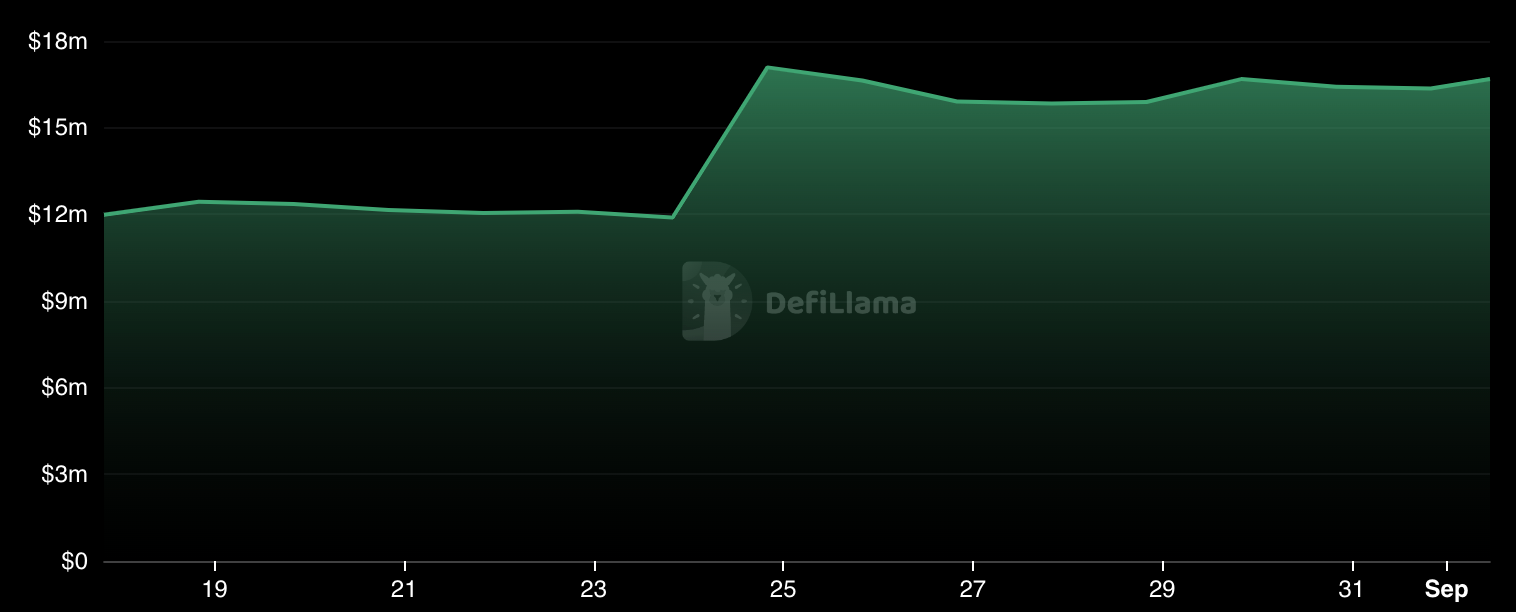

Mycelium has attracted $16.7M in TVL across its suite of products. The DAO also recently made waves by announcing Arthur Hayes, the former CEO of Bitmex, as an advisor. MYC currently has a market cap of $36M and an FDV of $60M.

Other Projects To Keep An Eye On

There are numerous other exciting projects building on Arbitrum that investors should keep an eye on including Umami Finance (UMAMI) a project building vaults that source non-emissions based yield, Vesta Finance (VSTA), a lending protocol and issuer of the VST stablecoin, Premia (PREMIA), an options protocol, and Galleon (DBL), a DAO building structured products.

While these tokens have smaller circulating market-caps and are less liquid than the three listed above, they should all still benefit from the expected growth of the ecosystem.

There are several other promising projects that have yet to go live on their Arbitrum launch. These include Rage Trade, an omni-chain perps protocol, STFX, a social trading platform, and Y2K, a protocol for hedging or speculating on asset pegs. These projects may do an airdrop for early adopters or community members - It is likely EV+ to start paying attention to them now.

2. Pick and Shovels: Cross-Chain Infrastructure

Another way in which investors can gain exposure to Arbitrum is by investing in “pick and shovels,” or the infrastructure projects that facilitate the adoption of the L2 ecosystem as a whole but are not beholden to any single rollup in particular.

The clearest pick and shovel play are bridges and messaging protocols. While the sector has been plagued with security issues over the past year, these systems remain critical pieces of infrastructure, as they allow users to quickly and easily move assets across networks, and critically, bypass the 7-day withdrawal period for optimistic rollups.

Although they may not benefit as directly from Arbitrum’s growth as the native projects built on top of it, they are still poised to reap the rewards from the expected liquidity inflows into the L2, as their revenue is based on fees taken as a percentage of transfers between networks.

Let’s touch on a few of these interoperability solutions with tokens, as well as potential targets for retroactive airdrop farmers.

Synapse (SYN), Hop (HOP), and Stargate (STG)

Synapse (SYN) is a cross-chain messaging protocol. The Synapse Bridge enables users to swap between canonical assets (assets natively issued on an L1 or L2) using an AMM. Synapse has facilitated $11.3B in bridging volume to date, and is planning to launch Synapse Chain, an optimistic rollup settling to Ethereum that leverages Snyapse’s cross-chain messaging capabilities. SYN has a MC of $233M and FDV of $311M.

Hop Protocol (HOP) is another tokenized cross-chain liquidity protocol. Hop is similar to Synapse in that it uses an AMM to facilitate swaps between canonical assets, and has facilitated $2.7B in bridging volume to date. HOP has a MC of $5M and FDV of $135M.

Stargate (STG) is a third cross-chain liquidity protocol that enables bridging to Arbitrum and has a native token. Stargate is built on Layer 0, and utilizes its omni-chain capabilities to enable users to transfer assets without needing to go through any bridge. The protocol currently has $631.2M in TVL, with STG trading at a MC of $84M and FDV of $635M.

3. Airdrop Farming

Another way in which investors can gain exposure to L2 infrastructure is through airdrop farming.

While Synapse, Hop, and Stargate all have tokens, there are numerous other projects which have yet to launch one that are likely to reward early users and community members with a token allocation if/when they do so.

A few candidates that stand out are cross-chain liquidity protocols Connext and Across as well as Li.Fi. a bridging aggregator.

Arbitrum Token Airdrop Farming

A final way in which investors can gain exposure to the Arbitrum ecosystem is through airdrop farming. As it does not require purchasing any tokens, airdrop farming is a great way for risk-averse investors to potentially share in the upside of the network.

While they have yet to officially confirm it, it is all but certain that Arbitrum will launch a token. Not only does a token provide upside to investors and team members, but when allocated properly, can serve as an incredible tool to incentivize desired behaviors and bootstrap an ecosystem. With other rollup providers such as Optimism, Polygon, ZK Sync, and Starkware all having or planning to launch tokens, Arbiturm would be at a competitive disadvantage were they not to launch one of their own.

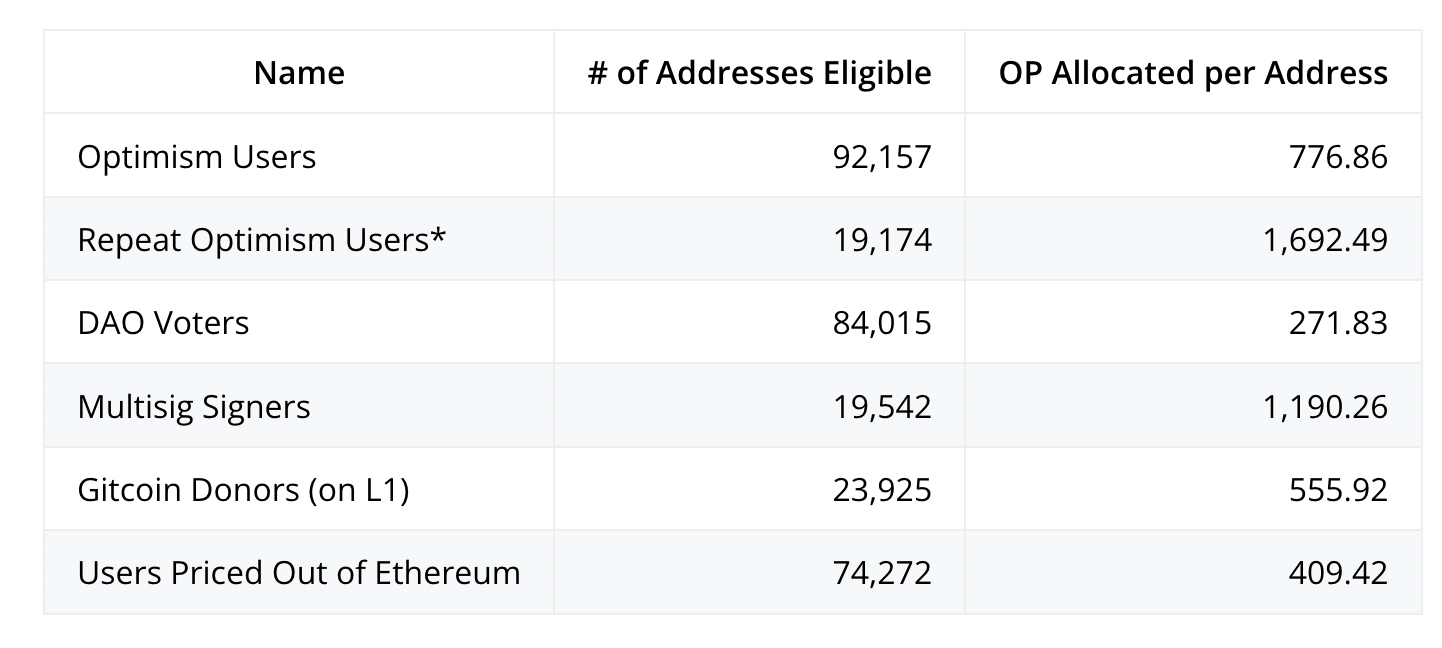

Assuming a token is inevitable it is highly likely that an Arbitrum token will be airdropped to early users (Optimism and Starkware have allocated 19% and 9% respectively to early users) So it should (literally) pay to be positioned accordingly.

To maximize airdrop surface area, there are two approaches a farmer should take. One is to bridge and transact on the network.

For more specific guidance, it could be a good idea to follow the criteria laid out for the Optimism (OP) airdrop in order to cover as many bases as possible.

For those willing to be more active, the second approach would be to participate in Arbitrum Odyssey. Odyssey is an eight-week event that is intended to encourage users to interact with protocols deployed on Arbitrum by rewarding them with custom NFTs (for more, see William Peaster’s Metaversal guide).

While Odyssey began in June, it was postponed during just its second week due to network congestion from increased activity due to users participating in the event. The Offchain Labs team has stated that the event will resume after the completion of Nitro - Pay attention to Arbitrum socials and their Discord!

Although it is unclear how Odyssey will factor into the airdrop criteria, it is highly likely that participating in the event will increase the size of a users allocation. Considering the low cost of transacting on the network and minimal effort required to earn the NFTs, it seems very EV+ to take the time to do so.

Arbitrum Szn Is Coming

Arbiturm is poised to experience significant growth over the coming weeks and months.

Between native DeFi projects, pick-and shovel exposure through the cross-chain infrastructure and retroactively farming their native token, there are numerous ways in which an investor can gain exposure to the Arbiturm ecosystem.

What will you choose?