5 Contrarian Takes with DegenSpartan

How cool would it be to have Bankless in video format? That’s where I want to go next. But I need your help! If you want the Bankless program in video give 1 DAI & let’s make it happen!

Dear Bankless Nation,

You may not like them but these are the opinions of DegenSpartan.

You don’t know Degen? This is him.

I say him but I have no idea who he, she, or they actually is. DegenSpartan is a pseudonymous account in the time honored-tradition of crypto.

Always witty, sometimes trollish, often controversial—but also worth listening to. There’s a clever mind behind the account with some serious crypto wisdom, particularly in DeFi.

That’s why I asked him to hit us with some contrarian takes.

Here they are.

Unfiltered. Unedited. Unabridged.

5 contrarian takes with the spartan of crypto!

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Guest Post: DegenSpartan is a Crypto Twitter shitposter and meme maker.

5 Contrarian Takes on DeFi with DegenSpartan

RSA note—I asked Degen to tell me his contrarian takes on crypto. He sent 5. Here they are. Unabridged. Unedited. After each take, I asked a question. I’ve included his answers too. Images mine.

#1 Mass adoption is unlikely to happen the way cypherpunks imagine

(Above) Sorry crypto anarchists this is not the future

If your imagination of a crypto future is people running their own nodes, using non-custodial wallets and making day-to-day transactions in BTC, ETH, or payment tokens, I have bad news for you.

Mass adoption will not come about with people learning about cryptography, private-public key pairs and management, and the technical peculiarities of using each blockchain.

Sats/byte? UTXOs? Change address? Gas Price? Gas limits? Token approvals? Nonces? What the hell are all of these?

I think it is very unlikely that we can onboard a significant amount of the world’s population into cryptocurrency converts based on the current state of things.

I find it most likely that most coins will end up being held by custodians. Possibly national, but definitely corporate for-profit custodians will exist.

Some have referred to this as “custodial banking”, but I’ll choose to be vaguer because I think exchanges and payment networks will become significant custodians as well.

Within these custodial networks, transactions will be fast and cheap, or even free. Private keys will be completely abstracted away and managed by the custodian. In fact, it is likely that within the network, the custodian will have the power to reverse transactions arising from disputes or even outright alter balances and freeze funds.

After all, it is their own network and walled garden. And the kicker is that the bulk of value transferred within and across all these custodial networks will be the digitized fiat currencies, not in BTC, ETH, or even silly payment tokens.

The silver lining is that I believe such custodial networks would still be connected to the public blockchains, meaning that users can opt-in to join these custodial networks to benefit from their network efforts but must agree to abide by their T&Cs. I view this as the most likely default outcome based on the current path the ecosystem seems to be heading towards.

RSA followup: Yeah, but can’t DeFi reverse the trend of custodial mega banks?

I do not think that DeFi can reverse the trend of custodial networks, but it will likely offer a very viable alternative for the group of people who value and choose to retain full custody and control over their assets and wish to remain outside of those systems. Everything is a trade-off and mega custodial networks likely have more flexibility to skew the benefits to themselves while also still keeping the optionality of tapping into the best that DeFi can offer. A case example is the entrance of Nexo Finance into the Maker ecosystem by opening a Vault using WBTC to earn the yield spread between the stability fee and the interest that they charge to their borrowers.

#2 Decentralized tokenization models of cross-chain crypto assets will not succeed

(Above) Almost all tokenized BTC is custodial

Projects in the tokenization niche (issuers) of DeFi whose business model comes from fees such as to burn, mint and/or maintain collateral to back the generated tokenized proxies are competing in a very tough environment. The obvious examples that come to mind are renBTC and tBTC.

It is a pincer attack on 2 fronts of supply and demand.

Centralized issuers like Tether, Paxos, and Trust already have the infrastructure to join Bitgo and issue a tokenized proxy without all the on-chain collateral complications. Tether has XAUT, Paxos has BUSD, and Trust has their whole line up of non-USD fiatcoins.

While decentralized issuers have to lock up the collateral on-chain for auditing to guarantee the value backing the issued tokens, custodial issuers are not obliged to do the same. They could lend out the collateral to generate income for themselves and could even subsidize tokenization and issuing if they wanted to. I am not saying that they do this now, but if they did, would you know?

This brings us to the other front that decentralized issuers would be struggling with, which is the demand side. Centralized lending and borrowing platforms will compete for assets. Companies like BlockFi, Celsius, and Hodlnaut are PAYING you to keep your assets with them. It is very unlikely that DeFi lending rates can sustainably be in excess over the centralized platforms, so tokenizing BTC to use on Ethereum’s DeFi makes little financial sense. Look no further than USD lending rates to see the disparity between on-chain and off-chain rates.

Someone looking to tokenize collateral like BTC will be paying in the opportunity cost of forfeited yield while paying all the project-specific tokenization fees. I highly doubt that people are willing to pay that much of a premium to avoid KYC and custodial risks, while still having exposure to smart contract risks which they would either have to hedge (additional cost) or bear.

Will the extended utility of tokenized BTCs to be used in DeFi be enough to overcome those drawbacks? It remains to be seen, but I would not hold my breath for it.

RSA followup: Are you bullish on custodied BTC options like wBTC then?

I am bullish on the growth of custodied BTC and I wouldn’t be surprised to see more issuers join in the fray soon. WBTC has a strong head start and is starting to look like the USDT of the tokenized BTC space and many in the DeFi community seem to be perfectly fine with WBTC.

#3. Custodial tokenization models of real-world assets will definitely succeed

(Above) Tokens in the left two quadrants will be very successful

The cruel irony of that above possibility playing out is that on the flipside, custodial real-world asset issuers are definitely going to succeed.

Not too long ago, this was considered as a sick joke or outright heresy - to have a trusted project running on a decentralized network. “It would defeat the whole purpose of a blockchain!”. Projects like DigixDAO (tokenizes the rights to redeem gold) in the past and even DMMDAO (tokenizes the rights to income from off-chain vehicle liens) recently has come under fire for such a blasphemous idea.

It is impossible to have assurances from outside of the blockchain!

However, the permissionless nature of crypto does allow for permissioned projects to run on it, but not vice versa.

There are 2 trends that are making this outcome very likely.

The first is the obvious rise in popularity of the fiatcoins like USDT and USDC throughout the Ethereum ecosystem. As trustless and permissionless as the DeFi community may believe itself to be, it seems that the overwhelming majority is extremely comfortable with accepting IOUs from a centralized issuer/gatekeeper with mandatory KYC. Perhaps the more interesting thing is that USDT is slowly, but surely, on the path to ecosystem-wide acceptance and domination.

The second is the advancement of oracles and the comfortability of projects to not only use oracles as part of their project but as a core critical component. The most exaggerated example is the Synthetix-Chainlink relationship, where currently most (and eventually, all), the price feeds that are mission-critical to Synthetix are provided by the Chainlink network. With this general acceptance of oracles bringing over real-world data onto the blockchain, I think it is likely that centralized issuers will be issuing a wide variety of tokens representing real-world assets with significant value.

RSA followup: What are the implications for ETH the asset in this world?

The implications for ETH in this sort of future is a weakening of the thesis that a large part of its value comes from it being the most trustless collateral in the ecosystem and that characteristic demanding a premium. That would no longer be true, except for Validators in a live Proof of Stake world. However, if EIP-1559 gets put into place, regardless of ETH’s usage as collateral, it still retains value for being postage in the system to move around all these assets, as well as scarcity arising from demand being larger than supply, as opposed to scarcity for scarcity’s sake alone.

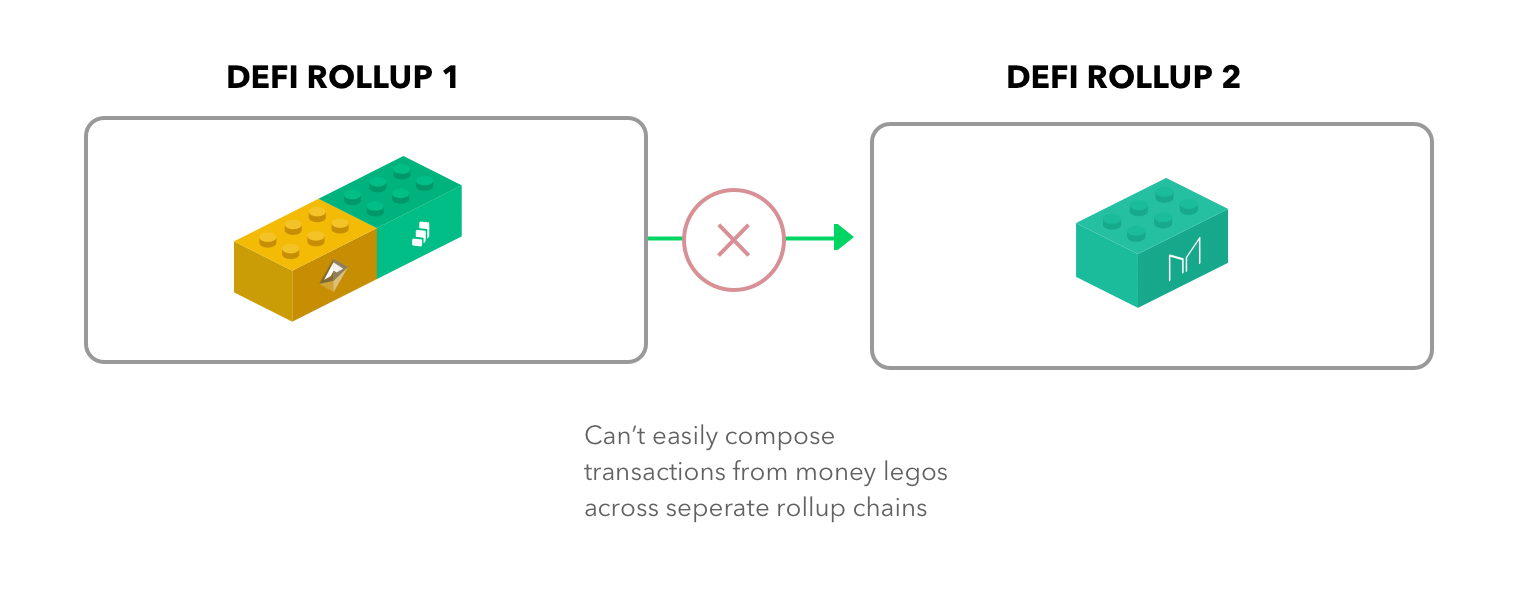

#4. L2s will be niche and suffer initially from lack of liquidity due to isolation

(Above) In an L2 world liquidity will silo

There has been a resurgence of hype around Ethereum Layer 2s (L2s) with some significant progress being made public in recent weeks.

While each have their own technical differences, they do have some similarities. The similarity that I would like to harp on is Liquidity or lack thereof.

L2s by their design will not be able to reap the benefits of Ethereum’s current composability in DeFi. The inability for atomic transactions means that flash loan capability is removed from L2s. The deposit and withdrawal process will limit the number of arbitrageurs and their efficiency. The lack of lending/borrowing platforms also means that capital in L1 cannot be leveraged or more efficiently managed to take advantage of market opportunities in L2.

The current solution to this problem seems to be very obvious—just onboard a lot of users and have them bring over deposits! This might be a tough sell since liquidity begets liquidity. How can you bootstrap liquidity?

The naive solution would be to pay for or subsidize market makers to operate on the L2 DEXes to bootstrap the supply side of the liquidity until there is enough organic growth for users themselves to make the markets efficiently and with ample liquidity.

Alternatively, if the L2 DEX just so happens to also run a CEX, they can “market make” for themselves by sharing liquidity from their CEX orderbook over to their DEX and facilitate the matching on both sides. This is exactly what Deversifi is doing, giving their DEX users access to their extremely deep (relatively) CEX orderbooks. There are some drawbacks to their Validium implementation in terms of custody since there are trust assumptions that (1) their Data Availability Committee has at least one honest member and (2) they have and will deposit assets from their CEX side into the L2 for user withdrawal if necessary, but no doubt that they are handling the trade-offs very well!

There is also one other unique alternative solution to address this liquidity issue, and it has little trust assumptions regarding asset availability and custody of funds, and that is the Synthetix solution of having users trade against a smart contract pool. Since the smart contract will always be able to accept any order of any size and prices are drawn in from Chainlink oracles instead of an orderbook, this solves the liquidity issue of L2s immediately from the get-go. It is a novel approach, but an interesting one to consider. The main drawback to this approach is the withdrawal time, but that will very likely be solved with liquidity providers offering quicker withdrawals to L1 for a small fee.

As the liquidity issue on L2s becomes apparent, I think many will start considering and exploring having some sort of AMM for users to trade with to solve their liquidity issue.

RSA followup: Do you think this liquidity problem will extend to Eth2 shards?

Unfortunately, I am not well versed enough regarding Eth2 shards to give my comments on that! If we can enter Phase 0, I’ll probably start reading up about sharding, haha!

#5. Altcoins lose correlation with BTC and ETH

A common saying within the space is that altcoins are like Bitcoins, but with leverage.

Previously, BTC was known as the “gateway drug” to the rest of the cryptocurrency world, including Ethereum. This was due to the simple reason that the most liquid base pair in every cryptocurrency was overwhelmingly in the favor of BTC. It is worth repeating that liquidity begets liquidity. In a twisted sense, BTC was like the “reserve currency” of the cryptocurrency world.

However, fast forward through a bear market, and now this is no longer the case in 2020. USDC has since come alone. USDT began migration from Omni over to Ethereum, and is a massive behemoth now, commanding north of $9B in marketcap across its supported blockchains. Look up almost any coin or token and you can see that most volume now is split pretty evenly between BTC and USD pairs.

As time progresses, I find it very likely that just like in the real world, the markets will tend towards a single base, and it is likely to be USD.

Even within the DEX side of the Ethereum space, this change is starting to blossom. Uniswap v1 forced ETH as the base pair to connect liquidity throughout all its pools. Uniswap v2 no longer mandates ETH to be a compulsory asset. Neither does Balancer. As this continues, it is very likely that the on-chain exchange ecosystem in Ethereum trends towards using the USD variants as the base pair.

Ultimately, the end result is that coins and tokens will no longer exhibit high correlation since they become less tethered (or maybe more Tethered? Pun intended) with each other. A pump in BTC will not cause a pump in altcoins, since the bulk of their volume would no longer be in the BTC pair.

Finally, the advent of applying traditional fundamental valuation techniques onto certain classes of tokens is allowing investors to value them in a very specific way, which could be entirely independent of the price movement of the major cryptocurrencies. Token Terminal has been doing a good job of popularizing this approach.

It’s likely that the future of the cryptocurrency markets will mature and diversify, similar to traditional markets today, where each niche have different fundamental head and tail winds, while within niches themselves, different projects have fundamental factors that play towards investors’ valuations of the specific projects and their tokens.

RSA followup: You’re saying USD replaces BTC and ETH as the reserve asset for crypto—is this bearish for BTC and ETH?

I do think that BTC and ETH still have much to offer being premium cryptocurrency assets in the space. This is not bearish for BTC and ETH outright, but it reduces their ability to “retain” value in the current and future landscape as well as it used to do in the past. On the bright side, this would also lead to more efficient markets in terms of pricing since arbitrage would be mostly done from a common base.

Conclusion

When I was asked to write this piece, it was not easy to think of things that I find contrarian.

However, I treated the article as an exercise for myself to imagine a future where what is likely to happen would happen, as opposed to what I want to happen would happen.

The cryptocurrency space is such a fast-moving industry, so I am sure this piece might look rather silly in retrospect a year from now. I encourage everyone who does not want to see any of the “likely” future scenarios to actually play out, to go out into the community, and push for changes.

If you care about the destination, then you need to steer the ship to where you want it to go! After all, this is our journey and we all are the participants.

Action steps

- Do you agree or disagree with Degen’s takes?

- Follow DegenSpartan on Twitter because he’s hilarious (and hugely knowledgable)

Author Bio

DegenSpartan is a Crypto Twitter shitposter and meme maker.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.