15 Bad Takes on Ethereum

Dear Bankless Nation,

Ethereum often receives many bad arguments.

“Ethereum tries to be too many things at once.”

“Ethereum’s supply is unpredictable.”

“Deflation is bad.”

On the eve of the unprecedented Merge, it seems an opportune time to address the many myths and misconceptions around Ethereum.

Today’s newsletter summarizes the many bad takes and myths around Ethereum as addressed by Justin Drake, Ethereum foundation researcher. (Watch it here)

Time to bust some myths around Ethereum.

- Bankless team

Authors: Justin Drake, Researcher at the Ethereum Foundation & Lucas Campbell, Editor at Bankless

Ethereum’s transition from Proof of Work to Proof of Stake has been planned for over 7 years.

It’s been a long journey, but today it’s finally here.

Ethereum’s on a mission to become the settlement layer for the internet of value. That is a grand goal. Naturally, there has been a lot of skepticism and hot takes over the years from both supporters and detractors as people learn about this new, emerging technology.

Some of them have been pretty good, some have been pretty bad.

Given the events of this historic week, we want to dispel some of the bad ones that we’ve seen.

Here are the 15 of the worst takes on Ethereum, as addressed by Ethereum Foundation researcher Justin Drake.

1. “The Merge will never happen”

The Merge never happening is a clearly falsifiable claim—and it will likely be proven wrong!

We will know in a few hours whether or not it happens. Feel free to Google “the Merge” if you want a simple countdown, or ultrasound.money which has more info.

Hint: It’s going to happen.

2. “Ethereum will never ship”

From the genesis block, to EIP 1559, to the Merge, there’s been a long history of “Ethereum will never ship”.

People continuously believe that Ethereum cannot ship and complete its roadmap. Yet Ethereum has proven time and time again that it can, and does, evolve despite securing hundreds of billions of dollars.

People also conflate Ethereum with its technical stack: the consensus layer, the execution layer, and the data availability layer. In reality, Ethereum strives to be greater than the sum of its parts, some of which may be incomplete. The mission is to settle the internet of value and early signs point towards Ethereum succeeding.

The last big feature in the roadmap is high-bandwidth data availability for rollups, also known as “sharding”.

Sharding research is complete and once the merge in the rear view mirror devs can focus on implementing it, starting with proto-danksharding.

And beyond the small set of ~100 consensus researchers and developers, Ethereum now enjoys hundreds of application-lever engineers working on pushing Ethereum’s execution capabilities to its limits with optimistic and zk rollups.

It’s not the flashiest timeline, but Ethereum ships.

3. “Ethereum is trying to be everything at once”

Over the years, there have been a lot of applications — from DAOs, to ICOs, to DeFi, to NFTs — built on top of Ethereum.

With this, people have made the claim that Ethereum is constantly changing its narrative (we’ll get to that later) based on the current meta.

But these are strictly the applications that are built on top of Ethereum. It’s not what Ethereum itself actually is, which is a settlement layer for digital value.

To draw a parallel, this is like saying the internet tries to do too many things. The internet is a digital communication layer for the world, and it has applications built on top of it ranging from video streaming, social media, email, e-commerce, etc.

Ethereum settles economic transactions on the internet — that’s it.

4. Ethereum can’t be both money and a smart contract platform

Critics often argue that Ethereum is simultaneously trying to be a settlement layer and a money. And that if it wants to be successful, it can’t be both.

Instead, it needs to focus on one of these things. If you want to be sound money, be sound money. If you want to be a settlement layer, be a settlement layer.

But it’s actually the exact opposite.

If you want to be successful at either, you need to be successful at both.

The reason for this is fairly simple. In order for billions to trust Ethereum as a safe and secure settlement layer for the world’s economic activity, you need trillions of dollars of economic security.

Why?

With 13.7M ETH staked, an attacker could launch a 51% network attack by buying what corresponds to roughly $21 billion. A large nation state could pull off such an attack and shake confidence in Ethereum as a global settlement layer. We need trillions of dollars of economic security so that no nation state could ever control Ethereum.

No matter the consensus mechanism (PoW or PoS), a WW3-grade amount of economic security can only be achieved by having the settlement layer’s native money accrue a monetary premium.

Money and settlement are not binary — If you want to become a global settlement layer, you need a native money that is valued in trillions.

5. ETH has an infinite supply

Unlike Bitcoin, Ethereum’s monetary policy does not hard code a supply cap.

In addition, there is perpetual tail issuance, creating a misconception that ETH’s supply will trend to infinity.

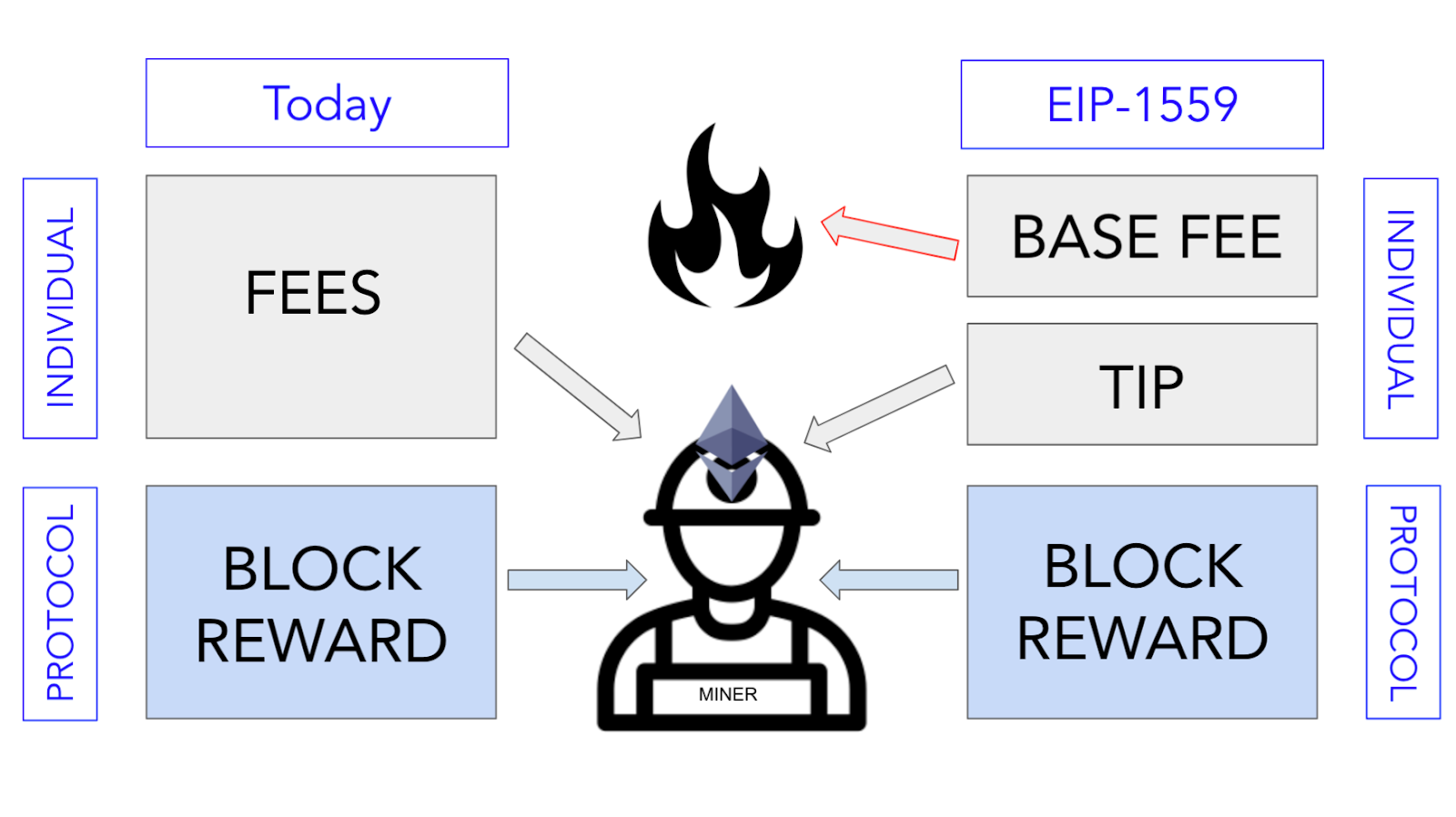

This isn’t true anymore because of EIP-1559, which was introduced in June 2021.

Before EIP-1559, it was possible for the tail ETH issuance to drive the ETH supply to infinity. But with EIP-1559, base gas fees previously paid to miners are now burned.

This new burn rate counter-balances ETH issuance, and in the long-term produces an equilibrium supply where burn and issuance exactly cancel out.

As the supply grows, Ethereum issuance (for both PoW and PoS) grows sub-linearly whereas the burn rate grows linearly. This simple model guarantees a supply equilibrium, preventing a runaway supply increase to infinity.

Interestingly, there’s also an argument that liquid ETH supply would not have grown to infinity prior to EIP-1559.

This is because some fraction of all ETH (say 0.1%) gets lost every year, e.g. due to lost private keys. Peter Todd has an article highlighting that Bitcoin would still have a capped BTC even if the 21M BTC was removed in favor of tail issuance to fund long-term Bitcoin security.

All else constant, the same goes for Ethereum!

6. ETH supply is unpredictable

A common argument against ETH is that the supply is unpredictable. Specifically, its monetary policy has changed over the years via the social layer (we’ll talk more about this later) rather than programmatically (like Bitcoin’s halving every four years).

This is true and a conceded point. The goal of crypto as a whole is unbiased monetary policy. Take out the humans and let the robots dictate it. Fortunately, this is what is happening in a few hours on Ethereum.

Monetary policy from the social layer (which led to the issuance being “manually” decreased from 5 ETH/block, to 3 ETH/block, 2 ETH/block) will be out, and market-driven, programmatic monetary policy will be in.

With the Merge, the future supply for ETH depends on two market-led forces, not arbitrary magic number like 2 ETH/block or 21M BTC.

Those two market forces are 1) the cost of money for staking (compensated for with issuance) and 2) demand for blockspace (transaction fees).

The future ETH supply can be modeled on ultrasound.money with two simple sliders, one capturing issuance, and the other capturing the burn.

Model it for yourself!

7. Ethereum is a plutocracy run by stakers

The common misconception is that validators run Ethereum via governance rights. To be clear, Ethereum validators do not have on-chain governance rights (unlike some chains like Tezos, Polkadot, or Dfinity).

Let’s dive into this more. There are two layers to consensus: the machine layer and the social layer.

The machine layer is responsible for the day to day consensus; it is driven by computers and operates on a timescale of seconds. The social layer is responsible for setting the rules of the machine layer; it is driven by humans and operates on a timescale of weeks, months, and years.

It is ultimately humans that decide which software the machines run: they have overarching control over machine consensus.

In every blockchain system, including Bitcoin and Ethereum (pre- and post-merge), the social layer has precedence over the machine layer. Meaning, it is possible to make changes to the machine layer via consensus on the social layer. It is the social layer that upgraded Bitcoin with features like SegWit and Taproot.

There’s no on-chain plutocracy on Ethereum. ETH holders and validators are not in control. There is not ETH-denominated voting to change the rules of consensus.

Like Bitcoin, the social layer sets the rules of consensus.

8. The rich get richer

In a similar fashion, one of the biggest misconceptions with PoS is that it's a scheme for the rich to get richer. Not true!

In PoS, everyone gets the same APR. This means that the rich stay equally as rich and the poor stay equally as poor.

It doesn’t matter if you stake a $1M of ETH or $100 of ETH, it’s an even playing field for everyone.

The barrier to entry is also very low — especially compared to Proof of Work. Try searching for the #stakefromhome hashtag on Twitter this week.

Under PoW, you have to spend millions of dollars to reach economies of scale on hardware and energy to have a remotely competitive (and profitable) system.

The bigger you are, the cheaper it is to mine with proof of work.

In contrast, staking protocols like Rocket Pool and Lido allow anyone to access the same yields as the person running $100M worth of validators. It becomes extremely accessible for everyone.

A more democratic system, PoS is.

9. Deflation is bad

Deflation is bad for the Ethereum economy over the long run - it incentivizes hoarding and no spending.

This concern has its intellectual roots in traditional economist thinking. This is a prevalent take that even some within Ethereum circles hold, and that is also directed to bitcoin for its deflationary economics.

But it’s important to distinguish between two different monies: collateral money (non-transactional, low-velocity) and debt money (transactional, high-velocity).

- Examples: gold is collateral money, fiat is debt money.

These are two different types of money, and each type thrives with different properties.

Debt money is money you borrow and spend. Examples include DAI, RAI, USDT and USDC. You want debt money to be inflationary because it’s easier and easier to pay off debts over time. In addition, price inflation creates an incentive to spend it and not hoard it, driving the high-velocity economy. If debt money was deflationary, you’d increase the risk of defaults and decrease spending (not good).

On the other hand, collateral money like ETH is the hard money you borrow against. Collateral money gives you leverage. You want collateral money to be deflationary to minimize the risk of liquidation, as well as increase your purchasing power over time.

ETH and BTC are both optimized as a collateral money. For ETH, it is collateral for staking and DeFi, backing billions of dollars in staking liabilities and loans.

Note that Ethereum as a network benefits from both types of money operating on it. High-velocity transactional money generates billions of dollars of cash flow for Ethereum via transaction fees.

And when ETH — the only pristine collateral on Ethereum — is used as locked up on the beacon chain and in defi, ETH velocity reduces and ETH monetary premium increases.

10. Higher ETH price necessarily means more expensive gas fees

This is a common misconception. People think that because fees are paid in ETH that if ETH prices go up then fees must also go up.

The reality is that there are two different markets at play: the ETH market (denominated in USD per ETH) and the gas market (denominated in ETH per gas).

We can be in a situation where 1 ETH is worth $1M but gas is low enough (a fraction of a Gwei) that a transfer only costs $0.01. Now only is this total bifurcation of the ETH and gas markets possible, but this is actually where we are directionally heading!

Granted, there is some correlation — especially on smaller timescales — between ETH price and gas price. If the price of ETH goes up, it means Ethereum the network has better security and higher economic bandwidth.

That makes Ethereum block space more useful, which increases demand for block space, and increases the price of gas.

As a rule of thumbs, during bull markets people are willing to pay more, and in bear markets people are willing to pay less. That said, there is fundamentally nothing that forces these short and medium-term correlations to dictate the long-term trend of ETH and gas markets.

ETH price can rise — even to $1M per ETH — all while transaction fees directionally decrease, even to $0.01 per transaction.

Note too that this criticism does not yet take into account the emergence of Layer-2 blockchains which are working to scale Ethereum by moving transactions off the mainnet.

11. ETH is a security

This is a falsifiable claim.

Security laws operate on a jurisdiction by jurisdiction basis. I can go to every jurisdiction and ask whether ETH is security in that jurisdiction.

There are roughly 200 jurisdictions in the world and not one (not one!) has yet declared ETH a security.

When people say “ETH is a security” they actually often mean “ETH is a security in the US”.

But this goes directly against the SEC informal guidance that ETH is not a security. Additionally, the CFTC has formally come out and said several times ETH is a commodity.

In the same vein, CME has listed ETH futures — something they can only do with commodities.

It also goes against the 7-year statute of limitations for securities — it’s now been more than seven years since ETH was created, and no enforcement action has been brought forward by regulators.

In the US, it feels clear that ETH is not a security (not legal advice!). However, this narrative has re-risen to prominence largely on the back of SEC Chairman Gary Gensler’s vendetta against crypto and his obsession of regulating the majority crypto assets as securities. 🤷♂️

Regardless, what if a jurisdiction does declares it a security?

Well…the Ethereum network wouldn’t really care. It would keep producing blocks and operate as normal.

Instead, compliance would happen outside of Ethereum, with some centralized exchanges delisting ETH.

Yet even if that happens getting your hands on ETH would still be relatively easy. For example, one could buy a different token (e.g. USDC or WBTC), withdraw it from the centralised exchange, and convert it to ETH on Uniswap.

12. Scalability reduces the burn

The argument here is that if Ethereum scales then per-transaction fees will go down, leading to a lower total ETH burn.

This is a common take, even within the Ethereum ecosystem. But there’s a simple rebuttal to this. Transaction fees may drop on an individual basis but it doesn’t account for the fact that Ethereum is now processing more fee-paying transactions.

In aggregate, the total burn could decrease or increase with scalability — both are possible.

Another important concept here is induced demand. That is, the more a system improves, the more usage the system sees.

A real world example of induced demand is traffic. If you have a highway with two lanes and there’s always traffic, the city could decide to add a third lane. But soon after the third lane is built, traffic builds up again as more people decide to commute on the highway because of the new additional lane.

In short: the higher capacity for activity, the more activity happens.

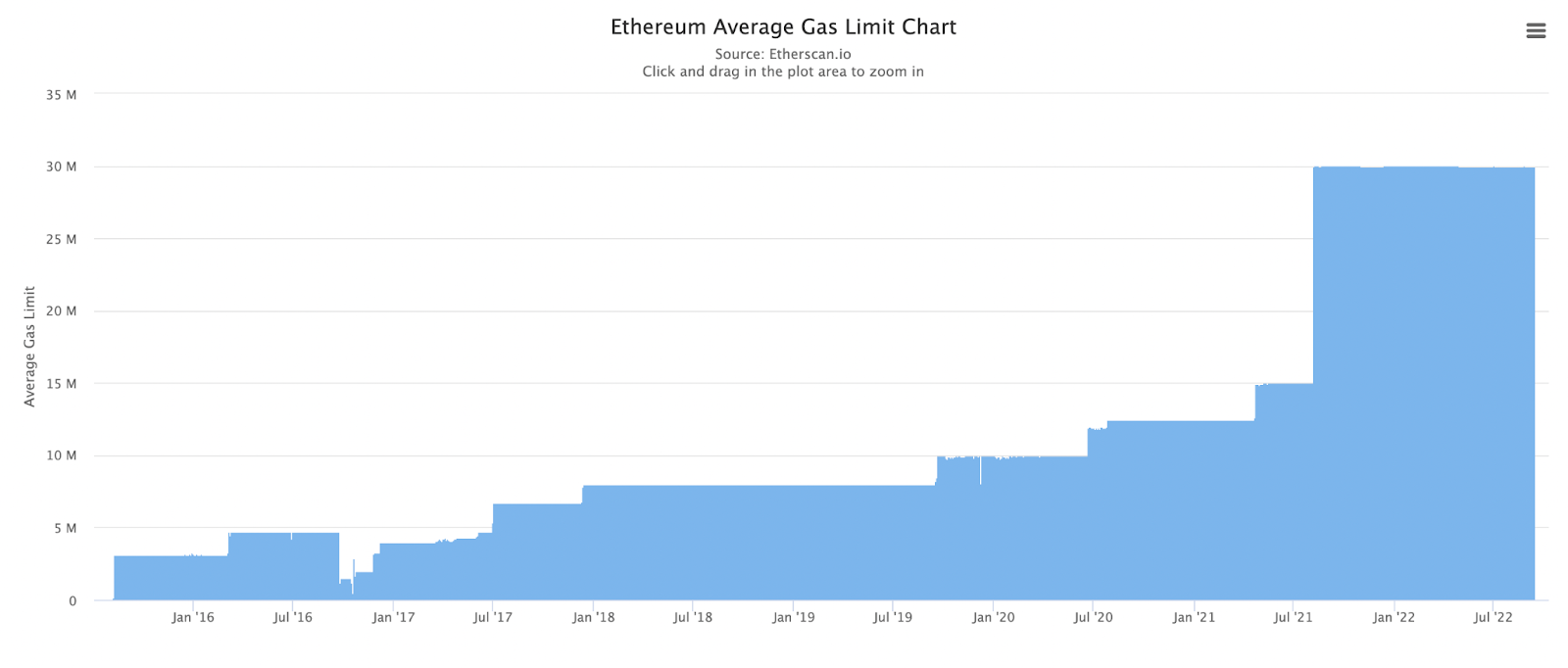

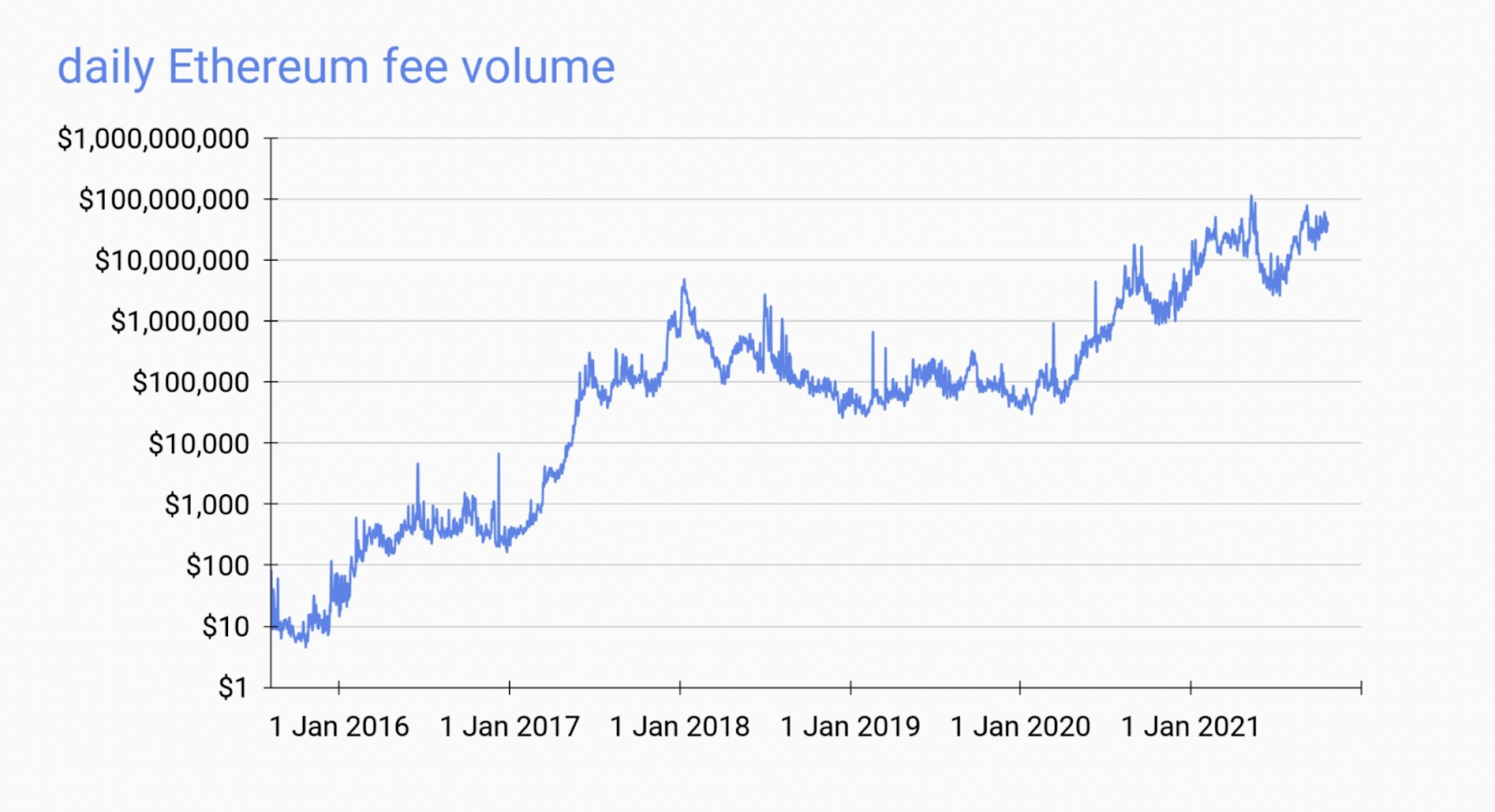

This is true when looking at Ethereum’s historical data. In fact, since genesis, the Ethereum network has scaled by ~50x while total transaction fees have scaled to billions of dollars per year. Let’s unpack.

At genesis, the block gas limit was set to 3 million gas (the maximum gas Ethereum transactions can consume in one block). As of writing, the average gas consumed per block is 15 million gas. That’s already a 5x increase in scalability.

But there’s another, more subtle, 10x in scalability: smart contract gas optimizations.

In the early days of smart contracts, developers were deploying extremely gas-inefficient contracts on Ethereum. Over the years, developers have gotten better and more efficient at writing efficient smart contract code.

Reducing the gas consumption of contracts is called “gas golfing”. It’s kind of like playing golf where a stroke is 1 gwei in cost and devs are trying to get the lowest score possible.

You can see this by comparing the gas efficiency of Uniswap V2 and Uniswap V3. There was an order of magnitude improvement in gas used per unit of trading volume between V2 and V3.

When you combine the increase in the gas limit and smart contract gas optimizations, you get that rough 50x.

Now… despite this scalability increase, has the total transaction fees gone down?

Nope — it’s been up only for over 7 years. It started with ~$10 per day in transaction fees. Now Ethereum is processing millions of dollars every day in transaction fee revenue. See the chart below!

Scalability does not hurt the burn.

As a rough heuristic, the more value Ethereum provides to the world, the greater to the income from transaction fees.

13. ETH is just a tech stock

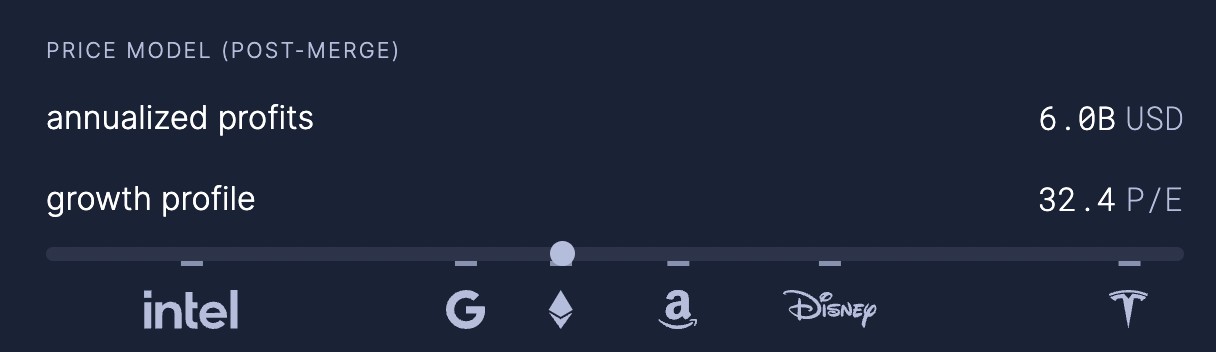

One could argue that Ethereum is like a tech company and that ETH should therefore be valued like a tech stock based on cash flows. This is partially true, but the situation is more subtle and bullish than it may seem.

When looking at Ethereum cash flows (burn = revenue from transactions, issuance = expenses for security) and profit margins, Ethereum has a ~32 P/E ratio — on par with Google or Apple.

But this is only one part of the story. It neglects ETH use as a low-velocity collateral money, and therefore neglects ETH’s potential to accrue monetary premium. You can use ETH as collateral in DeFi, and as collateral to secure the network via staking. But you can’t do either of these things with AAPL stock!

As more of the ETH supply becomes illiquid through these mechanisms, monetary premium will accrue to ETH on top of the “base” cash flow valuation. If over time most ETH is used as collateral (which it should because that’s what ETH is optimized for), then most of the ETH marketcap will be monetary premium.

If X% of all ETH is used as collateral money, then a “fair” multiplicative monetary premium factor would be 1 / (100% - X%). For example, if 90% of all ETH is collateral money, only 100% - 90% = 10% is liquid and relevant to a cash flow valuation, and the “fair” monetary premium factor is 1/10% = 10x.

14. Ethereum’s narrative always changes

Ethereum’s narrative has evolved over the years as categories of applications built on top of Ethereum have risen to prominence. ICOs, DeFi, NFTs, even DAOs — all of these are emergent stories for Ethereum.

But one should not confuse Ethereum with the applications built on top of it. Early internet narratives evolved alongside internet applications (from email, to forums, to image sharing, to social media, to streaming).

Yet nowadays it is well understood that the core purpose of the internet is to simply be a communication protocol.

Similarly, we can expect Ethereum to eventually be appreciated for what it is: simply a settlement layer for the internet of value.

15. “Ultra Sound Money is cringe” - Udi Wertheimer

Ultra Sound Money is cringe and stolen meme.

Some Bitcoiners argue the “ultra sound money” meme was stolen from Bitcoin’s “sound money” meme. Others argue “ultra sound money” is cringe — they think of pregnant ladies and the bat emojis remind them of COVID.

On the point that “ultra sound money” is stolen, this is especially ironic given that Bitcoin’s “sound money” meme was copied verbatim from gold bugs. 100% stolen without any innovation. The sound money meme is centuries old, and people forget that memetic history.

On the other hand, “ultra sound money” is a novel derivative of “sound money”.

Memes are viral pieces of cultural information.

They replicate, mutate, and evolve (just like biological viruses!) to spread through human culture. And this is exactly how “ultra sound money” came to be — it is a potent memetic mutation that has now spread to thousands of believers.

On the topic of cringiness, we can’t dispute that (you’re welcome Udi).

Cringiness is subjective.

But if we dive into the etymology of sound money, the “sound money” meme is (or at least was) itself cringe. The concept of “sound money” originated from the “clink” of a pure gold coin to test its authenticity. So, even the origins of the sound money meme are rather ridiculous.

Sound money contrarians could have easily ridiculed it as “ding ding money” or “la la money”.

If the purity test for gold was based on taste or smell, gold could have been called “taste money” or “smell money” — that’s how cringe “sound money” must have sounded when the term was first coined.

Anyway, it’s just a meme! 🤷♂️

Happy Merge Day 🐼

Action steps

- 📺 Watch Justin Drake addressing the same 15 ETH Bad Takes on the podcast

- 📚 Read David Hoffman’s classic article The Ethereum Watershed