Dear Bankless Nation,

In this article, we’ll go through the post-Merge Ethereum transaction life cycle.

- You’ll learn how a block on Ethereum comes to be built, and which actors capture value along the way!

- You’ll learn about the mechanism design that goes behind each step.

- You’ll see how ETH is the ultimate winner at the end of the process.

For very similar content on this, I encourage you to listen to this episode with Matt Cutler from Blocknative, who I also must thank for helping me write this piece!

- David Hoffman

In the post-Merge world, Ethereum transactions will flow through a very specific and orderly process. A powerful transaction supply chain is being constructed before our very eyes, and massive power structures are about to emerge.

The current state of the Ethereum transaction supply chain is blunt and naive. We all submit our transactions to the mempool, arbitrage bots descend and fight over the pennies of value, and then miners collate all these transactions to build a block.

In post-Merge Ethereum, this process gets codified and defined into the protocol. This fundamentally allows ETH stakers to harness the value capture at every step, ensuring that the value is passed to them at the end of the supply chain.

I’ve said it many times before, but I still haven’t said it enough: The best lens for a holistic understanding of crypto is through biology.

Crypto is an emergent and organic system, and it mimics the laws of nature. Even though humans are building these structures, the ‘optimal structure’ that has been discovered is one that mimics nature.

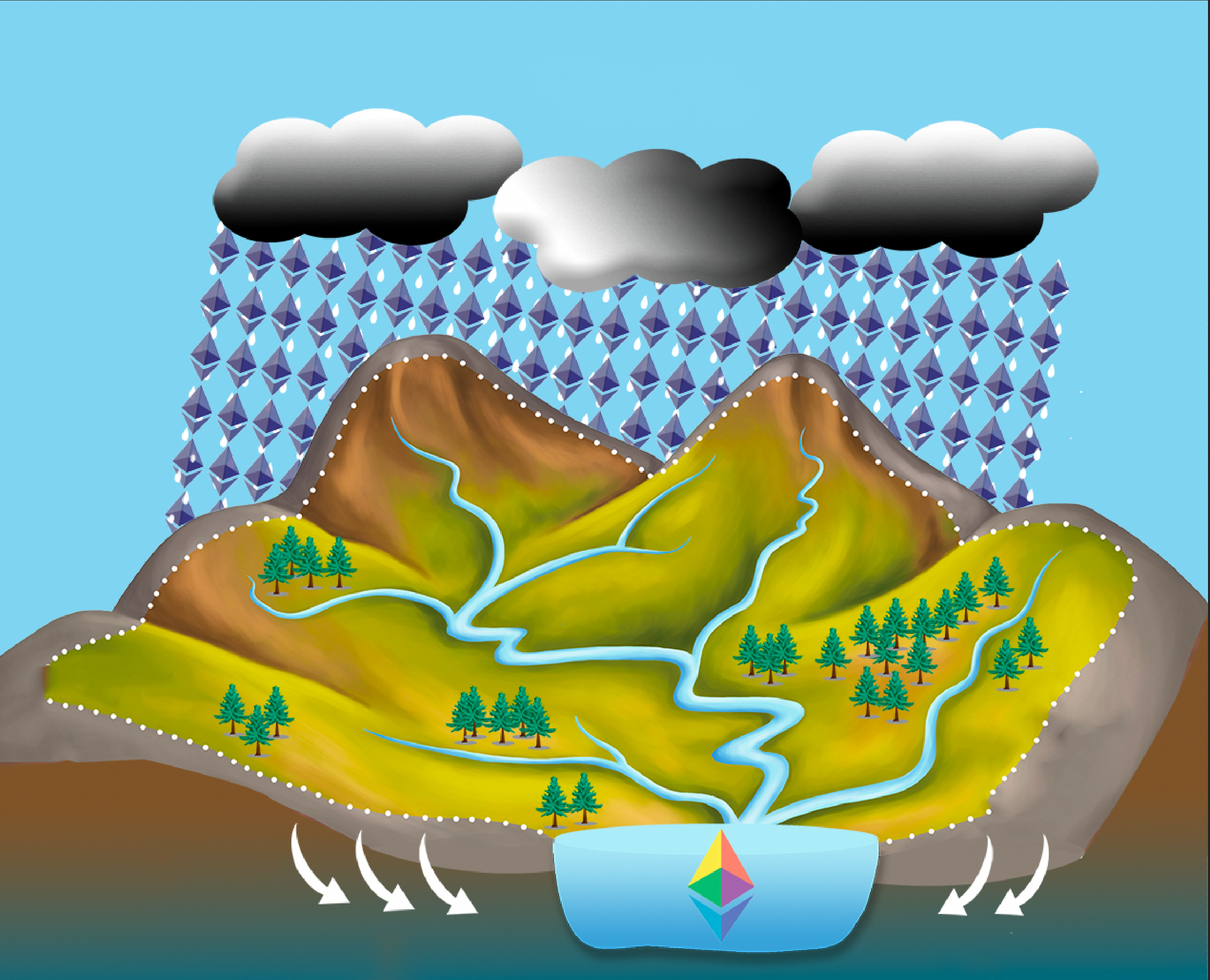

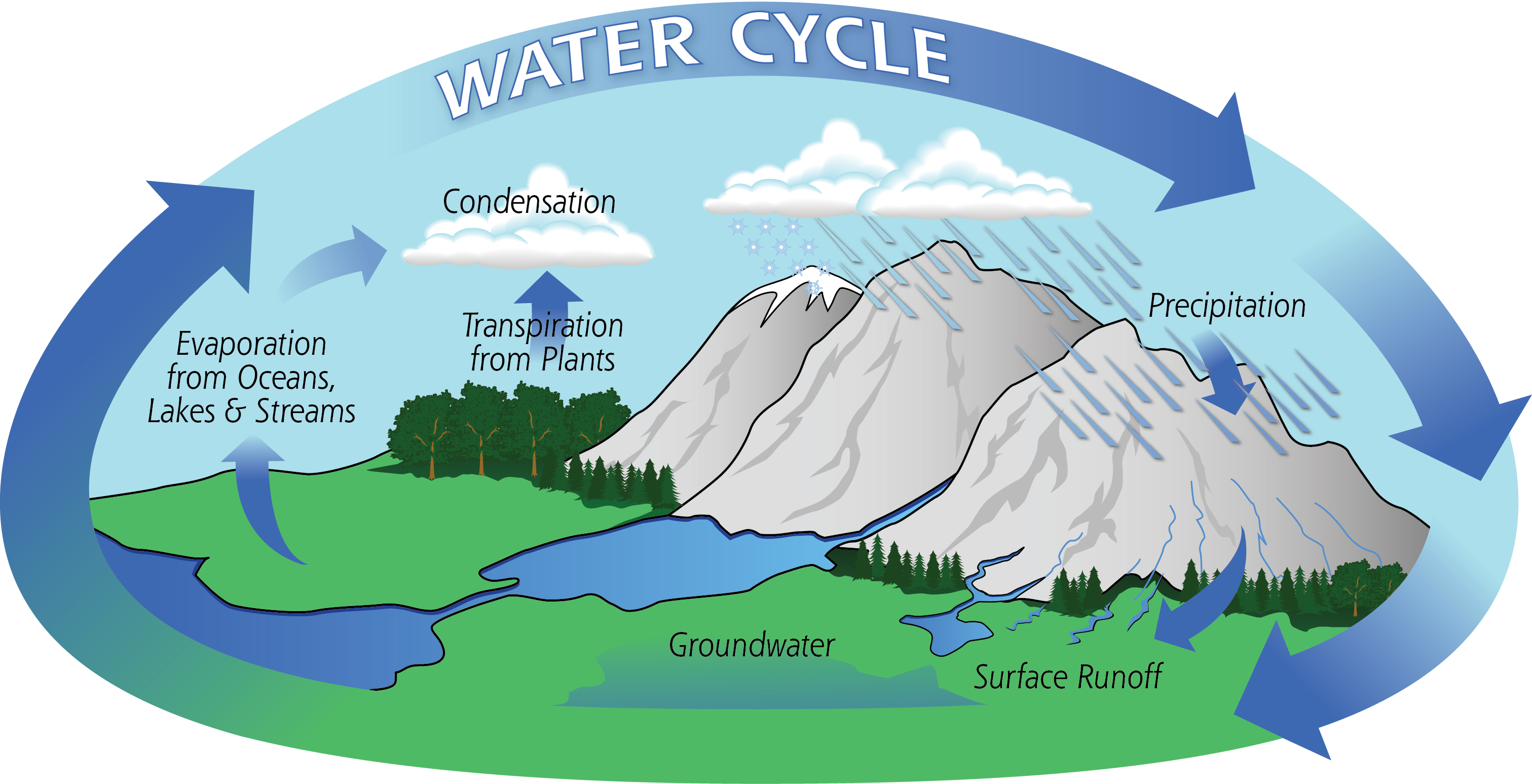

After years of R&D, Ethereum devs have built a transaction supply chain that looks a lot like a watershed. A watershed is a land area that channels rainfall or snowmelt to creeks, streams, and rivers, and eventually to outflow points such as reservoirs, lakes, or the ocean.

Transactions (raindrops) rain down on Ethereum all over. Some go to Uniswap, some to Aave, others to OpenSea, NFT mints, DEX aggregators, bridges, token transfers, etc.

But it doesn’t matter where a raindrop (transaction) falls in the Ethereum landscape; it always converges to the same spot and gets there via the same process.

Every raindrop is its own, unique drop that lands in a one-of-a-kind location, but soon the laws of nature take over. Droplets converge into a trickle, trickles become streams, streams into rivers, and rivers eventually pool at the deepest part of the watershed.

ETH Stakers.

I call this… the Ethereum Watershed.

Glossary

For those earlier in their crypto journey, this glossary can help prep you for the rest of the content in this piece.

- Priority Fee: All transactions on Ethereum come with a priority fee. From the user perspective, this is basically synonymous with a gas fee. The higher you pay, the faster your transaction gets included into the blockchain, because you’re increasing the incentive for your transaction to be selected.

- Mempool: The mempool (memory pool) is a smaller database of unconfirmed or pending transactions which every node keeps. When a transaction is confirmed by being included in a block, it is removed from the mempool. The mempool is not one canonical thing; each blockchain node has their own version of the mempool. Sometimes, transactions are broadcasted to only specific entities, making mempools incongruent with others.

- MEV: Maximal extractable value (MEV) refers to the maximum value that can be extracted from block production beyond the standard block reward and gas fees, by including, excluding, and changing the order of transactions in a block. Whoever has the power to order transactions in a block can do so in a way that is favorable to themselves, by ensuring that their transactions capture all available arbitrage opportunities.

- MEV Searcher: An MEV Searcher is an automated and highly optimized algorithm that scans the blockchain and mempool for potential arbitrage opportunities, and submits transactions that attempt to capture that opportunity when it’s identified.

- Transaction Bundle: MEV Searchers produce ‘transaction bundles’, which are a set of complex transactions that all get bundled into one package. It’s a single transaction that has many transactions inside of it. Just like a normal transaction, it also comes with a priority fee, or bribe, for inclusion into a block.

- Block Builder: A block builder takes all the transaction bundles that it can, as well as the highest priority fee mempool transactions, and construct a block that is eligible for inclusion.

- Block Proposer: You might know a Block Proposer by a different name: ETH Staker. Validating node. Block Proposers propose blocks for inclusion to the blockchain. This is a part of the normal ETH staking process, and is the last step in the transaction supply chain.

MEV: How Big?

Every transaction on Ethereum has some sort of value associated with it. If it didn’t, then the sender wouldn’t pay the gas fee. Someone is willing to pay something to change the state of Ethereum. People pay to change prices on Uniswap, they pay to raise or low liquidations levels on Aave, or engage is some sort of financial transaction that changes prices and values on Ethereum.

Every transaction on Ethereum produces a trail of arbitrage in its wake. When someone buys ETH on Uniswap, they dislocate its price versus every other marketplace, and creates a small micro-opportunity for arbitragers to rebalance. All financial transactions leave a wake of tiny little opportunities for arbitrage bots to capitalize on.

When you disturb the balance of a Uniswap pool, arbitrage bots descend, consume the arbitrage, and output a more balanced and healthy ecosystem. The more usage of Ethereum, the more total arbitrage exists. Arbitrage bots are akin to the high-frequency traders in TradFi; there are millions of algorithms looking for the tiniest little discrepancy, and they all race to capture that micro-opportunity.

Let’s talk about $$$.

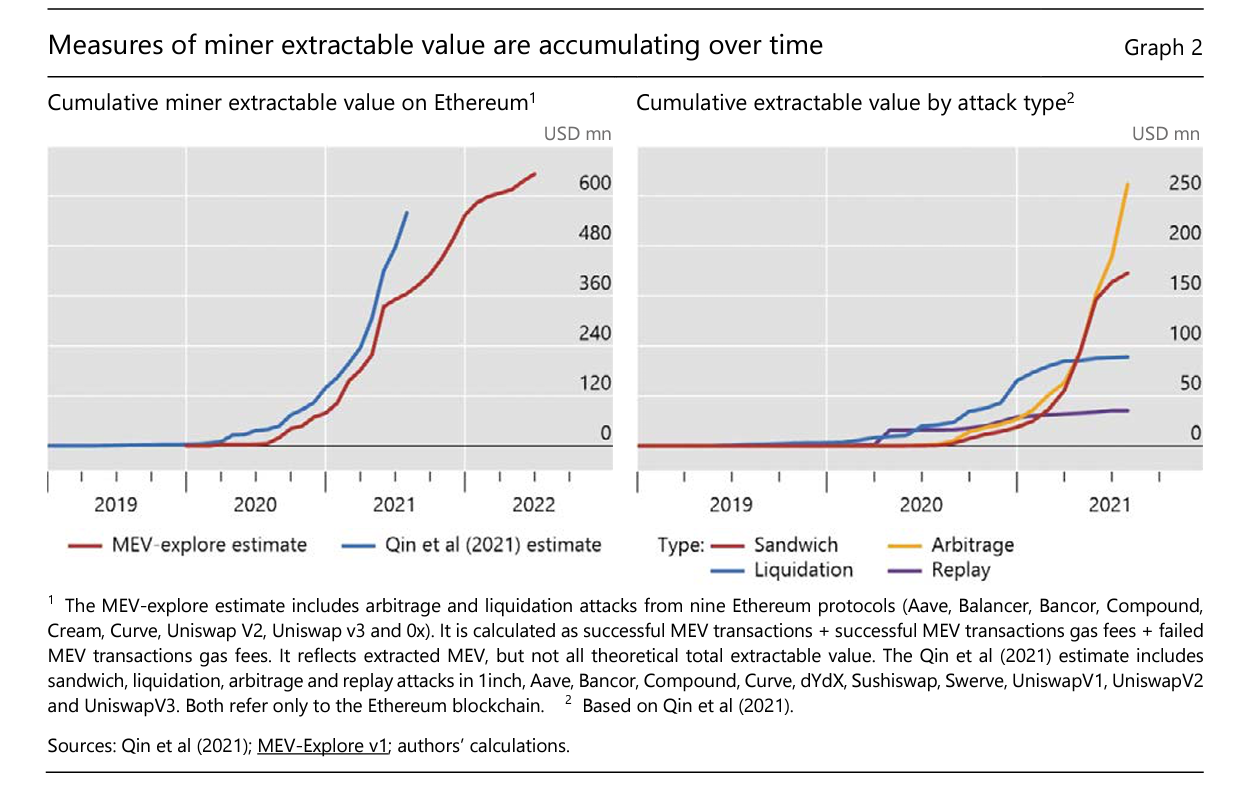

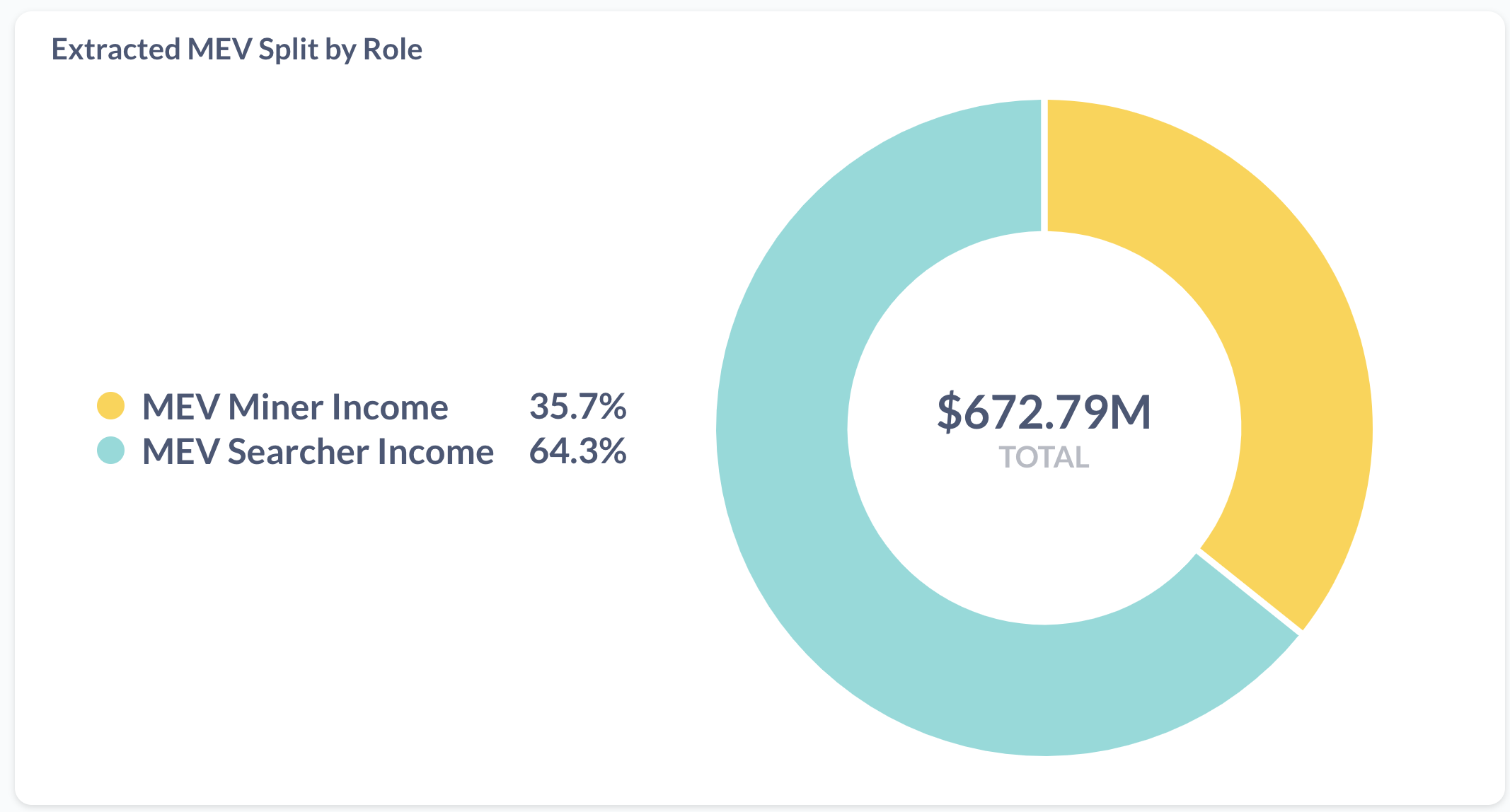

MEV is…uh…really big, amounting to $672M worth of value.

Steady lads… deploying charts:

And this is just the early days of MEV. MEV value capture is such a lucrative industry that it’s bound to increase by orders of magnitude very quickly. No one thinks that it won’t, especially when it’s generally considered that MEV is not a ‘solvable problem’.

At best, it can be harnessed… at worst, it’ll turn your blockchain into an oligarchic hellscape.

📺 Watch: Crypto’s Existential Crisis

But have no fear! The Ethereum devs are on the case. They’ve produced a system that harnesses MEV and makes it flow downstream to where it can become distributed to the widest number of market participants: ETH Stakers.

The Ethereum Transaction Supply Chain

Step 0️⃣ | Transaction Origination: “The Mempool”

Before transactions become embedded into the Ethereum blockchain, they exist in this ‘unborn’ state called the ‘mempool’. Mempool stands for ‘memory pool’, and it’s basically all of the broadcasted user transactions that have not yet been included in a blockchain.

When you make a transaction on Metamask, you broadcast it out to the Ethereum network of nodes. These nodes download this data, and they hold it in their computer memory.

The transactions that come with the highest Priority Fee get plucked out of the sea of transactions and added to a block for inclusion into the blockchain. I describe in the remaining steps below how transactions are chosen for inclusion, as there are more variables to consider beyond ‘which transaction paid the highest priority fee’.

The important thing to note: The mempool is a massive sea of transactions. Each one has a bid associated with its inclusion, and each one does something on Ethereum.

All transactions have two potential sources of value associated with them:

- Priority Fee: the explicit bribe users can choose to pay for inclusion

- MEV: the second-order effects on the state of Ethereum that produce an arbitrage opportunity

How transactions ultimately become a part of the Ethereum blockchain is a function of both the size of the Priority Fee and all the associated MEV for the transaction.

For example, one could create a transaction that has a $0 fee associated with it, basically asking miners to include the transaction for free. Miners or validators would normally ignore this transaction in lieu of ones that actually pay them money, but if that transaction is something like “Pay 1,000,000 DAI for 1 ETH” or “Sell Cryptopunk #1118 for 1 ETH”, that transaction is going to be immediately scooped up by the first MEV bot to find it.

Simply put, all transactions come with a reward for including it, either explicitly with the priority fee, or implicitly with its implied MEV value. The value of each transaction gets picked up by the next player in the supply chain: MEV Searchers.

Step 1️ | MEV Searchers: “Micro Arbitragers”

MEV Searchers are highly optimized arbitrage bots.

Each MEV searcher bot is optimized for one specific type of MEV, and its creator spends a significant amount of time and labor improving the bot, so that it can produce better arbitrage and earn more profit.

For example, there will be Searchers that are highly optimized to arbitrage imbalances across the various AMMs (Automated Market Makers; aka ‘Decentralized Exchanges’) in DeFi. If ETH is priced at $1998 on Uniswap, and $2002 on Sushiswap, an MEV bot that is optimized for DEX arbitrage will create a transaction that captures this spread and pockets a few gwei.

This same competition occurs internally with borrowing/lending applications like Aave, Maker, or Compound. A significant amount of value is paid to liquidation bots who all race each other to liquidate underwater DeFi loans. Over time, we’ve seen these DeFi liquidation bots compete over smaller spreads, ensuring that the loan is liquidated at the most favorable rate that the market will allow, maximizing how much value is retained by the loan.

There are thousands upon thousands of MEV searcher bots, scouring the mempool, fighting other MEV searcher bots over micro-pennies worth of arbitrage.

As these MEV Searchers get better and more gas-efficient, they will be able to fight over smaller and smaller amounts of arbitrage, organically ensuring that DeFi is a highly efficient marketplace.

Bundling

These MEV Searcher bots create ‘bundles’ of transactions; as it’s often a set of transactions that are required to fully capture the available arbitrage. The Bots need all these transactions to be included in a specific order for their operations to work, so they bundle them up in a neat little package, put a bow on it, and ship it off to the next player in the game: Block Builders.

Just like normal transactors, each MEV searcher bot submits a ‘bid’ with each transaction bundle they create. This is the price that the bots are willing to pay Block Builders to include their bundles. Since this game of MEV arbitrage is highly competitive, the margins become extremely slim.

Since these MEV bots are in a rapid game of bid-escalation, fighting for inclusion, the bids that MEV searchers pay to Block Builders quickly approach the full value of the arbitrage that they extract, meaning that Block Builders capture an amount of value that naturally approaches >99.99% of what the MEV Searchers can extract.

✨Perfect Competition✨

Step 2️ | Block Builders: “Macro Arbitragers”

The role of ‘block building’ is simple. Block builders construct the most valuable block possible and then bid to block proposers to accept their block.

This sounds simple, but in order to be as profitable as possible, builders must be highly competitive.

There are two vectors for block builder competition:

- Hardware and networking

- Order Flow

Hardware and Networking

Block builders must undergo a computationally intensive process of transaction simulation.

Builders can’t just blindly include every single transaction bundle without considering its contents. Many bundles submitted by Searchers will be going after the same arbitrage opportunities, and if a lazy builder were to include conflicting bundles, then the 2nd transaction bundle would be rejected, and the builder would forfeit its associated bid.

Bad!

Blockspace is precious, and builders must hyper-optimize the transactions it includes in a block, to make sure they’re not leaving money on the table.

Therefore, block builders go through an intensive transaction simulation process, where it plays out every single transaction, in order to check for conflicts. They will run through all possible permutations of transaction bundles to find the most profitable combinations, then fill the remaining block with basic mempool transactions, put a bow on it, and bid to block proposers for its inclusion.

All within 12 seconds.

👉Check out Blocknative’s Transaction Simulation Platform

Order Flow

Returning to what I said above about the Ethereum mempool…

The mempool is not a canonical thing. The ‘canonical thing’, the ‘single source of truth’ is the Ethereum blockchain. Until a transaction is ‘in the blockchain’, it’s in a limbo state.

Each and every Ethereum node has its own version of the mempool. When you make a transaction through Metamask (or whatever wallet), you’re broadcasting your transaction to each and every Ethereum node that will listen to you; after all, you just want your transaction included… you don’t really care how.

This is not true for every actor. Broadcasting a transaction is ‘showing your cards’. You are telling the world what you want to do. If ‘what you are doing’ is synonymous with ‘I have a bunch of alpha the market doesn’t know about’, broadcasting that transaction to everyone willing to listen is a sure way to lose every penny of that alpha that you’re trying to receive.

📺Watch a very old episode of Bankless: “Ethereum is a Dark Forest”

Okay, so you see a bunch of alpha on Ethereum… but if you broadcast your transaction, you’re going to reveal that alpha to some MEV bot, who is sure to beat you to the punch… because that’s what they do.

What do?

Private Order Flow.

Instead of broadcasting this transaction to everyone, you make an off-chain agreement with a mining pool that agrees to process your transaction without broadcasting it to everyone else.

Flashbots, god bless them, has produced ‘Flashbots Protect’ to democratize access to this power. You can check it out here.

The lesson to be learned here: not all mempools are created equal. Entities with better mempool vision and access to private transaction order flow will be able to capitalize on arbitrage opportunities that the rest of the market

These are the vectors that Block Builders compete on: who can see the mempool the best, either with improved hardware and networking, or private off-chain agreements for order-flow.

Bidding for Blocks

Block builders make money by collecting all the bids from all the transaction bundles from MEV searchers, and all Priority Fees from individual transactions. This will turn into a block that will net them 2.2 ETH, for example. They will then make a 1.9 ETH bid for this block to be proposed by a Block Proposer, in an attempt to pocket the 0.3 ETH spread.

Just like MEV Searchers, block builders will be highly competitive. A really good block builder could produce a block that has 3 ETH of value associated with it, and bid 2.2 ETH for its inclusion… but another block builder could build a block with only 2.4 ETH of value in it, and bid 2.3 ETH for its inclusion.

Naturally, the rational block proposer will accept the 2.3 ETH bidding block, and the builder who took the smaller spread will pocket the cash.

The margins collapse extremely quickly.

Step 3️ | Block Proposers: “ETH Stakers”

The last step is where the block actually gets added to the blockchain!

ETH Stakers, those who are running a validating node, simply select the block that has the highest bid associated with it.

They don’t even need to do any work. They simply select the most profitable block header and sign a message saying that they approve of this block with the full faith and credit of their 32 ETH bond.

And FINALLY, we get to the part of this piece that was the entire point all along.

💡 The Takeaway: Equality via Mechanism Design

Ethereum developers have spent an insane amount of time and R&D into making ETH staking as accessible and democratic as possible. There has been a massive effort that has gone into making ETH staking possible on basic consumer hardware, using the minimum amount of ETH possible (32 ETH, read this thread for why it’s the current theoretical lowest number).

These are Ethereum’s values: make home validation and participation in consensus as democratic and accessible as possible. It shouldn’t matter what your background is, all you need is basic consumer hardware and some ETH, and you can participate in Ethereum staking. App layer innovations like Rocket Pool and Lido help lower the 32 ETH threshold and in the future, it’s possible for 32 ETH to be lowered to 16 or even 8 for solo stakers.

We’ve discovered that MEV is a huge problem in Ethereum, that threatens to centralize the supply of ETH to a few privileged parties that can extract MEV better than anyone else. This reality threatens the entire effort of keeping Ethereum decentralized and democratic.

So what did the developers do? They used mechanism design to harness MEV and place it into the hands of the ETH holders.

As an ETH Staking individual, ask yourself… do you know how to run an MEV searcher bot? Do you know how to build the most optimal block? With the above process, you don’t have to. The entire supply chain is beholden to the most decentralized and accessible part of the stack: ETH holders.

The margins of MEV Searcher bots get maximally compressed by the fight for inclusion by block builders. The margins of block builders get maximally compressed by the fight for inclusion by block proposers.

And block proposers are the ETH Stakers.

All of the potential centralization threats of the best MEV searchers bots get passed downstream to the block builders, which get passed downstream to ETH stakers.

And this is really, really, really bullish for ETH.

Does it really end at the ETH Stakers?

Not necessarily.

Matt Cutler from Blocknative thinks that this competition will actually return back to the point of Transaction Origination: the wallet.

Since every transaction has an associated value with it, the wallet becomes a very powerful place of consumer interaction. Wallets become the source of proprietary deal flow; deal flow that block builders can capitalize on.

So block builders are likely to pay wallets for their transaction flow. For example, a specialized block builder could pay Metamask a lot of money to only route transactions to them, and not broadcast them to the world.

This sounds bad! Metamask users are going to have their transactions fleeced just like Citadel and Robinhood!

I don’t think it will be like this. Instead, I think it will result in something like credit card points or airline miles… but instead with actual monetary rewards like ETH or DAI.

Wallets will pay you to use them. All the margins that are extracted by this process might logically conclude with the transaction originator (that’s you!) with a rebate or kickback by your wallet service provider.

And naturally, this concludes the Ethereum Transaction Watershed cycle.

After the value of transactions has converged on a central pool: ETH stakers, it evaporates into the air, condenses into clouds, and rains down upon the mountains once again, returning to the top of the funnel, and feeding the Ethereum ecosystem with a constant flow of nutrients to feed off of.

Congrats fam, we built a self-perpetuating ecosystem 💪

Let a thousand dapps bloom.

Thanks for reading!

- David

P.S. Bullish humanity📈

Action steps

- 📖 Read David’s previous Everything You Need to Know About the Merge