Dear Bankless Nation,

I released a covid prep plan at the beginning of the outbreak. I think the predictions mostly panned out (though the fast V-shape stock recovery was a surprise).

It’s time to look at the broader macro-social landscape again today.

Four things I see happening right now.

1. $1,200 to shut you up

Hush money. It’s what those in power give to those without it to shut them up. Congress is on the cusp of approving another $1 trillion stimulus with another $1,200 check to each qualifying American. Bandaid meet bullet hole.

No question the economic fallout from covid-19 has been great. Objectively America’s response to covid-19 has been a failure so far. Stocks now approaching all-time-highs while the middle class gets gutted—that’s the Cantillon effect in action—when money is printed it goes to those close to the spigot.

Here’s another $1,200 in shutup money.

Don’t revolt k?

2. Boomer economy not working

If you’re young. If you’re middle class. If you don’t own stocks. If you live in a country without a global reserve currency. Then it’s not your economy.

It’s theirs.

The boomer economy was divvied up and claimed before you were born. The rules set. So now you have two options—you can join their game. Accumulate stocks. Get the boomer job. Work the system. No shame in that.

Or you can opt out. (we’ll get back to that)

3. Creeping authoritarianism

If you ever supported pro-democracy Hong Kong on social media the banks will "altogether prevent [you] from accessing banking services" (source). Locking you out of the economy. Seizing your assets. You know—fighting terrorism.

I’m not talking Chinese banks doing this I’m talking: Credit Suisse, HSBC, & UBS.

Think that can’t happen where you live?

“Coming soon to a Western Democracy near you” as my friend Ben Hunt would say.

Good news! Nation states are upgrading to digital money systems in order to drive efficiency and give more power to their people! LOL, jk—they’re doing it to gain godlike powers.

4. Twilight of American dominance

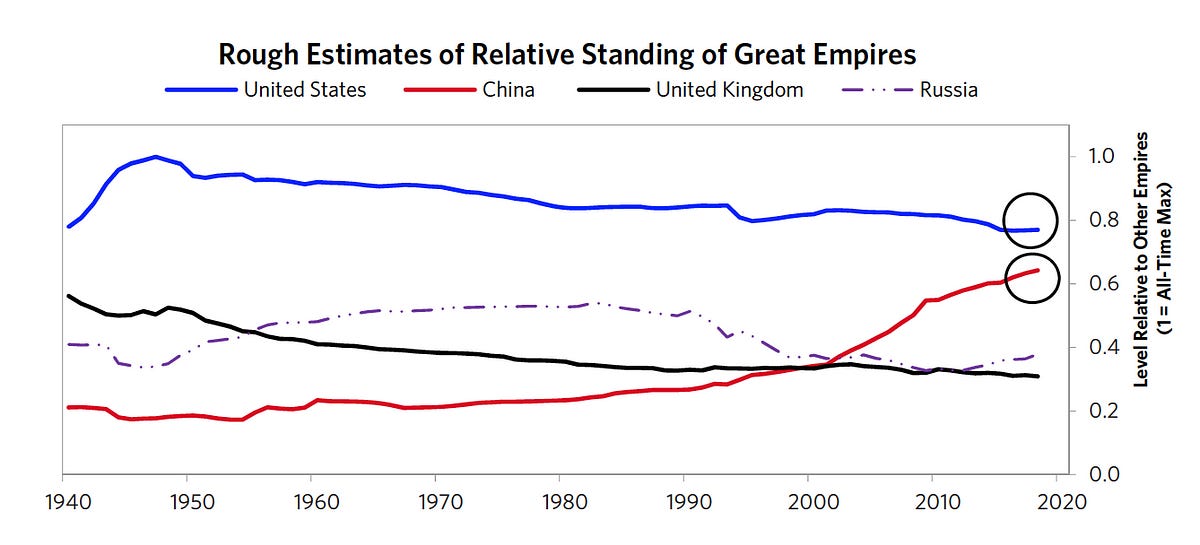

China rising—the U.S. diminishing. That’s the trend since the late 2000s. For the best supporting evidence of this look to Ray Dalio.

A rising power meets an incumbent power. Trade wars now. But trade wars can turn into cold wars can turn into hot wars. The dollar still undisputedly dominant—but reserve currencies are usually last to go in a waning empire.

Dalio again “the US is now very powerful because it can print the world’s money and would be very vulnerable if it lost its reserve currency status.”

What choices will the U.S. make when faced with this dilemma? What of China?

So let’s recap:

- Governments printing hush money so the oligarchs stay in power

- The boomer economy not working for a large swath of the people

- Authoritarianism creeping into our governments & banks

- American dominance entering its twilight

What to do?

There’s no perfect answer so I’ll just tell you what I’m doing.

I’m opting out.

I’m exiting the boomer economy.

I’m moving to an economy of vast unclaimed land. One with infinite whitespace. One where they can’t print money for their cronies. One that’s open to anyone and that’s neutral to geopolitics. One the tyrants and authoritarians can’t stop.

I’m going bankless.

Thanks for the $1,200 guys. We’re buying ETH.

- RSA

P.S. It’s Badge Minting Week—members who joined in July will get a claim link for their badge on Saturday August 1