Dear Bankless Nation,

Two years ago, I published my first article on Bankless titled “The Trillion Dollar Case for ETH.”

The article ran through a basic thought experiment on how the demand for ETH as collateral in DeFi would propel Ethereum to a trillion-dollar valuation.

ETH was trading at a $15B valuation at the time, and the ecosystem was a fraction of what it is today. It was a very simple thesis based on an existing trend.

The thought experiment didn’t account for anything other than the fact that ETH was being locked into financial protocols built on the network. No EIP 1559, no Proof of Stake, nothing—just the demand for ETH as collateral for a new financial system.

That was the trillion-dollar use case.

So it’s surreal to look back and see how far we’ve come. Crypto is now a multi-trillion dollar asset class, Ethereum is sitting comfy at a 12-figure market cap, and I’m now the Editor for the publication that shared my article years ago.

Ethereum reaching a trillion-dollar valuation no longer seems out of the question. Actually, it feels inevitable. But more importantly, it’s only just scratching the surface for the potential of this industry.

Recently, there’s been a fair amount of uncertainty with the Fed’s forecast for multiple rate hikes. Crypto has taken a downturn as a result. The good news is that it doesn’t really matter. Rising interest rates are a short-term catalyst in a long-term game.

In the long run, crypto is a $100T asset class.

As part of my two-year anniversary for publishing on Bankless, I’ll explain why this will be the case through a similar, very simple thought experiment.

It only accounts for two factors: (1) One of the greatest wealth transfers in modern history and (2) a recent academic paper that hypothesizes how markets move based on the flow of capital.

The Greatest Wealth Transfer in Modern History

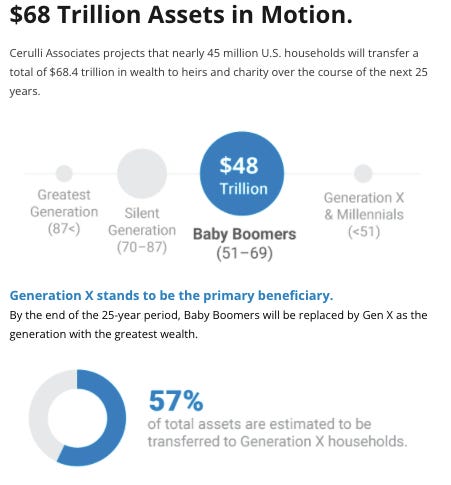

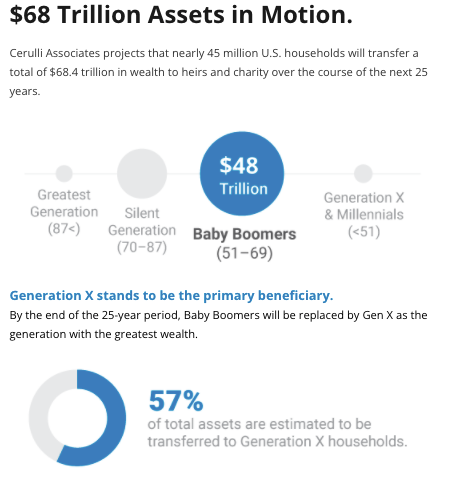

According to this study, baby boomers are set to transfer upwards of $68T to Millennials and Gen X over the next two decades. It’s being referenced as The Great Wealth Transfer and it will be one of the largest wealth transfers in modern history.

That’s all we need to know for now. Let’s keep this in the back of our minds.

The Inelastic Market Hypothesis

Last year, an interesting paper started circulating in the investing community.

The paper was authored by Xavier Gabaix and Ralph S. J. Koijen that hypothesized how assets move based on the in and outflows of capital.

It made the claim that assets don’t move 1:1, meaning that buying $1 of an asset doesn’t correlate to increasing its market valuation by $1.

Instead, the reaction is rather inelastic where a $1 buy increases the valuation by $X, depending on the asset and its liquidity. If you’ve been in crypto long enough, this concept should be rather familiar. According to the study, the stock market has a market inelasticity factor of around 8, meaning that $1 of capital will increase the market capitalization by $8.

This is due to the fact that there’s a degree of illiquidity as households and institutions hold certain assets with no intention to sell, causing volatility in price movements. They then go forward to theoretically and empirically prove why this is the case.

They call this the inelastic market hypothesis.

Interestingly, we published an article in the Bankless newsletter in October 2021 from Nilo Orlando that applied this framework to calculate the market inelasticity of Bitcoin and other crypto assets. It’s harder to identify the exact inelasticity for Bitcoin given that we don’t have nearly the same amount of data; however, the conclusion was tentatively around ~20.

This means that $1 flowing into Bitcoin increases its market cap by $20. This makes sense as Bitcoin (and the crypto market as a whole) is significantly more volatile than the stock market.

You’re probably starting to see where we’re going with this.

$100T Napkin Math

There’s $68T worth of capital that will end up in the hands of millennials and Gen X in the next twenty years.

While a significant amount will be handed to them in the form of equities, real estate, bonds, and more, it begs the question: how much of it will flow into crypto?

It’s probably a safe assumption that a marginal amount of that $68T is already in crypto assets—if any. Baby Boomers aren’t known for their interest in magic internet money. We can also imagine that Millennials and Gen X are significantly more open and optimistic about crypto. And they probably won’t want to hold government bonds that are netting a negative return.

Instead, they’ll want to hold internet bonds.

This is where our thought experiment begins.

How much of the $68T of capital will end up in crypto? And what’s the effect on the market cap when we factor in the market inelasticity hypothesis?

Let’s start small.

If 0.1% of the $68T ends up flowing into crypto, that would mean there would be $68B entering into the market.

If we apply our inelasticity factor of 20, this would mean that the market cap for crypto would increase by over $1.3T, roughly representing a 50% gain from where we stand today.

But 0.1% of the $68T is nothing. To give some context, 83% of millennial millionaires have a substantial position in crypto. The most financially successful young adults today have material positions in this asset class. That’s very telling of what younger generations perceive about this emerging market: They’re bullish.

As such, we can imagine that Millennials and Gen X will allocate more than 0.1% of their inheritance into crypto.

What if we bump this up 1% of the $68T?

This would mean $680B would flow into the crypto market, resulting in an increase of over $13T to crypto, bringing the total to $15T. That’s a 10x increase from today!

At today’s dominance levels, where Bitcoin holds 38% of the market and Ethereum represents 18%, this would put their valuations around $300,000 and $27,000, respectively. Pretty insane right?

But I still think that’s a relatively bearish case.

I would personally bet that it ends up somewhere in the 5-10% range.

At 5%, the crypto market cap would reach $68T.

At 10% of the $68T, crypto would quickly surpass the $100T mark at $138T.

For reference, this would finally put crypto in line with major asset classes like equities, bonds, fiat currencies, and real estate.

I know it may sound crazy to some of you reading this, but so did ETH at $1T just two years ago.

At the very least, this gives you a framework to consider. You can change the inelasticity factor. You can adjust the forecast on the inflow of capital.

Run the numbers for yourself.

Crossing the Chasm

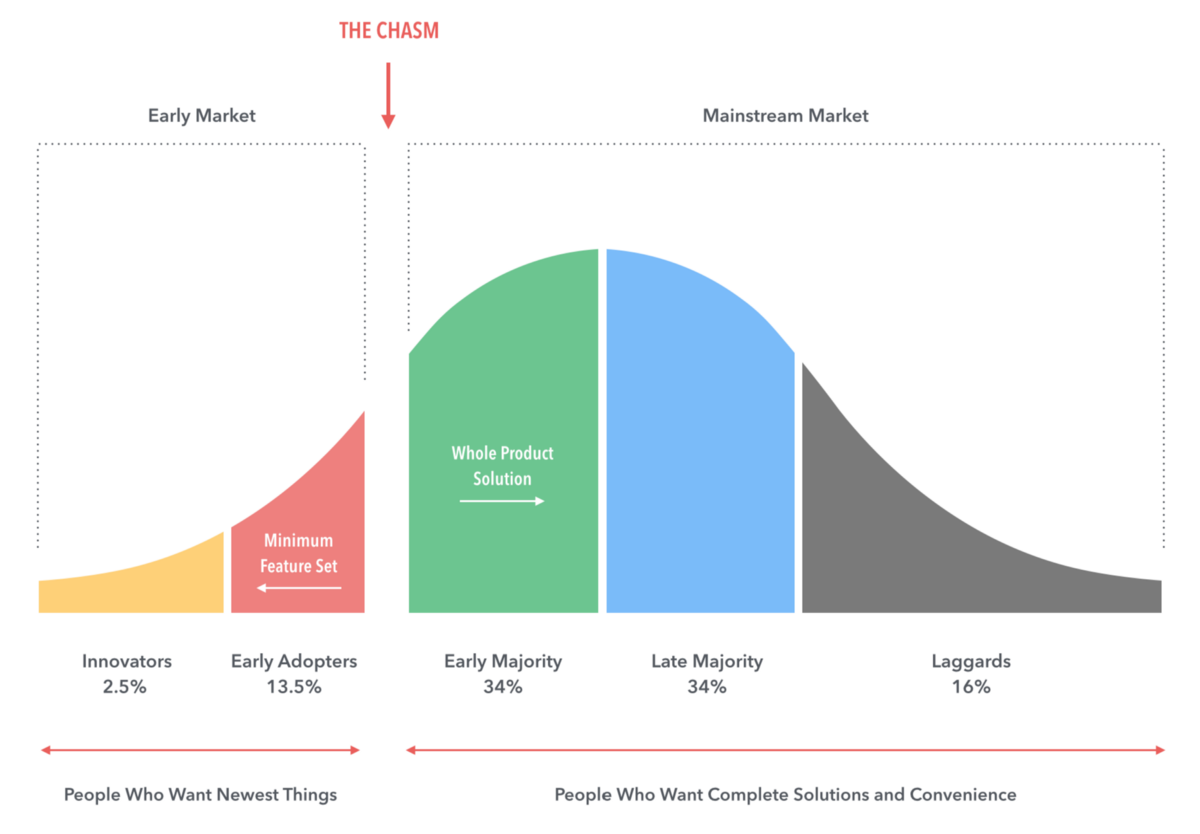

Crypto has crossed the adoption chasm.

It’s a multi-trillion dollar asset class. It’s being adopted as legal tender by nation-states. Legendary investors are allocating towards it. Celebrities are collecting NFTs.

Crypto is no longer an “if” question, but a “when” and “how”.

This article outlines one potential avenue for when and how crypto will join the same ballpark as other major asset classes. But let’s be clear: it’s just a simple thought experiment. All of the numbers should be taken with a grain of salt.

It only factors two independent things. It doesn’t really account for any of the qualities that make crypto valuable.

It doesn’t account for DeFi as a new, open financial system for the world.

It doesn’t account for the cultural revolution that’s happening with NFTs.

It doesn’t account for DAOs as the new LLC.

And it definitely doesn’t account for the fiscal irresponsibility of central banks and governments that this industry was founded to protect against.

All we know is that we’re in the midst of one of the greatest wealth transfers in human history.

The only question you need to ask is: How much of that will flow into crypto?

- Lucas