The trillion dollar case for ETH

Dear Crypto Natives,

If you’ve been following the program you know the concept of economic bandwidth—but have you ever run the numbers?

If DAI became a major currency what are the implications for the price of ETH?

How much demand will protocols like Synthetix drive to ETH?

Why does ETH needs to be worth trillions for this whole thing to work?

I loved this simple thought experiment.

Yes the numbers should be taken with a grain of salt—yes, collateral ratios will be different, of course the assumptions can’t be extrapolated as simply as presented here.

Don’t let that distract you from the core point of this exercise which is this:

A trustless economy requires trillions in economic bandwidth.

What could that mean for ETH?

- RSA

There’s a growing demand for Ethereum’s money protocols. In the past year alone, we’ve seen decentralized finance (DeFi) aggregate over $700M in TVL (total value locked).

Projects like MakerDAO and Compound leverage Ethereum’s permissionless financial infrastructure to create a new paradigm for global finance. MakerDAO allows global access to trustless, stable value. Compound opens up the door for the global population to earn high yielding interest rates.

What’s the common theme? All of these money protocols require permissionless, trustless value to fuel them. And where does that value come from? It’s not US Dollars. It’s not Bitcoin. It’s Ether.

In short:

Ether is trustless value supplying economic bandwidth for Ethereum’s permissionless money protocols.

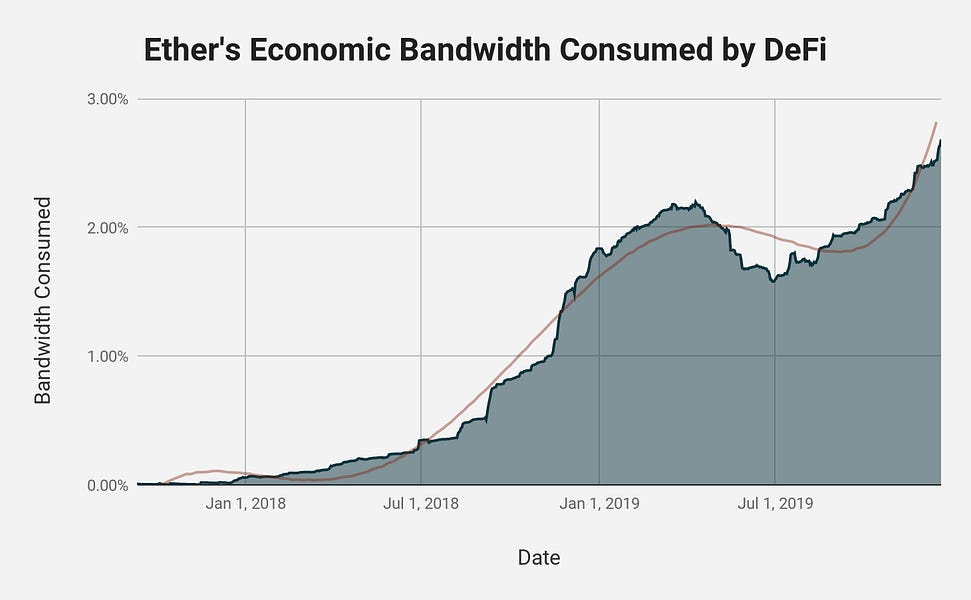

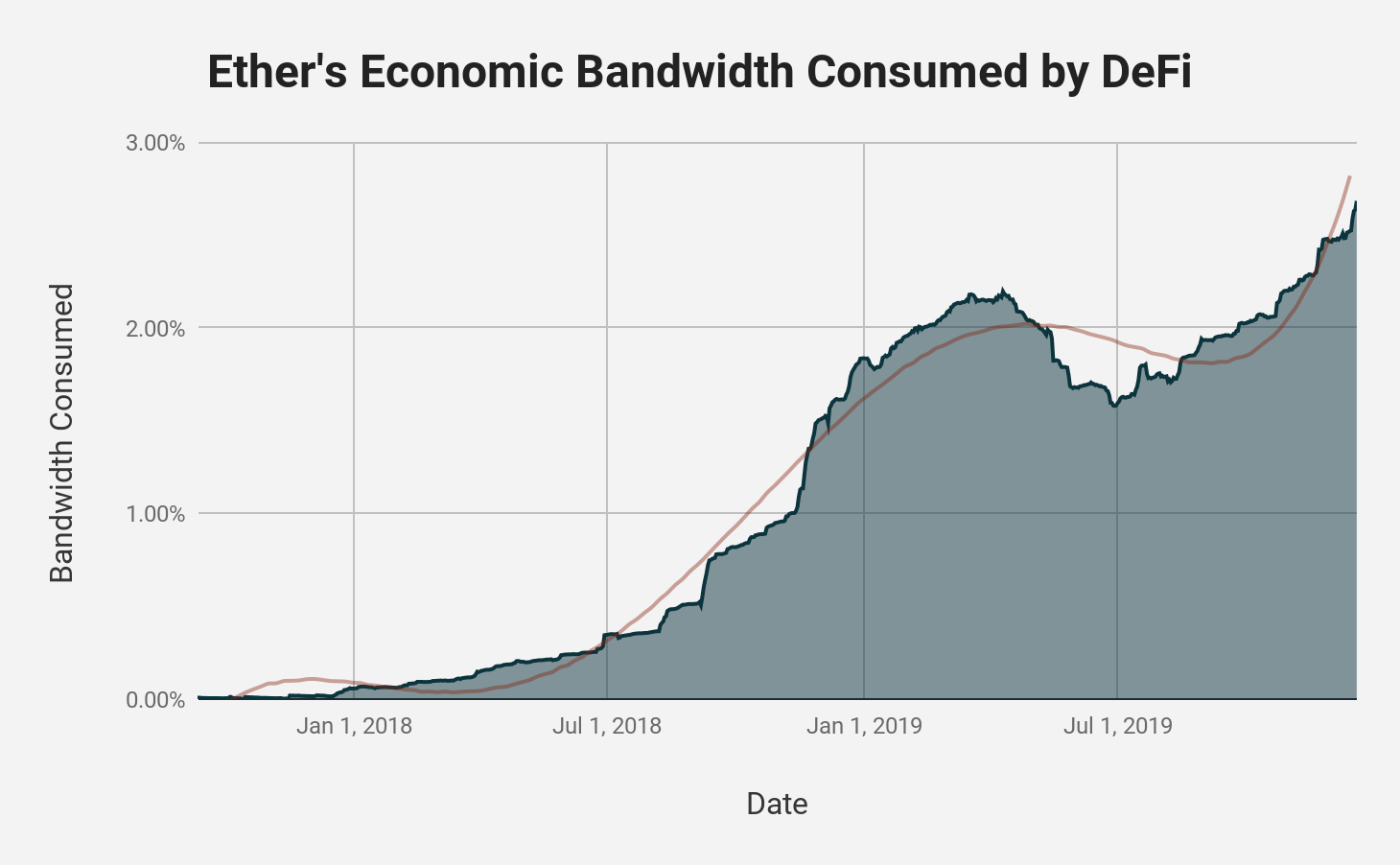

These money protocols have continued to consume more and more of Ether’s economic bandwidth over the past few years. Towards the latter half of 2019, DeFi’s consumption of Ether’s economic bandwidth experienced substantial growth and is now consuming nearly 3% of the asset’s total economic bandwidth.

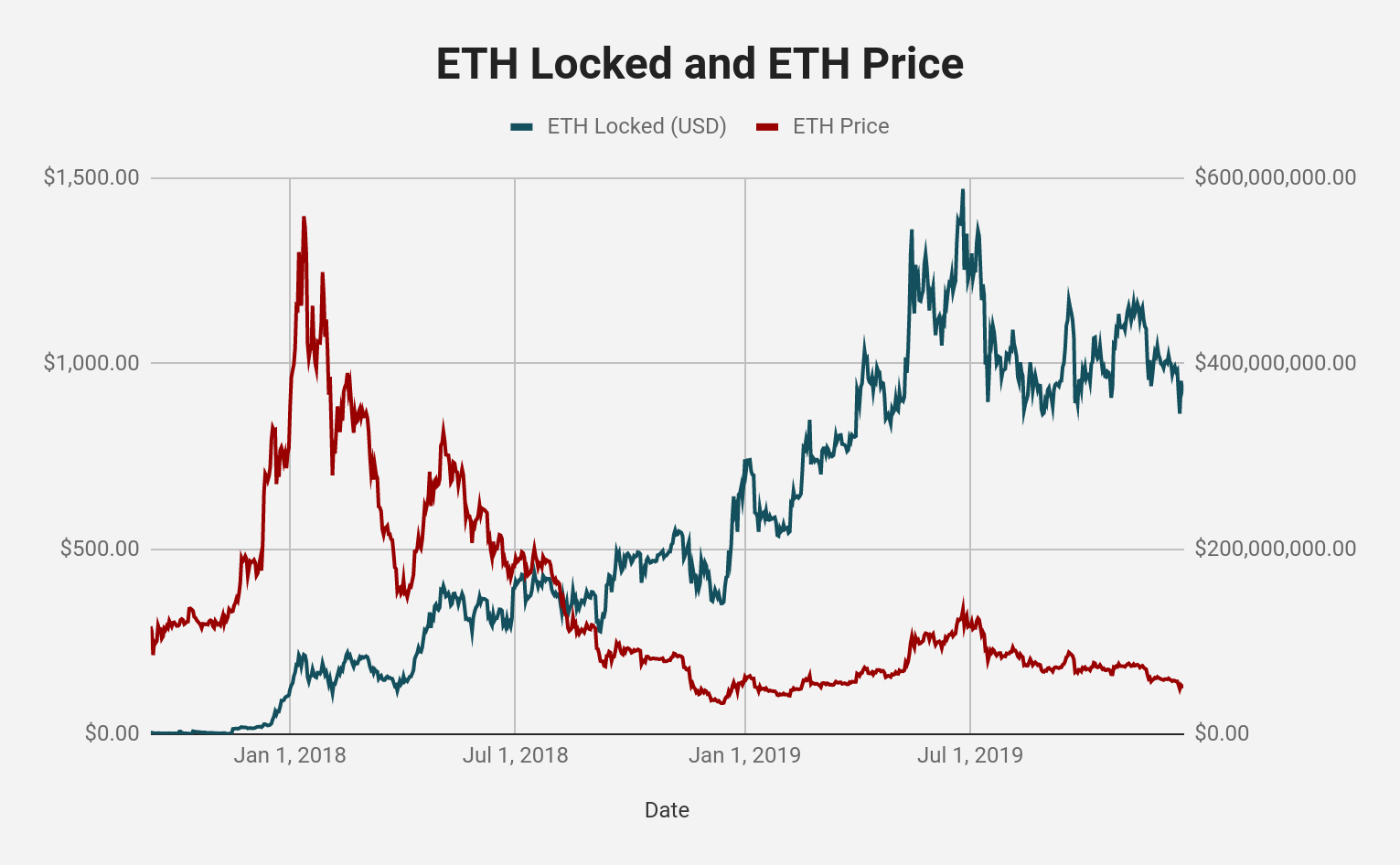

Within a few days of the new year, DeFi reached 3,000,000 ETH locked, or 2.7% of the total circulating ETH supply. Generally speaking, DeFi’s consumption of Ether’s trustless economic bandwidth has only increased since its initial burst in back in January 2018. Despite a declining price of Ether throughout 2019, the amount of ETH locked in DeFi continues to rise today.

Projects Competing for Bandwidth

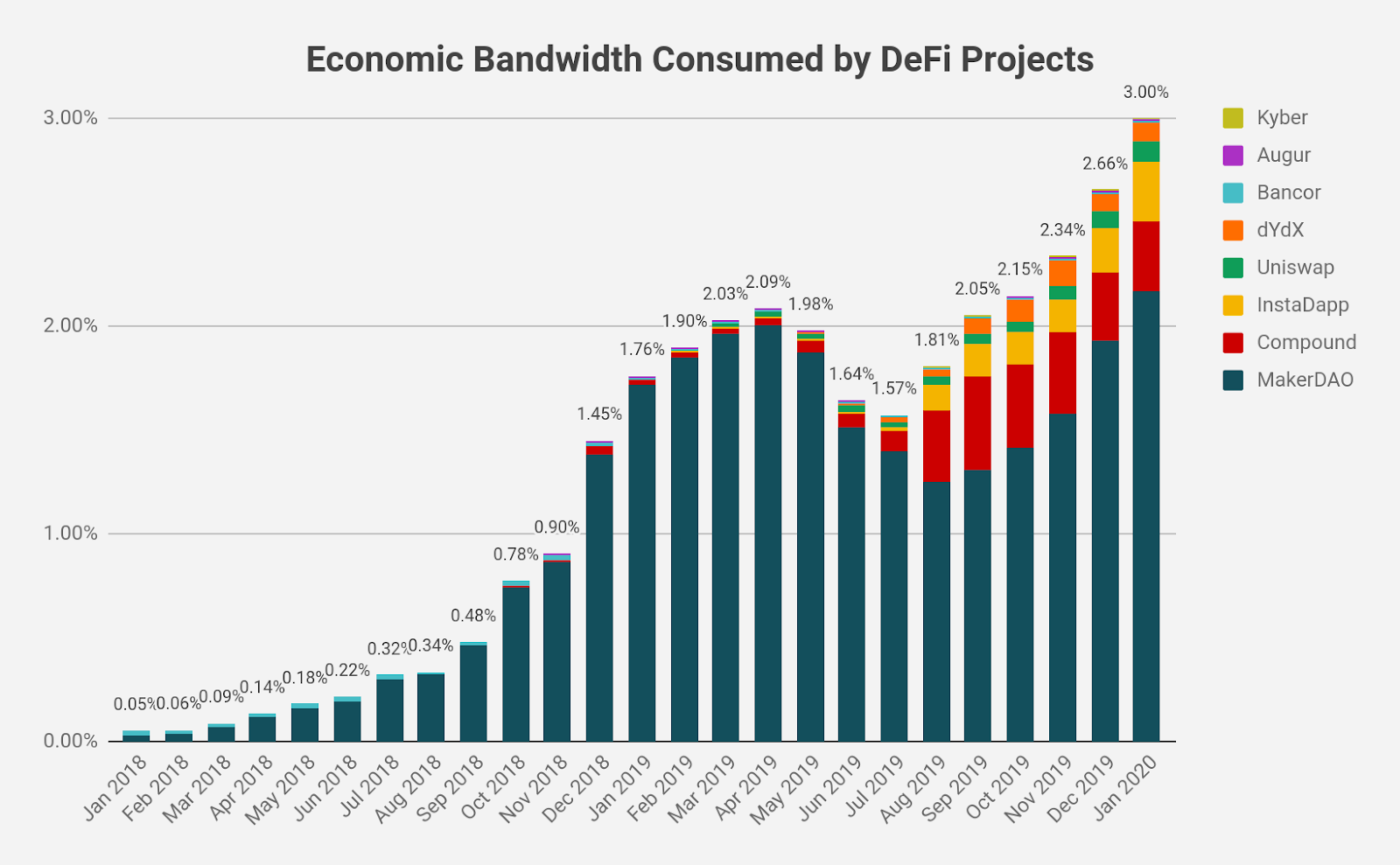

Before the start of 2019, DeFi largely comprised of two projects: MakerDAO and Bancor. Since then, dozens of new money protocols have emerged, carving out their own niche within the space. While MakerDAO continues to dominate permissionless finance, devouring over 2% of total bandwidth, we’ve seen an increasing amount of competition for Ether’s economic bandwidth from other lending protocols, derivatives, decentralized exchanges and DeFi products at large.

We’ve seen Compound, Uniswap, and InstaDApp explode into the scene, each providing permissionless mechanisms for lending, exchanging, and seamlessly managing assets.

All of these projects are eating up a slice of Ether’s trustless economic bandwidth. As of January 2020, Compound absorbed 0.34%, InstaDApp 0.29% and Uniswap 0.10%.

One other permissionless money protocol, Synthetix, has also seen an absurdly high growth this year. For those unfamiliar, Synthetix is a permissionless synthetic asset issuance protocol built on Ethereum. While the protocol has aggregated over $160M in total value locked, we’ve omitted it from this graph as it doesn’t use Ether as trustless value to collateralize its synthetic assets. Not yet anyway—mmore on this later.

Despite the growing competition for Ether’s trustless economic bandwidth, we’re only seeing the tip of the iceberg. As a historical comparison, The DAO in 2016 consumed $150M of Ethereum’s total $1.1B in 2016, or 13.3% of total economic bandwidth at the time.

While the Ethereum community was in its nascency at the time, this is an interesting benchmark to use for a popular application’s consumption of the asset’s economic bandwidth. If permissionless finance is Ethereum’s value-driving use case, the biggest money protocols each consuming 5-10% of total economic bandwidth to fuel global finance isn’t out of the question.

However, in order for Ether to successfully deliver permissionless, trustless finance to the world it will require a massive amount of economic bandwidth to support it.

Importance of Trustless Economic Bandwidth

In order to build a trustless economy, you need trustless value. Trustless value is only possible with decentralized crypto-native assets that settle on-chain with no central backing. BTC and ETH can be seen as trustless assets in their respective networks.

The aggregate liquid value of these trustless assets is the network’s trustless economic bandwidth. In other words, the total economic bandwidth of Ethereum in USD terms is the liquid market cap of Ether.

High economic bandwidth is vital to the overarching success of Ethereum’s permissionless finance. The higher the economic bandwidth, the more financial assets it can fuel with the network’s underlying trustless asset. If the value of Ether (in USD terms) rises 10x, Ethereum’s ability to collateralize new financial assets also increases 10x.

However, with Ethereum’s total bandwidth sitting around just $16.2 billion dollars, today Ethereum can’t even support a small nation-state economy let alone the entire world financial system.

Addressable Market for Economic Bandwidth

Fortunately there’s no shortage of addressable market. Global debt is $250 trillion, derivatives $542 trillion, and equity markets are closing-in on $90 trillion in aggregate value. Traditional capital markets are massive!

So let’s take a look at how much economic bandwidth Ethereum would need to simply capture a small slice of legacy capital markets.

Bandwidth needs of DAI

Mario Conti, Head of Smart Contracts at MakerDAO has a goal for Dai to hit 1 billion in circulating supply by the end of 2020.

Let’s assume that this is true, and all other factors within the system remained constant. MakerDAO’s collateralization ratio stays around ~250%, the price of Ether sits idle at ~$150 for the remainder of the year, and the liquid supply is ~108M ETH. In addition, for the sake of simplicity for our projections, we assume that Ether makes up 100% of the collateralized assets for Dai.

For Dai to hit 1B in circulating supply at current prices, 15.34% of all ETH would have to be locked by the end of the year in order to supply enough economic bandwidth for Conti to reach his goal. A few percentage points above The DAO’s peak in 2016.

Now let’s say that Ether has a great year and rises to a price of $500, still less than half from it’s ATHs. Assuming the same collateralization ratio of ~250%, only around 4.60% of circulating ETH would need to be locked within the system, doubling its current ~2% dominance while matching the entire DeFi market today in bandwidth consumption.

Let’s Talk Real Numbers

Ethereum is aiming to become the infrastructure for permissionless finance. An entirely new, alternative, digitally-native, financial system fueled by a trustless asset. Since Dai is stable Ether and is seen as the primary medium of exchange for permissionless finance, we can essentially view Dai’s addressable market as the market for fiat currencies and its encompassing money supply.

What if Dai served Argentina?

Now, let’s assume Conti’s home country of Argentina begins to adopt Dai as the primary currency for commerce as the appetite for the Argentine Peso dwindles. Argentina’s M1 money supply was reported at $26.64 billion USD in October 2019. For those unfamiliar, M1 includes all assets and funds in a national economy that are readily accessible for spending, including physical currency and coin, demand deposits, travelers’ checks and other deposits.

Given the current climate with Argentina’s financial system, let’s say Dai is widely successful and captures 51% of the Argentine M1 supply, resulting in a circulating supply of 13.58B DAI.

Assuming the above collateralization ratio and the current price of ETH at ~$150, the MakerDAO system would need 226.4M ETH locked (208.4% of the total liquid supply) in order to supply the 13.58B Dai.

Obviously this is impossible given Ether’s issuance schedule, but it does begin to show the importance of economic bandwidth.

The only realistic way for MakerDAO to supply that much Dai is for the economic bandwidth of ETH to increase by a few orders of magnitude. (Or, for Dai to become more premissioned by using larger portions of trusted assets as collateral).

Therefore, in order to provide a sustainable amount of economic bandwidth to become the primary MoE in Argentina, the price of ETH would need to reach anywhere between $2,500 (12.50% of liquid ETH supply locked) to $10,000 (3.13%).

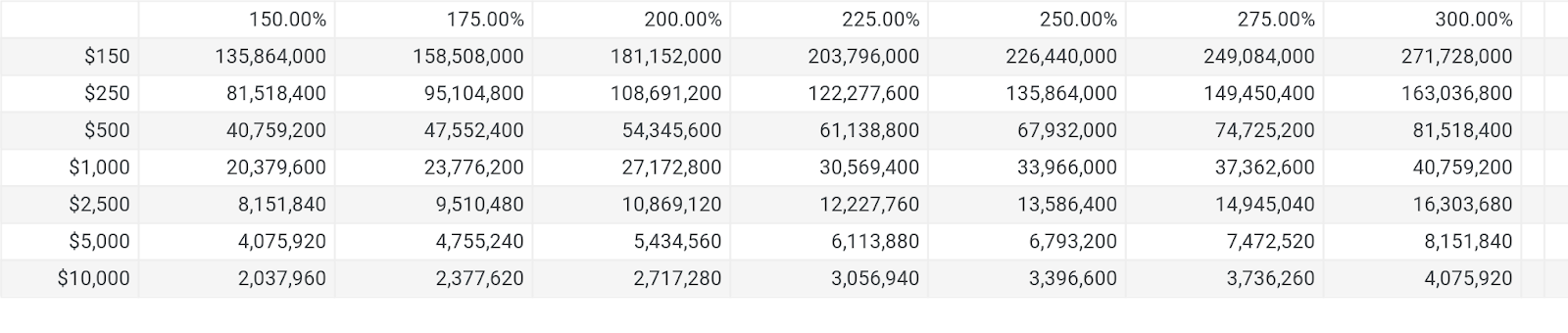

(Above) Necessary ETH locked to reach 51% of Argentina’s M1 Supply ($13.58B) given the respective ETH price and collateralization ratio

And that’s just for Argentina

While 13.58B in circulating Dai seems like a moonshot today, it’s actually just a tiny slice of a potential future for a global, permissionless financial system when you consider traditional capital markets aggregate hundreds of trillions in value.

Let’s take it a step further and theorize that Dai starts competing with the all-mighty US Dollar as a form of money in global commerce. There’s $4.034T in US dollar M1 money supply and let’s say Dai captures 10% of it, creating a circulating supply of 403.4B Dai.

How much economic bandwidth would Ether need to provide to successfully mint this much Dai assuming a collateralization ratio of ~250%?

Even at ATH prices of $1,400/ETH, 663.1% of the total liquid supply would need to be locked in order to supply enough bandwidth for the 403B in circulating Dai.

We’d need more economic bandwidth.

With a hypothetical 46.42% of total liquid supply locked in MakerDAO, over 3.5x higher than the DAO peak in 2016, the price of ETH would have to reach $20,000 to supply enough economic bandwidth to fuel hundreds of billions in circulating Dai.

At 18.57% of liquid ETH supply locked, we’re looking at an ETH price of $50,000.

Lastly, to bring the required ETH locked into the ballpark of today’s consumption rate, let’s say ~3.7% of total bandwidth, the price of ETH would have to surpass $250,000 with total trustless economic bandwidth (i.e. liquid market cap) reaching $27T.

That’s a 1,665x increase from today’s ~$16.2B market cap.

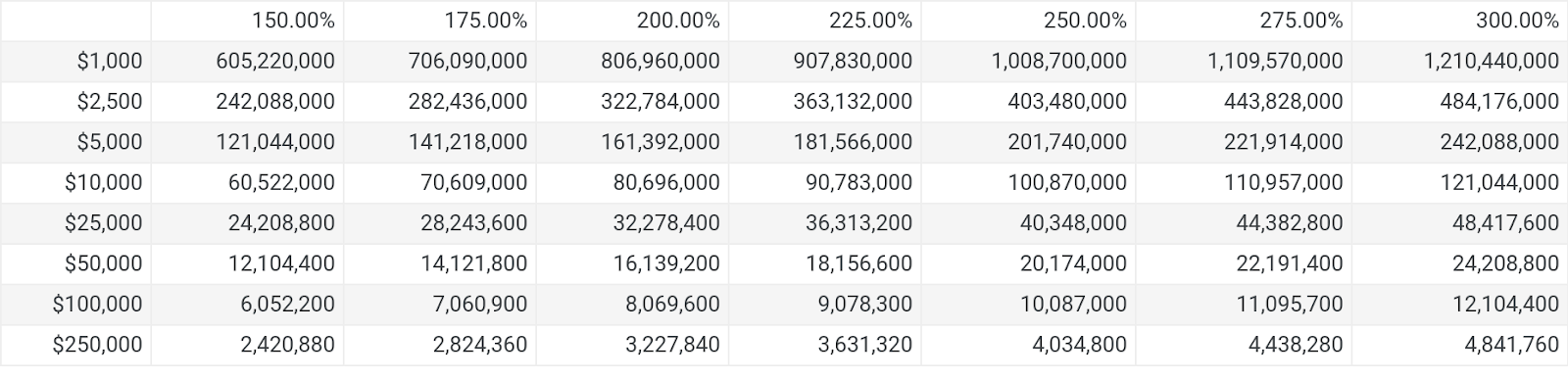

Necessary ETH locked to reach 10% of the United States’ M1 Supply ($403.4B) given the respective ETH prices and collateralization ratios

But Wait, There’s More…

We only outlined MakerDAO, one specific money protocol for permissionless, trustless stable value. However, there’s dozens of emerging money protocols all competing for economic bandwidth, and all tackling different addressable markets.

Bandwidth needs of Derivatives

The biggest capital market in existence today is the derivatives market, comprising of $640 trillion in notional contract value as of June 2019.

With that, let’s start off by assuming 0.1% of global derivatives is absorbed by Ethereum’s permissionless finance in the future, or $640B in notional contract value.

As collateralization ratios for ETH-based derivatives are largely untested so far, we’ll also have to assume our collateralization ratios rather than relying on circulating market data. With that in mind, we can make some relatively fair assumptions based on the ratios from different money protocols on the market today. MakerDAO has an average collateralization ratio of 250% and Synthetix, a derivatives issuance protocol, averages an active collateralization ratio of 714% with its native asset, SNX.

Given that derivatives are substantially more volatile than MakerDAO’s system for stable, permissionless value and ETH is a substantially more liquid asset than SNX, we can assume that collateralization ratios for tokenized derivatives will lie somewhere between 250-750%.

Therefore, let’s assume a base collateralization ratio of 350% for derivatives contracts collateralized by a liquid, trustless asset such as ETH.

If we wanted to hit $640 billion in tokenized derivatives collateralized by Ether, at around ~18.67% of liquid ETH supply locked, it would require Ethereum to provide $12T in total economic bandwidth and a price of ETH at $100,000.

Taking this one step further, let’s imagine Ethereum captures 1% of the $640T in existing derivatives. At our collateralization ratio of 350% and locking up the same 18.67% in liquid supply, Ether would ultimately have to hit $1,000,000 in order to supply enough economic bandwidth to power the $6.4T in derivatives.

Bandwidth Needs of Synthetix

Looking at the numbers today, we can imagine it will be nearly impossible for Synthetix to successfully capture enough value to provide sufficient economic bandwidth for existing capital markets solely through its native token, SNX.

The protocol will have to add additional liquid collateral types in order to expand its economic bandwidth.

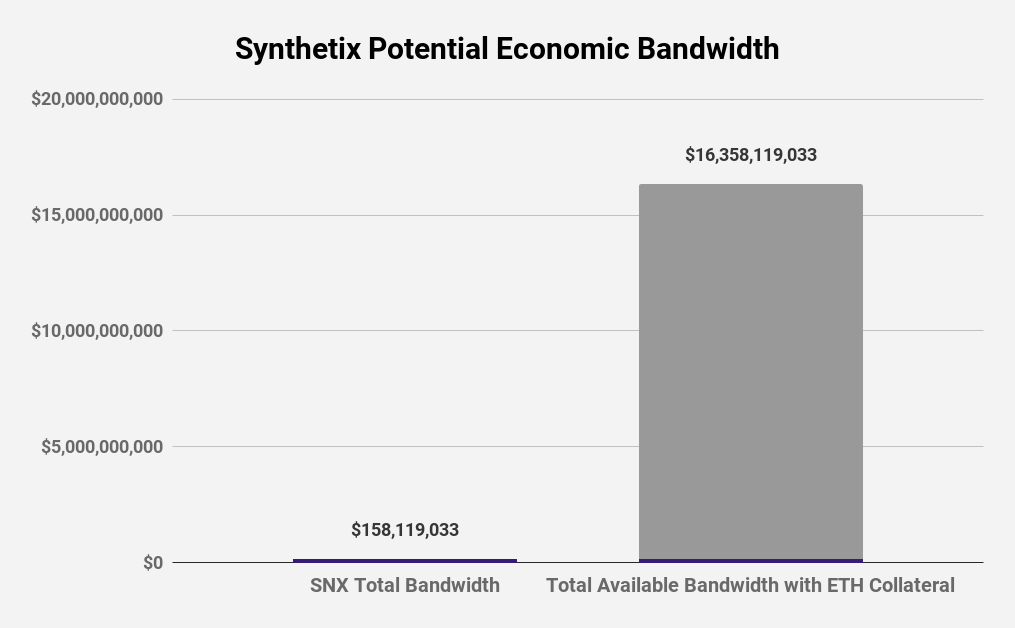

The protocol is beginning to reach its capacity as over 86% of the circulating tokens are currently being used to collateralize synthetic assets. There’s little room for additional tokens to be staked and therefore, the protocol must rely on a price increase in SNX to expand its potential economic bandwidth. However, by adding ETH as a trustless collateral type, it expands its total bandwidth by over 100x, allowing for an entirely new range of assets to be minted.

In September 2019, the Synthetix community opened up discussions about adding ETH as a potential collateral type for the protocol. Generally speaking, this should be a no brainer given the above graph and the implications it has on economic bandwidth for the protocol. (RSA note—appears Snythetix is planning to add ETH by January 30th)

Simply put, Synthetix can issue substantially more assets once they add more liquid, trustless collateral types like ETH.

To make this a reality, the biggest thing the Synthetix community will have to figure out is solidifying the economic model for new collateral types and ensuring value accrues to SNX when synthetic assets are issued through its protocol with different collateral types.

Conclusion

If Ethereum is going to create a new, alternative, permissionless, trustless financial system, then there’s no shortage of future demand for ETH as economic bandwidth.

If you have a low time preference, the next two decades for the proliferation of DeFi and permissionless finance at large is nothing short of exciting. There’s billions of individuals across the globe who could massively benefit from the future financial system being built today.

Hopefully this article serves as a thought exercise on the implications of trustless economic bandwidth and its importance within a trustless economy. Naturally, like any thought exercise, the exact numbers should be taken with a grain of salt.

The driving takeaway here is that in order for a decentralized smart contract platform with a native, permissionless, trustless asset to successfully provide the world with a permissionless, trustless economy, it will require its native asset to supply trillions in economic bandwidth. No crypto asset in existence today (not even all of them in aggregate) provides enough economic bandwidth to achieve this challenge.

With that in mind, there’s a long road ahead before we can make any meaningful strides towards creating a bankless future. A long but exciting one.

Action steps

- What’s the total potential size of the trustless money system?

- How much economic bandwidth would be required for this money system?

- Further reading: ETH and BTC are Economic Bandwidth