10 Ethereum charts that hit ATHs in 2020

Level up your open finance game 5x a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

ETH price is still down over 50% from all-time-highs (ATHs).

And yet…almost every other Ethereum metric already hit an ATH in 2020.

Will price catch up?

That’s for 2021 to decide.

For now Lucas shows us 10 Ethereum charts that have already hit all-time-highs. Thanks to Nic Carter’s recent Bitcoin piece for inspiring this Ethereum version.

BTC just hit its ATH.

Something tells me ETH isn’t far behind.

- RSA

Holiday schedule 🎅

No newsletter tomorrow or Friday as we celebrate the holidays! Rest up and enjoy the downtime. We’ll see you on Saturday for the Weekly Recap! Happy Holidays. 🏴

🙏 Sponsor: Argent – DeFi in a tap (👈 go download this wallet now - RSA)

WRITER WEDNESDAY

Bankless Writer: Lucas Campbell, Editor & Analyst for Bankless

10 Ethereum Charts That Hit ATHs in 2020

In the lens of broader awareness, Bitcoin has been in the spotlight in 2020.

BTC’s narrative as digital gold and the “fastest horse” as an inflation hedge started gaining recognition from the investor community. As a result, the asset experienced a wave of new institutional interest, driving the price to new highs.

Legendary money managers like Paul Tudor Jones and Stan Drunkenmiller started pouring capital into the asset and spreading the gospel. Meanwhile, Square, Mass Mutual and MicroStrategy became the first batch of companies to hold BTC on their balance sheet. Some more than the others...

And while the Ethereum community had DeFi Summer 2020, which featured the explosion of interest and capital into decentralized finance and unlocked a novel distribution mechanism for the ownership economy, this craze largely kept itself inside the community.

All the while ETH still sits at more than 50% down from it’s ATHs.

And yet…the Ethereum Economy had an outstanding year. It’s worth highlighting. From the launch of Ethereum 2.0 and the DeFi yield farming craze, the ecosystem experienced exponential growth across the board. Dozens of Ethereum metrics reached new highs over the course of the year.

Here are ten Ethereum charts that hit ATHs in 2020.

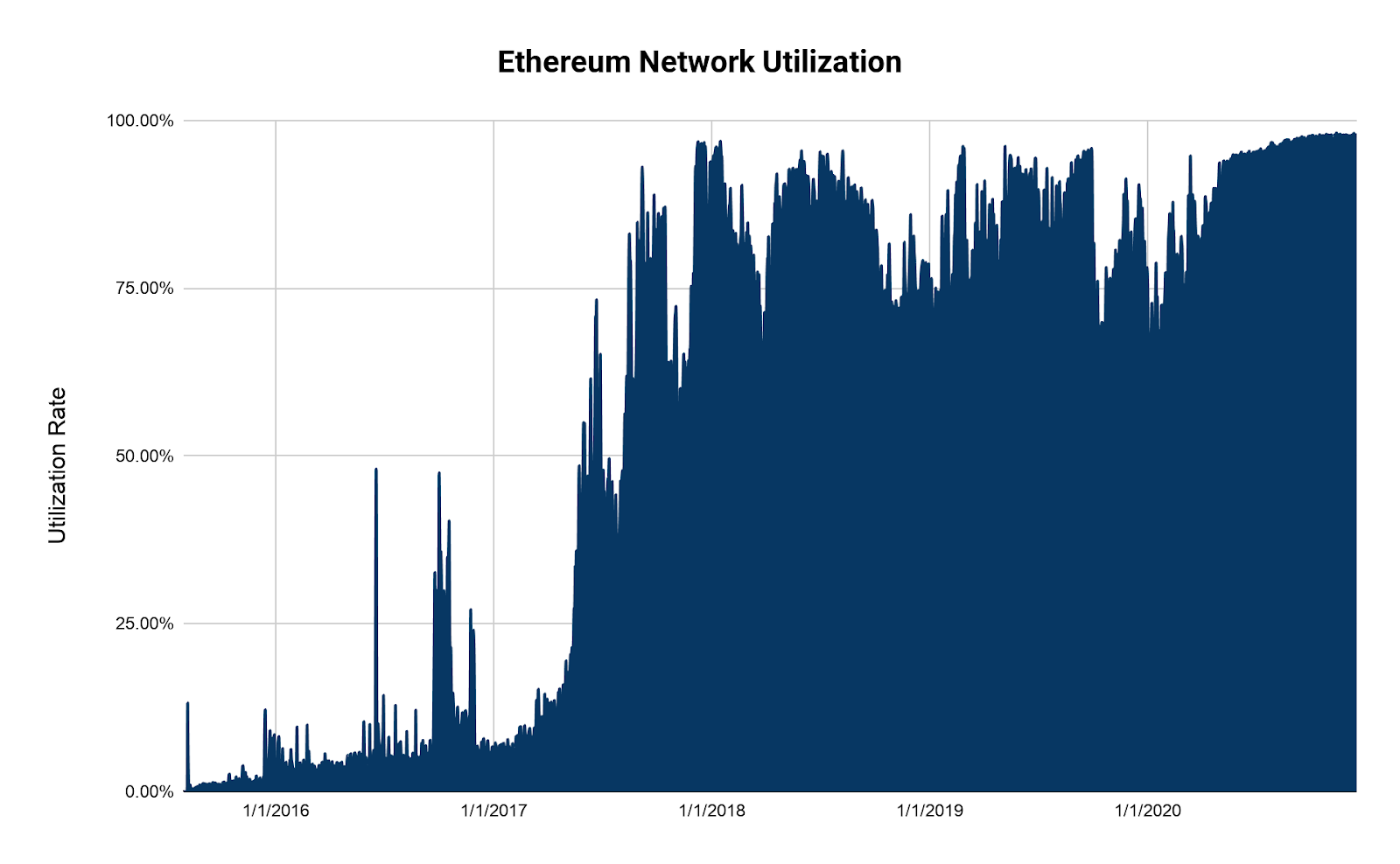

1. Ethereum Utilization

The network utilization rate is arguably one of the most fundamental metrics for gauging the health of any public blockchain. Simply put, it translates to the demand for block space. It means that people are actually willing to use (and pay for) the ledger as a settlement layer.

And the demand for Ethereum block space is maxed out. There’s such a significant, consistent demand to use the Ethereum that the network’s utilization rate has flatlined at the top. It literally can’t go any higher.

Whether it’s lending or borrowing capital on Aave or Compound, swapping tokens on Uniswap, trading derivatives on Synthetix, launching a DAO, or sending crypto dollars to anyone in the world, there’s significant demand for Ethereum as a settlement layer for the decentralized economy.

Now, Ethereum needs to scale. Whether it’s from layer 2 solutions like optimistic rollups or the coming upgrade of Eth2, the network has reached the point where there’s too much demand for block space and it needs an increase in capacity to realize its full potential.

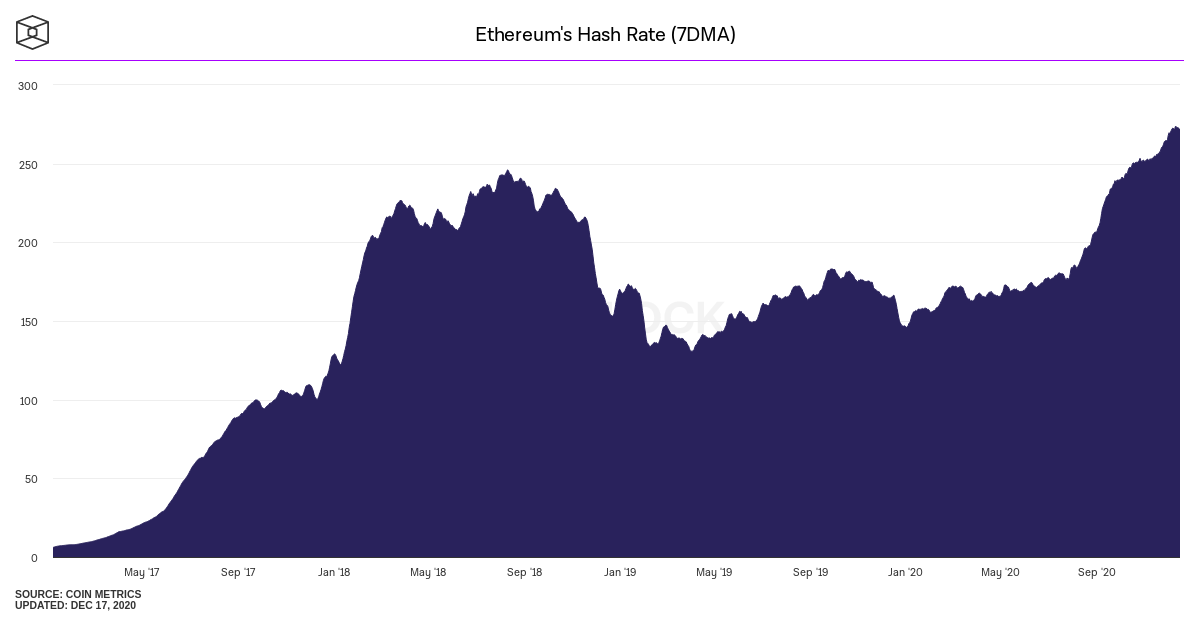

2. Ethereum Hashrate

Despite the upcoming transition to PoS, Ethereum’s hash rate has climbed to new highs. In other words, the network is more secure than it has ever been. According to The Block, Ethereum boasts over 271 TH/s, beating out it’s previous all time highs of ~240 TH/s back in September 2018 which it reached amid the bear market.

With the difficulty bomb set for July 2021, miners are gobbling up any remaining ETH they can before their hardware devices are bricked. But whether or not the community will need to delay the difficult bomb once more is whole another question.

Even though all Eth2 phases are being worked on in parallel, which should lead to a significantly faster rollout than the initial Phase 0 launch, the network shifting to PoS within the next six months seems a bit ambitious.

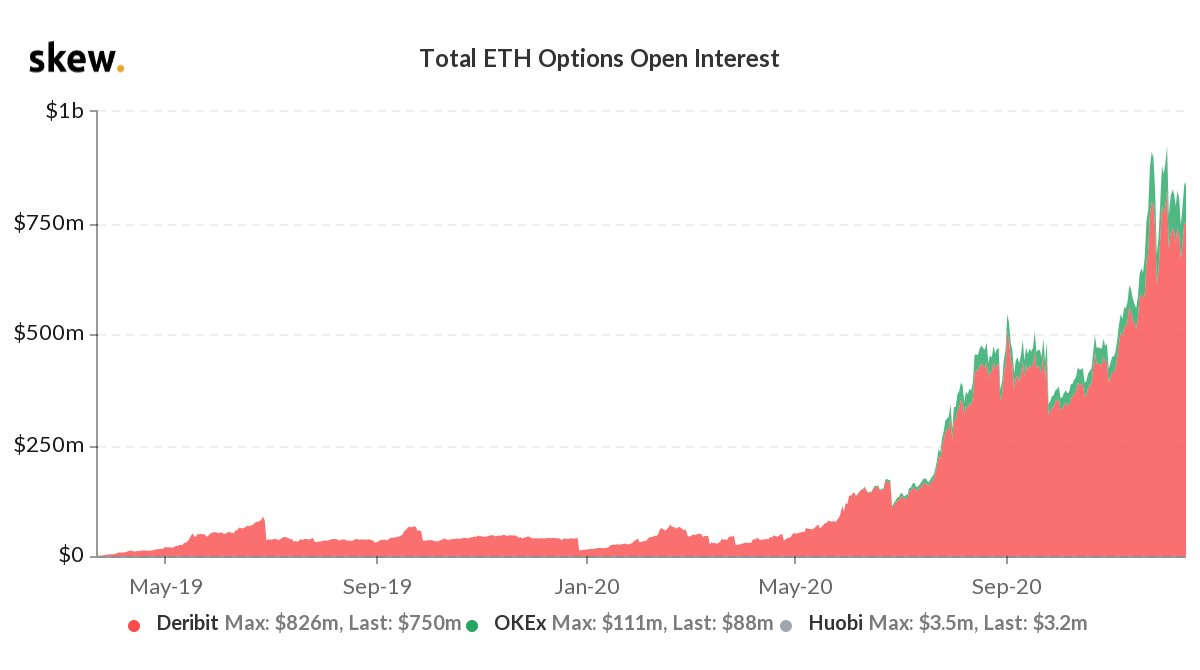

3. ETH Options Open Interest

Open interest for options is the total outstanding value of unexercised options. And this number for Ethereum is nearing $1B. While it’s still relatively small in the grand scheme of things, it does give us some key takeaways for the network. Nic described this aspect elegantly in his piece:

Just like derivatives first came into existence for farmers to hedge their exposure to crops and lock in a specific price for their harvest (and get liquidity on their future crops so they could buy seeds and fertilizer today), so too are options useful for the producers of Bitcoin — the miners. Miners can tell, roughly speaking, how many Bitcoins they will mine based on their equipment, under reasonable assumptions about hashrate. If they want to get an ‘advance’ on the coins they expect to mine, they can sell calls. This means they promise to deliver coins at a certain price on a certain date — but they get paid for that promise today. And with that cash advance, they can go ahead and finance their operation more efficiently.

What this chart tells me is that the producers of Bitcoin now have access to more sophisticated financial products which they can use to hedge their exposure. In theory, this should mean that the mining industry is more stable and less exposed to boom and bust periods. It lets miners focus on running their operations efficiently, and frees them from the burden of worrying about their unhedged exposure to their equipment.

In the same lens, the growth in Ethereum options enables more efficient miner operations due to the ability to hedge exposure against volatility and to finance operations by selling calls.

Additionally, options markets allow traders to express their outlooks more creatively, and that by having more tools available for market participants, it can naturally support more capital inflow.

All in all, the $1B in open interest is a positive sign for the network and the growth in financial tools available for all market participants.

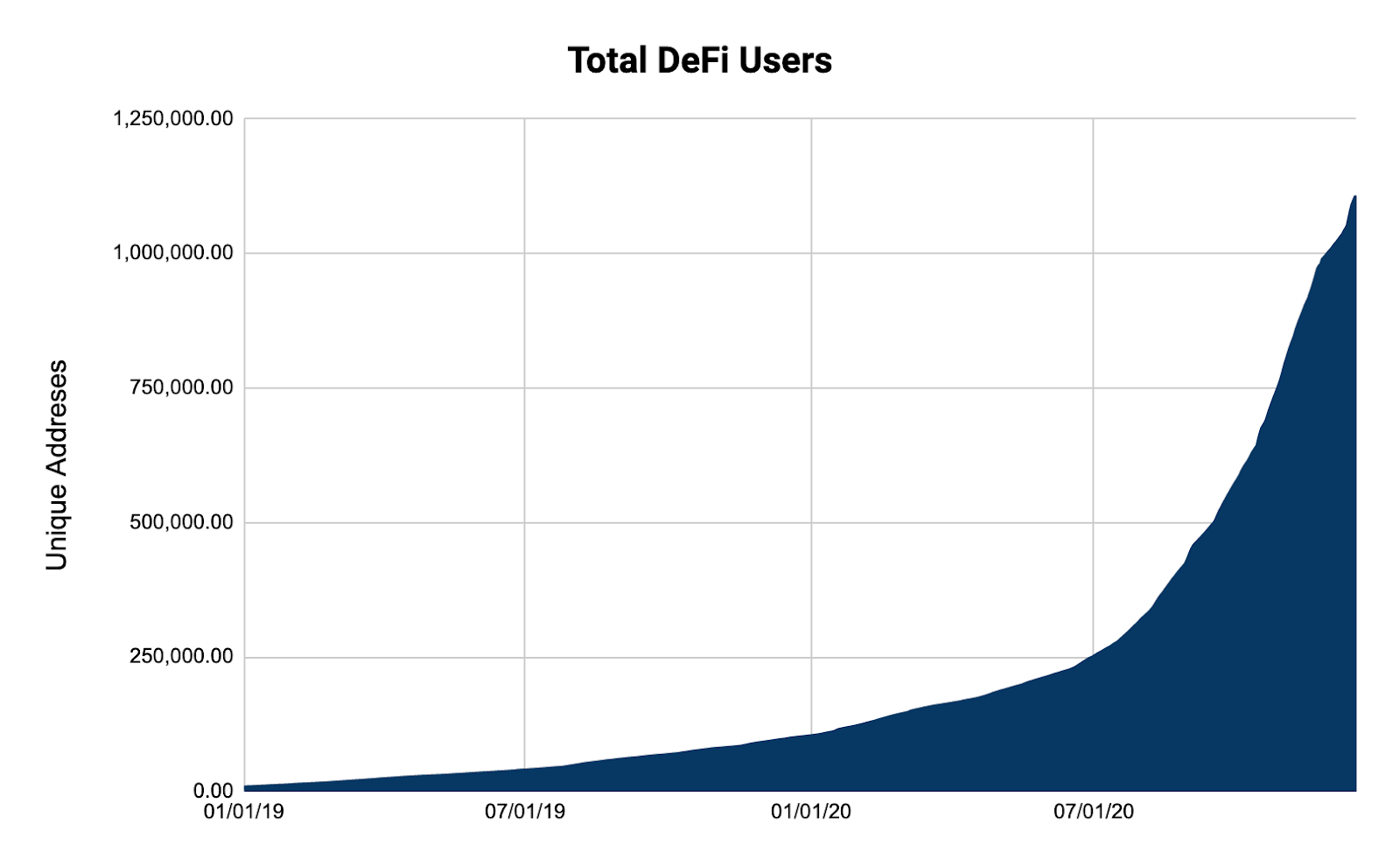

4. DeFi Users

After starting the year with less than 100,000 users, DeFi went parabolic this year as it reached over 1M users across all protocols. It’s important to note that “DeFi users' in this case is really just unique addresses, which likely over reports the actual number.

Regardless, the graph speaks for itself. The number of unique wallets interacting with DeFi went fully vertical—and we all know why.

The introduction of yield farming created a brief mania in the Ethereum ecosystem. And it got wild real quick. At it’s peak, there were new food farms every day, endless liquidity mining campaigns, and waves of degens aping into Pool 2’s only to get rug pulled within a few hours. It was reminiscent of the ICO days where new tokens were launched every day promoting the promise of bringing billions of users to crypto.

But it wasn’t all bad. The crypto industry unlocked a valuable distribution mechanism that could have profound changes on the way equity is distributed in the future. The focus? Giving ownership to those that provide and create the most value: the users.

Platforms like Facebook, Youtube, Twitter, Uber, and Airbnb don’t really rely on themselves to create value. They rely on individuals and network effects. Every person that uses those platforms makes it increasingly more valuable. Whether it’s creating video content for the global population or giving strangers rides across town, these multi-billion dollar platforms entirely rely on individuals to generate the value. People don’t go to Facebook to read Facebook’s content nor do people stay at Airbnb houses.

It’s all reliant on the individuals.

So why not give them ownership in the platform too? That’s what’s being pioneered in DeFi with yield farming. Individuals provide a valuable service to a network (like providing capital to Compound) and receive ownership in the protocol for doing so.

It’s not hard to imagine a future where Uber drivers are given a fraction of equity for every ride they give or Airbnb hosts for every guest they accommodate in their homes.

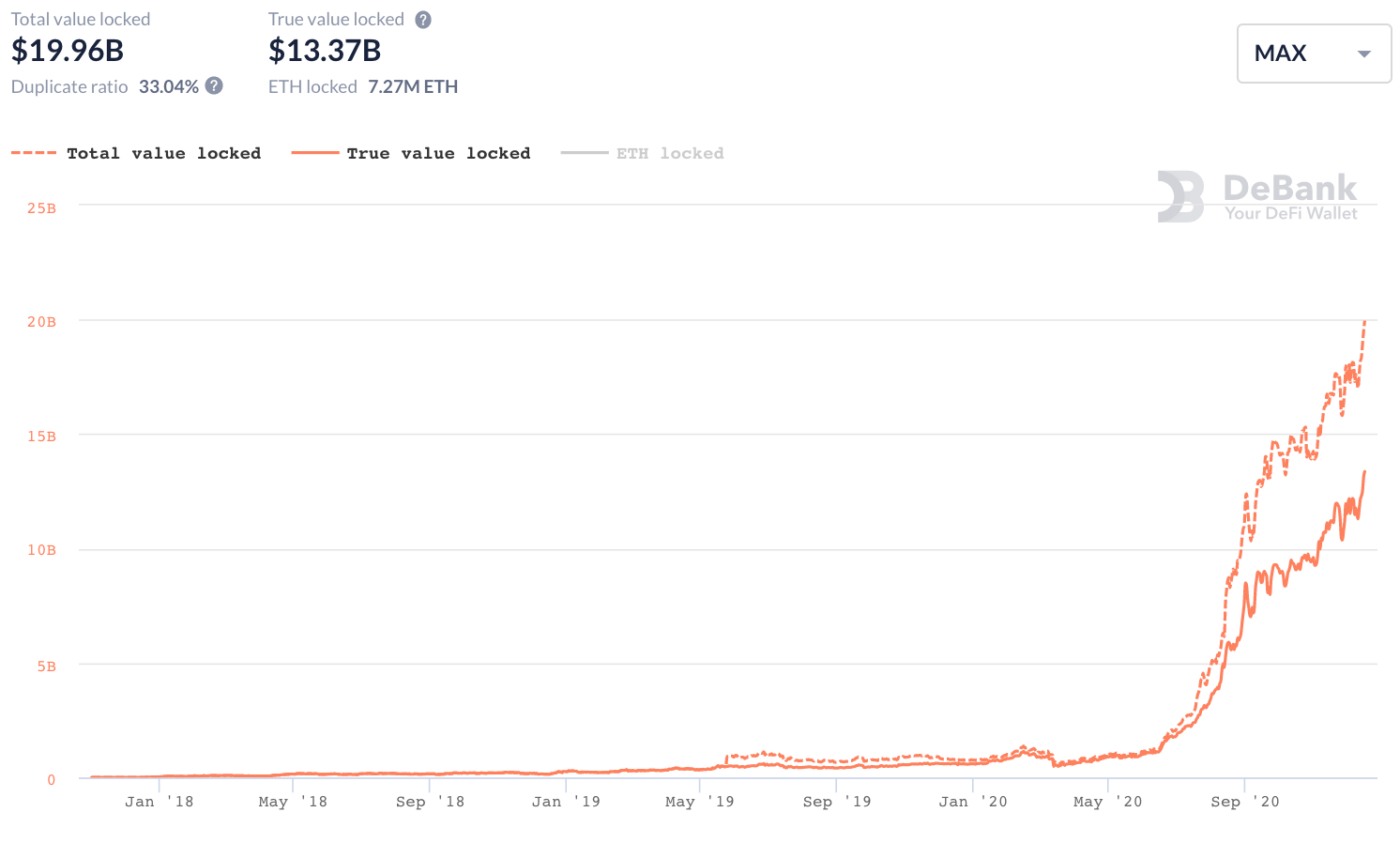

5. Total Value Locked

With the surge in unique wallets, total value locked (TVL) also saw a massive run up which can also be partially attributed to the yield farming frenzy.

The year started with around $600M in value held across all protocols. But it only took until February for the sector to reach unicorn status. Fast forward to the end of the year and value locked in DeFi sits well over $15B—a casual 25x a year. As mentioned, the growth in DeFi value locked was largely due to the yield farming mania throughout June and September.

Sparked by Compound’s COMP token, capital poured into nascent (and sometimes unaudited) DeFi protocols as investors earned astronomical passive income returns.

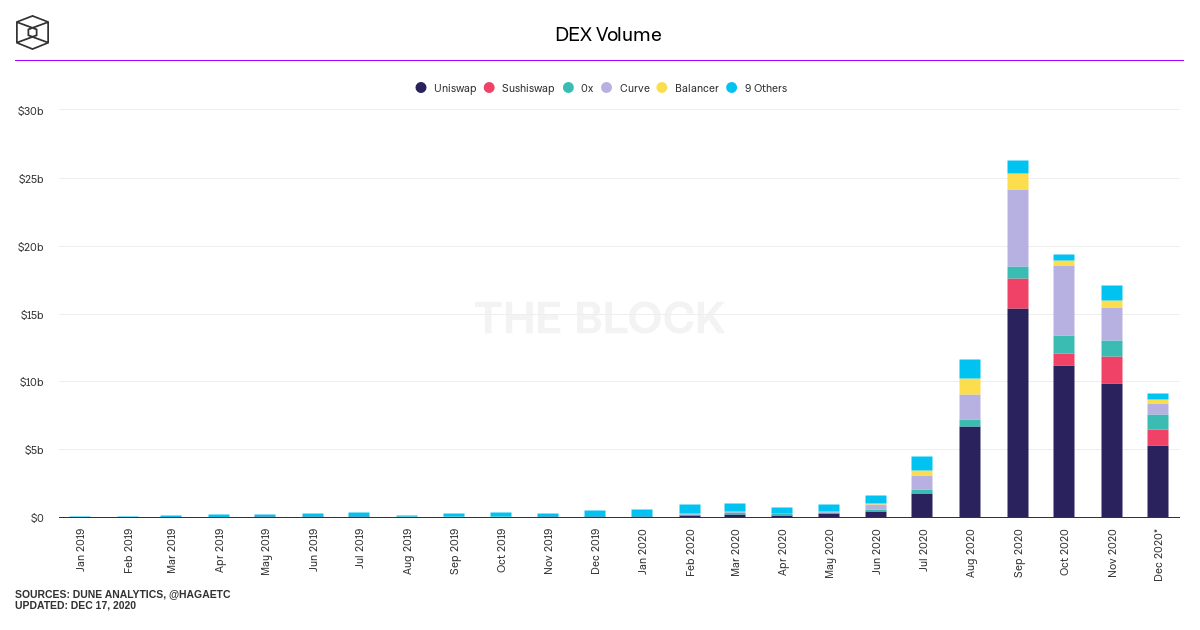

6. DEX Volume

The rise of Decentralized Exchanges (DEXs) was one of the compelling narratives from the year. While they’ve always been one of sought-after use cases for Ethereum, they’ve historically underperformed expectations. Clunky interfaces, slow trading speeds, and a whole lot more plagued the first batch of Ethereum DEXs. If you’ve been around, you probably remember trading shitcoins on EtherDelta—the OG Uniswap.

We’ve come along since then, and the tables have turned dramatically.

As an effect of the DeFi summer, DEX volumes soared in 2020 as they peaked at over $25B in the month of September alone. Better yet, these crypto native exchanges gained significant ground on Centralized Exchanges (CEXs) as the market share for DEX volume peaked at 15% of its centralized counterparts—a huge jump from its <1% average in 2019. Uniswap, Curve, and Balancer were all key drivers in the space.

But Uniswap was the dominant player, by far. The constant product AMM represents nearly 60% of all DEX volume while others supported low ten-figure dollar volumes. The space has significantly progressed over the past few years and it’s a promising sign to see DEXs genuinely compete with centralized exchanges.

After all, it should be a hard task to keep up with the permissionless, global nature of Ethereum financial protocols. This is especially true with Uniswap and co. when it comes to supporting the long tail of assets on Ethereum. Any ERC20 token can be listed immediately—no hoops to jump through, no listing fees, nothing. It’s a level playing field as everyone must play by the same rules. All you have to do is deposit the initial liquidity and that token can be accessible by anyone and anywhere—for either trading or liquidity provisions.

As a result, Goliaths like Coinbase and Binance have been notably quicker in listing new tokens as they watch DEXs start to eat their lunch. This was apparent with same day listings with Sushiswap’s SUSHI on Binance and recently the Graph’s GRT on Coinbase.

And maybe one day we’ll see CEXs starting to leverage liquidity protocols for trading rather than building their own infrastructure. Protocol sink thesis anyone?

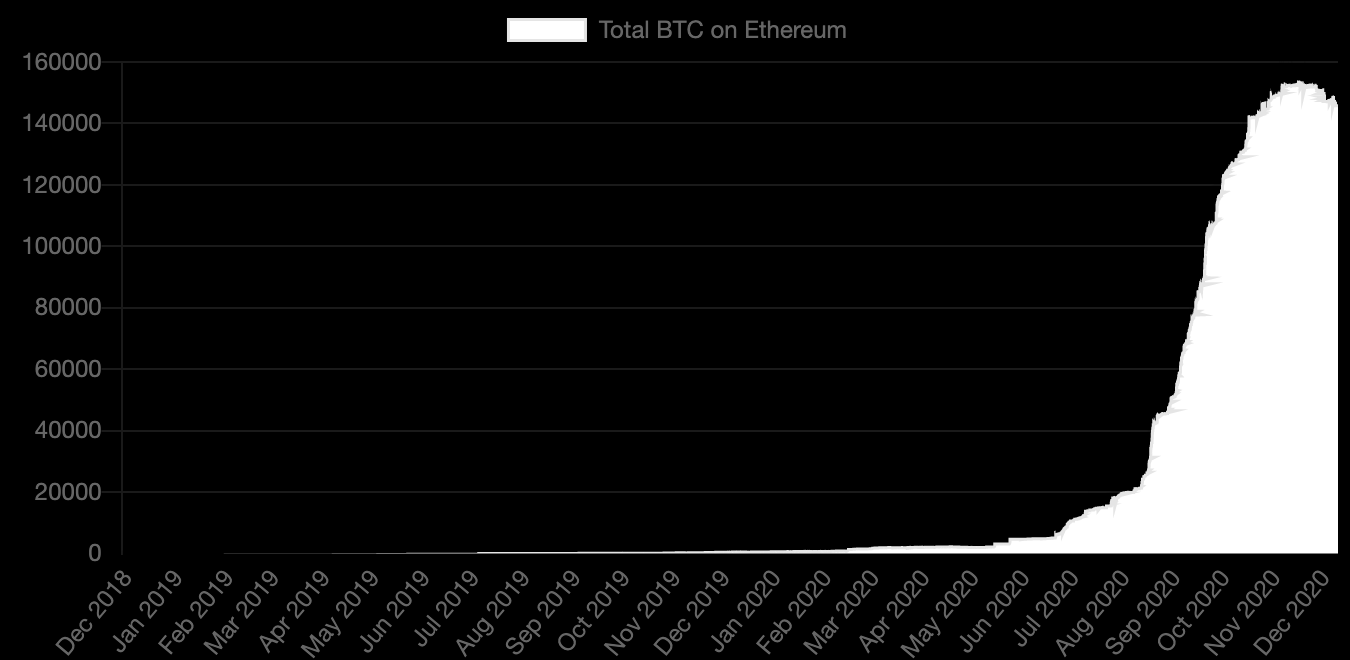

7. BTC on Ethereum

There’s now over $3.3B BTC circulating the Ethereum economy, representing 0.675% of all BTC in existence.

Similar to everything else in DeFi, this number went wildly parabolic as a result of the yield farming craze. People just couldn’t sit idle on their BTC any longer. Instead, they elected to put it to work using any of the dozens of high-yielding passive income opportunities available in DeFi. It just became too good to resist.

Whether it’s becoming a liquidity provider on Curve or Uniswap, or depositing it into platforms like Compound and Aave, Ethereum’s decentralized economy offers a multitude of ways for BTC holders to earn a passive yield in a non-custodial fashion that aligns with core cypherpunk ideals. This is a stark contrast to the options available to BTC holders where depositors would have to rely on centralized lenders like BlockFi or Celsius to earn a yield.

Better yet, there are more flavors of wrapped bitcoin on Ethereum than ever before. While wBTC has historically dominated the asset class, the ecosystem now has options to choose from, including renBTC, tBTC, sBTC and a few others.

I doubt this is a trend that will end anytime soon. Ethereum will only have more ways to utilize your capital in the future while BTC holders will only have more flavors of wrapped bitcoin to choose from.

That said, it’s only a matter of time before we see it inch up to 1% and beyond.

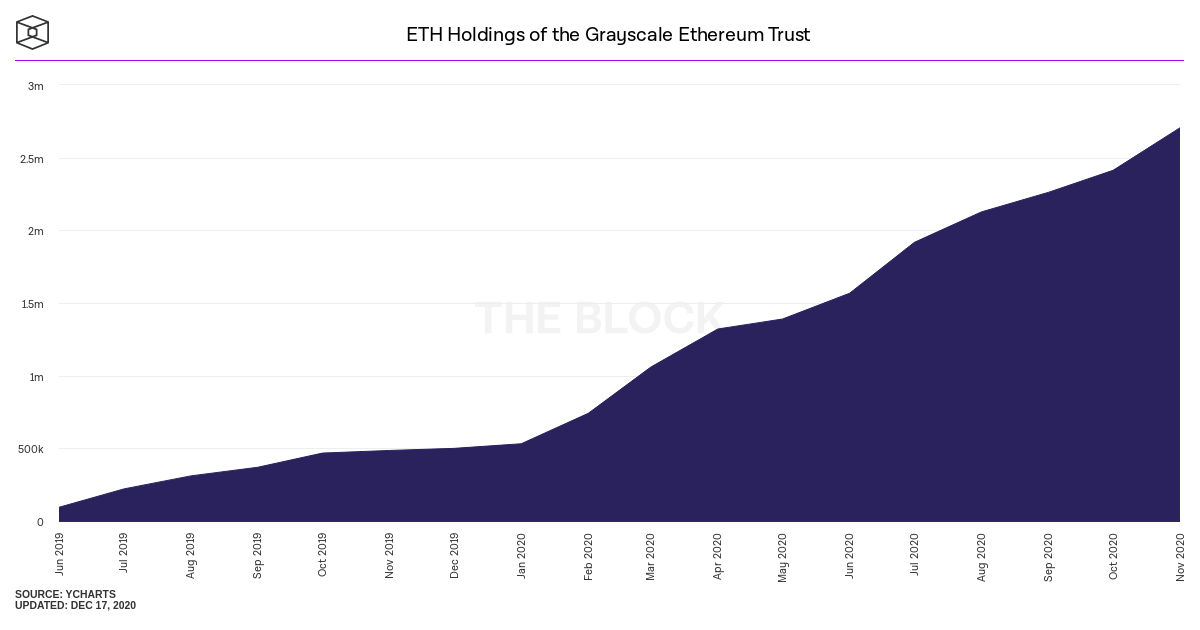

8. ETH Held by Grayscale

Grayscale is becoming a blackhole for crypto assets. Not only does the company hold 2.5% of all BTC, they’ve also grown their ETH position to 2.3% of the supply this year (roughly ~$1.7B) through their $ETHE investment product. The asset also reached all time highs in daily volumes with the average reaching over $24.6M per day in November—well above it’s previous record of $15.6M back in August 2020.

But there’s a slight caveat here. While the surge in Grayscale’s Ethereum product is a great sign, institutional interest (who are required for minting “shares”) may largely be capitalizing on the high premiums with $ETHE rather than using it for any meaningful, long-term investment positions.

For reference, premiums on $ETHE currently sit at 132%—not a bad return for locking up ETH for 6-12 months. Regardless, the rise of $ETHE does give institutional and accredited investors the opportunity to dip their toes in the Ethereum waters.

They have 6 months sitting on their hands waiting to flip the asset to earn the premiums, so we can only imagine that at least some of these investors will eventually go down the rabbit hole and start digging into their investment and understanding what Ethereum is.

Maybe a few of them will catch on…

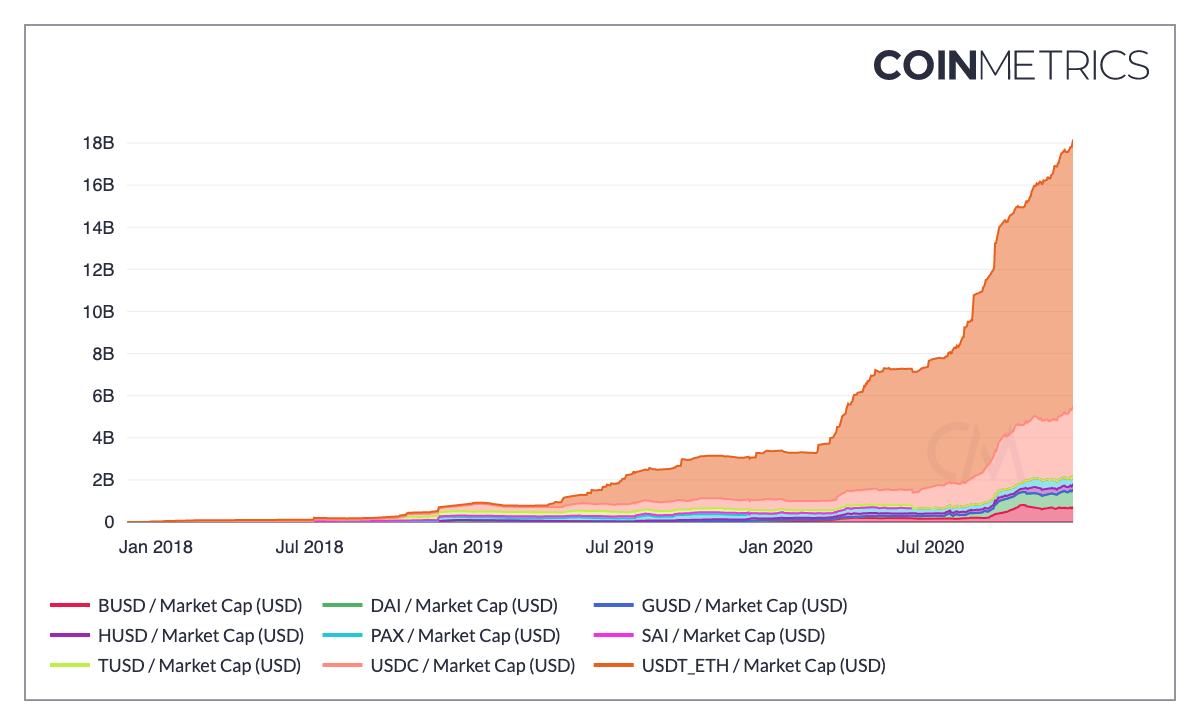

9. Stablecoins on Ethereum

The cambrian explosion in DeFi has only been possible with the growth of stablecoins or “crypto dollars” on Ethereum. These dollar-pegged assets have flourished into the ecosystem over the past two years and now represent nearly $20B in value on the network.

But in 2018, stablecoins barely existed outside of Tether (USDT). Now, there’s dozens of flavors of crypto dollars ranging from fiat-backed to algorithmic. And it doesn’t look like this trend is slowing down.

Since these synthetic dollars are openly accessible by anyone with an internet connection, Ethereum drastically increases the dollar’s reach to a wider range of users across the globe. The recent events in Venezuela is a perfect example. The institution behind USDC, Circle, partnered with Bolivarian Republic of Venezuela and Airtm to deliver aid to frontline Venezuelans medical workers by using USDC.

In a collaboration among multiple participants (including the U.S. government), they were able to bypass capital controls imposed by Maduro over the domestic financial system. As a result, they were able to put millions of dollars of funds into the hands of people fighting for the health and safety of the people of Venezuela.

This truly shows the power of embracing public blockchains. The U.S. and other nation states could bypass restrictions imposed by foreign jurisdictions to extend their reach and influence by leveraging these permissionless platforms rather than fighting them.

But will they? We’ll see.

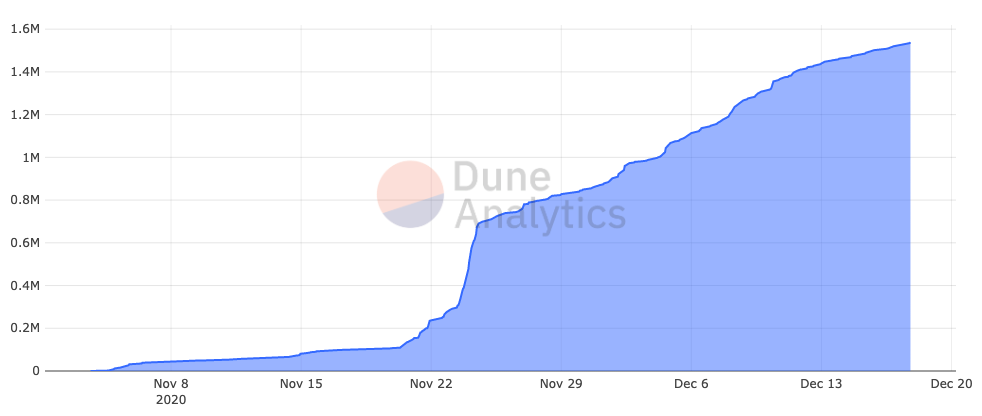

10. ETH in Deposit Contract

Source: Dune Analytics

The final graph is a bit of a cheat as it can only go up right now. Nonetheless, ETH became the first internet bond to reach unicorn status shortly after the launch of the Eth2 deposit contract. The contract now holds over 1.5% of the total ETH supply, representing over $1.1B in value securing Ethereum’s eventual public chain.

Even though it’s early, the signal of capital flooding into the contract shows the collective support from the Ethereum community to push forward on this new frontier of a scalable blockchain for the decentralized future.

The best part is that there’s only more and more infrastructure being built around Eth2.

Whether it’s major exchanges like Coinbase or Binance supporting ETH staking, the launch of decentralized staking providers like Rocket Pool, or better plug-and-play hardware solutions for individuals, participating in Eth2 validation is only going to become more accessible in the future.

Looking Forward

While BTC is celebrating new highs in price, Ethereum has plenty to celebrate as well. There’s a laundry list of metrics ranging from fundamentals to narratives that are showing the adoption of Ethereum as a global settlement layer for the internet of value.

The decentralized economy is being built, day-in and day-out. And there’s plenty of progress to show for it. Consider that the DeFi industry barely existed two years ago. Now, there’s over $15B of capital fueling powerful financial applications and $20B in tokenized dollars—all of it accessible to anyone with an internet connection.

While I highlighted these ten, there are many other metrics across the Ethereum economy breaking new records. NFT and digital art have hit seven figure volumes and crypto native financial primitives like flash loans have now surged to billions of dollars in volume too.

There’s no shortage of ways to cut it: Ethereum is growing.

And there’s fundamental catalysts to back the growth too. Ethereum 2.0 is moving along smoothly, CME recently announced they’ll be supporting ETH futures in 2021, and Jerome is warming up the money printer for another round of stimulus.

ETH all time high next?

Action steps

- Understand how these metrics drive a bullish case for ETH

- Read Nic Carter’s “Nine Bitcoin Charts Already At ATHs”

Author Bio

Lucas Campbell is the Editor and Analyst for Bankless. He also engages with teams on token economic & governance design through 🔥_🔥 (Fire Eyes DAO), working with industry-leading projects like Aave, Rocket Pool, and others.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Argent

You were promised the future of money. Instead you got '90s banking UX and a paper password. Enough is enough. Argent protects your assets and gives you peace of mind. Earn interest and invest in a tap. No seed phrase. No problem. This is one of the best DeFi mobile wallets in the game today. Start exploring DeFi on the go with Argent. 🔥

Argent just added even more…

🔥 Yearn Vaults live! Automatically earn yield on your assets. Simply choose a Vault and amount to invest, and Yearn handles the rest.

🔥 Balancer live! Earn BAL tokens by providing liquidity.

- RSA

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.