🚨 Alpha Alert: Uniswap V3 announced!

Dear Bankless Nation,

Uniswap just announced V3. It’s a major upgrade for the biggest DEX and most valuable DeFi asset in crypto. Here’s what you need to know.

Let’s get to the Alpha. 🚀

- RSA

P.S. We only send these Alpha Alerts to Bankless Premium members like you. 😎

Watch Alpha Alert: Uniswap V3

Ryan & David discuss all the updates surrounding Uniswap V3 including concentrated liquidity, deploying on Optimism, UNI protocol fees, and more.

🚨 ALPHA ALERT: Uniswap V3

What you need to know about Uniswap V3

Uniswap V3 was one of the most highly anticipated upgrade for the DeFi community.

The protocol is by far one of the most successful DeFi protocols to date, facilitating over 60% of all DEX volume while accumulating over $135B in total volume since the launch of V2 less than a year ago.

Uniswap serves as a crucial signal for the broader DeFi ecosystem—so it’s important for us to keep tabs on what they’re doing as it’s an indicator of where the industry is going.

Timeline

Uniswap is targeting a V3 launch on May 5th, 2021 with an Optimism deployment shortly after.

TL;DR

- Concentrated Liquidity: With V3, Uniswap LP’s can concentrate their capital within custom price ranges, effectively allowing LPs to set stop-losses on impermanent loss. More on this in key details below.

- Capital Efficiency: The protocol claims to increase capital efficiency for LPs by 4000x relative to Uniswap v2, allowing LPs to earn higher returns on their capital.

- Optimism Deployment: Uniswap will deploy a version of the protocol on Optimism—a promising L2 scaling solution—following the Ethereum mainnet launch.

- Flexible Fees: Uniswap v3 offers LPs three separate fee tiers per pool — 0.05%, 0.30%, and 1.00% depending on the volatility of the pair. As an example, the ETH/DAI pair is prone to highly volatility and therefore may be assigned with a 1% trading fee. Comparatively, USDC/DAI pair has virtually no volatility so we can assume it’ll incur the 0.05% swap fee.

- Uniswap Protocol Fee: In V2, Uniswap introduced the 0.05% governance cut (which was never turned on). V3 introduces governance fees on a per-pool basis and set between 10% and 25% of LP fees. All fees will be turned off by default but can be turned on at a later date via UNI governance.

- Non-Fungible LP tokens: With the introduction of concentrated liquidity, LP positions will be represented by non-fungible tokens (NFTs). However, common-shared positions can be made fungible via third party contracts and integrations.

- Advanced Oracles: Uniswap v3 offers significant improvements to the TWAP oracle, making it possible to calculate any recent TWAP within the past ~9 days.

- Gas Efficiency: Even with all of the above upgrades, V3 swaps will be even cheaper than v2.

- License: V3 will release under a Business Source License 1.1 which limits use of the v3 source code in a commercial or production setting for up to two years. Exceptions to this license will be granted under UNI governance. No forking V3!

Key Details

The two biggest upgrades for V3 are:

- Concentrated Liquidity

- Flexible Fees

Concentrated Liquidity & Capital Efficiency

Concentrated Liquidity is a unique feature that sort of creates an orderbook-style AMM where LPs can provide liquidity within certain price bounds, thus allowing LPs to choose how much impermanent loss they’d incur under maximal volatility. As an example, an LP can set their ETH/DAI liquidity between $1,800 and $2,400. If the price goes beyond the set parameters, the LPs liquidity becomes “inactive”. If it’s within the threshold, the liquidity is “active”.

If you’re having trouble wrapping your head around this watch the animation above

This effectively allows LPs to set stop-losses on their liquidity positions. One of the downsides with this design is that it now requires LP positions to be represented as NFTs—breaking a fair amount composability that’s enabled with ERC20 LP tokens.

Flexible Fees

Flexible fees are also another interesting addition as it boosts rewards for LPs for taking on more volatile pairs. We can assume that pools that incur a significant amount of volatility (think USD pairs) will be assigned with higher swap fees to accommodate the risk of IL, and improving the returns for LPs.

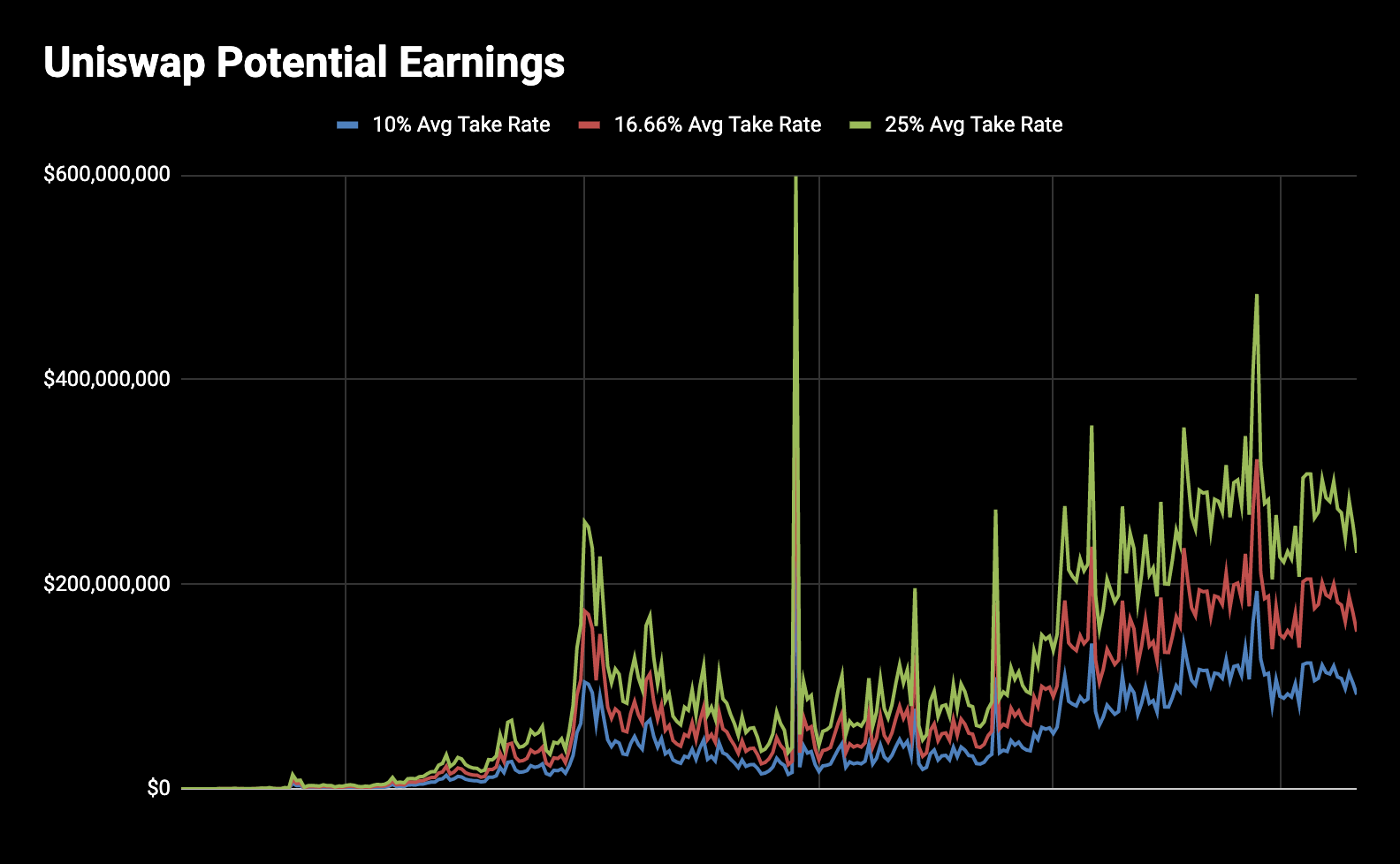

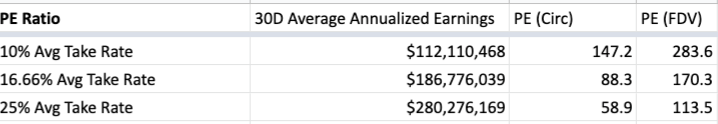

Moreover, with V2, Uniswap introduced an optional 0.05% take rate (16.66% of the swap fee) allocated to a governance treasury. In V3, this rate is set on a per-pool basis between 10% and 25% of LP fees.

Here’s what this looks like with basic napkin math:

All of the above should be taken with a grain of salt.

There were also no concrete details that these protocol earnings will accrue to UNI holders—it’s all up in the air for now but hopefully this gives you a good idea of what’s ahead :)

Alpha implications… 🧠

- AMMs eater? Will Uniswap’s new design eat liquidity from other AMMs? How will other AMMs respond? Does this make you more or less bullish UNI-alts?

- Ethereum first. Uniswap’s decision to deploy on Optimism signals: ETH first, Rollups First. Will other DeFi protocols join them or forge their own path? What are the implications for Layer 2’s and other Layer 1 chains?

- Cash flows and Coinbase. UNI is effectively a pre-revenue capital asset since Uniswap trading fees are not awarded to UNI holders…this could change in V3. What could this mean for the UNI token valuation at $15b? Say Coinbase is worth $100b…is UNI worth more or less than 15% of Coinbase?

- Why did you get this alpha? Because you subscribed to Bankless and made an effort to level-up by using DeFi protocols. This is the frontier! There’s risk…but there’s also reward! Today you were rewarded…congrats.

🙏Thanks to our sponsor

Aave

Aave is a decentralised, open source and non-custodial liquidity protocol enabling users to earn interest on deposits and borrow assets. Aave Protocol is unique in that it tokenizes deposits as aTokens, which accrue interest in real time. It also pioneered Flash Loans and Credit Delegation as innovative DeFi building blocks. The Aave Protocol V2 makes the DeFi experience more seamless with features that allow you to swap your assets for the best yields on the market, and more. Check it out here.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.