Your Guide to the Synthetix Ecosystem

Dear Bankless Nation,

In the decades-long, mega-macro battle between TradFi and DeFi, derivatives are essential.

That’s because assets and equities are just the tip of the iceberg. It’s derivatives that provide depth to the entire global financial system.

Of all the Web3 projects to take on derivatives, Synthetix has long been a leader with its pioneering of synthetic assets.

Synthetix’ early adoption of Optimism has paved the way for a community-led expansion of its offerings into a whole ecosystem.

Now — via offshoot projects like Kwenta, Lyra, Thales, and Aelin — the Synthetix ecosystem is rife with opportunity.

Let our Tuesday Tactician William Peaster show you how to make the most of it.

- Bankless

Your Guide to the Synthetix Ecosystem

Bankless Writer: William M. Peaster, Bankless contributor and Metaversal writer

Among DeFi’s most battle-tested and trailblazing projects, Synthetix has developed derivatives infrastructure that now lies at the center of an ecosystem of decentralized apps like Kwenta, Lyra, and beyond.

This Bankless tactic will show you how to navigate the contemporary Synthetix ecosystem.

- Goal: Navigate the top Synthetix ecosystem projects

- Skill: Intermediate

- Effort: 1 hour

- ROI: Leveling up your DeFi skill tree

Your guide to the Synthetix ecosystem

Synthetix explained

Beginning as a stablecoin named Havven in 2018, Synthetix has since evolved into one of the Ethereum ecosystem’s leading derivatives projects.

Specifically, Synthetix is a derivatives liquidity protocol that powers the creation of “synths” — or synthetic assets — that can be traded in a decentralized and permissionless manner.

Synths let traders capitalize on exposure to assets without having to directly own the assets in question. Today, some of Synthetix’s most popular synths are its forex synths, like sUSD and sEUR.

Synthetix is also a DeFi trailblazer renowned for pioneering yield farming in 2019, and for being one of the first major DeFi projects to embrace Optimism, the layer-two (L2) scaling solution in 2021.

To date, the Synthetix community has also fostered multiple additional DeFi protocols, and the Synthetix ecosystem now has a handful of dapps in its orbit.

Using Synthetix 101

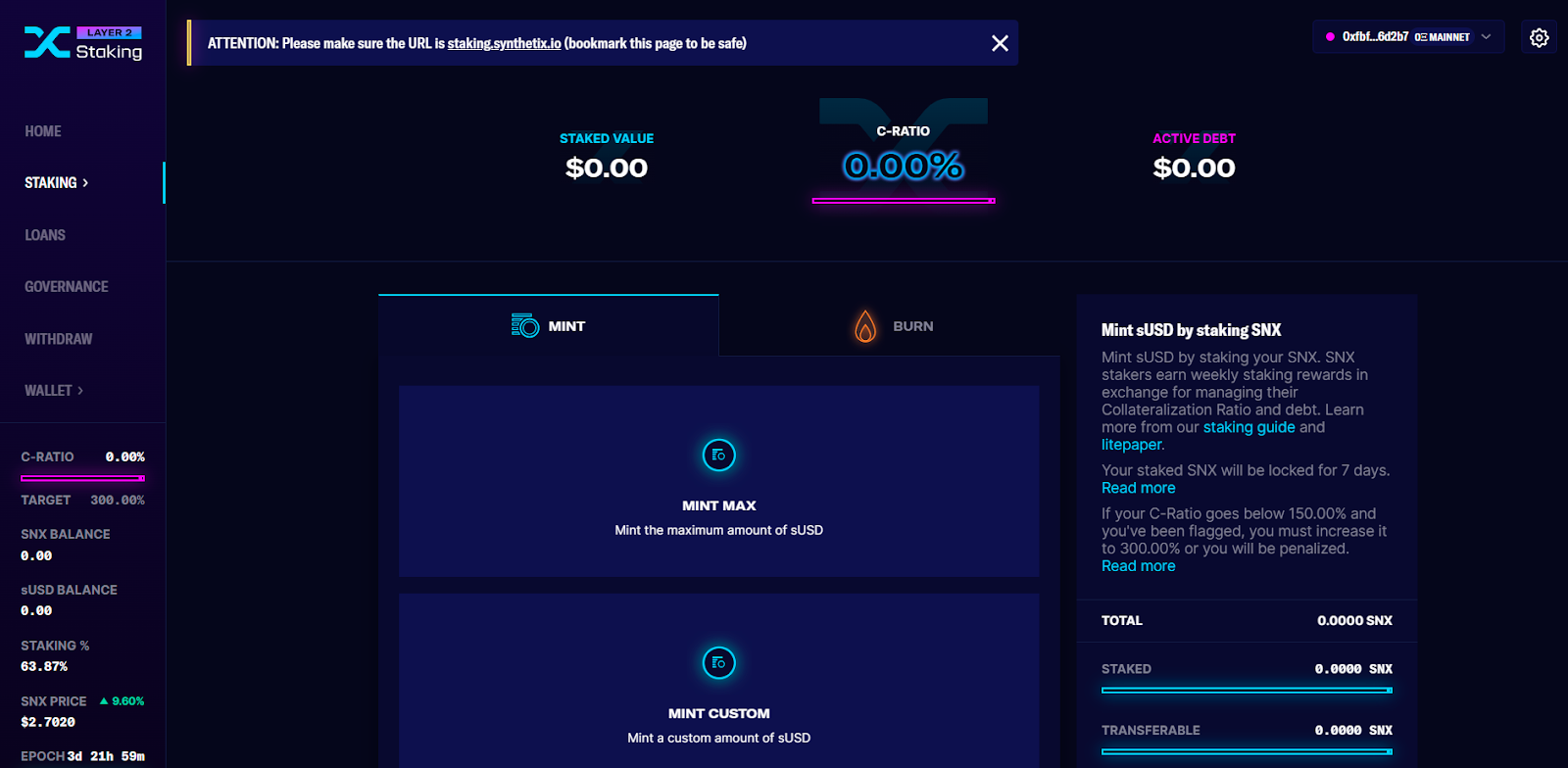

A foundational element of Synthetix is SNX staking, which is used for collateralizing the derivatives protocol and for creating deep liquidity for synths.

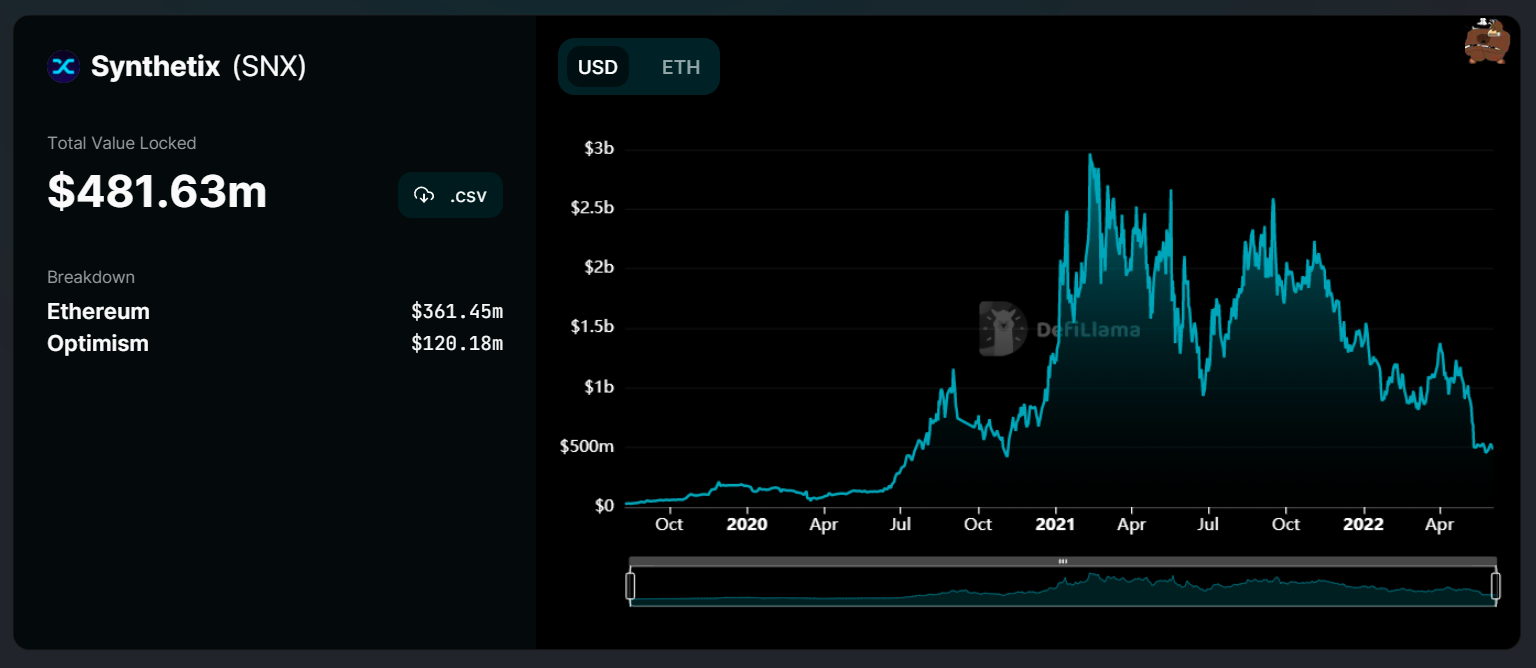

Per total value locked (TVL), Synthetix is currently the largest protocol on Optimism, and that is in no small part because the project migrated its SNX staking and sUSD minting operations over to Optimism early on in the L2’s lifespan.

Notably, not only do SNX stakers earn inflationary SNX rewards, but they also earn a cut of sUSD fees generated by protocols that work on top of Synthetix, like Kwenta and Lyra.

The basic steps of SNX staking are as follows:

- Acquire SNX, which is available directly on Optimism (e.g. via Uniswap), or can be bridged over from Ethereum (e.g. via the Optimism Bridge).

- Go to staking.synthetix.io/l2

- Connect a wallet and connect to the Optimism network

- Click the sidebar “Staking” button and then the “Mint & Burn” button

- Click the “Mint Max” button and confirm the transaction in-wallet

Staking rewards are calculated and then published once a week on Wednesdays. Positions just above the protocol’s L2 collateralization ratio (C-Ratio) — 300 % — will earn the most rewards, which can be claimed via staking.synthetix.io/earn/claim. Claimed SNX will be escrowed, i.e. non-transferable, for one year.

Kwenta: The Synthetix DEX

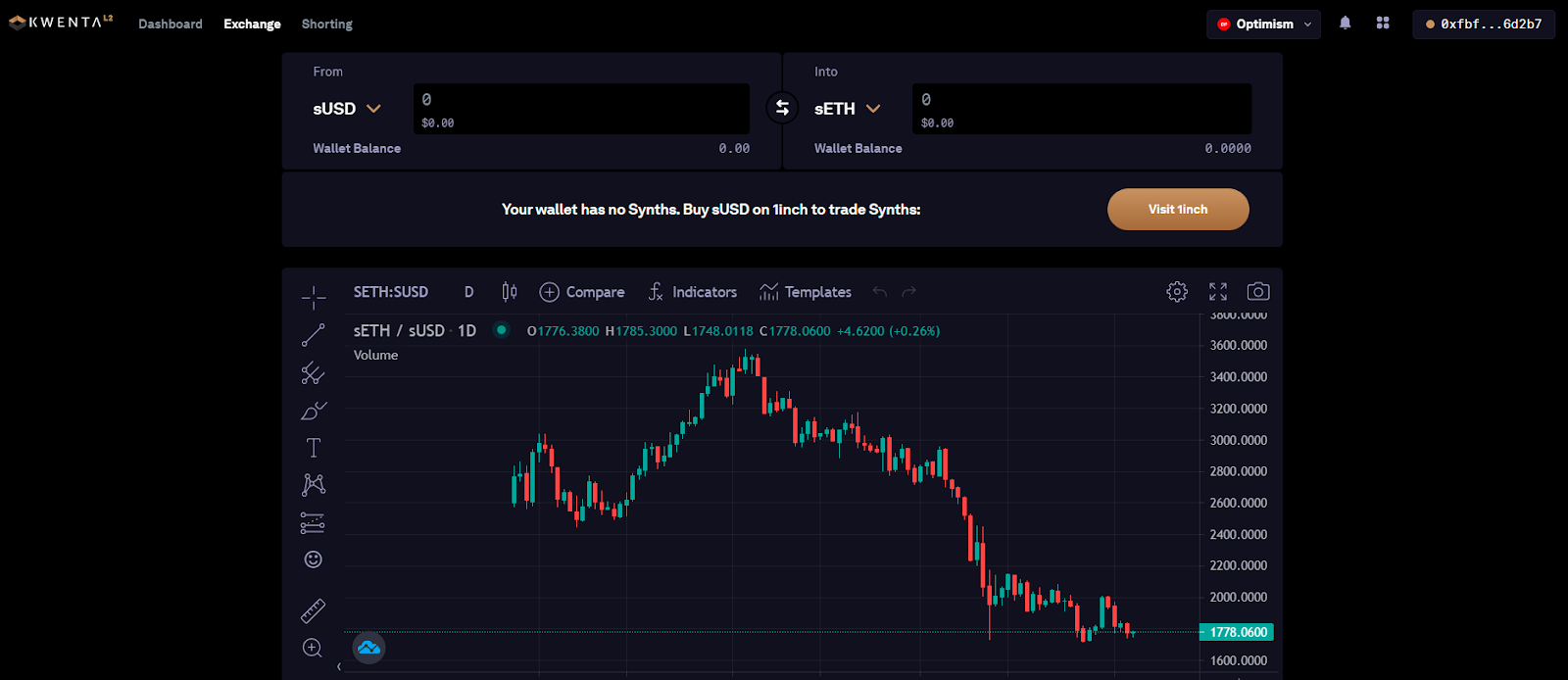

Designed to facilitate zero-slippage synth trading, Kwenta — the primary decentralized exchange (DEX) in the Synthetix ecosystem — is a rebrand of the former official Synthetix Exchange interface.

Interestingly, Kwenta doesn’t rely on an orderbook or liquidity pool model. Instead, the DEX employs a peer-to-contract (P2C) system in which synths are traded against a smart contract informed by Chainlink price feeds. Moreover, Kwenta only allows trading in synths, so other cryptocurrencies cannot be used here.

In September 2021, Synthetix deprecated low-volume synths on Ethereum, like sAAPL and sAMZN, to pave the way for relisting them on the Optimism L2 later.

As of June 2022, Kwenta’s available L2 synths include:

- sUSD

- sEUR

- sETH

- sBTC

- sLINK

- sSOL

- sAVAX

- sMATIC

- sAAVE

- sUNI

The basic steps of Kwenta L2 trading are as follows:

Acquire sUSD, or another Synthetix synth

sUSD can be obtained via SNX L2 staking or through an L2 DEX (e.g. 1inch)

Go to kwenta.io/exchange

Connect a wallet and connect to the Optimism network

Select a “From” synth, the amount to be traded, and an “Into” synth

Click the “Submit Order” button and confirm the transaction in-wallet

Lyra: Options Powered by Synthetix

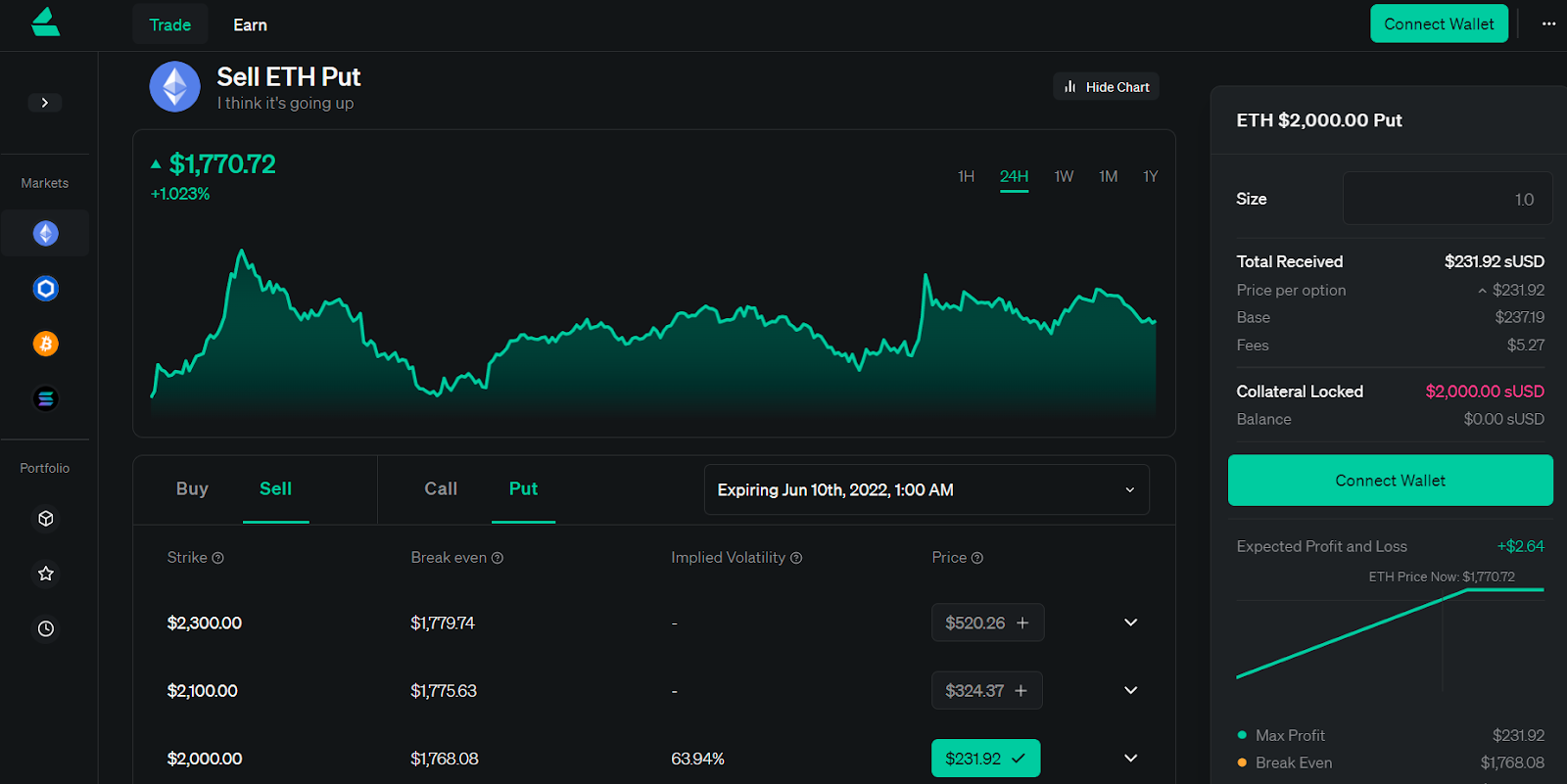

Lyra is a decentralized options trading protocol powered by a specialized automated market maker (AMM) system.

Notably, Lyra uses Synthetix’s sUSD stablecoin as its exclusive quote asset, so traders pay for opening long positions or closing short positions with sUSD. Lyra also uses Synthetix as a one-stop protocol for getting long and short exposure on its markets’ base assets, i.e. delta hedging.

For a full primer on trading options through Lyra, review A Guide to Options on Lyra, published by Bankless last year.

The basic steps remain the same today and are as follows:

- Acquire sUSD (or another synth, e.g. sBTC, if specifically selling call options)

- Go to app.lyra.finance

- Connect a wallet and connect to the Optimism network

- Choose a market (ETH, BTC, LINK, and SOL are currently available)

- Select an expiry

- Choose from the “Buy” or “Sell” options

- Select “Call” or “Put”

- Choose a strike price

- Press the “Open Position” button and confirm the transaction in-wallet

Thales: A Binary Options Hub

Thales is a decentralized binary options protocol that a group of Synthetix community members spun out from Synthetix in 2020.

If held until expiry, binary options have only two payoff possibilities: a predetermined amount of profit or nothing at all. Thales relies on Synthetix’s sUSD stablecoin for 1) minting its binary options tokens, and 2) as the platform’s unit of account.

Thales is now entirely independent, but the project is running a three year-long Merkle airdrop system that will see 35% of the THALES token supply distributed to SNX stakers to keep the Thales and Synthetix communities closely aligned.

The main ways to use Thales are as follows:

- Creating binary options markets

- Trading long and short binary options

- Exercising binary options

- THALES staking

Aelin: A Decentralized Fundraising Protocol

Last year, Synthetix founder Kain Warwick replied to a Mariano Conti joke tweet with his own joke about a SPAC (special purpose acquisition company), which led to Warwick laying out a SPAC in Ethereum-like terms:

This explainer took on a life of its own. Elements of the Synthetix community used it as inspiration for developing the Aelin protocol, which was launched on Ethereum and Optimism earlier this year.

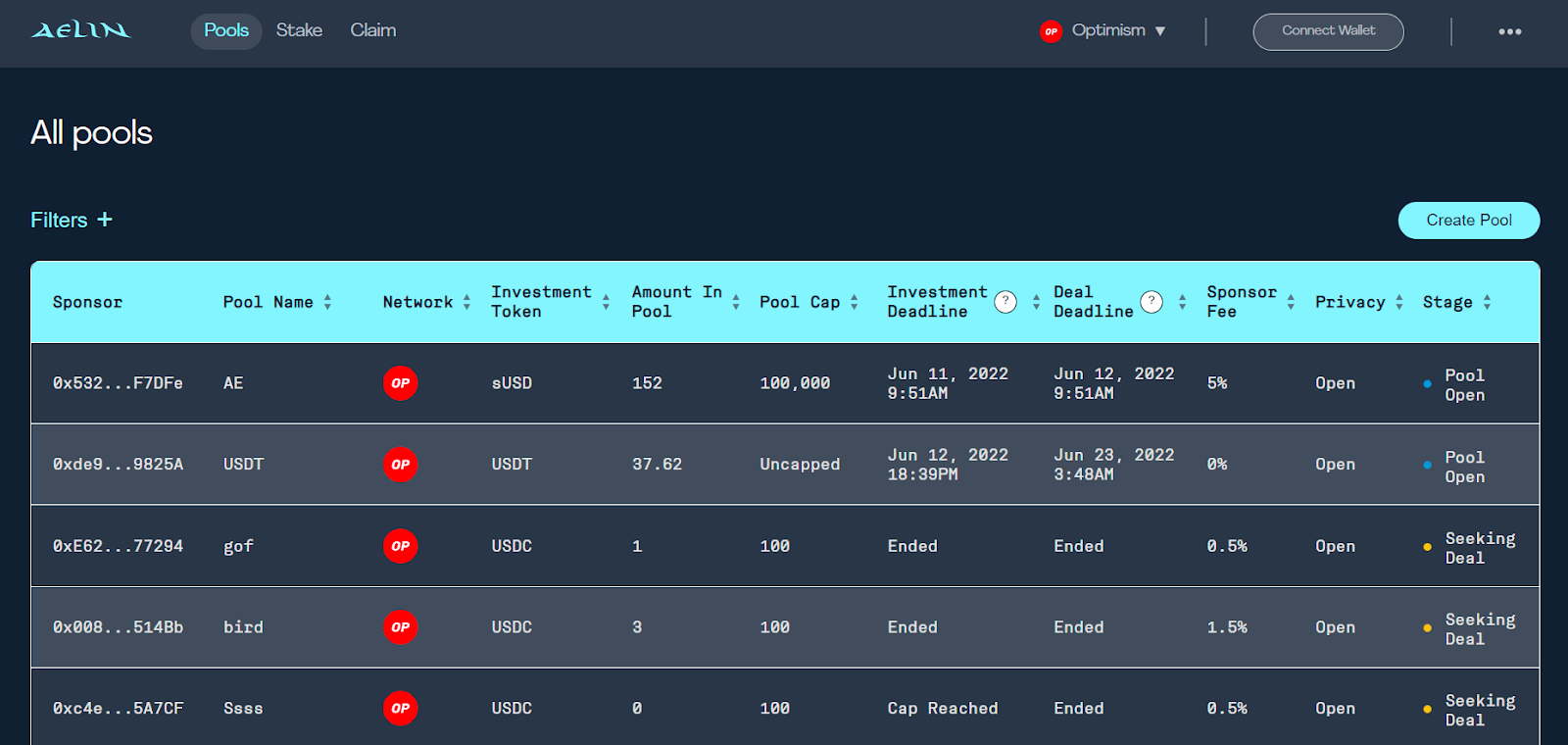

Aelin allows upstart DeFi protocols to bypass venture capitalists by raising funds and selling tokens directly to communities via special discrete pools.

On the flip side, pool investors get permissionless exposure to early funding rounds for new projects. It’s capital raises, DeFi style.

The main ways to use Aelin are as follows:

Conclusion

Synthetix’s early migration to Optimism paved the way for an ecosystem that’s been coming to life in recent months thanks to Optimism’s fast and cheap transactions.

Per current TVL stats Synthetix, Lyra, Aelin, and Thales are respectively Optimism’s 1st, 6th, 23rd, and 26th largest dapps at the moment. The Synthetix ecosystem is poised to drive considerable activity on Optimism for the foreseeable future, especially if the Synthetix community continues to spin out and support new projects that centrally rely on sUSD or Synthetix’s other synths.

Action steps

- 🔥 Check out Synthetix, Kwenta, Lyra, Thales, and Aelin

- 👀 See our previous tactic How to earn more trading fees on Uniswap if you missed it!