Dear Bankless Nation,

Uniswap pioneered the concept of concentrated liquidity.

This innovation drastically improved the capital efficiency available with DEXs, leading to a lot more trading fees for liquidity providers.

But these mechanics are not for the average user. It’s a technically complex, hands-on process. To be a successful liquidity provider in V3, you have to understand market-making and be active in your day-to-day management.

Put simply — It ain’t easy.

In fact, a Bancor study found that at least half of Uniswap LPs have earned a loss.

In response, new protocols are looking to automate the manual process with “set and forget” tools.

Arrakis Finance — A rebrand of Gelato G-UNI — is leading this charge.

Despite the bear market, the amount of value locked in the protocol has doubled in the past month, nearly reaching unicorn status.

Their token launch is also around the corner. 👀

Today, William gives us a step-by-step tutorial on how to automate Uniswap V3 LP with Arrakis.

- Bankless Team

How to Earn More Trading Fees on Uniswap

Built on top of Gelato Network and Uniswap V3, Arrakis Finance is an automated liquidity management protocol that offers DeFi users automated “set and forget” liquidity provider strategies. This Bankless tactic will show you how to use the Arrakis Incentivized Vaults system.

- Goal: Learn how to use an Incentivized Vault

- Skill: Beginner

- Effort: 20 minutes

- ROI: +50% rewards APR (at current rates, depending on vault)

Simplify Uniswap V3 LPing with Arrakis

The History of Arrakis

The roots of Arrakis Finance can be traced back to the Gelato Network.

Founded in 2019 and then first deployed on Ethereum in early 2020, Gelato is a web3 automation protocol. The project, which relies on a bot network, allows dapps and users alike to automate their DeFi activities in a “set and forget” style.

In June 2021, Gelato’s creators introduced G-UNI, an “automated liquidity provision ERC20 for Uniswap V3.”

Uniswap V3 offers DeFi liquidity providers (LPs) major capital efficiency as compared to its V2 and V1 predecessors. However, V3 LP positions require significant active management.

G-UNI simplifies the V3 LP experience by letting you deposit funds into a G-UNI ERC-20 token that automatically manages your deposited liquidity for you — all under the hood.

The G-UNI app quickly gained traction in DeFi as users migrated over liquidity for a more streamlined LP experience.

By March 2022, G-UNI’s development had become distinct enough from the rest of Gelato’s work that the Gelato team proposed spinning the app out and rebranding it to Arrakis Finance.

A G-UNI rebrand was approved by Gelato’s GEL token holders on March 28th, 2022. The vote paved the way not only for Arrakis Finance, but also an associated Arakkis DAO, a SPICE governance token, and pointing fees from the G-UNI Factory and Pool contracts to the new Arrakis DAO.

The State of Arrakis Finance

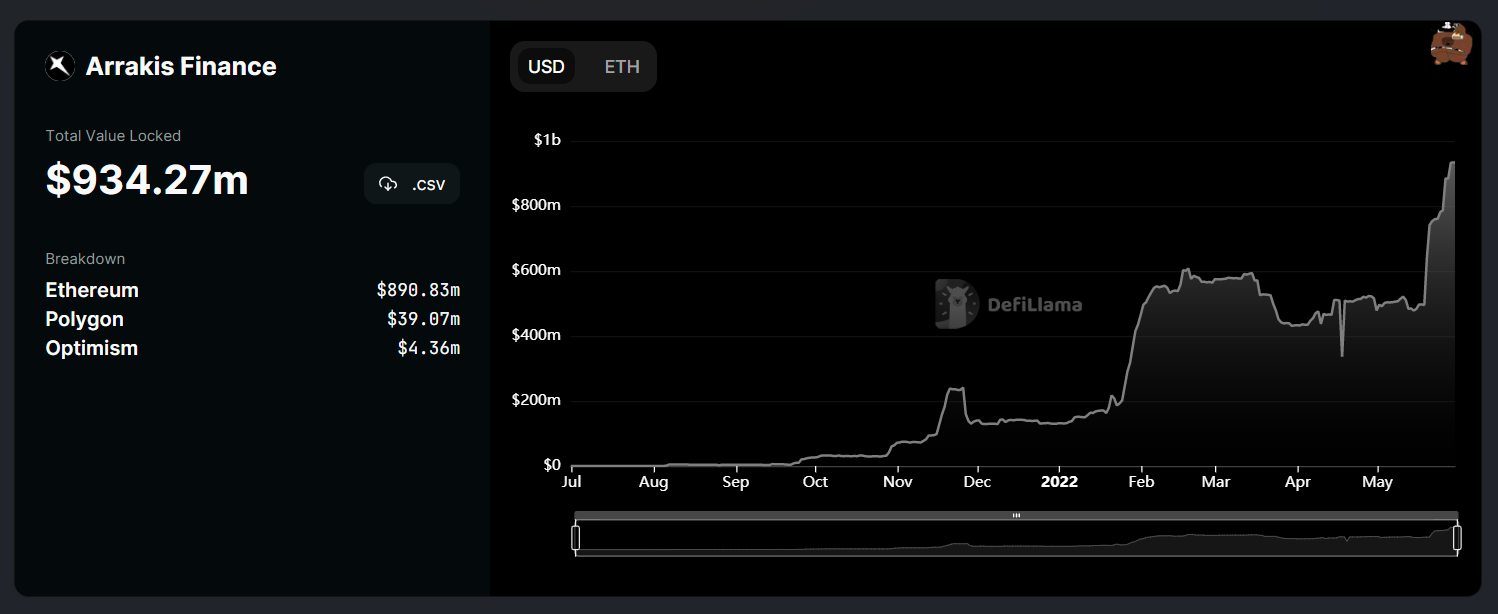

While many DeFi projects have seen declines in total value locked (TVL) in recent weeks, Arrakis Finance’s TVL has been trending sharply upwards over the second half of May 2022.

As of May 2022, the project boasts a +$934M TVL across its Ethereum, Optimism, and Polygon deployments. According to DeFiLlama, this sum currently makes Arrakis the 19th-largest DeFi dapp across all chains and the 14th-largest DeFi dapp on Ethereum.

How to Use Arrakis Finance

If you want to automate your Uniswap V3 liquidity management with Arrakis, here’s where you start:

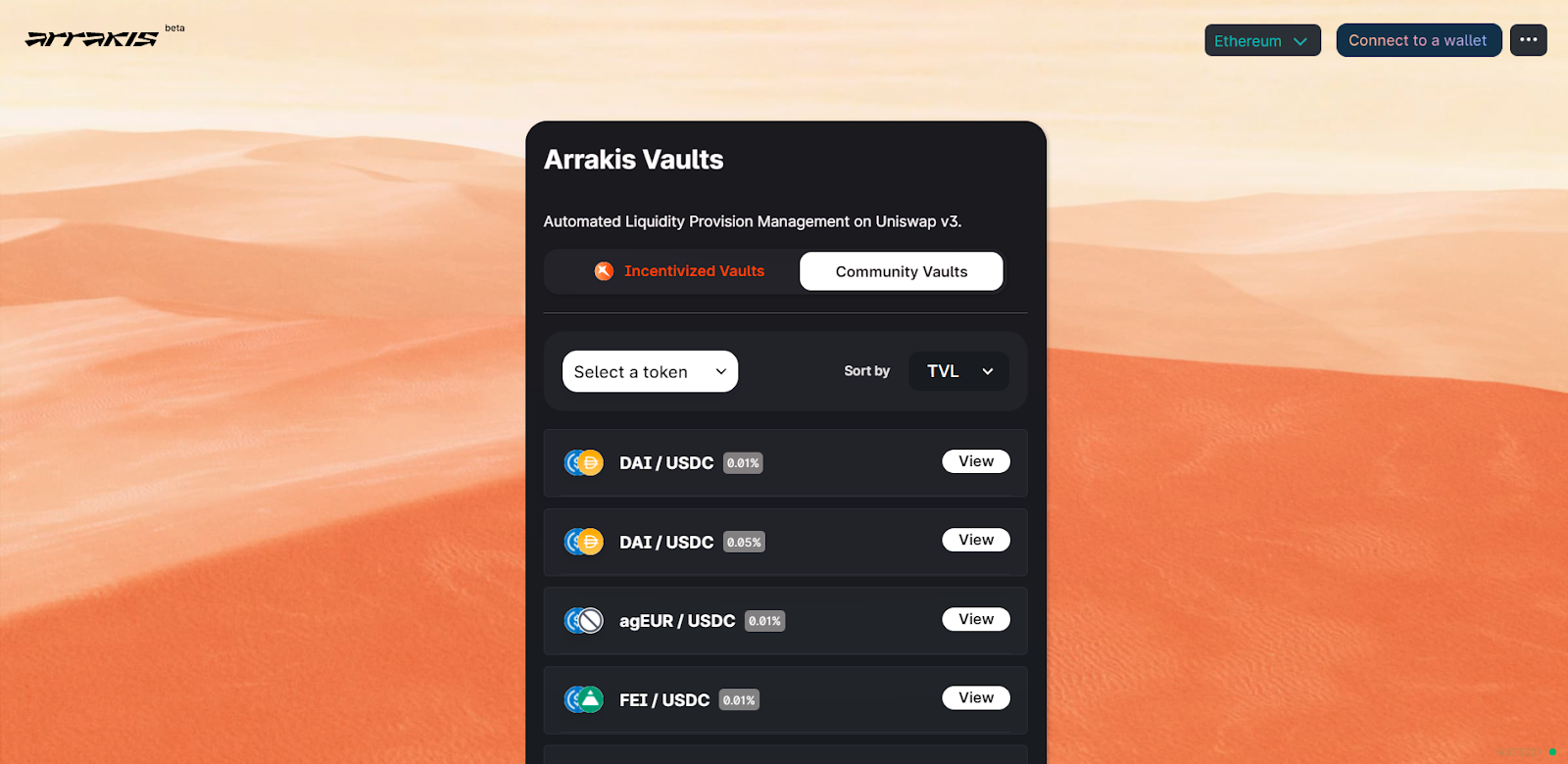

First, note that Arrakis Vaults come in two types — Community Vaults and Incentivized Vaults.

Community Vaults are created and overseen by third-party projects. These vaults may be anywhere between actively managed or invariable, so each one is unique and should be considered and researched separately.

In contrast, Incentivized Vaults are overseen by Arrakis sponsored managers, and are incentivized with token rewards via official Arrakis collaborations. Current Incentivized Vaults can earn MATIC rewards from Polygon, with more integrations expected shortly.

With the above in mind, we’ll demonstrate how to use an Incentivized Vault. They are more simple and higher-yielding than Community Vault alternatives. To get started, the process looks like this:

Head over to beta.arrakis.finance and connect your wallet.

Click the UI’s Incentivized Vaults button. You’ll be prompted to connect to the Polygon network.

Scroll down the available liquidity pools or use the Select a token button to find your pool of choice; then press View.

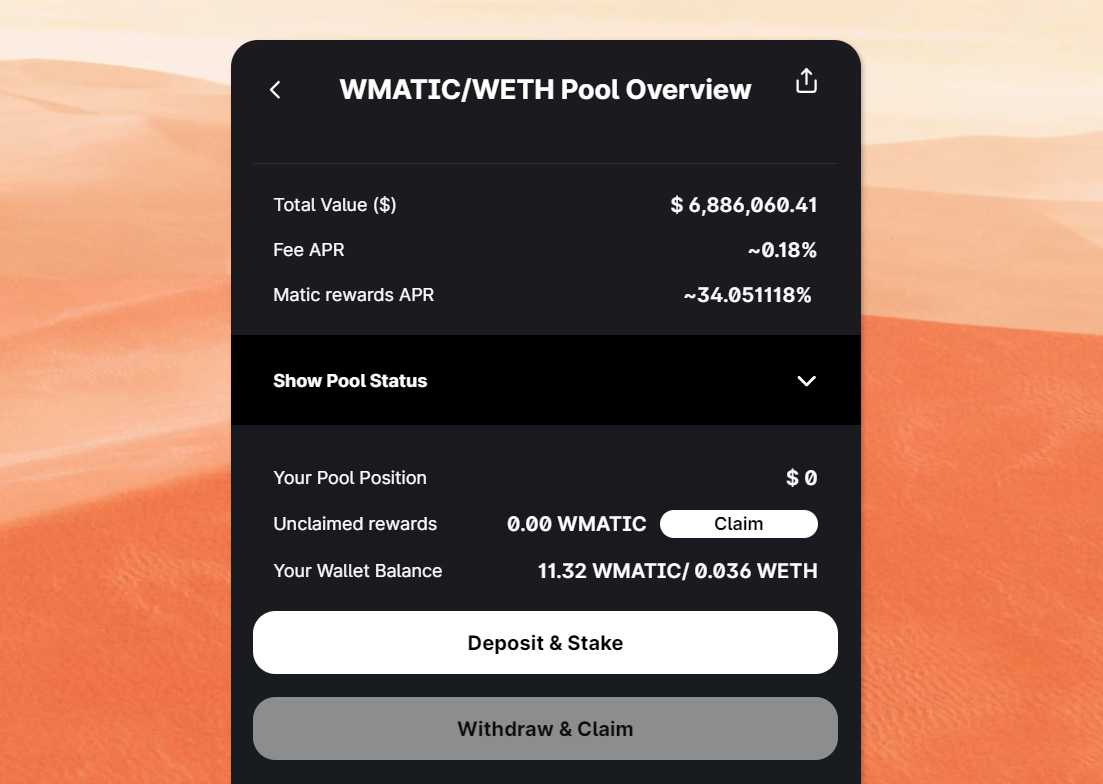

The ensuing screen shows your chosen pool’s current TVL, fee APR, and MATIC rewards APR. If you’re ready to proceed, press Deposit & Stake.

Input the amount of token liquidity you’d like to supply. With the WMATIC/WETH pool you’d input your desired deposit amounts, and then carry out two approval transactions: one for WMATIC and one or WETH.

Last: Press the Deposit & Stake button and carry out the transaction with your wallet. Once this transaction confirms, the Arrakis Vault will automatically start putting your liquidity to work and earning you yield.

Whenever you’re ready to claim your rewards or close out your position, you head back to your pool’s overview page and click the Claim button or the Withdraw & Claim button. Doing so will initiate your transaction process.

Conclusion

Navigating Uniswap V3 can be daunting for DeFi novices and veterans alike. Arrakis Finance is designed to level the playing field and make Uniswap V3 LP strategy approachable for users of all stripes.

Arrakis has gained traction by simplifying Uniswap V3 LPing, but that functionality may be just the tip of the iceberg for the automated liquidity management protocol. For instance: back in April, the Arrakis team predicted the protocol would eventually come to support more exotic tokenized products like “auto-hedged delta neutral LP positions,” “cross-AMM positions,” and beyond.

As DeFi continues to evolve and surface new demands and possibilities, look for Arrakis to also expand toward new helpful automated functionalities. Why manually stumble through your DeFi LP activities when you can securely streamline them with automation? That’s the Arrakis pitch.

Bonus Note: The SPICE Airdrop 👀

The Arrakis Finance SPICE token is deploying soon. To launch the token, Arrakis is running a three-week GEL Lockdrop Program ending on June 10th, 2022.

In 2023, Arrakis will distribute 30M SPICE tokens to users who locked their GEL tokens on Gelato as part of this program. The GEL lock-up period is for three months, so the earliest that participants can unlock their GEL would be September 8th, 2022.

Action Steps

- 🔥 Check out Arrakis Finance on Ethereum, Optimism, or Polygon

- 👀 Brush up on our How to earn governance bribes tactic