Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Yield farming is newest cryptoeconomic incentive scheme to come to DeFi and it’s shaking things up in crypto more than anything I’ve see since the ICO.

These incentives can create harmonious ecosystems. They can also create unintended consequences. They can be gamed.

The question is—what’s really going on in yield farming?

Will Price doesn’t just tell us. He shows us.

We see explosive growth yes.

We also see asset recycling.

We see cascading liquidation risks.

We see DAI bracing for impact.

We see the games that the biggest yield farming whales are playing.

All onchain and on full display for the world.

Let’s look at a visual guide of what's really going on in yield farming.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Guest Post: Will Price, Data Scientist at Flipside Crypto

Visual Guide to Yield Farming

Many DeFi protocols are attempting to bootstrap their way to network effects by incentivizing users with governance tokens. This strategy has been dubbed liquidity mining and was most prominently employed by Compound, which launched its governance token COMP in late June.

COMP is distributed to the protocol’s lenders and borrowers. Holders collectively have governance rights over the Compound protocol. This power includes the right to make arbitrary changes to the system, up to and including voting themselves a share of protocol revenue.

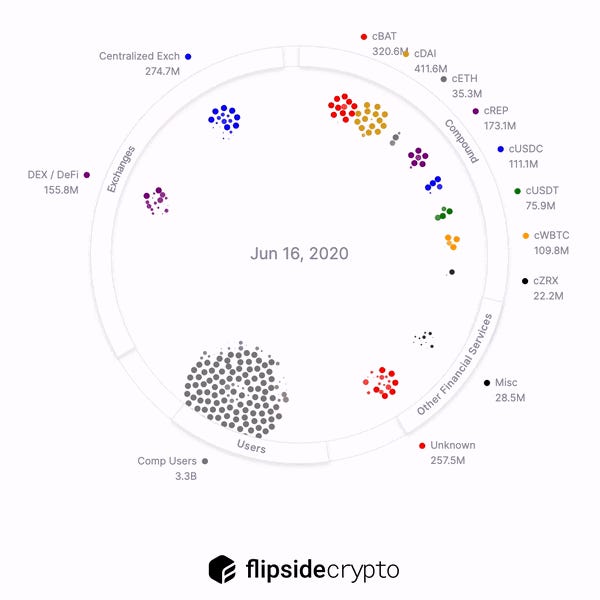

(Above) Compound User Net Asset Flows (USD)

The market reacted to the launch with speculative mania. Assets deposited to Compound increased several times over, while COMP’s fully diluted valuation was bid up to over 3 billion dollars.

These tokens are so valuable that many users are focused on gaming the incentive system to maximize their short term profits—these are the yield farmers. When a better opportunity arises, the yield farmers will rotate their crops to take advantage of it.

Yield Farming Strategy

Under the new distribution mechanism, the value of COMP earned by borrowers exceeds the interest paid, effectively creating negative interest rates. Unsurprisingly, this perverse incentive has caused a massive increase in demand for loans.

Currently, the strategy that maximizes yield works as follows:

- Borrow assets at a low interest rate.

- Supply assets at a high interest rate.

- Have enough of a buffer to avoid liquidation.

To minimize price risk, many farmers are supplying their borrowed assets back into the Compound protocol (recycling). The official Compound front end does not allow this behavior, but farmers can interact directly with the smart contracts or use third-party interfaces such as InstaDapp.

Market Impact

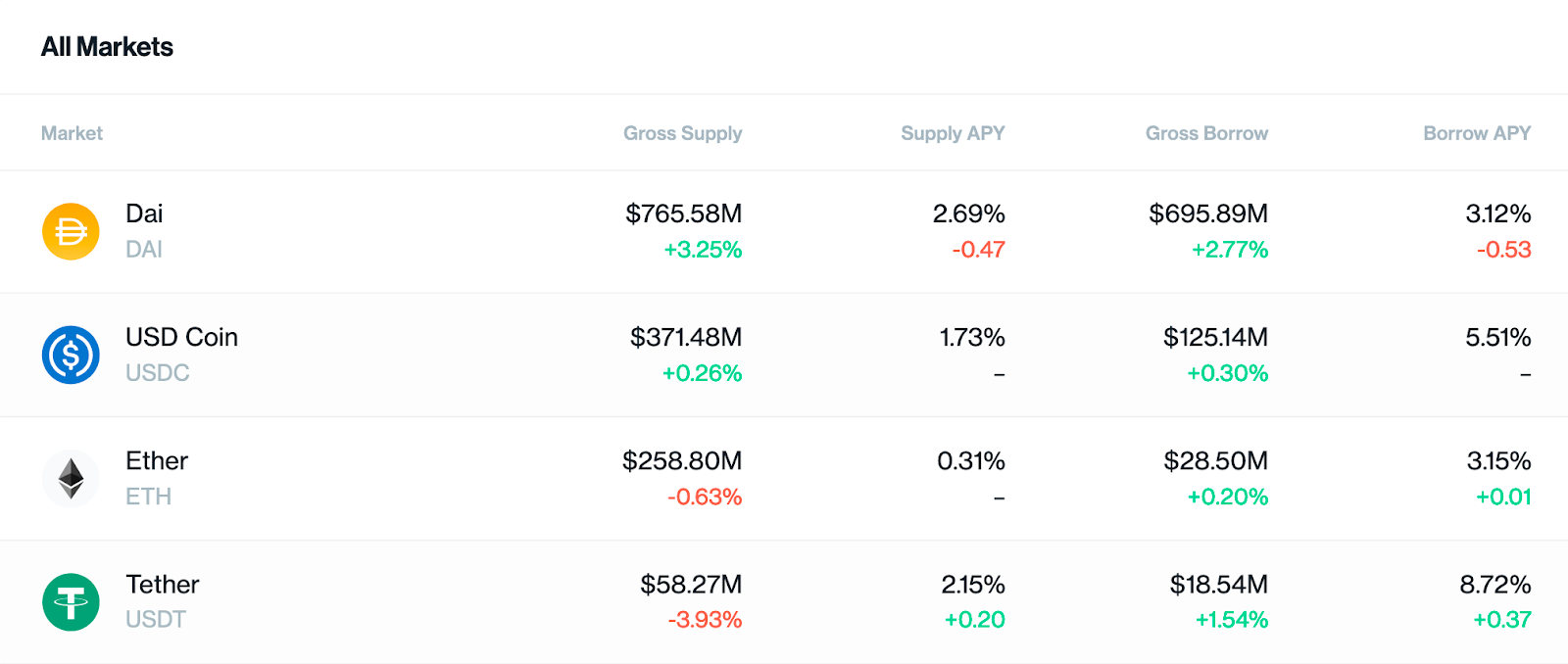

Source: https://compound.finance/markets

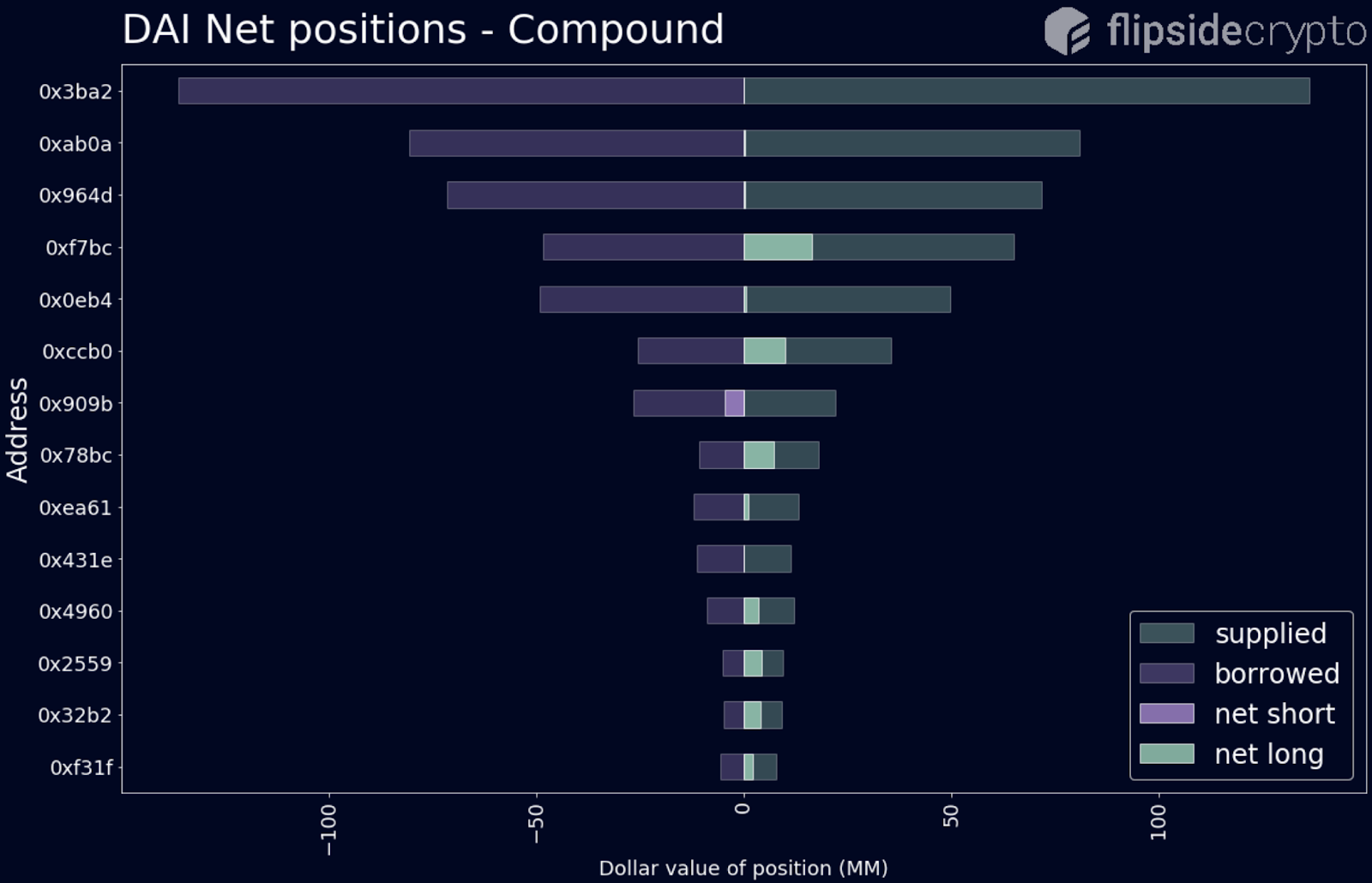

DAI is currently the asset most commonly used for recycling. This is because its supply/borrow interest rate spread is low, which minimizes the amount of interest that farmers must pay.

Coinbase Pro DAI/USD price

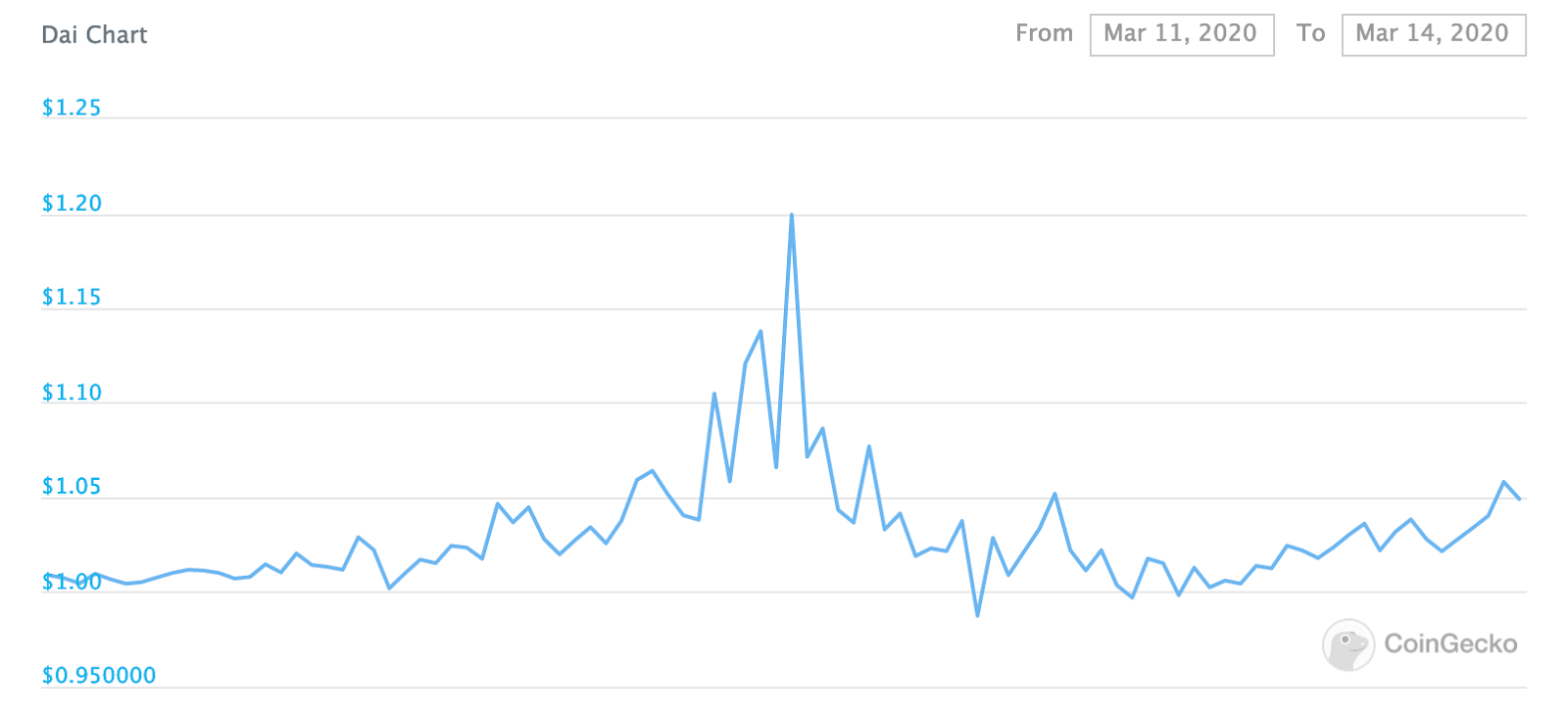

The COMP distribution mechanism was last changed on July 2nd. Prior to the rule change, the most commonly recycled asset was BAT. Demand for DAI has risen leading up to and following its implementation, putting upward pressure on DAI’s dollar peg.

DAI recycling is now so popular that the amount supplied to Compound is triple the amount of total DAI in existence, and its ripple effects are stress-testing the Maker ecosystem.

Yield Farming: An Aerial View

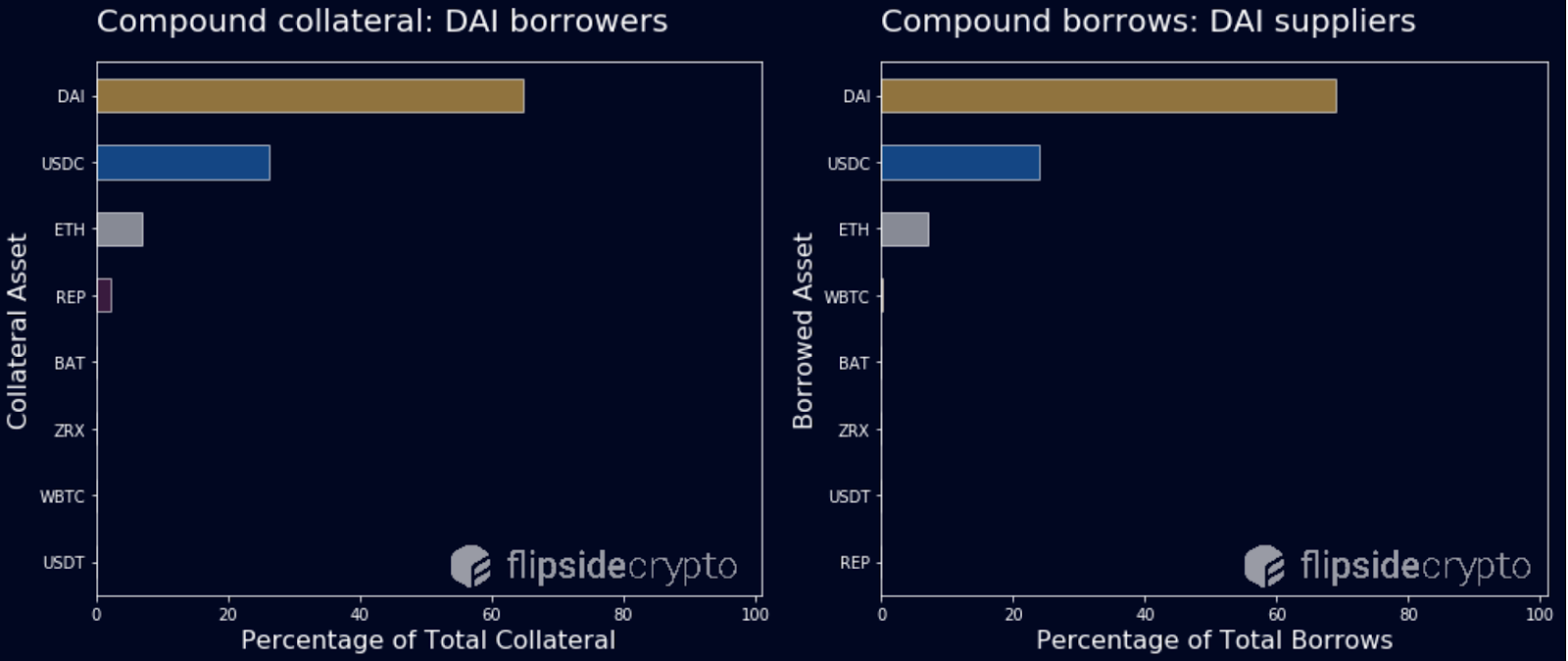

The majority of DAI is borrowed against itself. Some farmers have opened long DAI/USDC positions, speculating that DAI will rise above its peg.

All of the largest DAI suppliers are recycling. Those who are net-long are natural DAI holders, while those with a net neutral position are farming DAI with another asset supplied as collateral.

Natural DAI holders are borrowing DAI against itself and have almost no exposure to liquidation risk.

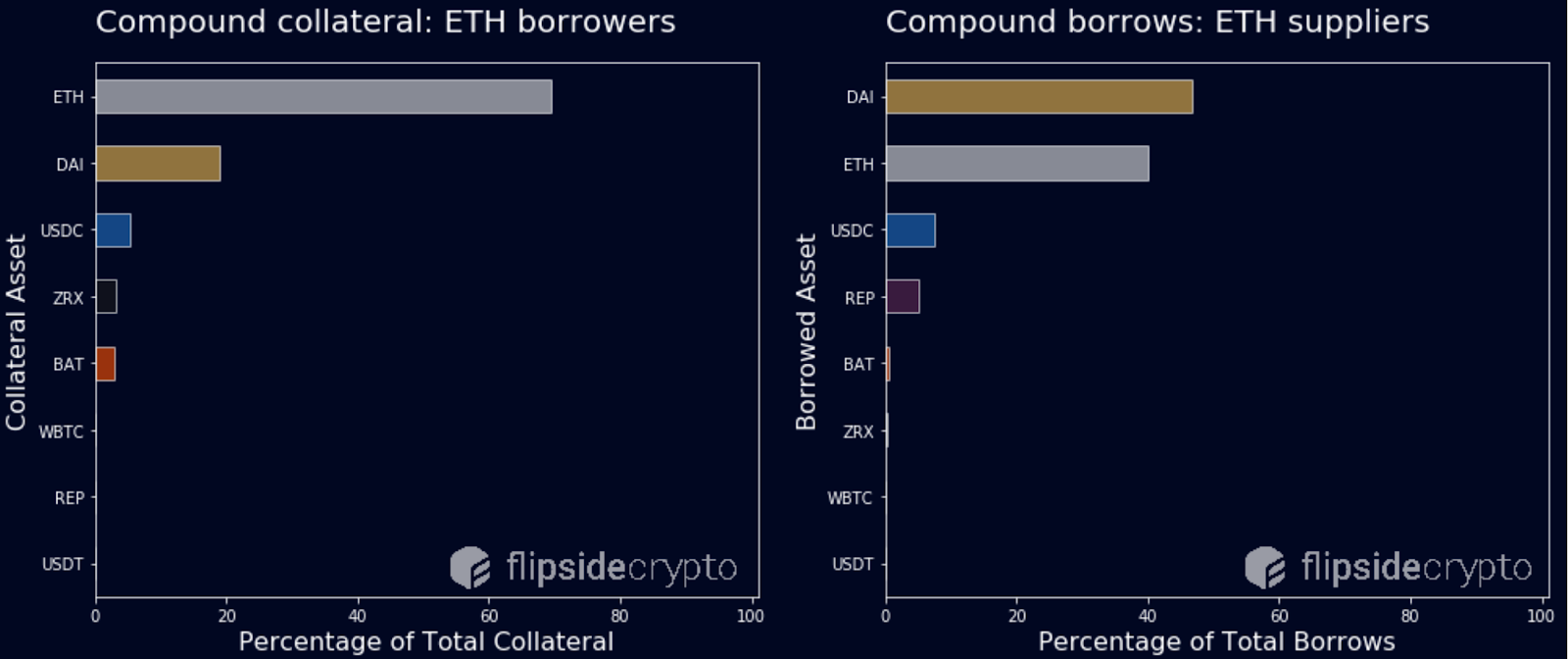

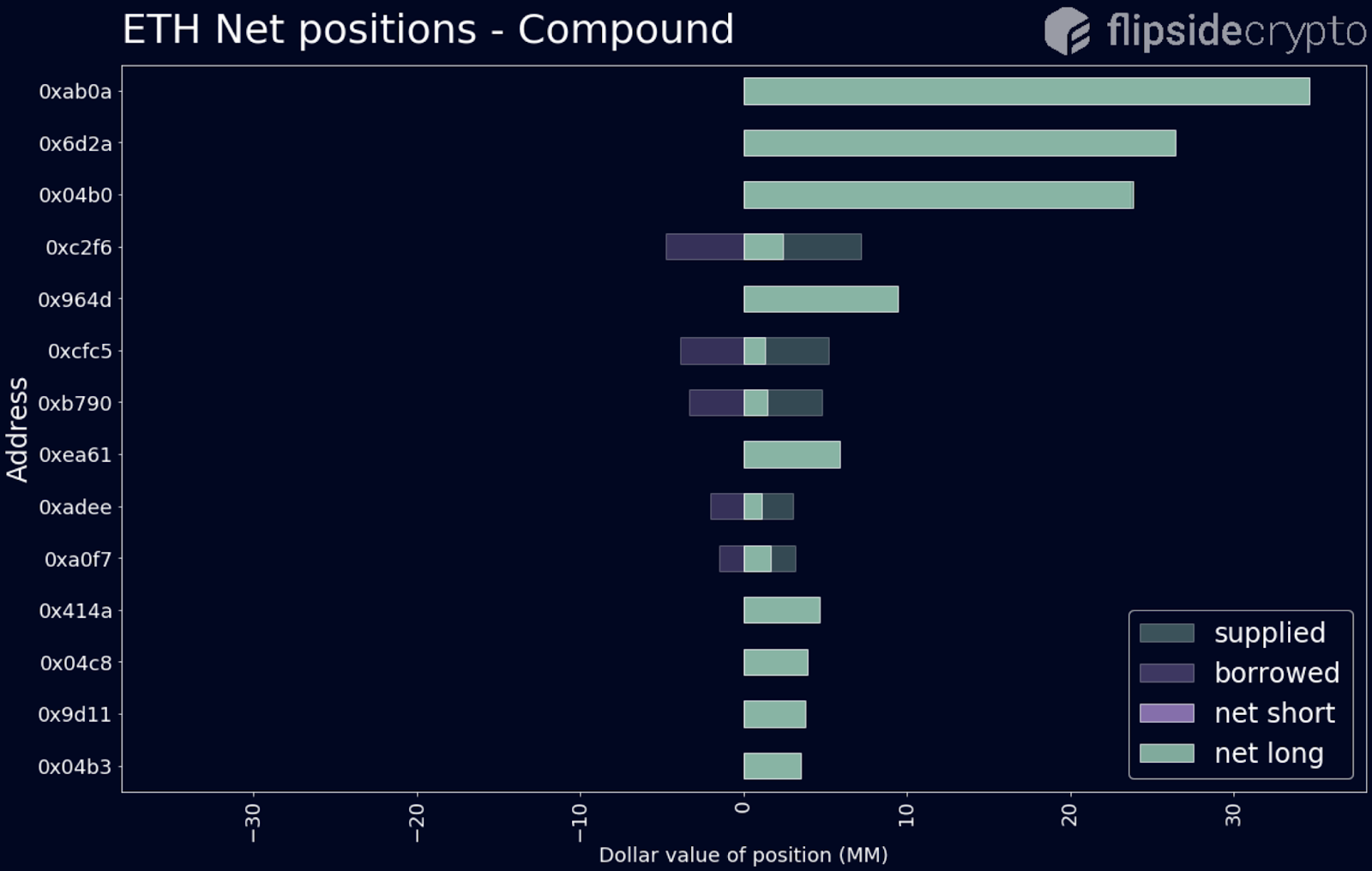

Meanwhile, most ETH that has been borrowed from Compound is also collateralized by itself. This implies that there is minimal natural demand to borrow / short it. Most yield farmers are therefore likely to be bullish on ETH.

With that, a majority of ETH supplied to Compound is being used as collateral for recycled DAI positions. Many of the addresses above with large DAI positions also show up here.

As discussed previously, a few ETH holders are borrowing ETH against itself. This strategy involves almost no risk, but generates significantly lower returns than borrowing and resupplying DAI.

What are the risks?

Yield farming on Compound is not for the faint of heart. The strategies with the best returns all involve some exposure to liquidation risk. And as we saw during crypto’s Black Thursday, a sharp change in asset prices could result in a lack of liquidators willing to take on the necessary price risk.

The price of DAI briefly reached $1.20 on Black Thursday.

Liquidation cascades are not unique to DeFi (see Bitmex), but thankfully, on-chain data allows a fully transparent assessment of the risks involved.

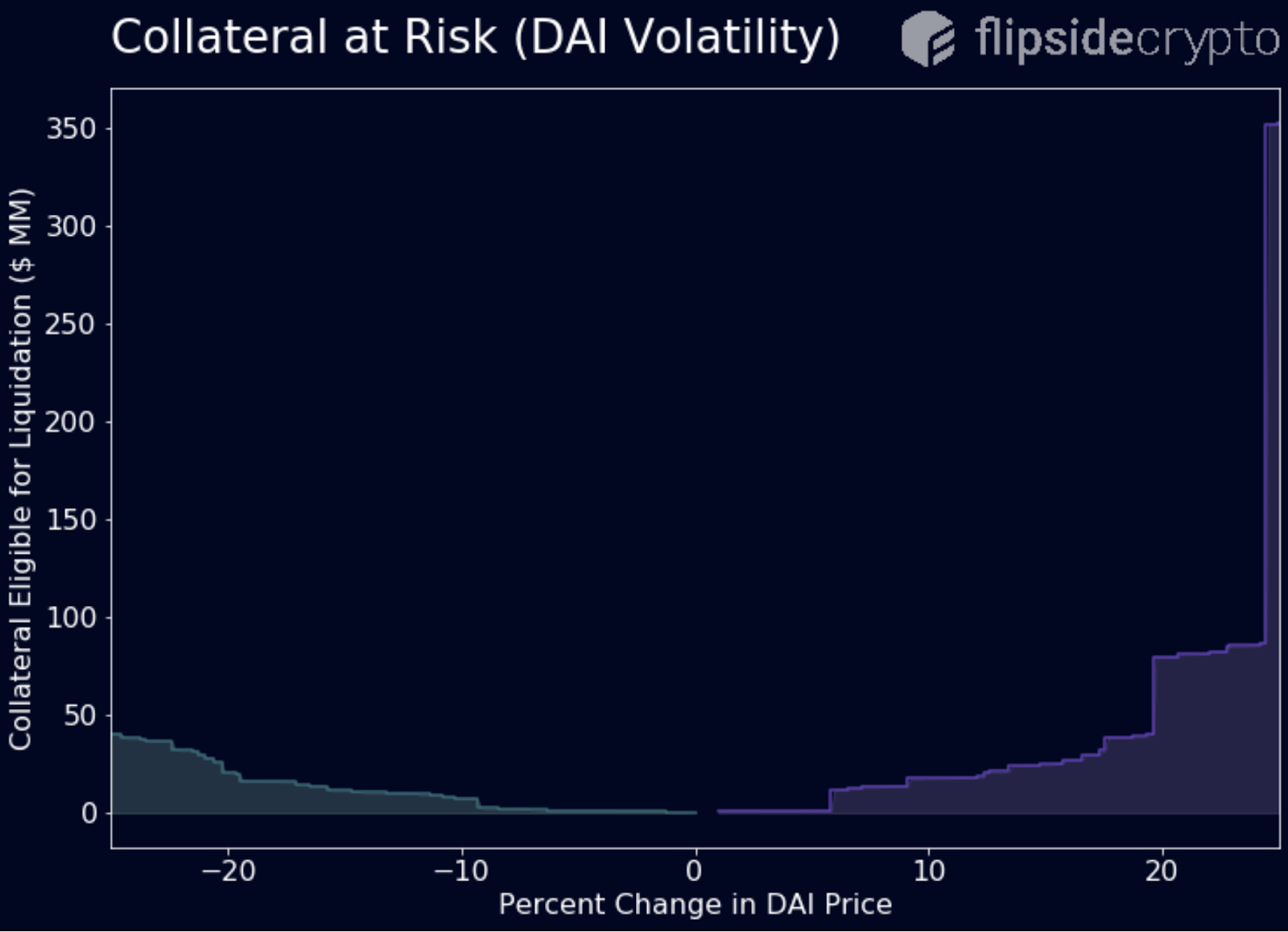

All else equal, a 5% increase in the DAI price would result in up to $10MM in liquidations, while an unlikely 25% increase would put over $300MM at risk—nearly double the total DAI supply.

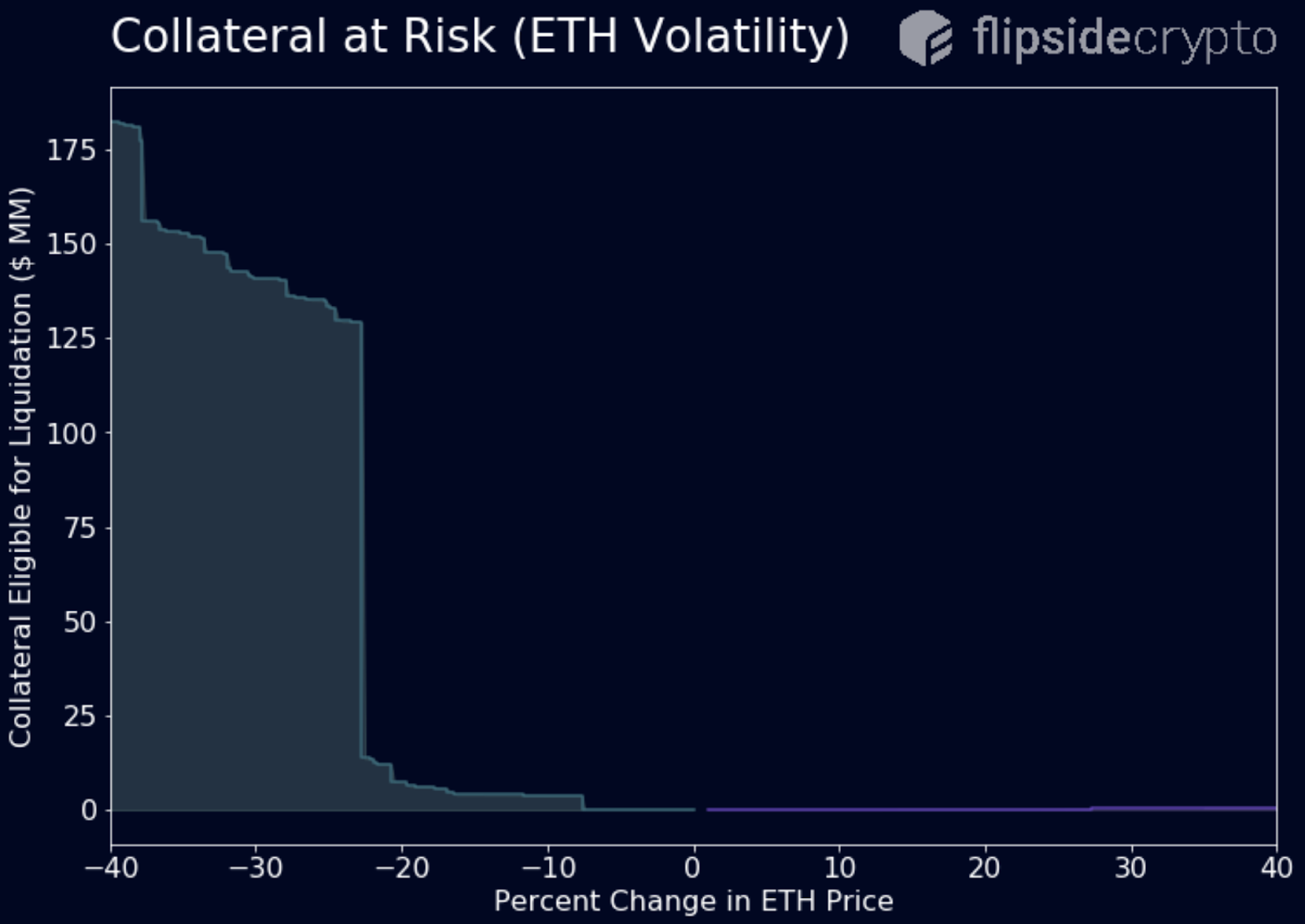

In a much more likely scenario, a 25% drop in the ETH price could cause up to $125MM in liquidations. We saw earlier that many ETH suppliers are borrowing DAI, so you might think that this scenario could cause the DAI price to spike.

This is possible, but the risk is lessened as most large DAI borrowers are recycling, and could simply withdraw DAI to repay their loan. The exception to this would be a bank run scenario. If all supplied assets were already borrowed, recyclers would be unable to unwind their positions.

Conclusion

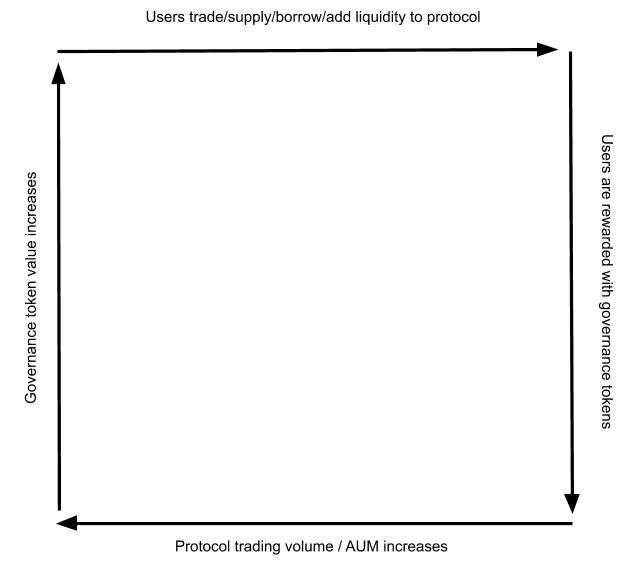

Liquidity mining is seductive because of the positive feedback loop it creates:

When incentives are properly aligned, this is attractive to both protocol developers and yield farmers. But if they are misaligned, farmers will maximize their yield in a way that does not provide long term benefits to the protocol.

Getting incentives correct from the start is nearly impossible, and the Compound community is actively iterating on their model.

Governance is a messy process, but is always fun to watch!

Action steps

- Identify high-risk assets for cascading liquidations due to volatility

- Read “Aquaponic Yield Farming” to get a glimpse of the future of yield farming

Author Bio

Will Price is a data scientist and resident DeFi enthusiast at Flipside Crypto—a firm focused on extracting, decoding, and interpreting on-chain behavior to enable blockchain protocols and applications to live up to their full potential.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.