Why Layer 2s are the future

Dear Bankless Nation,

We couldn’t get our favorite rollup thinker Polynya to jump on a podcast…so here’s the next best thing…

A full written interview with Polynya on rollups!

If you’re wondering why this interview is important, read Ultra Scalable Ethereum and listen to our Modular vs Monolithic Blockchain episode.

In short—modular chains are the future and Ethereum is leading the way.

But in this rollup paradigm we still have many questions.

What are the risks?

Will ETH accrue value?

Do Layer 2s need a native token?

What about composability?

Could it all fail?

There’s a lot to unpack here.

Here’s our interview on rollups, Layer 2s, and the future of Ethereum with Polynya. 🔥

- RSA

🤓 This is an interview between David Hoffman and Polynya—an anonymous Ethereum and crypto researcher publishing some of the best thinking on Layer 2s, zk-rollups, and the world of Web3.

📚 Check out their Medium to level up your knowledge on Ethereum’s scalability roadmap!

David Hoffman (DH): What’s your favorite L1 other than Ethereum?

Polyna (P): L1s are boring as sin, with a notable exception—validity proof / ZK-L1s like Mina. The caveat here is that ZK-Rollups (ZKRs) are even better!

ZKRs get almost all of the benefits of ZK-L1s long-term, but also inherit the highest security, sustainability, and liquidity properties, with more flexibility to focus on building the best execution layer. Fortunately, ZK-L1s also have the easiest path to becoming ZKRs, should that turn out to be the better solution for a specific ZK-L1 project. (See: Mir ➡️ Polygon Zero)

DH: What does a decentralized Layer 2 look like? What is actually being decentralized?

P: A decentralized Layer 2 is a rollup with a secured bridge to L1, with an escape mechanism to L1 even if the rollup fails completely (including funds in a smart contract).

Sequencing and proving are permissionless, which also means a failed rollup can be revived seamlessly by the community. Contract upgradeability is also decentralized, at the very least by governance — with some of the critical modules like the bridge holding funds being immutable.

Ideally, we’d like to have ossified rollups eventually that are fully immutable. There should be easily accessible tools that let people access and exit from the rollup without any trust assumptions beyond running L1 nodes. Do all of this and a rollup is practically as secure and decentralized as L1.

DH: Are all L2’s automatically safe to use?

P: Absolutely not!

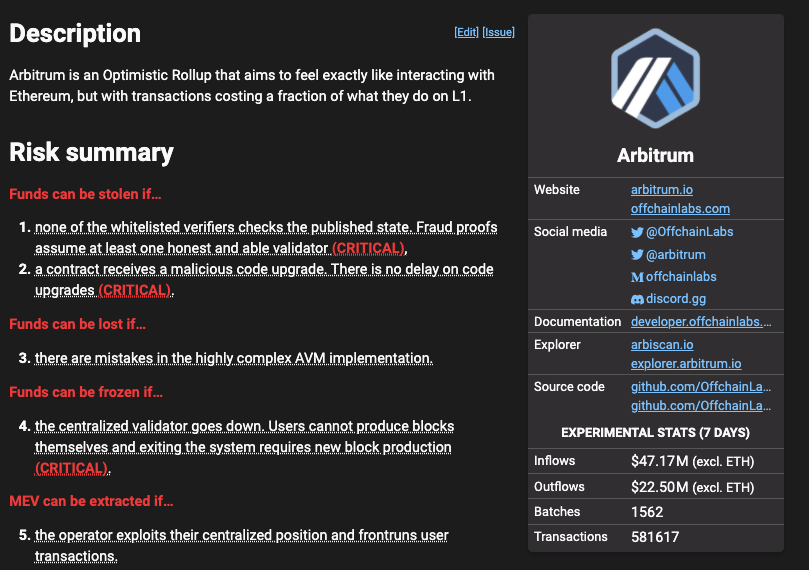

L2Beat.com has detailed descriptions of the security risks for each rollup. This is early tech, so proceed with caution!

DH: What are the largest risks with using an L2?

P: Currently, many rollups have multi-sig upgradability.

The multi-sig can collude to steal all funds in the rollups. Of course, there’s a spectrum here — how distributed is the multi-sig quorum? How transparent is it? Are there timelocks on upgrades?

Pragmatically, I think there are two risks here: 1) a Dr. Strangelove type situation where multiple people lose their marbles and decide to unleash chaos for the heck of it. 2) More likely, regulators order enough multi-sig signers to shut it down. 2) can be mitigated to a great extent by having a widely distributed community multi-sig from all around the world — zkSync has done a decent job with this. I believe timelocks with the ability to cancel upgrades are effective too.

Most rollups also have centralized sequencers, so the biggest risk is that there can be sequencer downtime, during which time it can be very difficult, expensive or impossible (depending on the rollup) to make transactions. Do note that your funds are never at risk.

The good news is that most rollup teams are committed to a path of progressive decentralization, and I’m optimistic this time next year many of the major rollups will have negligible risks.

DH: Do you think it's essential for tokenless L2s to launch their own native tokens to compete with alt L1s?

P: Yes, I think so. Can certainly have niche rollups without tokens, but community ownership seems a requirement for a large-scale rollup.

DH: What does “Ethereum alignment” mean to you? Why is it important? What/how do you evaluate different L2s on their “Ethereum alignment”

P: It means pragmatism to me.

Ethereum has the highest security, liquidity, network effects, and also the most ambitious technical roadmap for scaling rollups. It makes a lot of sense for rollups to focus on Ethereum. There’s definitely a spectrum to “Ethereum alignment”.

Many teams are ideologically aligned with Ethereum’s values, which are simply unavailable elsewhere. Some may focus on Ethereum because that’s where most of the liquidity and opportunity is. We’ll definitely see forks on other networks.

DH: How do you think L2 composability issues will be tackled?

P: All rollups are fully composable.

You can have a super-duper-rollup doing millions of TPS (when that becomes possible) that is fully composable. Furthermore, the potential for scalability with rollups are necessarily higher than L1s, so there’s less scope for fragmentation. Of course, just like L1s, composability breaks between rollups. But even here, rollups offer much superior interoperability possibilities, because they share a settlement layer. So, you can have solutions like dAMM where multiple rollups can share liquidity, or DeFi Pooling where multiple rollups can access L1 dApps.

The bridges between rollups are also secure, unlike L1s. With the Danksharding design, it’s possible for zk rollups to synchronously interop with L1. Finally, it’s possible that eventually, we can have multiple zk rollups composing internally, so to the L1 it appears as a single composable state with a single proof.

This one’s speculative, of course, but the point is — rollups have a much wider design space that makes composability and fragmentation much, much less of an issue than between L1s.

DH: How does ETH's L2 ecosystem begin to feel more connected?

P: By abstracting all of this from the user.

The user just uses a smart wallet like Argent, and they don’t need to know what rollups are. They just use the applications and use cases of their choice, and all of the blockchain stuff is seamlessly abstracted under the hood. Of course, this is a long-term vision that’ll take a few years to materialize.

In the here and now, we already have pretty seamless bridges & DeFi pooling solutions (see: Argent on zkSync).

DH: How will Ethereum L2s entice newcomers who are already using other L1s to come?

P: It’s simple — long term, rollups have higher scalability potential, functionality, programmability, UX than any L1 ever could.

The real game-changer would be unique and innovative applications that are not even possible on L1s. We’ve seen @guiltygyoza on Twitter already build physics engines and 3D models on StarkNet. In the long term, users will use rollups because they are simply far superior to L1s in every way.

In the short term, developer adoption and token incentives can be effective.

DH: What do you think is the lowest hanging fruit for developers that could vastly improve the Ethereum ecosystem?

No idea, I’m not a developer. I don’t know what low-hanging fruit would be!

This is definitely not low hanging fruit, but I’ll state the obvious: UX is horrible & fragmented. I think we need some standardization — more initiatives like Sign in with Ethereum so there’s a somewhat coherent user experience.

DH: Are you concerned that the increase in blockspace capacity due to L2's will outpace the increase in transaction demand?

P: Yes! Certainly, the type of applications that exist today doesn’t require the kind of capacity rollups & data shards offer.

The hope is that with the higher capacity and better functionality we’ll see new types of apps with orders of magnitude wider userbases. But that is just hope at this point. We shall see!

DH: Is this a race to the bottom or does transaction demand increase exponentially as gas prices fall?

P: There’s definitely a ceiling to meaningful transaction demand. Sure, if you make things cheap enough or free it’ll be filled with spam. But I’d argue these are parasitic and should be avoided.

DH: What is something only a few people understand about the future of the crypto industry but is crucial to its success?

P: Trust is a fundamental tenet of our species — most people highly value trust.

The goal should not be absolute trustlessness, but improving our trust systems by leveling the playing field.

DH: How could Ethereum fail in your eyes?

P: Paradox:

- By not decentralizing and ossifying fast enough.

- Something completely revolutionary comes and obsoletes Ethereum, and because it’s ossified & decentralized it can’t respond fast enough.

Also, worth noting that I believe the fates of ETH the asset and Ethereum the network can diverge. (Almost certainly going to happen with BTC & Bitcoin.)

DH: Could a new general-purpose Data Availability (DA) project gain traction? If yes, could they use these network effects and launch a settlement layer to steal market share from Ethereum?

P: Those are two separate things. A general-purpose DA project can certainly gain traction. But this network effect is largely unrelated to what’s required for a settlement layer — i.e. quality money, high economic security, wide token distribution, breadth and depth of liquidity, Lindy, etc.

Also, Ethereum is building its own highly scalable DA layer to supplement its established settlement layer. Now, there may be certain siloed applications that don't care about any of the above, in which case I’d say it’s targeting a different market than Ethereum.

DH: Can zkrollups ever have EVM equivalence?

P: Yes! There’s already a detailed spec by the ConsenSys Applied R&D Team.

A zk-evm specification - General Layer 2 - Ethereum Research

The Ethereum Foundation (EF) is collaborating with multiple other teams. Polygon Hermez & Scroll are building EVM equivalent zk-rollups along very similar concepts. There’s growing consensus that a native zkEVM implementation is possible by the end of the year; however, they may take some time to mature and scale-up.

DH: How do you think about the distribution of winners in crypto? Winner take? Winner take most? How much is ‘most’? What are your justifications for your answer?

Winner takes most is the obvious answer. Or oligopoly. It’s just how technology has always worked, and there are stronger social consensus pressures in crypto. Curiously, I think we can have a long tail thanks to the religious nature of crypto.

DH: You tweeted a thread on value accrual for different layers: Do you believe that the fat protocol thesis is invalid?

I added a caveat to the thread: quality money. Also, it depends on the use cases. If you can build quality money, and the dominant use case is DeFi, it stands to reason the base asset accrues a ton of value.

DH: Additionally, can you talk about the supply/demand flows of ETH in a fully built-out rollup-centric landscape and when you expect this to stabilize?

P: ETH will be used as money throughout the ecosystem. Rollups will pay transaction fees. Though per transaction this will be minuscule, it’ll add up to a big number.

I don’t want to say too much, as it’s still early days!

🔥 Off-Topic Questions

Some final off-topic questions to wrap up!

DH: Do you own any NFTs and PFPs and if yes which ones or do you like>

P: Yes, a couple, mostly to experiment. Nothing fancy, though I did pass on minting my free CryptoPunk because I had just sold all my ETH and was too lazy to buy some back to pay the gas fees!

DH: Where did you accrue your blockchain knowledge, are you self taught?

P: Just general curiosity over many years, reading and watching what people building have to say, conversing with some of them etc. Rollups are interesting, you read about them, you learn about them. To be very clear —I only have a superficial understanding of rollups, and couldn’t put two lines of code together to save my life.

Definitely not an expert — just a well-informed hobbyist :)

DH: Do you own any traditional equities? For which industries/companies?

P: Most of my portfolio is private equity, not going to doxx myself! AMD is the only public equity I own currently.

🙏 Thank you Polynya for joining us and answering our burning questions on the future of Ethereum, rollups, and everything else!

Action steps

💭 Consider Polynya’s take on zk-rollups and value accrual for ETH

📖 Read Polynya’s Blog—tons of great info!

⬆️ Level up on modular blockchains with these Bankless Resources