Dear Bankless Nation,

In 2017, Mike Novogratz presented a keynote titled The Herd is Coming.

The herd referred to the wave of institutional investors that would pour into crypto—up until that time crypto had been mostly a retail phenomenon.

It took a bear market and a resurgence in prices to get crypto back on the institutional radar. But since then, we’ve seen some big money come in from a smattering of traditional hedge funds, billionaires, corporations, and endowments.

Was this the herd?

We haven’t felt the stampede.

Where’s the big money? Like the really big money…

Where are the sovereign wealth funds and pension plans with their millions of beneficiaries?

These entities operate massive pools of capital—upwards of $100 billion, $500 billion, and some even over $1 trillion 🤯

These institutions are starting to understand crypto’s value proposition.

But they’re still not here.

The good news is that it’s no longer a question of why.

It’s a question of how.

The folks who made the largest institutional purchase of ETH and BTC explain.

- RSA

Guest Writer: Shaun Martinak & Sebastian Bea, One River Asset Management

The global economy has been digitizing for decades.

At first, basic communication tools like email and early websites were seen as a novelty. Thirty years later, these applications along with communication networks, data centers, and tools like machine learning have fundamentally transformed industries across the globe. Advertising, pharma, and global trade have changed how they operate, some by choice and some by force, through the impact of digital technology.

This shift has always been one-way. Digital technologies lower costs, improve flexibility, and democratize access. Now, after resisting change for years, the financial sector is—finally—traveling this same digital path.

Such a change needs investment, and in this note, we will explain The Institutional Investor’s Path to Digital Assets. We will explain why and how institutions may adopt digital assets. We will shine a light on some of the restrictions that have slowed direct investment thus far. We will explain how many institutional investors think, operate, and invest. And we will project a path for the industry as that engagement takes hold in time.

We believe that the global financial infrastructure is set to fundamentally remake itself, with crypto underpinnings. While the rest of the global economy has gone online, “fintech” thus far has mostly been about better apps and user interfaces on top of the same slow, expensive, inflexible, and censor-prone infrastructure.

Digital property rights and internet native money are here. They fill crucial gaps in the inevitable march towards a fully digital global economy.

A fundamental re-architecting of the financial system is coming. Institutional investors, along with regulatory bodies and incumbent financial players, are starting to recognize this trend and they are moving.

Regulators warming

Regulatory bodies in the US, including the Federal Reserve, the Security and Exchange Commission (SEC), the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation have all declared that digital is the future in their own way. This is clearest in the President’s Working Group report on stablecoins.

American leaders have stepped forward recently to support the industry and its importance to America’s financial strength. A notable example is the WSJ op-ed from Jay Clayton, former SEC Chair and current One River Digital advisory council member. His headline is simple and clear: The US needs to act fast to preserve its advantage in the tokenization of our financial infrastructure.

What about the big money?

It is increasingly obvious that digital is the future of finance. But is it obvious to Pensions and Sovereign Wealth Funds? What is stopping these large institutional investors from seeing the future, and investing in the assets, applications, and networks that will bring this all about?

This is a good time to better describe what an Institutional Investor is—and yes, there is confusion on this point. We are not talking about the large mutual fund or hedge funds that you see mentioned in the press.

We are talking about the big asset owners, the large entities with unfamiliar acronyms.

These entities operate investment pools of $50 billion, $100 billion, $500 billion, and some even over $1 trillion. Their names are often some combination of letters and numbers that sound like an error code on your computer, like AM2, XCorp, Super Fund, GCIF. Or in the US, take your state initial and add “ERS” to it.

These mega-funds are the pools of capital that, for the most part, have only started to officially consider digital assets. They are sovereign wealth funds or pension plans with thousands or even millions of end beneficiaries. Their staff is usually public employees with strict ethical and legal requirements to uphold.

These hard-working investment professionals have not been slow to invest in digital assets out of neglect or disinterest. Their pace has been dictated by who their plan/fund is and how these entities operate. Let’s pull back the curtain on how these investors construct their investment plans (and how that has impacted institutional adoption of digital assets).

Institutional Investment Plans

Almost all institutional investors construct an investment policy statement or IPS. This document is usually paired with a strategic investment plan, often referred to as a Strategic Asset Allocation, or SAA.

The IPS is a document that defines the objective of the client (i.e., pension plan), and what rules the manager (pension staff) needs to follow to best seek these objectives. It is in this plan that institutional investors will specify the plan’s goals, risk tolerance, and liquidity requirements. Also within this plan is a list of acceptable assets (bond, stocks, private equity, etc.).

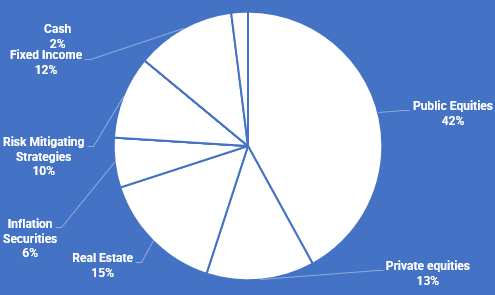

What does a large pension plan SAA look like?

A bit like this:

Example Large Pension Plan Strategic Asset Allocation

Until recently, regulatory uncertainty for digital assets was enough to keep digital assets out of the SAA. Another stumbling block had been total market capitalization. But even after a pullback, the liquid crypto market capitalization is approximately $2 trillion, and that’s before accounting for private companies.

Warming Up to Crypto

With the accelerated evolution of the digital ecosystem and increasing signs of maturity, institutional investors have started to warm to the appeal of the industry (this is notable in custodial services, for example Coinbase here).

That is also evident in the recent increase of fundraising by Venture Capital (VC), and in VC deployment.

Institutions have started to warm to the case for digital assets. For reference, One River Digital made the first large institutional allocation. Some of the thinking behind that investment was documented in our paper read over 100,000 times. A deeper look, In Math We Trust, explores various perspectives on why digital assets could have a place in portfolios.

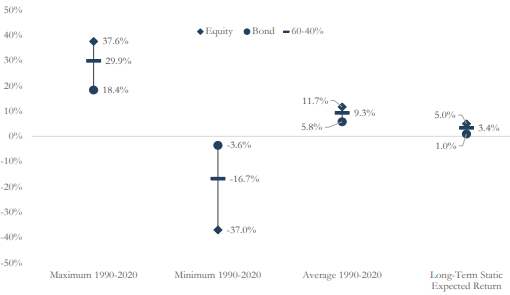

Strong past “balanced” performance suggests low future returns

We find that many Institutional Investors have already decided Why they might invest in Digital Assets. But, as they consider adding this asset class to their IPS/SAA, they have also been confounded by the fundamentally different nature of this asset class.

Why Institutions Haven’t Invested Yet

How to invest is quite hard for many institutions at first, due to the unique features of these assets. Digital Assets are “bearer instruments”.

If you have them, you own them. Their storage and safekeeping are vastly different as compared to traditional assets. Initially, institutional investors do not necessarily have the knowledge to diligence cold storage, hot wallets, and the like.

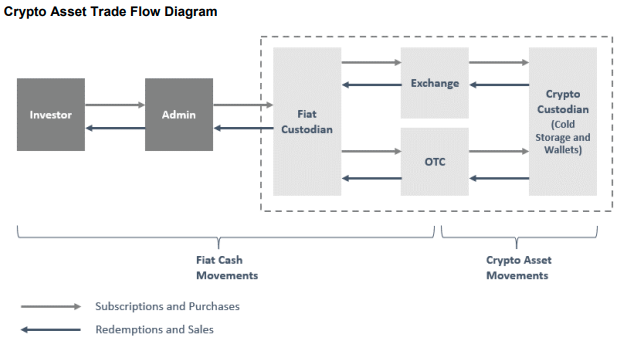

To solve the How, industry groups have stepped in to help. The Standards Board for Alternative Investment (SBAI) published a Guide to Operational Due Diligence on Crypto Assets.

The Toolbox memo looks at custody, trade processes, valuation, asset verification, conflicts of interest, and regulatory risk.

Crypto Asset Trade Flow Diagram

This is what it takes institutions to get started on the journey to a digital future.

If you were frustrated by their slow speed of adoption, you can start to feel some empathy. Imagine being an investor running a portfolio at one of these institutions.

Imagine you have fallen far down the rabbit hole and are bringing your colleagues with you. Imagine the urgency you feel to make sure the thousands of people you represent don’t miss out on one of the most important drivers of growth in the global economy in the coming decades. And then to be stopped cold….by asset storage.

Change is not easy when these are the impediments in your way. Four years ago, these were major impediments. Today, these problems are being solved with groups like SBAI, asset managers, and institutional-grade custodians.

Asset Selection

After Institutions determine Why and How they can invest in digital assets, then they need to select the right investments. Asset selection means determining the investment types (VC, passive index, income, long-biased hedge, etc.), and then performing due diligence on investment managers. Institutional Investors are already experts at selecting the right investment managers and picking the right strategies.

This next step would be relatively straightforward if an established list of familiar professional managers existed. But it doesn’t. This is partly why One River Digital exists; we extend eight years of successful institutional asset management into the digital ecosystem, providing a bridge for institutional investors to complete their journey.

Before investors arrive at their digital destination, these investors will stop to focus on paying the right price. Would you pay a hedge fund manager 2% fees and 20% on performance to be long Bitcoin?

No, and they wouldn’t either! But why is that? Because we all understand that investment managers should be paid for the value that they add.

This is where separating “beta”, the market return, from “alpha”, the value add, comes in. When a market is growing fast and knowledge is in the hands of very few experts, getting exposure looks like alpha to the outside world. That is the state of digital assets today and it is a state that never lasts long in any market. We believe that Institutions will quickly adopt institutional-grade benchmarks to better measure and invest in the digital ecosystem. Using these benchmarks, institutions will be better able to separate and invest in the underlying return drivers from the crypto industry.

Gradually, Then Suddenly

All of this takes time. But it is happening.

With all the work still to be done, and the investments that follow, we can’t help but feel excitement for the future of the digital ecosystem. Long-term engagement with the largest asset owners may bring increasingly stable and long-term capital to the digital marketplace.

We believe that such engagement could ward off the next crypto winter, transforming the next market lull into something more constructive. And it is in this next phase that we believe the industry will build its base for its next phase of growth and gains.

That’s “What’s Taking So Long.”

If you enjoyed this letter and want to read more from One River Digital, please email us at info@oneriveram.com.

Important Disclosures

This document (the "Paper") has been furnished to you for informational purposes only. This Paper is not a solicitation for an investment, is not comprehensive, and should not form the basis for any investment decision. This Paper is not an offer to sell or a solicitation of an offer to buy an interest in any investment vehicle managed by One River Asset Management, LLC ("One River") or any other security. and may not be relied upon in connection with the purchase or sale of any instruments or interests in investment Any offer to buy interests in a vehicle managed by One River will be made pursuant to the delivery of the vehicle's related organizational and offering documents, which will be furnished to qualified investors only.

One River is not acting as an investment adviser to you. This document has not been prepared for, and should not be construed as, providing investment advice or recommendations to any recipient. Clicking on a link containing this Paper or receiving this Paper through a distribution does not create a client relationship between you and One River. Such a relationship would only be established pursuant to relevant agreements. Before making any investment, One River strongly suggests that you obtain independent advice in relation to any investment, and with respect to any financial, legal, tax, accounting or regulatory issues resulting from such an investment. In addition, because this Paper is only a high-level summary; it does not contain all material terms pertinent to an investment decision. This Paper should not form the basis for any investment decision.

Information contained in this document has been obtained from sources that One River believes to be reliable, however One River makes no assurance or guarantee that such information is true and/or accurate, and One River expressly disclaims liability arising from the use of information contained herein.

This Paper contains statements of opinion. These statements of opinion include, but are not limited to, One River's analysis and views with respect to: digital assets, projected inflation, macroeconomic policy, the market adoption of digital assets, and the market in general. Statements of opinion herein have been formulated using One River's experience, research, and/or analysis, however, such statements also contain elements of subjectivity and are often subjective in nature. In addition, when conducting the analyses on which it bases statements of opinion, One River has incorporated assumptions, which in some cases may prove to be inaccurate in the future, including in certain material respects. The analysis and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing in this Paper represents a guarantee of any future outcome, or any representation or warranty as to future performance of any financial instrument, credit, currency rate, digital currency or other market or economic measure. Information provided reflects One River's views as of the date of this document and are subject to change without notice. One River is under no obligation to update this document, notify any recipients, or re-publish the content contained herein to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. Certain information contained in this Paper constitutes "forward-looking statements," which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "target", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof or other variations thereon or comparable terminology.

Forward-looking statements made in this Paper are based on current expectations, speak only as of the date above, as the case may be, and are susceptible to a number of risks, uncertainties and other factors. Assumptions relating to the foregoing involve judgments with respect to, among other things, projected inflation, the regulation of digital assets and macroeconomic policy, all of which are difficult or impossible to predict accurately and many of which are beyond our control.

Although we believe that the assumptions underlying the projected results and forward-looking statements are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that the forward-looking statements included in this Paper will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation to future results or that the objectives and plans expressed or implied by such forward-looking statements will be achieved.

Action steps

- 🤔 Understand what’s preventing institutions from investing into crypto

- ❤️ Read Institutional Investors Love DeFi

Author Bio

Shaun Martinak: Research/Portfolio Manager for Digital Assets at One River Asset Management. Shaun is responsible for the creation and execution of digital asset investment products, as well as contributing to research in the field. Prior to One River, Shaun was a managing director at British Columbia Investments, one of Canada's largest pension plans at ~$160B. Prior to BCI, Shaun worked for Ontario Teachers' Pension Plan (+$170B), running a $3B portfolio of systematic and discretionary liquid market trading strategies.

Sebastian Pedro Bea, OLY: President of One River Digital, and Head of Sales/Strategy for One River Asset Management. Sebastian is responsible for development and execution of ORD’s strategic plan. Sebastian and his sales & strategy team engage with institutions worldwide to best deliver OR/ORD’s investment capabilities. Prior to joining One River, Sebastian worked for BlackRock, beginning in 2012. Sebastian was most recently a Managing Director at BlackRock, co-leading investment strategy globally for BlackRock Systematic Active Equity.