Visa is going to pay ETH holders

Dear Bankless Nation,

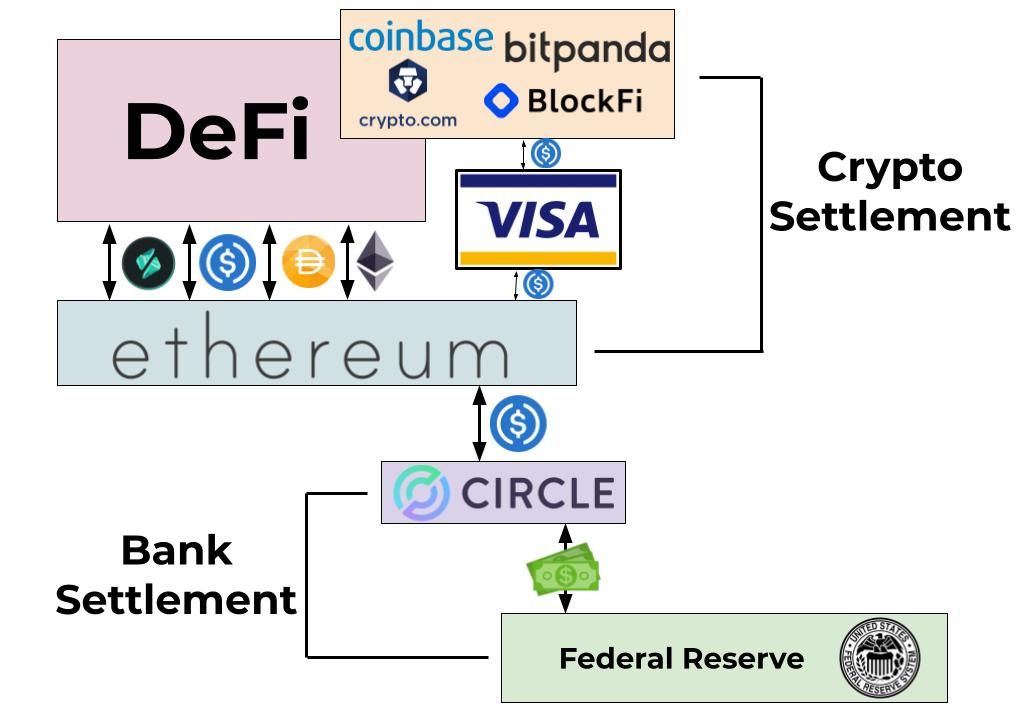

Visa just announced that it will be using Ethereum to settle payments using USDC.

This means that part of Visa’s payment networks will use USDC for payments, and that Visa will settle those payments on Ethereum. Bullish?

“[Visa], which moves billions of dollars each day in 200 markets, today announced it accepted the first settlement payment in U.S. Dollar Coin (USDC), a cryptocurrency pegged to U.S. dollar in a 1:1 ratio, from its global crypto wallet partner Crypto.com over the Ethereum blockchain. This marks the launch of a pilot which would allow Crypto.com to settle a portion of its obligations for the Crypto.com Visa card program in USDC.”

“The credit card giant is already partnering with 35 digital currency platforms, including Coinbase, Crypto.com, BlockFi and Bitpanda, which collectively have more than 50 million active users.”

- Nina Bambysheva, Forbes Staff

Visa Will Start Settling Transactions With Crypto Partners In USDC On Ethereum

This is Visa using its own payments network as a way to scale USDC payments on Ethereum. Visa’s payment network can process over 1,500 transactions per second—an advantage only a centralized service provider can offer. The revolutionary new feature is that Visa is using Ethereum to submit ‘final settlement’ transactions.

Thousands of transactions can happen internally on Visa’s network, and then Visa can make a single, batched transaction to Ethereum that updates the balances of its partners that leverage Visa for USDC transfers.

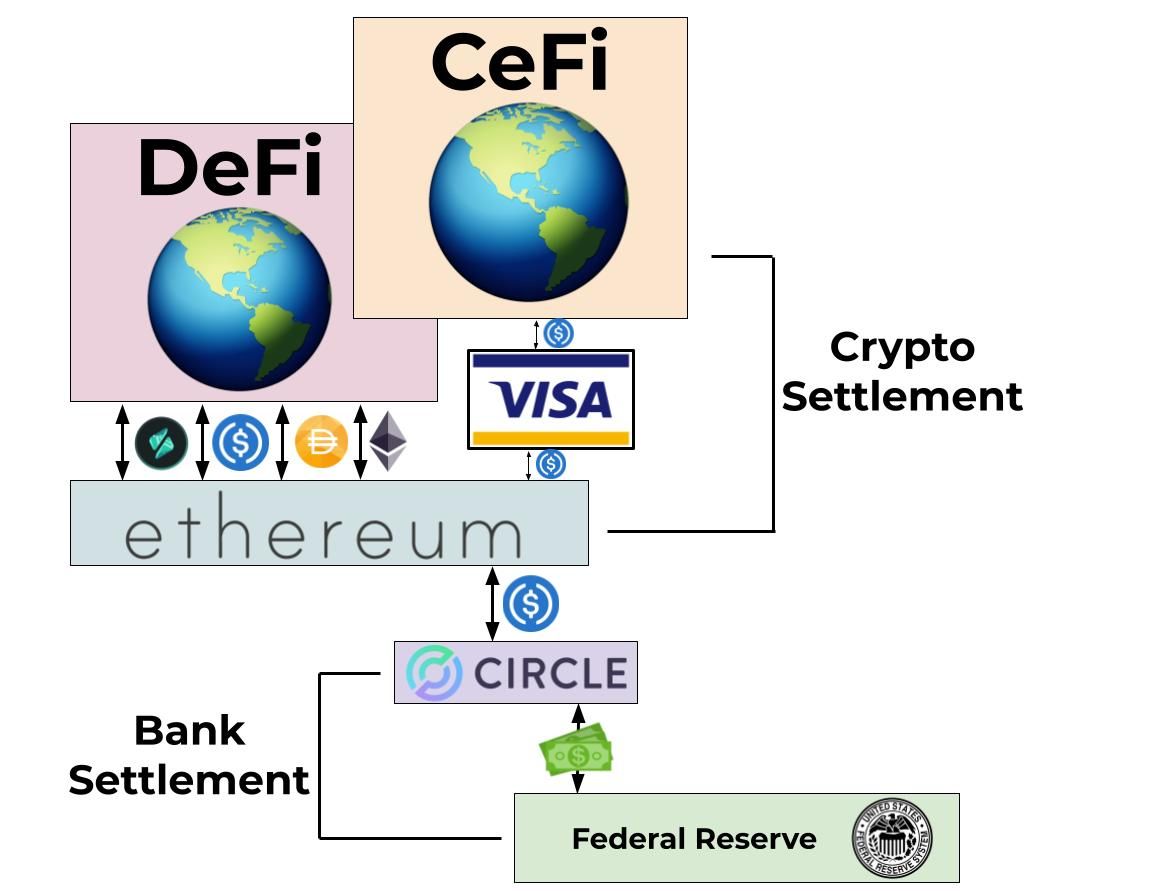

Slowly Rugging the Fed

As an institution, the Federal Reserve is ‘the final boss’ for DeFi. Under a cryptocurrency revolution, the power, value, and brand of the U.S. dollar is at stake. The Federal Reserve and the U.S. Dollar have a monopoly as the US Dollar is the world’s reserve currency, and the Federal Reserve controls the ledger of the U.S. Dollar.

USDC settling on Ethereum using Visa doesn’t change this. All dollars settle back to the Federal Reserve no matter what. But what it does do is move more and more economic activity onto Ethereum’s payment rails. It’s an on-ramp of everyday, normal economic activity—like buying coffee—that settles on Ethereum. Cool right?

Visa pushes a ton of volume through its network. While this announcement is only a fraction of overall Visa volume, it’s a strong foot-in-the-door for the growing USD volume that settles on Ethereum.

What happens when this Visa<>Ethereum integration grows just beyond the crypto-banks, and expands into more generalized payment merchants?

Visa is just a payments network; it doesn’t have its own native asset for payments. It can settle any asset.

Today, USDC.

Tomorrow, DAI?

Then after, WBTC, ETH or even RAI?

Imagine the implications of Visa settling the RAI stablecoin on Ethereum!

RAI: A self-referential stablecoin that is pegged to itself, rather than $1, and thus is completely self-sovereign from the monetary policy of the Federal Reserve, and does not need the Federal Reserve for settlement. It’s 100% Ethereum native. Also, it’s backed by ETH.

If the people of the world demand it, Visa will satisfy that demand. Visa is a for-profit company and owes no homage to the Federal Reserve. Visa just processes dollar payments because people want dollars today.

What happens when people want something else tomorrow?

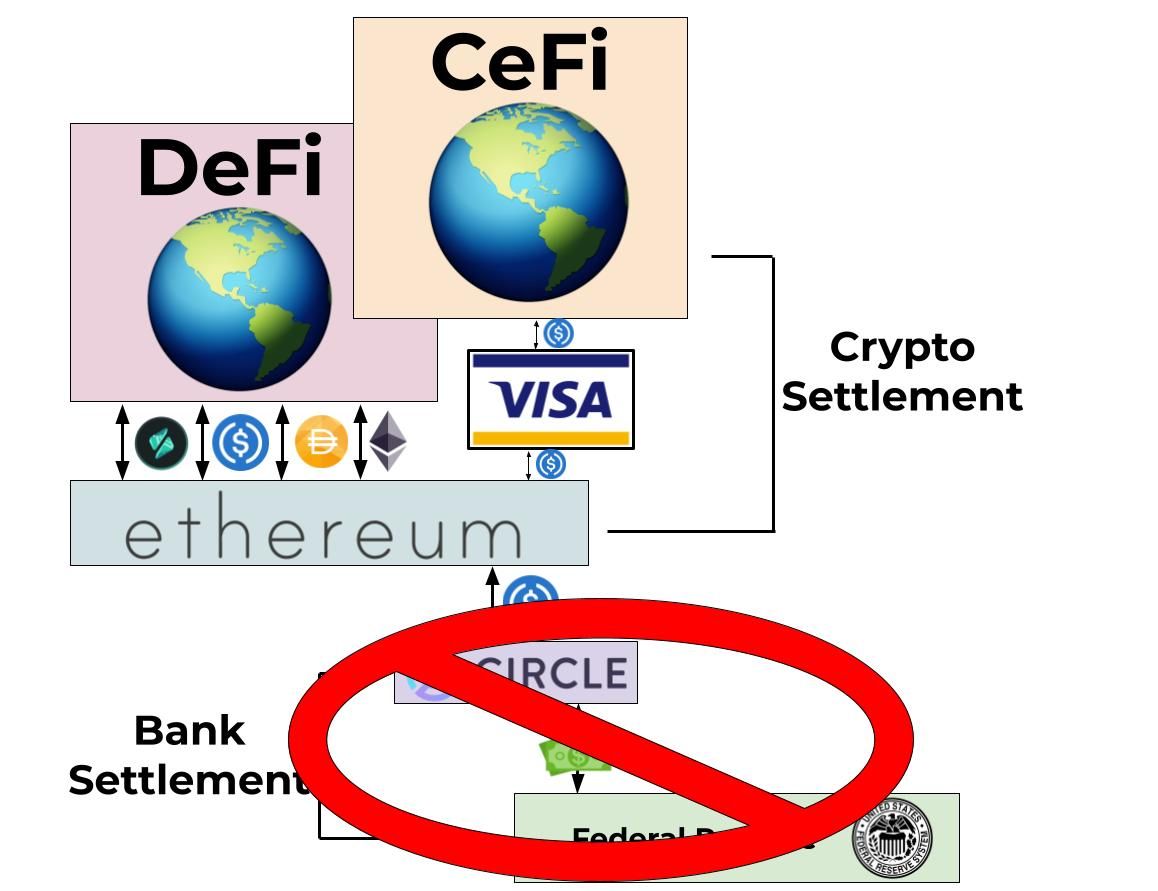

This is how crypto rug-pulls the Fed. First, we start settling dollars on Ethereum, and get Ethereum integrated as the settlement layer for centralized finance. Then, the merits of ETH, DeFi, and digitally native money and assets take over, and people naturally choose these populous-approved assets.

People will flee the dollar and into sound money. Or dare we say ultra sound money?

Visa will pay ETH holders

This week’s Bankless podcast episode discusses EIP 1559 with renowned crypto-economic researcher Hasu.

After diving into all the various aspects of EIP 1559, we finished off the discussion with how EIP 1559 impacts ETH’s monetary policy. He described Ethereum’s monetary policy like this:

“You could have an ETH-holder funded subsidy, but the holders don’t feel any inflation because the deflationary pressure from the burn could be larger than the inflationary pressure from mining from the block subsidy.”

Hasu - EIP1559 | Bankless Podcast

Ok so what does this mean in relation to today’s news?

Well…Visa is putting economic activity on top of Ethereum. And if there’s one thing we’ve seen the growth of Ethereum: economic activity on Ethereum is pretty sticky.

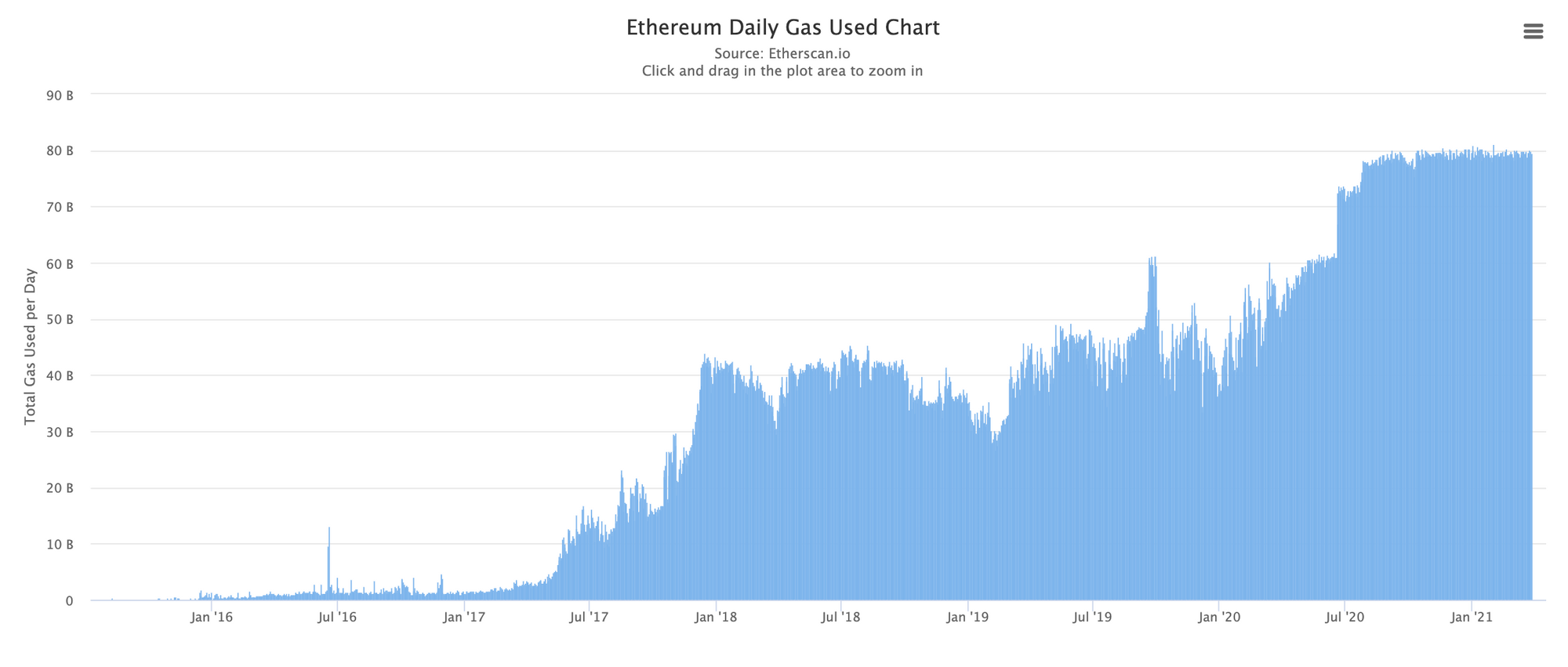

Here’s the chart for daily gas used on Ethereum, which is basically a proxy for fee-paying economic activity.

See that high plateau that’s been established since the start of 2020? That’s what saturated blocks look like. Ethereum blocks are 99.9% full—all the time. Any further demand for Ethereum blockspace results in high gas auction prices, which ultimately manifests as ETH’s burn rate with EIP 1559.

Thanks, Visa, for deciding to settle a small fraction of your economic activity on Ethereum, and thusly adding to the scarcity of ETH and the security of Ethereum.

While Visa is just dipping its toes into Ethereum (1 transaction per day to ‘settle up’), I expect Visa to continue to explore ways that it can leverage Ethereum’s blockspace to help improve the quality of its product offering for the merchants on its payment network.

One day, these narratives will breach the insular circle of crypto-twitter and DeFi believers.

I believe that the broader crypto market cannot possibly be pricing in EIP 1559 into the value of ETH. Nor is it pricing in the massive issuance reduction in coming with Proof of Stake. While it has yet to be implemented on mainnet, it’s becoming hard to deny that both these economic optimizations are going to happen.

I believe this is crypto’s most valuable alpha today.

It’s weird that this is still alpha because so many of us have been yelling this from the rooftops for years. But for some reason this has not yet landed with most people inside this industry who keep getting tripped up by high Ethereum gas fees or by those who chant that “Ethereum changes its monetary policy as often as the "Federal Reserve”

Oh well. Not everyone sees what we see, I guess. 🤷♂️

Here’s what’s clear to anyone paying attention:

- Visa just became an Ethereum sidechain

- Visa is going to be paying ETH holders

Crazy times.

Anyways, see you at $10k ETH.

- David