Ultra Sound Conviction

Dear Bankless Nation,

There’s no point in trying to keep up with all the info that circulates the cryptosphere. It’s impossible. You’re usually going to miss out on the next pump, so it’s not really a viable way to invest in these hyper fast moving markets.

So what’s the alternative?

You build ultra sound conviction. You invest based on a thesis that you strongly believe in.

Today’s author built his ultra sound conviction around DeFi derivatives. Why?

Because derivatives are the biggest market in traditional finance.

It’s hard to calculate just how big derivatives are (watch the first part of our convo w/ Hart from UMA where we try), but know that it’s massive. It’s roughly 100x bigger than the global money supply.

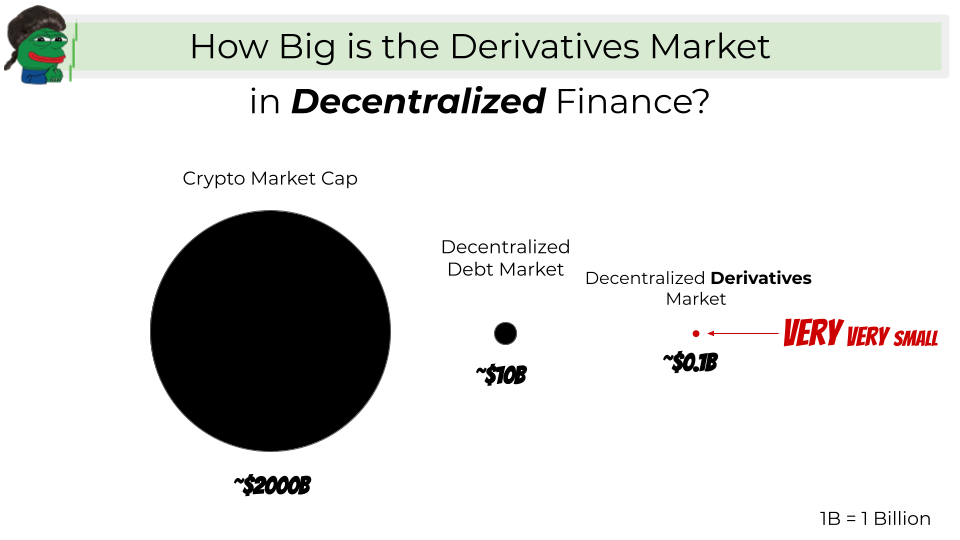

But interestingly, this is the opposite in DeFi right now.

The total crypto market is in the trillions and the “money supply” (ETH, BTC, USDC, etc.) represents a significant portion of it. And yet the derivatives are one of the smallest markets in the ecosystem. So will that change?

The author today thinks so. They’re an anon and what they has to say is rather compelling.

Let’s dig in.

- RSA

P.S. Last chance to register for Consensus 2021! Listen to David, Ray Dalio, and Michael Saylor talk crypto. Get $20 off your ticket with this link. Event starts May 24th.

📺 We’re live streaming with Udi Werthheimer later today!

Special livestream today w/ infamous crypto troll, Udi Wertheimer. CMS donated $100K to Gitcoin so now he’s going to convince us on BNB as hyper sound money. We’ll see on that…

WRITER WEDNESDAY

Guest Writer: Your Frog Highness, Anonymous

SafeMoon ain’t a safe ride. Decentralized Derivatives are.

People often like to denounce how much resources are wasted by PoW consensus. But have you ever thought of all the heat that was generated by crypto investors’ brains trying to keep up with all the info on Crypto Twitter, hoping to not miss out on the next x100 gem?

Being woke up by a Doge tweet from Elon in the middle of the night, just to realize you are 10 minutes late on that big fat green candle generates a lot of stress, frustration, and anxiety. This takes a toll on your health.

What if there was an alternative? A parallel world, where crypto investors don’t burn out their brains looking at financial advice on TikTok and instead spend their time relaxing in a zen garden. Similar to how Ethereum is transitioning to PoS, what if you could become a better version of yourself.

Think of an energy-efficient crypto investor: Low brain temperature, High return on investment?

The good news: this is within your reach. All you need is to adopt an Ultra Sound Conviction.

I’ve been working on mine for over a year now, throwing it at the wall just to see it coming back stronger and stronger. Beware! It’s neither cute nor there is “moon” in its name. But it’s Ultra Sound. If you are curious or just tired of the crypto noise, keep reading!

All good investment thesis starts with a story. This one talks about crop farmers (no, not yield farmers) and takes place near Chicago in the 19th century. The costs of running a farm were largely predictable (labor, seeds, tools), however, the market price of the crops wasn’t. Not only would it vary a lot from one year to another, but farmers had to wait months between the moment the seeds were sowed and the moment the harvests were sold for cash—there was a lot of uncertainty for farmers.

To put it in perspective, imagine you’ve been farming a lot of $CAKE for 3 months on the BSC, and just when you planned to dump them, you’d realize all your fellow apes rugged you to move back to Uniswap L2 and your $CAKEs are now worth peanuts. Pain.

In fact, farmers' job has never been to speculate on the price fluctuation of the crops. Back on April 3rd, 1848, the CBOT (Chicago Board of Trade) was created. There, farmers were finally able to find counter parties (speculators) agreeing to buy the crop that would be harvested in 4, 5, 6 months time at today’s price, effectively passing the fluctuation risk on to them. Boom.

At first, farmers and speculators were negotiating their own customized contracts, but at some point, the exchange started to list a standard version of these contracts. As the contracts were standardized, they became fungible and could be bought and sold by anyone. This proved to be a big hit, and soon the CBOT created a spinoff called the CME (Chicago Mercantile Exchange) that would eventually (169 years later) list an Ether derivatives contract.

Let’s take a break here and reflect on three major innovations brought by derivatives contracts that originated from farmers:

Using Leverage

Capital efficiency refers to the ability to do a LOT with FEW assets. Usually, the higher the capital efficiency, the better. The use of leverage dramatically improves capital efficiency by allowing traders to do more with fewer assets. There are two ways a trader can take on leverage: Either by borrowing extra assets from someone else or by trading on an account featuring a margin monitoring and a liquidation engine. Derivatives exchanges all offer the latter environment.

To illustrate the magic, with $1,000 on its account, using a 100x leverage, a trader can purchase $100,000 worth of contracts. Would the price move against him by 1%, the exchange monitoring engine will automatically trigger a liquidation event, effectively closing the trader’s $100k position, and transferring the whole account balance ($1000) to the counterparty who won the bet. On the other hand, would the price move in the right direction, the trader’s position would be positive by +100%, corresponding to a $1000 latent profit. Make 100% (or be liquidated = rekt) on a 1% price change. Noice!

Going Short

Before derivatives contracts were created, betting on the depreciation of an asset implied being able to borrow this asset from someone, sell it on the spot markets, wait for the price to decrease, buy it back, repay the loan, and pocket the difference. Laborious.

But thanks to the way derivatives are designed, the ability to go short is actually built into the contracts. For each derivatives contract traded, one of the contracting parties has to take an upside bet (long), while the other one has to take a downside bet (short).

Offering such an easy way to short an asset is a game-changer and can serve a variety of purposes. One such use case is for merchants to hedge the risk of the goods they have in inventory (ex: wheat, soybean). When the underlying asset appreciates, their short position is losing money, and when the underlying asset depreciates, their position is making money, hence fixing the overall value of the goods at the time the contract is opened.

Trading ANY Asset

Derivatives contracts can be based on virtually any underlying asset as long as it can be priced. This allows investors to easily gain exposure to an asset without having to deal with the physical storage of this asset.

Put it simply, one can now make a bet on the price of crude oil without owning a tanker. But these contracts do not necessarily have to derive their value from physical assets. The outcome of a presidential election, the volatility of a market, or interest rates are a few of many possibilities to base a derivatives contract on.

Given all these advantages, few among our ape ancestors could resist the appeal of trading derivatives, and they quickly became the world’s largest financial market. It’s difficult to speak of the size of the derivatives market, but one way is to compare it to the world’s money supply.

Derivatives markets are estimated to be 100x bigger. Period.

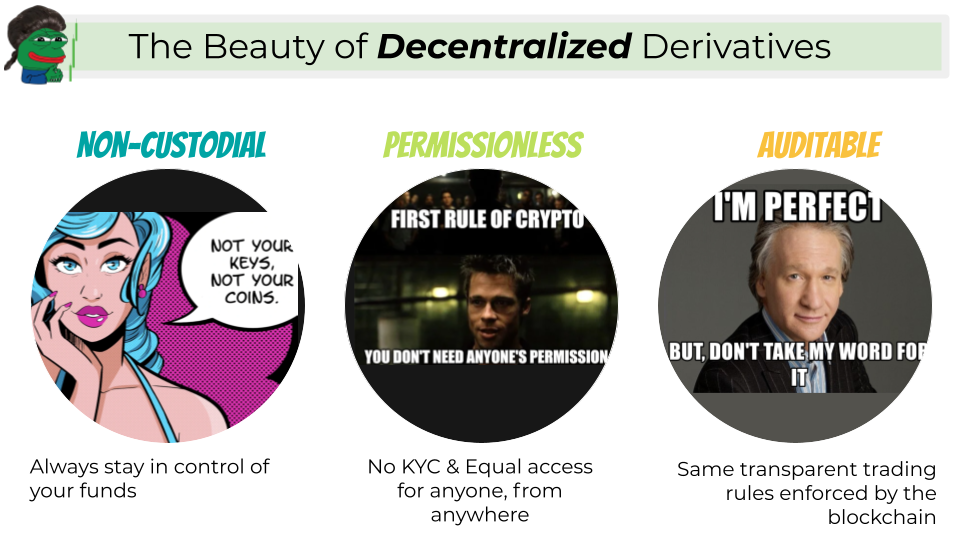

But this gigantic market is about to be disrupted by decentralized derivatives. Not because derivatives traders care about decentralization, but because it brings real added value to the table.

Here are three tangible advantages of decentralized derivatives over their centralized equivalent:

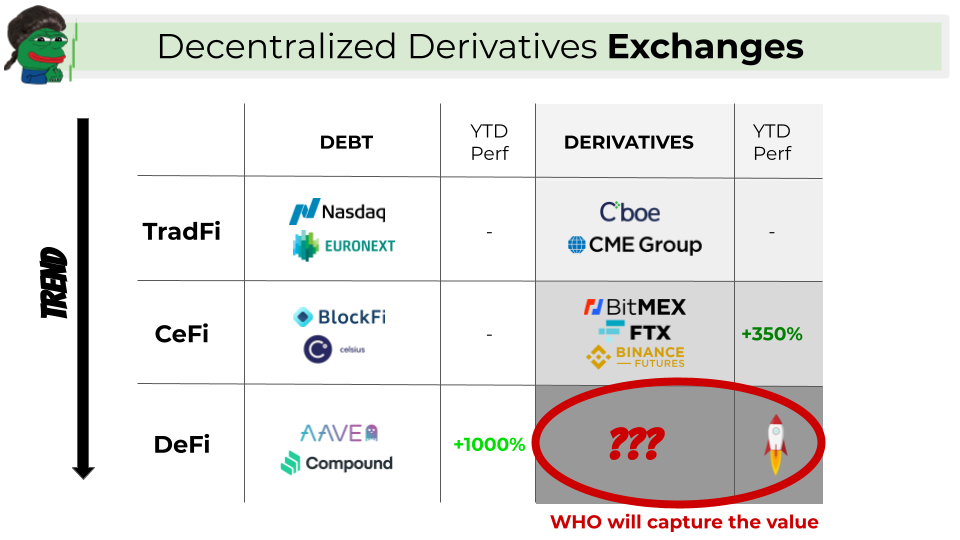

We’ve seen how debt markets protocols like AAVE or COMPOUND started to eat their equivalent in TradFi and CeFi. Assumption N°1: It’s only a matter of time for the same thing to happen in the derivatives segment.

Now let’s make a second assumption: What if the proportions between the markets in DeFi eventually look the same as in TradFi?

We would get DeFi money supply (ETH, USDT) be 10x smaller than DeFi debt markets (AAVE, COMPOUND), being in turn 10x smaller than DeFi derivatives markets. But funny enough, today’s proportions in DeFi are quite the opposite.

I intimately believe that DeFi will eat TradFi AND that the proportions of the markets in DeFi will eventually look the same as the ones in TradFi.

This is my Ultra Sound Conviction, and this says a lot of the growth potential of decentralized derivatives.

So here we are. The plot is all set, and the path to serenity seems so close...how to get there? As nicely put by Jesse Walden from a16z, “Crypto’s Business Model is Familiar. What Isn’t is Who Benefits”. This means that anyone can benefit from the growth. I repeat: Anyone can buy a ticket, jump on the derivatives train, and enjoy a truly safe ride.

The second good news is that his frog highness has been working his green ass off at putting all decentralized derivatives protocols together on one single public spreadsheet (feel free to comment on the spreadsheet and suggest any improvements).

One piece of advice before buying the token of a decentralized derivatives exchange: You should understand the major differences between these three types of derivatives: Futures/Perpetuals, Options, and Synthetics.

While some protocols may support more than one type of derivatives, I believe it's more important to focus on a single type and be the best at it, hence increasing the chances to gain traction and win market shares before diversifying into other types of derivatives. This has been the strategy of Binance Futures so far, by starting to offer Futures/Perpetuals first, and later adding Options and Synthetics.

Binance left nothing to chance: Volume is the main revenue stream for exchanges and futures/perpetuals have historically driven more volumes than options in TradFi (which can be explained by futures/perpetuals being simpler to understand than options, whose pricing model is all but trivial).

This proved to be true in the crypto CeFi space (FTX, Binance Futures, Deribit), also dominated by Futures/Perpetuals in terms of trading volume, and everything suggests that the same trend will apply to DeFi. That’s why I’m more bullish on exchanges specialized in Futures/Perpetuals like dYdX or MCDEX (see the full list here).

Why haven’t plebs noticed yet? First, derivatives used to be the apanage of rather sophisticated traders. Thankfully, Binance futures helped democratize their use among retail investors, and people are now much more familiar with derivatives and therefore able to grasp the narrative.

Second, the inner working of a derivatives exchange is an order of magnitude more complicated than a spot exchange. Combined with the gas cost of running on Ethereum, there was a high barrier to entry, both for builders and users. Now that some layer 2 solutions are out (ex: Starkware) and some others are just around the corner (Arbitrum, Optimism), adoption metrics of decentralized derivatives exchanges (trading volumes and TVL) will soon speak by themselves.

The rest will be history.

🧠 This article was written based on this original 9 slides presentation deck.

Action steps

Review the derivatives exchanges in this spreadsheet

Learn more about derivatives w/ these bankless resources:

📺 AMA with Hart Lambur (Founder of UMA)