Dear Crypto Natives,

Last week we wrote 4 things to expect in the coronavirus era. Sum it up this way:

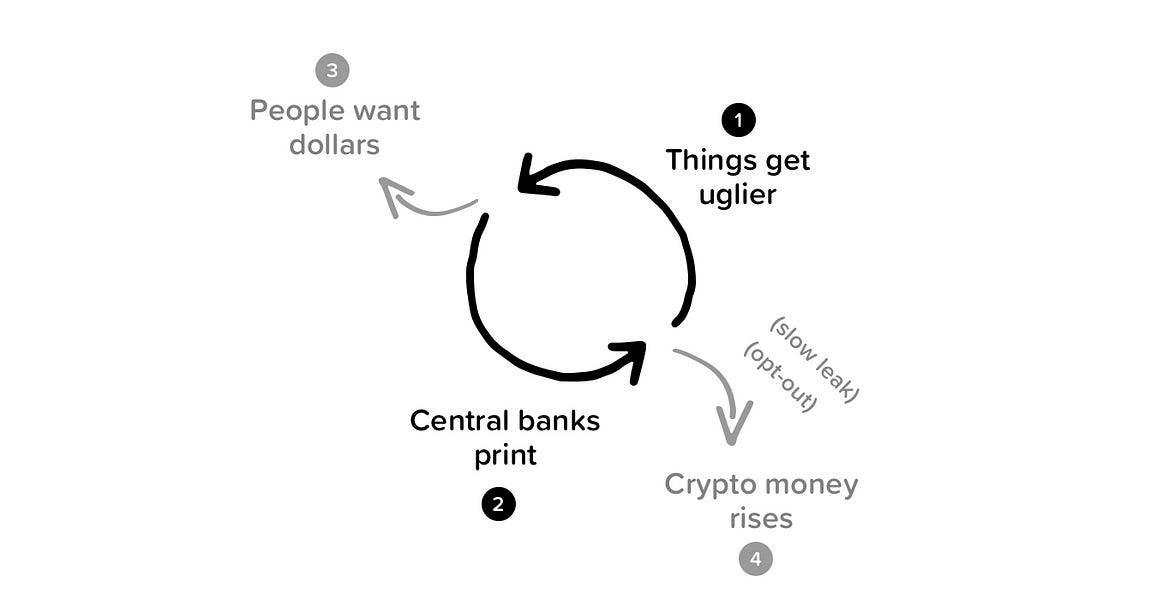

As things get uglier the central banks print more.

When things are ugly, people move to dollars to weather the storm. But the more central banks print the more people opt out of fiat and into crypto.

The money printing happens in punctuated cycles, first one in 2008-2013. Second one just started now—who knows when it’ll end. After how many trillions?

We’ve now entered the second money printing cycle since the birth of crypto

During each cycle the opt-out process is like a slow leak, fiat doesn’t lose its value all at once. And weaker non-dollar fiats lose their value faster. But in the last cycle, $145b leaked from other store-of-value assets to BTC and ETH.

1st Cycle (2010-2019): BTC and ETH grows from 0 to $145b

2nd Cycle (2020-2020): BTC and ETH grows from $145 to _______?

(Above) BTC & ETH grew from zero to $145b during the 1st money printing cycle

In this second cycle crypto is stronger.

There’s a maturing crypto banking system—Coinbase and Binance can onboard tens of millions from fiat. There’s regulatory clarity—BTC and ETH are commodities. There’s a fledgling open finance system—the bankless money protocols of DeFi.

And this second second cycle will unleash unprecedented money printing. Ray Dalio calls what we’re about to see Monetary Policy 3.

The trillion dollar platinum coin

Do you know what this is?

A mock-up for a trillion dollar coin. The U.S. protocol allows Congress to mint platinum coins of any denomination via the Treasury—issuance by governance vote.

In a proposal Representative Rashida Tlaib’s proposal put forth to U.S. Congress last week the Treasury would mint two of these—$2 Trillion dollars ex nihilo. This USD protocol issuance would be airdropped to the people via debt card—$2k per person to start, then $1k per person per month for as long as the crisis persists.

Yes, the U.S. indirectly prints money all the time through budget deficits and the selling of treasuries. Yet, to date it’s preferred to maintain the illusion that this debt will be paid off one day. The signal here is different. This cuts out the middleman and prints money directly via fiscal policy—pure Monetary Policy 3.

The 3rd, 4th, and 5th coin become far easier

A proposal like this won’t pass today. The overton window hasn’t yet shifted enough to allow it. But it may be closer than you think. Do you remember how the establishment laughed at universal basic income 6 months ago?

Today there’s not a government on earth that isn’t considering some form of temporary UBI. It’s moved from Unthinkable to Sensible, perhaps even Popular in the space of a few months.

How long until $1 trillion coins are just another policy tool? As one writer puts it:

The point of two coins is precedent. We’ve done it not just once, but twice. As Daniel Craig says in the movie Casino Royale, the second one is always the hardest. This moves us over that hump and makes the 3rd, 4th and 5th coin far easier

After two coins, the 3rd, 4th, and 5th coin become far easier.

The central bankers want this too

The central bankers are already providing unlimited QE. Today the Fed even announced they’re buying ETFs for the first time. 🤯

There’s no longer stigma attached to it—Ben Bernanke would dance around the term money printing. Not the new central bankers. Watch this 13 min interview with a Fed banker and the guy who implemented TARP.

Q: Is the Fed just going to print money?

A: (Nodding head yes) That’s literally what congress has told us to do.

His biggest wish—that congress would take more direct responsibility for printing money, do it fast, and get it to those who need it.

What are you going to do with your $1,200 airdrop?

Maybe this is the only way out for governments given the circumstances. Or maybe there are less destructive approaches. I’m less interested in that question and more interested in this one:

What are people going to do with their $1,200 airdrop?

The fiscal stimulus bill is stalled for the moment, but make no mistake—something like it will pass shortly. The political pressure makes it a near certainty. If you’re a U.S. citizen that meets the criteria you’ll be getting a USD airdrop soon.

My friend in the tweet above? He ain’t buying tolietpaper.

He’s planning to put his check in crypto money. He’s selling his airdropped dollars for crypto. Just like I sold my airdropped Stellar (XLM) for ETH.

He’s taking the first step to opt-out.

No, it’s not because he believes in the big vision and wants to go bankless. At least not yet. It’s because he think’s he might make 5x, maybe 10x on crypto—and he suddenly smells something fishy in fiat. (Didn’t many of us start this way?)

Yes, my friend is fortunate. He’s in the position of not needing to spend his USD airdrop immediately on daily living. Many are not so lucky in this corona economy.

But how many others are like him? When given the choice, how many will pick good money over bad? This crypto money thing is highly speculative, for sure. But holding USD while Congress mints trillion dollar coins—you’re telling me that’s not speculation?

This is the slow leak.

This is crypto rising.

This is the bet.

This is the decade of bankless.

- RSA