Dear Bankless Nation,

The bullish undercurrents that the industry has been feeling lately are caused by a single common denominator: becoming understood.

We see this in many instances, from the eruption of bitcoin champion Michael Saylor onto the media stage, to the monumental shifts we’ve seen lately from Ray Dalio.

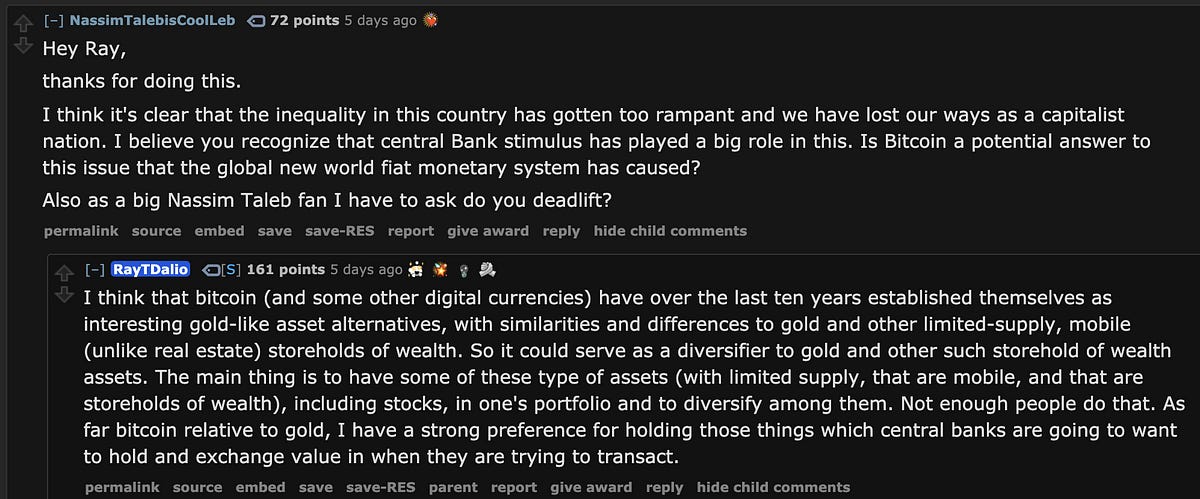

Ray went from this on November 17th:

To this on December 9th:

The most bullish thing for Bitcoin is being understood, because the rest of the story writes itself.

Ethereum fights this same battle. But it’s a harder fight for ETH. Like blocks propagating through the internet, knowledge spreads better in smaller packets. And Ethereum is harder to fold into a small bundle of information.

Nevertheless, Ethereum is making progress in this uphill battle. Ethereum’s ability to overcome the difficulty of being understood is aided by three factors:

- Big Brother Bitcoin

- High Knowledge Surface Area

- Proximate Models

1. Big Brother Bitcoin

Bitcoin is 12 years old and has over a decade of Lindy behind it. It’s fought the slog of boom and bust cycles all alone, and without a real friend. It did the hard work of forcing the conversation of Internet money, and its merits are finally being recognized.

Fortunately, this is a battle that only has to be fought once. Once someone’s mind is opened to the possibility of a ‘cryptocurrency’ being legitimate, a world of interesting assets opens up.

The crypto space seems tribally divided between Bitcoin, Ethereum, and everything else. But the outside world does not see our industry this way. Once Bitcoin becomes legitimate in the eyes of the people, so does the entire industry.

Few people will extend legitimacy to Bitcoin, and not, therefore, cryptocurrency at large. New entrants usually don’t meaningfully separate Bitcoin from the rest of the industry as most Bitcoiners do.

I remember my older sister getting mad that my parents gave me a cell phone much sooner in my life—she had to wait longer. That’s what’s happening here. Ethereum is Bitcoin’s younger sibling that automatically receives the benefits of all the effort the older sibling already put into advocating for themselves.

2. High Knowledge Surface Area

Bitcoin’s ability to compress its value proposition is a feature of the simplicity of the network and the asset. However, it sacrifices a component of reach while doing so.

What could Ethereum do for you?

- Payments?

- Yield?

- Exchange?

- Assets?

- Disintermediation?

- Open-source financial engineering?

- Internet collectives?

- Art and gaming?

If you’re not going to be maximally reductive like Bitcoin, you better be maximally expressive like Ethereum. You don’t need to understand every single facet of Ethereum to know that it provides you with something you’re interested in.

The ‘Blind Men and an Elephant’ metaphor is often used in crypto. Each blind man feels a part of the elephant and describes what they feel.

An elephant is like a snake, says the man feeling the trunk.

It’s like a tree! says the man feeling the leg.

It’s like a rope! says the man feeling the tail

As people are coming to learn what Ethereum is, they have so much more surface area to cover before it is known what it is being discovered. This leaves two points to consider:

Pessimistically, this means that it’s harder to understand Ethereum. Optimistically, it means that Ethereum has more optionality with how it chooses to express itself to the rest of the world.

3. Proximate Mental Models

I believe there are a few extremely strong mental models of Ethereum that resonate with the investor-class.

I. The Internet Bond

After accepting the concept of Internet-issued money via Bitcoin, the concept of an Internet bond market isn’t far off.

Sovereign bond markets are a naturally occurring phenomenon that emerge as aftermarket to sovereign debt. Like the State, Ethereum can never default. Ethereum can issue new ETH in perpetuity. However, like Bitcoin, its issuance is constrained by code and its value is derived from people’s belief in the code to properly manage the money.

In a world devoid of yield, where the average interest rates of global bond markets (over $70 trillion market) approach 0%, Ethereum’s ability to guarantee yield under any conditions is a uniquely compelling and understandable value proposition.

II. Backed by the Decentralized Economy

Ethereum is an economy, and it’s easy to understand this after one sees Ethereum hosting $20B in stablecoins or after an Ethereum exchange starts hosting more volume than Coinbase.

Just as the value of a dollar is backed by the U.S. economy, the value of ETH is backed by Ethereum’s decentralized economy. Now, imagine the Ethereum economy growing 10x in size, while the issuance of ETH is constrained by code to be below 1%.

These are the mental models that will onboard Ethereum’s own version of a Michael Saylor or a ETH buy for the MassMutual balance sheet. And we’re already seeing this with companies like Ether Capital (podcast next week) and funds like 3iQ.

The Second Non-Sovereign Asset

The people who are tribal about BTC vs ETH vs XYZ or who are arguing about which of these are money or not are people who are already inside the industry.

The rest of the world has no resistance to increasing the number of non-sovereign SoV assets produce by the cryptocurrency industry from ‘1’ to ‘2’, so long as the arguments are there.

I believe that the world is not only capable of understanding how ETH fits into their portfolio, they are hungry for it.

The investor class is curious and autodidact. The world has just gone through a year of massive change and shifts. They’re starting to understand Bitcoin.

Now they’re about to understand Ethereum.

- David

P.S. We published another Vitalik Speaks! Listen to Ethereum’s co-founder break down his article Concave vs. Convex Dispositions and how people process tradeoffs.