The Holy Trinity for Adoption

Dear Bankless Nation,

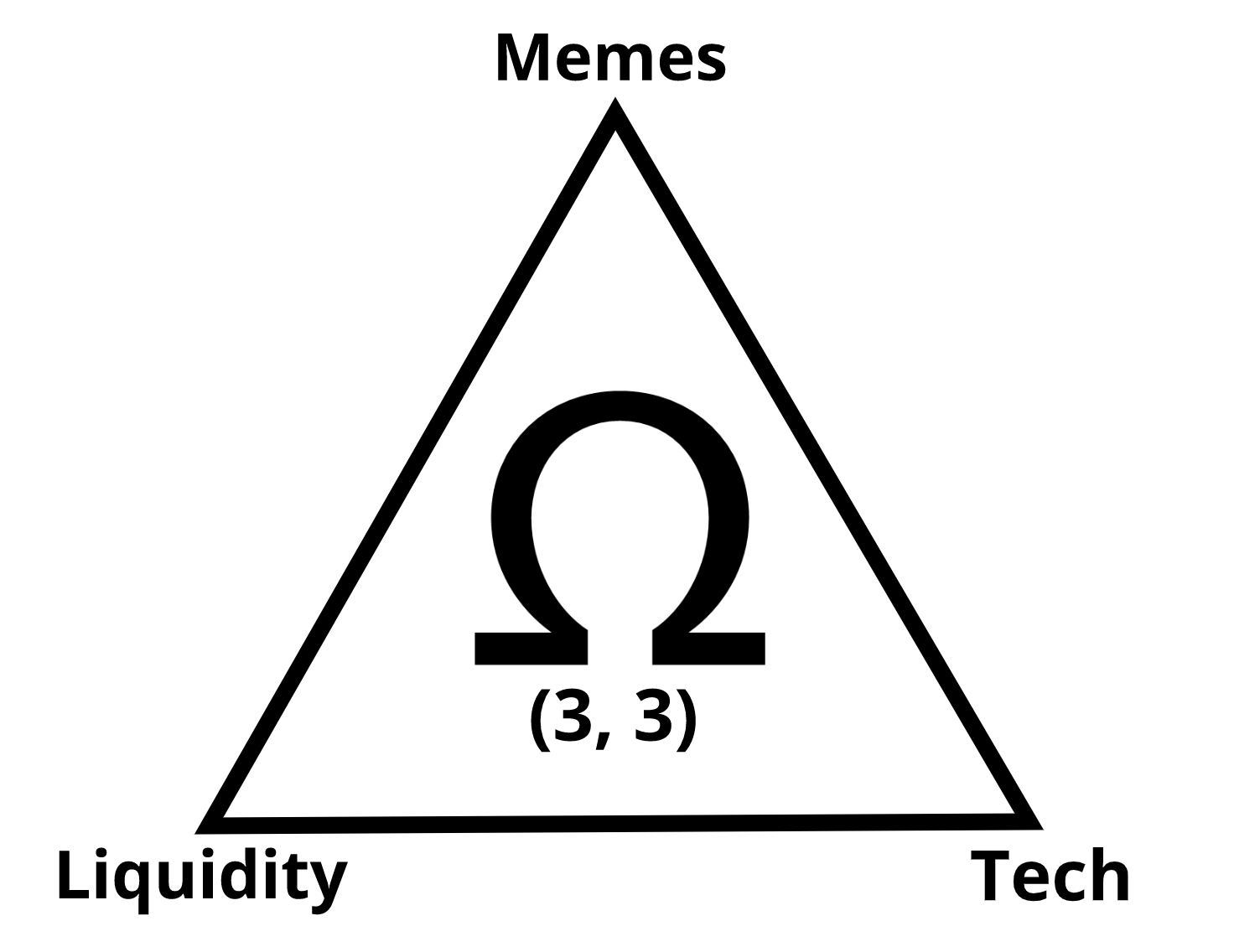

Tech, memes, and liquidity—this is the adoption trinity for any asset that’s trying to become a money.

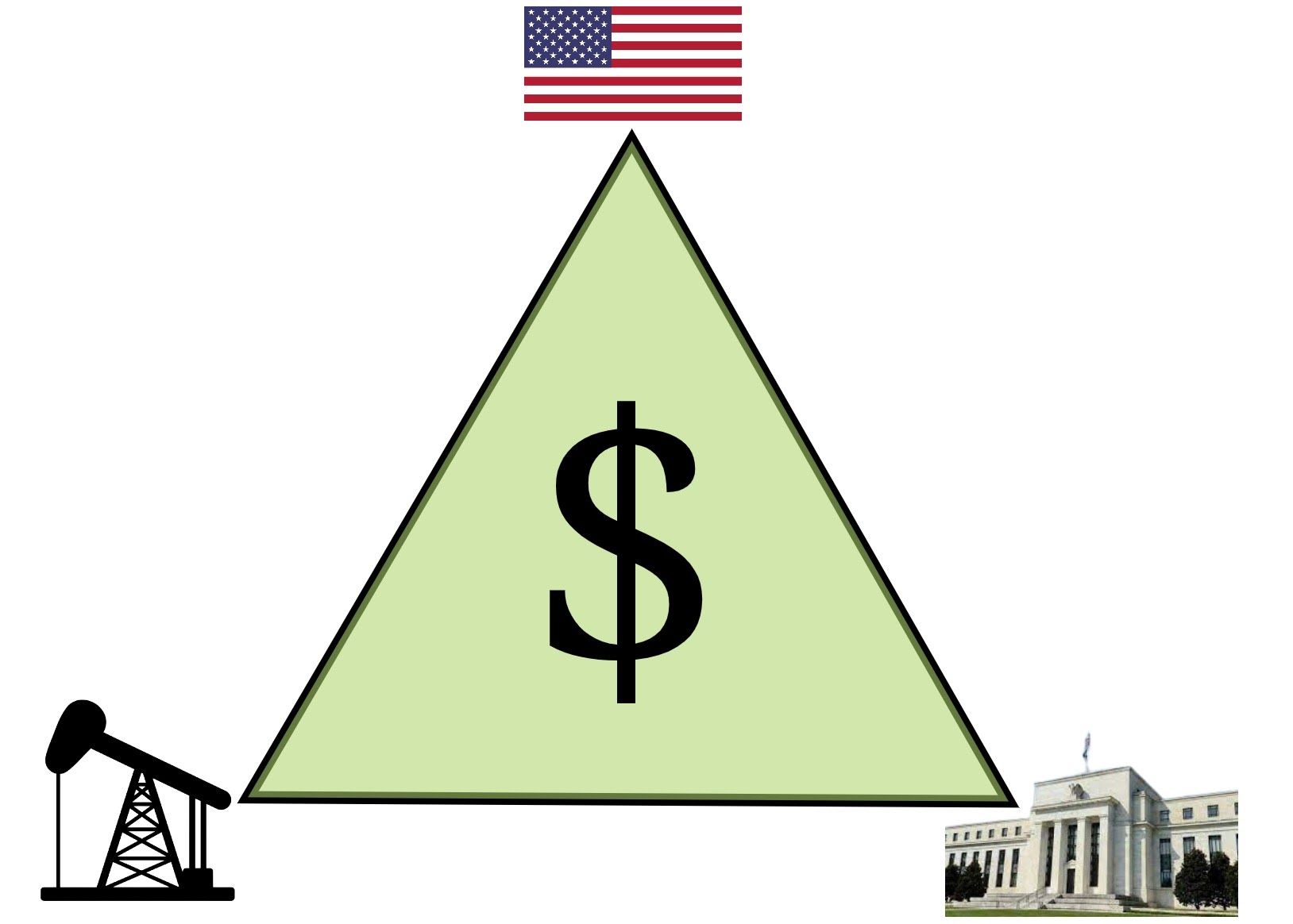

The U.S. dollar did it:

- Tech: The FED and U.S. Military.

- Liquidity: The adoption of the petrodollar and Bretton Woods.

- Memes: The American Dream™

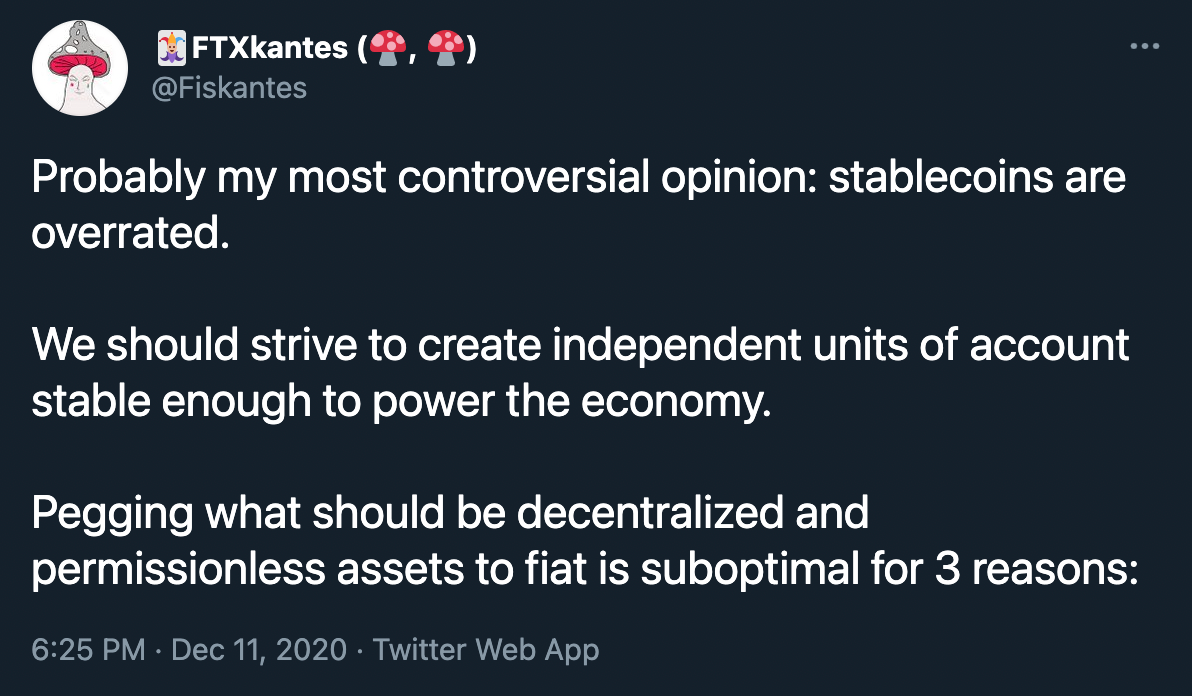

Bitcoin also did it. Bitcoin built innovative tech that solved the double-spend problem and creating a fixed supply digital asset. Early adopters provided the liquidity and memed a new money into existence with hodl and digital gold narratives.

Ethereum is doing this now. Ethereum generalized digital scarcity tech with a built-in programming language leading to the creation of an entire DeFi economy. Demand for ETH as a reserve asset within the Ethereum economy and for ETH denominated blockspace has made ETH the petrodollar for the decentralized economy.

Now, Ethereum is getting memed into the mainstream as ultra sound money.

The creation of a new money is a massive wealth generation opportunity.

It gives us new institutions that don’t depend on the nation state.

Creating a self-sovereign money is the most important thing we’re doing here.

It’s happening with BTC and ETH. Could it happen again in crypto?

Maybe.

But let’s not be naive: crypto is absolutely littered with failed monetary experiments.

Does something like OlympusDAO have a path to success or is it just another hopeless experiment?

Read and judge for yourself.

- RSA

Ohmies Ain’t No Normies

Technology, Memes and Liquidity

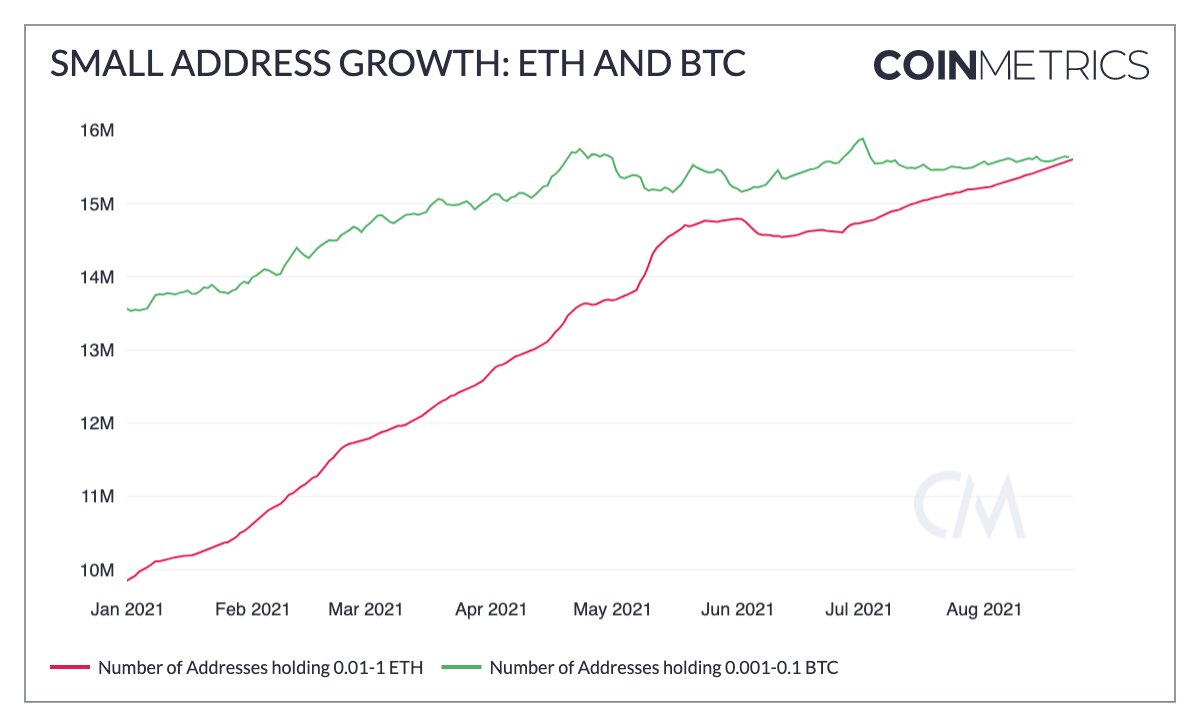

Blockchains such as Ethereum enable consumers to participate directly in a new monetary regime.

There’s no longer a need for a bank that enjoys exclusive access to the central bank. Applications, centralized or decentralized, can do everything a bank does, better and without the moral hazard.

But there’s more than that. It is likely that we will see a rise of private floating currencies backed by other crypto assets, run by an online decentralized community—a new type of central banking.

Bitcoin is minimalist in terms of how humans can interact with it. All the players can merely organize around it, mine it, buy it and sell it. The economy has been built around it.

With more flexible blockchains or state machines, such as Ethereum, we are able to build economies directly into it. This is the great unbundling of money.

In “I still can’t draw a line” Arthur Hayes describes the inadequate equilibrium of the current financial and monetary system stating that “the fundamental problem with TradFi is that banks operate the Value Transfer Mechanism and are the largest intermediaries”.

Crypto’s superiority lies in its ability to integrate users directly into the Value Transfer Mechanism and separate it from the intermediary, “...because in crypto, the intermediaries do not uphold the payments system and take financial risk.”

Crypto, and DeFi in particular, have created a new integration point.

Stability Amid Volatility

Anonymous founder, an edgy idea, and a devoted community of early supporters. This high-level description fits bitcoin well but I am describing OlympusDAO—a rather unusual experiment in crypto. Its token OHM is supposed to become, in time, an independent stable value reference.

📚 Want to learn more about Olympus DAO? Check out this bankless article.

In other words, OlympusDAO set out to build a reserve mechanism backing OHM, which should get close to becoming a unit of account. A new competition to legislated money, OHM should be stable but not pegged; a good old floating currency without a nation-state, but with an online decentralized bank.

As crypto becomes widely regarded as the asset class of the 21st century, the value stored in stablecoins increases exponentially. The money does not necessarily desire to leave the market but occasionally will seek stability/market-neutrality as with any risk-on asset class.

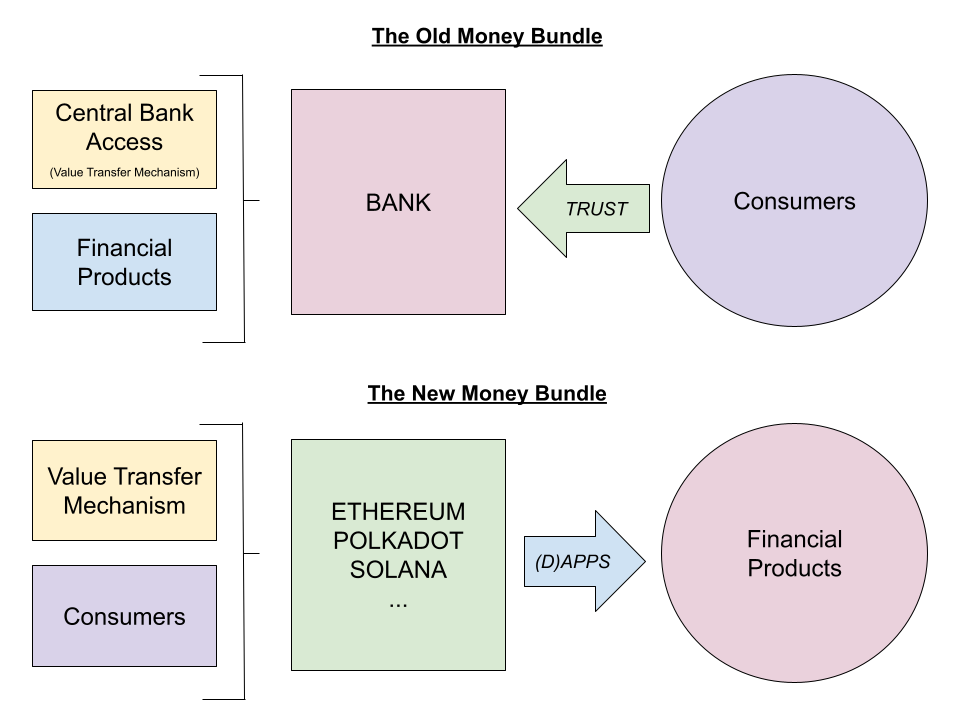

Stablecoins are crypto versions of fiat currencies. They are usually pegged to the value of the dollar and they can be centralized or decentralized, asset-backed or algorithmic.

As cryptomarkets are growing and are largely dollar-denominated, we witness the rise of cryptodollarization. For the dollar, crypto is just a new market that it can conquer just like the petrodollar had conquered the oil market.

Pegged dollar stablecoins get a lot of regulatory scrutiny and present a trojan horse that the crypto community welcomes and accepts as a necessary evil. The abstract of this recent paper co-authored by the FED reads:

“We present proposals to address the systemic risks created by stablecoins, including regulating stablecoin issuers as banks and issuing a central bank digital currency.”

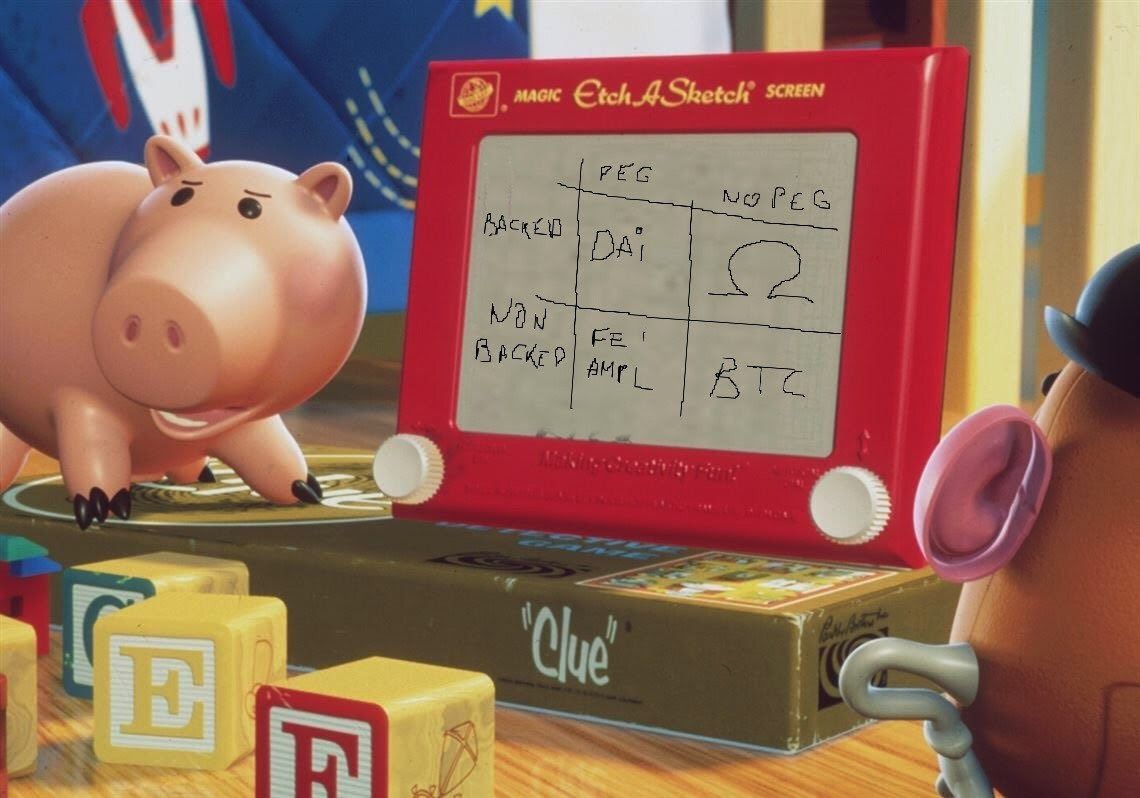

We ignore the threat that dollar-pegged stablecoins present because they are convenient and they help us to get and feel rich. My partner at Zee Prime Capital, Fiskantes, dove deep in his criticism of stablecoins in a Twitter thread from late 2020:

The demand for stablecoins leads to experimentation beyond creating a pegged dollar reference. OlympusDAO is probably the most outrageous of the attempts to create a relatively stable asset. The reason why it is outrageous and controversial is that it aims to achieve this without being hard-pegged to anything.

I will not go into the details about the mechanics of OlympusDAO. You can read about it HERE or watch THIS video.

The key takeaway for the reader is that OHM is not required to be stable in US dollar terms. Other assets should be stable in OHM terms. Avoiding a reference to any external unit of account is a way to escape dollar absolutism and advance the independence of decentralized finance.

Why do we need OlympusDAO?

Bitcoin has succeeded in creating a digital commodity that optimizes for trust-minimization. Ethereum enabled a creation of a trustless monetary base (ETH) with monetary aggregates built on top of it. MakerDAO, a lending application built on Ethereum, proved effective in creating a dollar-pegged decentralized bank.

Bitcoin and Ethereum compile monetary rules into code. The code serves as a coordination mechanism for market participants.

OlympusDAO is more flexible, meaning the rules and its strategy can adjust in time, evolving like a company's product—it’s not a dogma. Ethereum (and other blockchains) provide a foundation upon which more markets can be created via applications, giving direct access to more people in novel and efficient ways.

Although the monetary base of blockchains is governed by the code, the applications have to be governed and involve some element of trust in some humans or on-chain identities. And that is ok, since we’re separating The Value Transfer Mechanism (the monetary base of ETH) from the intermediaries (banks/applications) who can, and in fact, should go bankrupt in some instances.

This enables building novel forms of monies and capital assets. Fiskantes has posited that OHM represents a new type of money in crypto and a third alternative. We have two types of money in crypto:

- Commodity money (BTC, ETH)

- Peggies (dollar stablecoins)

We have a dilemma between these: 1. is volatile but deflationary and 2. is relatively stable but is inflationary and dependent on external oracles and monetary regime of FED. OHM is aiming to become the third choice.

OHM is relatively stable, unlike commodity money where supply is restricted and spikes in demand cause volatility. It is also independent of external force, unlike stablecoins which are dependent on oracles, peg holding mechanisms, and FED.

We can also think about money in terms of algorithmic versus managed money. OHM is a case of a mixed model with a legislative, and algorithmic executive: the legislature can encode new processes for the management of credit.

Fundamentally, OHM is an alternative that is enabled by the commodity money (ETH) on top of which it is built. It could become a missing piece, enabling relative independence of decentralized finance from the tyranny of the dollar. OlympusDAO plans to harness the volatility of crypto to deliver relative stability—a safe harbour.

Having such a safe harbor on ETH feeds back into the commodity-based monetary system, increasing the utility and value of the monetary system upon which it is built.

This is how a crypto macro economy could emerge.

How To Bootstrap a Currency (3,3)

Will Durant wrote:

“...wealth is an order and procedure of production and exchange rather than an accumulation of (mostly perishable) goods, and is a trust (the “credit system”) in men and institutions rather than in the intrinsic value of paper money or checks...”

Durant makes a reference to a system of trust, whether in men or institutions. He describes “an order and procedure”, something dynamic rather than static. With technology, humans have gained the ability to build a fluid, open and flexible system of trustless financial institutions in the digital world.

At the very beginning of bitcoin’s existence, the early hodlers had to trust in more than just a code. They had to trust Satoshi and later the core bitcoin team. And then they had to trust each other to bootstrap the critical amount of users into the network by supporting the market price.

In short; they had to trust men.

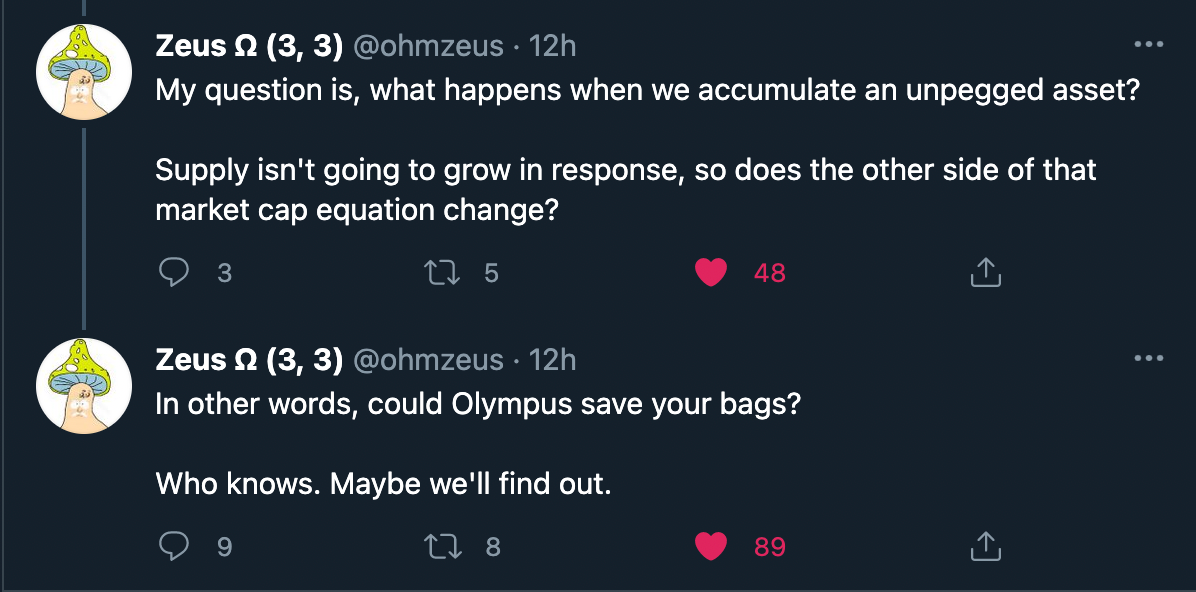

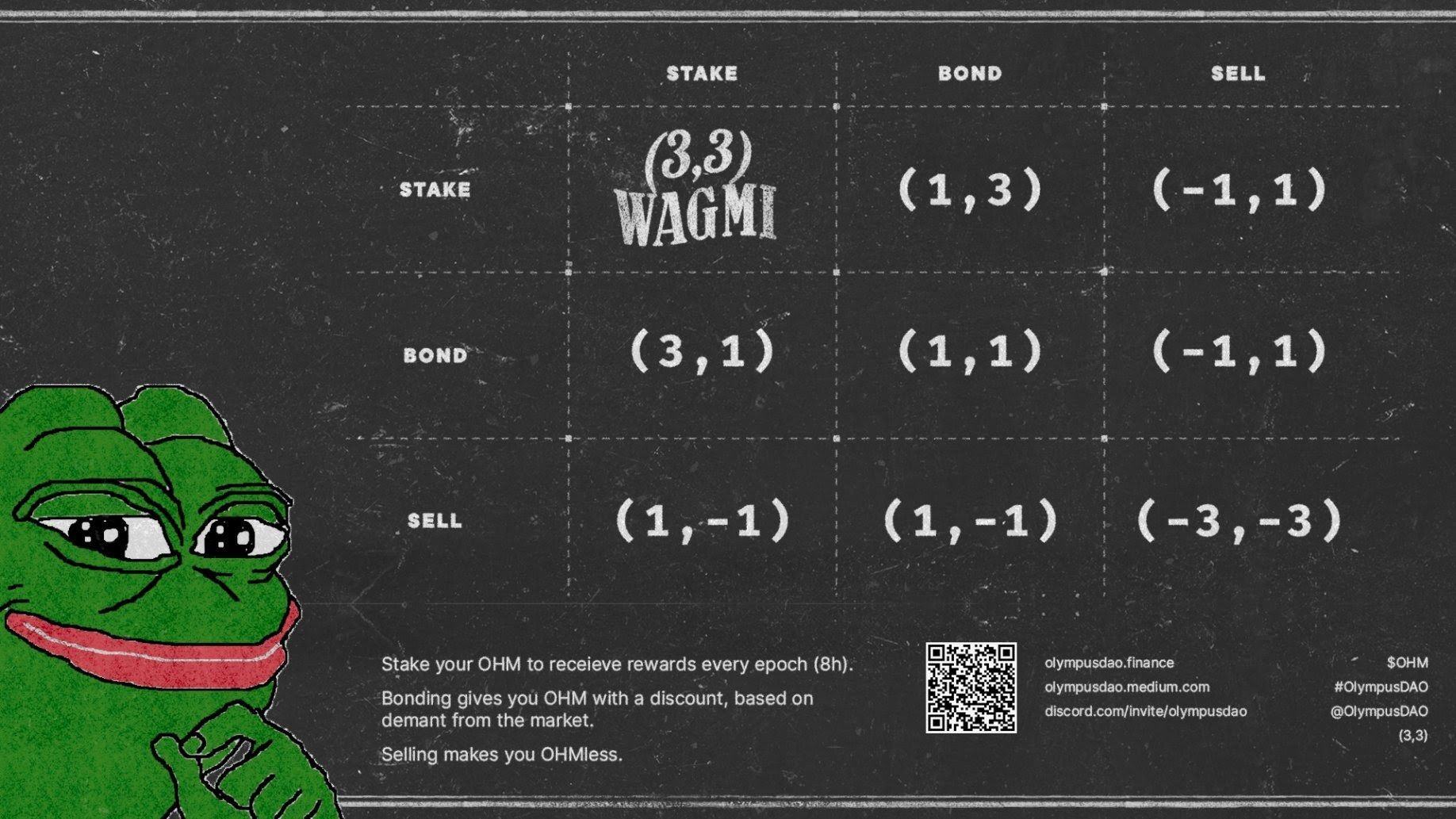

OlympusDAO uses the same initial playbook of bootstrapping the currency and does it very well. Bitcoiners were too (3,3) since this only a different way of saying “HODL” or “stack sats”.

The (3,3) meme is encouraging and demonstrating a positive-sum environment created by cooperative strategy. This is where the analogy with Bitcoin stops. OHM and bitcoin represent completely different approaches in building a currency and understanding what currency actually means.

The revanchist nature of bitcoiners reduces their vision into a so-called bitcoin standard, replacing the old gold model with bitcoin. The end game of such a minimalist approach of building a commodity-based monetary system may end up impractical due to inherent volatility, with hyperbitcoinization relying on the world burning.

Bitcoiners are leading an aggressive user acquisition campaign relying on narrative changes. If they reach mass adoption, a universal bitcoin standard can be imposed. There are other ways to experiment with monetary and financial systems that leverage coordination of public accounting.

OlympusDAO founders and its community understand the importance of user acquisition. Reducing nuance and maximizing rewards is critical. Optimizing for profit and supply growth in the early stages of the network helps in kick-starting the flywheel up. Speculators turn the users. Up to this point, it’s a copy of the bitcoin playbook.

But Ohmies have a different ambition. The user acquisition and attracting liquidity is a mere stepping stone in creation of a first actively managed permissionless central bank with an independent currency. At a certain point in time, the goal changes to achieving stability and the DAO will flip the switch.

The anonymous founder Zeus, has hinted that the prerequisites for stability will be a lower emission state (cannot stabilize with five figure yield) and higher capitalization to protect against speculative attacks against the peg à la Soros.

When the above prerequisites are met (e.g. <20% APY and >$5b assets) OlympusDAO can create a secondary two-way bond market (in contrast to existing one-way bonds) with treasury as a counterparty that provides liquidity and allows the treasury to manage price.

Ohmies are creating a decentralized central bank for their own currency—without a peg but with levers to maintain practical stability in the long run, with protocol being the biggest liquidity provider and “whale” in its own game. Ultimately, OlympusDAO could become one of the largest liquidity providers in crypto.

Compared to commodity crypto money, they have to sacrifice permissionless-ness to some extent. They need to achieve flexibility which enables them to build a more sophisticated tool. This requires trusting humans and not only the code. This involves some elements of active governance over problems such as adding a new type of collateral.

OlympusDAO is an ambitious monetary experiment that relies on complex human coordination. This is a rare and refreshing instance in a pessimist world in which we are moving away from ambitions of complex coordination and optimistic planning.

The definite pessimism of bitcoiners rejects this on the sole premise of involving a trust in humans, understanding trustlessness as governance-minimization. The indefinite pessimism of the current centralized monetary regime will regard it as an overcomplicated Rube-Goldberg-like contraption with many moving parts with non-credentialed entities behind the wheel.

OlympusDAO resembles the definite optimism of the past—aiming to build something complex and hard, embracing and empowering humans via code to actively participate and govern. This mechanism is enabled by the technological solution that Ohmies are building.

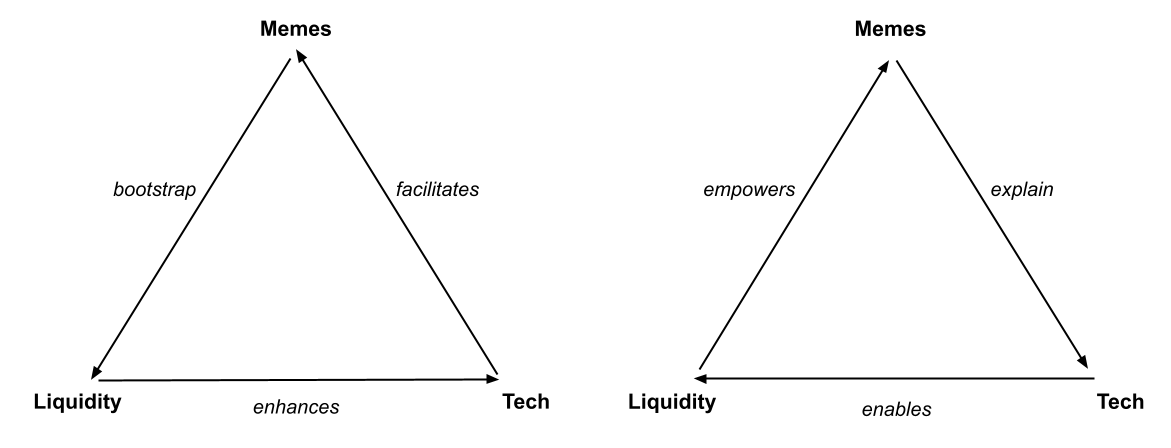

To bootstrap a successful currency, and a successful cryptoasset in general, you need additional two critical components besides the tech: the memes and the liquidity. This “Holy Trinity'' needs to become fluent; one component feeding into the other, propelling the vision and possibilities forward.

We could alternatively dub this the “adoption triangle”. You start with the solution (tech) and give it a narrative, reducing nuance and attaching an emotion. Then come innovators and early adopters, who bring initial liquidity to the table.

The memes intensify as the number goes up.

In order to amplify the adoption, people behind the tech should observe the memes and converge on the expectations that these memes project. This could sometimes mean a pivot or that they need to double-down on what they are doing.

Memes can interpret the tech but could also interpret user feedback and product expectations. OlympusDAO has the flexibility to improve its product. If the end goal is to deliver a relatively stable floated reserve currency, it needs a mechanism to govern and develop new features to achieve its vision.

Looking at traditional fiat currencies such as the dollar, we can also identify the holy trinity components. The dollar is the mighty USA; freedom, big business, and The American Dream. The FED is the solution, the enabler of this monetary system. The petrodollar app liquidity was bootstrapped in the mid-70s via oil price denomination, bringing in liquidity.

Mo Monies, Mo Problems

The invention of cryptocurrencies allows for new economic organization.

One such innovation could be an online decentralized banking system that is permissionless. From a digital commodity of bitcoin, through a generalized state-machine of Ethereum that enabled a permissionless asset-backed dollar through MakerDAO, to an autonomous asset-backed floating currency managed by OlympusDAO, the old monetary system will be revolutionized by technology.

OHM wants to become a currency without a nation-state and a decentralized central bank. It is very early in its experiment. At this stage, it faces the same issue and has the same goal as bitcoin had in its early days—attract liquidity and build a community.

OlymusDAO leverages blockchain technology just like bitcoin, but takes it further, involving an online community of contributors to help in creating a private currency that seamlessly connects to DeFi markets.

Bootstrapping a floating, asset-backed currency is a step in building monetary and banking primitives for decentralized finance—especially in times of government tightening their grip on central banks and central banks on markets.

As the crypto market grows, the demand for a crypto-native currency with relatively stable value increases. OHM is not a stablecoin by any means, but it could serve as the foundation for a relatively stable crypto-native asset.

To this day the experimentation with monetary models has been open to few. Perhaps in the world of permissionless monetary and financial systems we can iterate faster and dare to innovate. The over-financialization could be a result of the exclusionary nature of the current monetary and financial system.

I came across a theory that sophisticated and educated ancient Greeks did not manage to achieve technological breakthroughs because their slave-based society did not force them to use the tools. There was no real user feedback or an incentive to iterate and improve. Problems were solved by adding more cheap slave muscle.

We might just be experiencing this problem in reverse. We are disenfranchising the majority from taking part in the financial system, so there is no real user feedback or an incentive to iterate and improve, with the disenfranchised bearing the costs.

The crypto primitive of a floating currency with a managed reserve is an important endeavor. Many may dismiss it as foolish. Sometimes it’s the most outrageous that win. Decentralized online communities running “banks” are a valuable endeavour and a realistic vision for the future of fluid programmable value embedded into the web.

Today, this is more important than ever. Decentralization is the first condition, not a choice, but a necessity in order to avoid being crushed. As governments and central banks become increasingly aggressive in protecting investors, crypto must radically innovate to decouple itself from the old monetary regime.

Thank you to Fiskantes, Zeus, Amir and Rachel-Rose for all feedback and help with this article!

Action steps

- Understand the importance of an online decentralized central bank

- Read “WTF is Olympus DAO?”

Author Bio

Matti is leading Venture Communist and Definite Optimist at @ZeePrimCap aka "And Others Capital". He’s also an occasional writer for Wrong A Lot.