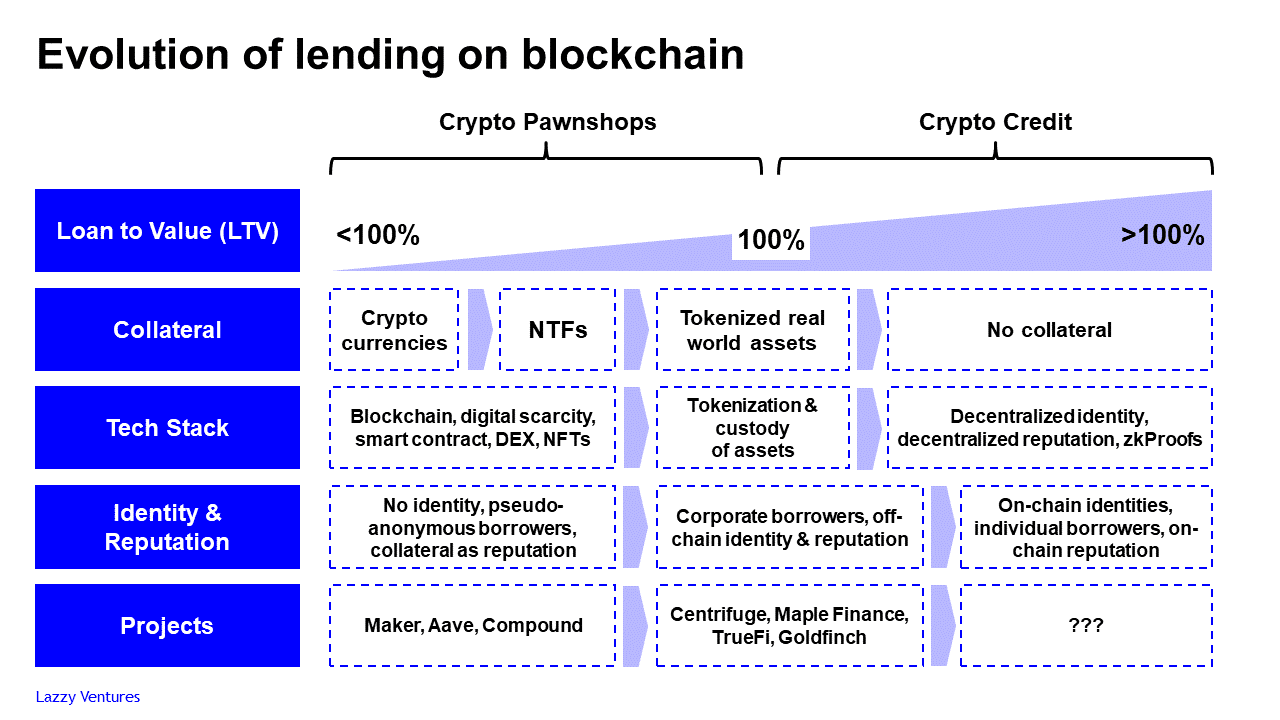

The Evolution from Crypto Pawn Shops

Dear Bankless Nation,

We’ve said before that lending protocols aren’t lending protocols. They’re more like interest rate protocols.

That’s a good start. But maybe they’re more like modern day pawn shops that have been around for centuries.

Historically, you would give a pawn shop something valuable (collateral) and they would issue you a loan based on the value of the collateral. You could return the money, and they’ll return the valuable item to you. If you don’t pay back the loan, they keep the collateral.

Sound familiar?

While this model existed for a long time in human history, it eventually made way to credit. Who wants to borrow money when you have to lock up more than you can actually borrow anyways?

We didn’t need to give a pawn shop the collateral anymore—we don’t even need the collateral! They just issue a loan based on your creditworthiness.

This takes into account your identity and financial reputation (in the form of a credit score).

So can we build this same model in DeFi? We’re starting to find out.

Roman explores today (he’s also the first open submission to make it to the big leagues! congrats!).

Let’s give him a warm welcome.

This is the evolution of DeFi Lending.

- RSA

THOUGHT THURSDAY

Guest Writer: Roman Buzko, Founder of Lazzy Ventures

Lending on Blockchain — From Crypto Pawnshops to Credit Institutions

The dominant form of borrowing and lending in DeFi today is through overcollateralized loans. To get $100 in DAI, one needs to put $150 worth of ETH as collateral.

There are attempts to make under-collateralized lending happen, but the winning paradigm is yet to emerge. This article looks at various existing and yet-to-launch crypto lending protocols and what could be next for credit on blockchain.

Let’s get into it.

TL;DR

Today’s leading DeFi lending protocols are the pawnshops of the past. With more assets coming on-chain, the collateral universe will eventually include NFTs and tokenized real-world assets.

The primary headwind here is limited liquidity and poor price discovery. Undercollateralized DeFi lending will first be available for off-chain legal entities and is already gaining some momentum. For individuals to access undercollateralized crypto loans, two things are necessary: digital identity and decentralized reputation.

Intro

The principal reason why all the lending in DeFi requires over-collateralization today is that the parties have pseudo-anonymous identities in a true crypto fashion. The lender is not aware of the identity of the borrower and her reputation and vice versa.

Without any credit score on the borrower, the lender can only extend credit in an amount below the collateral value. This is generally described by a loan to value (LTV) ratio that must be below 100%.

- LTV = Loan / Collateral Value * 100%

In the above example, with $100 in DAI as a loan and $150 in ETH as collateral, LTV is equal to 67%. Currently, the average LTV in major DeFi lending protocols ranges from 50% to 80%, depending on the quality of the collateral asset.

This model is no different from what traditional pawnshops have been doing for centuries. In fact, pawnshops are some of the oldest financial primitives dating back to the 5th century AD in China.

With the advance of financial knowledge and the emergence of various intermediaries, pawnshops have given way to credit. The principal difference between the pawnshop business model and lending on credit is that in the latter case, the lender is willing to extend more than the value of the collateral provided (i.e. when LTV > 100%).

To do so, the lender would conduct its own due diligence based on the available information and assess the risk of default of a particular borrower. However, this exercise requires (a) a non-transferable identity and (b) more or less reliable data about this identity’s creditworthiness.

The current state of DeFi is that of crypto pawnshops whereby autonomous protocols facilitate overcollateralized lending, replicating the playbook of the dark ages.

But the industry will move forward. Below we look at the current state of affairs and what the future can look like.

Crypto Pawnshops

As described above, pawnshops extend loans based on LTV below 100%. The two principal business model parameters for a pawnshop are:

- LTV

- Collateral Quality

LTV depends on the quality of the collateral.

In the first generation of crypto pawnshops, the borrower’s creditworthiness is manifested solely by the quality and quantity of the collateral. However, in real life, many other factors are taken into account to assess the loan applicant’s creditworthiness.

As mentioned, this is not the case in DeFi today due to the pseudo-anonymous nature of the transactions.

Good Collateral

Good collateral has several qualities. According to the framework from the European Central Bank (ECB), good collateral is liquid and safe (further defined in the said study).

It is no surprise that BTC and ETH are the most commonly used types of collateral in DeFi lending protocols. Apart from volatility, they seem to meet the above criteria. And even the volatility is mitigated by immediate liquidation made possible by stable liquidity at decentralized exchanges (DEX).

Non-Fungible Tokens as Collateral

The next frontier for DeFi pawnshops is less liquid crypto assets that are difficult to value at the moment. Enter the domain of non-fungible tokens (NFTs).

NFTs have skyrocketed in 2021. With the proliferation of NFT owners, several teams have started building protocols for borrowing against NFTs as collateral:

The problem with NFTs is low liquidity and opaque valuations due to the lack of constant price feeds. It is difficult to liquidate the collateral immediately when the price drops. It is equally challenging to know when the price actually drops, given the secondary nature of the market.

One way to approach the lack of liquidity and price discovery is to have NFTs tokenized back into ERC20 and have them traded on DEX. NFTX and NFT20 are doing that right now. Tokenization can help with price discovery and liquidity.

On the opposite hand, if we can compare this to the world of physical art, authenticity is less of a problem for NFTs. That should be the counterbalancing factor. Beeple art is algorithmically attached to the author, whereas Pablo Picasso authorship can be questioned.

There are many different types of NFTs out there, and the question is which of them will be used as collateral for DeFi lending first. Based on the qualities of collateral discussed in detail on the ECB’s paper above, it will be the NFT that is the most liquid and the easiest to value.

In this context, tokenized NFTs will be the first to serve as collateral due to liquidity.

Next, in our opinion, will be NFT assets from games and metaverse. First, game assets usually have specific digital utility (fancier skins, stronger weapons, etc.), as opposed to digital collectibles whose value is in the eye of the beholder.

Second, assets from virtual games are also much more likely to have continuous price feeds and deeper liquidity within their respective ecosystems. However, for game assets to be used as collateral, the gaming ecosystems themselves should not be walled, which appears to be the case at the moment.

Real World Assets

After traditional crypto and NFTs, the next big basket of collateral is tokenized real-world assets (RWA). Fiat currencies, real estate, gold, securities (stocks and bonds), invoices, tickets all can be used as collateral for lending on the blockchain. Fiat currencies and real estate have already been tested as collateral in DeFi lending protocols (USDC in MakerDAO and RealT tokens in Aave).

In addition to standard qualities of sound collateral, tokenized RWA are subject to peculiar risks arising from the process of tokenization.

- Is there an issuing entity, like Circle Internet Financial Limited behind USDC?

- How transparent is the issuing entity?

- Are the reserve assets auditable?

- Where are the assets actually held in real life (banks, custodians, etc.)?

- Do the assets require any specific storage or maintenance procedures (like gold, for instance)?

- If the issuing entity is a state, what are the political risks?

- Is there a sound legal enforcement framework to rely on in case of default of the borrower?

Further, certain RWAs can be subject to special rules, such as KYC/AML and transferability requirements (like the travel rule). These will impact the scoring of such assets for collateral purposes and maybe even make such assets impracticable to be traded on a global scale.

Crypto pawnshops will move from over-collateralization towards more capital-efficient lending practices. For this to happen, two primitives must emerge:

- Digital Identity

- Digital Reputation

We’ll dive into this more below.

Crypto Credit Institutions

The transition from the pawnshop business model to lending on credit (undercollateralized lending) requires there to be:

- A non-transferable identity of the borrower, and

- Some information about its creditworthiness (credit score).

The identity should not be transferable, since otherwise the lender can never be confident of who is behind this identity and whether this credit score really belongs to that individual.

Corporate DeFi Lending

From a legal perspective, there are two types of actors in this world: natural persons (individuals) and legal entities (companies). The former have been around for a long time, but the latter have emerged relatively recently. One of the first legal entities is The Dutch East India Company (VOC) chartered in 1602.

In this sense, legal entities are 1/750 of the age of Homo Sapiens. So young!

Compared to individuals, however, companies are the first to access undercollateralized DeFi loans. The following projects are building in the area:

🗒️ *Note: Centrifuge is positioning itself as a platform for bringing traditional financial assets to DeFi, but it also provides credit against tokenized assets.

These protocols look more like traditional banks that originate borrowers, assess their creditworthiness, and enter into legally binding lending agreements.

The main difference between these protocols and conventional banks is the source of capital. Banks get their capital from deposits, whereas these protocols obtain their financing from the pool of anonymous (TrueFi) or non-anonymous (Centrifuge) crypto-native investors.

The borrowers on these protocols are usually well-known brands in the crypto industry, such as crypto trading pools, miners, crypto funds, etc. This can serve as a proxy for credit scoring ensuring alignment of values between borrowers and lenders.

Corporate DeFi lending is only emerging with no more than $100M* in pools locked in the protocols and available for corporate borrowers. Compare it with $26.5B locked in top-3 lending protocols (Compound, Maker, Aave).

💰 *Note: $89.8 ml in TrueFi and $9.7 ml in Centrifuge. Maple is yet to launch but it reportedly has once $40 ml of loans in the pipeline, according to Sidney Powell from Maple. No data on Goldfinch.

Whether DeFi corporate lending will reach any measurable traction depends on whether these protocols will be able to match demand and supply.

From the demand-side perspective, the question is whether these platforms will be able to originate enough corporate borrowers willing to take out loans nominated in cryptocurrency at a given rate.

Potential crypto DeFi borrowers are likely the companies (or DAOs) that cannot obtain loans in the traditional financial markets (credit lines in banks, bonds, etc.). Also, crypto DeFi borrowers are likely to use the loan proceeds for purposes related to crypto.

These two factors automatically put such borrowers in the high-risk category, making credit scoring a critical factor.

From the supply-side perspective, the central point is whether interest rates offered by corporate lending protocols will be good enough to attract crypto native investors. Obviously, interest rates cannot be very high as this will scare away the borrowers. To compensate for this, corporate lending DeFi protocols will use the battle-tested playbook of DeFi protocols and offer their native tokens to liquidity providers.

We are unlikely to see a massive spike in corporate DeFi lending but there is certainly room for it. The growth for these protocols is limited by the speed of originating new borrowers, which requires marketing outreach from the business development team and traditional due diligence on the borrowers. The competition between such platforms will be very similar to that in the traditional world, and protocols may even hire executives from banks.

By implication, we will likely see the first corporate defaults on crypto loans in the next few years when this cycle reverses. This will pose interesting legal challenges.

Someone would have to explain to a judge how a decentralized autonomous organization (DAO) can issue a loan from a pool of anonymous creditors.

Consumer Loans to Individuals

Unlike corporate DeFi lending, extending undercollateralized loans to individuals in a decentralized fashion is more complicated. Mainly because the costs to underwrite one consumer loan well exceed the expected gain from issuing the loan.

Underwriting costs include due diligence, credit risk assessment, onboarding, and potential enforcement costs. Unlike corporate borrowers, individuals usually look for smaller loan amounts, making it impossible to spread such costs among the loan applications in an economically efficient manner.

Plus, consumer lending is also a regulated business in many jurisdictions, so successful implementations of DeFi consumer lending protocols are much more likely to attract regulators’ attention.

One notable example in this area is Teller Finance (currently in testnet). Teller promises to allow consumer loans without collateral. How is it going to do that? By connecting to a bank account of a prospective customer and making the credit assessment based on the account history. Not much different from how it works in TradFi today.

When granting access to the bank account, the loan applicant will also disclose its identity, which may discourage the current generation of DeFi users.

Teller has to rely on bank account history due to the lack of any other DeFi native credit scores. If there had been such credit scores that can be reliably associated with a particular loan applicant, Teller would have been happy to extend DeFi loans without connecting to the customers’ bank accounts.

This brings us to the concepts of digital identity and digital reputation that are necessary for the uncollateralized DeFi lending to evolve and reach full potential.

Digital Identity and Digital Reputation

The reason collateral has to exceed the loan amount today is the lack of such concepts as digital identity and digital reputation in crypto, resulting in the absence of trust that is handled only by over-collateralization.

We will stop short of further discussing decentralized identities here, given that this area is well beyond the authors’ circle of competence. Instead, we will point the reader to the standards being developed by W3C and this short but comprehensive lecture by Michael Sena, founder of Ceramic, delivered at ETHDenver 2021. Let’s now turn to reputation.

Reputation is all the data points associated with an identity, allowing interested third parties to assess the risk of default and calculate the creditworthiness of a particular borrower. In TradFi, the reputation of borrowers is usually evaluated based on the following criteria:

- Pay stubs

- Bank account transaction history

- Credit scores issued by credit bureaus

- Savings balance

- Past defaults

- Number of recent credit inquiries

- Lack of criminal records

All of the above exist in federated or centralized registries maintained by police, banks, etc. They are also usually locked within a particular nation-state.

With all these intermediaries eventually coming on-chain, we may see the emergence of purely digital credit scores. Initially, such digital credit scores will replicate the off-chain ones, giving more weight to financial factors.

However, with the further development of the Web 3.0 technology stack and the advent of the metaverse, digitally native factors are likely to be given more prominence in assessing creditworthiness. Such factors can include:

- Number of followers in any given social network

- Creation of valuable content and other IP verifiably authored or owned by the borrower via NFT

- History of the borrower’s interaction with DeFi (your wallet is not only your resume but also your credit score), including participation in the governance of major protocols

- Benevolent behavior via participation in grant programs (Gitcoin, etc.)

- Ranking in on-chain virtual worlds

- Guarantees or suretyships from other on-chain native subjects, such as individuals or protocols

Using such factors for credit scoring genuinely requires decentralized identity that will be used instead of national IDs. Several projects are attempting to solve this, such as Ceramic, BrightID, and Idena. The team behind Spectral Finance seems to be building just that—aggregating wallets in one NFT and assigning it an on-chain credit score, however, it is not obvious on how they will approach the implementation of non-transferable identity.

The Future of DeFi Lending

Let’s sum it up. DeFi lending today is dominated by overcollateralized loans with crypto blue chips serving as collateral.

The next iteration of this business model is tokenized NTFs and RWAs. Liquidity and price discovery is critical here.

Moving past that, undercollateralized lending will first be available to corporate borrowers, given the economics of the underwriting process. It’s the most viable path in the short term. But for individual borrowers to access undercollateralized loans, the market needs to solve for decentralized identity and on-chain reputation.

While DeFi lending has exploded, we’re only in the early innings. DeFi will begin to support more collateral, more institutions, and more forms of lending with the introduction of DID and on-chain reputation.

It’s still early. But we’re making progress every day.

Acknowledgements

I would like to thank Sidney Powell from Maple Finance, Artem Gramma from Index Coop and Kirill Medvedev from Tenzor Capital for the valuable feedback.

Many thanks to my colleagues Evgeny Krasnov, Vasily Agateev and Andrey Andriyaynen for the initial review and research.

Action steps

- Explore some of the projects & primitives needed for DeFi credit

- Read “DeFi lending doesn’t exist (yet)”

Author Bio

Roman Buzko is a crypto enthusiast with finance and legal background. He runs Lazzy Ventures where we are looking to support teams building in the field of blockchain, metaverse, digital art, and some other crazy shit. Reach out via Twitter or email.