The Data Wars Are Coming

Dear Bankless Nation,

Data is the new oil.

Scratch that.

On-chain data is the new oil.

Seriously…have you ever thought about the value of onchain data?

Virtually every DeFi protocol in this nearly hundred billion dollar market needs secure data feeds to function.

Who provides this data?

Today it’s an assortment of oracles providers like Chainlink, crypto exchange companies, and financial protocols like Uniswap.

And who profits from it?

Not you.

But in the future maybe there’s a way for you the DeFi user to profit.

It’s hard to tell how this will play out but one thing is clear…

The data wars are coming.

Read on to learn how it may take shape.

- RSA

Data Wars: Pricing Data for DeFi

For DeFi spectators and commentators, a clear future is emerging—DeFi derivatives will consume and replace any market that can have an oracle price feed.

Right now, it’s clear that data relationships will play an important role for many of the DeFi protocols looking to create meaningful products that extend beyond crypto price feeds.

In the Information Age, data wars have been fought on many different battlefields. In this article, we will discuss the upcoming financial data wars to be fought by oracle providers, traditional financial firms, and financial protocols.

Data Wars in DeFi

Within the DeFi economy there will be two sources of data that exist for derivative contracts. In both instances, data inputs are a cost for that contract that will inevitably have to be paid for in fees by the derivative user:

- Off-chain proprietary data relayed by oracles such as Chainlink

- On-chain exchange contracts or meta-oracle contracts that source pricing data from a variety of different on-chain contracts.

The traditional centralized market for derivative pricing data is massive. Each day, at different frequencies and times around the world, derivative contracts are marked to market using pricing data delivered by proprietary firms who have curated their feeds to be unbiased and reliable.

To grasp the sheer size of this pricing data market, CME’s financial reports that determine $545.4M in revenue (of $3.85B total) stems from data services. To zoom a bit further out, the traditional financial market data industry is said to be valued in the range of $33B, and growing.

The on-chain market for pricing data is only just beginning. Protocols such as Uniswap—which harbor large portions of spot exchange volume—are now able to provide reliable pricing data that can be used for other ecosystem derivative contracts that can read directly from the on-chain Uniswap contract.

Due to this emerging model, discussions have led to propositions that UNI should be an oracle token. (RSA note—here’s our take on UNI as an oracle)

A derivatives protocol like Tracer needs to consume these oracle price feeds to provide secure and reliable markets for end consumers. Let’s talk about two property rights models:

- Exchange owned data; and

- User Owned data.

These two models will overlap and compete. So let’s discuss the implications these data wars may have for a data consuming DeFi protocols like ours.

1) Exchange Owned Data

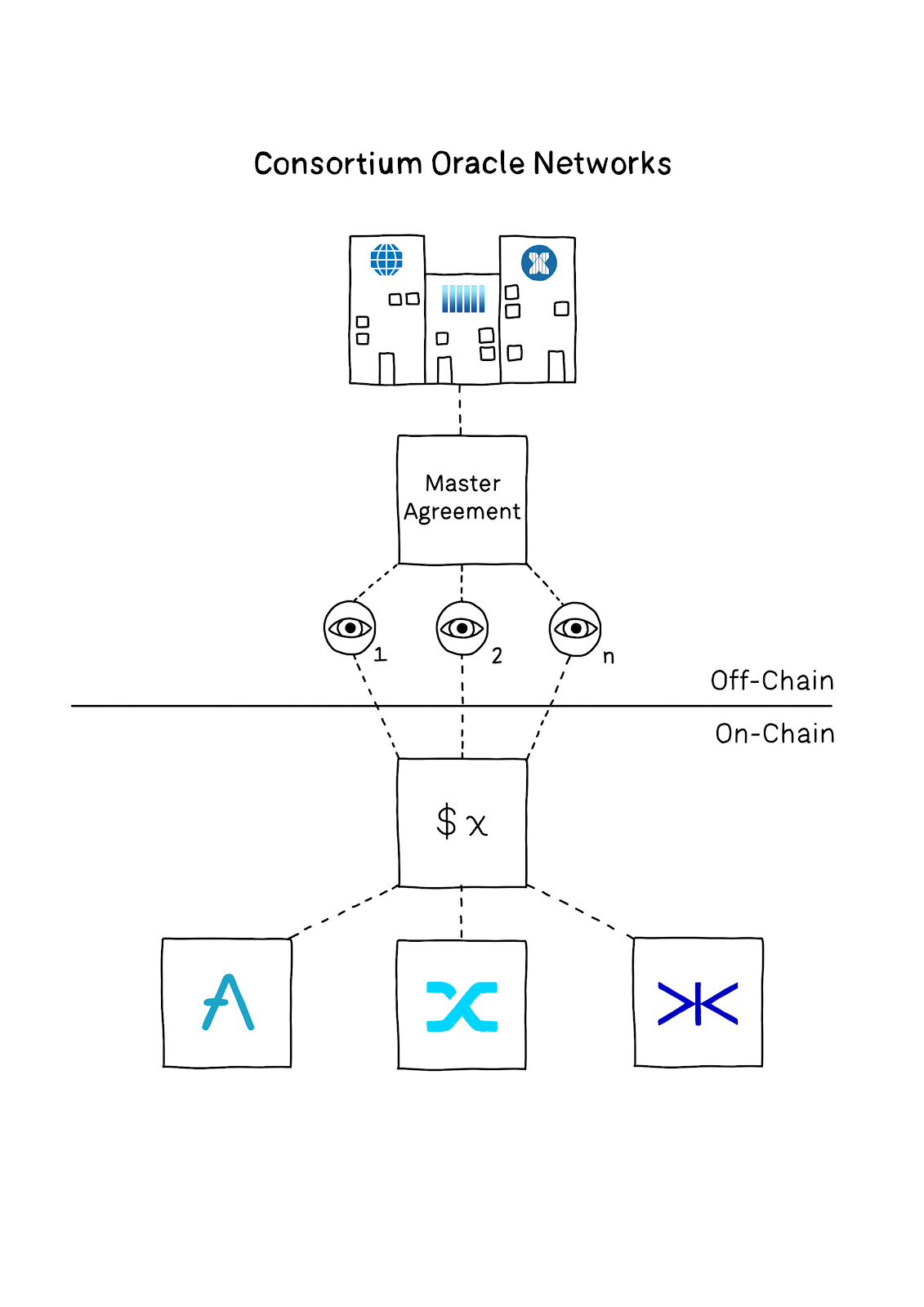

Consortium Oracle Networks are a likely eventuality in the next 2 year timeframe within DeFi. Centralized exchanges that seek additional revenue through data licensing are likely to form agreements with different oracles that form a Chainlink DON.

These firms will most likely instantiate master-agreements with cohorts of Chainlink oracles that deal with licensing and data sales. These consortium oracle networks will form around traditional financial exchanges that sell their pricing data as a product, such as the CME, NYSE and the ASX.

Traditional financial firms such as the CME have proprietary data relating to the derivatives and products traded on their platform. Oracle providers brokering relationships with firms to re-sell their data for the pricing of DeFi derivative contracts will introduce a new revenue stream for such firms. Within this model, it is likely that relationships will be formed between trusted protocols that pay the appropriate fees and have been able to license their contracts (whether that be through AML/KYC networks or by other means).

Current hurdles around AML/KYC and the reselling of data are still to be solved. These hurdles are preventing a lot of current pricing data from finding its way onto DeFi contracts. Another cause of this issue is that the majority of demand within DeFi is for higher-returning crypto assets, due to the average DeFi user’s risk tolerance.

There are clear economic incentives within DeFi when it is compared to traditional financial markets. Higher yields and lower transaction costs are just some of those advantages. As these advantages become clearer to traditional traders, it is inevitable that equities, commodities and forex markets will be traded using DeFi infrastructure.

For a data consuming protocol, most on-chain oracle feeds have yet to fully determine their pricing and licensing model due to the nascence of the industry. Currently, any protocol can basically gain access to on-chain price feeds for free, without paying the feed provider. Future models will introduce ZKPs for data values and whitelisted read addresses that are either:

- Paying customers; or

- A combination of paying and licensed customers.

With respect to data that natively exists on-chain, such as a Uniswap oracle, exchanges now have a choice between the smart contracts owning the data, or the user having rights to the data that they have created.

Next, we will discuss a new model where the user owns their data inputs and own rights to the revenue stream that’s generated from it.

2) User-Owned Data

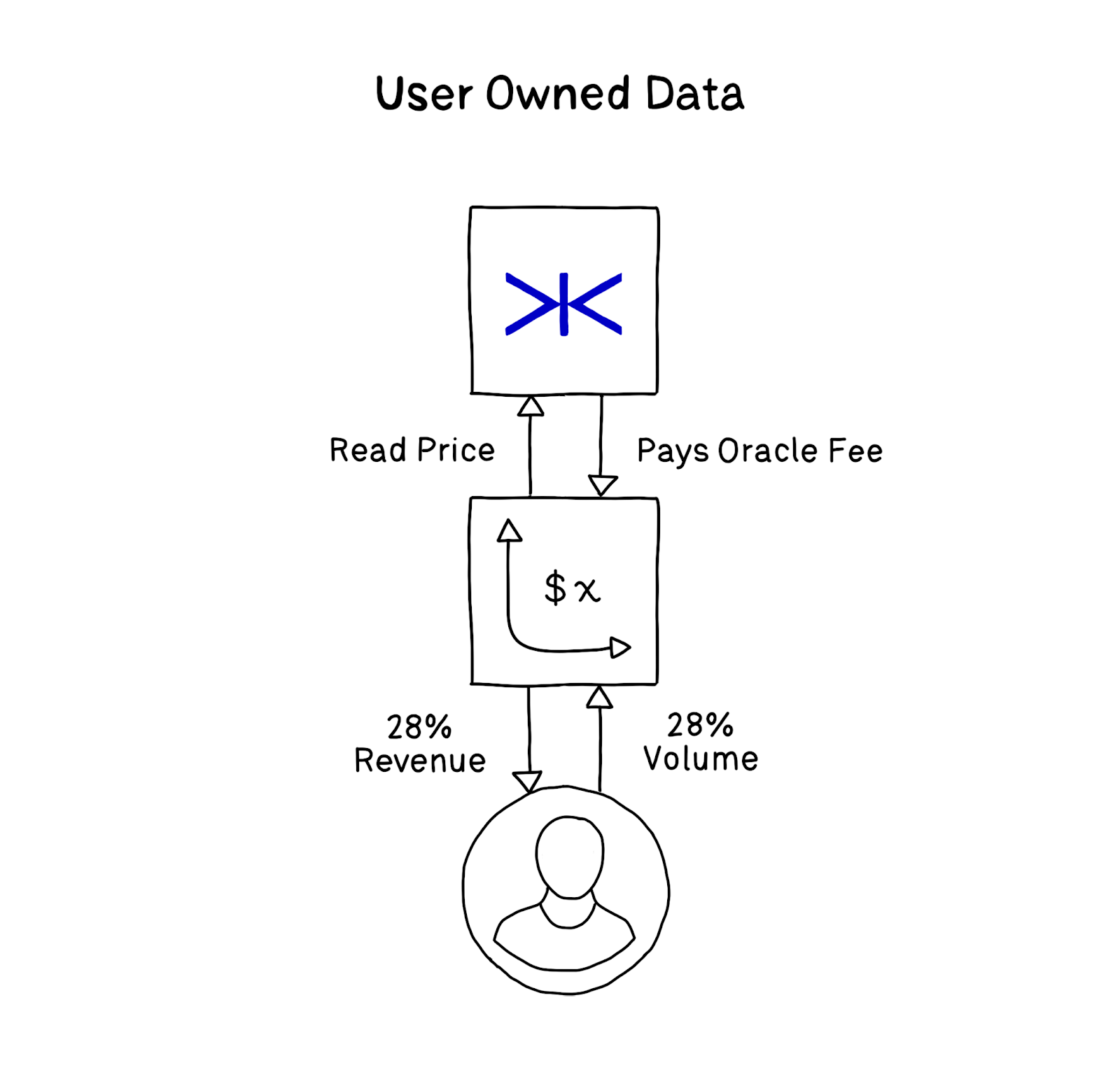

In this reality, the user that contributes volume towards a TWAP value on Uniswap, or whatever form of aggregated data value, has an economic claim to any revenue that is generated from that price. This is somewhat of a brave new world that we’d love to see spot exchanges adopt and consider in more detail.

In this model, a Sushiswap user that has contributed 28% of volume towards an ETH/DAI market would have rights to 28% of any revenue derived from ETH/DAI oracle-paying customers. This would be dependent on how the price had been aggregated for a given period of time. Should any DeFi contract like Tracer be a consumer of the Sushi oracles, the fees paid by Tracer contracts would be sent to a distribution contract within the Sushi protocol and dispersed to users from there.

The protocol then simply acts as a vector for exchange. Its revenue model is taking exchange fees. On-chain meta-oracles that source pricing data from many on-chain sources will be able to exist on top of these contract layers and provide effective aggregation services for potential DeFi consumer contracts.

Regulatory arbitrage likely exists for protocols that are not willing to take protocol fees, who can then profit from the oracle data sales instead—creating ambiguity as to the exact economic model that the user is buying into. For retail customers, usually this financial revenue that’s generated from the sale of their data is completely abstracted from their trading experience in the form of zero fees or costs to using the exchange.

Where things become interesting is when a tokenomic incentive for data sales is introduced. In exchange-owned models, you can earn a share of the future revenues generated from the sale of any of your data rights that you had sold to the protocol. This model compensates the user more than current centralized exchange models or even social media platforms.

The Data Wars Are Coming

To conclude, there will be a variety of ways that oracle data is sourced and derived on-chain. Many different business models will be formed around them to successfully extract value at the transaction layer.

Today we discussed how traditional financial data may be ported on-chain through Consortium Oracle Networks, as well as how users may be able to own their own pricing data and be paid for their contributions.

Given the progression of technologies such as Ethereum, Chainlink & ZKPs, I expect to see a future where each financial exchange user can be their own oracle, and own their transaction data, having right to its sale.

All of us within the DeFi community are in a unique position to ensure that we don’t permit data exploitation, which played such a prominent part in traditional finance over the past 20 years. Tracer as a DeFi protocol will continue to deeply consider the data rights of its users, and will make sure that our future users are compensated for their data contributions.

Action steps

Understand the future implications of data ownership

Read up on previous bankless readings on oracles