The Best DeFi Business Models

Dear Bankless Nation,

During the liquidity rush of the bull run, TVL was investors' preferred metric of choice to gauge the success of a protocol and its usage.

Now that liquidity is drying up, focus has shifted to fundamental revenue and profitability metrics.

The fundamentals have always mattered.

The bull run merely obscured, but not obviated them.

It’s important to remember that DeFi protocols are startups. Even the oldest ones are just a couple years old, while many are no older than a few months.

It is unrealistic to demand instant profitability right now.

However, the auditability and transparency of blockchains gives us the unique ability to better understand these protocols and assess a path to profitability.

Today, Ben lays out a competitive analysis between four major DeFi verticals:

- Decentralized exchanges

- Lending markets

- Asset managers

- Liquid staking protocols.

Let’s get into it.

- Bankless team

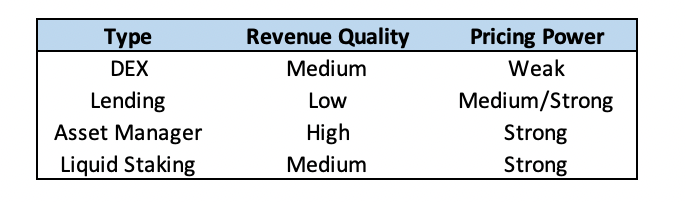

People like to refer to DeFi as a monolith - but it’s not. Each type of DeFi protocol operates distinct businesses from one another, with differing quality of revenue and pricing power due to their competitive advantages.

In a mature market, like in TradFi or Web2, you’d expect projects with higher quality revenue and stronger pricing power to trade at richer valuations than those with lower quality and weaker revenue.

Which DeFi protocols have the best business models?

To find out, let’s dive into the business models of four different types of protocols: decentralized exchanges (spot and perpetuals), lending markets (over and undercollateralized), asset managers, and liquid staking protocols.

1. Decentralized Exchanges

- Description: This refers to protocols that operate exchanges for either spot or perpetual futures trading.

- Examples: Uniswap, Curve, Balancer, GMX, dYdX, Perpetual Protocol

- How They Make Money: Both spot and perpetual futures exchanges generate revenue from trading fees. Though the allocation differs by exchange, these fees are split between the protocol and the DEX’s liquidity providers, with the former often choosing to allocate some (or all) of its share to tokenholders.

🧐 Revenue Quality: Medium

DEX revenue is of medium quality.

DEX revenue is hard to forecast, as trading volumes are correlated to market activity. Although exchanges will do considerable volume during any sort of volatile period, whether it be to the upside or the downside, over longer-periods of time trading activity tends to increase during bull markets and sink during bears.

DEX revenue can either be high or low margin, depending on the exchange.

This is due to the varying degree to which different DEXs have chosen to incentivize liquidity in order to gain market share.

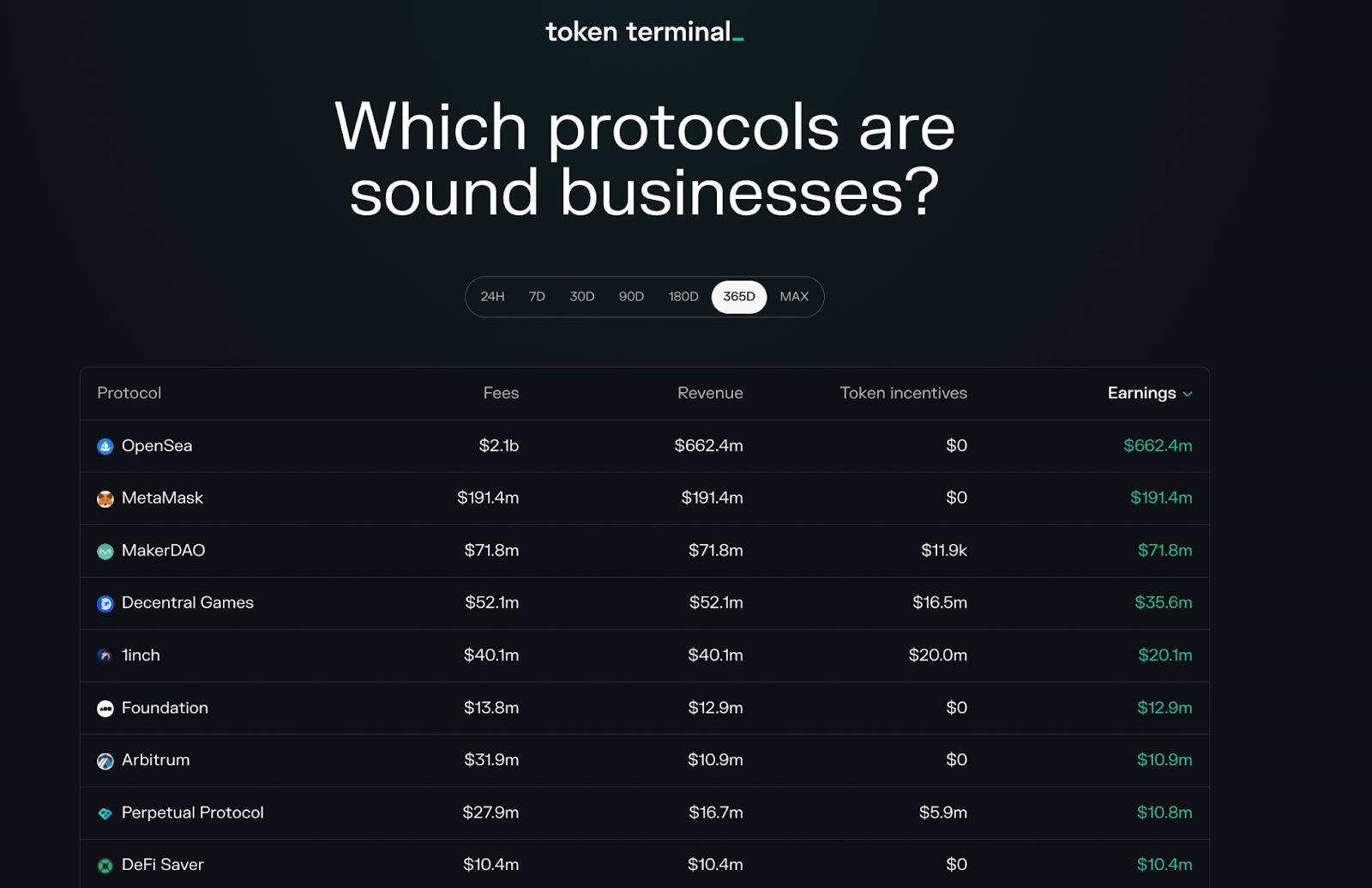

For instance, dYdX has emitted $539.1M over the past year, operating at a loss of $226.8M with a profit margin of -73%.

However, other exchanges like Perpetual Protocol have managed to remain profitable, as the DEX only emitted $5.9M in tokens to earn $10.9M in profit at a 64.6% margin.

It remains to be seen whether frugality or aggressive growth will pay off in the long-run.

💪 Pricing Power: Low/Medium

Spot and derivatives DEXs differ when it comes to their pricing power.

Spot DEXs are vulnerable to fee-compression in the long-run, as they do not manage risk, can be easily forked, and have low-switching costs for traders who seek to have the best possible execution on their swap.

Although some liquidity and volume is likely to be loyal to individual exchanges due to their brand recognition and trust among their user-base, spot DEXs are still vulnerable to the price wars that we have seen among centralized exchanges. The first signs of this have already begun to emerge, as Uniswap has added a 1bps fee-tier for certain pairs (mostly stablecoin <> stablecoin).

DEXs that offer leveraged trading (like perpetuals) are less vulnerable to these pricing pressures than their spot counterparts. One reason for this is that these exchanges require their DAOs and core-team to actively govern and maintain the exchange in order to manage risk, as these stakeholders are responsible for listing new markets and setting parameters such as margin ratios.

In addition, DEXs that offer synthetic leverage and that only need a secure price feed to list new markets, can differentiate themselves more easily from other competitors by being able to support novel assets.

These two factors means that as a whole, DEXs, to borrow from TradFi, should be able to keep fees HFL (higher for longer).

2. Lending

- Description: This refers to protocols that facilitate either over-collateralized or under-collateralized borrowing and lending.

- Examples: Aave, Compound, Euler Finance, Maple Finance, TrueFi

- How They Make Money: Overcollateralized lending markets generate revenue by taking a cut of the interest paid to lenders. Undercollateralized lending markets generate revenue by charging origination fees, with some also taking a cut of the interest paid to lenders.

🧐 Revenue Quality: Low

Lending platforms have low-quality revenue.

Interest revenue for both over and under-collateralized lending markets is unpredictable. This is because it, like trading fees, is dependent on market conditions.

The demand to borrow is positively correlated with price action, as the demand for leverage increases when prices rise and decreases when prices fall.

Origination fees for undercollateralized lenders is also unpredictable, as demand for under-collateralized loans is predicated on the same factors.

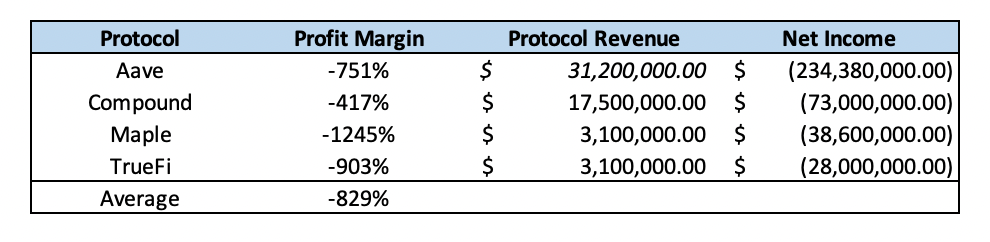

In addition, lenders have very low margins relative to other DeFi protocols, as they’ve had to aggressively emit tokens in order to attract liquidity and gain market share, with the average TTM (trailing twelve months) profit margin for lending markets sitting at -829%.

💪 Pricing Power: Medium/Strong

Over and under-collateralized lending platforms have differing degrees of pricing power.

Over-collateralized lending markets should be able to retain some degree of pricing power, as these protocols benefit from strong brand recognition and user trust due to considerable risk management required from their governing DAO to ensure they operate properly.

This creates a barrier to entry for challengers, as while heavily incentivized forks have proven capable of attracting billions in TVL, this liquidity has not proven to be sticky in the long-run likely due to the reasons listed above.

Undercollateralized lending markets however have stronger pricing power as they benefit from even higher barriers to entry for competitors due to their focus on compliance and institutional customers (hedge funds, VCs and market makers). Furthermore, as they provide these entities with a highly valuable and differentiated service, these protocols should likely be able to continue to charge origination fees while remaining insulated from fee-compression for the foreseeable future.

3. Asset Management

- Description: This refers to protocols that operate yield generation vaults as well as those that create and maintain structured products.

- Examples: Yearn Finance, Badger DAO, Index Coop, Galleon DAO

- How They Make Money: Asset managers generate revenue from AUM-based management fees, performance fees, and/or minting and redemption fees for structured products.

🧐 Revenue Quality: High

Revenue for asset managers is of high-quality.

This is because revenue for asset managers is far more predictable than many other protocols due to the recurring nature of AUM-based management fees, or revenue that is generated at predetermined intervals.

Due to its stability, this form of revenue is considered to be the gold standard by traditional investors. However, it should be noted that performance and minting/redemption fees are less predictable, as like trading and interest revenue, these revenue streams are largely dependent on market conditions.

Asset managers benefit from very high margins.

These protocols often do not need to issue large amounts of token incentives, as both yield vaults and structured products intrinsically generate their own yield.

For instance, two asset managers, Yearn and Index Coop earned $49.0 and $3.8M in revenue over the past year despite spending $0 and $355K on emissions respectively.

💪 Pricing Power: Strong

Asset managers have strong pricing power.

Asset managers are likely to be insulated from compression due to managing a considerable amount of risk. Although yield generation strategies can be copied, users have shown a tendency to park capital with asset managers that have strong commitment to security, even if they offer lower returns and have a more aggressive fee-structure than their competitors.

Furthermore, given that many individual structured products are highly differentiated from one another, it may take some time for the industry to converge on a single, standardized fee structure, helping further protect the pricing power of asset managers.

4. Liquid Staking

- Description: This refers to protocols that issue liquid staking derivatives (LSDs).

- Examples: Lido, Rocket Pool, StakeWise

- How They Make Money: Liquid staking protocols earn revenue by taking a commission of the total staking rewards earned by validators. Staking rewards are composed of issuance, transaction fees, and MEV.

🧐 Revenue Quality: Medium

Revenue for liquid staking protocols is of medium-quality.

Revenue for LSD issuers is somewhat predictable, as block issuance is tied to staking participation rates, which changes slowly over time. However, revenue from transaction fees and MEV is less predictable, as it is highly correlated with market conditions and volatility.

LSD issuers also benefit from earning fees entirely in ETH (or a native asset for other L1s). This means the value of their earnings can increase dramatically in dollar-terms as these assets (hopefully) appreciate over the long run.

While to date liquid staking protocols like Lido have had to spend considerably on emissions to incentivize liquidity, they are likely to have very strong margins over the long-run as their network effects set in (more on that below).

💪 Pricing Power: Strong

Liquid staking protocols have strong pricing power.

These protocols benefit from strong network effects stemming from deep liquidity and integrations for their LSDs. This network effect increases switching costs among users, as large stakers will be less inclined to hold and stake with a provider that has a less liquid and useful LSD.

Liquid staking protocols also benefit from high barriers to entry for competitors, as these protocols cannot be easily forked due to the technical sophistication required to manage these protocols properly, as well as due to the illiquidity of the underlying deposits to staking queues and withdrawal delays.

These competitive advantages means that liquid staking protocols should be able to maintain their current take rate for the foreseeable future.

Conclusion

As we can see, DeFi protocols are not all created equal.

Each type of protocol has its own unique business model with varying degrees of revenue quality and pricing power.

One interesting take away from my evaluation is the strength of the asset management business model, as they have both high-quality revenue and strong pricing power.

Although yield generation vaults like those operated by Yearn have gotten a considerable degree of traction, protocols that employ this business model have yet to see the same degree of success as exchanges, lenders, or LSD issuers, as YFI is the only asset management token to place in the top 15 by market cap.

Action steps

- 📖 Read Ben’s previous article on the Best Real Yields in DeFi

- 📖 Read Ben’s previous analysis on Which DeFi Protocols Are Profitable?