Stablecoins have become a cornerstone of the cryptocurrency market, providing a buffer against the volatility of cryptocurrencies like Bitcoin and Ethereum. One such prominent stablecoin is Tether (USDT), which aims to maintain its value as close to one US dollar as possible, backed by reserves held by its issuing company, Tether Ltd.

What is USDT?

Tether (USDT) is a centralized, asset-backed stablecoin that strives to keep a 1:1 parity with the US dollar. It maintains this stability through a reserve of assets held by Tether Ltd., which claims to hold cash or cash equivalents that are more than equal to, or over-collateralized, to the number of USDT in circulation.

The governance of the stablecoin is managed by Tether Ltd., which oversees the issuance and redemption of USDT.

The History of USDT

The precursor to Tether, originally named "Realcoin," was announced in July 2014 by co-founders Reeve Collins, Brock Pierce, and Craig Sellars.

The first tokens were issued on October 6, 2014, on the Bitcoin blockchain. This was done by using the Omni Layer Protocol. On November 20, 2014, Tether CEO Reeve Collins announced the project was being renamed to "Tether.”

We now know the owner of Tether Ltd. is iFinex, the parent company of the Bitfinex cryptocurrency exchange, although the connection wasn’t initially publicized. In January 2015, Bitfinex enabled trading of Tether on their platform. Since then, the stablecoin has expanded across 10 blockchains and counting and has exploded in popularity.

Amid Tether’s surge to prominence, in December 2017 the U.S. Commodity Futures Trading Commission (CFTC) notably subpoenaed Bitfinex and Tether Ltd. regarding the backing of the USDT stablecoin.

Despite Tether's initial assertions of full backing with USD, Tether Ltd. paid a $41.6 million fine in October 2021 per a CFTC order for inaccurately representing its collateral, which actually included a mix of USD and other assets such as unsecured receivables and commercial papers. Tether then adjusted their claim, stating that all tokens were now pegged 1-to-1 with a matching fiat currency and fully backed by Tether’s reserves. Assurance reports from 2017 to 2022 have since been released by Tether.

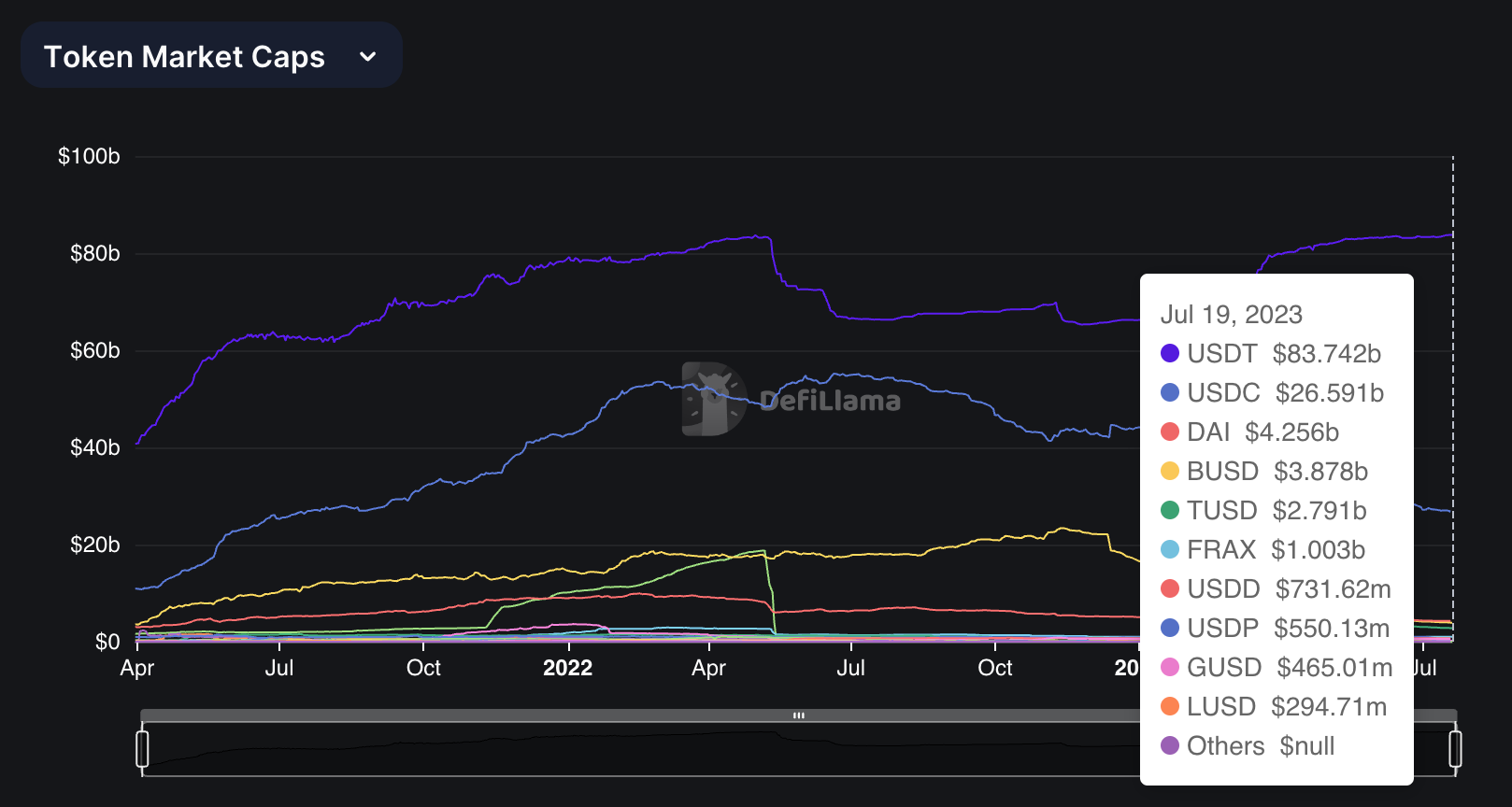

As for where USDT stands today, the stablecoin is currently the largest in the cryptoeconomy per its $83.74 billion market capitalization as of July 19, 2023. While many regulators continue to look at the token with great skepticism, USDT has won over a varied audience of users from all around the globe regardless thanks to its ease of use and wide availability.

How to acquire USDT

Tether can be purchased on various cryptocurrency exchanges like Binance, Coinbase, or Kraken using other cryptocurrencies or fiat money. USDT is also available on decentralized exchanges like Curve and Uniswap. Alternatively, Tether can be obtained directly from Tether Ltd. by depositing the equivalent amount of USD, although this method is typically only used by larger institutional users.

How to use USDT

Tether can be used as a store of value or as a medium of exchange, much like other currencies. It's commonly used as a “safe haven” asset during market volatility in the crypto space. Moreover, Tether is frequently used in decentralized finance (DeFi) applications for lending, yield farming, and for stable trading pairs on various exchanges.

Risks of USDT

While Tether provides stability and liquidity, it's not without risks. One risk is the potential for loss of parity if the reserves held by Tether Ltd. are found to be insufficient. There are also governance risks, as the centralization of Tether's management could potentially lead to manipulation or mismanagement.

Additional USDT resources

If you want to delve deeper into the world of Tether, here are some useful resources:

- 🌐 Tether Official Website

- 🔍 Tether Transparency Update

- 🦎 CoinGecko Tether Page

- 🦙 DefiLlama USDT Dashboard

Zooming out

Tether plays a significant role in the crypto space by providing a popular stable digital currency that bridges the gap between fiat currencies and cryptocurrencies. Its impact on liquidity and stability in the crypto markets is substantial, and it continues to be a critical component of many blockchain-based applications.

However, like all cryptocurrencies, it's important to understand the risks involved and to use Tether responsibly. As the crypto space continues to evolve, Tether's role as a stablecoin is poised to continue being pivotal for the foreseeable future.

More about Tether USDT

👉 Bankless Tether Profile

👉 Tether CEO on Their $100B Stablecoin ($USDT)