Dear Bankless Nation,

PoolTogether is a global no-loss lottery.

This is one of the more unique DeFi applications around. Not something that could have existed in the traditional world.

With PoolTogether, anyone can deposit DAI, USDC and other tokens into the application, and the protocol “pools together” all of the deposits and puts it to work on a lending protocol (like Aave or Compound). Then every week, the protocol randomly distributes all of the interest to one lucky winner.

All participants retain their deposits and always have the right to withdraw at any time. Anyone can play the lottery and no one loses their principle. Crazy right?

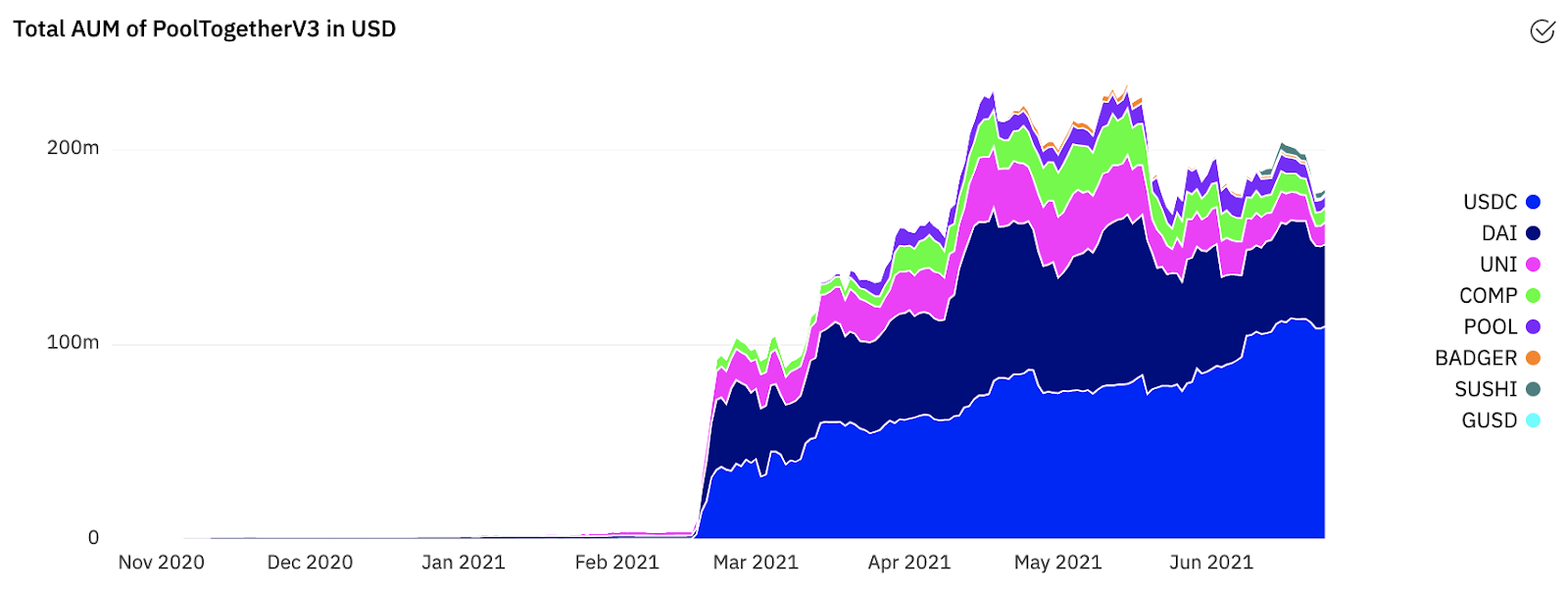

In February, the protocol launched its native governance token ($POOL) along with a liquidity mining program. As you can imagine, the protocol soared in value locked and interest earned.

PoolTogether now has over $200M in deposits and distributing nearly $100K per week in prizes across all pools.

One of the more interesting parts of PoolTogether is how this protocol generates cash flows to naturally diversify its treasury over time.

Bitwise’s DeFi Analyst, Ryan Rasmussen, explains.

- RSA

DeFi Summer 2.0: The Perfect Time To PoolTogether

PoolTogether is a popular DeFi app with almost $200 million in TVL, a steady stream of cash flows, and an impressive treasury.

Today we’ll take a dive into the protocol’s growing reserves and no-loss prize pools to see what could make PoolTogether a sought after destination in another DeFi summer.

On The Surface

Leighton Cusack built PoolTogether in 2019 as a “no-loss lottery” platform for individuals to participate in lottery games where nobody loses, and the prizes pay for themselves. To participate, users simply deposit their assets into a prize pool.

The platform “pools together” all of the user deposits, and uses these funds to earn interest via other DeFi protocols. After one week of the pool collecting interest, one randomly selected participant wins all of the accrued interest. Everyone retains their deposited principal, have the right to withdraw at any point, and are automatically reentered into the next prize pool drawing for another chance to win.

With their Dharma smart wallet integration, the POOL token airdrop in February, and the recent launch of PoolTogether 3.0, they’ve continued to attract more users, assets and prizes to the protocol. The protocol’s deposits grew to $200 million from less than $100 million at the beginning of March (the big step in the chart from February to March was due to the token airdrop and encompassing liquidity mining program).

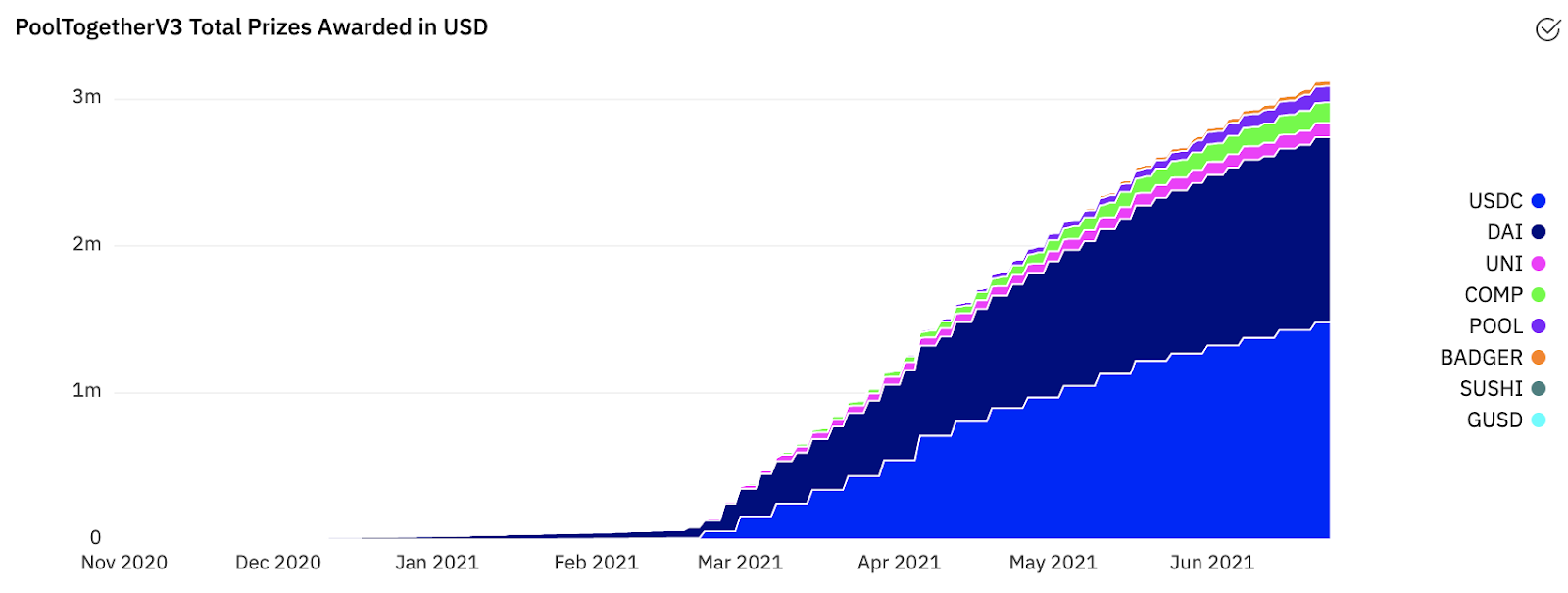

PoolTogether pays out $87,000 in weekly prizes and has paid out over $3 million in winnings to-date, according to their website and Dune Analytics. It’s worth noting those prize values displayed are all net of the reserve that stays with the protocol (more on that later).

The core principle of PoolTogether is that every user has a chance to win prizes and is entitled to get their principal back. It’s all made possible by the power of smart contracts and the interoperability of the DeFi ecosystem.

Diving Into the Fundamentals

While the prize pools are compelling, the strength of PoolTogether resides in the POOL token and the claim it has on the protocol’s rapidly growing reserves.

While the interest generated on prize pools is paid out to lucky winners, the prize pool reserves also retain a percentage of the winnings earned through operations, and redeposited into the next prize pool. This increases the principal used to generate prizes, essentially adding capital into the prize pool which is ineligible to win any prizes. As this loop repeats, it creates a one-way flow of tokens into the reserves.

This is an incredible value capture mechanism of the protocol that should not be dismissed: win or lose, all of the funds go right back into the prize pools. Deposits only leave the prize pools when users withdraw them.

With constantly growing reserves, the demand for PoolTogether tickets should continue to grow, as users are incentivized to participate in prize pools in which reserves are contributing to the size of the interest paid to winners. In turn, earnings on those reserves, or the protocol’s cash flow, will continue to grow.

Valuing PoolTogether

Thanks to the inherent transparency of blockchain protocols, we can apply traditional fundamental analysis and valuation metrics to the POOL token using on-chain data.

Revenue-to-TVL

The Revenue-to-Value Locked ratio evaluates capital efficiency, or the protocol’s ability to generate fees from the capital it holds.

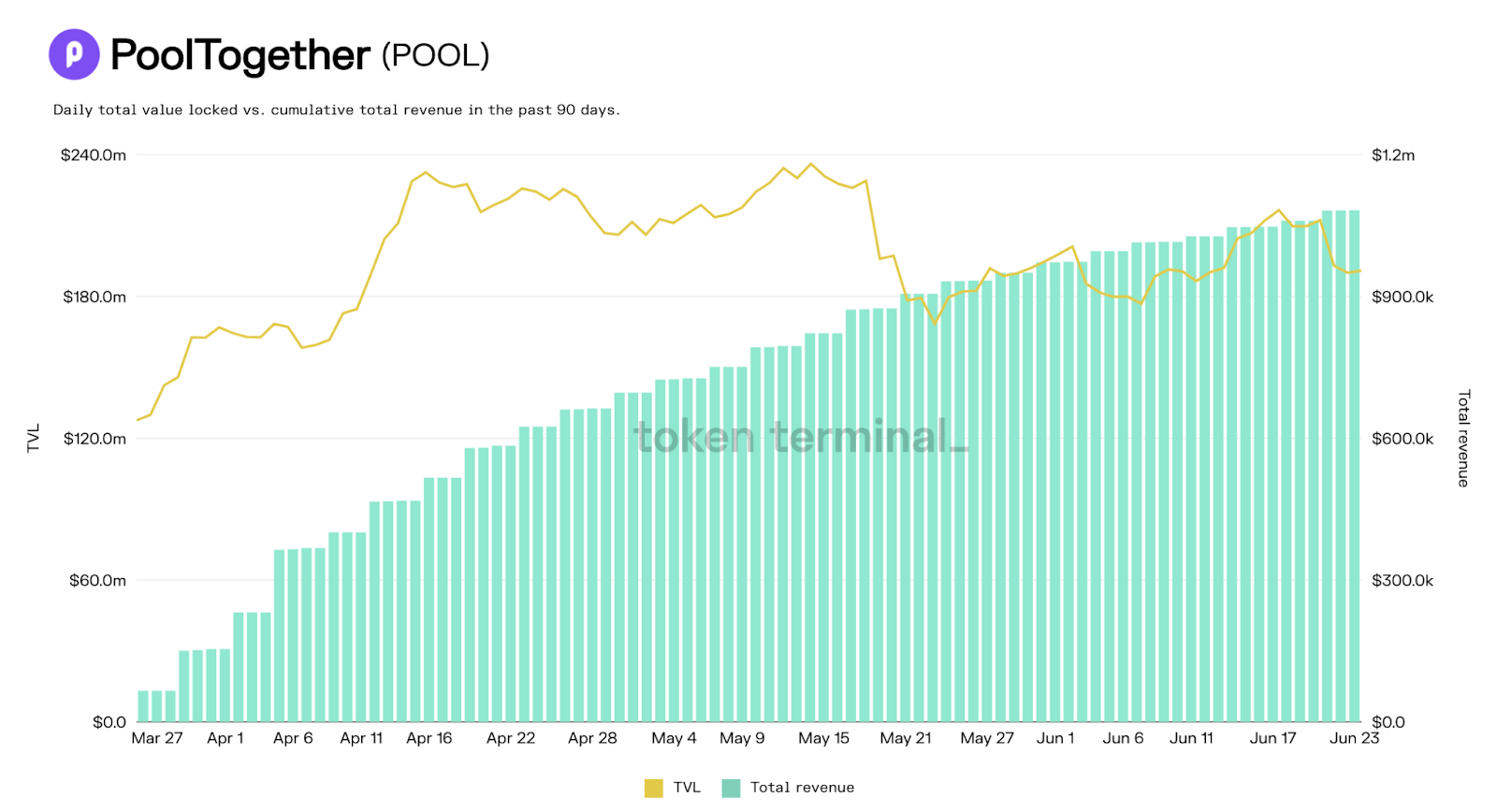

PoolTogether is currently sitting on $190.9 million of TVL and has generated $1.1m in revenue in the past 90 days, which translates to $4.4 million annualized—a Revenue to TVL ratio of $0.023.

This translates to $0.023 in revenue generated on every $1 locked in the protocol.

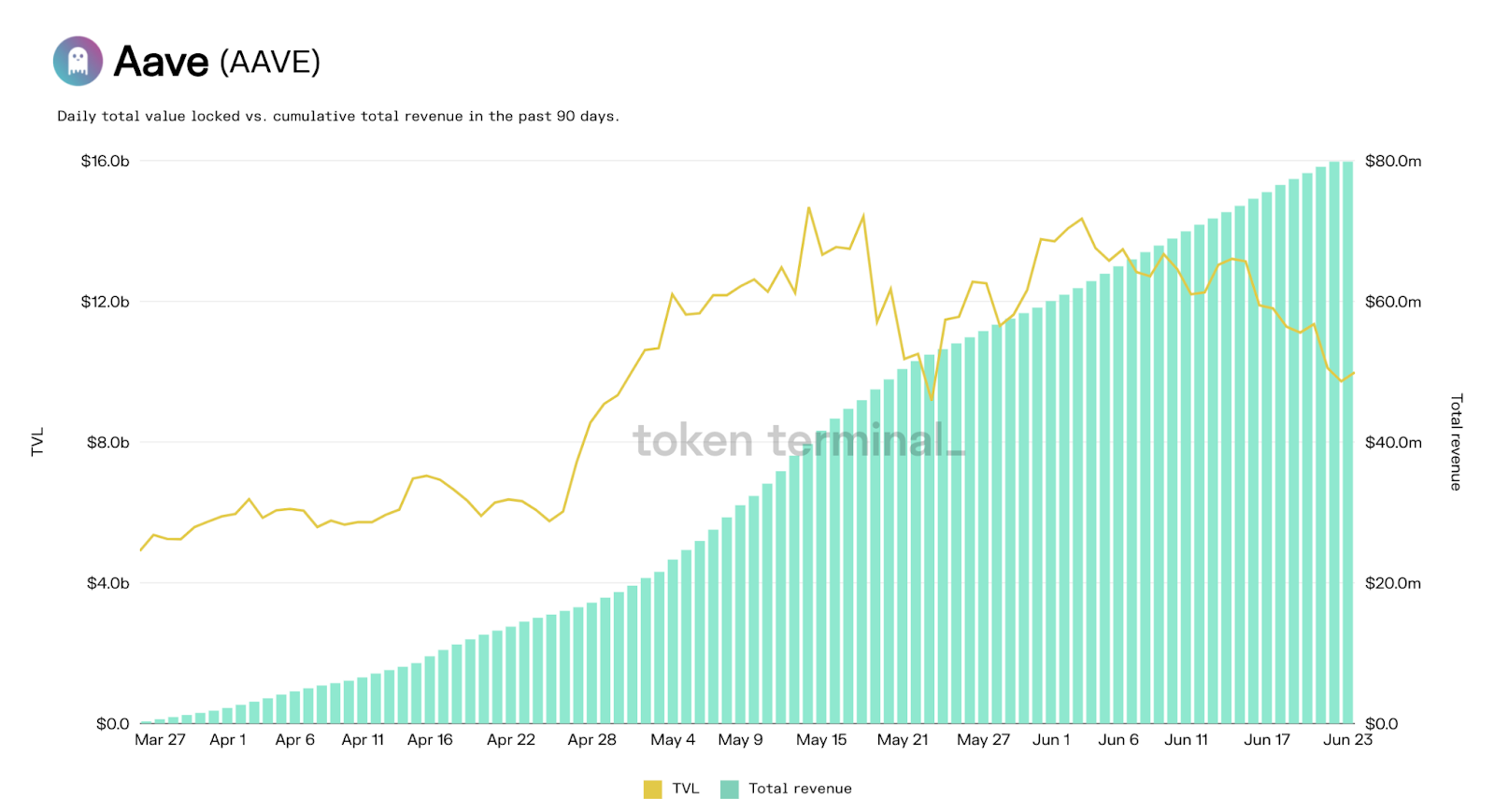

Aave’s Revenue to TVL ratio over the same period was $0.032, with $319.6 million of annualized revenue and current TVL of $10.0 billion.

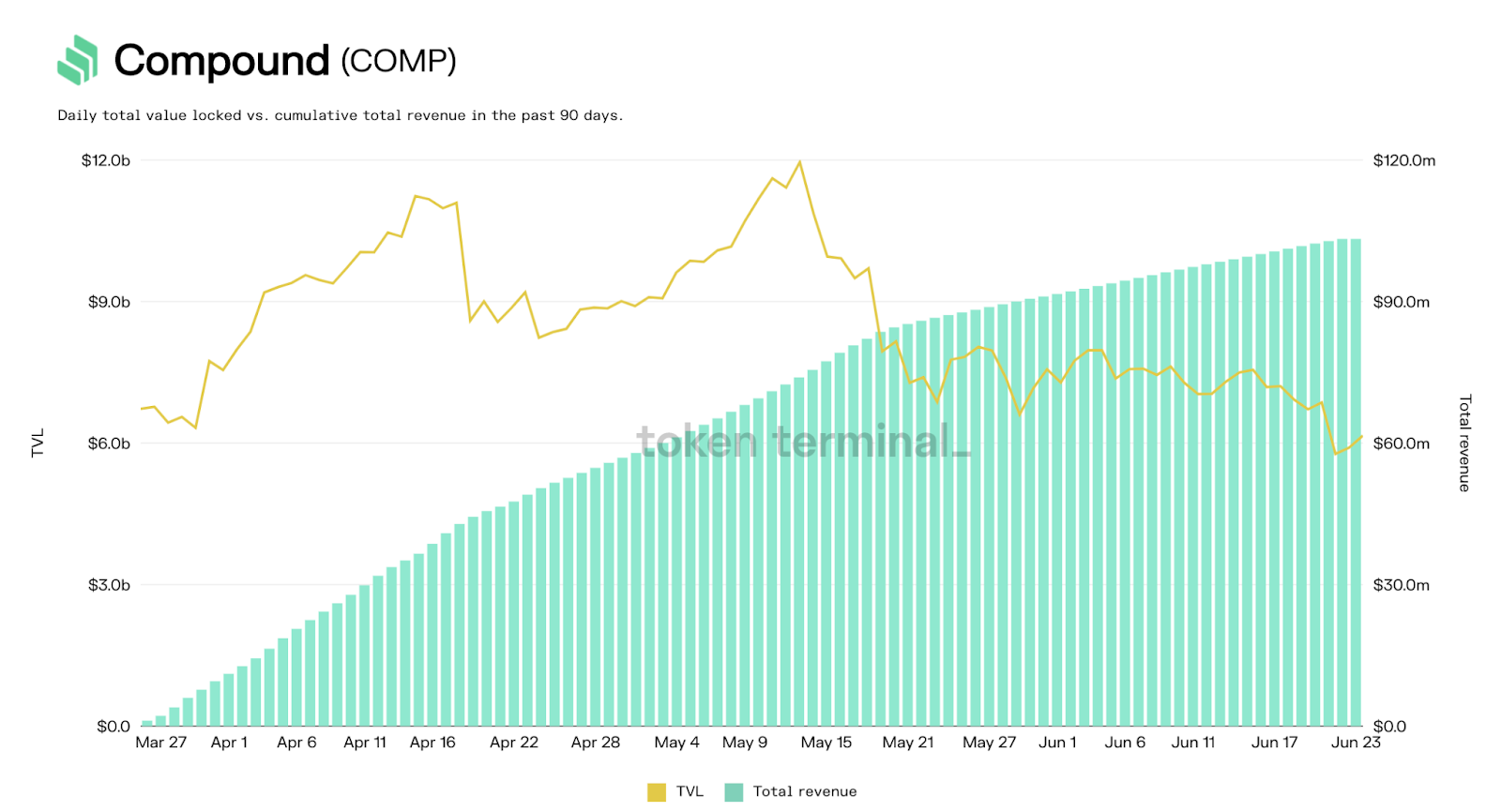

Compound’s Revenue to TVL ratio over the same period was $0.067, with $413.2 million of annualized revenue and current TVL of $6.2 billion.

PoolTogether’s represents a fraction of the money markets that it generates yield from. It's no surprise that it currently trails Aave and Compound in Revenue to TVL; these DeFi behemoths are operating at greater scale, enabling them to be more efficient with their capital. However, this does allow us to benchmark PoolTogether’s current capital efficiency and, going forward, we can track the protocol’s ability to scale its efficiency.

Treasury & Cash Flows

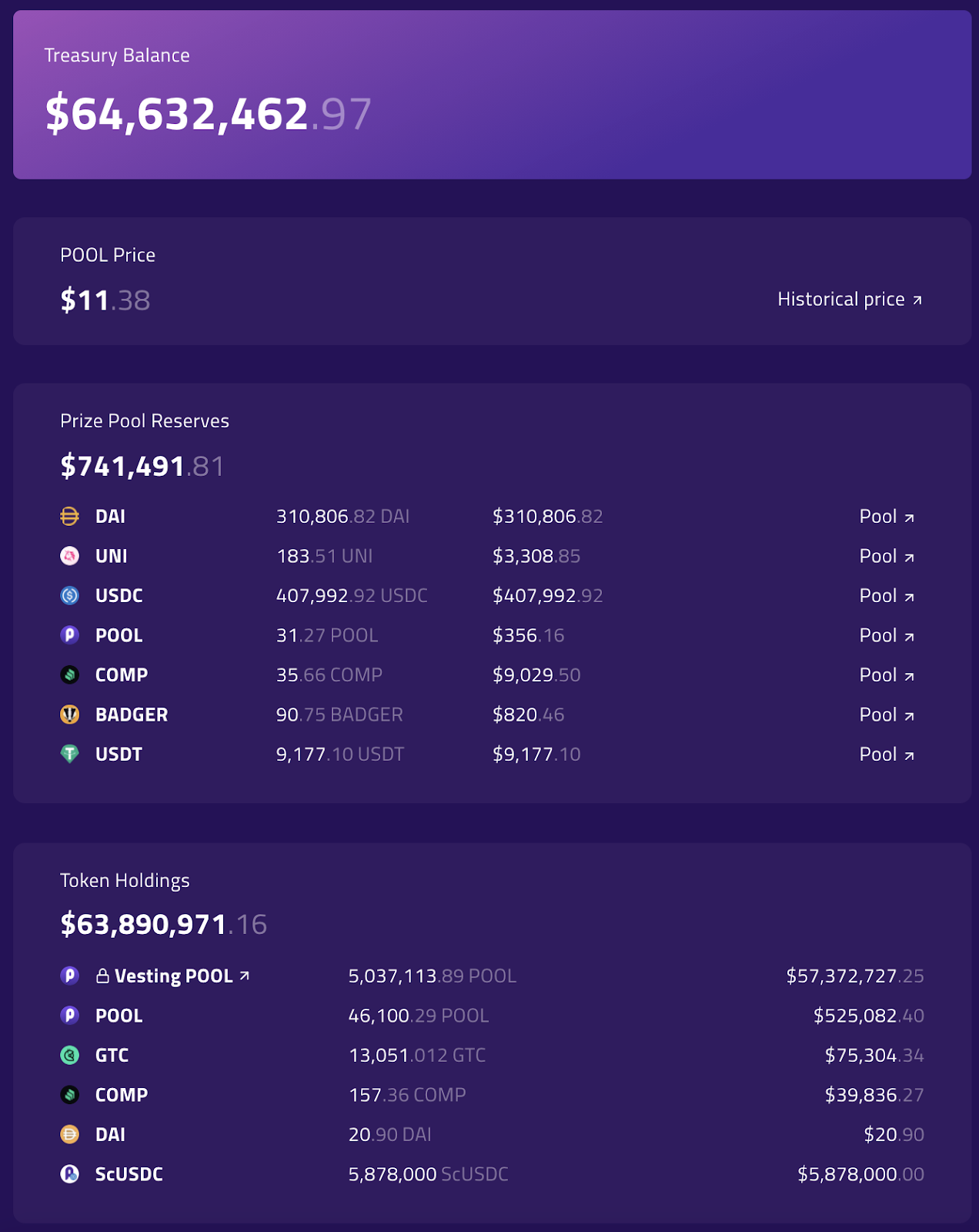

As of June 24, 2021, PoolTogether’s treasury is sitting close to $65 million. The majority of that consists of POOL tokens that were allocated to the treasury at the time of the token launch and are subject to a multi-year vesting schedule.

PoolTogether’s cash flow comes from interest income generated on deposits, and is compounded by the protocol’s reserve system. This is why cash-flows generated by PoolTogether are so important—any increase in reserves instantly results in a corresponding increase in cash-flows for more prizes and funding the treasury.

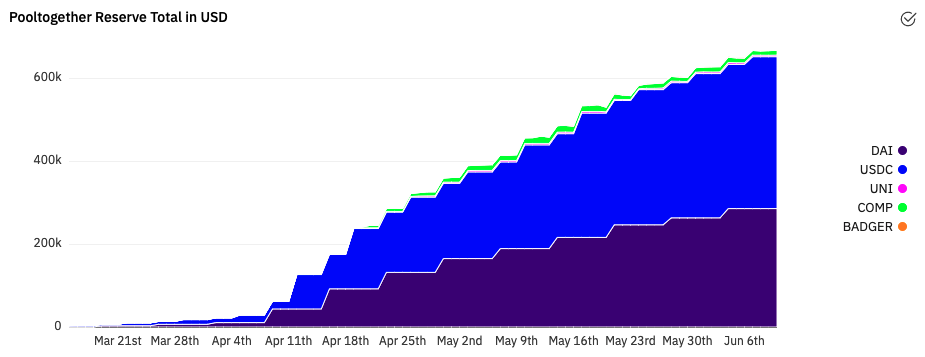

The reserves are the cash on-hand that POOL token holders can control, and if they ever vote to implement fees to token holders (i.e. dividends), those would likely be paid out of the reserves. These reserves doubled in May, growing from ~$300 thousand to ~$600 thousand.

What’s really interesting is that as PoolTogether continues to launch new prize pools, their reserves (and therefore their treasury) continues to diversify, addressing a growing issue across DeFi today where treasuries are predominately denominated in their protocol’s token. While the value of these prize pools will move up and down with the markets, the count of tokens in the pool reserves are set to grow with every payout.

Price to Sales (P/S)

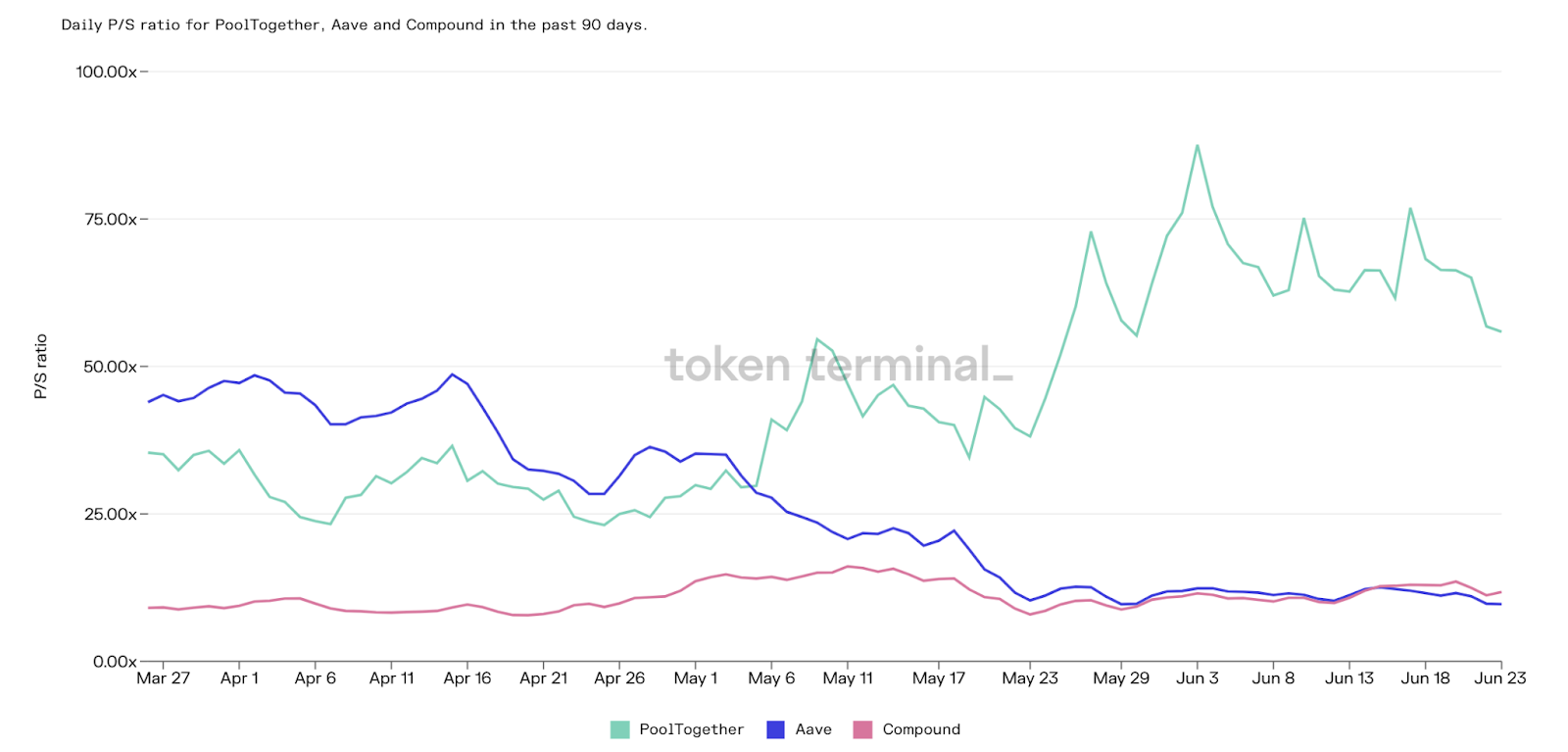

With a relatively high P/S of 46x (over the same 90 day period we’ve been analyzing), this metric isn’t quite as refreshing as the others. This could indicate the price of the POOL token is high relative to the protocol’s sales.

Alternatively, the protocol’s relatively high P/S could be interpreted as the premium that token holders are willing to pay for the expected future growth of the reserves. As previously mentioned, those reserves doubled from $300 thousand to $600 thousand in the month of May alone.

On The Horizon

As a governance token, POOL is used to vote on how to deploy the protocol’s treasury.

Showcasing the power of DAOs and DeFi, the community of POOL token holders have been the driving force behind some of the recent developments of PoolTogether, including the $500k PoolGrants fund aimed at expanding and improving the ecosystem and and the creation of a Rari Capital and PoolTogether lending market.

The new lending market expands the protocol’s reach by allowing users to, if they choose to do so, borrow against their PoolTogether deposits.

This is a game-changer for a DeFi protocol that is sitting on nearly ~$200m of assets, the majority of which are stablecoins. Users are now able to borrow and re-deposit those borrowed funds into PoolTogether prize pools, compounding their chances of winning. Users could also deploy the borrowed funds elsewhere in the DeFi ecosystem to earn yield or swap USDC for risk-on assets.

If the protocol continues to ship new features and partner with other popular dapps, they could see a tidal wave of new users and deposits flowing into their prize pools. That would result in larger payout pools that attract more deposits, which in turn, will generate even larger payout pools and reserves.

As the basket of tokens held by protocol’s reserves becomes further diversified, the POOL token might start being viewed as an index of the tokens in its reserve. Today, those reserves are heavily weighted towards the POOL token itself, however, as more prize pools with additional tokens are added to the platform, one could assume that distribution would normalize.

Going forward, the important thing to watch will be the growth rate in those reserves and how the POOL token holders decide how to deploy the treasury. Further, as the deposits, prize pools, and revenue grow, the Revenue-to-TVL and P/S ratios will need to show that PoolTogether is becoming more capital efficient for it to become a popular destination for DeFi summer and beyond.

Disclosure: Investments in crypto assets are inherently risky and include the possible loss of principal. Nothing in this article is or should be construed as a recommendation to buy or sell any securities. Past performance is not an indicator of future performance.

Action steps

Dig into the data yourself (always DYOR!!)