State of Ethereum | Q1 2022

Dear Bankless Nation,

It’s no secret that Bankless is bullish on Ethereum.

But being bullish without the numbers to back it up is meaningless.

That’s what our Ethereum’s quarterly reports aim to bring.

Numbers to back the bullishness.

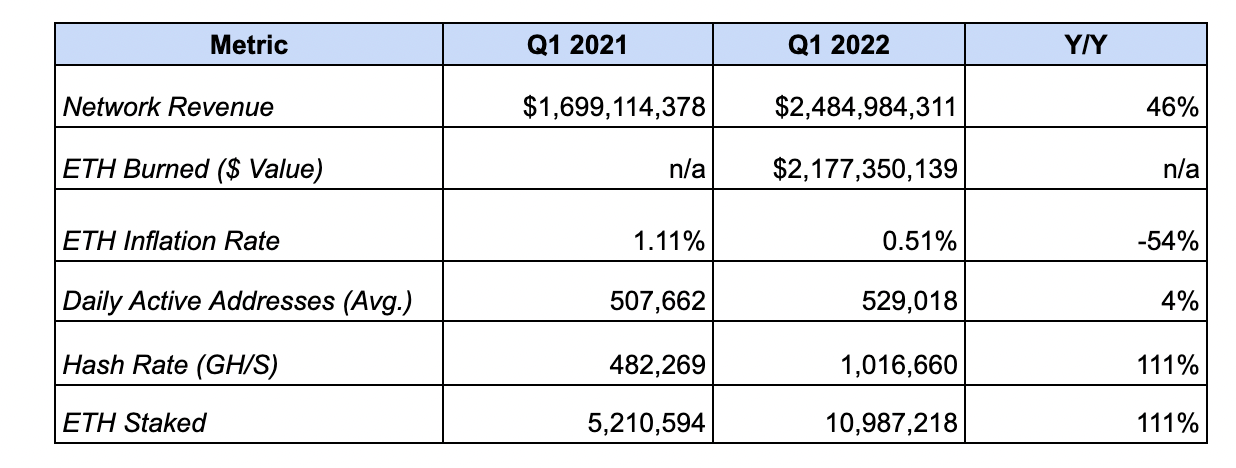

Here’s a snapshot of Ethereum’s progress from Q1 2022 (year over year):

- Network Revenue increased 46% from $1.6 billion to $2.4 billion 📈

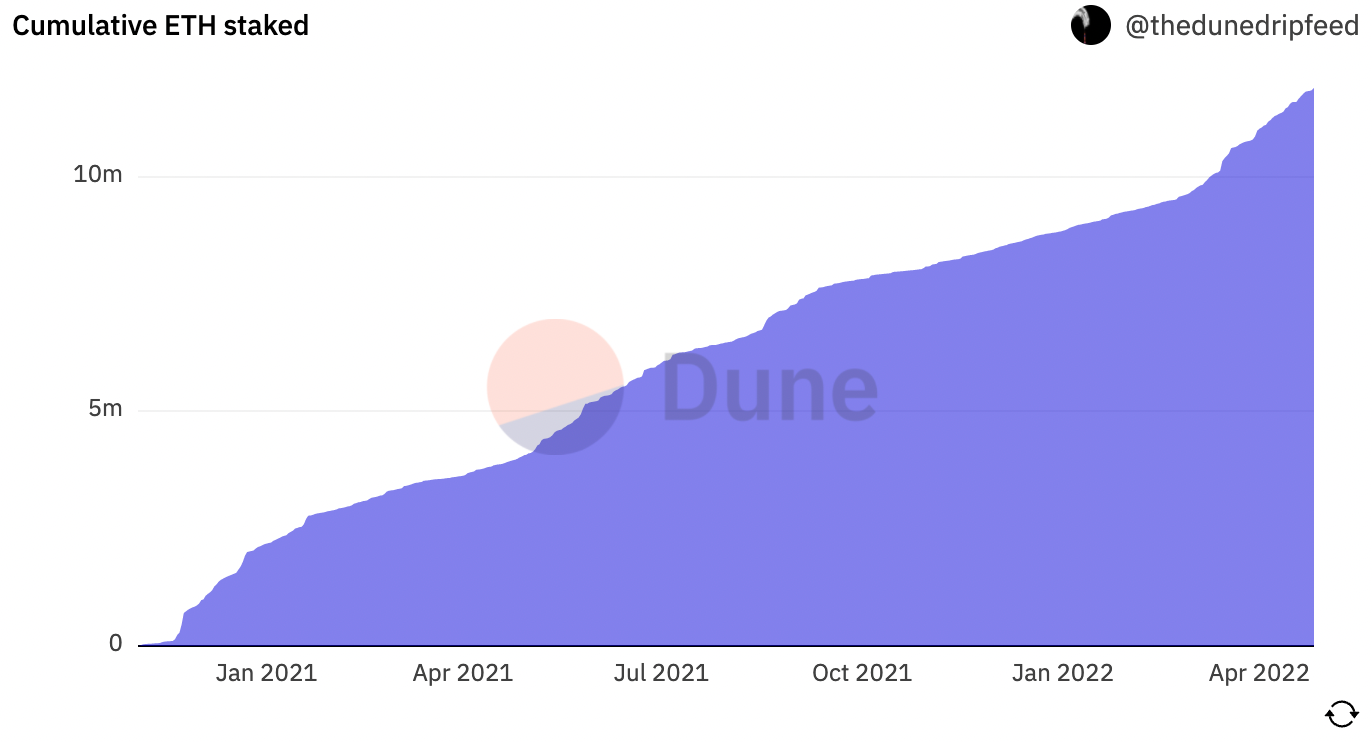

- ETH Staked rose 111% from 5.2 million to 10.9 million 📈

- DeFi TVL increased 82% from $49.1 billion to $89.5 billion 📈

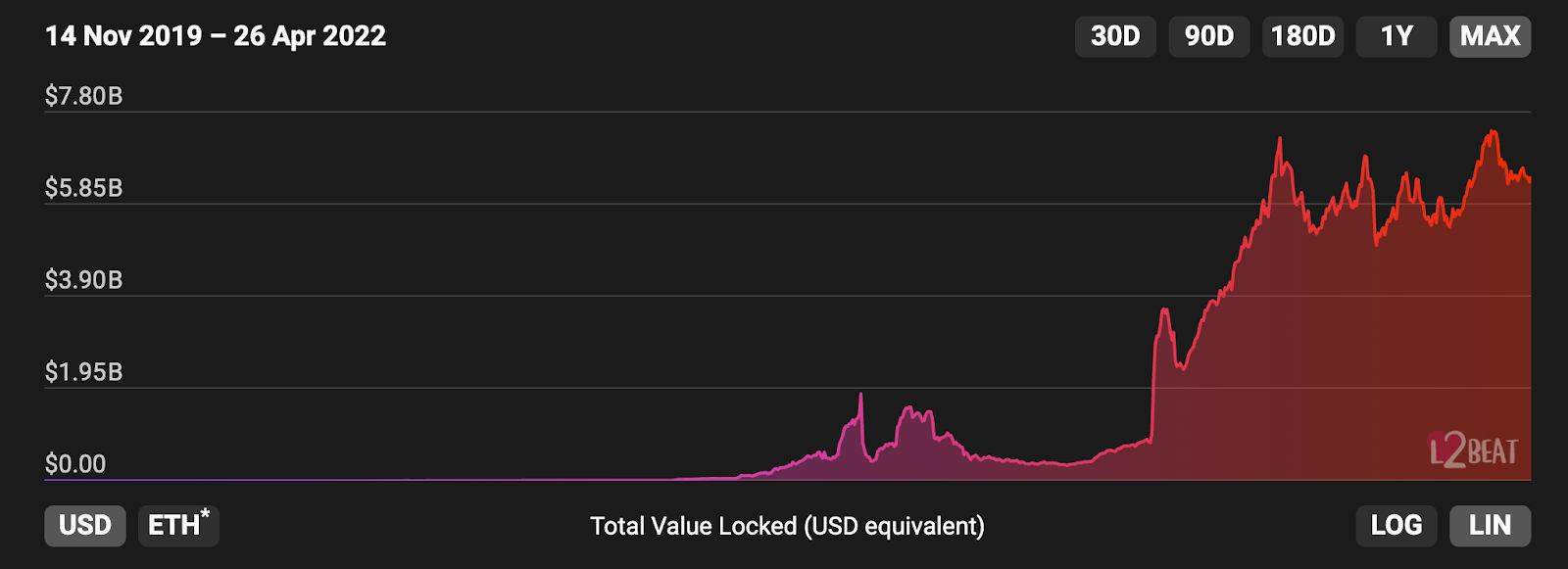

- The Layer-2 TVL increased 964% from $686.9 million to $7.3 billion 📈

Today, Ben brings us an update today on all Ethereum activity across the network, DeFi, Layer 2s, NFTs, and stablecoins for Q1 2022.

LFG.

- Bankless Team

P.S. Check out also Ben’s previous State of Ethereum Q4 report.

Ethereum, the world’s leading smart contract platform, reported financial results for the first quarter ended March 31, 2022.

Key Results

These numbers compare performance in Q1 2021 to Q1 2022.

The Ethereum Protocol

- Network Revenue increased 46% from $1.6 billion to $2.4 billion. This measures the value of the transaction fees, paid in ETH, by network users. $2.1 billion of this revenue (87%) was removed from the circulating supply of ETH via the burning mechanism implemented via EIP-1559, which went live in August 2021.

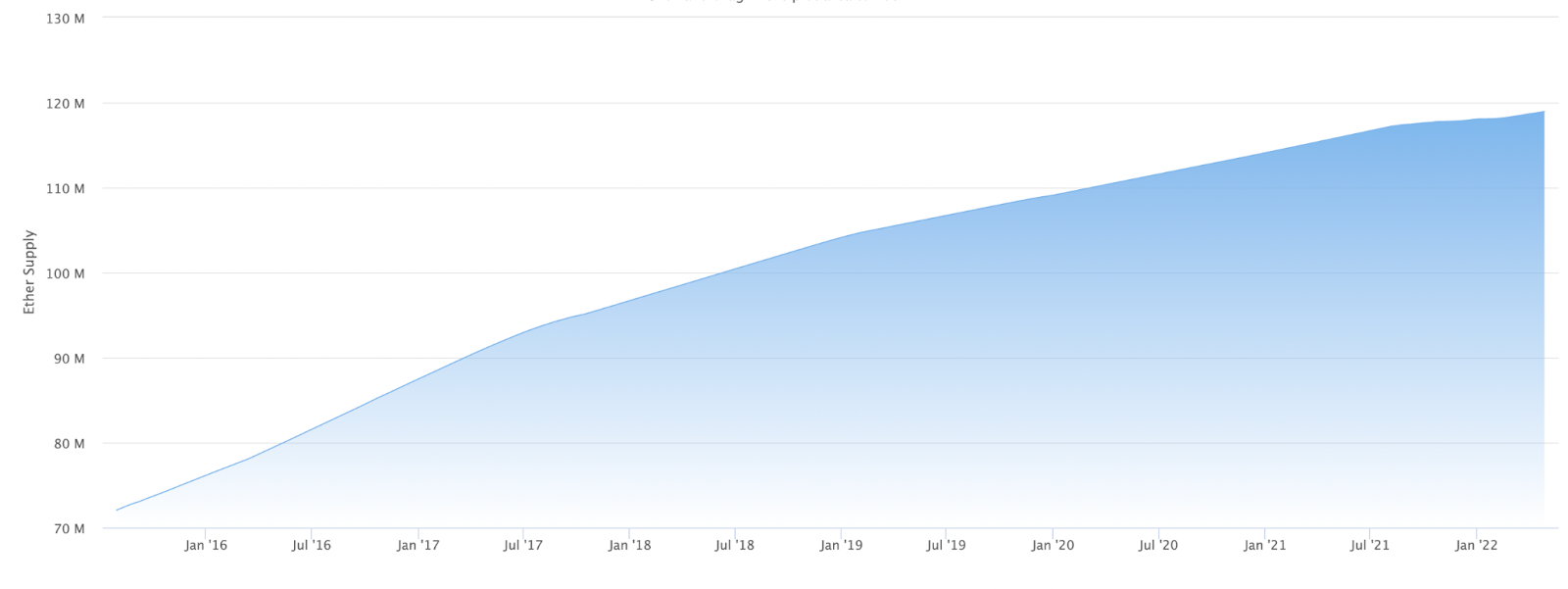

- The ETH Inflation Rate rate decreased 54% from 1.10% to 0.51% during Q1. This metric tracks the net change in the supply of ETH. New ETH is issued through block rewards, which are paid out to miners as a reward for confirming network transactions, and burned through the aforementioned EIP-1559.

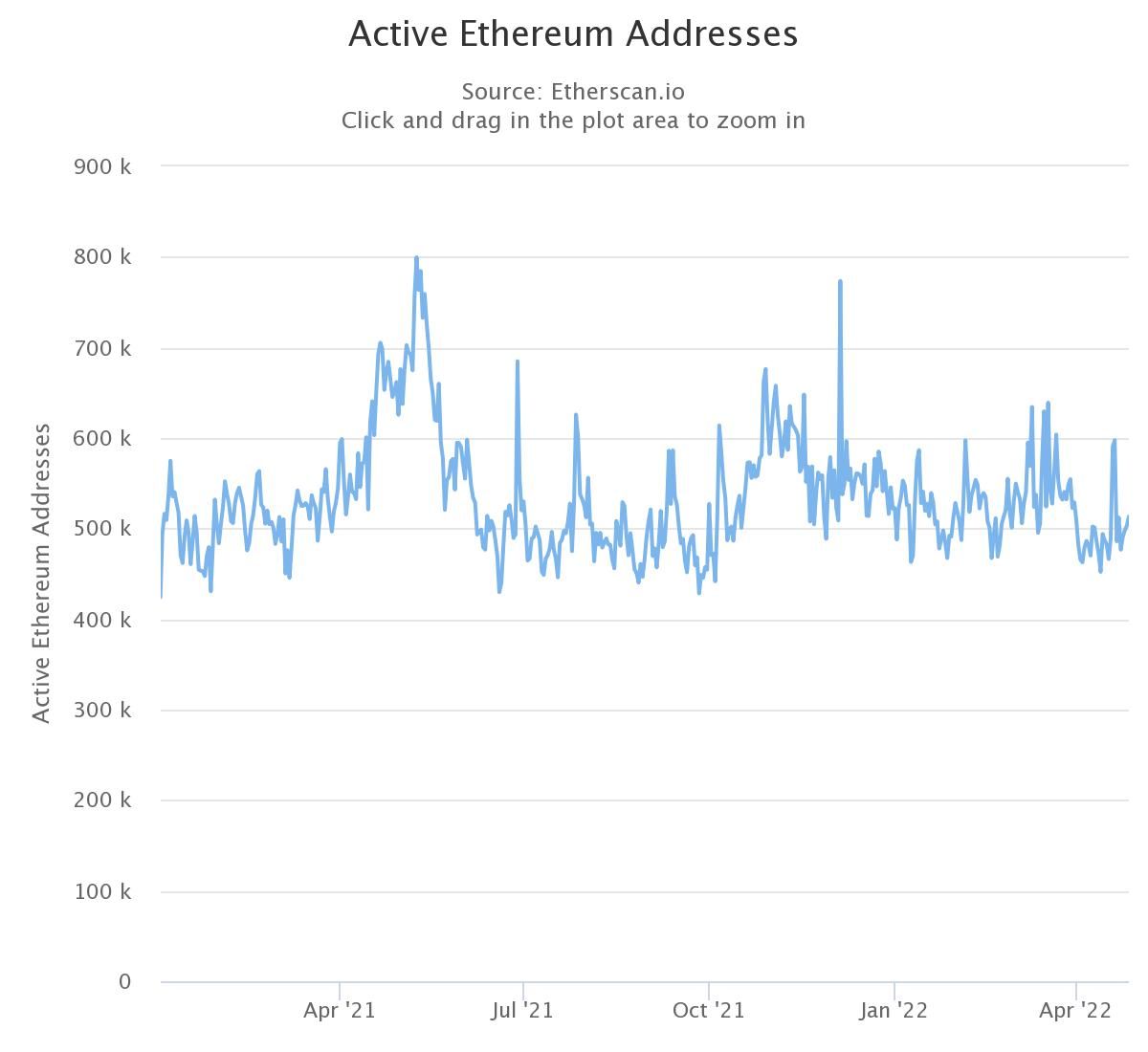

- The Average of Daily Active Addresses rose 4% from 507,662 to 529,018. This tracks the average number of addresses that interacted with the network each day over the course of the quarter.

- ETH Staked rose 111% from 5.2 million to 10.9 million. This represents the number of ETH staked on the Beacon Chain ahead of Ethereum’s transition from utilizing a Proof-Of-Work (PoW) consensus mechanism to Proof-Of-Stake (PoS). Approximately 9.2% of the total ETH supply is staked in anticipation of “The Merge.”

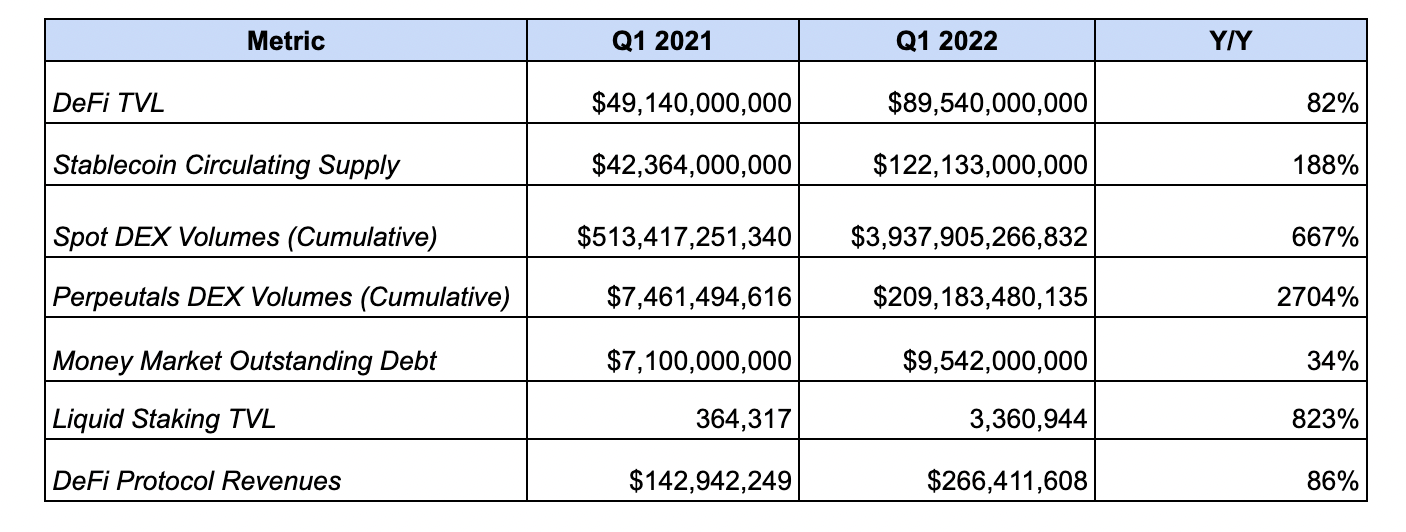

DeFi Ecosystem

- DeFi TVL increased 82% from $49.1 billion to $89.5 billion. This measures the value of the assets deposited into Ethereum-based DeFi protocols, such as decentralized exchanges, money markets, and options vaults.

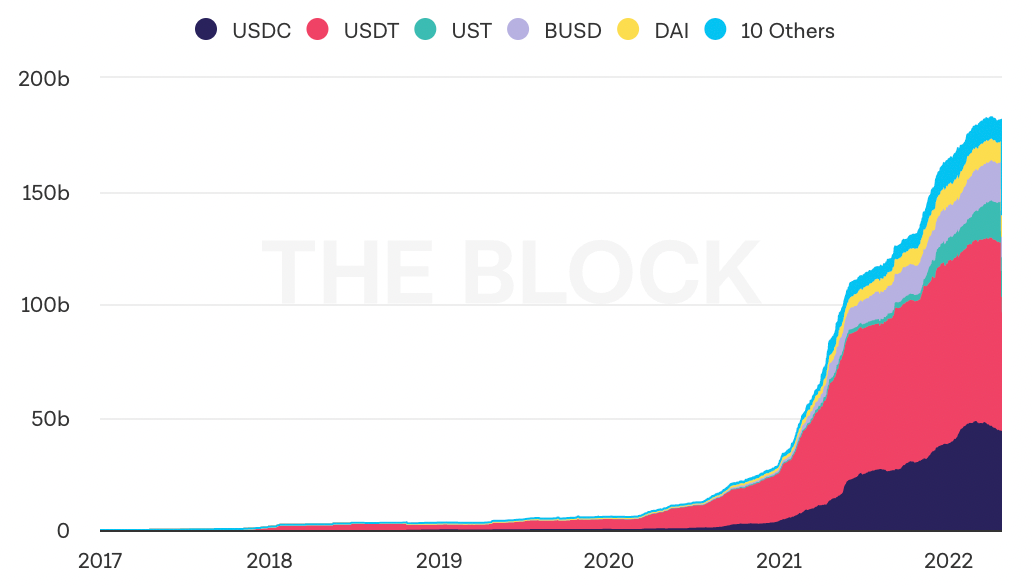

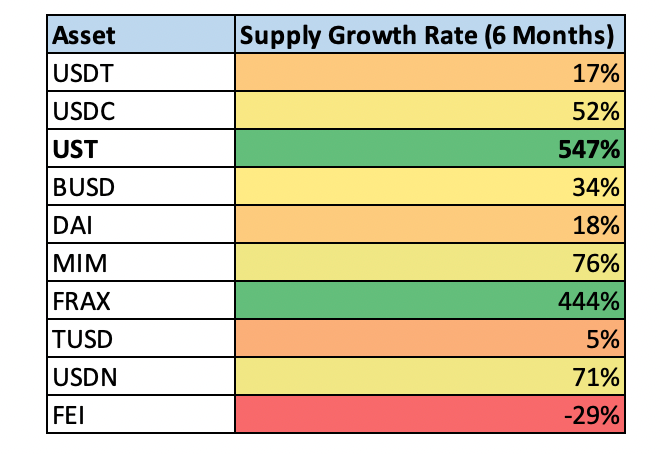

- Stablecoin Circulating Supply rose 188% from $42.3 billion to $122.1 billion. This measures the value of both centralized and decentralized stablecoins that are either natively issued or bridged onto Ethereum. The stablecoins included in the calculation are USDC, USDT, DAI, FEI, FRAX, MIM, UST, LUSD, HUSD, PAX, TUSD, sUSD, and BUSD.

Note: This above chart includes stablecoins on all chains, not just Ethereum, as the data for this metric had to be pulled from numerous sources. However, it is still largely representative of the sector's growth.)

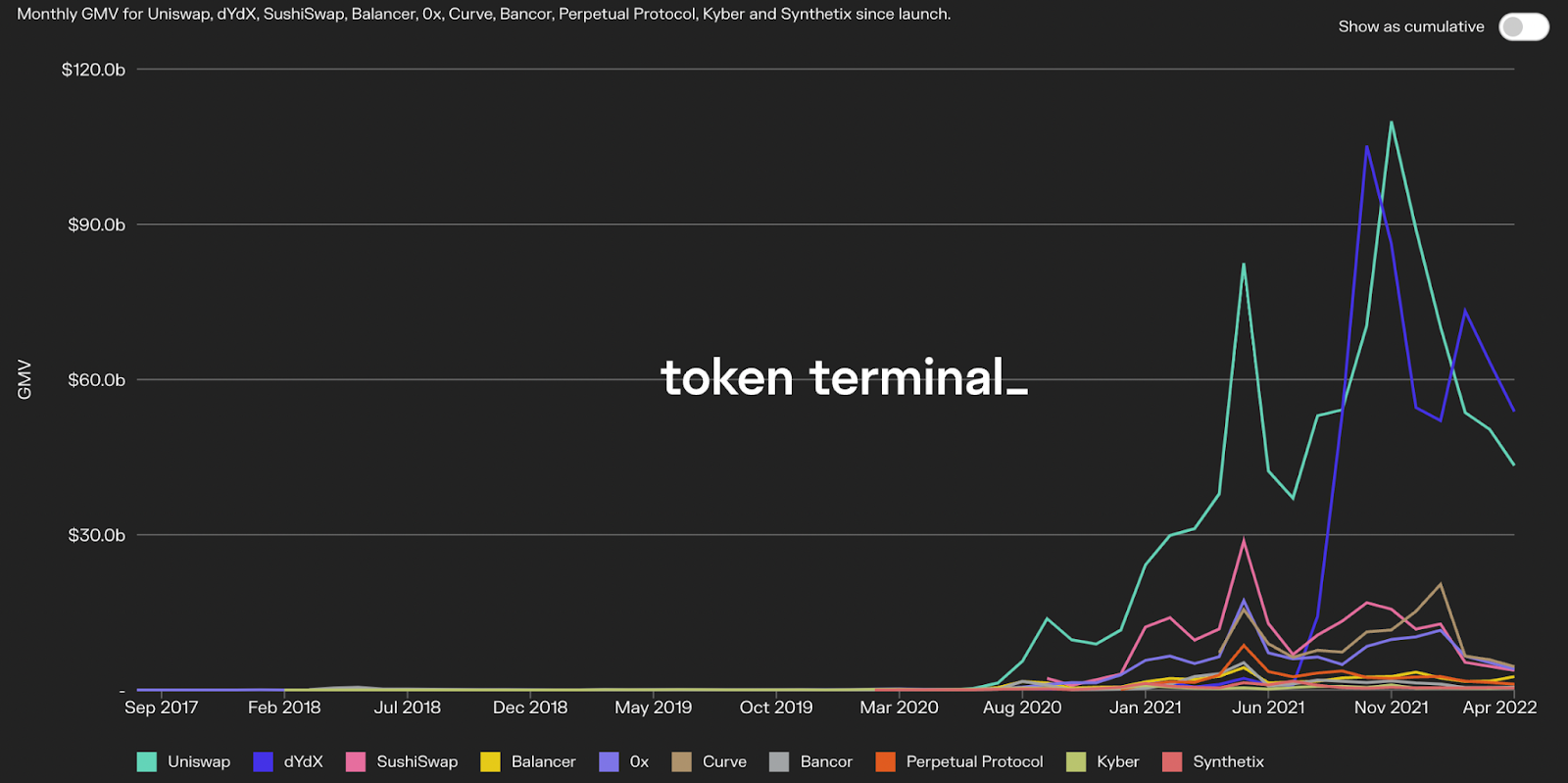

- Spot DEX volumes grew 667% from $513.4 billion to $3.9 trillion and Perpetuals DEX volumes exploded 2704% from $7.4 billion to $209.1 billion. These track the trading volumes on decentralized spot exchanges that live on Ethereum mainnet, and perpetual futures exchanges that are live on Ethereum Layer-2s, respectively.

Note: The above chart does not include GMX, which was included in the Perpetuals DEX Volume calculation. The data for that can be found here.

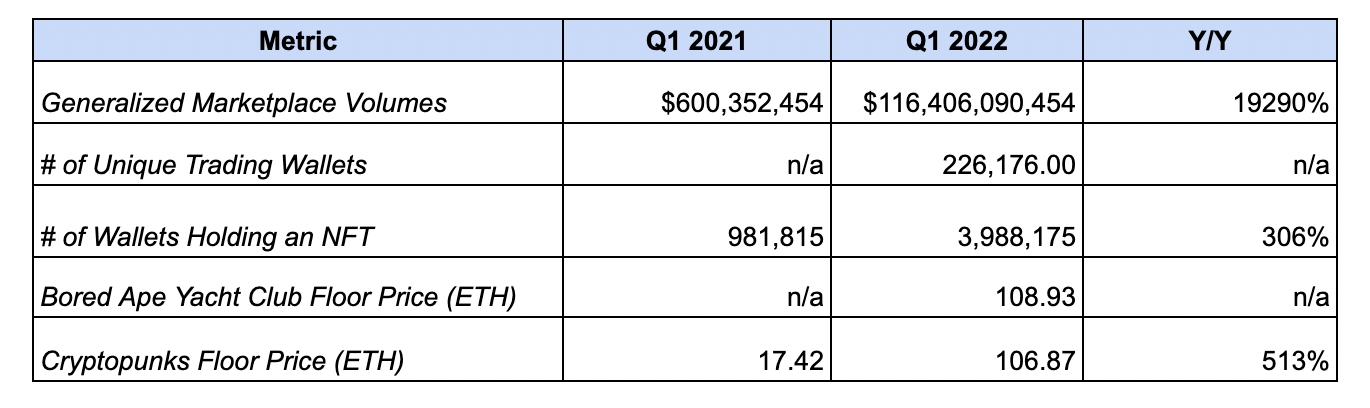

NFT Ecosystem

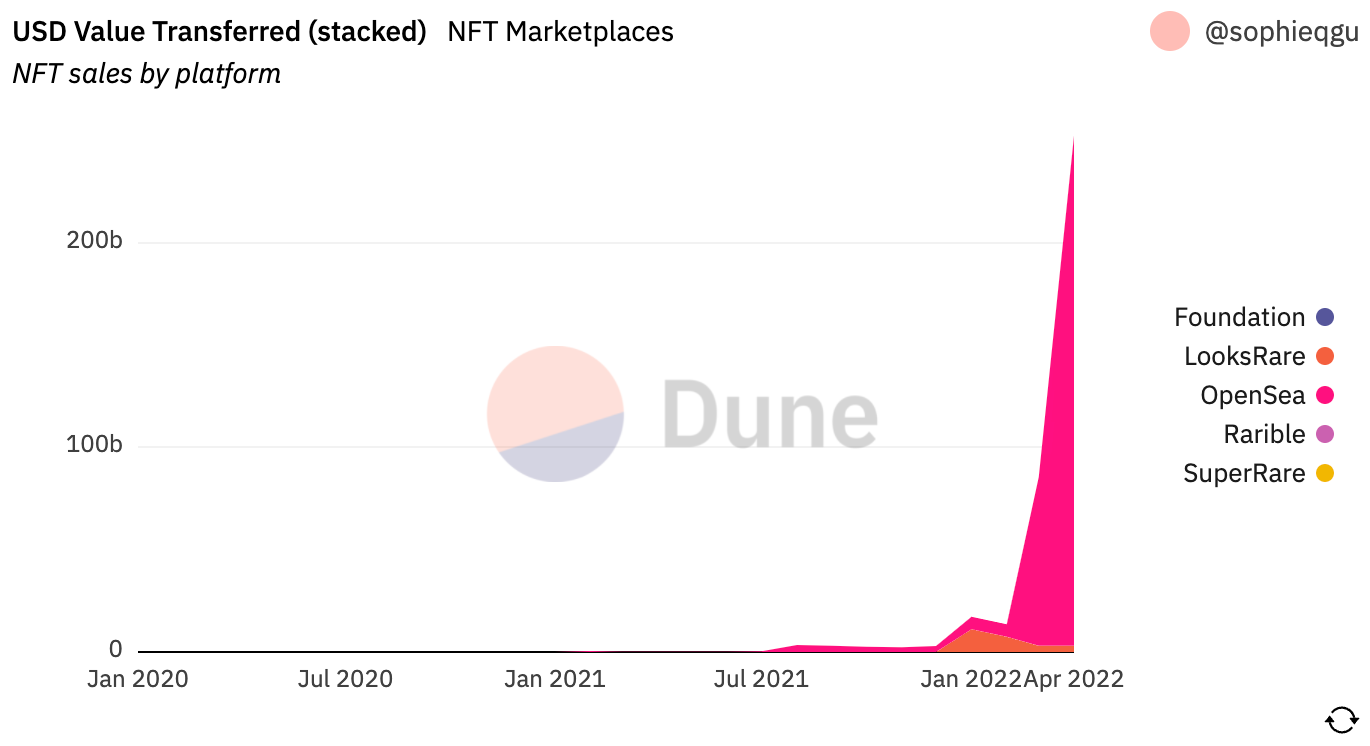

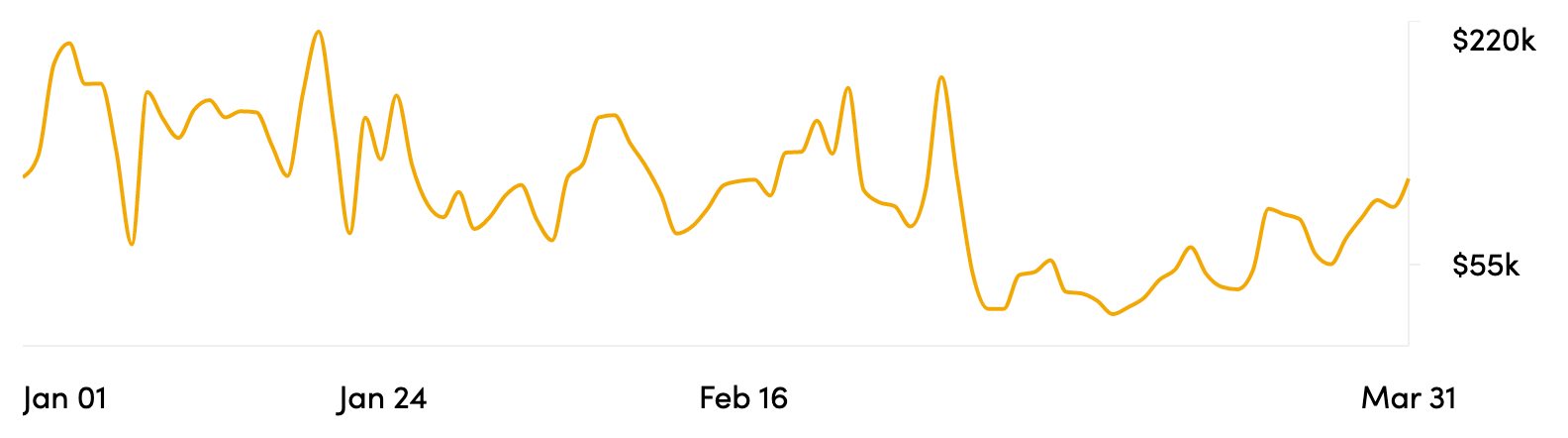

- Marketplace Volumes erupted 19,290% from $606.3 million to $116.4 billion. This tracks the trading volume on the two largest generalized NFT marketplaces, OpenSea and LooksRare. There were 226,176 unique wallets to either buy or sell an NFT during the quarter.

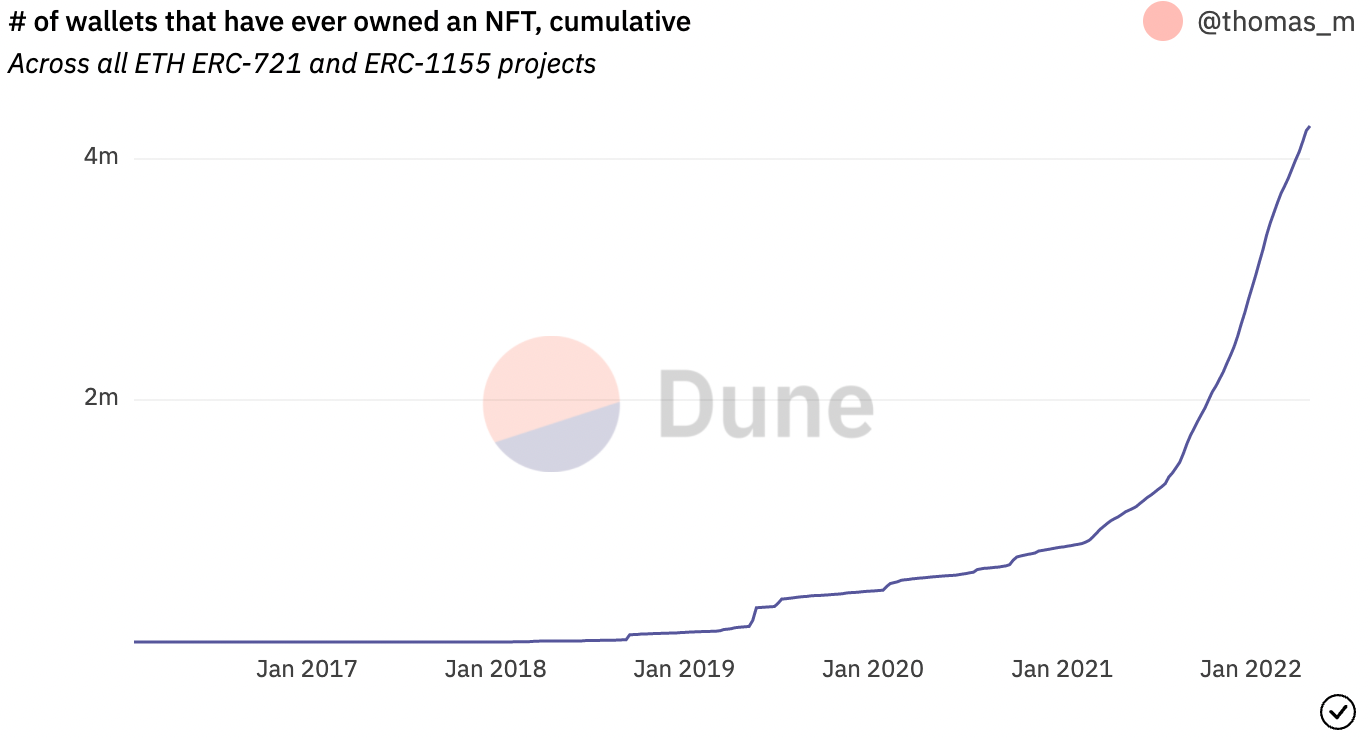

- The Number Of Unique Wallets Holding an NFT rose 306% from 981,315 to 3.98 million. This measures the number of wallet addresses which have at one point in time held an ERC-721 token, the token standard used to issue NFTs.

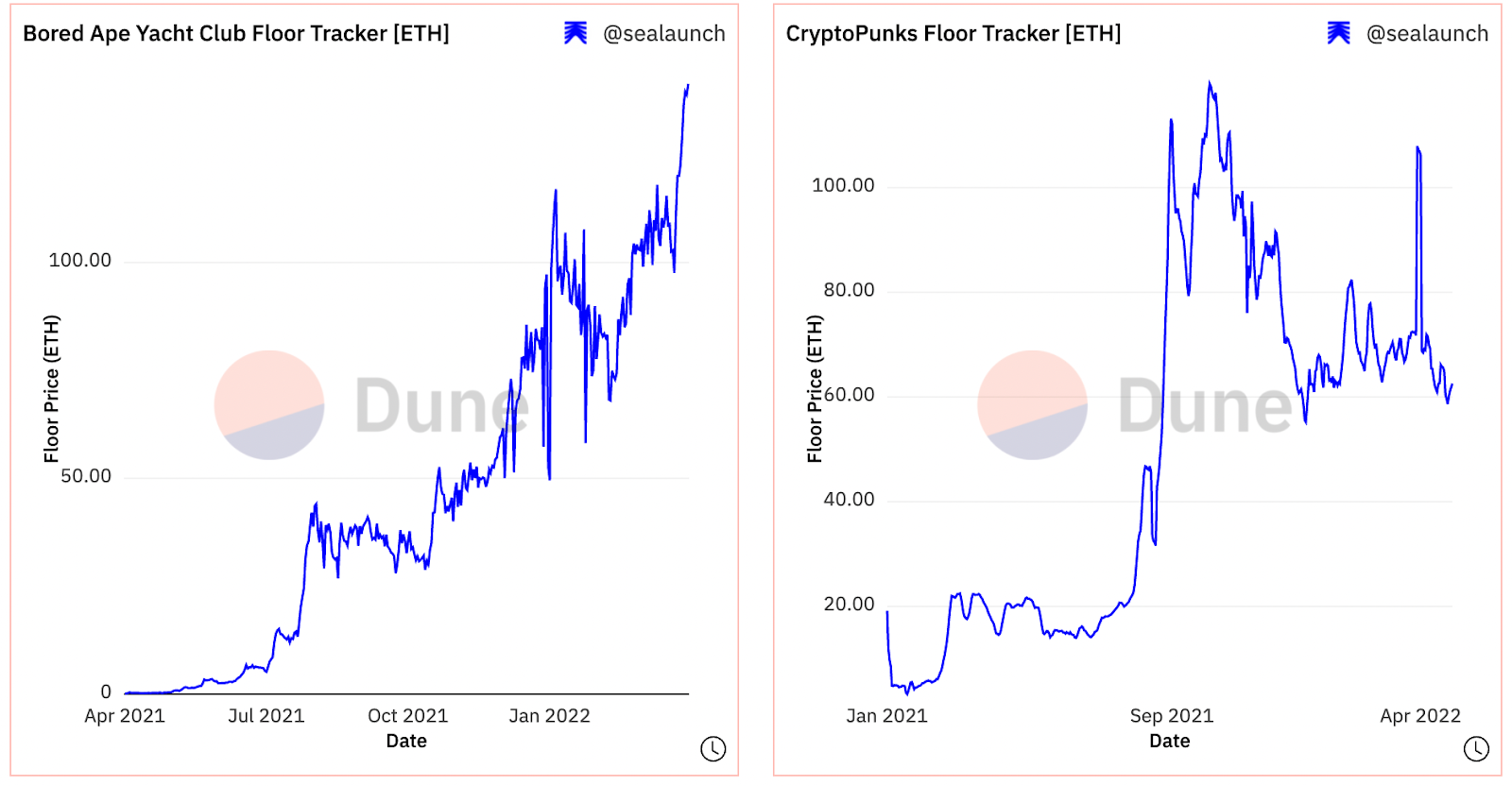

- The Floor Price of CryptoPunks rose 513% from 17.42 ETH to 106.87 ETH. This tracks the lowest price at which a CryptoPunk was most recently sold. While it launched in Q2 2021, the floor price of Bored Ape Yacht Club (BAYC), the most expensive profile-picture NFT collection by this metric, ended the quarter at 108.93 ETH which was worth ~$351,000 based on prices at the time.

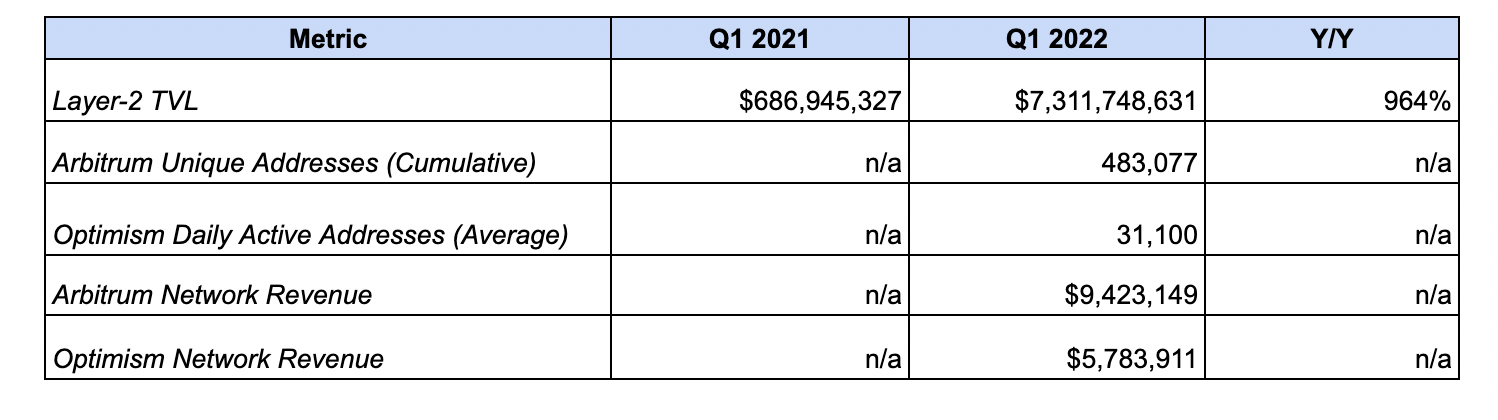

Layer 2 Ecosystem

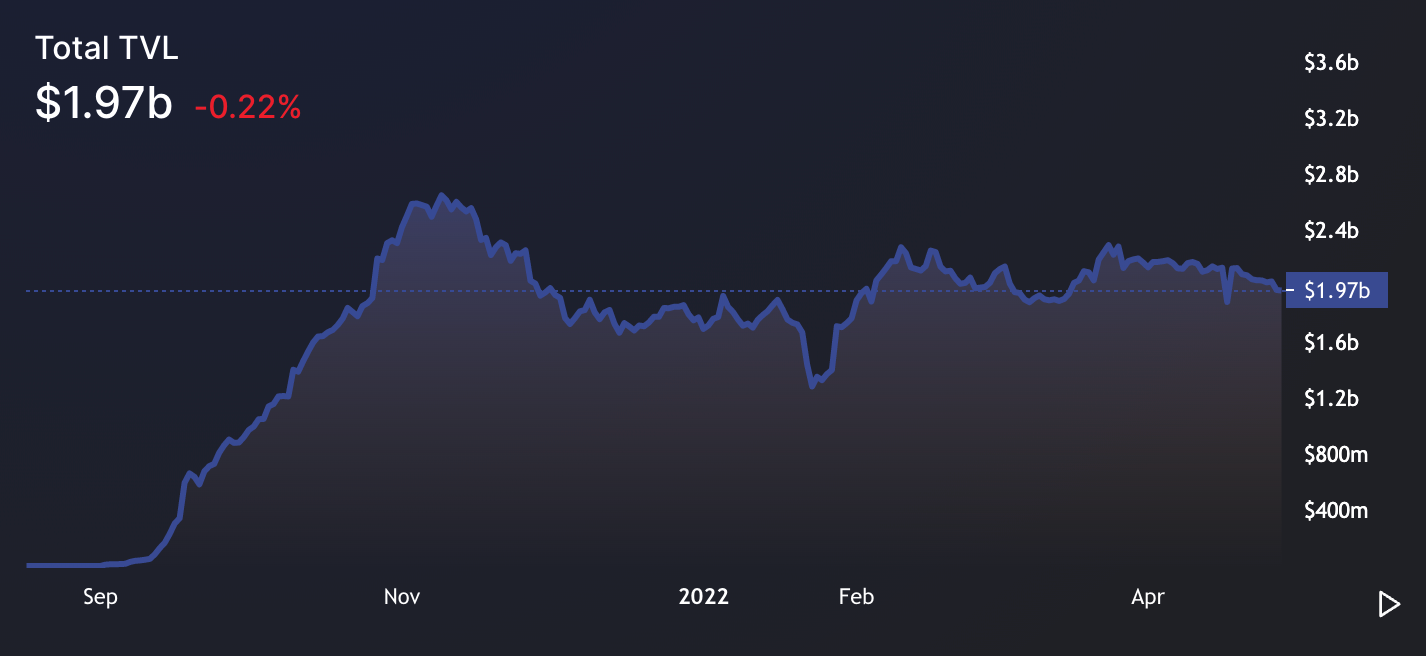

- The Layer-2 TVL increased 964% from $686.9 million to $7.3 billion. This measures the total value locked in Ethereum L2 scaling solutions, such as optimistic rollups, zero-knowledge rollups, and validiums. As of writing, more than $23 billion in assets, including $4.2 billion of ETH, has been bridged from Ethereum to these L2s and other L1 blockchains.

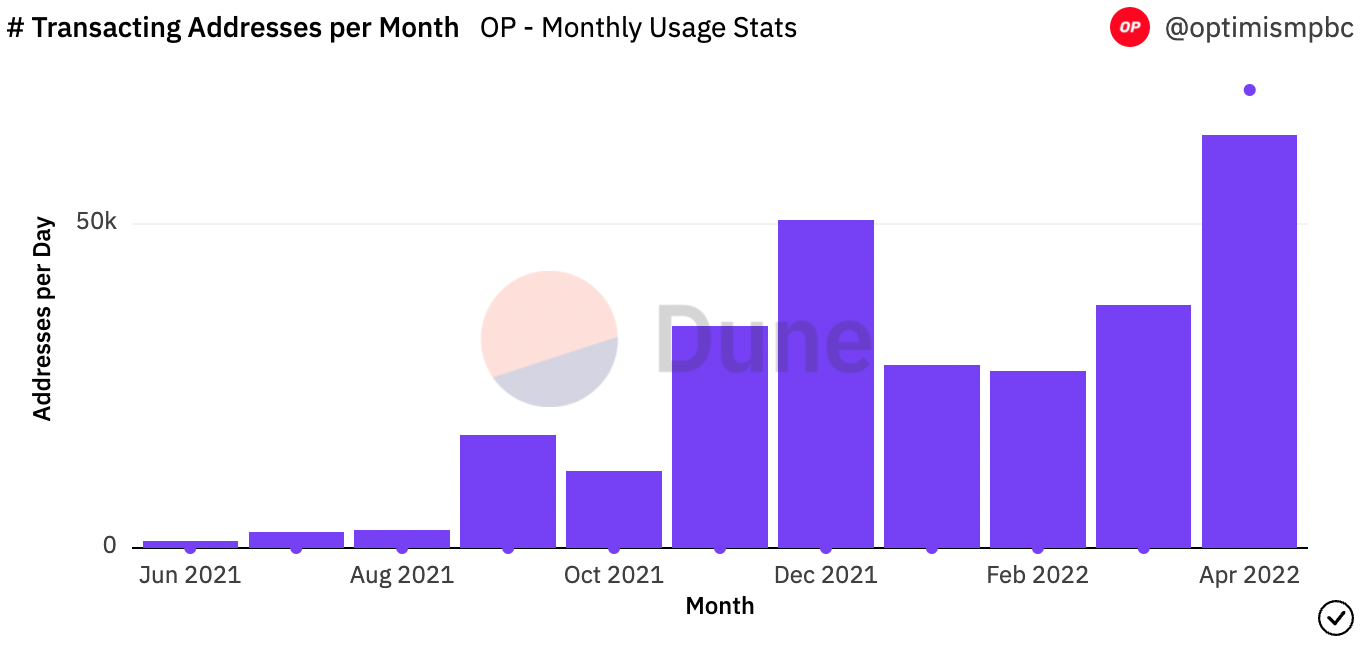

- The Average Monthly Active Addresses on Optimism was 31,100, while the Cumulative Unique Address Count for Arbitrum clocked in at 483,077. This measures the average number of addresses to have transacted on Optimism, an optimistic rollup, each month during the quarter as well as the total number of unique addresses on Arbitrum, another optimistic rollup. Given that both networks launched in Q3 2021, and that both networks have limited available data, we are not able to make year over year comparisons.

- Arbitrum Network Revenue was $9.4 million, while Optimism generated $5.7 million in Network Revenue. This measures the fees paid in ETH by users to transact on the optimistic rollups Arbitrum and Optimism respectively.

Ecosystem Highlights

Stablecoins, Curve Wars, and Bribes Oh My

There were numerous exciting developments in Ethereum over the course of Q1, with none perhaps more significant than the continued rise of stablecoins. As mentioned above, stablecoins saw their circulating supply on Ethereum increase more than 188% Y/Y to $122 billion+. In particular, algorithmic stablecoins such as FRAX and UST saw outsized growth relative to their competitors. This growth indicates that despite weakness in the markets, capital may not have fled the Ethereum economy en-masse.

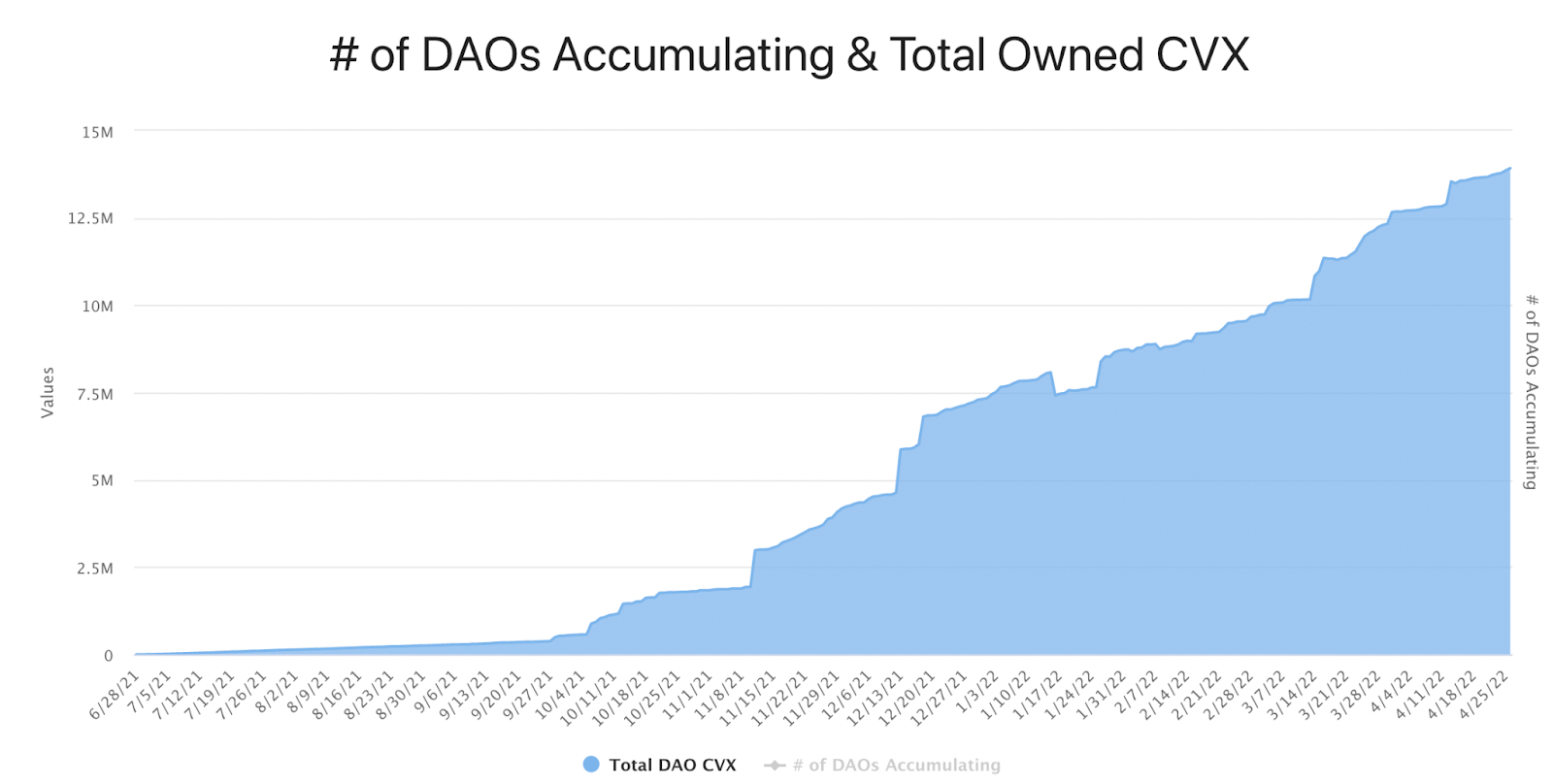

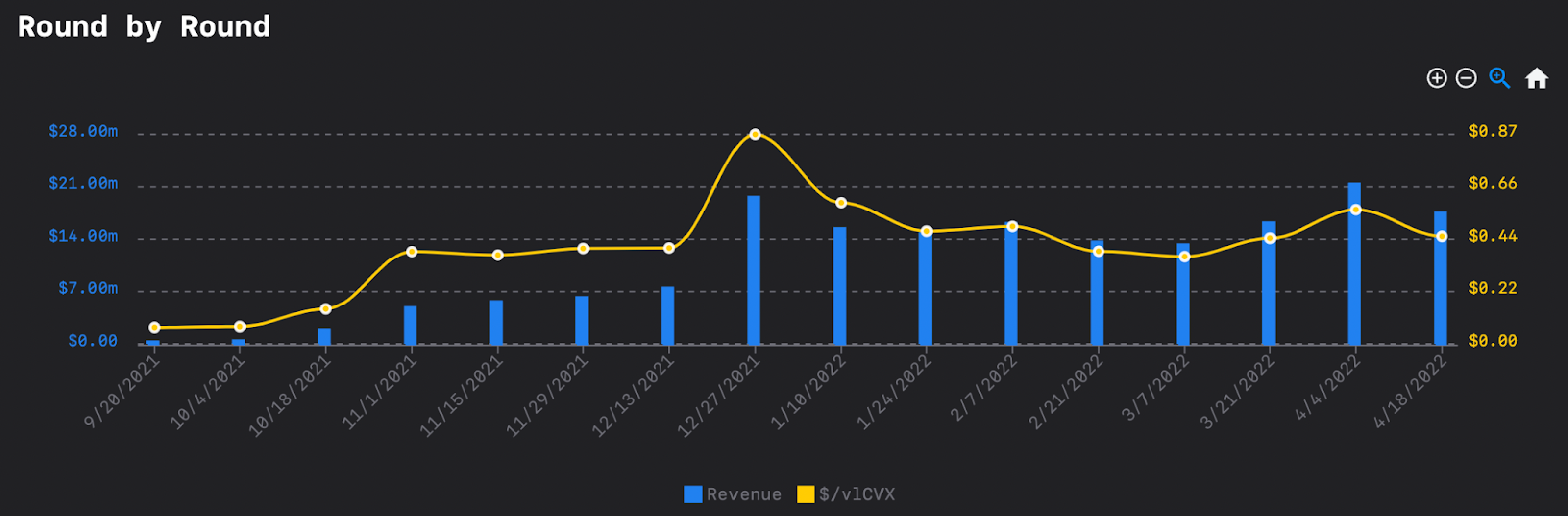

One of the more noteworthy second-order effects from the boom in the stablecoin sector was the continued progression of “The Curve Wars”. This was a battle among primarily stablecoin DAOs to build up liquidity on Curve, DeFi’s largest decentralized exchange by TVL. Q1 saw this “conflict” take center stage with DAOs increasing their holdings of CVX, the native token of Convex Finance, the protocol that controls a plurality of the supply of CRV, Curve’s governance token, by more than 73%.

To go along with their purchases, DAOs paid out more than $89.2 million in bribes to CVX holders who locked their tokens in order to secure their votes in directing emissions of CRV to different pools on the exchange. With the annualized yield from these CVX bribes north of 40%, Q1 cemented the notion that these payouts can be a significant source of cash flow for holders of strategically important governance tokens. Furthermore, Q1 saw many protocols, such as Ribbon Finance, Balancer, Yearn and more, propose or implement a switch to a vote-escrowed token model in the hopes of replicating Curve’s success.

There were also several exciting protocol releases over the course of the quarter:

- Alchemix V2, which is the second iteration of the self-replaying loan protocol that includes support for a plethora of new collateral assets and yield generation strategies

- Aave V3, the third version of the multi-chain money market that comes with new isolated lending features

- Syndicate Protocol, which allows for the creation of on-chain investment clubs

NFTs LOOKS to be Heating Up

Riding the momentum of its explosive growth over the previous two quarters, there were several significant shake-ups within Ethereum’s NFT ecosystem over Q1.

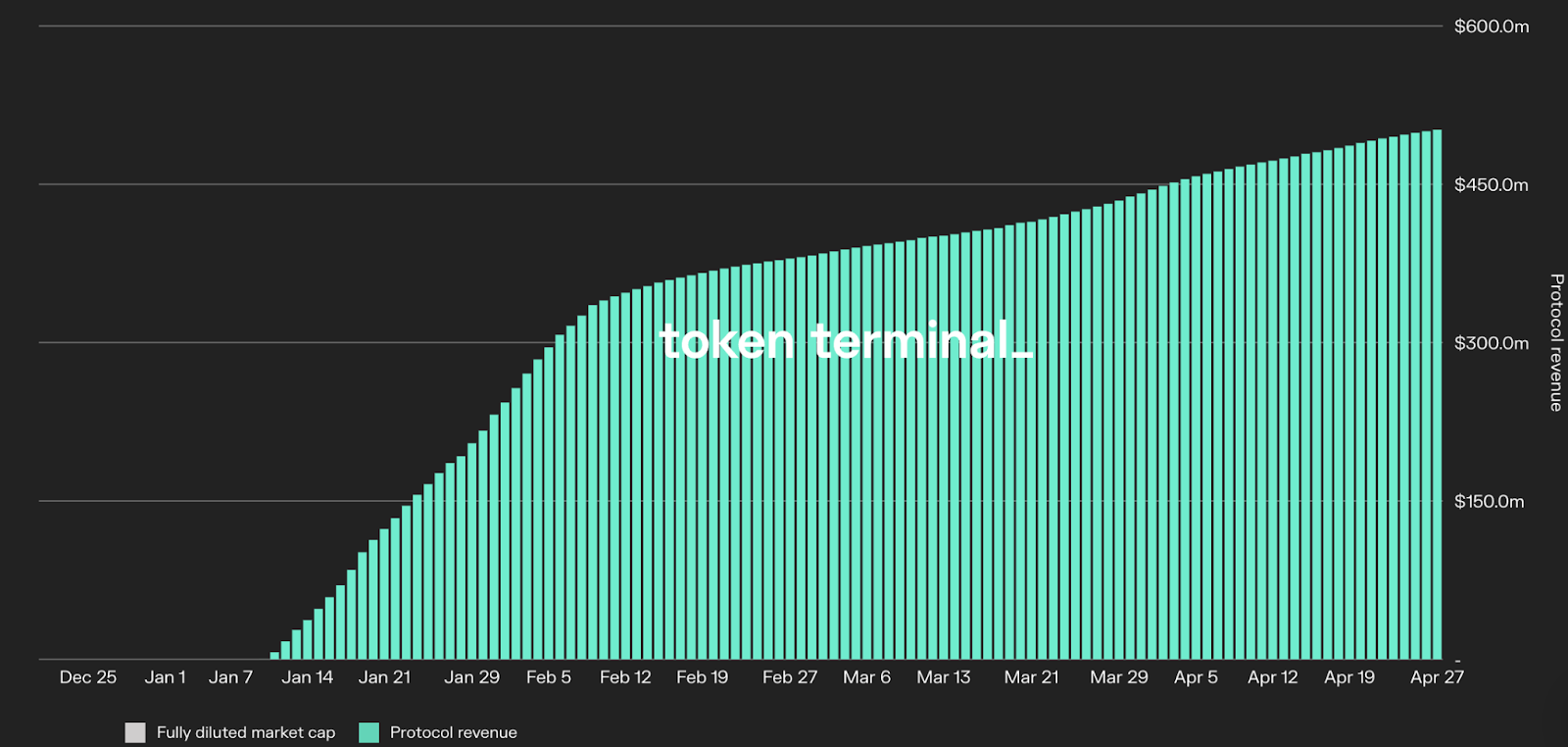

One was the January launch of LooksRare, a new generalized NFT marketplace and competitor to OpenSea, which previously had near-complete dominance over the sector. LooksRare, which was built in stealth, conducted a quasi-vampire attack on their rival by airdropping their native governance token, LOOKS, to OpenSea’s users. The marketplace also enables LOOKS holders to stake their tokens to receive emissions and ETH-based fee revenue generated by the platform. While this has led to allegations of wash trading in order to farm these rewards, LooksRare facilitated more than $22.1 billion in volume during the quarter, generating more than $444 million in revenue for stakers. Although the LOOKS valuation currently sits ~79% below its all-time high, LooksRare seems to have turned its sector from a monopoly into a duopoly.

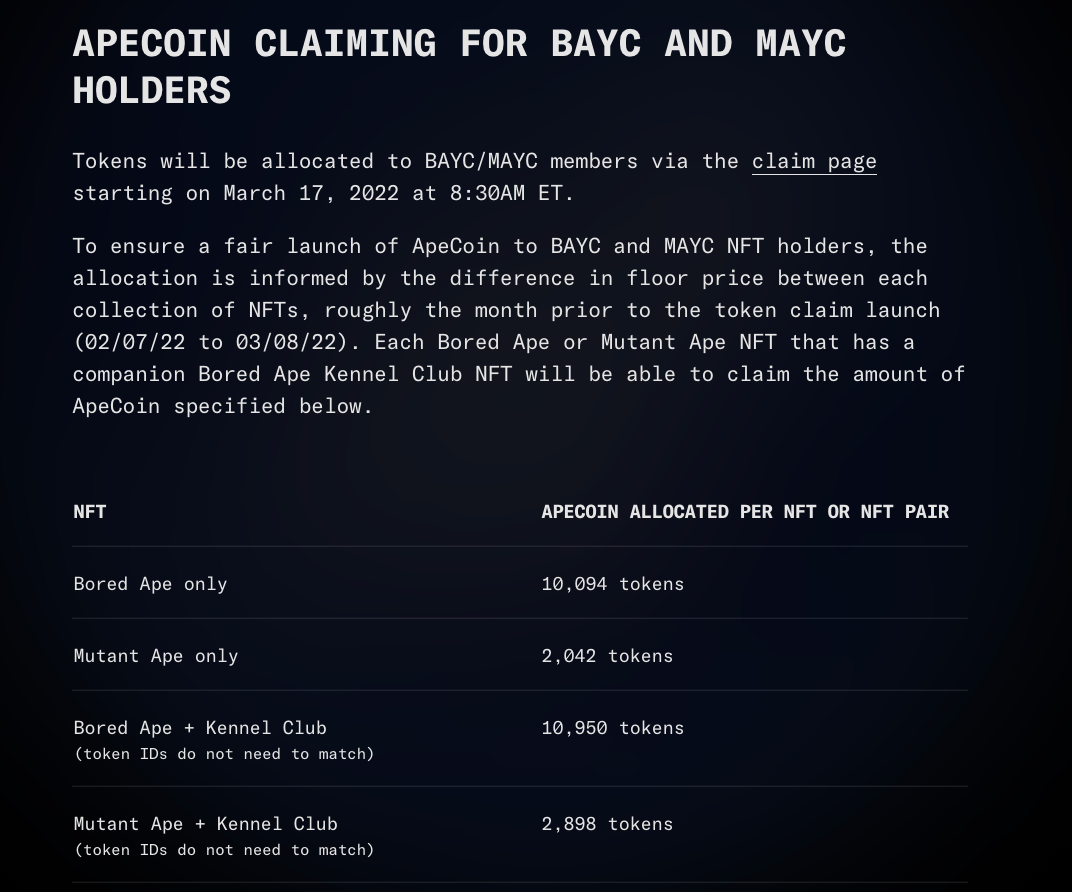

Another major development in Q1 was the establishment of Yuga Labs as an ecosystem powerhouse. Fueled by a rise in the value of Bored Ape Yacht Club (BAYC), which has become a favorite among celebrities and is now the most valuable NFT profile-picture (PFP) collection by floor price, Yuga made several significant moves to bolster its standing within this burgeoning sector of Ethereum’s economy.

First, the company acquired the intellectual property for Larva Labs NFT collections, including Cryptopunks and Meebits. Shortly after, Yuga announced the release of Apecoin (APE) in which a portion of the token’s supply was allocated to BAYC holders, with some airdrops being more than six-figures.

APE, whose price is currently at an all-time high with a fully-diluted valuation of more than $20 billion, will serve as a governance and utility token within the company’s ecosystem of various metaverse projects such as the Otherside, a recently teased game. These developments have entrenched Yuga as a blue-chip brand and metaverse media powerhouse within the broader NFT ecosystem.

L2s are 2 Hot 2 Handle

Ethereum’s burgeoning Layer-2 ecosystem continued to grow in Q1.

As previously mentioned, the TVL locked into Ethereum L2s increased 964% Y/Y to more than $7.3 billion by the end of Q1. Combined, this cohort of L2s account for the fifth largest TVL when ranked among other L1 networks. Arbitrum stands out as the leader in value locked among L2s, with a TVL of more than $2.1 billion.

Many of the L2 native applications that have seen most traction come from the derivatives sector. Taking advantage of the increased scalability that L2s provide, applications like dYdX, Perpetual Protocol, and GMX have established themselves as three of the five largest decentralized perpetuals exchanges by volume, and are live on StarkEx, Optimism and Arbitrum respectively.

Along with perpetuals, another class of derivatives, options, have begun to see meaningful traction on L2s, with Dopex, and Lyra, two decentralized options exchanges, live on Optimism and Arbitrum respectively. The two applications have combined to hold more than $119 million in deposits, with each placing among the top-five most used applications on each of their networks.

These derivatives protocols, along with other L2 native projects such as Tracer DAO, Jones DAO, and Vesta Finance, seem poised to see further growth through riding several tailwinds such as the increased desire among DeFi natives to hedge and seek alternative sources of yield amidst treacherous market conditions, as well as the impending launch of tokens for their respective rollups (more on that below).

Forward Outlook

While markets face a maelstrom of macro headwinds, there are several catalysts on Ethereum’s horizon that seem posed to strengthen its fundamentals, competitive positioning, and token economics.

Merge, Merge, Merge

The most significant is the upcoming PoW to PoS merge, a switch that brings with it numerous significant changes Ethereum the network and ETH the asset. For the former, the merge is poised to result in an order of magnitude reduction in the blockchain’s energy consumption, as PoS is far less energy intensive than PoW. This helps to reduce Ethereum’s environmental impact, and increase its attractiveness among traditional institutional investors who are conscious of ESG (Environmental, Social, and Governance) mandating when making allocation decisions.

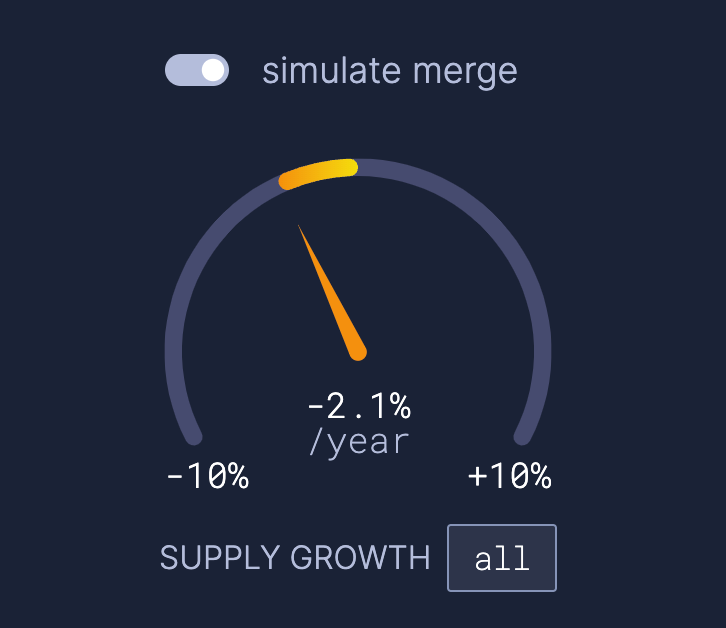

The merge will also have major ramifications on the supply schedule and value proposition of ETH. While EIP-1559 has led to a substantial decrease in its inflation rate, the transition to PoS seems likely to bring with it a deflationary Ether. Based on the current amount of ETH staked, and the gas consumption since the activation of EIP-1559, ETH is projected to be deflationary, with a projected issuance of -2.1%.

Although the current staked supply, which is non-transferrable, will progressively unlock and become liquid post-merge, this massive supply shock may create a long-term Bitcoin-halving type impact in that it drastically reduces the sell-pressure on ETH. The merge also seems likely to establish the ETH staking rate, projected to reach as high as 10%+ post-merge, as the risk-free-rate of Web3, further increasing the attractiveness of Ether as a cash-flow productive asset and internet native bond.

Beyond changes to Ethereum’s ESG profile and ETH the asset, the merge will help to pave the road for future scalability upgrades such as sharding and danksharding. This better positions Ethereum to meet the insatiable demand to transact within its economy.

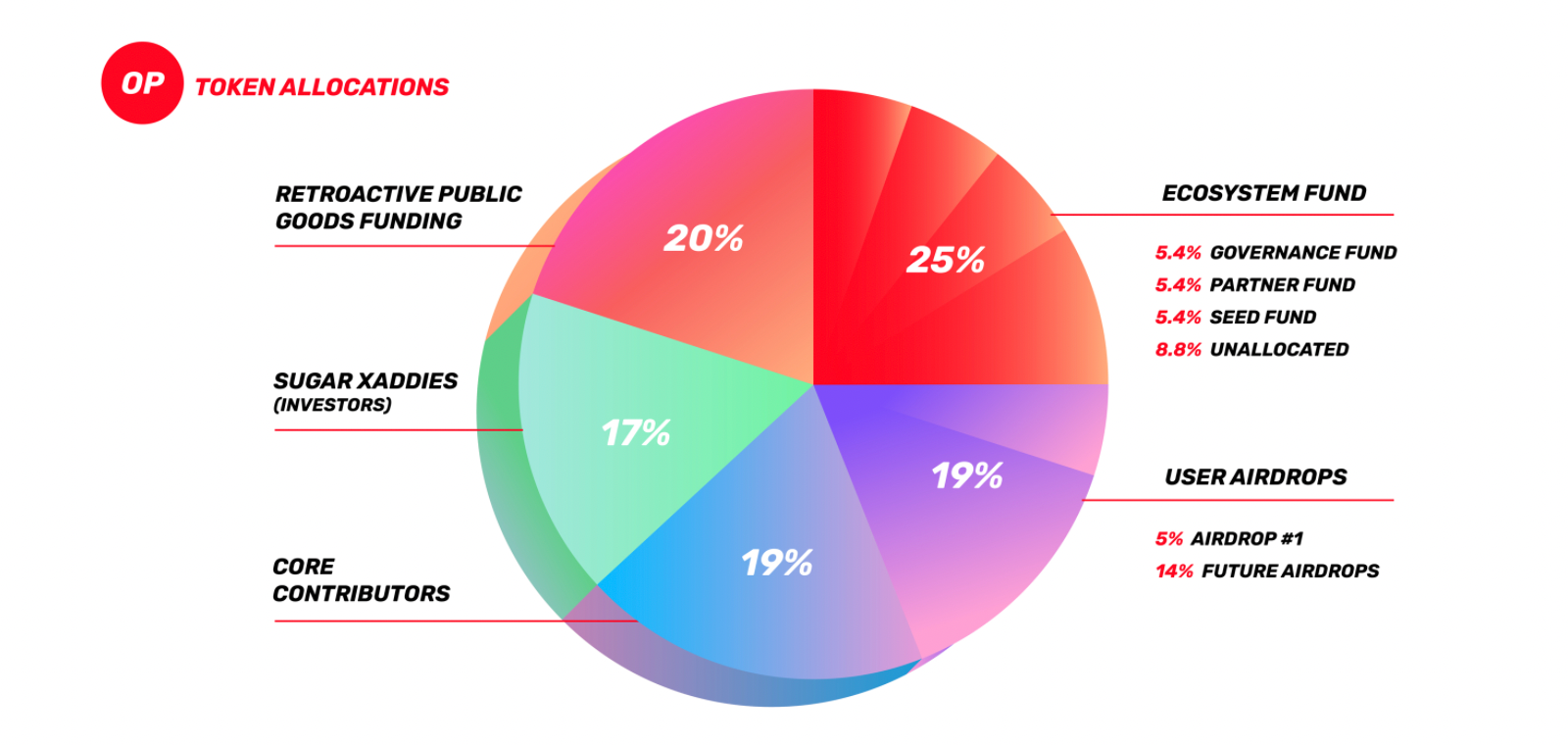

Rollout The Rollup Tokens

Another major catalyst for Ethereum’s growth is the launch of L2 tokens. While L2s have managed to garner meaningful traction without a native token or network-wide incentive program, the launch of governance tokens for these networks seems poised to catalyze their growth and bring about the long awaited “L2 summer.”

The first domino on this front fell this week, on April 26th, when Optimism announced $OP, which will be utilized within the networks governance system and, most likely, to incentivize activity within its nascent but burgeoning DeFi ecosystem.

As seen with the explosive growth of ecosystems that utilized chain-wide incentive programs, such as Avalanche, Polygon, and Fantom, this tactic is highly effective at bootstrapping usage, liquidity, and developer activity. Should this be implemented, it stands to reason that Optimism would experience a similar level of growth.

Along with Optimism, the two other generalized rollups, Arbitrum and ZK Sync, which are optimistic and zero-knowledge rollups respectively, are prime candidates to see similar boosts in usage from the rollout of their tokens. While Arbitrum has yet to confirm it will be launching one, ZK Sync has already revealed that they will have a token that will be used to decentralize their rollups sequencer, the entity that batches transactions to be posted to the L1.

The rollout of these rollups’ tokens and incentive programs should serve as a significant catalyst to help Ethereum retake market share, which as a percentage of total DeFi TVL has fallen from 80% to 51% Y/Y, from other Layer-1 networks and increase the accessibility among everyday users of participating in the decentralized economy.

Results Tables

Protocol Results

DeFi Ecosystem Results

NFT Ecosystem Results

L2 Ecosystem Results

About Ethereum

Ethereum is an open-source, decentralized blockchain network. Ethereum is a technology that's home to digital money, global payments, and applications. The community has built a booming digital economy, bold new ways for creators to earn online, and so much more. It's open to everyone, wherever you are in the world – all you need is the internet (Taken from the Ethereum.org website.)

About This Release

This release is not a release by Ethereum or the Ethereum foundation.

Note: This post previously contained a metric, “Average Transaction Fee” which was calculated inaccurately. It has since been removed.