Dear Crypto Natives,

Let’s talk two stablecoin flippenings.

Flippening 1

There was something different in March’s crypto sell off. Yeah, people sold their crypto—but this time many didn’t fully exit crypto.

This time ETH and BTC weren’t just exchanged for plain old dollars they were also exchanged for Coinbase stablecoins:

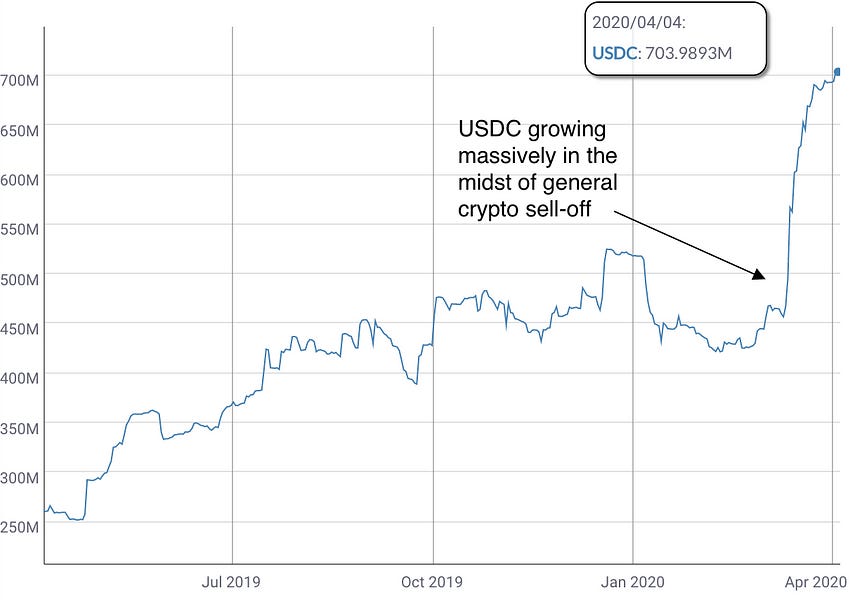

- USDC grew 50% in the last 30 days—from $500m to $700m

- USDC and USDT waiting on exchanges doubled over the last 30 days

- Stablecoins are closing in on $9b in value—up by almost $3b this year

This is USDC growth over the last year:

Seems many people positioned themselves for Covid by de-risking out of crypto and into dollars but they kept those dollars on crypto rails as stablecoins.

Why? Their dollars were more useful in crypto bank accounts and Ethereum addresses than inside legacy banks accounts.

Crypto rails gives them:

- Higher interest rates. Coinbase 1.25% on USDC vs. 0.01% in WellsFargo

- Different lending options. BlockFi 8.6% on USDC vs. (nothing comparable)

- Native to crypto. Pay, lend, borrow, trade—w/o a bank in the crypto system

- Quickly convert. Can hold USDC on sidelines & convert back to crypto money

In contrast holding dollars in a WellsFargo bank account feels…limiting.

Coinbase dollars becoming more useful than WellsFargo dollars?

Crypto bank accounts flippen traditional bank accounts—that’s the first stablecoin flippening. Coinbase building on money protocols gives Coinbase capabilities WellsFargo can’t replicate in the legacy financial network.

This flippening is happening in small ways now. It’ll happen in big ways soon. My only question—will big banking or big tech wake up to this first and do something?

And make no mistake—they will wake up.

Flippening 2

Last year Bitcoin was the largest stablecoin settlement network. While Ethereum had an assortment of newer bank stablecoins like USDC and PAX, Bitcoin was home to the reigning king of stablecoins—a $3b stablecoin called Tether (USDT) which settled exclusively on Omni a Bitcoin-specific asset platform.

But that was last year. And things changed fast.

This is stablecoin growth on Ethereum over the 12 months (up $5b in the last yr):

This is USDT growth on Bitcoin vs. Ethereum (lots of USDT converted to Ethereum):

Not only have the other Ethereum stablecoins grown, but USDT itself has also converted the bulk of its stablecoins to the Ethereum network. Today Ethereum settles over 75% of the entire crypto stablecoin market.

Why are banks issuing their stablecoins on Ethereum instead of Bitcoin? Because stablecoins are more useful on the Ethereum network than the Bitcoin network.

Ethereum gives stablecoin issuers:

- Programmability. Ability to whitelist/blacklist & add logic to stablecoins

- Access to DeFi. Access to DeFi protocols (e.g. Coinbase adding $1.1m last wk)

- Improvements. Access to scalability & UX network improvements

- Ecosystem. Access to Ethereum wallet, developer, & exchange ecosystem

The last three of these have network effects. They’re Ethereum moats.

While it’s possible another network could surpass Ethereum on stablecoin issuance, it’s unlikely that crypto banks will issue on anything other than a credibly neutral platform—that’s why we’re unlikely to see USDC on Binance chain or Tether on a chain controlled by Coinbase. (Listen to today’s Bankless podcast for more on this)

Are there any other credible neutral settlement networks with traction?

Ethereum flippens Bitcoin as the stablecoin settlement network—that’s the second stablecoin flippening.

That leaves us with two stablecoin flippenings:

- Coinbase USD flippens WellsFargo USD in utility (happening now)

- Ethereum flippens Bitcoin as the stablecoin network (happened already)

And it leaves us with many more flippenings ahead:

At some point your crypto net worth exceeds your legacy net worth.

At some point your crypto bank becomes more useful than your traditional bank.

At some point your Ethereum address becomes more useful than your bank accounts.

We’ll get there first. Because we’re the frontier.

Then they catch up.

- RSA