Safely Unlocking the Synthetics Era

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Collateral + Oracle + Settlement

With these three components you can build any financial asset in existence.

We call them synthetics. And they play an essential role in our modern financial system.

Crypto money systems are unlocking a new era of digital synthetics on top of internet-native and permissionless settlement networks.

We now have the three components:

- Economic bandwidth—that’s the collateral.

- Ethereum—that’s the settlement network.

- Just add an oracle and BAM—we can build any financial asset in existence.

Is it that easy? Yes and no. The components we use matter. The oracles matter.

In this post Allison gives us a fundamental understanding of synthetics so we’re ready to unlock this new era.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Safely Unlocking the Synthetics Era

Guest Post: Allison Lu is the co-founder of UMA protocol

You probably use synthetic products already.

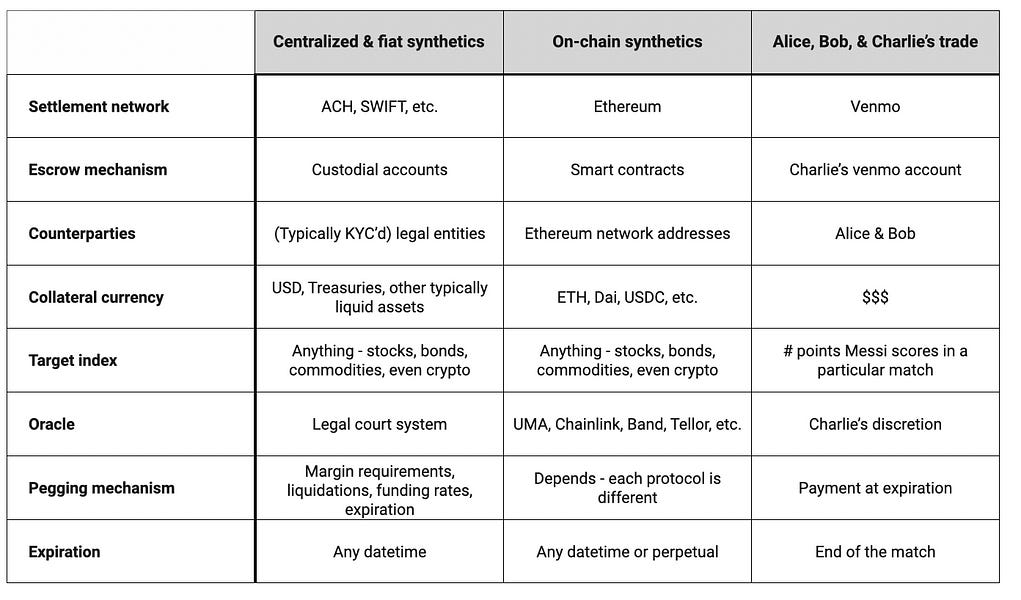

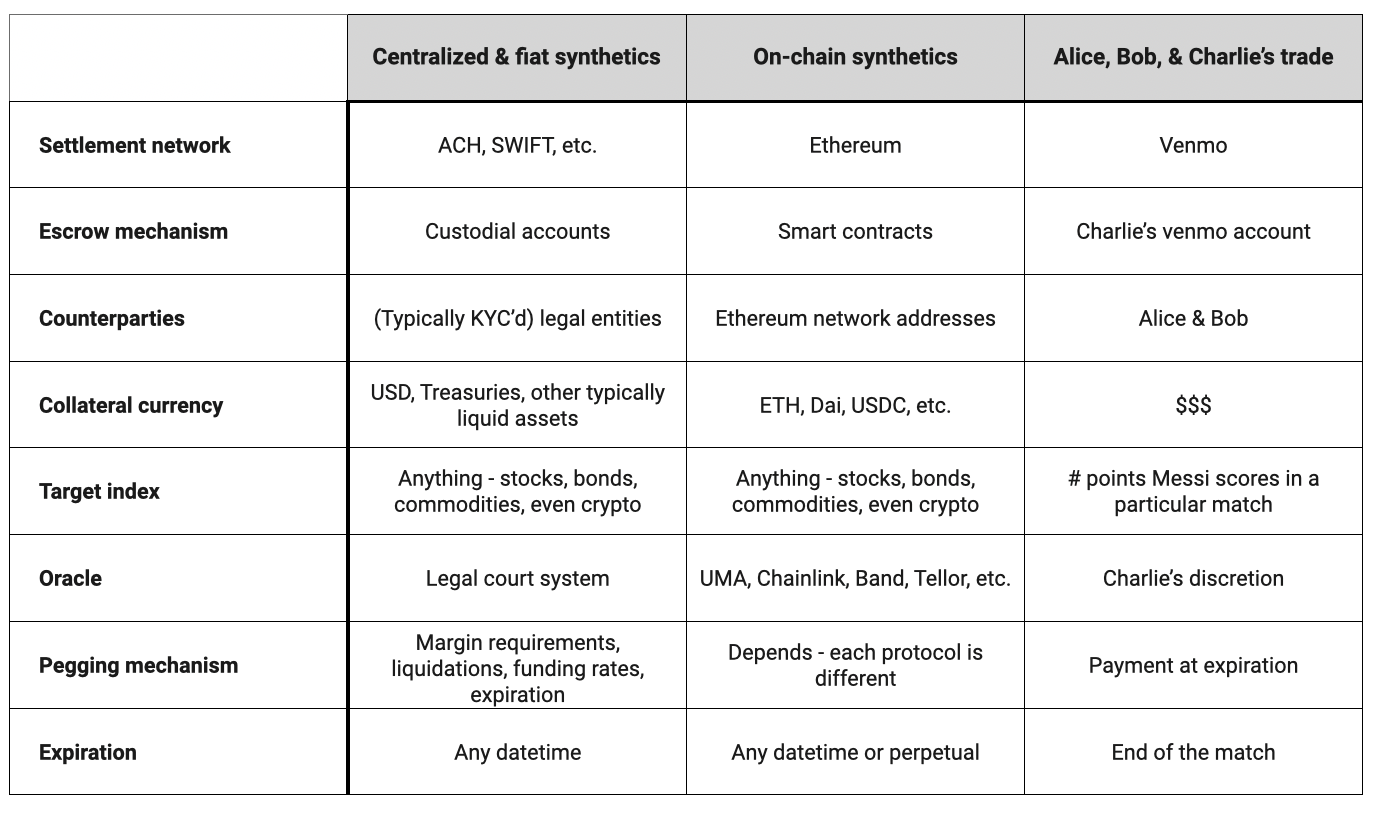

If you’ve ever made a bet, where the payout between you (“Alice”) and your friend (“Bob”) depended on the outcome of something else, like a sports game, then you’ve made a synthetic trade. And, if you’ve ever had another friend (“Charlie”) hold onto your money to ensure that payouts actually occur over Venmo at the end of the game, then you’ve used an escrow & settlement layer. If you further trusted Charlie’s discretion to arbitrate disputes, then you’ve used an oracle.

Every synthetic product has these core components:

Synthetic products are popular precisely because they are so flexible. They enable market participants to hedge risks that are otherwise impossible to buy or sell, making them one of the most useful concepts of modern finance.

Before derivatives, commodity producers could not hedge against price decreases of their future production; commodity consumers could not hedge against price increases of their future consumption. There’s also the $500T+ fiat interest rate derivatives market that allows borrowers and lenders to hedge their interest rate exposure. A liquid interest rates market enables products like the 30-year fixed rate home mortgage in the United States—otherwise, what bank wants to commit to giving out a 30-year fixed rate loan when bank obligations tend to have dynamic rates?

Why on-chain synthetics matter

Open financial markets require fair access for all market participants. Tokenizing real-world assets via centralized intermediaries allow useful products to exist on a shared settlement layer. However, they don’t remove all barriers to access because users ultimately must trust the centralized intermediary or custodian and comply with their rules. Synthetic products on blockchain promote fair and open markets by removing all barriers to access for every financial market, allowing any individual, entity or DAO to access any type of financial risk, without centralization or single points of failure.

DeFi Synthetics

Dai, a stablecoin managed by the MakerDAO system, is a synthetic asset.

Two key characteristics make it synthetic:

- Dai’s value is pegged to something (USD); and

- Dai’s value comes from the value of the collateral backing it, and is not intrinsic to the token itself.

Dai uses the price of USD/ETH, but by plugging a different target price into Maker you can create different synthetics:

- Plug in Gold/ETH—you get synthetic Gold tokens, collateralized by ETH

- Plug in EUR/ETH—you get synthetic euros, collateralized by ETH

- Plug in S&P/DAI—you get a synthetic S&P index, collateralized by Dai

Financial alchemy allows you to convert any collateral token into any synthetic token. You could even use synthetic token A as collateral for synthetic token B. There’s really no limit to the creativity of financial engineers!

(Above) Synthetic assets can be designed to enable all kinds of useful applications—both for the synthetic tokenholder, and the issuer. The illustration above barely scratches the surface.

That said, not all synthetics are created equal. Depending on your use case, you’ll want to carefully consider a synthetic’s characteristics. It’s not hard, really. Just ask:

- What is the synthetic token’s target price?

- Under what conditions can I rely on the synthetic token value being on-peg?

Evaluating DAI vs sUSD

To illustrate, this is how you might evaluate Dai vs. sUSD. Both have a target price of $1. The liquidity guarantees and mechanism for maintaining the pegs, however, are vastly different.

sUSD is better for short-term speculation. sUSD is tradeable at exactly $1…but only on synthetix.exchange. So long as their oracle price is accurate and the pool is adequately collateralized, all synthetix.exchange trades are done at fair value. This makes sUSD extraordinarily useful as a means of speculation relative to other Synthetix synths, but there are fewer direct tools for maintaining stability outside the platform.

Dai is better for longer term holding. Dai is rarely tradeable at exactly $1… but as the price of Dai fluctuates, there are a number of levers that the MakerDAO governance system can use to re-balance supply and demand. In a worst-case scenario, Global Settlement can cause all Dai to become redeemable for exactly $1 of collateral. As long as MKR-holders enact proper governance, Dai maintains its value. This makes Dai less useful as a short-term trading substitute for USD, but the guarantees as a stable store of value are stronger (if you believe in MKR and the work of the MakerDAO Foundation).

Different synthetic asset mechanisms grapple with tradeoffs like this.

As a user, ask yourself what guarantees you require, and over what time frame. Is it short-term liquidity? Long-term value? This can help you to determine which synthetic asset protocol is right for you.

The Oracle problem

Regardless of which asset protocol you use, they will all rely on Oracles in some way.

Oracles are a way to make smart contracts aware of data from the outside world. DeFi contracts use this data to determine who can claim the collateral inside of them. This means that if you control the oracle output, then you control the assets locked inside DeFi contracts.

Oracles are the single biggest problem facing DeFi today. Problems with oracles have been made clearly visible by recent events: the bZx flash loan attack, SNX oracle front running, and Maker’s Black Thursday.

Solving the oracle problem with off-chain price feeds

Most solutions to the oracle problem propose fetching data securely from trusted off-chain APIs to the blockchain as quickly and frequently as possible. Provable Things, Chainlink, and even Compound’s Open Oracle initiative are different versions of this solution. Many DeFi contracts add further safety by introducing a lag before an on-chain price can be used, or adding “circuit-breakers” (the maximum amount that a price can move over a given period of time). Tactics like this have tradeoffs, such as introducing opportunity for oracle frontrunning or greater execution uncertainty.

Solving the oracle without price feeds

Another solution is to make DeFi safer and more scalable by minimizing oracle usage in the first place. Instead of trying to solve the decentralized oracle problem head on, a more blockchain native way of writing DeFi contracts is to write them in such a way that doesn’t assume that an accurate on-chain price feed will always exist. Instead, “Priceless” contracts use oracles that can look backwards in time for a price if-and-only-if there is a dispute that’s otherwise unresolvable by contract counterparties. And, for any oracle price that does need to get pushed to the blockchain, provide an economic guarantee about that price’s accuracy.

Final Thought

Synthetics are powerful finance primitives and open finance allows users to form them in new ways. But we shouldn’t blindly use any synthetic token that comes our way just because it’s trendy and comes with a good meme. The design patterns have not been well tested yet, and each will come with a set of tradeoffs. As users, we have an amazing opportunity to participate in the experimentation happening now and contribute to establishing the standards that we value for the next generation.

Action steps

- What are the core components of a DeFi synthetic?

- Consider the DeFi synthetics you use today—what are the tradeoffs of each?

Author Blub

Allison is the co-founder of UMA: a decentralized “priceless” financial contracts platform built on Ethereum to enable Universal Market Access. Pre-crypto, she ran Credit for Tala, a Paypal-backed mobile lending platform in emerging market countries, and was also an institutional interest rates trader at Goldman Sachs.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.