Russia Invades Ukraine

Dear Bankless Nation,

“In war there are no winners, only widows.”

This week has been a harrowing one as Russia launched an invasion against Ukraine.

Lives will be lost, homes will be reduced to rubble, and millions will be displaced on the whims of a power-hungry maniac stuck in decades past.

Our heart goes out to our brothers and sisters in Ukraine. ❤️

War is the ultimate human coordination failure.

I’m no geopolitical expert. I’ll leave it to them to read between the lines around why this is happening, what the future may look like, and its implications for the world.

Bankless has a history of offering up mental models and frameworks to understand institutions and systems, so that is where I’ll focus today.

Specifically, I’ll borrow from a book I’ve been reading recently, Ray Dalio’s Principles for Dealing with the Changing World Order.

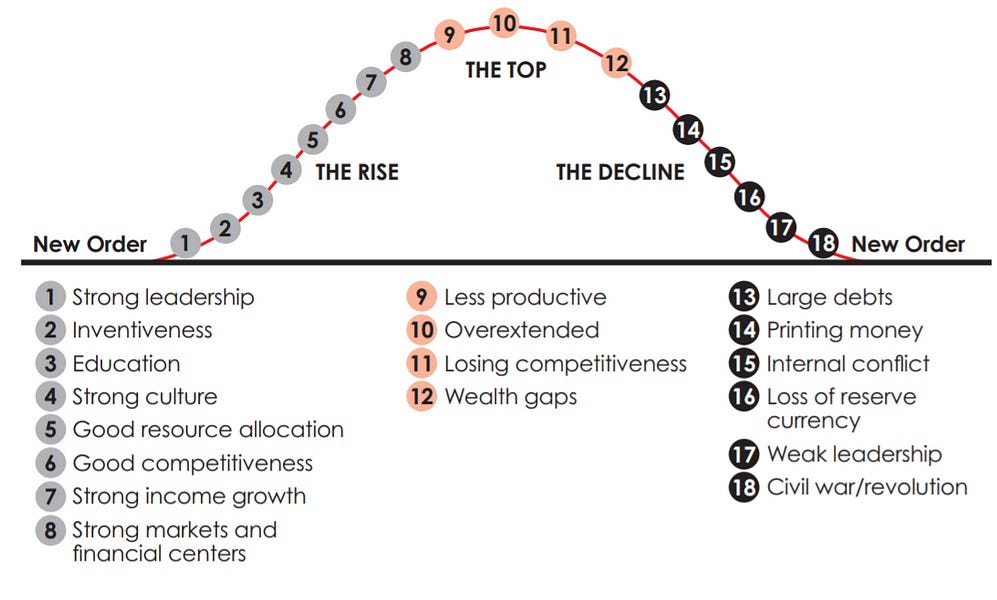

In it, Dalio lays out his mental model for how empires rise and fall, which he chalks up to three pillars that operate in cycles:

- The Debt Cycle

- The Internal Order Cycle

- The External Order Cycle

When all three of these cycles are simultaneously in their late stages, the world can expect to see turbulent times as we transition from one world order to the next.

We’re currently in a U.S.-led world order set up after WW2, but this structure is now in decline and in the process of being tested across each pillar.

Debt Cycle Test

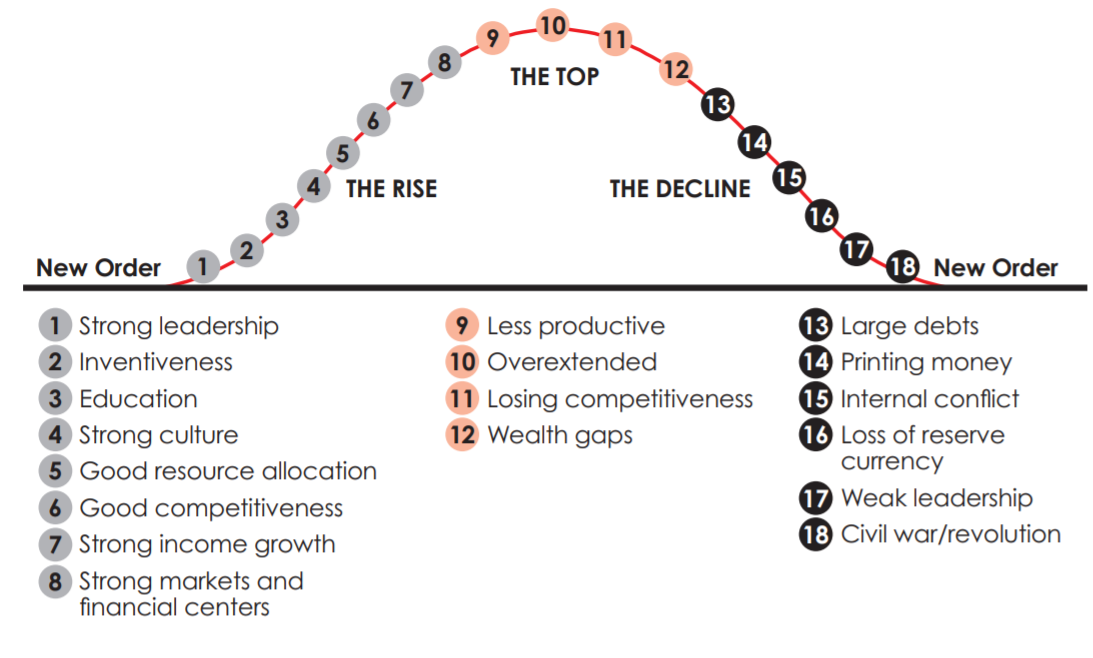

The dollar is currently the world’s reserve currency, meaning that foreign banks hold significant quantities of USD in their reserves and the dollar is the world’s primary medium of exchange and unit of account.

But currencies reigns do not last forever. Before the dollar the pound sterling reigned supreme. Before that was the dutch guilder. Currency reigns move to late stage when debt is aggressively monetized and government bonds are issued to pay for expanding budgets, and in extreme cases, fiat money is printed to cover debt issuance.

The U.S. printed $13 trillion for Covid and QE over the past two years.

Internal Order Cycle

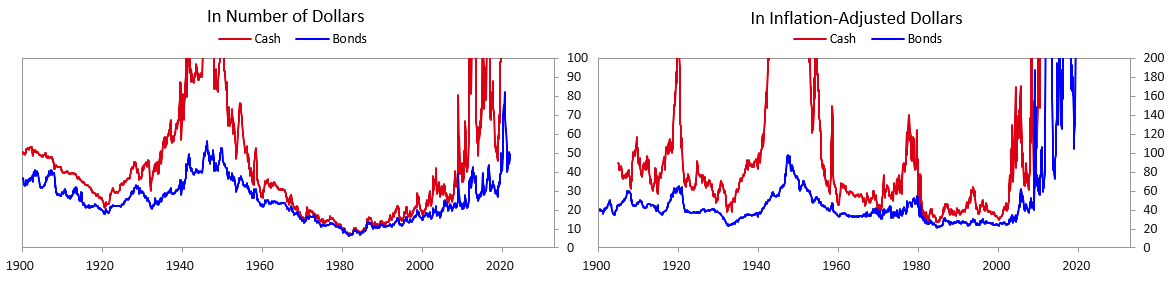

Political ideologies within a nation converge and diverge over time, but I can’t remember a time when politics has been so divisive. Not only in the US, but we see strife in many Western nations—last week it was Canada.

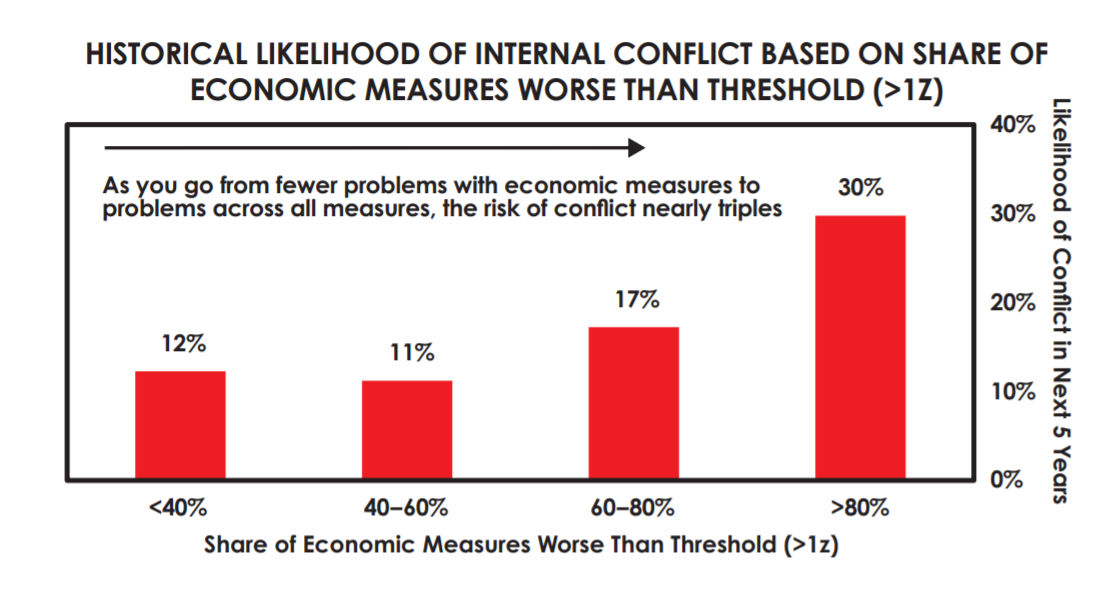

Dalio argues that political strife is often a result of economic insecurity in the late stages of a cycle. And with the wealth gap continually squeezing the middle class, these tensions have teeth.

External Order Cycle

The final pillar of stability in Dalio’s model is the geopolitical landscape between nations. In periods of peace and prosperity, nations work together to increase trade, established international relations, and work productively.

But in periods of strain and declining empires, we see conflict. We see war. Driven by ego, resource shortages, and a desire to militarily expand influence.

My point here isn’t that we’re all doomed and the world is going to combust.

Neither does Dalio:

But it feels like each year the probability of something new increases…

- Massive printing of the world’s currency reserve

- Populism on the rise across the world

- Riots at the US Capitol

- Increasing wealth inequality

- COVID-19

Russia invading Ukraine.

Now is a good time to learn how to use crypto and manage your private keys.

Here’s what we have lined up for next week:

- Podcast episode with Ryan Watt, former head of gaming at Youtube!

- Our Q1 token airdrop guide (check out last quarter’s guide - free version here)

- An inclusive guide on earning fixed-rate yields

Have a 🙏 weekend,

- RSA

P.S. if you have the capacity to do so, consider donating to help Ukraine.