Rational Exuberance

Dear Bankless Nation,

In bull markets, it can be tough to keep your head straight.

There’s so much news and excitement that all signals turn into noise, making it easy to lose your bearings.

It leads me to one of my favorite rules: don’t let the bullishness of others impact your own level of bullishness. Just because all my friends are getting bullish doesn’t mean that I should be getting more bullish.

When everyone becomes overly bullish, the market enters ‘euphoria’. And it generally indicates a ‘top-signal’ in a market cycle. However, today let’s indulge. I want us to take a stroll down Bull Street—because big things are happening….and they’re happening fast.

Here’s my case for why the exuberance today might be…rational.

1. Elon Musk is in

Elon Musk is the world’s richest man and owns the world’s most valuable car (and clean energy) company. He is a meme-lord and understands the power of branding, media, and narrative.

And he just made the biggest purchase of Bitcoin ever.

If there’s anyone you want on your side, it’s Elon Musk. The influence and command he has should not be downplayed. After announcing the Tesla $1.5B purchase of Bitcoin, BTC jumped from $38K to $48k, meaning Tesla is already up ~$500M on its purchase. Not bad.

2. Institutional FOMO

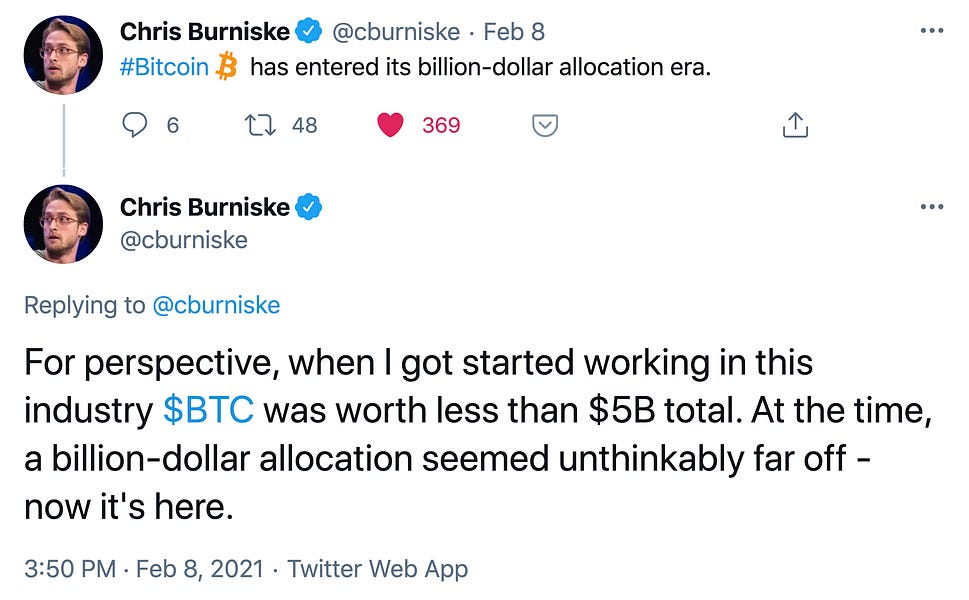

It’s somewhat counter-intuitive, but the BTC price going up is actually more bullish for Bitcoin, because it means that it has more bandwidth for larger and larger purchases from institutions.

Imagine if Tesla tried to buy $1.5B of Bitcoin when the market cap was $5B. The price of Bitcoin would have jumped to ♾, because it wasn’t capable of absorbing the inflows.

Now, Bitcoin can absorb $1.5B purchases, and I think that’s just the start.

Not to mention Michael Saylor putting on a “Bitcoin for Corporations” virtual seminar, attended by over 1,000 companies, was basically a “how to buy Bitcoin” for institutions.

Pierre Rochard summed it up nicely in a recent interview he did. His calculus:

- Company X buys BTC

- Company X announces BTC purchase

- Company X share price goes up; BTC price goes up

At the end of the day, institutions are just collections of people—they experience human emotions just like the rest of us.

Since January 2020, the BTC’s price tag has been going up at an average of ~$3,500 per BTC per month. Meanwhile, companies are adding billions of it to their balance sheet. It’s slowly becoming normalized for corporate treasuries. One by one, the dominos are falling.

Every institution is starting to feel the fomo.

3. The Coinbase IPO

At some point this year, Coinbase will IPO.

This public offering opens the crypto asset class to equity investors. Coinbase stock will be available to every single person with a brokerage account.

Coinbase isn’t tied to ‘Bitcoin’, ‘Ethereum’, or any other specific asset in the crypto-industry. Coinbase is selling shovels to the gold rush, and its fate isn’t tied to the outcome of one particular coin or chain. While I have my convictions about certain assets, not everyone shares these beliefs. Coinbase equity on publicly traded markets will offer neutral, pure, exposure to crypto markets.

Companies like Square or MicroStrategy have some exposure to crypto, but still are embedded in their native business models. Coinbase, however, is and always will be crypto-first.

Here’s the FTX Coinbase futures market, trading at $89B valuations:

I expect this to only climb higher.

4. The Bitcoin ETF

With the elimination of BitMEX from the picture, there are increasingly few reasons as to why there shouldn’t be a BTC-ETF available on public markets. At this point, it’s just a matter of time.

We already know there’s insane demand for BTC exposure due to the explosion in BTC that Grayscale holds (650k BTC). Similarly, an ETF is likely going to be a one-way street for BTC to be bought up from crypto markets and placed into the legacy-markets.

Again…imagine the buying pressure that comes from direct capital allocations out of brokerages like TD Ameritrade or Fidelity… or Robinhood.

The buying pressure is going to be insane.

5. DeFi is Here To Stay

Unlike the fleeting ICO tokens of 2017, DeFi tokens are here to stay.

Cash flows are real and objective. They enable fundamental value analysis in ways that the rest of the financial world can understand.

Additionally, some tokens are becoming increasingly aged and mature. For example, MKR has existed for almost 5 years now! Maker as a protocol has already collected $11M in revenue and has $50M more in ‘accounts receivable’ (money the protocol is owed).

These are terms that legacy investors can understand.

Other protocols like Compound and Uniswap have much younger tokens, but the protocols themselves have been operational for years now. And of course, they are all generating cash flows.

The investments made into DeFi tokens are going to be sticky. The maturity these protocols have are going to be reflected in the types of investors they attract, and when these tokens make it into these investors’ balance sheets, they’re going to stay there for a long time.

6. Celebrity NFTs

The celebrity NFT mania is already underway. Logan Paul, the world’s biggest YouTuber, and Mesut Ozil (futbol player with 26M twitter followers) are getting into NFTs. And that was just last week.

The beauty behind NFT issuance is that they are free from securities law violations. Instead of celebrities minting their own currencies, NFTs offer a compliant and ethical way for celebs to monetize their reputation.

The hype generated behind celebrity NFTs is going to be insane, and by its very nature, is going to go extremely viral. Going virtual is what celebrities do best after all, and now it’s Ethereum that captures all of that energy.

7. The Money Printer

The dollar is still world’s reserve currency and the U.S. government is still continuing to print it at unprecedented rates.

This last one is different than all the others. The above items are additive where the Money Printer is multiplicative. The strong injection of cash into the economy amplifies the exuberance we are going to see in the markets.

We’ve already seen what happens when you give stimulus checks to Robinhood investors; they start playing the Stock Market casino.

The surplus of cash in the economy raises the floor of what irrational exuberance is. As asset prices appreciate, wealthy inequality increases and retail investors feel an increasingly large sense of despair that their 9-5 jobs (which have salaries that haven’t kept up with inflation) aren’t going to provide the lifestyle their parents had.

So what do they do?

They go all-in on trades that have 100x potential. How else are they going to escape a 9-to-5-to-death lifestyle, other than trying to strike it rich?

In a world in which younger investors are YOLO’ing funds into speculative bets, DeFi is the perfect fit. It is a landscape full of opportunity that the boomers haven’t touched yet… fertile lands for young investors.

As soon as DeFi becomes the shelling-point for Robinhoods and WSB’s 100x gains, it will be game over and DeFi will have won.

8. Full Penetration

At the end of this cycle, Crypto will be mainstream.

This wasn’t the case in 2017—yes crypto briefly penetrated into the mainstream news cycle, but it was brief and cursory.

Different story in this cycle. At the end of this cycle, rypto will exist inside the S&P (it already is with Tesla), inside brokerages, and inside the hearts and minds of celebrities and households alike.

This cycle, we’re getting everyone involved.

I think the stars are aligning for a bull market of bull markets. All the ingredients are present, and we’re just waiting for the legacy world to figure out how it all fits together.

We’re headed to euphoria.

-David