Prize Savings: the ultimate money lego

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

The U.S. Constitution is 4,543 words—not much longer than this article. Yet this simple mechanism runs the largest democratic republic in the world.

Ethereum gives us the power to create simple mechanisms for capital coordination. These are credibly neutral, enforced by code, and backed by social consensus. We call them money legos but money mechanism fits too.

Today’s money mechanism hacks our frail human psyche and pools our capital to get us to do something we’re particularly bad at as a species: saving our money.

It’s called prize savings.

The household savings rate in the US is 7%—in the EU it’s 4%. What if a mechanism like this bumped it closer to 10%?

How would an extra trillion in savings improve our quality of life?

What if those savings were tied to a stablecoin like Dai which in the future is indexed to a something governments can’t inflate away?

It’s impossible to get people to save. Really? What if you give them a long-term value store and a chance to win $57m dollars every week?

That’s the power of this simple mechanism.

Let’s dive in.

- RSA

THURSDAY THOUGHT

Prize Savings: the ultimate money lego

Post by: Leighton Cusack, co-creator of the PoolTogether protocol

One of the most popular financial products in the world is one you’ve likely never heard of—prize linked savings. Prize Linked Savings (PLS) have existed in different forms for at least 400 years, they combine the chance to win large monetary prizes without the risk of principal loss. This is possible because the prizes are funded by the interest that accrues on money deposited into prize linked savings accounts.

One modern example is “Premium Bonds” available in the UK. Started in 1954 this program currently has over $100 billion dollars deposited from more than 22 million account holders. This money earns a 1.4% annualized yield which generates millions of dollars in monthly prizes. The photo below is a poster from the launch of the premium bond program.

Why are Prize Linked Savings so Popular?

Prize linked savings are popular because they take human psychology seriously and use it to build financially healthy behaviours.

So many modern products use our psychological weaknesses to get us to spend on things we don’t need, eat things that make us sick, and give our attention to things that won’t fulfill us. Prize savings attempts to do the opposite by exploiting some of the same biases to reinforce healthy behaviors.

Specifically prize savings are appealing because of the psychological principles of loss aversion—“people's preferences to avoid losing compared to gaining the equivalent amount.” And an observed preference for uncertain payoffs. Or to put it more simply—winning a prize is more fun than earning interest.

Psychological reasons aside, prize savings are a compelling economic product and highly differentiated from standard interest bearing accounts. The National Bureau of Economic Research articulated the value proposition well:

“The potential appeal of PLS products must also be understood in the context of alternative products. Emergency savers who demand liquidity and no principal loss are usually limited to some sort of low-yielding demand deposit. While theory might suggest that the power of compound interest would provide strong motivations to save, for an emergency saver whose uncertain horizon might be a few years or a few months, compounding does not offer compelling reasons to save.”

Despite immense popularity and unique value proposition prize linked savings have been an overlooked financial primitive in the blockchain and decentralized finance space thus far.

Prize Savings + Ethereum = 10x Better

Prize Linked Savings built on Ethereum are far better than traditional alternatives. Administration via smart contracts means they run more efficiently creating larger prizes. The use of decentralized stable coins makes them accessible anywhere. Open source and audited contracts ensure fair prize disbursal and most importantly, prize linked savings become a programmable money lego.

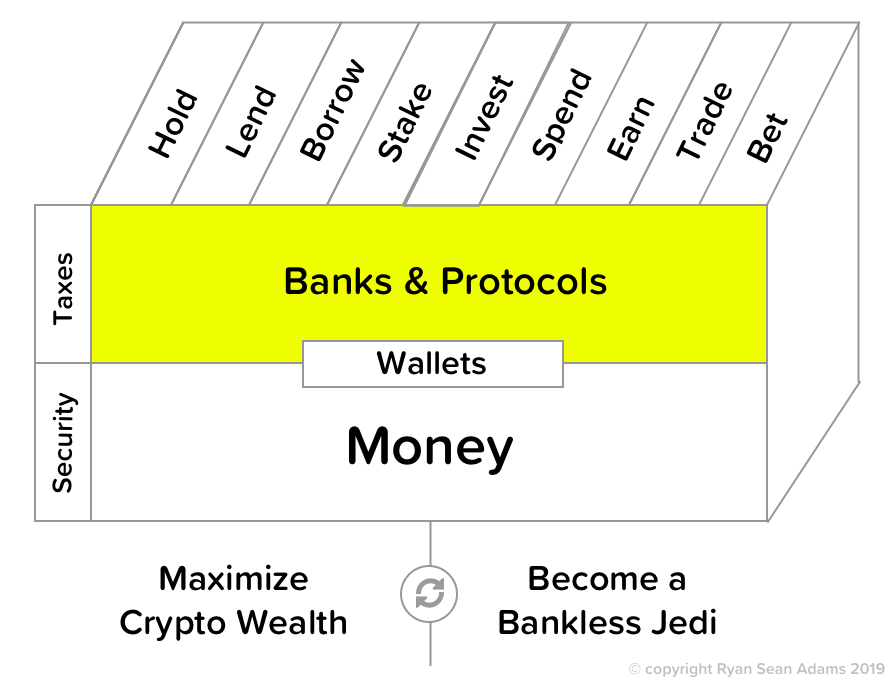

Thanks to Totle for letting us borrow their money legos graphics!

The PLS Money Lego

The PoolTogether protocol has brought prize linked savings to Ethereum for the first time creating a permissionless and composable way to interact with Prize Savings. The design of the protocol is optimized to always provide a higher expected value than simply earning interest and enable developers to choose the risk / return ratios they would like to offer.

The higher expected value comes through the presence of “sponsored Dai” in the protocol. “Sponsored Dai” contributes interest to prizes but is not eligible to win, currently the protocol has ~$250,000 of sponsored Dai provided by the PoolTogether company. This makes the expected value of the PoolTogether protocol always higher than using comparable interest generating products. As of this writing the effective APR from PoolTogether is 11.5% compared to the Dai Saving Rate of 7.5%

The ability to choose a return profile comes from the tokenization of deposits. For each Dai deposited the PoolTogether protocol mints “plDai”, these plDai can then be transferred and grouped with other entrants to increase their chance of winning. When tickets are grouped together this is referred to as a “pod”. Developers can build their own interfaces to mint and aggregate tickets depending on what they would like to offer in their products. Crucially, regardless of the interface they are minted through, all tickets go to the same capital pool ensuring the largest possible prizes.

For example, the Argent Wallet can offer direct entry into the PoolTogether protocol through a pod, all users of the Argent Wallet can then both be entered to win the weekly prize from the protocol and optionally offered additional prizes only to users of the Argent Wallet. For simple math imagine the Argent Wallet had 100 users deposit 1,000 Dai each into PoolTogether protocol, given the current pool size that would give Argent Wallet users a 20% chance of winning the weekly prize. Over a 5 week period that is 68% chance of winning at least once, winning once generates a $1,088 Dai return vs. the $730 Dai return the same amount of money would generate being deposited into the Dai Savings Rate for the same period of time.

Why Prize Linked Savings Will Onboard Millions

Prize linked savings offer a chance to win life changing amounts of money with no risk of principal loss. This is an incredibly powerful and unique value proposition.

There are a few ways to reason the total market for prize saving products. Research shows at least some portion of money spent on traditional lottery products would go to prize savings if available. In 2017 the global spending on lottery products was $283 billion. It’s more difficult to find exact numbers on the global prize savings market but as mentioned earlier, in the UK alone it exceeds $100 billion. Because prize savings perform much better built on Ethereum than traditional systems it’s again reasonable to assume some existing money will move to the superior products.

Given these numbers, getting $10 billion Dai into the PoolTogether protocol over the next 5 years would still only represent a very small slice of the addressable market. Taking a conservative interest rate estimate of 3% annual yield, that would generate a $5.7 million dollar weekly prize which would likely be split among ten of thousands of weekly winners who have all joined through different wallets and apps.

These numbers may sound large right now but given the clear market demand and clear advantages of prize savings built on Ethereum we view them as reasonable.

Action steps

- Save your Dai using Prize Savings in PoolTogether—$1,284 wkly prize!

Author Blub

Leighton Cusack is the co-creator of the PoolTogether protocol. He was previously the co-founder and CEO of Kindrid.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet. Costs less than a coffee per week. Don’t invest in crypto until you invest in yourself.

Filling out the skill cube

Prize linked savings are another money lego in the protocols layers of the skill cube today. Could this simple mechanism improve savings rates across the globe?

👉Send us a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.