Dear Bankless nation,

Here’s a recap of the largest news in crypto for the fourth week of May:

1. Gamestop wallet

Another wallet gets dropped this week, this time by GameStop.

It’s a self-custodial Ethereum wallet with Loopring integration (more Layer 2s to come), direct fiat to L2 onramps, and NFT compatibility.

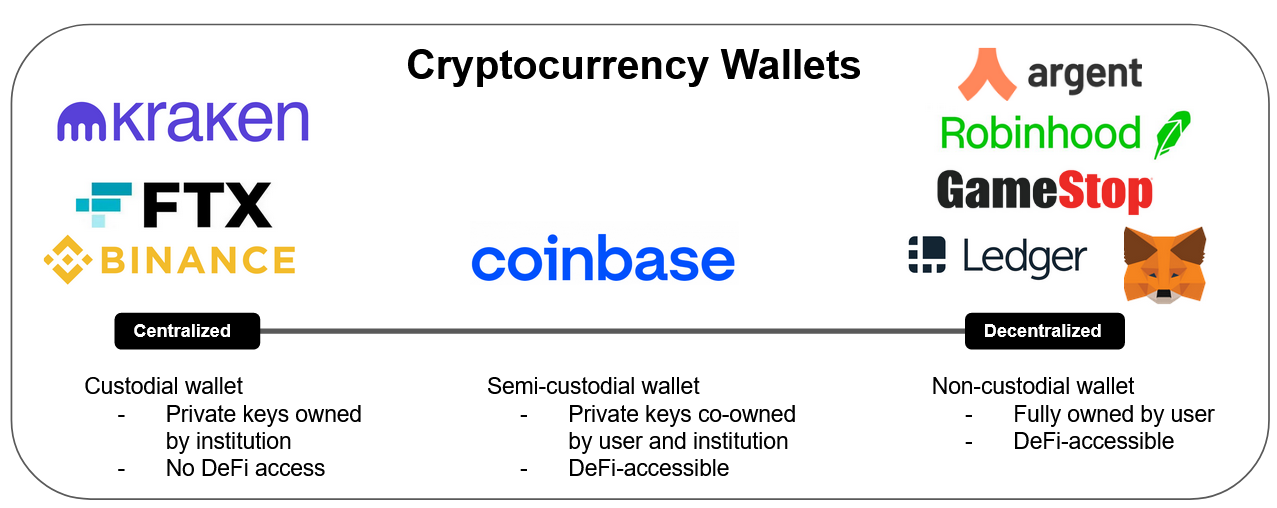

In last Friday’s recap, we created a basic taxonomy of wallets on a decentralized-centralized spectrum. Here’s an updated version:

2. Terra update

Is Terra rising from the ashes?

A proposal has been passed to relaunch Terra as “Terra 2.0”. Here’s what’s noteworthy:

- No algorithmic stablecoin this time!

- The old chain will be termed Terra Classic ($LUNC) with the new chain Terra ($LUNA)

- The new LUNA will be airdropped across different stakeholders including LUNA Classic stakers/holders, residual UST holders, and developers on the old Terra chain (see details)

- The chain is designed to be fully community-owned, with the notable absence of any token allocation to Terra’s parent organizations (Luna Foundation Guard/Terraform Labs)

Terra’s special sauce was always its fast growing algorithmic stablecoin. With UST out of the picture, this begs the question—what’s special about Terra?

In any case, Terra 2.0 may be moving onward to greener pastures, but its legal entities aren’t out of the woods yet.

- South Korean police are investigating the Luna Foundation Guard under allegations that the non-profit was embezzling funds and have asked exchanges to block LFG’s ability to withdraw funds.

- The five largest crypto exchanges in Korea — Bithumb, Coinone, Gopax, Korbit and Upbit — have also been summoned by legislators to be held accountable for token loss.

3. Is Elizabeth Warren suing DeFi?

Okay, not quite. Not Elizabeth directly. It’s the former technology lead for Elizabeth Warren presidential campaign who’s suing PoolTogether.

The plaintiff is Joseph Kent, a software engineer who served as a former technology lead for Warren’s 2020 presidential campaign, after depositing a grand total of 10 dollars on PoolTogether.

PoolTogether is a gamified savings application that offers a no-loss lottery generated by pool interests; deposited collateral is eligible for a chance at winning a lottery, but losers don’t lose their collateral even if the lottery doesn’t pick them. We’ve written about them many times.

👉 Check out our previous interview with its founder Leighton Cusack.

Of all the DeFi DeGen things this guy chooses to sue a savings account??

We think it’s worth taking a stand on this one. Join us in funding the legal costs to defend PoolTogether by minting a Pooly NFT.

Expect more of these lawsuits to come. Just last month, Uniswap got sued in a class-action lawsuit. As the DeFi market grows, builders and tourists come onboard.

But so do opportunists.

4. The ENS Boom

The Ethereum Name Service (ENS), a name and lookup service for Ethereum has been hitting all-time-highs of late.

Here are some ENS stats from April 2022 alone:

And May’s growth continues to climb.

What explains ENS’ staggering growth? ENS communities and social clubs. Read Bankless writer William Peaster’s fantastic article for more on this.

5. Seth Green Loses his NFT 😭

Last but not least, Seth Green’s upcoming animated TV show has been halted, after losing the rights to his Bored Ape in a phishing scam.

How did he lose his show rights?

The owners of the BAYC brand Yuga Labs, grants intellectual property freedom to monetize your apes if you’re a holder. This is in contrast to NFTs issued under the Creative Commons license that allows holders and non-holders alike to use the brand for monetization. For more on CC0 NFTs, see The Bull Case for CC0 NFTs by Donovan.

His lawyer says the show can continue… our question is why?

Never a dull moment in crypto.

Here’s what we have lined up next week.

- Reinventing the Internet with Marc Andreessen & Chris Dixon of a16z (Premium members have early access!)

- Why central bank digital currencies (CBDCs) are bad

- Top 5 airdrops to look out for this quarter

Have a great weekend.

- Bankless