The Essential Guide to GMX

Dear Bankless Nation,

GMX has been in the limelight recently. There’s good reason for it.

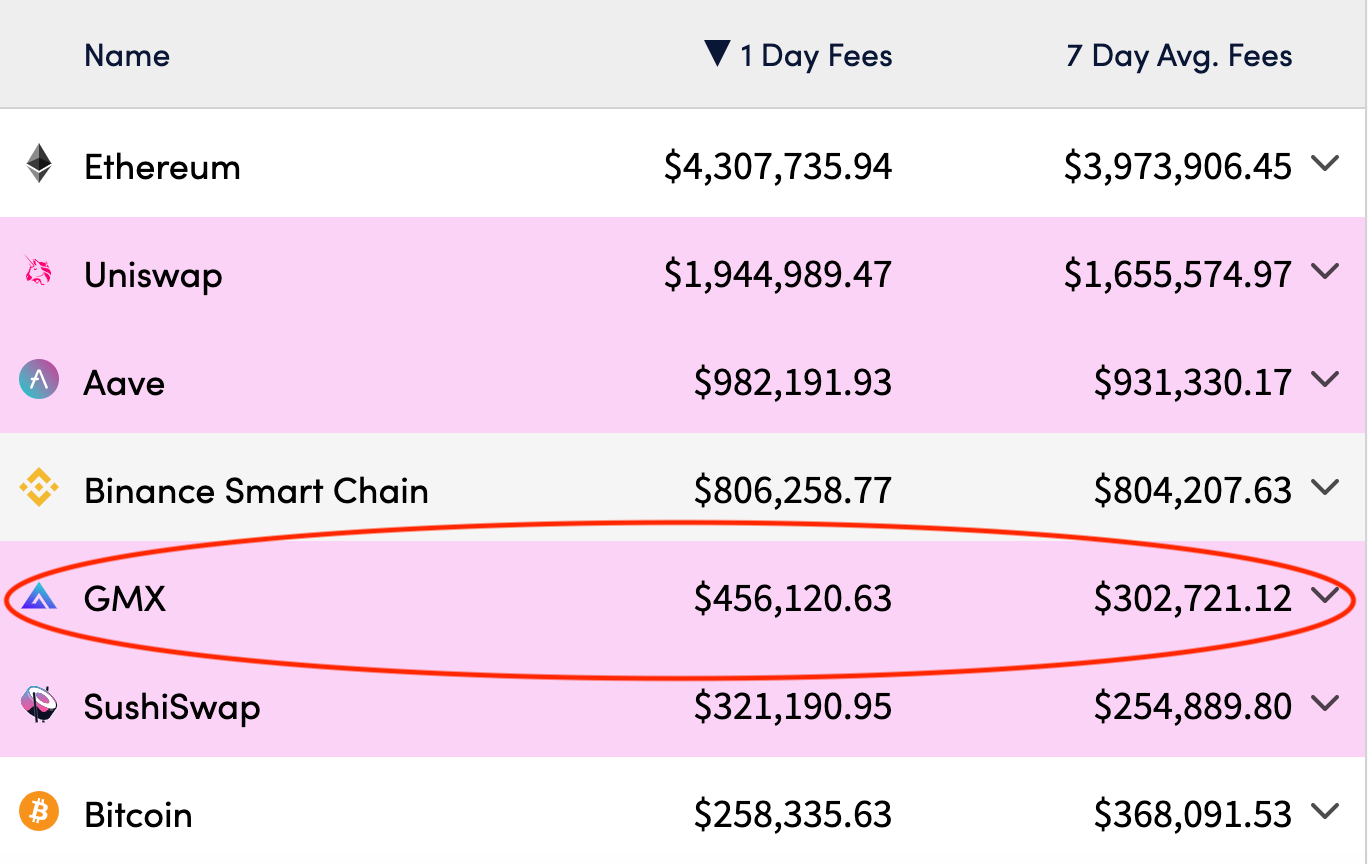

This Layer 2 native perpetual protocol has crossed over $2.3B in cumulative volume and is now competing with DeFi blue chips in terms of fees.

As you could expect, there are a ton of market opportunities on the protocol.

You can trade perpetuals on ETH, BTC, UNI, LINK, and other tokens with up to 30x leverage.

You can also purchase an index of the assets supported on the protocol, provide liquidity, and earn 25% APY in ETH. Not bad.

Lastly, you can stake their native token, GMX, and earn ETH on it too. Real cash flows!

Want to learn more?

William’s got you covered.

- Bankless Team

The Essential Guide to GMX

GMX is a decentralized derivatives exchange on Arbitrum that specializes in perpetual contracts.

This Bankless tactic will walk you through how to long or short top cryptocurrencies with leverage using GMX’s perpetual swap markets.

- Goal: Learn how to trade on GMX

- Skill: Intermediate

- Effort: 1 hour

- ROI: The potential for amplified gains via leverage

What is GMX?

GMX is a decentralized derivatives exchange currently deployed on the Arbitrum One Layer 2 (L2) scaling solution and the Avalanche blockchain.

The protocol offers spot trading for a handful of top cryptocurrencies and stables, namely ETH, WBTC, LINK, UNI, DAI, USDC, USDT, and FRAX.

GMX’s main claim to fame? Its perpetual swap markets allowing traders to long or short major tokens with up to 30x leverage.

For now, GMX offers perpetual swap markets for ETH, WBTC, LINK, and UNI on its Arbitrum deployment. That initially modest selection hasn’t slowed GMX’s growth, however.

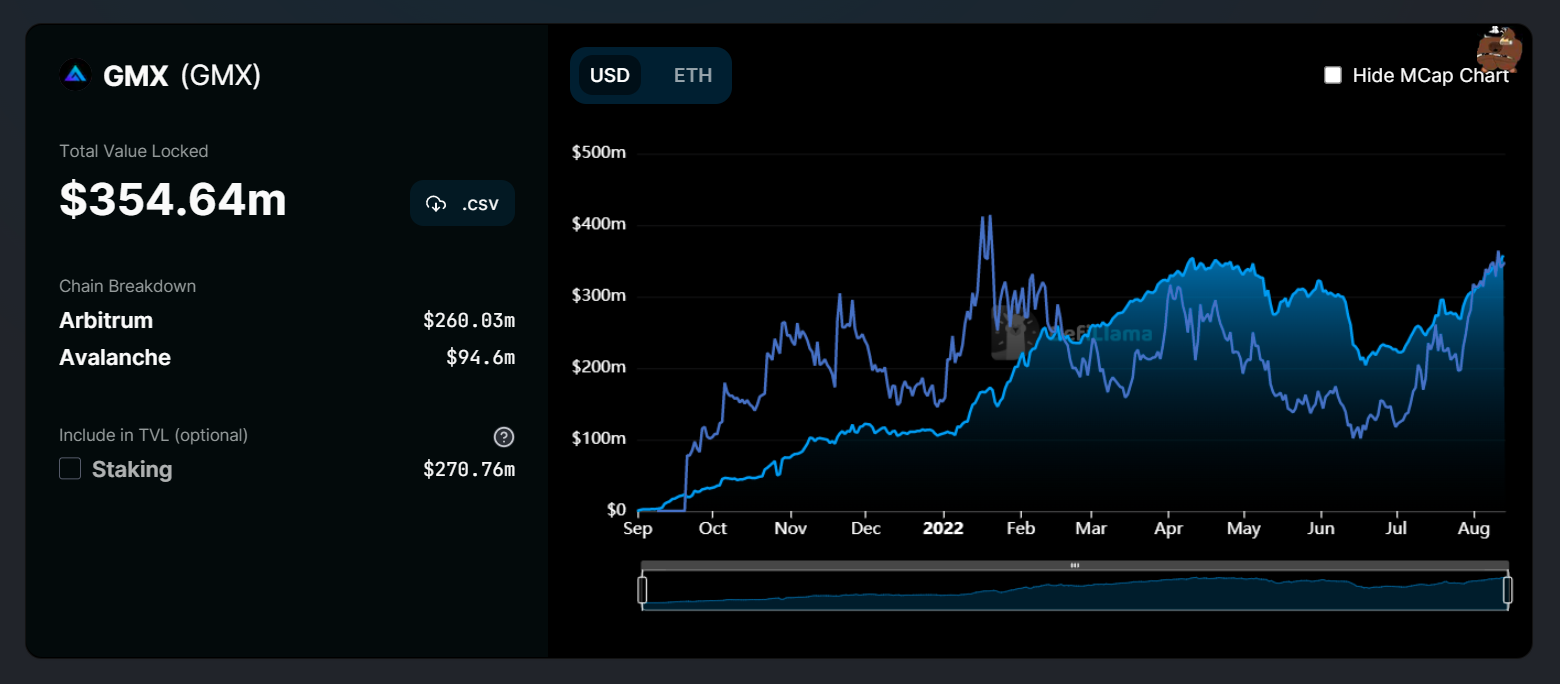

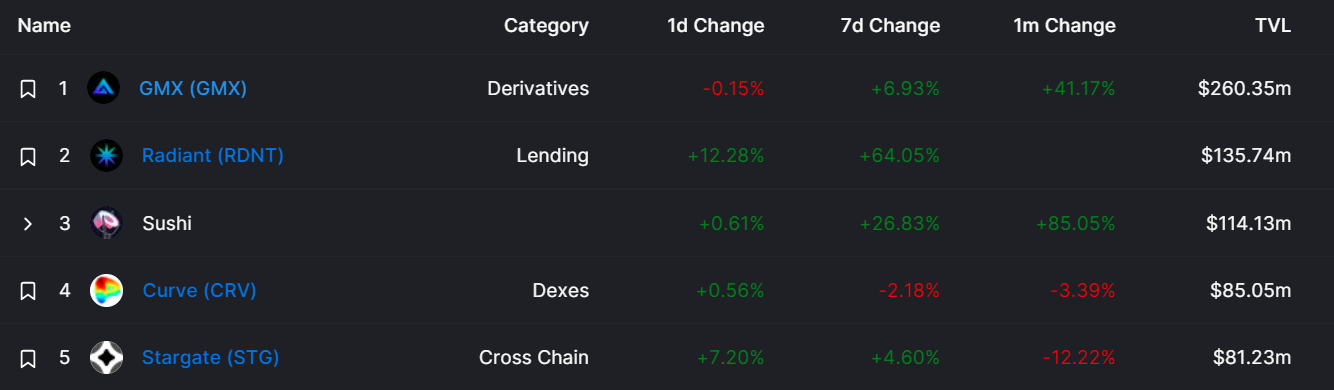

The project’s $260M+ total value locked (TVL) on Arbitrum makes it the largest dApp on the largest L2 as it stands today.

Why Perpetual Swaps? Why GMX?

A perpetual swap is like a futures contract that has no expiry, meaning the instrument can be held indefinitely. In DeFi, perpetuals are used to speculate on crypto price action and require little capital upfront to support very leveraged positions.

As for GMX specifically, the project provides non-custodial perpetual swap trading with an emphasis on friendly UX. On GMX, traders can make longs and shorts with rapid transactions and low swap and transaction fees, while liquidity providers (LP) can earn by providing assets to the protocol’s multi-asset pool system to support leverage trading and swaps.

GMX Longs and Shorts Explained

GMX’s perps make it simple to long a token, which is a way to speculate on and earn from, a token’s price going up. Conversely, if that token’s price drops, those who longed the asset lose money and may get liquidated.

The same is true in reverse for GMX’s perps and shorting: these instruments are a means for speculating on and earning from a token’s price going down, and shorters lose money and can get liquidated if the token’s price instead goes up.

When going long or short on GMX, the minimum leverage possible is 1.1x while the maximum allowed leverage is 30x. To start a perp trade, you’d first provide collateral in the form of one of GMX’s supported collateral types. After this, the protocol’s multi-asset liquidity pool would lend you the necessary funds to open your long or short position.

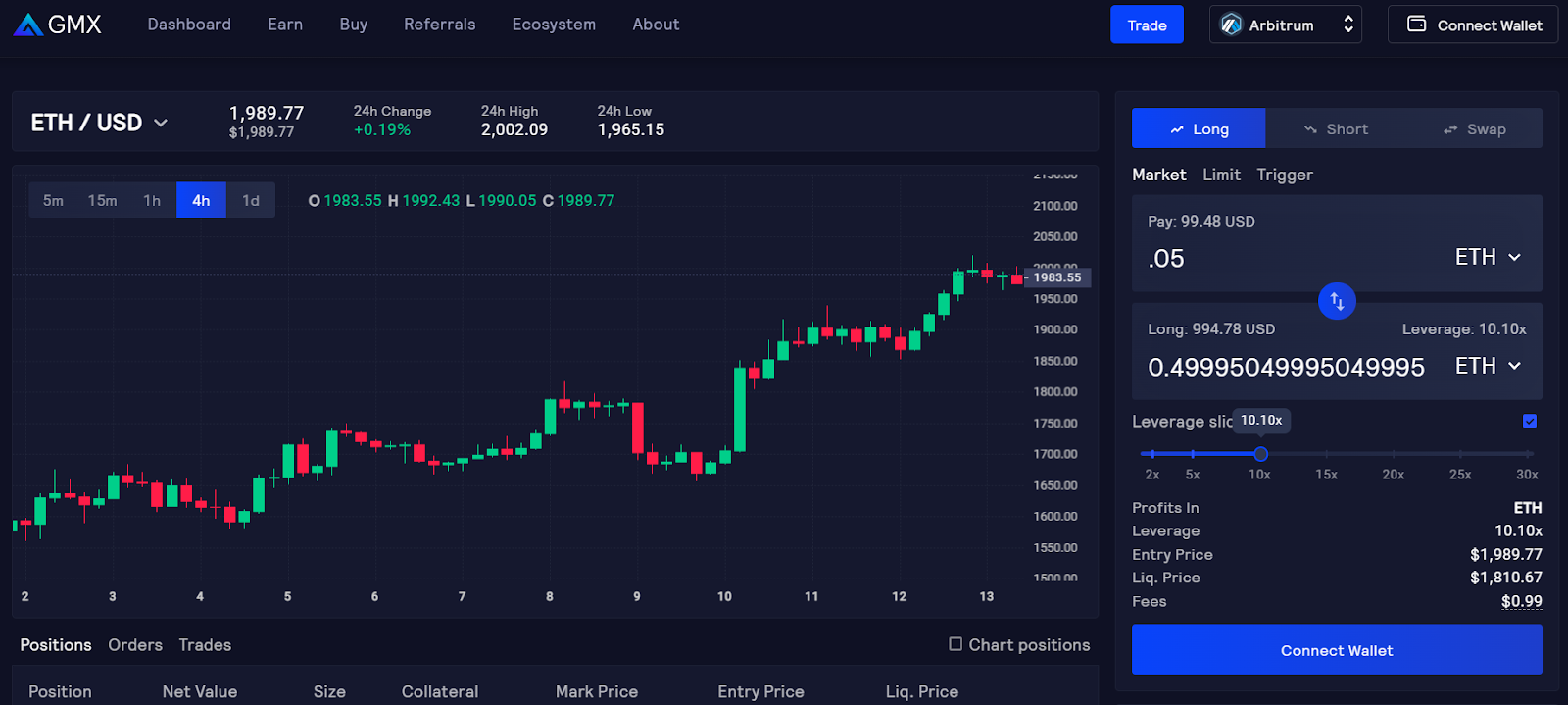

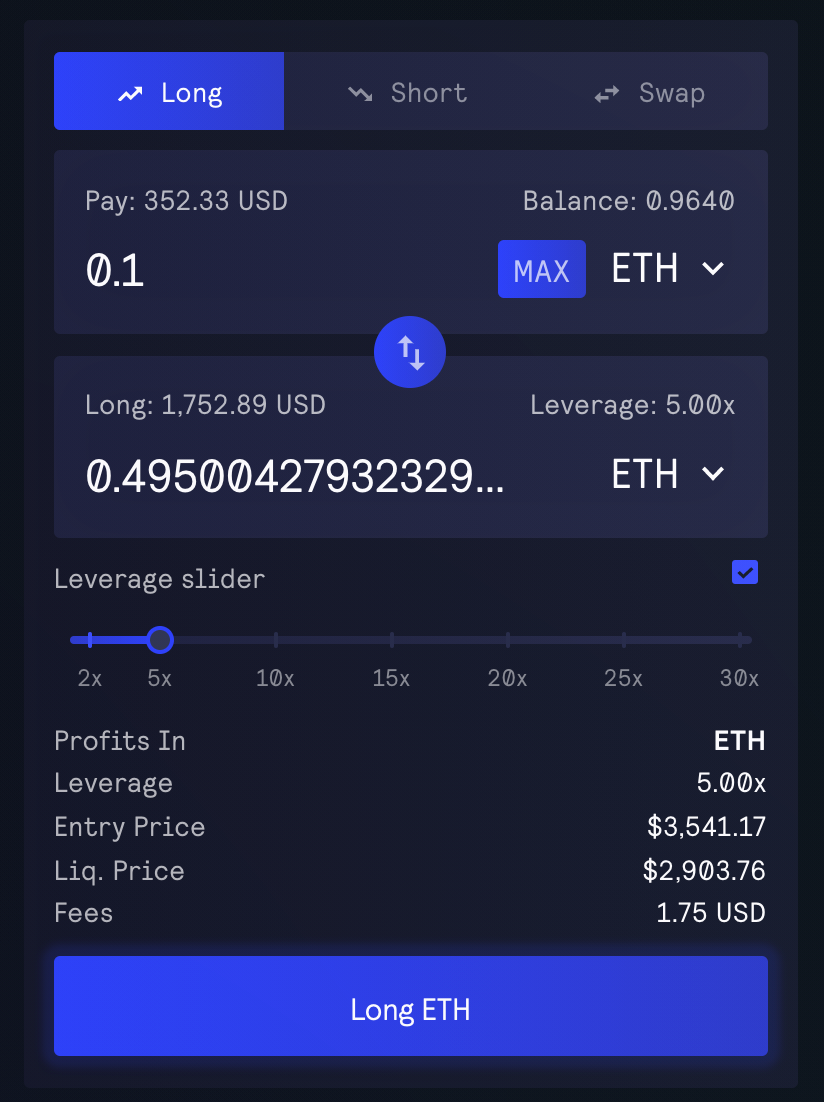

Once you select your desired leverage amount, the trading UI will confirm the denomination of your profits (longs payout in the asset being longed, shorts payout in stables), your leverage, your entry price, your liquidation price (i.e. the price at which your position will be closed), and the fees being charged.

Note that GMX charges an opening fee of 0.1% on your position size and a closing fee that charges the same. There is also an ongoing borrowing fee that margin traders must pay hourly to GMX LPs; this amount is calculated as:

(assets borrowed) / (total assets in pool) * 0.01%.

How to trade L2 perpetuals on GMX

- Go to app.gmx.io/#/trade, connect your wallet, and switch to the Arbitrum network

- Choose from the ETH, WBTC, LINK, or UNI perps markets in the trading UI

- Select from the “Long” or “Short” buttons depending on your desired trade type

- In the “Pay” box, input how much crypto (e.g. ETH) you want to collateralize

- Next use the UI’s “Leverage slider” button to determine the amount of leverage you want to use

- Press “Enable Leverage” and fire off an approval transaction to let GMX access your funds

- Review your trade’s details one last time and then if everything looks alright, finalize the transaction; if you’re longing ETH, you’ll press the “Long ETH” button here

- Complete the trade transaction with your wallet, after which your perp position will be live

- Use the “Positions” tab on app.gmx.io/#/trade to manage or close your position when you want

- You can also use the “Orders” tab to manage stop-loss and take-profit orders as you please

What about the GMX and GLP tokens?

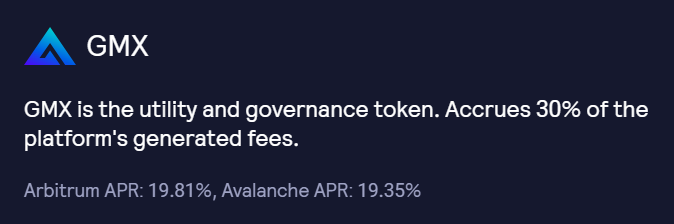

The GMX token is the GMX protocol’s native governance and utility token. The asset can be staked to earn escrowed GMX, or esGMX, rewards.

Stakers on Arbitrum also earn ETH, as 30% of the protocol’s generated fees are converted to ETH and then allocated to GMX stakers on an ongoing basis.

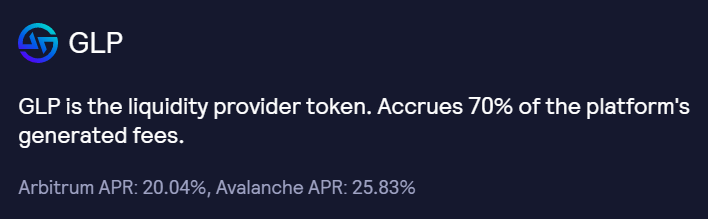

As for GLP, it’s the protocol’s native liquidity provider token.

The asset serves as an index of the assets that exist within the GMX multi-asset pool system, and it can also be staked to earn esGMX and ETH rewards over time. Notably, GLP stakers receive 70% of GMX’s accrued fees.

Potential Risks

The GMX team is composed of anonymous contributors. This approach has its pros, though complete anonymity does raise the risk factor of unaccountability in the event that things go south for a project.

At the same time, GMX’s smart contracts speak for themselves. The contracts were audited by ABDK, the same firm that audited Uniswap V3, so the codebase appears sound from a bird’s-eye view.

As for actually trading on GMX, it goes without saying that leverage is risky insofar as it can magnify your losses compared to simply hodling. Trading perpetuals is far from a guaranteed profit avenue, and you will lose money if price action goes decidedly against your bets!

Layer 2 Perpetuals

GMX has grown rapidly this year, and that surge speaks to how the project has honed in on the rising demand for L2 perpetual swaps in DeFi.

Decentralized derivatives can be complicated affairs, but GMX facilitates streamlined perps markets at the front-end and protocol levels to create win-win UX for both traders and liquidity providers.

If you’re keen on using leverage to hedge or speculate on top tokens, GMX’s Arbitrum deployment is something you’ll want to have on your radar.

Action steps

- 📈 Open a long or short position on GMX

- 🐻 Check out my previous tactic How to earn in a bear market (NFT edition) if you missed it!