Top 5 Ways to Earn OP on Optimism

Dear Bankless Nation,

Optimism is one of the dominant Layer 2s on Ethereum.

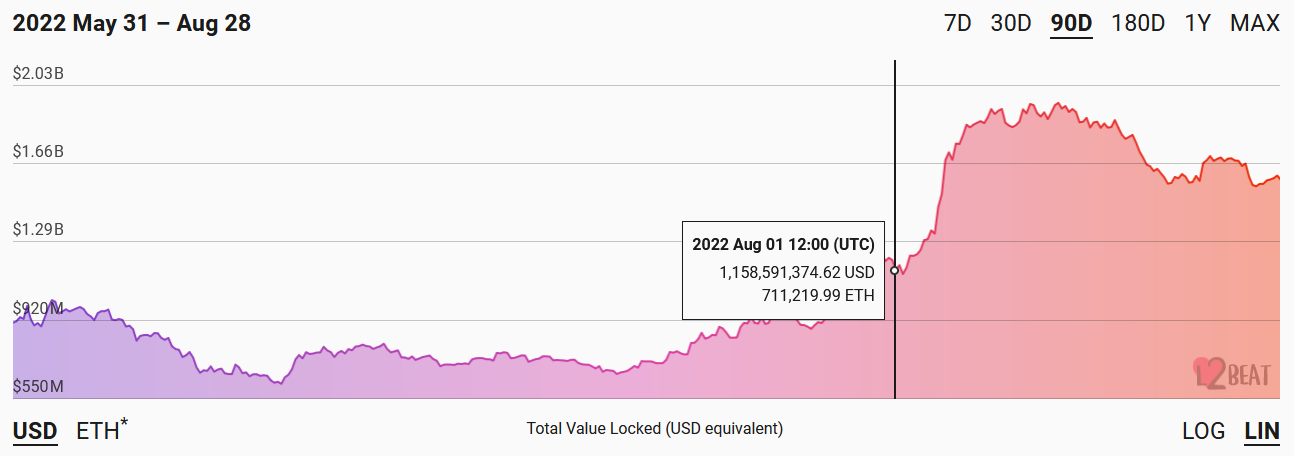

Since the start of August, total value locked (TVL) on Optimism has jumped by ~26%.

This is because there are a ton of market opportunities, allowing users to earn OP—the network’s recently launched governance token—by using a range of different applications.

Want to get in on the action?

Here’s a guide with the top 5 best opportunities to look out for.

Don’t wait too long though, because these rewards are all up for grabs and all liquidity mining campaigns will eventually come to an end!

OP Summer is here. 🔴

Let’s capitalize on it.

- Bankless Team

This summer, the Optimism Ecosystem Fund has been allocating $OP tokens to dApp teams on Optimism.

In turn, these projects have been distributing the tokens to incentivize and reward their users who make the L2 leap. This Bankless tactic will show you the best opportunities to target right now in order to maximize your $OP earnings!

- Goal: Identify and use the best $OP reward programs

- Skill: Intermediate

- Effort: 30 minutes

- ROI: $OP rewards 🔴✨

OP Summer’s Hottest Programs

Optimism is currently the second-largest L2 in the crypto economy, and efforts in the scaling solution’s ecosystem now stretch across the whole gamut of web3, including bridges, DAOs, DeFi protocols, NFTs collections, wallets, and beyond.

However, not all of these projects are offering their users OP rewards. And of the ones that are, we’ve seen a big range in reward pool sizes. For example, some dapps have had only 300,000 OP to distribute, while others have set aside as many as 9M OP for rewards.

All that said, if you want to maximize your potential OP earnings right now, you want to be targeting the projects that have the largest OP reward pools.

The idea?

The higher the number of OP to distribute, the more earnings there can be for more people. Intuitively, 9M tokens will go much farther than 300K.

So let’s say you already have some funds on Optimism and you’re keen to start earning as much OP as you can.

Where should you start?

No worries, I’ve got you covered — here are the 5 dapps with the deepest OP reward pools at the moment!

🔥 Five OP opportunities on Optimism

1) Synthetix

💰 Reward allocation: 9,000,000 $OP

🗓️ Rewards start date: Aug. 25th, 2022

🤝 Actions rewarded: Liquidity providing

What You Need to Know

- Decentralized derivatives protocol Synthetix kicked off its initial wave of OP reward distributions last week by allocating 10k OP each to liquidity providers of the sUSD/3CRV and sETH/ETH pools on Curve.

- The idea with these rewards is to entice LPs to migrate their Synthetix synths, i.e. sUSD and sETH, from the Ethereum mainnet over to Optimism where the UX is friendlier. If you want to earn OP rewards to help bolster this migration, consider depositing into the designated Curve pools.

2) Aave

💰 Reward allocation: 5,300,000 $OP

🗓️ Rewards start date: Aug. 4th, 2022

🤝 Actions rewarded: Borrowing and lending

What You Need to Know

- Decentralized lending protocol Aave started a 90-day OP liquidity mining program for Aave V3 users earlier this month, meaning there are still over 60 days left in the campaign.

- To participate, you’d simply head over to Aave V3’s Optimism Market and lend and borrow tokens. You can currently supply ETH, DAI, and USDC, while the tokens currently available for borrowing are ETH, DAI, USDC, WBTC, LINK, and sUSD. Claiming support for your accrued OP rewards isn’t live yet, but it will be soon.

3) Perpetual Protocol

💰 Reward allocation: 5,200,000 $OP

🗓️ Rewards start date: July 14th, 2022

🤝 Actions rewarded: Liquidity providing

What You Need to Know

- Perpetual Protocol, which facilitates decentralized perpetual futures, launched its OP liquidity mining program, the Pool Party, last month. The goal was to incentivize and boost liquidity into the Perp v2 system.

- On a weekly basis, the Pool Party is currently distributing 27k OP among LPs in the Perp v2 ETH market, 5k OP among LPs in the AAVE, BNB, BTC, FLOW, and PERP markets, and 3k $OP among LPs in all the remaining markets.

- To earn from these distributions, simply head to the Perp v2 app, deposit liquidity into the market of your choice, and then collect your OP rewards every Monday when they’re allocated.

4) Lyra

💰 Reward allocation: 3,000,000 $OP

🗓️ Rewards start date: Aug. 2nd, 2022

🤝 Actions rewarded: Staking and liquidity providing

What You Need to Know

- As part of its new Avalon Incentives program, decentralized options protocol Lyra has started distributing OP rewards to LYRA stakers and to LPs of its Market-Maker Vaults.

- You can stake LYRA at the Lyra Rewards dashboard. Just keep in mind that OP rewards are released every two weeks, and that there’s also a two-week unstaking period if you want to withdraw your underlying LYRA.

- As for LPing, you could go to the Vault dashboard and supply liquidity to the Ethereum (sETH-sUSD) vault or the Bitcoin (sBTC-sUSD) vaults to earn OP rewards, which are also released every two weeks.

5) Velodrome

💰 Reward allocation: 3,000,000 $OP

🗓️ Rewards start date: July 13th, 2022

🤝 Actions rewarded: Token locking

What You Need to Know

- Decentralized liquidity marketplace Velodrome, which I wrote a tactic about earlier this month, is currently distributing OP rewards to users who lock their VELO tokens for veVELO.

- Over the next few months, the protocol is allocating ~50k OP every two weeks to VELO lockers. To join in, you’d head over to Velodrome’s Vest dashboard and customize your lock position.

🚨 Future OP opportunities

Many OP liquidity mining programs are not live yet but are on the verge of launching soon.

Some you will want to keep on your radar for when they do drop are as follows:

- Uniswap — 1,000,000 $OP allocated

- Hop Protocol — 1,000,000 $OP allocated

- Celer — 1,000,000 $OP allocated

- Aelin — 900k $OP allocated

- Pika Protocol — 900k $OP allocated

- Polynomial Protocol — 900k $OP allocated

- xToken Gamma — 900k $OP allocated

- ZipSwap — 900k $OP allocated

- Biconomy — 750k $OP allocated

- Beefy Finance — 650k $OP allocated

Zooming out

Activity on Optimism is blooming out in all directions right now, and the OP token offers a straightforward way to get “index-like exposure to [this] broader Optimism ecosystem,” as my colleague Ben Giove recently noted.

If you’re interested in stacking as much OP as possible, make sure you’re not sleeping on the biggest OP liquidity mining campaigns taking place today!

Optimism starter pack

Still finding your footing around Optimism? Here are some Bankless resources to help you more easily navigate the L2:

- 🔴 A Beginner’s Guide to Optimism

- ❗ The Optimism Collective & $OP airdrop #1

- 🎈 Optimism and NFTs

- 📈 Bankless Token Ratings | Aug. 2022 (ft. $OP)

Action steps

- 🔥 Check out the $OP Summer programs on Synthetix, Aave, Perpetual Protocol, Lyra, and Velodrome

- 👀 Also check out our previous How to get liquidity on your NFTs tactic if you missed it!