Open Reply to Lyn Alden & Ethereum Skeptics

Dear Bankless Nation,

On Monday, we released a podcast episode with Lyn Alden (now with video! 📺).

We talked about the hidden forces behind US Dollar dynamics, shifting global power, Bitcoin… and of course, Ethereum.

Just as we did with Raoul Pal, we wanted to open up the conversation about Ethereum and make the case for ETH—or at least make enough of a case to spark some curiosity on the subject.

Well, we succeeded…sort of. She did her research. And while she wasn’t convinced by our case, she published her own report with an open request for comment from the Ethereum community.

So that’s exactly what we did. And the amount of responses was amazing! We got over 50 comments in the document, including a number from Vitalik.

Thank you to everyone who contributed.

Here’s what the Ethereum community had to say.

- David, Ryan, & Lucas

P.S. Our episode with Drake is live on the Bankless premium feed! Goes live for everyone on Monday. Full subscribes already have access. Episode was 🔥🔥🔥

THURSDAY THOUGHT

Bankless Writer: The Ethereum Community, David Hoffman, and Lucas Campbell

We want to thank Lyn Alden for her analysis and openness to the dialog! We’re big fans! Subscribe to her work here.

An Open Reply to Lyn Alden’s “Economic Analysis on Ethereum”

It’s safe to say that Lyn Alden is skeptical on Ethereum.

ETH’s $160 billion market cap doesn’t yet register on the macro radar. Ethereum’s narrative is more incorporative of technological innovation, rather than a monetary revolution. In contrast, Bitcoin’s $700 billion market cap and finite supply offer very strong tailwinds in the current macro environment.

From what I gather, when Lyn applies her mind to something, she does her best to think critically and remove herself from bias. Her article was not written to add to the Bitcoin Maxi FUD on Ethereum; rather it was an open invitation for checking facts, analysis, and conclusions.

If Lyn Alden is skeptical about something, that skepticism is noteworthy and deserving of attention. Some of the critiques in her report are nuanced and require thorough unpacking and analysis; some that I also believe are the results of the cohort of Bitcoiners that she has had strong exposure to when she came into the crypto space through Bitcoin, as so many of us do.

You can read Lyn’s Economic Analysis of Ethereum for context, as well as her accompanying tweet thread.

Here’s our response to Lyn Alden’s stance on ETH.

Claim: Vitalik made Ethereum because Blizzard used its centralized power to nerf his WoW character

Alright, let’s start by clearing the air on this one. Despite what people have heard (us included), Vitalik’s motivation behind the creation of Ethereum was not actually getting his Warlock in WoW nerfed—that was a joke from his bio on his website. This isn’t really important to Lyn’s piece, so not really worth getting into. But it’s at least worth clarifying (mainly because Vitalik did).

Claim: Ethereum relies on Trust for Stablecoins

“People rely on a third party in the sense that they have to trust that the custody and collateral backing up the tokens are solid, but the exchanging of the tokens between counterparties is permission-less.”

For Tether and USDC, yes you must have to trust the issuing institution, as well as having regulatory support from the country where the issuer resides in. This was exacerbated with the STABLE Act, where legislation proposed that all stablecoin currency issuers would be forced to file federal banking charters, rendering them into national extensions of the Nation-State. We agree with Lyn here—this is not very crypto economic or permissionless.

But the power of Ethereum is that it enables optionality in the construction of money and assets. Fiat collateralized stablecoins are just one of three identified stablecoin designs:

- Fiat-backed: These are 1:1 crypto dollar to US dollar, secured by a regulated entity (Ex: USDC, USDT, GUSD)

- Crypto-backed: Synthetic dollars over-collateralized by crypto assets, secured by code and incentives. (Ex: DAI, sUSD)

- Algorithmic: Self-perpetuating and collateral-less crypto assets secured by code and incentives. (Ex: ESD, DSD, Basis Cash)

Fiat-backed crypto dollars like Tether and USDC have the ability to blacklist addresses (Tether has blocked ~250 Ethereum addresses from receiving USDT), but crypto-backed and algorithmic stablecoins like DAI or ESD do not—they’re trust minimized and permissionless assets.

The future of stablecoins on Ethereum is not destined to be inside an environment of trust.

Ethereum is an expressive piece of software and has optionality in how problems can be solved on its platform. Perhaps a trusted stablecoin model like USDC or USDT is actually the optimum model, but the point is that Ethereum has the optionality to choose other paths—so long as the market demands it.

Claim: Ethereum Is Circular & Self-Referential

In this section, Lyn focuses on a qualitative analysis of the nature of the economic activity going on in Ethereum. She says that Ethereum is a “big operating system powered by crypto tokens for the purpose of moving around… crypto tokens”, basically implying: what’s the big deal?

I think this is where Ethereum may lose a lot of people who are too skeptical or cautious to extrapolate on Ethereum’s future trajectory.

Some people aren’t willing to take 6 years of Ethereum history, and extend it out 60 years into the future; there’s insufficient data to back up such an extended extrapolation, especially when Ethereum’s app layer only really came alive in 2017.

From what I can tell, Lyn is a data-driven pragmatist, who is likely is less interested in narrative over matured evidence.

Lyn is a macro investor and comes with a macro perspective. As I alluded to above, Ethereum $160B market cap and its ‘micro-cap’ tokens being traded and speculated on do not register on the macro radar.

However, there is a similar pattern seen in DeFi today that I think is an extension of early Bitcoin, and it’s my belief that the prudent macro investor should be savvy to the comparisons being drawn here.

Bitcoin’s volatility has been touted as, counter-intuitively, one of its best features (by Bitcoiners of course). The narrative that Bitcoiners put forth about BTC volatility is something like this:

Of course it’s volatile, it’s a monetary revolution starting from $0 and ending with a total value not measurable in dollar terms. How would you expect BTC to go from 0 to Quadrillions without speculative volatility along the way? If BTC wasn’t volatile, it wouldn’t be making BTC holders extremely wealthy along the way, and thus would have no bootstrappability mechanism.

I think we can extend this same reasoning to DeFi.

DeFi summer, an era marked by degenerate ‘apeing’ into unaudited contracts in chase of yield and upside, has already produced key DeFi infrastructure in its wake:

- Yearn: An automated yield-optimizing robot in DeFi

- SushiSwap: Uniswap clone facilitating ~$500M in daily volume, not far behind Uniswap’s $1B in daily volume.

- Yam Finance: A DAO that funded itself via a rebasing mechanism (found in algorithmic stablecoins), and has used that funding to produce the Umbrella Protocol, a smart contract insurance platform, and Degenerative Finance, a platform focused on building unique synthetics on UMA Protocol. And there’s still plenty of capital left over to fund more ventures.

All of these protocols were a direct consequence of speculative aping, which Gitcoin founder Kevin Owocki dubbed “Regenerative Finance: How DeFi ‘Degens’ Are Funding the Next Wave of Open-Source Development”

If you asked me if Yearn, Sushi, or Yam were going to be key DeFi infrastructure in the long term, I would probably answer no.

The difference between Bitcoin’s speculative volatility and DeFi’s speculative apeing is that Bitcoin is designed to keep attentional focus on BTC the asset, whereas DeFi is a modular structure where components can ‘die off’ and be replaced by more effective components.

Where individual cells in the DeFi body die, new and better cells come to replace them. To the outsider, this may appear to be an endless cycle of speculation and rotation, but in reality, it is closer to a biological exponential multiplication.

Where Bitcoins early speculation created exponential multiplication in its market cap, DeFi’s early speculation created exponential multiplication in its surface area.

📚 Further reading on this subject:

- How DeFi ‘Degens’ Are Funding the Next Wave of Open-Source Development

- Ethereum is an Emergent Structure

- Ethereum the Tree of Trust

So that addresses the speculation argument; now let’s address the self-referential argument:

Monies and economies are inherently circular. Contrary to popular belief, barter was never a materially dominant form of exchange in human history; the ‘barter economy’ is more of a thought experiment that illustrates why money is efficient, not how it comes to be.

The alternative thesis behind the genesis of money and economics is from an orchestrated effort based on human consensus. David Graeber in his book Debt: The First 5,000 Years illustrates the more common model for currency creation (extremely paraphrased):

Governments need to protect themselves, so they use their sovereign power over a land to issue currency. They use this issuance of currency to fund a military to protect the land that they have domain over. The soliders of said government goes out and spends this currency, and because the government charges taxes in this currency, the people of the land must go out and create value for the soliders so they can afford food and taxes. Thus, an economy is created.

Economies are inherently circular. Bitcoin is a blockchain that requires BTC to pay for transaction fees. Ethereum is an economy that uses ETH for transaction fees. If you want to use the Bitcoin network or the Ethereum network to settle value, you must pay transaction fees in each respective economy’s money. Security comes from the transaction fees paid to the protocol. In order to use these protocols, people must provide value in exchange for the asset by erecting businesses.

The competitive advantage that Ethereum has is that it has both an internally-native economy that doesn’t have the option to not use ETH as money, and drives external demand to its native ETH asset for reasons external to the native Ethereum economy, such as asset transfer and payment rails.

In this regard, ETH competes with the USD and BTC to become a dominant global macro SoV asset.

To me, any macro investor should see the patterns behind ETH and an internet-scaled organization that operates under a new iteration of the same fundamental money system that humans have seen since the dawn of money itself.

We know that the crypto industry has already produced one non-sovereign public SoV asset (Bitcoin). It has also produced a ton of shitcoins. But Ethereum illustrates the same fundamental characteristics that a younger Bitcoin once did: strong and persistent demand for block space, speculation on the future, creeping asset monetization, and a fervent community. Those are all of the ingredients you need.

Yes, Ethereum is young, and the DeFi apps on it are even younger. All DeFi has right now is yield, speculation, and belief. But that is more than enough to bootstrap this $160B asset—one that has already surpassed the valuations of Wells Fargo, Morgan Stanley and other major financial institutions—into market caps that compete with Nation State currencies.

Even outcompete them? It’s possible.

As I’ve attempted to illustrate in Ethereum is an Emergent Structure and Ethereum the Tree of Trust, the early, primitive money legos will evolve into more complex, adaptive systems, and grow into a larger and larger variety of financial use cases.

DeFi is a singular structure of money legos, that grows from a Festival of the Commons, where anyone that builds something on the structure makes the structure more useful and more efficient.

This trends towards evolutionary fitness over time, and anyone who pays close attention to DeFi knows how fast the iterative development cycles can be.

Claim: Ethereum’s Monetary Policy Is The Same As The Fed’s

“Ethereum developers change their monetary policy as often as the Federal Reserve does, and for similar reasons.”

Yes, Ethereum’s monetary policy. Let’s get into it.

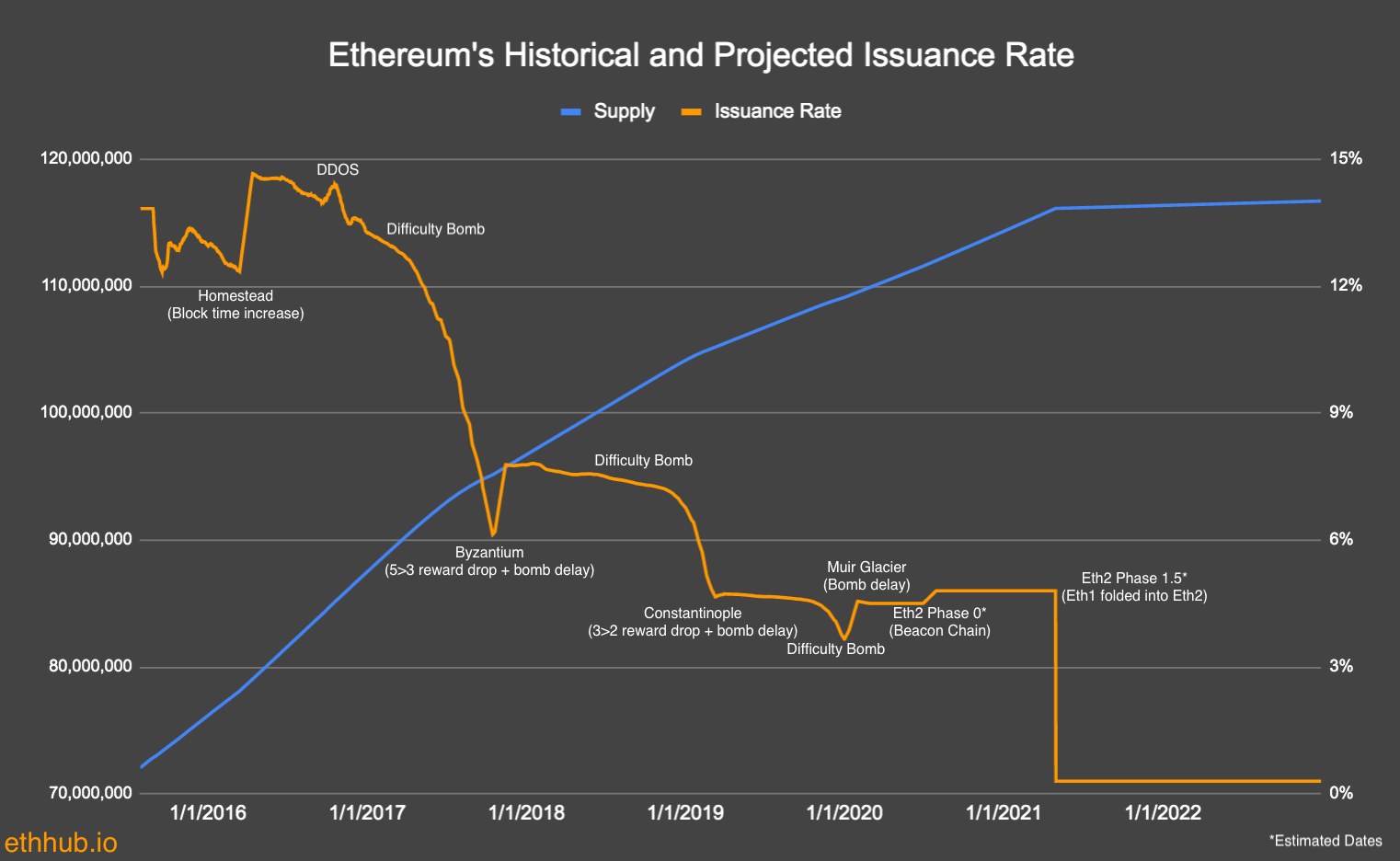

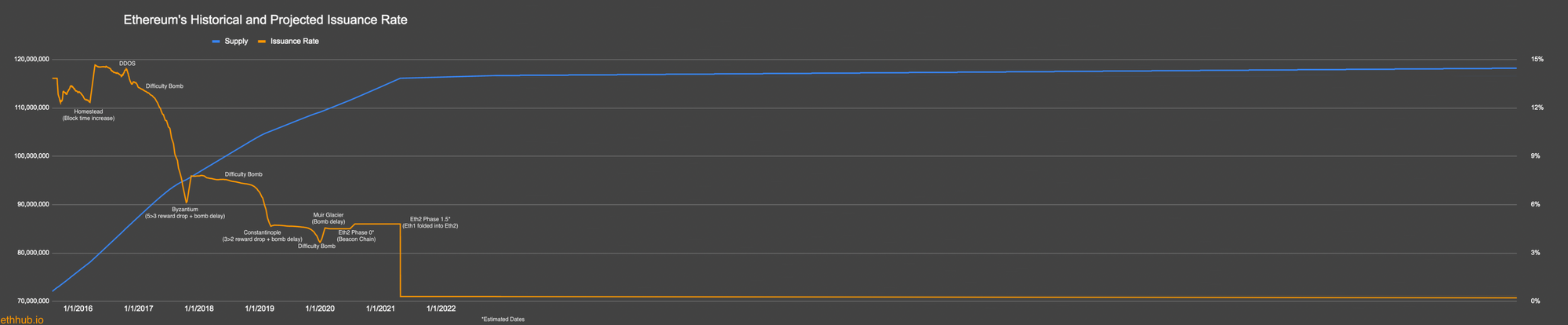

Ethereum has formally changed the issuance rate of ETH three times.

- Block 0 to Block 4,369,999: 5 Ether per block

- Block 4,370,000 to 7,280,000: 3 Ether per block (changed via EIP-649)

- Block 7,280,000 to now: 2 Ether per block (changed via EIP-1234)

There have also been other protocol changes or impacts that have altered the rate of ETH issuance, but it’s important to note that the change in ETH issuance is a downstream result of other changes to the protocol, mainly around block times. These two forces, block times and ETH issuance per block, are the two reasons behind why the historical ETH issuance graph is choppy and undefined:

Ethereum in its current form makes no claims to be a finished product. A lot of the division between Bitcoiners and Ethereum is largely focused around Ethereum being a project committed to R&D, and also not yet being outside of its R&D phase.

It’s incredibly valuable that this industry has a product like Bitcoin that committed to calcifying itself ASAP, in order to escape the dark forest of meat-space power dynamics and capture, and propel itself into the macro conversation.

Ethereum doesn’t prioritize calcification the way Bitcoin does. Instead, the community asks the question “What benefits can we achieve if we commit to an R&D phase to Ethereum’s genesis, in order to see what dimensions about public blockchains are we able to maximize”.

Bitcoin and Ethereum share common aspirations in that they are designed to be able to withstand crises. Even in worst-case scenarios—maybe like WWIII—Bitcoin and Ethereum should be able to survive and continue.

Bitcoin has fully reached that state, Ethereum has not.

Ethereum is being held back by its commitments to researching how to make a public blockchains more efficient and powerful without sacrificing the qualities that make Bitcoin so great—like decentralization, censorship-resistance, etc.

These efforts are distilling down to maximizing inclusiveness. The 6 years of Ethereum R&D has gone into:

- Creating a consensus mechanism that every interested participant is capable of participating (Proof of Stake).

- Creating a blockchain that has the scale needed to enable every interested participant to make a transaction on the base layer of Ethereum (Sharding).

Because of these commitments, Ethereum has had a social contract of tinkering and exploration in order to find the optimal peak on the landscape of public blockchain designs. That’s largely why the ETH issuance curve is jagged and unpredictable.

But let’s be clear: the monetary policy of ETH is ‘Minimum Viable Issuance’ because the social layer behind Ethereum understands that ETH needs to have a monetary premium in order to maximize security. At the same time, it also refuses to commit to a supply hard cap as we currently lack any evidence that a fixed supply currency on a public blockchain is a long-term, sustainable design for the network’s security.

The difference between ETH and BTC monetary policy is that Ethereum is choosing to go through the ‘hard part’ of blockchain design upfront, before it settles and calcifies, instead of kicking the can down the road and possibly coming to a head after the ability to adapt has been removed from the tool belt.

It’s nice to think that Bitcoin has this elegant monetary policy of “issuance halves every 4 years until there’s no more BTC to be issued”, and that we dust off hands and call it a day.

Ethereum has the aspirations and intention of supporting all possible global economic activity and has the responsibility to provide security assurances to all economic actors on its platform, current and future.

Hence, the ‘viable’ part of Minimum Viable Issuance. Ethereum is prepared to sacrifice long-term total supply assurances in ETH, in order to ensure long-term security assurances for all economic actors on its platform.

With all of that in mind, the social contract around Ethereum understands that optimal security for Ethereum includes a stable monetary policy for ETH. The next 60 years of ETH issuance should not be judged the first 6 years of Ethereum R&D, rather it should be judged by the intentions of the design of Ethereum.

Here’s my projected graph on ETH issuance and supply over time.

Another excerpt from Lyn’s report:

“Maybe if EIP 1559 is in place for five years, proves itself to work as intended, and doesn’t change, and Ethereum 2.0 is operating smoothly, I’ll agree there’s reasonable confidence that it won’t change anymore and that the system is working as intended. Until then, all I can do is watch and see how things turn out.”

See, I think we’re actually pretty aligned here. The difference between the typical Bitcoiner and Etherean tend to excuse Ethereum’s early R&D phase, and Bitcoiners tend to criticize it.

Lyn appears to simply be waiting for the Ethereum narrative around its monetary policy to play out. If it does, it sounds like she’s willing to be more inclusive of it in her macro perspective.

I think the line that is crossed is if you, as an investor, are willing to make a bet that Ethereum will achieve its goals and aspirations before they are achieved. Obviously, if Ethereum does achieve its goals and aspirations, the market cap of ETH will likely be significantly higher than its current $160B valuation.

Putting on my macro investor hat, I think I would take my interest in Bitcoin and how it’s changing the macro landscape just 12 years after its birth, and I would want to look for similarly rising platforms coming out of the crypto space.

If crypto is able to produce one major macro asset in its first 12 years of life and grow to over $1T in total market capitalization, I would assume that there could be another one not too far behind it.

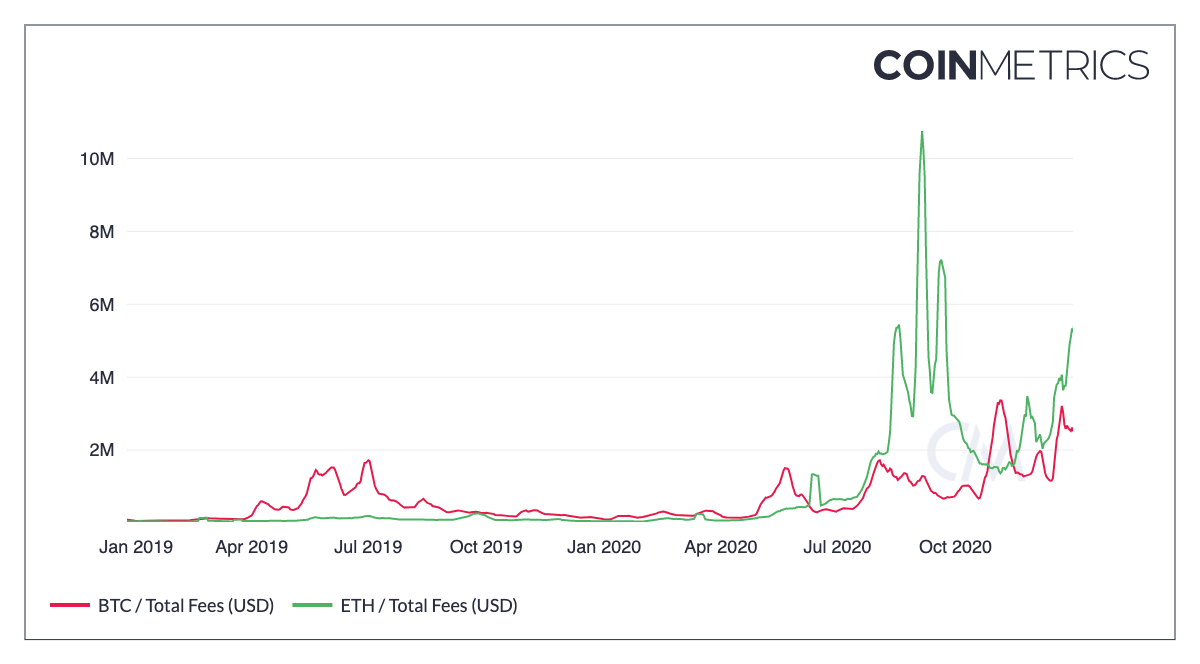

This is why the “total fees collected” by public blockchains is such a crucial metric. It directly indicates how much demand there is for these platforms and how much people are willing to pay to use them.

A substantial amount of transaction fees translates to long term demand and sustainability, and that’s what draws the line between Bitcoin and Ethereum—as well as all other L1 blockchains.

For reference, here are daily fees collected for Bitcoin and Ethereum since 2011:

If we zoom into 2020, we can actually see Ethereum poking out ahead of Bitcoin and even sustaining that lead, as well as building 10-1 lead during certain periods.

Lyn’s criticisms of Ethereum all seem to fall into the ‘it’s not mature yet’ category, which is fine. This perspective makes sense from a “show me the evidence” macro first perspective.

At the end of the day, investing in ETH today really depends on your risk tolerance and your willingness to bet on Ethereum fulfilling its envisioned future.

Personally, I believe there’s sufficient evidence for me to have exposure to ETH, as I believe that whatever market cap Bitcoin can achieve via its value proposition as digital gold, Ethereum can achieve orders of magnitude more as a platform for the internet of value.

I also think that there is a meaningful amount of evidence that Bitcoin’s long term security is in question, due to the prioritization of BTC the asset over Bitcoin the blockchain.

📚 Further reading on Bitcoin and Ethereum’s Security Model

- A model for Bitcoin’s security and the declining block subsidy

- On the instability of Bitcoin without a block reward

- The Economic Limits of Bitcoin and The Blockchain

- The impact of transaction fees on Bitcoin mining strategies

- BTC's monetary policy is overrated (Bankless)

- ETH's monetary policy is underrated (Bankless)

Maximizing assurances in monetary policy comes with trade-offs, and the tradeoff is sacrificing assurances in the network security. Controlling for volatility of issuances directs that volatility into the security of the chain.

- Bitcoin: I can assure you how much BTC there will be, but I can’t assure you how secure I will be.

- Ethereum : I can't assure you how much ETH there will be, but I can assure you that I will be secure.

To me, this is the correct order of operations. Prioritizing the asset above the infrastructure that supports the asset is putting the cart before the horse.

The addition of EIP-1559 adds in a speculative element that total ETH supply might actually be significantly lower than what the ETH issuance trajectory suggests. By burning ETH at a rate that is a function of the demand for Ethereum, it instantiates upside exposure to the Ethereum economy into ETH.

While no one can tell you how much ETH the fee model will burn, its beauty relies on the fact that the demand for Ethereum as a settlement layer drives ETH Scarcity. It’s also worth considering the possibility that a significant amount of BTC economic activity actually occurs on the Ethereum blockchain, in the form of tokenized BTC.

In a world where a significant portion of BTCs economic activity is hosted by Ethereum, the fees on this economic activity are paid to Ethereum instead of Bitcoin, lowering Bitcoin’s security and increasing Ethereum’s in its place. This is not good for a blockchain that has given up long-term BTC issuance in lieu of transaction fees for its security model.

DeFi offers financial tools for digital assets, and capital is simply more efficient inside of Ethereum. DeFi acts as a blackhole for value, as things tend to migrate into Ethereum and all the DeFi apps act as sinks for keeping the assets there. Watching the charts on BTConEthereum.com indicate this may be a one way street for BTC from Bitcoin to Ethereum.

Claim: Ethereum is overly reliant on Infura and AWS

Lyn contends that Ethereum is heavily reliant on Infura to operate, and without it, many of the applications would fail to operate. There’s some truth to this. Infura is a crucial piece of infrastructure for ecosystem. However, when Infura went down in November 2020, only centralized exchanges and some other applications had problems. Ethereum continued to process transactions, users were able to swap tokens on Uniswap, etc. Simply put, despite the downtime, Ethereum kept working with minimal problems.

Additionally, Ethereum is a high-touch blockchain for developers and builders, who need to iterate quickly to get their code deployed. Third party node providers help serve developers needs to frequently interact with the blockchain without being burdened themselves.

There’s no meaningful evidence that 3rd party node operators present a significant risk to the Ethereum blockchain.

Claim: BTC is digital gold, ETH is digital oil. ETH is an ‘enabler of work.

That’s correct, but under this definition, Lyn describes ETH only as a consumable asset. But in the Triple Point Asset thesis, we contend how ETH fits into all three asset superclasses:

- Store of Value

- Capital

- Consumable/Transformable

It’s the third category that Lyn is calling ETH the ‘enabler of work’, but that’s missing the other two components of what makes ETH the asset so unique.

Under PoS and EIP1559, ETH becomes a capital asset as it represents the rights to cash flows generated from the economic activity on Ethereum (i.e. transaction fees).

ETH also acts as a SoV asset in DeFi as the most trust-minimized reserve asset. You can collateralize ETH for a range of actions in the Ethereum economy like minting synthetic dollars, or taking out a loan, thus creating SoV-type characteristics for the asset.

Under all of these scenarios, ETH becomes the first asset in the world that holds all three attributes—SoV, capital, and consumable—of the “asset superclasses”.

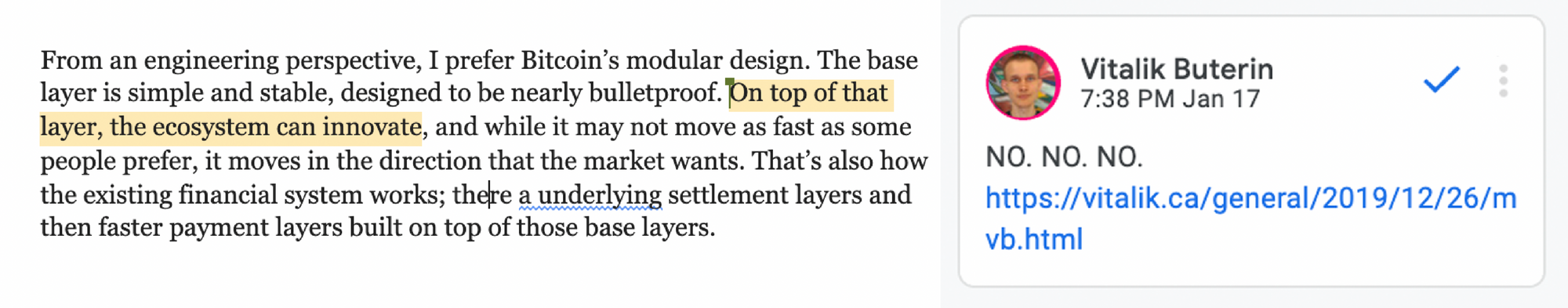

Claim: “Building on top of Bitcoin is optimal”

Lyn says that Bitcoin is simple and secure enough to offer the optimal platform for developers. It’s safe to say that Vitalik doesn’t agree and links his article, Base Layers And Functionality Escape Velocity. Here’s what he concludes in his piece:

“Keep layer 1 simple, make up for it on layer 2" is NOT a universal answer to blockchain scalability and functionality problems, because it fails to take into account that layer 1 blockchains themselves must have a sufficient level of scalability and functionality for this "building on top" to actually be possible (unless your so-called "layer 2 protocols" are just trusted intermediaries).

This is also a core idea within the Bankless Thesis. Using BTC is different than building on top of Bitcoin. Because Bitcoin has been a reductive system, it has eliminated the ability to natively build on top of the blockchain with high degrees of modularity, and thus has forced innovation into the trusted intermediary layer, which largely goes against the cypherpunk ethos of the crypto industry.

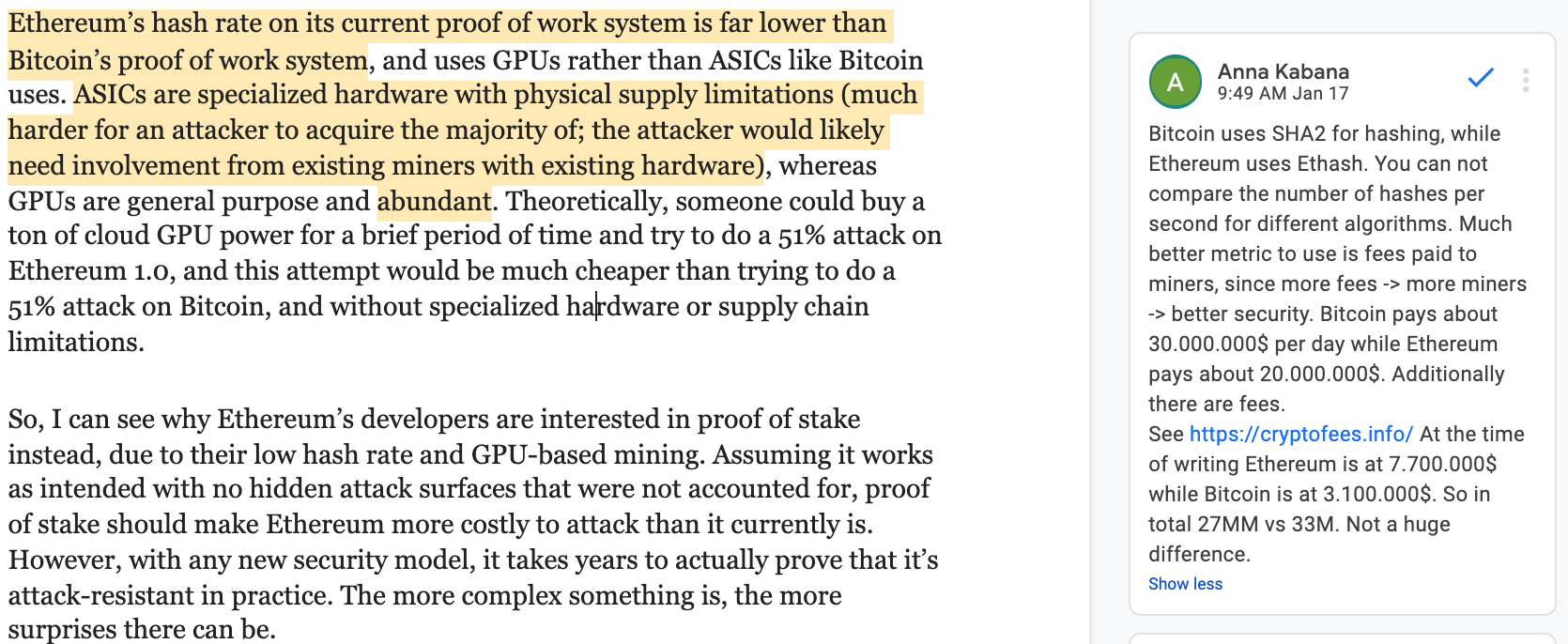

Claim: Ethereum PoW is Less Secure than Bitcoin

Even though Lyn recognizes that comparing Ethereum’s hash rate to Bitcoin’s hash rate is not an apples-to-apples comparison due to the difference in hardware requirements, there’s actually a better reason why this is an unfair comparison.

Ethereum and Bitcoin use two different hashing algorithms. Ethereum’s hash function is significantly harder to compute than Bitcoin’s, meaning that you cannot compare the number of hashes calculated per second as there will naturally be significantly less on Ethereum due to the higher computational difficulty.

Instead, we contend that fees paid is a much more universally sound measurement on the security of a network. The more fees paid, the more miners earn, meaning the more secure the network is. And Ethereum currently has the lead under this measurement!

Claim: Ethereum is subject to The Concorde Risk

Lyn’s core argument here is drawing a parallel to The Concorde and that despite the technological innovation it brought to the airline industry, it doesn’t mean it will translate to economic sustainability or mainstream adoption. While the Concorde Risk can hold true for certain innovations, Vitalik argues that this doesn’t hold true for Ethereum.

Transaction fees are one of the key metrics for measuring the sustainability of a public blockchain. It defines how much people are willing to pay to use the network as a settlement layer for value. And today, as mentioned, Ethereum is actually more “sustainable” than Bitcoin under this measuring stick. See monetary policy section above.

Closing Thoughts for Lyn Alden and other Ethereum Skeptics

The fact that Lyn was willing to take the time, do her due diligence, and present her evidence on Ethereum shows her commitment to investing based on data and evidence. But, a lot of the conclusions and evidence, in both her report and ours, are nuanced. There’s an argument for both sides.

Regardless, we hope that this response serves as a point of clarification for common criticisms of Ethereum as a network and ETH as an asset.

Thank you to the Ethereum community for taking the time to add your comments—it was invaluable for building this response.

At the end of the day, it doesn’t matter what we believe, what Bitcoin maximalists believe, or what ETH skeptics believes. The market is the only referee that matters.

So give it some time, and eventually the winner will be declared.

Action steps

- Read Lyn Alden’s “An Economic Analysis of Ethereum”

- Draw your own conclusions—what points do you agree or disagree with?